Beruflich Dokumente

Kultur Dokumente

9943 1.5 Iran's Economy

Hochgeladen von

IbrahimOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

9943 1.5 Iran's Economy

Hochgeladen von

IbrahimCopyright:

Verfügbare Formate

1.

5 Irans Economy

The choice for a nuclear program is evident for Iran and as this has some positivity,

it also comprises of a lot of negative elements that could disturb Irans Economy. It

is also implied that at both macro and micro economic levels the potential direction

has crumbled under the burden of this decision. It is also evident that Iran has given

a lot of attention in this domain and has weighed all its choices well before deciding

the fact of their current stance. These decision makers in Iran might have

overlooked the international market and might be just focused on self-sustenance.

This approach has given the country and its citizens a steady degree of nationalism,

extremism and radicalism. It can further be seen that they previously had been

denied with the indulgence in international markets, Foreign investment,

Information Technology and other such variants which predominantly give rise to

potential economic sabotage.

There have been extreme international sanctions that have been placed on Iran on

the basis of its nuclear policy. This in turn has worsened the domestic and fiscal

deficit and reduced trade to mere ashes in Iran. The elections of 2009 signified the

presence of two groups in the country. One, who disagree with the sanctions and

argue it with their European counterparts, the second group however is of the point

of view that want Iran to change its policies in order to make their lives easier. It

also highlights the second group to be more powerful of the two. It is potential

stance of military and political pressure that mounts the position in a manner that

violates all the terms but accepts the consequences. The Former President,

Ahmadinejad is known for this policy and is ill-reputed for his policies on the matter.

The 1979 Islamic Revolution changed the Irans economic

structure and its history too. Khomeini changed the whole

outlook of Iran and transformed it into an Islamic state

with a public-sector-dominated economy. After the

revolution, the eight years exhaustive Iran-Iraq (1980-

1988), put a hard blow to the economy of Iran. In terms of

GDP, Iran, more than U.S. $ 482.45 billion, is the second

largest economy in the Middle East after Saudi Arabia. In

terms of population, at about 73 million, it is also the

second largest nations of the Middle East. Iran's economy

is dependent on a large hydrocarbon sector. Small-scale

private agriculture and services, manufacturing and

state-controlled financial organizations are important

sectors of Irans economy.

The natural resources of a state are considered valuable

and quantifiable, so they tend to rank high in everyone's

power inventory. A naturally occurred substance is called

a natural resource, which are useful for the people. Those

needs, however, change with time. Natural resources

include soil, water, forests, metallic and non-metallic

minerals and many other elements of the physical

environment that are difficult to evaluate. Iran has

suffered many earthquakes because it is located in a

major seismic belt. Iran is blessed with natural resources,

including petroleum and natural gas. Copper is one of the

most important minerals in Iran. Two of the country's

largest copper mines are Mirduk and Sarcheshmeh, both

in the province of Kermanshah. Iran's desert has plentiful

supplies ofsalt. Other minerals found in Iran include

asbestos. Chromium, gold, iron ore, lead, manganese,

sulphur, tungsten, turquoise, uranium, and zinc. Rising

around 914 to 1,524 meters above sea level, the Iranian

plateau dominates much of the country's interior. The

Iranian plateau is almost surrounded by mountain ranges

to the west lays the Zagros Mountains, Iran's longest

range, while to the north lays the Elburz Mountains,

including the highest peak in the country.

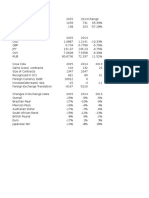

In the Iranian fiscal year 2010/211 (March 21, 2010-March

20, 2011), the service sector (including government), at

about 50 percent, contributed the largest percentage to

Irans GDP. The hydrocarbon sector is the second largest

contributor to the countrys GDP at about 25 percent.

Furthermore, agriculture contribution is about 10 percent.

In terms of its natural gas resources, Iran ranks second in

the world and third in oil reserves. According to the latest

estimates and reports, it is the second largest OPEC oil

producer with output that is more than 441,000 million

barrels per day in 2012. The major source of income of

the country is the exports of its petroleum products and

natural gas. Therefore, its economy depends upon the

international prices set for these commodities. Irans

domestic oil consumption is about 1,774,000 barrels per

day (b/d) which affected its exports. Iran's average crude

oil production, in adherence to the production quotas set

by the OPEC, was 4.3 (millions barrels per day) in 2009

and 4.9 (millions barrels per day) in 2010. Irans Oil

exports in 2009/2010 were 2,165 (thousand barrels per

day) reduced by a little margin to 2,102 (millions barrels

per day) in 2010/2011.

