Beruflich Dokumente

Kultur Dokumente

Intel Corporation Q2 2010 Earnings Review: ATF Capital

Hochgeladen von

Andre SetiawanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Intel Corporation Q2 2010 Earnings Review: ATF Capital

Hochgeladen von

Andre SetiawanCopyright:

Verfügbare Formate

ATF capital Stock Focus

Intel Corporation Q2 2010 Earnings Review

Highlights from the Company’s website:

Net Income at $2.9 billion, +175% (y/y);

EPS of $0.51 per share, +183% (y/y);

Revenue at $10.8 billion, +34% (y/y);

Operating Income $4.0 billion, +177% (y/y);

Gross Margin at 67%;

PC and server segments are expected to continue increasing in the foreseeable future;

Projections for Q3 & Full Year 2010:

Revenue at $11.6 billion, plus or minus $400 million (Q3’10);

Gross margin at 67%, plus or minus a couple percentage points (Q3’10), 66% (FY 2010);

R&D plus MG&A spending approximately at $3.2 billion (Q3’10) and to increase to $12.7 billion (FY 2010)

plus or minus $100 million;

Tax rate will be about 32% for the third and fourth quarters;

Capital spending: $5.2 billion, plus or minus $200 million (FY 2010), up from previous expectations of $4.8

billion, plus or minus $100 million.

Review

Intel’s share price was at $21.00 (+2.09%) during the market close but before the earnings report was

released;

The Q2 2010’s result was the best quarterly result in the company’s history;

Asia-Pacific remained as the main contributor (57%) towards Intel’s overall revenue, followed by Americas

at 20%, and Europe (12%) and finally Japan (11%). Europe’s contributions declined from 14% (Q1 2010) to

12% while Americas’ increased 2% from 18% to 20%, which is likely caused by the recent crisis in Europe.

PC Client Group remained as the top contributor as microprocessor revenue jumped to $6,155 million,

sending the total revenue from PC Client Group amounted to 72.8%. Data Center Group contributed to

19.6% of Intel’s total net revenue, and other Intel Architecture groups contributed 3.8%.

Technical Analysis

Intel broke through the trendline resistance and settled at $21.01 by the end of Tuesday. It went back above its 200-day

EMA ($20.60) and also towards $20.90 EMA (50). It is now climbing towards the next resistance at $21.12 and $21.70.

Beyond the latter, resistance will be found at $22.30. Intel’s MACD also suggests for more upside potential. Supports are to

be found around the EMA200 at $20.60. BUY dip towards $20.60 and $20.90 with risk set at 20.00 and target set at $21.70,

$22.30 and $23.00. After-hours trade had set Intel up towards $22.49 or an additional 7.04% above the closing price. This

puts the objective directly at $23.00 and then $24.22 (the highest point since the 2008 crisis).

July 14th 2010 Page 1

ATF capital Stock Focus

July 14th 2010 Page 2

ATF capital Stock Focus

FINANCIAL STATEMENTS

INTEL CORPORATION

CONSOLIDATED SUMMARY STATEMENT OF OPERATIONS DATA

(In millions, except per share amounts)

Three Months Ended Six Months Ended

June 26, June 27, June 26, June 27,

2010 2009 2010 2009

NET REVENUE $ 10,765 $ 8,024 $ 21,064 $ 15,169

Cost of sales 3,530 3,945 7,300 7,852

GROSS MARGIN 7,235 4,079 13,764 7,317

Research and development 1,666 1,303 3,230 2,620

Marketing, general and administrative 1,584 1,248 3,098 2,446

R&D AND MG&A 3,250 2,551 6,328 5,066

European Commission fine - 1,447 - 1,447

Restructuring and asset impairment charges - 91 - 165

Amortization of acquisition-related intangibles 4 2 7 4

OPERATING EXPENSES 3,254 4,091 6,335 6,682

OPERATING INCOME (LOSS) 3,981 -12 7,429 635

Gains (losses) on equity investments, net 193 -69 162 -182

Interest and other, net 11 31 40 126

INCOME (LOSS) BEFORE TAXES 4,185 -50 7,631 579

Provision for taxes 1,298 348 2,302 348

NET INCOME (LOSS) $ 2,887 $ (398.00) $ 5,329 $ 231.00

BASIC EARNINGS (LOSS) PER COMMON SHARE $ 0.52 $ (0.07) $ 0.96 $ 0.04

DILUTED EARNINGS (LOSS) PER COMMON SHARE $ 0.51 $ (0.07) $ 0.94 $ 0.04

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING:

