Beruflich Dokumente

Kultur Dokumente

Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)

Hochgeladen von

Shyam SunderOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

Date: February 9, 2017

To,

To, BSE Limited,

National Stock Exchange of India Limited, The Department of Corporate Services

Listing Department, Department of Corporate Services

Exchange Plaza, Mumbai 400 001

Bandra (E), Mumbai 400 051

Ref: Scrip Code: 533156

Ref Symbol: VASCONEQ

Subject: Outcome of the Meeting

Dear Sir/ Madam

Please find attached outcome of the meeting of Board of Directors of Vascon Engineers Limited,

commenced at 11.00 a .m and concluded at 1.00 p.m. on February 9, 2017.

Request you to take the same on record.

Thank you.

For Vascon Engineers Limited,

Digitally signed by MUTHUSWAMY KRISHNAMURTHI

DN: c=IN, o=Personal , CID - 4422262,

MUTHUSWAMY 2.5.4.20=3d73fbc0362b7e511daa9f8f0bf706ea3067c8

9f0ff76daf98f82452debc1648, postalCode=411014,

st=Maharashtra,

KRISHNAMURTHI serialNumber=6d8963e34b786f3f6f548ff260c8665f0d

c59c80d802c84993387b2efcc85aed,

cn=MUTHUSWAMY KRISHNAMURTHI

M. Krishnamurthi

Date: 2017.02.09 13:02:15 +05'30'

Company Secretary & Compliance Officer

Enclosures: As above

This document is signed electronically

Date: February 9, 2017

To, To,

National Stock Exchange of India Limited, BSE Limited,

Listing Department, The Department of Corporate Services

Exchange Plaza, Department of Corporate Services

Bandra (E), Mumbai 400 051 Mumbai 400 001

Ref Symbol: VASCONEQ Ref: Scrip Code: 533156

Subject: Outcome of the Board Meeting of Vascon Engineers Limited held on February 9,

2017.

Dear Sir/ Madam,

The Board of Directors of Vascon Engineers Limited, in their meeting commenced at 11.00 a .m and

concluded at 1.00 p.m. on February 9, 2017 have discussed and approved the following:

1. Approved and taken on record Unaudited Standalone Financial Results (reviewed) of the

Company for the quarter ended December 31, 2016, as per the format prescribed under

Regulation 33 SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015

(LODR) along with limited review report from Auditors. (As enclosed).

This is for your information and records.

Thanking you,

Yours faithfully,

For Vascon Engineers Limited,

Digitally signed by MUTHUSWAMY KRISHNAMURTHI

DN: c=IN, o=Personal , CID - 4422262,

MUTHUSWAMY 2.5.4.20=3d73fbc0362b7e511daa9f8f0bf706ea3067c89f

0ff76daf98f82452debc1648, postalCode=411014,

st=Maharashtra,

KRISHNAMURTHI serialNumber=6d8963e34b786f3f6f548ff260c8665f0dc5

9c80d802c84993387b2efcc85aed, cn=MUTHUSWAMY

KRISHNAMURTHI

Date: 2017.02.09 13:01:57 +05'30'

M. Krishnamurthi

Company Secretary & Compliance Officer

This document is signed electronically

. Vascon Engineers Limited

CIN: L70100MH1986PLC038511

.

Registered Office: 15/16, Hazari Baug, LBS Marg, Vikhroli (West}, Mumbai- 400083

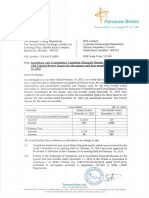

STATEMENT OF UNAUDITED STANDALONE FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED 31ST DECEMBER, 2016

(Rs. In Lakhs}

STANDALONE

Quarter Ended Nine Months

Sr. No. PARTICULARS Dec 31,2015 Dec 31, 2015

Dec 31,2016 Sep 30,2016 Dec 31,2016

(Refer Note 7} (Refer Note 7}

(Unaudited} (Unaudited} (Unaudited} (Unaudited) (Unaudited}

1 Income from operations

a) Net Sales I Income from Operations 4,790 5,198 7,053 14,860 23,242

b) Other Ope~ating Income 203 94 306 1,052 1,171

Total Income from operations (net) 4,993 5,292 7,359 15,912 24,413

2 Expenses

a) Construction Expenses I Cost of materials consumed 4,029 4,167 5,557 12,309 18,017