Macroeconomic imbalances and inefficient public

administration has stifled the Irans economic growth,

particularly private business. High inflation is one of the

key Irans macroeconomic problems. Inflations have

consistently remained at double-digit levels, despite

major efforts of the Central Bank of Iran. Furthermore,

balance of the Oil Stabilization Fund was reduced, due to

the high oil prices. This boom and bust cycles in Irans

economic performance and condition further impeding

the private sectors investment and reduced the job

creation in the country. Because of lower international

commodity prices, a sharp fall in inflation occurred in

2009/10 because of lower international commodity

prices. The rates of the commodity prices have been

falling from 25 percent in 2008 to about 10 percent- the

lowest in the last three years.

Irans economy is under pressure due to international

sanctions relating to its nuclear program. Since the turn

of the new century, Iran had experienced positive rates of

the real economic growth. According to the International

Monetary Fund (IMF) reports, the annual change in GDP of

Iran registered at 5.8 percent for 2006, 6.5 percent for

2007, 3.5 percent for 2008, 2.6 percent for 2009, and 2.6

for 2010 too. Iran stands at the position of 94, as

compared to the world in terms of real economic growth.

Analysts argue that Irans economy will face growth, and

this economic growth will be just because of the rising

international prices of the petroleum products. In

addition, the growth of the Irans economy also has been

associated with the weather-related agricultural recovery

and the reforms under the current Iranian President

Mahmoud Ahmadinejad. They are monetary and fiscal

policy reforms and weather-related agricultural recovery.

The oil-related economic growth of the country has been

modest partly due to the Organization of the Petroleum

Exporting Countries (OPEC) oil production capacity

constraints on Iran.

Other macroeconomic indicator includes inflation.

According to the reports, inflation levels have been

increasing in Iran due to international sanctions and it is

consistently having been in the double-digits. The anti-

inflationary policies Iranian government have reduced

inflation considerably from the average rate of 23 percent

in the 1977 98 periods. The official rates of inflation for

fiscal year 2010/2011, was 10.2 percent. Irans currency,

the Riyal, has been devaluing in real terms against the

U.S. dollar because of inflation and many other

international sanctions are playing their role as well.

In Iran, the basic commodities prices have been on the

rise due to the inflation. The Iranians have been

struggling hard to adjust their budgets with the rising

cost of the basic commodities, like foods, such as rice,

chicken, and eggs, and the housing prices. The oil and

gas sectors are under the total control of the Iranian

government. The National Iranian Oil Company (NIOC),

which is totally state-owned organization, has the total

monopoly over the oil and gas production and exploration

in Iran. Iran accounts for almost10 percent of the worlds

proven oil reserves, which are approximately 137 billion

barrels. Most of the countrys crude oil deposits are in the

south-western region. It is also a fact that Iran is the

worlds second largest gasoline (Petrol) importer after the

U.S. Iran imports gasoline from India, Turkmenistan, the

Netherlands, Azerbaijan, France, Singapore, and the

UnitedArab Emirates (UAE).

Agriculture sector of Iran is substantial. Caviar and

pistachio nuts constitute significant portion of Irans non-

oil exports. In fact, the climate change issue would

definitely affect Irans agriculture sector. Drought period

from 1988-2001 was highly damaging. Iran, as result of

that drought period, became major importer of wheat.

Iran used its oil export revenues to pay the agricultural

imports to meet its domestic needs. However, Irans

economy is under pressure due to the rising international

food commodity prices combined with the population

increase. According to the official reports released by the

Iranian government, total farming and horticultural crops

were increase compared.

In 2009/10, 175.2 thousand tons of agricultural goods,

valued at Riyals. Furthermore, Riyals 484.8 billion traded

on Iran Mercantile Exchange., indicating one percent

increase and 24.7 percent decrease respectively, in terms

of weight and value, compared with the year before.