BASIC 5,563 5,595 5,546 5,584

DILUTED 5,711 5,595 5,696 5,656

July 14th 2010 Page 3

ATF capital Stock Focus

INTEL CORPORATION

CONSOLIDATED SUMMARY BALANCE SHEET DATA

(In millions)

June 26, March 27, Dec. 26,

2010 2010 2009

CURRENT ASSETS

Cash and cash equivalents $ 5,514 $ 4,988 $ 3,987

Short-term investments 6,715 5,927 5,285

Trading assets 6,074 5,427 4,648

Accounts receivable, net 2,430 2,192 2,273

Inventories:

Raw materials 407 464 437

Work in process 1,637 1,473 1,469

Finished goods 1,301 1,049 1,029

3,345 2,986 2,935

Deferred tax assets 1,206 1,423 1,216

Other current assets 1,180 781 813

TOTAL CURRENT ASSETS 26,464 23,724 21,157

Property, plant and equipment, net 16,946 17,028 17,225

Marketable equity securities 916 926 773

Other long-term investments 3,947 4,326 4,179

Goodwill 4,481 4,452 4,421

Other long-term assets 4,937 5,317 5,340

TOTAL ASSETS $ 57,691 $ 55,773 $ 53,095

CURRENT LIABILITIES

Short-term debt $ 215 $ 330 $ 172

Accounts payable 2,126 1,912 1,883

Accrued compensation and benefits 1,962 1,377 2,448

Accrued advertising 958 843 773

Deferred income on shipments to distributors 582 653 593

Income taxes payable - 916 86

Other accrued liabilities 2,094 2,881 1,636

TOTAL CURRENT LIABILITIES 7,937 8,912 7,591

Long-term income taxes payable 174 174 193

Long-term debt 2,058 2,052 2,049

Long-term deferred tax liabilities 586 707 555

Other long-term liabilities 1,095 1,028 1,003

Stockholders' equity:

Preferred stock - - -

Common stock and capital in excess of par value 15,741 15,466 14,993

Accumulated other comprehensive income (loss) 231 414 393

Retained earnings 29,869 27,020 26,318

TOTAL STOCKHOLDERS' EQUITY 45,841 42,900 41,704

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 57,691 $ 55,773 $ 53,095

July 14th 2010 Page 4

ATF capital Stock Focus

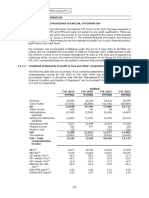

INTEL CORPORATION

SUPPLEMENTAL FINANCIAL AND OTHER INFORMATION

(In millions)

Q2 2010 Q1 2010 Q2 2009

GEOGRAPHIC REVENUE:

Asia-Pacific $6,166 $5,888 $4,409

57% 57% 55%

Americas $2,173 $1,906 $1,698

20% 18% 21%

Europe $1,294 $1,404 $1,153

12% 14% 14%

Japan $1,132 $1,101 $764

11% 11% 10%

CASH INVESTMENTS:

Cash and short-term investments $12,229 $10,915 $9,021

Trading assets - marketable debt securities (1) 5,543 5,427 2,284

Total cash investments $17,772 $16,342 $11,305

TRADING ASSETS:

Trading assets - equity securities (2) $531 - $319

Total trading assets - sum of 1+2 $6,074 $5,427 $2,603

SELECTED CASH FLOW INFORMATION:

Depreciation $1,086 $1,080 $1,211

Share-based compensation $232 $248 $258

Amortization of intangibles $63 $61 $75

Capital spending ($1,048) ($928) ($981)

Investments in non-marketable equity instruments ($100) ($69) ($83)

Proceeds from sales of shares to employees, tax benefit & other

$218 $230 $1

Dividends paid ($877) ($870) ($784)

Net cash received/(used) for divestitures/acquisitions ($33) ($37) -

EARNINGS PER COMMON SHARE INFORMATION:

Weighted average common shares outstanding - basic 5,563 5,529 5,595

Dilutive effect of employee equity incentive plans 96 101 -

Dilutive effect of convertible debt 52 51 -

Weighted average common shares outstanding - diluted 5,711 5,681 5,595

STOCK BUYBACK:

Cumulative shares repurchased (in billions) 3.4 3.4 3.3

Remaining dollars authorized for buyback (in billions) $5.7 $5.7 $7.4

OTHER INFORMATION:

Employees (in thousands) 80.4 79.9 80.5

July 14th 2010 Page 5

ATF capital Stock Focus

INTEL CORPORATION

SUPPLEMENTAL OPERATING GROUP RESULTS

($ in millions)

Three Months Ended Six Months Ended

Q2 2010 Q2 2009 Q2 2010 Q2 2009

Net Revenue

PC Client Group

Microprocessor revenue $ 6,155 $ 4,567 $ 12,068 $ 8,816

Chipset, motherboard and other revenue 1,684 1,432 3,445 2,544

7,839 5,999 15,513 11,360

Data Center Group

Microprocessor revenue 1,797 1,208 3,349 2,220

Chipset, motherboard and other revenue 317 276 636 528

2,114 1,484 3,985 2,748

Other Intel Architecture groups 417 328 792 654

Intel Architecture group revenue 10,370 7,811 20,290 14,762

Other operating groups 386 172 755 321

Corporate 9 41 19 86

TOTAL NET REVENUE $ 10,765 $ 8,024 $ 21,064 $ 15,169

Operating income (loss)

PC Client Group $ 3,428 $ 1,297 $ 6,571 $ 1,998

Data Center Group 1,064 434 1,899 700

Other Intel Architecture groups -18 -60 -47 -136

Intel Architecture group operating income 4,474 1,671 8,423 2,562

Other operating groups -21 -35 -42 -188

Corporate -472 -1,648 -952 -1,739

TOTAL OPERATING INCOME (LOSS) $ 3,981 $ (12) $ 7,429 $ 635

(In millions, except per-share amounts)

Three Months Ended Six Months Ended

June 26, June 27, June 26, June 27,

2010 2009 2010 2009

GAAP OPERATING INCOME (LOSS) $ 3,981 $ (12) $ 7,429 $ 635

Adjustment for EC fine - 1,447 - 1,447

OPERATING INCOME EXCLUDING EC FINE $ 3,981 1,435 $ 7,429 2,082

GAAP NET INCOME (LOSS) $ 2,887 -398 $ 5,329 231

Adjustment for EC fine - 1,447 - 1,447

NET INCOME EXCLUDING EC FINE $ 2,887 $ 1,049 $ 5,329 $ 1,678

GAAP DILUTED EARNINGS (LOSS) PER COMMON SHARE $ 0.51 $ (0.07) $ 0.94 $ 0.04

Adjustment for EC fine - 0.25 - 0.26

DILUTED EARNINGS PER COMMON SHARE EXCLUDING EC FINE $ 0.51 0.18 $ 0.94 0.3

DISCLAIMER

This report has been prepared by ATF Capital on behalf of itself and its affiliated companies and is provided for information purposes only. Under no circumstances is it to

be used or considered as an offer to sell, or a solicitation of any offer to buy. This report has been produced independently and the forecasts, opinions and expectations

contained herein are entirely those of ATF Capital. While all reasonable care has been taken to ensure that information contained herein is not untrue or misleading at the

time of publication, ATF Capital makes no representation as to its accuracy or completeness and it should not be relied upon as such. This report is provided solely for the

information of clients of ATF Capital who are expected to make their own investment decisions without reliance on this report. Neither ATF Capital nor any officers or

employees of ATF Capital accept any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents. ATF Capital and/or persons

connected with it may have acted upon or used the information herein contained, or the research or analysis on which it is based, before publication. ATF Capital may in

future participate in an offering of the company's equity securities.

