Beruflich Dokumente

Kultur Dokumente

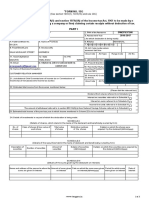

Form No. 15 H: Bar Code: Pan

Hochgeladen von

Sajal KulshresthaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Form No. 15 H: Bar Code: Pan

Hochgeladen von

Sajal KulshresthaCopyright:

Verfügbare Formate

Bar Code : PAN :

FORM No. 15 H

[See section 197A(1C) and rule 29C(1A)]

Declaration under section 197A(1C) of the Income-tax Act, 1961 to be made by an individual an individual who is of the age of

sixty years or more claiming certain receipts without deduction of tax

PART-I

1. Name of Assessee (Declarant) 2. PAN of the Assessee

3. Age 4. Assessment Year

(for which declaration is being made)

5. Flat/Door/Block No. 6. Name of Premises 7. Assessed in which Ward/Circle

8. Road/Street/Lane 9. Area/Locality 10. AO Code (under whom assessed last time)

Area Code AO Type Range Code AO No.

11. Town/City/District 12. State

13. PIN 14. Last Assessment Year in which assessed

15. Email 16. Telephone No. (with STD Code) and Mobile No. 17. Present Ward/Circle

18. Name of Bussiness/Occupation 19. Present AO Code (if not same as above)

20. Jurisdictional Chief Commissioner of Income-tax or Commissioner of Income-tax ( if not assessed to Area Code AO Type Range Code AO No.

Income-tax earlier)

21. Estimated total income from the sources mentioned below:

(Please tick the relevant box)

Dividend from shares referred to in Schedule I

Interest on securities referred to in Schedule II

Interest on sums referred to in Schedule III

Income form units referred to in Schedule IV

The amount of withdrawal referred to in clause (a) of sub-section 2 of section 80CCA referred to in Schedule V

22. Estimated total income of the previous year in which income mentioned in Column 21 is to be included

23. Details of investments in respect of which the declaration is being made:

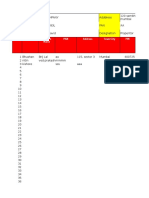

SCHEDULE-I (Not Applicable)

(Details of the shares, which stand in the name of the declarant and beneficially owned by him)

No. of shares Class of shares and face value of each share Total value of shares Distinctive numbers of the shares Date(s) on which the shares were acquired

by the declarant

(DD/MM/YYYY)

SCHEDULE-II (Not Applicable)

(Details of the securities held in the name of the declarant and beneficially owned by him)

Description of securities Number os securities Amount of securities Date(s) of securities Date(s) on which the securities were

acquired by the declarant

(DD/MM/YYYY)

(DD/MM/YYYY)

SCHEDULE III

Name and Address of the person to whom the sums are given on interest Amount of sums given on Date on which sums were given Period for which such Rate of interest

interest on interest sums were given on

(DD/MM/YY) interest

HDFC BANK LTD

CUST ID:

FD NO :

FD NO :

FD NO :

FD NO :

FD NO :

FD NO :

FD NO :

FD NO :

FD NO :

FD NO :

Mandatory : To be filled by the Branch

Checklist for Form 15H (For individual >= 60 years)

I have checked and confirm the below Tick ( or )

Customer is >= 60 years (if < 60 years than fill form 15 G)

PAN No. is updated in Bank Records against the Cust Id of customer

Copy of PAN Card attached ( if not updated in the system)

Customer has signed in six places (indicated by)

Fields marked are mandatory to be filled

Name of the Emp _____________________ Emp. Code _______________

Emp. Sign ___________________________ Date ____________________

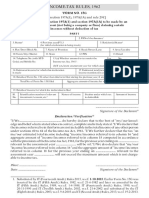

SCHEDULE-IV (Not Applicable)

(Details of the mutual fund units held in the name of the declarant and beneficially owned by him)

Name and address of the Mutual Fund Number of units Class of units and face value of each Distinctive number of units Income in respect of units

unit

SCHEDULE-V (Not Applicable)