Corn, barley, soybean meal, tea, poultry, wheat, and

wheat bran traded as major Iranian agricultural exports,

on the Agricultural Commodity Exchange. In that year

(2009/2010), based on preliminary data released by the

Customs, 3.1 million tons of various agricultural goods,

worth U.S. $4.3 billion were exported indicating 8.6

percent decrease in terms of weight and 23 percent

increase in terms of value. Meanwhile, 18.4 million tons of

various agricultural products, valued at U.S. $ 8.5 billion

were imported, showing 1.7 percent increase and 6.6

percent decrease, respectively. The trade balance of the

agriculture sector ran a deficit of US $ 4.2 billion in

2009/10, down from $5.6 billion in the year before.

According to the statistics issued by the Central Bank of

Iran, in 2009/2010, government general revenues totalled

Riyals 460,737.1 billion, representing an increase of 21.5

percent compared with the preceding year. Share of the

tax revenues in total revenues increased in 2009/2010.

The share of government tax revenues reached the Riyals

300,035.5 billion in 2009/10, indicating 25.1 percent

growth. In fact, the highest share in tax revenues, 69.7

percent, belonged to direct taxes. Therefore, the Iranian

government reliance on tax revenues to finance expenses

is a matter of great concern.

Expansion and enhancement of foreign trade, particularly

export of any state is the maininterest. This is the major

cause of economic growth, and ultimately raises the

competitive capabilities of any country in the world. The

council of Public Culture declared the October 21 as the

National Day of Export in the Islamic Republic of Iran, in

1997. This decision indicates the existence of Iranian

governments will to promote exports and consequently

to promote economic growth of the country. Japan, China,

Turkey, Italy, United Arab Emirates (UAE), and South

Korea are major trading partners of Iran. A prominent

Iranian economist, SadighehAtrkar Roshan, argues that a

basic issue in applied economics is the role of exports in

the process of growth. From a demand-side perspective,

the continuous demand growth cannot maintain in small

domestic markets like Iran, which is bound to be

exhausted quickly. He further argues that export markets

are almost limitless. Hence, they do not involve growth

restrictions on the demand side.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Time Value of Money & Factors Affecting Components of Interest RatesDokument2 SeitenTime Value of Money & Factors Affecting Components of Interest RatesIbrahimNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Sales Forecasting Techniques Allow Companies To Predict SalesDokument3 SeitenSales Forecasting Techniques Allow Companies To Predict SalesIbrahimNoch keine Bewertungen

- 4408 ReplyDokument1 Seite4408 ReplyIbrahimNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 2219Dokument4 Seiten2219IbrahimNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- 2215 ReplyDokument1 Seite2215 ReplyIbrahimNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Abdullah Aldawsari Production 200 Cost 5.4 Markup 75% Mark Up 4.05 Selling Price 9.45Dokument29 SeitenAbdullah Aldawsari Production 200 Cost 5.4 Markup 75% Mark Up 4.05 Selling Price 9.45IbrahimNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Overview 11353Dokument1 SeiteOverview 11353IbrahimNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Running Head: Abdullah Aldawsari 1: Assignment On Quantitative Methods by XXX DatedDokument6 SeitenRunning Head: Abdullah Aldawsari 1: Assignment On Quantitative Methods by XXX DatedIbrahimNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 1128 2Dokument6 Seiten1128 2IbrahimNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- 99 t925Dokument1 Seite99 t925IbrahimNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Running Head: Operational Research 1Dokument5 SeitenRunning Head: Operational Research 1IbrahimNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- 1156Dokument2 Seiten1156IbrahimNoch keine Bewertungen

- Running Head: Research 1: Assignment On Research by XXX DatedDokument4 SeitenRunning Head: Research 1: Assignment On Research by XXX DatedIbrahimNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- 99 t925Dokument6 Seiten99 t925IbrahimNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Problem 1Dokument4 SeitenProblem 1IbrahimNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Running Head: Statistics 1: Assignment On Statistics by XXX DatedDokument3 SeitenRunning Head: Statistics 1: Assignment On Statistics by XXX DatedIbrahimNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Impact of Remittances On Economic Growth and Poverty ReductionDokument8 SeitenImpact of Remittances On Economic Growth and Poverty ReductionIbrahimNoch keine Bewertungen