July 14th 2010 Page 6

Das könnte Ihnen auch gefallen

- Corporate Actions: A Guide to Securities Event ManagementVon EverandCorporate Actions: A Guide to Securities Event ManagementNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Microsoft Financial Data - FY19Q3Dokument29 SeitenMicrosoft Financial Data - FY19Q3trisanka banikNoch keine Bewertungen

- Announcement of Results For The Year Ended 31 DECEMBER 2010: (Incorporated in Bermuda With Limited Liability)Dokument25 SeitenAnnouncement of Results For The Year Ended 31 DECEMBER 2010: (Incorporated in Bermuda With Limited Liability)shiyeegohNoch keine Bewertungen

- Microsoft Financial Data - FY19Q1Dokument26 SeitenMicrosoft Financial Data - FY19Q1trisanka banikNoch keine Bewertungen

- Rezultate Financiare AppleDokument3 SeitenRezultate Financiare AppleClaudiuNoch keine Bewertungen

- (Amounts in Philippine Peso) : See Notes To Financial StatementsDokument9 Seiten(Amounts in Philippine Peso) : See Notes To Financial StatementsBSA3Tagum MariletNoch keine Bewertungen

- Eastboro ExhibitsDokument9 SeitenEastboro ExhibitstimbulmanaluNoch keine Bewertungen

- HE 4 Questions - Updated-1Dokument13 SeitenHE 4 Questions - Updated-1halelz69Noch keine Bewertungen

- Case 29 Gainesboro Machine Tools CorporationDokument33 SeitenCase 29 Gainesboro Machine Tools CorporationUshna100% (1)

- Revenue and earnings analysis of company from 2019-2021Dokument8 SeitenRevenue and earnings analysis of company from 2019-2021ashwani singhaniaNoch keine Bewertungen

- CH 1 Exhibit 1 Q 1-5Dokument6 SeitenCH 1 Exhibit 1 Q 1-5ЭниЭ.Noch keine Bewertungen

- Balance Sheet For Intel CorpDokument2 SeitenBalance Sheet For Intel CorpriskyindraNoch keine Bewertungen

- ChinaNet 2012 Investor PresentationDokument74 SeitenChinaNet 2012 Investor PresentationJosé ivan LópezNoch keine Bewertungen

- Session 5 Financial Statement Analysis Part 1-2Dokument17 SeitenSession 5 Financial Statement Analysis Part 1-2Prakriti ChaturvediNoch keine Bewertungen

- Balance Sheet P&G 2009Dokument5 SeitenBalance Sheet P&G 2009Saad BukhariNoch keine Bewertungen

- 60 HK Food Investment 1Q2011Dokument17 Seiten60 HK Food Investment 1Q2011Lye Shyong LingNoch keine Bewertungen

- Intellipharmaceutics International Inc. q2 2021Dokument31 SeitenIntellipharmaceutics International Inc. q2 2021Sandesh PatilNoch keine Bewertungen

- Apple FinancialDokument8 SeitenApple FinancialmeoboyNoch keine Bewertungen

- Coca-Cola and Best Buy Income Statements and Financial ProjectionsDokument9 SeitenCoca-Cola and Best Buy Income Statements and Financial ProjectionsEvelDerizkyNoch keine Bewertungen

- Q3fy16consolidated Financial StatementsDokument3 SeitenQ3fy16consolidated Financial Statementsतरुण दीवानNoch keine Bewertungen

- Antler Fabric Printers (PVT) LTD 2016Dokument37 SeitenAntler Fabric Printers (PVT) LTD 2016IsuruNoch keine Bewertungen

- Espresso Financial StatementsDokument38 SeitenEspresso Financial StatementsAnwar AshrafNoch keine Bewertungen

- STAR FINANCIAL STATEMENTS REVENUE $62B NET INCOME $18.7BDokument38 SeitenSTAR FINANCIAL STATEMENTS REVENUE $62B NET INCOME $18.7BAnnisa DewiNoch keine Bewertungen

- A3 6Dokument3 SeitenA3 6David Rolando García OpazoNoch keine Bewertungen

- I. Case BackgroundDokument7 SeitenI. Case BackgroundHiya BhandariBD21070Noch keine Bewertungen

- Case 9Dokument11 SeitenCase 9Nguyễn Thanh PhongNoch keine Bewertungen

- Half Yearly Report 2010Dokument12 SeitenHalf Yearly Report 2010tans69Noch keine Bewertungen