b) Purchase of stock- in- trade - - - 1 -

c) Changes of inventories of finished goods, work in progress and stock- (234) (277) (166) (1016) 260

in-trade

d) Employees benefits expenses 873 704 (186) 2,425 1,894

e) Depreciation and amortisation expenses 167 195 196 546 592

f) Other expenses 779 424 694 1,688 2,086

Total Expenses 5,614 5,213 6,095 15,953 22,849

3 Profit from Operations before Other Income, Finance costs and (621) 79 1,264 (41} 1,564

Exceptional Items (1-2}

4 Other Income 1,439 991 778 2,859 2,238

5 Profit from ordinary activities before Finance costs and Exceptional 818 1,070 2,042 2,818 3,802

Items (3+4)

6 Finance costs 799 747 604 2,319 2,864

7 Profit from ordinary activities after Finance costs but before 19 323 1438 499 938

Exceptional Items (5-6}

8 Exceptional items - - - - -

9 Profit from Ordinary Activities before tax (7+8} 19 323 1438 499 938

10 Tax Expenses - 236 1 236 3

11 N~t Profit from Ordinary Activities after tax (9-10} 19 87 1437 263 935

12 Extraordinary Items - - - - -

13 Net Profit for the period (11-12} 19 87 1437 263 935

14 Other Comprehensive Income (OCI) 17 5 3 46 (1)

15 Total comprehensive income (13+14} 36 92 1440 309 934

16 Paid-up Equity Share Capital (Face Value Rs . 10/- per share) 16,134 16,134 16,131 16,134 16,131

17 Earnings Per Share (EPS)

a) Basic EPS (in Rs.) (Not Annualised) 0.01 0 .05 0.90 0.16 0.70

b) Diluted EP5(in Rs.) (Not Annualised) 0.01 0.05 0.89 0.16 0.69

~

Segment wise Revenue, Results, Assets and Liabilities for the quarter and nine months ended 31st December, 2016

Quarter Ended Nine Months

Dec 31, Dec 31,

Particulars Dec 31,2016 Sep 30,2016 2015(Refer Dec 31,2016 2015(Refer Note

Note 7) 7)

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

1. Segment Revenue

EPC (Engineering, Procurement and Construction) 4,600 4,846 6,334 14,107 20,712

Real Estate Development 393 446 1,025 1,805 3,701

Total 4,993 5,292 7,359 15,912 24,413

Quarter Ended Nine Months

Dec 31, Dec31,

Particulars Dec 31,2016 Sep 30,2016 2015(Refer Dec 31,2016 201S(Refer Note

Note 7} 7)

(Unaudited) {Unaudited) {Unaudited) (Unaudited) (Unaudited)

2. Segment Results

EPC (Engineering, Procurement and Construction) 1,845 1,312 866 4,198 4,283

Real Estate Development 98 59 397 654 787

Subtotal 1,943 1,371 1,263 4,852 5,070

Less: Interest (799) (747) (604) (2,319) (2,864)

Other Unallocable expenditure net off Unallocable income (1,125) (301) 779 (2,034) (1,2681

Total Profit I (Loss) before Tax 19 323 1,438 499 938

Quarter Ended Nine Months

Dec31, Dec 31,

Particulars Dec 31,2016 Sep 30,2016 ZOlS(Refer Dec 31,2016 2015(Refer Note

NntA 71 71

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

3. Segment Assets and Liabilities

Segments Assets

EPC (Engineering, Procurement and Construction) 22,372 23,641 23,488 22,372 23,488

Real Estate Development 50,165 49,274 48,067 50,165 48,067

Unallocable 40,139 42,130 42,192 40,139 42,192

Total 1,12,676 1,15,045 1,13,747 1,12,676 1,13,747

Segments Liabilities

EPC (Engineering, Procurement and Construction) 12,151 15,158 12,751 12,151 12,751

Real Estate Development 12,481 12,381 13,417 12,481 13,417

Unallocable 88,044 87,506 87,579 88,044 87,579

Total 1,12,676 1,15,045 1,13,747 1,12,676 1,13,747

Notes

1. Ihe above financial results have been reviewed by the Audit Committee and approved by the Board of Directors of the Company at its meeting held on 9th

February, 2017.