- Report BuilderDokument15 SeitenReport BuilderIbrahimNoch keine Bewertungen

- Overview 11031Dokument1 SeiteOverview 11031IbrahimNoch keine Bewertungen

- Running Head: Transaction ExposureDokument9 SeitenRunning Head: Transaction ExposureIbrahimNoch keine Bewertungen

- Running Head: Compensation 1: Assignment On Compensation by XXX DatedDokument3 SeitenRunning Head: Compensation 1: Assignment On Compensation by XXX DatedIbrahimNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Overview 11135Dokument1 SeiteOverview 11135IbrahimNoch keine Bewertungen

- There Are Six Transaction Exposures in Coca Cola There Is A Table in There For BothDokument1 SeiteThere Are Six Transaction Exposures in Coca Cola There Is A Table in There For BothIbrahimNoch keine Bewertungen

- Running Head: Forecasting 1: Assignment On Forecasting by XXX DatedDokument7 SeitenRunning Head: Forecasting 1: Assignment On Forecasting by XXX DatedIbrahimNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Running Head: Forecasting 1: Assignment On Forecasting by XXX DatedDokument6 SeitenRunning Head: Forecasting 1: Assignment On Forecasting by XXX DatedIbrahimNoch keine Bewertungen

- The Interest Amount Has Been Corrected, If You Still Find Errors Kindly Point Them Out SpecificallyDokument1 SeiteThe Interest Amount Has Been Corrected, If You Still Find Errors Kindly Point Them Out SpecificallyIbrahimNoch keine Bewertungen

- A (X - X 100) B (X - 120 X 160) C (X - X 200) D (X - 100 ! X ! 200)Dokument5 SeitenA (X - X 100) B (X - 120 X 160) C (X - X 200) D (X - 100 ! X ! 200)IbrahimNoch keine Bewertungen

- Final Exam Score - Scatter PlotDokument2 SeitenFinal Exam Score - Scatter PlotIbrahimNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- 5511 1Dokument2 Seiten5511 1IbrahimNoch keine Bewertungen

- Sheikh Ezzedin HosseiniDokument2 SeitenSheikh Ezzedin HosseiniJumanji juNoch keine Bewertungen

- MEB120Dokument10 SeitenMEB120Crown Center for Middle East StudiesNoch keine Bewertungen

- Long Live Khomeini (R.a.), Long Live Wilayat Al - Faqih On The 38th Anniversary of The Islamic Revolution, Iran Is Mightier Than EveDokument8 SeitenLong Live Khomeini (R.a.), Long Live Wilayat Al - Faqih On The 38th Anniversary of The Islamic Revolution, Iran Is Mightier Than Evetrk868581Noch keine Bewertungen

- Iran Power PointDokument66 SeitenIran Power PointRussell BradleyNoch keine Bewertungen

- Sdnnew 23Dokument359 SeitenSdnnew 23Davis JermacansNoch keine Bewertungen

- Iran RevolutionDokument14 SeitenIran Revolutionᕼᓱᑳᕱ ᖽᐸᖺᕬᘗNoch keine Bewertungen

- The Publisher Arktos and The Nazification of Anglo-American Regime Change Efforts Against IranDokument5 SeitenThe Publisher Arktos and The Nazification of Anglo-American Regime Change Efforts Against IranWahid AzalNoch keine Bewertungen

- Released in Part BL, 1.4 (B), 1.4 (D), B5 UnclassifiedDokument9 SeitenReleased in Part BL, 1.4 (B), 1.4 (D), B5 UnclassifiedMike LaSusaNoch keine Bewertungen

- نقشه مترو تهرانDokument1 Seiteنقشه مترو تهرانlionelmehdi0012Noch keine Bewertungen

- Mohammad Reza Shah PahlaviDokument28 SeitenMohammad Reza Shah Pahlavizee100% (1)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Abrahamian. Iran Between Two Revolutions. Book ReviewDokument5 SeitenAbrahamian. Iran Between Two Revolutions. Book ReviewRiaz KhokharNoch keine Bewertungen

- Iran Human Rights IssuesDokument243 SeitenIran Human Rights IssuesYounes YadegariNoch keine Bewertungen

- Prisoners Table (Female) March 2010Dokument7 SeitenPrisoners Table (Female) March 2010Coalition for Democracy in IranNoch keine Bewertungen