- 3 - CokeDokument30 Seiten3 - CokePranali SanasNoch keine Bewertungen

- Jollibee Foods Corporation: Consolidated Statements of IncomeDokument9 SeitenJollibee Foods Corporation: Consolidated Statements of Incomearvin cleinNoch keine Bewertungen

- Financial Modeling - Module I - Workbook 09.28.09Dokument38 SeitenFinancial Modeling - Module I - Workbook 09.28.09rabiaasimNoch keine Bewertungen

- Budget Artikel ExcelDokument8 SeitenBudget Artikel ExcelnugrahaNoch keine Bewertungen

- Budget PT Abcd Balance Sheet Projection of Year 2017Dokument8 SeitenBudget PT Abcd Balance Sheet Projection of Year 2017Abdul SyukurNoch keine Bewertungen

- Condensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Dokument10 SeitenCondensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Annemiek BlezerNoch keine Bewertungen

- Forecasting ProblemsDokument7 SeitenForecasting ProblemsJoel Pangisban0% (3)

- FIN448 DCFwWACC SolutionDokument9 SeitenFIN448 DCFwWACC SolutionAndrewNoch keine Bewertungen

- Financial Statements ofDokument11 SeitenFinancial Statements ofConversionApiTestNoch keine Bewertungen

- Consolidated Statements of Operations - USD ($) Shares in Millions, $ in MillionsDokument20 SeitenConsolidated Statements of Operations - USD ($) Shares in Millions, $ in MillionsLuka KhmaladzeNoch keine Bewertungen

- MOD Technical Proposal 1.0Dokument23 SeitenMOD Technical Proposal 1.0Scott TigerNoch keine Bewertungen

- Financial Ratios of Home Depot and Lowe'sDokument30 SeitenFinancial Ratios of Home Depot and Lowe'sM UmarNoch keine Bewertungen

- 17 Philguarantee2021 Part4b Akpf FsDokument4 Seiten17 Philguarantee2021 Part4b Akpf FsYenNoch keine Bewertungen

- Section A (Group 11)Dokument14 SeitenSection A (Group 11)V PrasantNoch keine Bewertungen

- SELECTED FINANCIAL DATA 2006-2002Dokument1 SeiteSELECTED FINANCIAL DATA 2006-2002junerubinNoch keine Bewertungen

- Financial MStatements Ceres MGardening MCompanyDokument11 SeitenFinancial MStatements Ceres MGardening MCompanyRodnix MablungNoch keine Bewertungen

- HBL FSAnnouncement 3Q2016Dokument9 SeitenHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNoch keine Bewertungen

- AAPL DCF ValuationDokument12 SeitenAAPL DCF ValuationthesaneinvestorNoch keine Bewertungen

- Period Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares OutstandingDokument4 SeitenPeriod Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares Outstandingso_levictorNoch keine Bewertungen

- Awasr Oman and Partners SAOC - FS 2020 EnglishDokument42 SeitenAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91Noch keine Bewertungen

- Group work ratios analysisDokument10 SeitenGroup work ratios analysisEnizel MontrondNoch keine Bewertungen

- Statements of Financial Position As at December 31 Assets Current AssetsDokument8 SeitenStatements of Financial Position As at December 31 Assets Current AssetsCalix CasanovaNoch keine Bewertungen

- Net Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsDokument1 SeiteNet Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsMaanvee JaiswalNoch keine Bewertungen

- Historical Financial Performance and Position of CSSBDokument154 SeitenHistorical Financial Performance and Position of CSSBOliver Oscar100% (1)

- Walt Disney Corporation FSDokument6 SeitenWalt Disney Corporation FSJannefah Irish SaglayanNoch keine Bewertungen

- Walt Disney Corporation FSDokument6 SeitenWalt Disney Corporation FSJannefah Irish SaglayanNoch keine Bewertungen

- Pidilite Industries Income StatementDokument4 SeitenPidilite Industries Income StatementRehan TyagiNoch keine Bewertungen

- Understanding Financial StatementsDokument30 SeitenUnderstanding Financial StatementsCalvin GadiweNoch keine Bewertungen

- Nike, Inc. Consolidated Statements of Income Year Ended December 31 (In Millions) 2019 2018Dokument3 SeitenNike, Inc. Consolidated Statements of Income Year Ended December 31 (In Millions) 2019 2018David Rolando García OpazoNoch keine Bewertungen