2.The financial results of the Company have been prepared in accordance with Indian Accounting Standards (lnd AS) notified under the Compan ies (Indian

Accounting Standard) Rules, 201S as amended by the Companies (Indian Accounting Standards) (Amendment) Rules 2016. The Company adopted lnd AS from 1st

April 2016, and accordingly, these financial statements (including for all the periods presented in accordance with lnd AS 101 - First-time Adoption of Indian

Accounting Standards) have been prepared in accordance with the recognition and measurement principles in lnd AS 34- Interim Financial Reporting, prescribed

under Section 133 of the Companies Act, 2013 read with the relevant rules issued thereunder and the other accounting principles generally accepted in India.

3.The format for unaudited quarterly results as prescribed in SEBI'S circular CIR/CFD/CMD/7S/2015 dated 30th November 2015 has been modified to comply with

requirements of SEBI's circular dated 5th July 2016, lnd AS and Schedule Ill to the companies Act, 2013.

4. For the purpose of Standalone Results, the Company has identified in line with lnd AS 108 "Operating Segments", into two primary reporting business segments

as follows:

a) Engineering, Procurement and Construction (EPC)

b) Real Estate Development

5. The reconciliation of net profit recorded in accordance with previous Indian GAAP to total comprehensive income in accordance with lnd AS is given below:

Rsinlakhs

For the quarter For the Nine

Particulars ended Months ended

Dec 31,2015 Dec 31,2015

Net Profit as per previous Indian GAAP 1,287 494

Reclassification of actuarial gains I losses, arising in respect of

employee benefit schemes to Other Comprehensive Income (OCI) (3) 1

Non amortisation of investment in partnership firm 80 229

Net impact of measuring financial assets and financial liabilities at

67 199

amortized cost

Effect of fair valuation of financial guarantee premium 7 20

Impact of recognising the. cost of the employee stock option scheme

at fair value

- (8)

Net Profit as per lnd AS 1,437 935

Other Comprehensive Income 3 (1)

Total Comprehensive Income as per lnd AS 1,440 934

6.Pursuant to the approval of the Right Issue Committee of the Board of Directors dated 1st August, 2015, the Company approved the allotment of 6,66,66,666

equity shares of face value of Re .10 each at a price of Rs. 15 per equity share (including share premium of Rs. 5 per equity share) for an amount not exceeding Rs

10000 lakhs to the existing equity shareholders of the.Company on rights basis in the ratio of 14 equity shares for every 19 equity shares held by equity shareholders

under chapter IV of the SEBIICDR Regulations and provisions of all other applicable laws and regulations.

Rsinlakhs

Actual

Amounts to be

Particulars utilization till

utilized

Dec 31,2016

Repayment/ pre-payment, in full or part, of certain identified loans

6,200 6,200

availed by our Company

Finance the construction of our Ongoing Projects 2,800 2,550

General corporate purposes and Issue Expenses 1,000 1,000

Total 10,000 9,750

The balance unutilized amount had been temporarily deployed in fixed deposits with banks.

7. The lnd AS compliant financial results, pertaining to the quarter and nine months ended 31st Dec, 2015 have not been subjected to limited review or audit.

However, the management has exercised necessary due diligence to ensure that the financial results provide a true and fair view of its affairs.

8. There is a possibility that these quarterly financial results may require adjustments before constituting the finallnd AS financial statements as of and for the year

ending March 31, 2017 due to change in financial reporting requirements arising from new or revised standards or interpretations issued by MCA f ICAI or changes

in the use of one or more optional exemptions from full retrospective application of certain lnd AS as permitted under lnd AS 101.

9. During the current quarter ended December 31, 2016, the Company has sold its stake in Viorica Hotels Private Limited for a consideration of Rs. 1,560 Lakhs, the

transaction resulted in a loss of Rs. 863 lakhs. Since Rs . 561lakhs was provided for in earlier years, balance loss of Rs. 302 Lakhs has been accounted for in current

quarter.

