Beruflich Dokumente

Kultur Dokumente

Prioritizing City Projects

Hochgeladen von

Elise StolteCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Prioritizing City Projects

Hochgeladen von

Elise StolteCopyright:

Verfügbare Formate

Attachment 5

C APITAL G ROWTH P ROFILE P RIORITIZATION

Profile Attributes and Scoring Criteria

April 22, 2014

Infrastructure & Funding Strategies

Corporate Strategic Planning

Financial Services & Utilities

Attachment 5

Table of Contents

OVERVIEW ..................................................................................................................................................... - 1 -

1. Mandate ................................................................................................................................................ - 1 -

2. Geographic Impact (External) OR Organizational Impact (Internal) ..................................................... - 3 -

3. Value for Money .................................................................................................................................... - 6 -

3.1. Change in Demand (Capacity Measure) ........................................................................................ - 6 -

3.2. Capital or Operational Savings ...................................................................................................... - 7 -

3.3. Levels of Service ............................................................................................................................ - 8 -

4. Project Readiness .................................................................................................................................. - 9 -

5. Profile Growth & Renewal ................................................................................................................... - 11 -

6. Strategic Alignment ............................................................................................................................. - 12 -

7. Corporate Operational Risk ................................................................................................................. - 14 -

Attachment 5

C APITAL G ROWTH P ROFILE P RIORITIZATION

Profile Attributes and Scoring Criteria

OVERVIEW

The information contained in this document is intended to assist in strategic decision-making with respect

to the optimization of City funding resources to Capital Growth projects. Developed collaboratively, this

Capital Prioritization Framework is designed to facilitate the systematic evaluation of project profiles based

on a select number of categories and scoring criteria.

The categories and subcategories currently include the following and are discussed in more detail in the

body of this document. Currently, the criteria are not weighted relative to each other. Capital Prioritization

Planning Committee (CPPC) intends to do this at a time further along in the Capital Plan development

process.

1. Mandate

2. Geographic Impact (External) OR Organizational Impact (Internal)

3. Value for Money

3.1. Change in Demand (Capacity Measure)

3.2. Capital or Operational Savings

3.3. Level of Service

4. Project Readiness

5. Profile Growth & Renewal

6. Strategic Alignment

7. Corporate Operational Risk

This represents one step in the process of Growth Profile prioritization. Once complete, a funding

allocation exercise must follow to ensure an optimal use of available Grants, Pay-As-You-Go, and other

funding sources. Furthermore, Corporate Leadership Team (CLT) and CPPC must review to ensure the

recommendations are reasonable and reflect the spirit of Councils expectations for the Capital Program

they will eventually approve.

Profile Attributes & Scoring Criteria April 22, 2014 -1-

Attachment 5

1. Mandate

Which of the following criteria does the profile meet?

Federal or Provincial Directive / Regulatory & Legislative and/or

Council / Board / Authorities Motion and/or

Best Practices Industry

Operational Definition:

What criteria best represents the mandated nature of the profile? Directives, Regulations, and Legislation

must:

be current and directly applicable to the profile

include terms that the City of Edmonton must be in compliance with at a date specified within the

period;

As such, it is expected that few profiles will score a 10 in this category.

Scoring:

The score is calculated by determining the % of Profile Cost that applies to any of the criteria and then

multiplying by the respective assigned points. Note, Profiles progress through the scoring, they do not

accumulate scoring (total score cannot be greater than 10).

% of Profile Cost

Prorated Points

Points Criteria (Entered by User -

(calculated)

must add up to 100%)

The consequence of not funding the profile will result in the City not meeting

10

Federal or Provincial Directives / Regulations & Legislation 20% 2.0

Council has directed this profile as a priority via prior committed funding; for

7

example, land and/or design 50% 3.5

5 Council has directed this profile as a priority via a motion

0.0

3 Profile is identified in a Strategic Plan or Master Plan

0.0

0 No Mandate to Provide the Profile

30% 0.0

TOTAL 100% 5.5

Profile Attributes & Scoring Criteria April 22, 2014 -1-

Attachment 5

Example:

1) Co-located Dispatch and Emergency Operations Center

The Co-located Dispatch and Emergency Operations Center has a legislated component related to the

provision of the 911 service. This component amounts to 20% of the overall costs of the project. 50%

of the profile relates to the provision of emergency management, as directed by policy, and to that end

Council has previously funded land for use by this profile. The remaining 30% of the profile costs are

related to future focused opportunity expenses to increase functionality, and therefore score 0.