- SGR Calculation Taking Base FY 2019Dokument17 SeitenSGR Calculation Taking Base FY 2019Arif.hossen 30Noch keine Bewertungen

- Fujita Kanko Financial SummaryDokument5 SeitenFujita Kanko Financial SummaryDamTokyoNoch keine Bewertungen

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryVon EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Slumped, Again: Revenues in Billions of Dollars Earnings Per ShareDokument5 SeitenSlumped, Again: Revenues in Billions of Dollars Earnings Per ShareAndre SetiawanNoch keine Bewertungen

- Disenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Dokument5 SeitenDisenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Andre SetiawanNoch keine Bewertungen

- Super Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualDokument5 SeitenSuper Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualAndre SetiawanNoch keine Bewertungen

- Penalized On Revenue Miss: .DJI 12,263.60 (-117.53.06) .SPX 1,314.16 (-10.30) .IXIC 2,744.79 (-26.72)Dokument6 SeitenPenalized On Revenue Miss: .DJI 12,263.60 (-117.53.06) .SPX 1,314.16 (-10.30) .IXIC 2,744.79 (-26.72)Andre SetiawanNoch keine Bewertungen

- Stays On Course: .DJI 12,690.96 (+95.59) .SPX 1,355.66 (+8.42) .IXIC 2,869.88 (+22.34)Dokument6 SeitenStays On Course: .DJI 12,690.96 (+95.59) .SPX 1,355.66 (+8.42) .IXIC 2,869.88 (+22.34)Andre SetiawanNoch keine Bewertungen

- Season Greetings!: (Earnings)Dokument6 SeitenSeason Greetings!: (Earnings)Andre SetiawanNoch keine Bewertungen

- For The Fed: WaitingDokument5 SeitenFor The Fed: WaitingAndre SetiawanNoch keine Bewertungen

- Calling Skype: .DJI 12,684.68 (+45.94) .SPX 1,346.29 (+6.09) .IXIC 2,843.25 (+15.69)Dokument5 SeitenCalling Skype: .DJI 12,684.68 (+45.94) .SPX 1,346.29 (+6.09) .IXIC 2,843.25 (+15.69)Andre SetiawanNoch keine Bewertungen

- Powered The Dow: .DJI 12,810.54 (+47.23) .SPX 1,363.61 (+3.13) .IXIC 2,873.54 (+1.01)Dokument11 SeitenPowered The Dow: .DJI 12,810.54 (+47.23) .SPX 1,363.61 (+3.13) .IXIC 2,873.54 (+1.01)Andre SetiawanNoch keine Bewertungen

- Earnings Lifted The Street: UpbeatDokument6 SeitenEarnings Lifted The Street: UpbeatAndre SetiawanNoch keine Bewertungen

- In Focus: .DJI 12,285.15 (+14.16) .SPX 1,314.52 (+0.11) .IXIC 2,760.22 (-1.30)Dokument6 SeitenIn Focus: .DJI 12,285.15 (+14.16) .SPX 1,314.52 (+0.11) .IXIC 2,760.22 (-1.30)Andre SetiawanNoch keine Bewertungen

- The Unthinkable: ThinkDokument5 SeitenThe Unthinkable: ThinkAndre SetiawanNoch keine Bewertungen

- The Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Dokument4 SeitenThe Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Andre SetiawanNoch keine Bewertungen

- Pulled The Rug: GoldmanDokument4 SeitenPulled The Rug: GoldmanAndre SetiawanNoch keine Bewertungen

- Lifted The Mood: PayrollsDokument5 SeitenLifted The Mood: PayrollsAndre SetiawanNoch keine Bewertungen

- To Drop Capsugel: .DJI 12,400.03 (+22.31) .SPX 1,332.87 (+0.46) .IXIC 2,789.19 (-0.41)Dokument5 SeitenTo Drop Capsugel: .DJI 12,400.03 (+22.31) .SPX 1,332.87 (+0.46) .IXIC 2,789.19 (-0.41)Andre SetiawanNoch keine Bewertungen

- Inners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Dokument5 SeitenInners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Andre SetiawanNoch keine Bewertungen