(Details of the withdrawal made from National Savings Scheme)

Particulars of the Post Office where the account under the National Savings Scheme is maintained Date on which the account was The amount of withdrawal from the account

and the account number opened(dd/mm/yyyy)

Signature of declarant

Declaration / Verification

I ................................................. do hereby declare that I am resident of India within the meaning of section 6 of the Income-tax Act, 1961. I also, hereby declare

that to the best of my knowledge and belief what is stated above is correct, complete and is truly stated and that the incomes referred to in this form are not

includible in the total income of any other person u/s 60 to 64 of the Income-tax Act, 1961. I further declare that the tax on my estimated total income, including

*income/incomes referred to in column 21 computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year ending on .....................

relevant to the assessment year ................. will be nil.

Place: ..................................................

Date: ..................................................

.............................................................................

Signature of Declarant

PART II

[For use by the person to whom the declaration is furnished]

1. Name of the peron responsible for paying the income referred to in Column 22 of Part I 2. PAN of the person indicated in Column 1 of Part II

HDFC BANK LTD

3. Complete Address AAACH2702H

HDFC Bank House, Senapati Bapat Marg, Lower Parel, Mumbai, Maharashtra - 400013 4. TAN of the person indicated in Column 1 of Part II

5. Email : support@hdfcbank.com 6. Telephone No. (with STD code) and MUMH03189E

Mobile No. 7. Status Domestic Company

8. Date on which Declaration is Furnished 9. Period in respect of which the dividend 10. Amount of income paid 11. Date on which the

has been declared or the income has been income has been

(dd/mm/yyyy) paid/credited paid/credited

(dd/mm/yyyyy)

12. Date of declaration, distribution or payment of dividend/withdrawal under the National 13. Account number of National Saving Scheme from

Savings Scheme (dd/mm/yyyyy) Not Applicable which withdrawal has been made Not Applicable

Forwarded to the Chief Commissioner of Income-tax ...............................................................................

....................................................................

Signature of the person responsible for

Place: ............................................. paying the income referred to in

Date: ............................................. Column 21 of Part I

Notes:

1. @ Give complete postal address.

2. The declaration should be furnished in triplicate.

3. * Delete whichever is not applicable.

4. Before signing the verification, the declarant should satisfy himself that the information furnished in the declaration is true, correct and complete in all

respects. Any person making a false statement in the declaration shall be liable to prosecution under Section 277 of the Income Tax Act, 1961, and on

conviction be punishable -

(i) In a case where tax sought to be evaded exceeds twnety-five lakh rupees, with rigorous imprisonment which shall not be less than 6 months but

which may extend to seven years and with fine;

(ii) In any other case, with rigorous imprisonment which shall not be less than 3 months but which may extend to two years and with fine;

5. The person responsible for paying the income referred to in column 21 of Part I shall not accept the declaration where the amount of income of the

nature referred to in section 197A(1C) or the aggregate of the amounts of such income credited or paid or likely to be credited or paid during the

previous year in which such income is to be included exceeds the maximum amount which is not chargeable to tax and deduction(s) under Chapter

VI-A, if any, for which the declarant is eligible.";

Disclaimer

1. Form 15H is to be filled only for Individuals more than or equal to 60 years ( if < 60 yrs then fill Form 15G)

2. TDS waiver will not be marked if PAN details are not updated on the Bank's records

3. TDS waiver will be marked from the date of submission of this form

4. TDS which has already been deducted will not be refunded back and to be sought from Income Tax department

5. A fresh Form 15H needs to be submitted in each new Financial Year within the start of the Financial Year.

6. Form 15H needs to be submitted in Triplicate

7. Form 15H needs to be submitted for every fixed deposit booked with the Bank.

8. The Bank shall not be liable for any consequences or loss arising due to delay or non or wrong submission of Form 15H

9. I/We fully understand that wrong quoting of PAN may result in penal consequences under section 272B of Income Tax act 1961 and the bank is not

responsible for any consequences arising due wrong quoting of PAN

Das könnte Ihnen auch gefallen

- Form 15H DeclarationDokument2 SeitenForm 15H DeclarationIndrasish BasuNoch keine Bewertungen