20% x 10 (20% of Profile costs are due to a Legislative requirement at 10 points)

50% x 7 (50% of Profile costs are due to a motion by Council who has directed this project as a

priority via prior committed funding for land and/or design at 7 points)

30% x 0 (30% of Profile costs address other needs at 0 points)

5.5 (Total points scored for the project)

Profile Attributes & Scoring Criteria April 22, 2014 -2-

Attachment 5

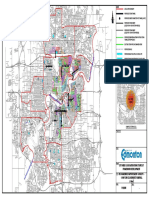

2. Geographic Impact (External) OR Organizational Impact (Internal)

Operational Definition:

This is a matrix style score, which measures the Profiles area of influence within a defined geographic

region (see Sector/Area Structure Plan map on following page) OR organizational unit coupled with % of

population of that region OR % of employees of that unit that will actually use the asset(s) in the Profile on

an annual basis.

Scoring:

% OF AREA POPN' OR ORG. UNIT USING THE ASSET/SERVICE

0-10% 11-25% 26-50% 51-75% 76-90% 91-100%

CITY or REGIONAL /

(Pop'n: 200,000 -

CORPORATION

825,000+)

3 5 6 8 9 10

(Pop'n: 50,000-200,000)

SECTOR / DEPT'

2 4 6 7 8 9

AREA OF INFLUENCE

(Popn; 5,000 - 50,000)

ASP / BRANCH

1 2 4 6 6 8

(Pop'n: 0 - 5,000)

NHBD / SECTION

0 1 2 3 4 5

Profile Attributes & Scoring Criteria April 22, 2014 -3-

Attachment 5

Examples:

1) North East Transit Garage (Organizational Impact)

This profile would score 6 points as the Area of Influence is at the Branch level and 50-75% of the

organizational unit would use this service.

2) Coronation Community Recreation Centre (with a Velodrome) (Geographic Impact)

This profile would score 3 points as the Area of Influence is at the Regional level but would only impact

0.1% of the Area Population.

3) Neighbourhood Library (Geographic Impact)

This profile would score 2 points as the Area of Influence is at the ASP level and 25% of the population

utilizes the service.

4) New Pocket Park Composite (Geographic Impact)

This (fictional) profile is proposed to build between 5-6 pocket parks throughout the City. Assuming

one pocket park per neighbourhood, and approximately 5 neighbourhoods per typical ASP, this would

qualify at the ASP Area of Influence. Assuming 10% of the population would access these parks results

in a total score of 1

Profile Attributes & Scoring Criteria April 22, 2014 -4-

Attachment 5

Profile Attributes & Scoring Criteria April 22, 2014 -5-

Attachment 5

3. Value for Money

The following three sub-categories, each with their own distinct scoring system, are grouped together to

create the Value for Money category. These sub-categories are scored based on the individual sub-

weightings assigned to them.

3.1. Change in Demand (Capacity Measure)

Operational Definition:

What is the likely increase in service demand that your profile is addressing? Note that the demand

being considered can only consider the current situation (i.e. the asset being built does not yet

exist), and the service being supplied is contributing to the Citys strategic goals. The demand

projection should consider a 10-year horizon. Note that change in demand is in excess of general

population growth (estimated at 3% annually).

Scoring Table 1:

SCORE Change in Demand for the Project (Capacity Measure)

10 Substantial Increase Profile addresses substantial increase in demand (25% or more)

7 Signification Increase Profile addresses significant increase in demand (15% - 24%)

4 Modest Increase Profile addresses modest increase in demand (5% - 14%)

1 Minimal Increase Profile addresses minimal increase in demand (1% - 4%)

Examples:

1) Yellowhead Trail Improvements

In the next 35 years, use of Yellowhead Trail is projected to double. However, so will

Edmontons overall population, therefore it would score at best a 1 (i.e. this change in demand

is not in excess of the population growth)

2) Transit Fleet Growth

Transit use has been growing on average by 5% a year, contrasted with an average population

increase of 3%. Over 10 year planning horizon, this nets to 20% increase in demand, and

therefore would score a 7.