- D3006042011Dokument5 SeitenD3006042011Andre SetiawanNoch keine Bewertungen

- Orporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Dokument4 SeitenOrporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Andre SetiawanNoch keine Bewertungen

- Orporate Ews: .DJI 12,297.01 (+81.13) .SPX 1,319.44 (9.25) .IXIC 2,756.89 (+26.21)Dokument4 SeitenOrporate Ews: .DJI 12,297.01 (+81.13) .SPX 1,319.44 (9.25) .IXIC 2,756.89 (+26.21)Andre SetiawanNoch keine Bewertungen

- Of Steam: .DJI 12,018.63 (-17.90) .SPX 1,293.77 (-4.61) .IXIC 2,683.87 (-8.22)Dokument4 SeitenOf Steam: .DJI 12,018.63 (-17.90) .SPX 1,293.77 (-4.61) .IXIC 2,683.87 (-8.22)Andre SetiawanNoch keine Bewertungen

- Uneventful: .DJI 12,197.88 (-22.71) .SPX 1,310.19 (-3.61) .IXIC 2,730.68 (-12.38)Dokument3 SeitenUneventful: .DJI 12,197.88 (-22.71) .SPX 1,310.19 (-3.61) .IXIC 2,730.68 (-12.38)Andre SetiawanNoch keine Bewertungen

- .Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Dokument6 Seiten.Dji 11,613.30 (-242.12) .SPX 1,256.88 (-24.99) .Ixic 2,616.82 (-50.51)Andre SetiawanNoch keine Bewertungen

- On Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Dokument5 SeitenOn Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Andre SetiawanNoch keine Bewertungen

- Deal Boosted Dow: .DJI 12,036.53 (+178.01) .SPX 1,298.38 (+19.18) .IXIC 2,692.09 (+48.42)Dokument5 SeitenDeal Boosted Dow: .DJI 12,036.53 (+178.01) .SPX 1,298.38 (+19.18) .IXIC 2,692.09 (+48.42)Andre SetiawanNoch keine Bewertungen

- Orporate Ews: .DJI 12,214.38 .SPX 1,321.82 .IXIC 2,765.77Dokument5 SeitenOrporate Ews: .DJI 12,214.38 .SPX 1,321.82 .IXIC 2,765.77Andre SetiawanNoch keine Bewertungen

- Says "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Dokument4 SeitenSays "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Andre SetiawanNoch keine Bewertungen

- Strikes Back: .DJI 11,774.59 (+161.29) .SPX 1,273.72 (+16.84) .IXIC 2,636.05 (+19.23)Dokument4 SeitenStrikes Back: .DJI 11,774.59 (+161.29) .SPX 1,273.72 (+16.84) .IXIC 2,636.05 (+19.23)Andre SetiawanNoch keine Bewertungen

- Orporate Ews: .DJI 11,855.42 (-137.74) .SPX 1,281.87 (-14.52) .IXIC 2,667.33 (-33.64)Dokument6 SeitenOrporate Ews: .DJI 11,855.42 (-137.74) .SPX 1,281.87 (-14.52) .IXIC 2,667.33 (-33.64)Andre SetiawanNoch keine Bewertungen

- Oints of Nterest: .DJI 11,984.61 (-228.48) .SPX 1,295.11 (-24.91) .IXIC 2,701.02 (-50.70)Dokument5 SeitenOints of Nterest: .DJI 11,984.61 (-228.48) .SPX 1,295.11 (-24.91) .IXIC 2,701.02 (-50.70)Andre SetiawanNoch keine Bewertungen

- DBBL Online Banking AssignmentDokument11 SeitenDBBL Online Banking AssignmentzonayetgaziNoch keine Bewertungen

- ABRAHIM Research .2021.update .Dokument43 SeitenABRAHIM Research .2021.update .Abdi Mucee TubeNoch keine Bewertungen

- Acre v. Yuttiki, GR 153029Dokument3 SeitenAcre v. Yuttiki, GR 153029MiguelNoch keine Bewertungen

- It FormDokument13 SeitenIt FormMani Vannan JNoch keine Bewertungen

- Deed of Absolute SaleDokument2 SeitenDeed of Absolute SaleNga-nging Pusao79% (14)