- WND PIU4 BP Xi 235 N Z390Dokument2 SeitenWND PIU4 BP Xi 235 N Z390Nishant VincentNoch keine Bewertungen

- Form 15H DeclarationDokument2 SeitenForm 15H Declarationyraju88Noch keine Bewertungen

- Form 15G PDFDokument6 SeitenForm 15G PDFSmitha GowdaNoch keine Bewertungen

- Form15H PDFDokument2 SeitenForm15H PDFSrinivasulu NatukulaNoch keine Bewertungen

- Form No. 15GDokument2 SeitenForm No. 15GGaneshNoch keine Bewertungen

- Form 15 GDokument2 SeitenForm 15 Gthe.mentor.inNoch keine Bewertungen

- Formno. 15G: Bar Code: PanDokument2 SeitenFormno. 15G: Bar Code: PanRajesh ManogaranNoch keine Bewertungen

- Form 15GDokument2 SeitenForm 15GmuraliswayambuNoch keine Bewertungen

- Adobe Scan Mar 25, 2022Dokument2 SeitenAdobe Scan Mar 25, 2022GaneshNoch keine Bewertungen

- Form No. 15G: (Please Tick The Relevant Box)Dokument4 SeitenForm No. 15G: (Please Tick The Relevant Box)Santosh DasNoch keine Bewertungen

- "Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Dokument3 Seiten"Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Christopher Vinoth0% (2)

- Adobe Scan 4 Jan 2024Dokument2 SeitenAdobe Scan 4 Jan 2024paplujiNoch keine Bewertungen

- ABC Company PAN and Interest DetailsDokument15 SeitenABC Company PAN and Interest DetailsAnonymous 6z7noS4fNoch keine Bewertungen

- Form No. 15G: Part - IDokument3 SeitenForm No. 15G: Part - ImohanNoch keine Bewertungen

- FORM 15G DECLARATIONDokument2 SeitenFORM 15G DECLARATIONbalaji stationersNoch keine Bewertungen

- Form 27 C FormatDokument4 SeitenForm 27 C FormatYash KediaNoch keine Bewertungen

- Form 27CDokument2 SeitenForm 27Ctulsi22187Noch keine Bewertungen

- Form No 15GDokument4 SeitenForm No 15Graghu_kiranNoch keine Bewertungen

- JadejaDhirubha15G CompressedDokument3 SeitenJadejaDhirubha15G CompressedRishirajsinh JadejaNoch keine Bewertungen

- Form No 15GDokument3 SeitenForm No 15GSanjeeva ReddyNoch keine Bewertungen

- Form 27CDokument1 SeiteForm 27CSandesh JhawarNoch keine Bewertungen

- JadejaDilipsinh15G CompressedDokument3 SeitenJadejaDilipsinh15G CompressedRishirajsinh JadejaNoch keine Bewertungen

- BijayLata15G CompressedDokument3 SeitenBijayLata15G CompressedRishirajsinh JadejaNoch keine Bewertungen

- PF Form 15G PDFDokument1 SeitePF Form 15G PDFSorabh BhargavNoch keine Bewertungen

- PF Form 15GDokument1 SeitePF Form 15GSorabh BhargavNoch keine Bewertungen

- Form 15G PDFDokument2 SeitenForm 15G PDFLegend RickNoch keine Bewertungen

- Form 15HDokument2 SeitenForm 15HNithya SathyaprasathNoch keine Bewertungen

- Form No.15gDokument2 SeitenForm No.15gPrakash GowdaNoch keine Bewertungen

- Form No. 15H: (IT Dept. Copy)Dokument9 SeitenForm No. 15H: (IT Dept. Copy)jpsmu09Noch keine Bewertungen