10. The figures for the corresponding period have been regrouped and rearranged wherever necessary to make them comparable .

Place: Pune

Date: February 9, 2017

By r

Ole; th, oard of Directors

~~Y R. Vasudevan

Das könnte Ihnen auch gefallen

- Economic Indicators for South and Central Asia: Input–Output TablesVon EverandEconomic Indicators for South and Central Asia: Input–Output TablesNoch keine Bewertungen

- Economic Indicators for Eastern Asia: Input–Output TablesVon EverandEconomic Indicators for Eastern Asia: Input–Output TablesNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument7 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument10 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Reg30LODR AuditReport 31dec2019Dokument13 SeitenReg30LODR AuditReport 31dec2019Shreerangan ShrinivasanNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Can Fin Home Out Come of BM 21012021Dokument13 SeitenCan Fin Home Out Come of BM 21012021Ravi KNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- UIP-V-' ..: Tomorrow's Solutions TodayDokument12 SeitenUIP-V-' ..: Tomorrow's Solutions Todaysayantan.astrologerNoch keine Bewertungen

- Hdeil: Steel Strips WheelsDokument3 SeitenHdeil: Steel Strips WheelsSiddharth ShekharNoch keine Bewertungen

- JIL Results 31122022Dokument12 SeitenJIL Results 31122022shalini15_85Noch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report, Results Investor Release For December 31, 2016 (Result)Dokument10 SeitenStandalone & Consolidated Financial Results, Limited Review Report, Results Investor Release For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q3 Results (Standalone) & Results Press Release For The Quarter Ended December 31, 2016 (Result)Dokument5 SeitenAnnounces Q3 Results (Standalone) & Results Press Release For The Quarter Ended December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Kesarp .... Tro Roducrslimiied: Dear SirDokument4 SeitenKesarp .... Tro Roducrslimiied: Dear Sirmd zafarNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Bse Scrip Code: 500249 Nse Symbol: KSBDokument11 SeitenBse Scrip Code: 500249 Nse Symbol: KSBSushant KanadeNoch keine Bewertungen

- Q2FY22 ResultsDokument16 SeitenQ2FY22 ResultsrohitnagrajNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- 500 1000 Imo Result 20230215Dokument12 Seiten500 1000 Imo Result 20230215Contra Value BetsNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- ab2bee9c-826b-4dac-94a7-881be49a1c26Dokument8 Seitenab2bee9c-826b-4dac-94a7-881be49a1c26catgadhaNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- RP-Sanjiv Goenka Group: Growing LegaciesDokument10 SeitenRP-Sanjiv Goenka Group: Growing Legaciessouvik dasguptaNoch keine Bewertungen

- 400008-20221109 Reg30LODR - AnnualResults - LRReport - Sep2022Dokument3 Seiten400008-20221109 Reg30LODR - AnnualResults - LRReport - Sep2022AnveshNoch keine Bewertungen

- Sarda: Corporate Jeejeebhoy Exchange Exchange Complex (E)Dokument4 SeitenSarda: Corporate Jeejeebhoy Exchange Exchange Complex (E)Anonymous 6jagNym706Noch keine Bewertungen

- Swastivinayalg,': Synthetics LimitedDokument4 SeitenSwastivinayalg,': Synthetics LimitedAmrut BhattNoch keine Bewertungen

- Rectified Financial Results For The Period Ended December 31, 2016 (Result)Dokument5 SeitenRectified Financial Results For The Period Ended December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument7 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Quick ResultsDokument10 SeitenQuick Resultsamibro miueNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Fajarbaru Builder Group BHDDokument5 SeitenFajarbaru Builder Group BHDShungchau WongNoch keine Bewertungen

- KILAnnualReport2020 2021Dokument224 SeitenKILAnnualReport2020 2021rkumar_81Noch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Annual Results Mar17Dokument5 SeitenAnnual Results Mar17bbaalluuNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Statement of Title To The Lands of Ballyogloghs in The County of AntrimDokument6 SeitenStatement of Title To The Lands of Ballyogloghs in The County of AntrimNevinNoch keine Bewertungen