- Institutional Framework FOR International Business: Business R. M. JoshiDokument45 SeitenInstitutional Framework FOR International Business: Business R. M. JoshiIshrat SonuNoch keine Bewertungen

- Mary Rieser "Things That Should Not Be"Dokument22 SeitenMary Rieser "Things That Should Not Be"Tony OrtegaNoch keine Bewertungen

- Preliminary Chapter and Human RelationsDokument12 SeitenPreliminary Chapter and Human Relationsianyabao61% (28)

- CIS Union Access Update 2021Dokument6 SeitenCIS Union Access Update 2021Fernando Manholér100% (3)

- Judical Review On Government ContractsDokument6 SeitenJudical Review On Government ContractsPriyanshu tyagiNoch keine Bewertungen

- Comparing Police Systems in Southeast AsiaDokument2 SeitenComparing Police Systems in Southeast AsiaKrizzia SoguilonNoch keine Bewertungen

- How to Charge Invoices on ERPDokument9 SeitenHow to Charge Invoices on ERPClarissa DelgadoNoch keine Bewertungen

- How to Make a Fortune with Other People's Junk_ An Insider's Secrets to Finding and Reselling Hidden Treasures at Garage Sales, Auctions, Estate Sales, Flea Markets, Yard Sales, Antique Shows and eBay ( PDFDrive )Dokument258 SeitenHow to Make a Fortune with Other People's Junk_ An Insider's Secrets to Finding and Reselling Hidden Treasures at Garage Sales, Auctions, Estate Sales, Flea Markets, Yard Sales, Antique Shows and eBay ( PDFDrive )Blink SNoch keine Bewertungen

- Affidavit of Consent-JonaDokument1 SeiteAffidavit of Consent-Jonajude thaddeus estoquiaNoch keine Bewertungen

- CASE BRIEF Switzerland v. Nigeria San Pedro Pio Case PDFDokument3 SeitenCASE BRIEF Switzerland v. Nigeria San Pedro Pio Case PDFDILG STA MARIANoch keine Bewertungen

- PS (T) 010Dokument201 SeitenPS (T) 010selva rajaNoch keine Bewertungen

- Marxist Theory of Citizenship - Anthony GiddensDokument4 SeitenMarxist Theory of Citizenship - Anthony GiddensRamita UdayashankarNoch keine Bewertungen

- DocsssDokument4 SeitenDocsssAnne DesalNoch keine Bewertungen

- Tax 3 Mid Term 2016-2017 - RawDokument16 SeitenTax 3 Mid Term 2016-2017 - RawPandaNoch keine Bewertungen

- Trilogy Monthly Income Trust PDS 22 July 2015 WEBDokument56 SeitenTrilogy Monthly Income Trust PDS 22 July 2015 WEBRoger AllanNoch keine Bewertungen

- Identity Theft WebquestDokument2 SeitenIdentity Theft Webquestapi-256439506Noch keine Bewertungen

- The Three Principles of The CovenantsDokument3 SeitenThe Three Principles of The CovenantsMarcos C. Thaler100% (1)

- Marraige and CompatabilityDokument3 SeitenMarraige and CompatabilityRamesh Menon100% (1)

- 2011 Veterans' Hall of Fame Award RecipientsDokument46 Seiten2011 Veterans' Hall of Fame Award RecipientsNew York SenateNoch keine Bewertungen

- Sde Notes Lit and Vital Issues FinalDokument115 SeitenSde Notes Lit and Vital Issues FinalShamsuddeen Nalakath100% (14)

- Ds Tata Power Solar Systems Limited 1: Outline AgreementDokument8 SeitenDs Tata Power Solar Systems Limited 1: Outline AgreementM Q ASLAMNoch keine Bewertungen

- 14-1 Mcdermott PDFDokument12 Seiten14-1 Mcdermott PDFDavid SousaNoch keine Bewertungen

- Indian Ethos and ManagementDokument131 SeitenIndian Ethos and ManagementdollyguptaNoch keine Bewertungen

- Court Directory and Contact NumbersDokument51 SeitenCourt Directory and Contact NumbersMarion Lawrence LaraNoch keine Bewertungen

- Prince SmartFit CPVC Piping System Price ListDokument1 SeitePrince SmartFit CPVC Piping System Price ListPrince Raja38% (8)