- FD - Form 15 - G - Oct 2015Dokument6 SeitenFD - Form 15 - G - Oct 2015mohantamilNoch keine Bewertungen

- ANS - 17A - Apr2012 (AR 2011)Dokument488 SeitenANS - 17A - Apr2012 (AR 2011)cuonghienNoch keine Bewertungen

- Income-Tax Rules, 1962Dokument2 SeitenIncome-Tax Rules, 1962Abdul SattarNoch keine Bewertungen

- Form 15 H - 2020-21Dokument2 SeitenForm 15 H - 2020-21Lavesh DixitNoch keine Bewertungen

- FORM A 1-For Import Payments OnlyDokument6 SeitenFORM A 1-For Import Payments OnlyAnonymous rPwwJGksANoch keine Bewertungen

- Form No 15GDokument2 SeitenForm No 15Gnarendra1968Noch keine Bewertungen

- Form 15GDokument3 SeitenForm 15Gsriramdutta9Noch keine Bewertungen

- Adobe Scan 13 Mar 2021Dokument1 SeiteAdobe Scan 13 Mar 2021Pankaj BhamareNoch keine Bewertungen

- Form 15gDokument4 SeitenForm 15gcontactus kannanNoch keine Bewertungen

- 15g MehandiDokument3 Seiten15g MehandiAjay ParidaNoch keine Bewertungen

- Form No. 15GDokument9 SeitenForm No. 15Gjpsmu09Noch keine Bewertungen

- 2000-OT January 2018 ENCS v3Dokument27 Seiten2000-OT January 2018 ENCS v3cefaem.00Noch keine Bewertungen

- Form 15GDokument3 SeitenForm 15GRahul DattoNoch keine Bewertungen

- Reserve Bank of IndiaDokument14 SeitenReserve Bank of IndiaJAYANTHI BNoch keine Bewertungen

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDokument3 SeitenFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNoch keine Bewertungen

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Dokument2 SeitenApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Chintan JainNoch keine Bewertungen

- INCOME-TAXDokument3 SeitenINCOME-TAXarjunv_14100% (1)

- Form-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)Dokument1 SeiteForm-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)mrthilagamNoch keine Bewertungen

- India Patent Form 1Dokument5 SeitenIndia Patent Form 1adityakochharNoch keine Bewertungen

- Bar CodeDokument6 SeitenBar CodeAkashNoch keine Bewertungen

- 0031SISS: Individual 11. Gmai TomDokument1 Seite0031SISS: Individual 11. Gmai TomVarun reddyNoch keine Bewertungen

- "Form No. 15G: AO No. AO Type Range Code Area CodeDokument2 Seiten"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaNoch keine Bewertungen

- "Form No. 15H: Area Code Range Code AO No. AO TypeDokument2 Seiten"Form No. 15H: Area Code Range Code AO No. AO Typepkw007Noch keine Bewertungen

- Form 15H Format 1Dokument4 SeitenForm 15H Format 1ASHISH KININoch keine Bewertungen

- Declare Transactions Without PANDokument1 SeiteDeclare Transactions Without PANprabu rajNoch keine Bewertungen

- The Superintending EngineerDokument7 SeitenThe Superintending EngineerShivamNoch keine Bewertungen

- Form No. 27B: (In Case Return Has Been Filed Earleer)Dokument1 SeiteForm No. 27B: (In Case Return Has Been Filed Earleer)anon-418665100% (1)

- As Approved by Income Tax DepartmentDokument5 SeitenAs Approved by Income Tax DepartmentRicha JoshiNoch keine Bewertungen

- Enjoy 2% Cashback: Use Your Samba Credit Card at Kalyan Jewellers andDokument1 SeiteEnjoy 2% Cashback: Use Your Samba Credit Card at Kalyan Jewellers andSajal KulshresthaNoch keine Bewertungen

- FAB Yearend Spend Campaign Oct Jan2020 TnC1Dokument1 SeiteFAB Yearend Spend Campaign Oct Jan2020 TnC1Satyanarayana MukkuNoch keine Bewertungen