Profile Attributes & Scoring Criteria April 22, 2014 -6-

Attachment 5

3.2. Capital or Operational Savings

Operational Definition:

The profile generates net capital or operating savings for the City. Consider process efficiency,

reductions to FTE requirements, or reductions to operating budget requirements. This can also

include cost avoidance, provided it can be clearly demonstrated, measured, and potentially

reallocated to other purposes.

Scoring Table 2:

The scoring is based on the matrix table below which looks at the %return on the capital

investment relative to the time to pay back the capital investment.

% OF RETURN ON CAPITAL INVESTMENT

0% 1-25% 26-50% 51-75% > 75%

6 - 10 YEARS 10 - 20 YEARS > 20 YEARS

0 1 2 3 4

TIME FOR PAY BACK OF CAPITAL INVESTMENT

0 3 4 6 8

0 4 6 8 9

0 - 5 YEARS

0 6 8 9 10

Examples;

1) LED Streetlights

This program includes converting all existing roadway streetlighting to LED technology

(requiring less power consumption) and the operating savings will yield a 100% return on the

capital investment within 13-17 years. Based on this assessment the program would score an 8.

2) Parking Management Technology

This program includes the equipment supply and installation to operate an automated system

for public on-street parking. The investment is expected to have efficiencies in the operation as

well as opportunities for increased revenue from enforcement. The rate of return against the

original capital investment is expected to be 100% and to occur over a period of 5 years. Based

on this assessment the program would score a 10.

Profile Attributes & Scoring Criteria April 22, 2014 -7-

Attachment 5

3.3. Levels of Service

Operational Definition:

Levels of service are parameters or combinations of parameters that reflect social, environmental,

and economic outcomes that the organization has agreed to deliver. The profile is ranked based on

the below Service and Cost chart.

Scoring Table 3:

5 The profile will allow for an increase in program service levels with a decrease in

costs.

3 The profile will allow for an increase in program service levels with maintained costs

or maintained service levels with a decrease in costs.

1 The profile will allow for an increase in program service levels with an increase in

costs or a decrease in service levels with a decrease in costs.

0 The profile will allow for maintained program service levels with maintained costs.

-3 The profile will allow for maintained program service levels an increase in costs or

decreased service levels with maintained costs.

-5 The profile will cause a decrease in program service levels with an increase in costs.

Higher Same Lower

Cost Cost Cost

Higher

Service 1 3 5

Same

Service

-3 0 3

Lower

Service

-5 -3 1

Example:

1) New Firehall

A fire hall provides higher service at a higher cost resulting in a score of 1.

Profile Attributes & Scoring Criteria April 22, 2014 -8-

Attachment 5

4. Project Readiness

Operational Definition:

Based on the 2015-2018 Capital Budget Cycle, identify which of the criteria are applicable to your profile. It

is acceptable to have an N/A in the non-asterisked criteria. *The asterisked criteria (A, C, D, F, and H)

would apply to all projects whereas the non-asterisked criteria may or may not apply. Therefore, a project

would not be penalized for criteria that have a non-applicable status.

Scoring:

10 Profile meets 89-100% of the Criteria

8 Profile meets 64-88% of the Criteria

5 Profile meets 41-63% of the Criteria

3 Profile meets 21-40% of the Criteria

1 Profile meets 13-20% of the Criteria

How many of the following criteria does the profile meet?

Enter '1' if Criteria Met

CRITERIA Enter N/A if Not Applicable

(Rows B, E and G ONLY)

A Substantive Project Plan in Place (Including Charter, construction timelines, etc)* 1

B Approvals in Place (Environmental, Historical, etc) N/A

C Internal/External Stakeholder Involvement in Place of Completed* 1

D Needs Assessment Complete* 1

E Land / Zoning in Place N/A

F Project Risk Identified & Mitigating Strategy in Place*

G Project Funding from Other Sources in Place N/A

H Operating Impact of Capital Identified* 1

% Criteria Met 80%

Points 8

Profile Attributes & Scoring Criteria April 22, 2014 -9-

Attachment 5

Example:

In this hypothetical example, as shown on the above table, Criterias B, E and G are not applicable to the

profile. Criterias A, C, D and H are applicable and a score of 1 is entered into the appropriate cell. Criteria

F could potentially apply to the project but the risk has not yet identified and there is no mitigating strategy

in place and therefore the cell is left blank. The calculations for the % criteria met are as follows:

Maximum possible number of criteria (Criteria A to H inclusive) = 8

Number of criteria applicable to the profile (Criteria A, C, D, H) = 4

Number of criteria that do not apply to the profile (Criteria B, E, G) = 3

Therefore, % Criteria met:

= # of applicable criteria divided by (possible maximum of 8 criteria minus the # of non-applicable criteria)

= 4 / (8-3) = 4/5 = 80%

The profile meets 80% of the criteria which falls within the 64-88% range in the Scoring table resulting in

the adjacent score of 8.

Profile Attributes & Scoring Criteria April 22, 2014 - 10 -

Attachment 5

5. Profile Growth & Renewal

Operational Definition:

For a profile to receive points in this category, it must be demonstrated that there is a renewal need that

must be addressed within the period in which funding is requested. If 90% or greater of the profile is for

renewal purposes, the profile is considered to be a Pure Renewal profile and is outside the scope of this

prioritization exercise and will be considered as part of the renewal allocation.

Scoring:

The scoring is based on the percentage of renewal need as demonstrated in the Scoring List below. For

example, if a Profile contains a 30% renewal component, then that profile would score a value of 4.

SCORING LIST

CRITERIA FOR SCORING 'GROWTH & RENEWAL' CATEGORY

% RENEWAL SCORE

85% - 89% 10

80% 9

75% 9 Enter % of profile

70% 8 related to

65% 8 RENEWAL

60% 7

55% 7

50% 6

45% 5 30% % of Profile related to RENEWAL

40% 5

35% 4 70% % of Profile related to GROWTH

30% 4

25% 3

20% 3

15% 2 SCORE 4

10% 2

5% 1

0% 1

Example: Hypothetical Roadway Twinning Project (where the existing two lanes require rehabilitation)

In this hypothetical example, 30% of the profile is considered to be for renewal purposes and the remaining

70% is for growth purposes. 30% Renewal needs would therefore score a 4.

Profile Attributes & Scoring Criteria April 22, 2014 - 11 -

Attachment 5

6. Strategic Alignment

Operational Definition:

The foundation for scoring Strategic Alignment is based on strategic goals and corporate outcomes as

contained in the City of Edmontons Strategic Plan, The Way Ahead. On March 26, 2014, a report to City

Council revising the Transportation goal and corporate outcomes was approved. Within The Way Ahead

are six Directional plans that provide long-term strategic direction. The profiles are evaluated based upon

the number of corporate outcomes met for each of the six Directional plans and the degree of impact (as

shown on the following table) for each outcome.

Scoring:

Impact Score Strategic Alignment Description

High 10 The profile has a significant direct impact on the corporate outcomes that can

be clearly defined and articulated and will be visible to citizens and Council at

large.

Medium 5 The profile has a moderate direct impact on the corporate outcomes that can

be clearly defined and articulated and will be visible to citizens and Council.

Low 1 The profile has a minor direct impact on the corporate outcomes that can be

clearly defined and articulated and will be visible to citizens and Council.

The criteria table for scoring Strategic Alignment is shown on the following page. The strategic goals

(Directional Plans) contained within The Way Ahead each contain a number of desired corporate outcomes.

For example, the strategic goal, Transform Edmontons Urban Form, contains two corporate outcomes;

Shift Edmontons Transportation Mode contains two corporate outcomes, and so on for a total of 12

corporate outcomes. Each of the strategic goals contributes equally to the final prorated score. It is highly

unlikely that any profile would achieve a score of 10 (the maximum) as this would mean the profile has a

high impact on all 12 corporate outcomes.

For illustration purposes, the following table shows that if all six strategic goals and their associated

corporate goals scored a 10, then each strategic goal contributes equally (1/6th of the total) to the final

prorated score. At the end of this section, the Valley LRT Line project is used to demonstrate the scoring

method.