- Iran'S Foreign Policy After The Nuclear Agreement: Farhad RezaeiDokument261 SeitenIran'S Foreign Policy After The Nuclear Agreement: Farhad RezaeiAryamerNoch keine Bewertungen

- Iran-Iraq War 1980-88Dokument2 SeitenIran-Iraq War 1980-88Anoosha GhorbaniNoch keine Bewertungen

- Iran Military Power V13b LRDokument130 SeitenIran Military Power V13b LRRambo Cordon100% (1)

- Persepolis - Cheat SheetDokument1 SeitePersepolis - Cheat SheetAnkush MalikNoch keine Bewertungen

- Ahmad MadaniDokument15 SeitenAhmad Madanioana77PNoch keine Bewertungen

- The Iran Hostage Crisis: USS Nimitz USS Coral SeaDokument1 SeiteThe Iran Hostage Crisis: USS Nimitz USS Coral SeaDhey Ortega ManahanNoch keine Bewertungen

- An Autopsy of MKO August Terrorist AtrocityDokument7 SeitenAn Autopsy of MKO August Terrorist Atrocitymojahedin-wsNoch keine Bewertungen

- Violent Aftermath: The 2009 Election and Suppression of Dissent in IranDokument130 SeitenViolent Aftermath: The 2009 Election and Suppression of Dissent in IranIHRDCNoch keine Bewertungen

- The Informal Roots of The IRGC and The Implications For Iranian Politics TodayDokument8 SeitenThe Informal Roots of The IRGC and The Implications For Iranian Politics TodayCrown Center for Middle East StudiesNoch keine Bewertungen

- Chidambaram: Imo Crew ListDokument1 SeiteChidambaram: Imo Crew ListVivek AnandNoch keine Bewertungen

- Iran, Before and After The Shah (20060116)Dokument14 SeitenIran, Before and After The Shah (20060116)fractalusNoch keine Bewertungen

- Iran's Security SectorDokument27 SeitenIran's Security SectorShafat YousufNoch keine Bewertungen

- Reading Lolita in TeheranDokument6 SeitenReading Lolita in TeheranRoxana Nicolae100% (2)

- Has Iran's Islamic Revolution Ended?: Saïd Amir ArjomandDokument7 SeitenHas Iran's Islamic Revolution Ended?: Saïd Amir ArjomandRicky VobanNoch keine Bewertungen

- Meydan-E Mohammadiyeh: Management of Communication and International AffairsDokument1 SeiteMeydan-E Mohammadiyeh: Management of Communication and International AffairszedminerirNoch keine Bewertungen

- National Security Decision-Making in IranDokument20 SeitenNational Security Decision-Making in IranOpen BriefingNoch keine Bewertungen

- Yasubedin Rastegar JooybariDokument3 SeitenYasubedin Rastegar JooybariJahanzaib ShahNoch keine Bewertungen

- Cry from the Deep: The Sinking of the KurskVon EverandCry from the Deep: The Sinking of the KurskBewertung: 3.5 von 5 Sternen3.5/5 (6)

- Reagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarVon EverandReagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarBewertung: 4 von 5 Sternen4/5 (4)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- The Tragic Mind: Fear, Fate, and the Burden of PowerVon EverandThe Tragic Mind: Fear, Fate, and the Burden of PowerBewertung: 4 von 5 Sternen4/5 (14)

- How States Think: The Rationality of Foreign PolicyVon EverandHow States Think: The Rationality of Foreign PolicyBewertung: 5 von 5 Sternen5/5 (7)

- Can We Talk About Israel?: A Guide for the Curious, Confused, and ConflictedVon EverandCan We Talk About Israel?: A Guide for the Curious, Confused, and ConflictedBewertung: 5 von 5 Sternen5/5 (5)

- The Bomb: Presidents, Generals, and the Secret History of Nuclear WarVon EverandThe Bomb: Presidents, Generals, and the Secret History of Nuclear WarBewertung: 4.5 von 5 Sternen4.5/5 (41)

- From Cold War To Hot Peace: An American Ambassador in Putin's RussiaVon EverandFrom Cold War To Hot Peace: An American Ambassador in Putin's RussiaBewertung: 4 von 5 Sternen4/5 (23)