- CBD Credit Card Cashback T&CsDokument2 SeitenCBD Credit Card Cashback T&CsSajal KulshresthaNoch keine Bewertungen

- Strainer Information PDFDokument6 SeitenStrainer Information PDFmahdiNoch keine Bewertungen

- Arabian Oryx Physical FeaturesDokument4 SeitenArabian Oryx Physical FeaturesSajal KulshresthaNoch keine Bewertungen

- Grade 1Dokument2 SeitenGrade 1Sajal KulshresthaNoch keine Bewertungen

- Grade 1 Science WorksheetDokument3 SeitenGrade 1 Science WorksheetSajal KulshresthaNoch keine Bewertungen

- Strainer Information PDFDokument6 SeitenStrainer Information PDFmahdiNoch keine Bewertungen

- Form 15G TDS waiverDokument2 SeitenForm 15G TDS waiverPalaniappan Meyyappan83% (6)

- Hotl ListDokument1 SeiteHotl ListSajal KulshresthaNoch keine Bewertungen

- Pressure VesselsDokument9 SeitenPressure VesselsSajal KulshresthaNoch keine Bewertungen

- Close Bank Account RequestDokument1 SeiteClose Bank Account RequestlogisrinivasNoch keine Bewertungen

- Trunnion PDFDokument7 SeitenTrunnion PDFSajal KulshresthaNoch keine Bewertungen

- Ellipsoidal Head Dimensional CharacteristicsDokument2 SeitenEllipsoidal Head Dimensional CharacteristicsSajal KulshresthaNoch keine Bewertungen

- Modal Mass IDokument8 SeitenModal Mass ISajal KulshresthaNoch keine Bewertungen

- FirstRewardsCatalogue PDFDokument9 SeitenFirstRewardsCatalogue PDFSajal KulshresthaNoch keine Bewertungen

- Common Ions Anions and CationsDokument2 SeitenCommon Ions Anions and CationsSajal KulshresthaNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Spark Resistance HoistDokument4 SeitenSpark Resistance HoistSajal KulshresthaNoch keine Bewertungen

- Walnut CakeDokument1 SeiteWalnut CakeSajal KulshresthaNoch keine Bewertungen

- AccountClosureRequest NewDokument1 SeiteAccountClosureRequest NewSajal KulshresthaNoch keine Bewertungen

- Input EchoDokument10 SeitenInput EchoSajal KulshresthaNoch keine Bewertungen

- WJM Technologies: Excellence in Material JoiningDokument5 SeitenWJM Technologies: Excellence in Material JoiningA K SinghNoch keine Bewertungen

- The Damage Could Have Been Greater Had He Not Stopped Himself From Paying The Fourth and Final InstalmentDokument1 SeiteThe Damage Could Have Been Greater Had He Not Stopped Himself From Paying The Fourth and Final InstalmentSajal KulshresthaNoch keine Bewertungen

- Harrington Manual Trolleys and Hoists Product Specification FormDokument1 SeiteHarrington Manual Trolleys and Hoists Product Specification FormSajal KulshresthaNoch keine Bewertungen

- WRC 107Dokument3 SeitenWRC 107Aqeel BismaNoch keine Bewertungen

- Exchanger CostingDokument2 SeitenExchanger CostingSajal KulshresthaNoch keine Bewertungen

- AlgurgDokument1 SeiteAlgurgSajal KulshresthaNoch keine Bewertungen

- Seismic Design Lec 2 PDFDokument32 SeitenSeismic Design Lec 2 PDFGuillermo Cordero100% (1)

- Umang UG Fest Brochure PDFDokument8 SeitenUmang UG Fest Brochure PDFDebarshee MukherjeeNoch keine Bewertungen

- GatoradesalesprojectDokument6 SeitenGatoradesalesprojectapi-267015511Noch keine Bewertungen