Profile Attributes & Scoring Criteria April 22, 2014 - 12 -

Attachment 5

CRITERIA FOR SCORING 'STRATEGIC ALIGNMENT'

DOES THE PROFILE ACHIEVE THE CORPORATE SCORE PRORATED

OUTCOME? SCORE

Select YES or NO

If you answered YES then

from the

what is the degree of impact

STRATEGIC GOALS CORPORATE OUTCOMES Dropdown List

(Select Low, Medium, or

High from the Dropdown

Menu)

Transform Edmonton's Edmonton is attractive and compact.

YES High 10

Urban Form

The City of Edmonton has sustainable and 1.7

accessible infrastructure. YES High 10

Shift Edmonton's Edmontonians use public transit and active

Transportation Mode modes of transportation. YES High 10

1.7

Goods and Services move efficiently through

the city YES High 10

Improve Edmonton's Edmontonians are connected to the city in

Livability which they live, work and play. YES High 10

Edmontonians use facilities and services that

YES High 10 1.7

promote healthy living.

Edmonton is a safe city.

YES High 10

Preserve and Sustain The City of Edmonton's operations are

Edmonton's Environment environmentally sustainable. YES High 10

1.7

Edmonton is an environmentally sustainable

and resilient city. YES High 10

Ensure Edmonton's The City has a resilient financial position

Financial Sustainability YES High 10 1.7

Diversify Edmonton's Edmonton has a globally competitive and

Economy entrepreneurial business climate. YES High 10

1.7

Edmonton Region is a catalyst for industry and

business growth. YES High 10

TOTAL SCORE STRATEGIC ALIGNMENT (Max Score of 10) 10.00

Profile Attributes & Scoring Criteria April 22, 2014 - 13 -

Attachment 5

7. Corporate Operational Risk

Operational Definition:

There may be a risk to corporate operations and an impact to the City's ability to provide existing services if

the profile being considered is NOT UNDERTAKEN. Risk is determined by rating Impact and Probability and

then applying it to the scoring matrix on the following page.

Scoring Impact Table:

Impact (Consequences) Corporate Operational Risk

Disastrous A direct and measureable negative impact on multiple provisions

of service, the majority of which are in critical areas and may endanger the lives

or livelihood of citizens

Severe A direct and measureable negative impact on operations, with a

broad impact to a number of different provisions of service, with a minority

in critical areas

Substantial A externally noticeable negative impact on operations, though in non-critical areas

Moderate Some negative impact to operations, however mostly internal

Negligible Impact is small

Scoring Probability Table

Probability (Likelihood) Corporate Operational Risk

Imminent Impact may be imminent or has already occurred

Very Likely Impact likely to occur at some time within 1 year

Likely Impact likely to occur at some time within 2 years

Unlikely Impact likely to occur at some time within 4 years

Negligible Impact unlikely to occur within 10 years

Profile Attributes & Scoring Criteria April 22, 2014 - 14 -

Attachment 5

Scoring Matrix

IMPACT - CORPORATE OPERATIONAL RISK

Negligible Moderate Substantial Severe Disastrous

Very Likely Imminent 4 7 8 9 10

PROBABILITY - CORPORATE OPERATIONAL RISK

2 4 6 7 8

Likely

2 3 5 6 6

Unlikely

1 1 3 4 5

Negligible

0 1 1 2 3

Example:

1) Fire Fleet Growth

This example profile is to add additional units to the Fire Fleet to increase capacity to ensure that

there are sufficient units to keep in service at all times. The Probability is Very Likely - in essence it

has occurred in the past but is not a daily occurrence, and the Impact would be moderate with

some negative impact to operations resulting in a total score of 4.