- AtcpDokument2 SeitenAtcpnavie VNoch keine Bewertungen

- HDFC - Annual Report 2010Dokument196 SeitenHDFC - Annual Report 2010Sagari KiriwandeniyaNoch keine Bewertungen

- Mutual FundsDokument36 SeitenMutual FundsRavindra BabuNoch keine Bewertungen

- Branding & Promotional Article On 'Bank of Ceylon'.Dokument3 SeitenBranding & Promotional Article On 'Bank of Ceylon'.Umi MariamNoch keine Bewertungen

- Close CorporationDokument6 SeitenClose CorporationMike E Dm0% (1)

- Tally Ledger List in Excel FormatDokument12 SeitenTally Ledger List in Excel FormatHimanshu Patel50% (2)

- Jesko Fezer - Housing After The Neoliberal Turn International Case StudiesDokument124 SeitenJesko Fezer - Housing After The Neoliberal Turn International Case StudieslikethecityNoch keine Bewertungen

- CREDO PresentationDokument23 SeitenCREDO PresentationPampalini01Noch keine Bewertungen

- Jenburkt Research 03012011Dokument49 SeitenJenburkt Research 03012011equityanalystinvestorNoch keine Bewertungen

- Banking Services Online and OfflineDokument39 SeitenBanking Services Online and Offlineonkarskulkarni0% (1)

- Validus Lawsuit Against Transatlantic HoldingsDokument61 SeitenValidus Lawsuit Against Transatlantic HoldingsDealBookNoch keine Bewertungen

- Wilson Dennis Colberg Trigo - FINRA BrokerCheck ReportDokument28 SeitenWilson Dennis Colberg Trigo - FINRA BrokerCheck ReportvernonhealylawNoch keine Bewertungen

- Basic Cash Formulas Manual April 2009 - 2.8Dokument123 SeitenBasic Cash Formulas Manual April 2009 - 2.8horns2034Noch keine Bewertungen

- Safekeeping of Valuables and Certification of Value: Rose - Chapter 01 #1Dokument20 SeitenSafekeeping of Valuables and Certification of Value: Rose - Chapter 01 #1Lê Chấn PhongNoch keine Bewertungen

- Crisil Sme Connect Aug12 PDFDokument60 SeitenCrisil Sme Connect Aug12 PDFSK Business groupNoch keine Bewertungen

- Sirisha 1234 PDFDokument54 SeitenSirisha 1234 PDFAMAR NATHNoch keine Bewertungen

- Mergers and AcquisitionsDokument23 SeitenMergers and AcquisitionsArjun JunejaNoch keine Bewertungen

- Project of ITC LTDDokument97 SeitenProject of ITC LTDRavi BarotNoch keine Bewertungen

- Vinu New ProjectDokument87 SeitenVinu New ProjectRajesh RajiNoch keine Bewertungen

- Zim Asset SummaryDokument5 SeitenZim Asset SummarySolomon ZindomaNoch keine Bewertungen

- MATH4512 - Topic - 1 Duration Bond MatchingDokument110 SeitenMATH4512 - Topic - 1 Duration Bond MatchingKennyNoch keine Bewertungen

- Value at Risk ProjectDokument10 SeitenValue at Risk Projectsankalanhazra100% (1)

- Sez ActDokument5 SeitenSez ActTapasya KabraNoch keine Bewertungen

- ARK Invest 052919 Whitepaper DI-Why-NowDokument12 SeitenARK Invest 052919 Whitepaper DI-Why-NowSam Kei100% (1)

- Revival and Rehabilitation of Sick Companies (Companies Act 2013)Dokument10 SeitenRevival and Rehabilitation of Sick Companies (Companies Act 2013)Chiramel Mathew SimonNoch keine Bewertungen

- Maf5102 Fa Cat 2 2018Dokument4 SeitenMaf5102 Fa Cat 2 2018Muya KihumbaNoch keine Bewertungen

- AXA Art Market StudyDokument14 SeitenAXA Art Market StudyGabriela GKNoch keine Bewertungen

- Reliance Life InsuranceDokument89 SeitenReliance Life InsuranceGaurav2853090% (10)

- HECO-NextEra DecisionDokument410 SeitenHECO-NextEra DecisionHawaii News NowNoch keine Bewertungen