- Distribution and Logistic (Materi # 4)Dokument65 SeitenDistribution and Logistic (Materi # 4)ayuelvinaNoch keine Bewertungen

- CreditMangerEurope Number 4 - 2013Dokument40 SeitenCreditMangerEurope Number 4 - 2013Anonymous bDCiOqNoch keine Bewertungen

- Insurance Law Review 2015Dokument43 SeitenInsurance Law Review 2015peanut47Noch keine Bewertungen

- Group Directory: Commercial BankingDokument2 SeitenGroup Directory: Commercial BankingMou WanNoch keine Bewertungen

- E StatementDokument3 SeitenE StatementBkho HashmiNoch keine Bewertungen

- Business Law ReviewerDokument16 SeitenBusiness Law ReviewerTerence Jeff TamondongNoch keine Bewertungen

- NBPDokument57 SeitenNBPbeehajiNoch keine Bewertungen

- Bharti Realty Report - FinalDokument89 SeitenBharti Realty Report - FinalArnob G MazumdarNoch keine Bewertungen

- IOE425 Syllabus Winter 2017 002 v1.1Dokument7 SeitenIOE425 Syllabus Winter 2017 002 v1.1jstnjoseNoch keine Bewertungen

- Rule of Investigation HourensouDokument4 SeitenRule of Investigation Hourensouminhchi2608Noch keine Bewertungen

- Group8 StayZIllaDokument8 SeitenGroup8 StayZIllaRibhav KhattarNoch keine Bewertungen

- 1 SM IntroductionDokument15 Seiten1 SM IntroductionAurangzeb KhanNoch keine Bewertungen

- CH 2 Business EnviromentDokument36 SeitenCH 2 Business EnviromentSeema TanwarNoch keine Bewertungen

- 21.SAP MM - Service ManagementDokument8 Seiten21.SAP MM - Service ManagementNiranjan NaiduNoch keine Bewertungen

- Business LetterDokument6 SeitenBusiness LetterGlory Mae OraaNoch keine Bewertungen

- T3.Hull Chapter 10Dokument11 SeitenT3.Hull Chapter 10Abhishek Gupta100% (1)

- How To Use Transaction SOST & SCOT For Chec..Dokument2 SeitenHow To Use Transaction SOST & SCOT For Chec..ghenno18Noch keine Bewertungen

- C Hanaimp142Dokument2 SeitenC Hanaimp142karamananNoch keine Bewertungen

- Analyst SkillsDokument2 SeitenAnalyst SkillsGarvit HarisinghaniNoch keine Bewertungen

- Oligopoly For MPADokument41 SeitenOligopoly For MPAAshraf Uz ZamanNoch keine Bewertungen

- Fin Model Class2 Excel NPV Irr, Mirr SlidesDokument5 SeitenFin Model Class2 Excel NPV Irr, Mirr SlidesGel viraNoch keine Bewertungen

- NBN Co: Financial Management SolutionDokument2 SeitenNBN Co: Financial Management SolutionAccentureAustraliaNoch keine Bewertungen

- Project On MicrofinanceDokument54 SeitenProject On MicrofinancevbrutaNoch keine Bewertungen

- Weekly RM call log COVID rosterDokument2 SeitenWeekly RM call log COVID rosterarzu tabassumNoch keine Bewertungen

- "Brands Aren't Just Names On Packages!": Executive PerspectiveDokument5 Seiten"Brands Aren't Just Names On Packages!": Executive PerspectiveMeray George Wagih EbrahimNoch keine Bewertungen

- Banks Guarantee Rules Under UNCITRALDokument6 SeitenBanks Guarantee Rules Under UNCITRALjewonNoch keine Bewertungen

- Senior Executive Title Operations Management in Tampa Bay FL Resume Mark WanichDokument2 SeitenSenior Executive Title Operations Management in Tampa Bay FL Resume Mark WanichMarkWanichNoch keine Bewertungen

- Raza Building StoneDokument9 SeitenRaza Building Stoneami makhechaNoch keine Bewertungen