Profile Attributes & Scoring Criteria April 22, 2014 - 15 -

Das könnte Ihnen auch gefallen

- DECL OCL Joint Letter On DC2 Density ConcernsDokument2 SeitenDECL OCL Joint Letter On DC2 Density ConcernsElise StolteNoch keine Bewertungen

- SDAB DecisionDokument17 SeitenSDAB DecisionElise StolteNoch keine Bewertungen

- NAIOP Tax Comparision ReportDokument13 SeitenNAIOP Tax Comparision ReportElise StolteNoch keine Bewertungen

- IAEA Access Without Fear ResponseDokument3 SeitenIAEA Access Without Fear ResponseElise StolteNoch keine Bewertungen

- Response From OPIC On Yellowhead Trail Land Acquisition ListsDokument6 SeitenResponse From OPIC On Yellowhead Trail Land Acquisition ListsElise StolteNoch keine Bewertungen

- ICE Phase 2 Open House BoardsDokument16 SeitenICE Phase 2 Open House BoardsElise StolteNoch keine Bewertungen

- Metro Line LRT Signalling Bid Evaluations and IntroductionDokument66 SeitenMetro Line LRT Signalling Bid Evaluations and IntroductionElise StolteNoch keine Bewertungen

- City Ruling On FOIP Request For Valley Line LRTDokument2 SeitenCity Ruling On FOIP Request For Valley Line LRTElise StolteNoch keine Bewertungen

- RFEOI 932733 Exhibition LandsDokument10 SeitenRFEOI 932733 Exhibition LandsElise StolteNoch keine Bewertungen

- City Manager Remarks To Audit CommitteeDokument4 SeitenCity Manager Remarks To Audit CommitteeElise Stolte100% (1)

- Edmonton Mayor Lobbies The Province For Green Energy FinancingDokument2 SeitenEdmonton Mayor Lobbies The Province For Green Energy FinancingElise StolteNoch keine Bewertungen

- Infill - Greenfield ComparisonDokument1 SeiteInfill - Greenfield ComparisonElise StolteNoch keine Bewertungen

- Jasper Avenue DesignDokument1 SeiteJasper Avenue DesignElise StolteNoch keine Bewertungen

- Scenario 3Dokument1 SeiteScenario 3Elise StolteNoch keine Bewertungen

- CreekWatch Annual Report - 2016Dokument33 SeitenCreekWatch Annual Report - 2016Elise StolteNoch keine Bewertungen

- Hockey Canada Letter Re: Edmonton ColiseumDokument2 SeitenHockey Canada Letter Re: Edmonton ColiseumAnonymous TdomnV9OD4Noch keine Bewertungen

- Draft Recommendations From The Citizens Panel On Winter Road MaintenanceDokument11 SeitenDraft Recommendations From The Citizens Panel On Winter Road MaintenanceElise StolteNoch keine Bewertungen

- Hardisty Too - Restrictive CovenantDokument16 SeitenHardisty Too - Restrictive CovenantElise StolteNoch keine Bewertungen

- Community Speed Limit Reduction Process - Procedure AmendmentDokument2 SeitenCommunity Speed Limit Reduction Process - Procedure AmendmentElise StolteNoch keine Bewertungen

- Mainstreet - Edmonton October PDFDokument11 SeitenMainstreet - Edmonton October PDFElise StolteNoch keine Bewertungen

- School Community PlanDokument5 SeitenSchool Community PlanElise StolteNoch keine Bewertungen

- Request For ReviewDokument7 SeitenRequest For ReviewElise StolteNoch keine Bewertungen

- Edmonton's New Civic DepartmentsDokument2 SeitenEdmonton's New Civic DepartmentsElise StolteNoch keine Bewertungen

- End Poverty RoadmapDokument66 SeitenEnd Poverty RoadmapElise StolteNoch keine Bewertungen

- EPL - Milner - Imagine What's PossibleDokument12 SeitenEPL - Milner - Imagine What's PossibleElise Stolte100% (1)

- City of Edmonton Affordable Housing StrategyDokument26 SeitenCity of Edmonton Affordable Housing StrategyElise StolteNoch keine Bewertungen

- Should Neighbourhood Flood Prediction Maps Be Public?Dokument4 SeitenShould Neighbourhood Flood Prediction Maps Be Public?Elise StolteNoch keine Bewertungen

- Matt Lindsay's $1,100 Uber ReceiptDokument2 SeitenMatt Lindsay's $1,100 Uber ReceiptElise StolteNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Notice: Report On The Performance of Drug and Biologics Firms in Conducting Postmarketing Commitment Studies AvailabilityDokument3 SeitenNotice: Report On The Performance of Drug and Biologics Firms in Conducting Postmarketing Commitment Studies AvailabilityJustia.comNoch keine Bewertungen

- Oligopoly Practice QuestionsDokument2 SeitenOligopoly Practice QuestionsanirudhjayNoch keine Bewertungen

- Principal Administrative OfficerDokument3 SeitenPrincipal Administrative OfficerRashid BumarwaNoch keine Bewertungen

- Restrictive Covenant Validity UpheldDokument1 SeiteRestrictive Covenant Validity Upheldhappyreader32434Noch keine Bewertungen

- Industrial Enterprises v. CADokument6 SeitenIndustrial Enterprises v. CADessa ReyesNoch keine Bewertungen

- Waste Recover and Disposal RecordsDokument28 SeitenWaste Recover and Disposal RecordsRofel CagasNoch keine Bewertungen

- MGT 212 Appraising Foreign MarketsDokument26 SeitenMGT 212 Appraising Foreign MarketsjazonvaleraNoch keine Bewertungen

- Concept of Social JusticeDokument10 SeitenConcept of Social Justiceanchal1987100% (1)

- The Global Diamond Industry: So-Young Chang MBA '02Dokument17 SeitenThe Global Diamond Industry: So-Young Chang MBA '02Pratik KharmaleNoch keine Bewertungen

- Liability in ContractDokument3 SeitenLiability in ContractShivon RajNoch keine Bewertungen

- MBA Banking and Financial Institutions Course OutlineDokument3 SeitenMBA Banking and Financial Institutions Course Outlinechitu1992Noch keine Bewertungen

- Ra 7076Dokument5 SeitenRa 7076Jha NizNoch keine Bewertungen

- H.E. Heacock Vs MacondrayDokument2 SeitenH.E. Heacock Vs MacondrayRea Nina OcfemiaNoch keine Bewertungen

- This Study Resource Was: Lecture NotesDokument9 SeitenThis Study Resource Was: Lecture NotesKristine Lirose BordeosNoch keine Bewertungen

- Saint Paul School of Business and Law Accounting 17ND Final ExamDokument14 SeitenSaint Paul School of Business and Law Accounting 17ND Final ExamKristinelle AragoNoch keine Bewertungen

- CBR ProcterGamble 06Dokument2 SeitenCBR ProcterGamble 06Kuljeet Kaur ThethiNoch keine Bewertungen

- Land LAW II 7th SemseterDokument17 SeitenLand LAW II 7th SemseterKumar YoganandNoch keine Bewertungen

- Chemical - Regulations in India PDFDokument50 SeitenChemical - Regulations in India PDFSANDAMARNoch keine Bewertungen

- 2014 3M Annual ReportDokument132 Seiten2014 3M Annual ReportRitvik SadanaNoch keine Bewertungen

- Uber Lawsuit Against SeattleDokument29 SeitenUber Lawsuit Against Seattleahawkins8223Noch keine Bewertungen

- CPM Efe PDFDokument3 SeitenCPM Efe PDFAzenith Margarette CayetanoNoch keine Bewertungen

- Notice: Banks and Bank Holding Companies: Change in Bank ControlDokument1 SeiteNotice: Banks and Bank Holding Companies: Change in Bank ControlJustia.comNoch keine Bewertungen

- PD 1445Dokument36 SeitenPD 1445Eric VillaNoch keine Bewertungen

- Women N Law ProjectDokument14 SeitenWomen N Law ProjectShubhankar ThakurNoch keine Bewertungen

- CIR v. Bicolandia DrugDokument4 SeitenCIR v. Bicolandia DrugMariano RentomesNoch keine Bewertungen

- PPM SampleDokument61 SeitenPPM SamplePro Business Plans50% (2)

- Signed Order Confirming Plan For ScribdDokument10 SeitenSigned Order Confirming Plan For ScribdNorma OrtizNoch keine Bewertungen

- Legal Study PWDDokument363 SeitenLegal Study PWDlalunebleueNoch keine Bewertungen

- What Is NACE and NORSOK Renown Engineering LTDDokument2 SeitenWhat Is NACE and NORSOK Renown Engineering LTDjr_satish6965Noch keine Bewertungen

- 01-23 QCS 2014Dokument12 Seiten01-23 QCS 2014Raja Ahmed HassanNoch keine Bewertungen