Beruflich Dokumente

Kultur Dokumente

AR:VR Ecosystem Slide

Hochgeladen von

ArchitectPartnersCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

AR:VR Ecosystem Slide

Hochgeladen von

ArchitectPartnersCopyright:

Verfügbare Formate

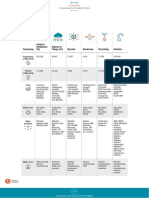

VR/AR ECOSYSTEM OVERVIEW

Common Categories Major Players Aspiring Players (total capital raised) Equity Capital Raised ($mm) & Number of Deals

Business / Enterprise Microsoft 8i ($42M) Marxent ($14M) 59 9 115 133 117 71 98 65 37

Education Intel (Voke) Atheer ($23M) Niantic ($25M) 10

Number of Deals

Games Oculus AltspaceVR ($16M) NextVR ($116M) 8

Applications

Other Consumer Trimble Blippar ($99M) Virtual Reality ($25M) 6

Virtual Commerce High Fidelity ($38M) WEVR ($38M) 4

Jaunt ($100M) Within Unlimited ($13M) 2

0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2015 2016 2017

= $704M = 53 financings

Application Store Autodesk Oculus Atheer ($23M) ODG ($58M)

61 41 25 142 6 24 197 27 3

SDK Dolby Samsung APX Labs ($29M) SilverVR ($10M) 10

Software Enablers

Number of Deals

VR / AR Engines Google Sony Augmedix ($40M) Unity ($289M) 8

HTC Improbable ($22M) Valve 6

IBM Meta ($73M) 4

Microsoft Occipital ($21M) 2

0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2015 2016 2017

= $519M = 30 financings

Capture Cameras AMD Nvidia Altotech ($10M) Merge Labs ($11M) 61 74 49 43 948* 71 178 95 88

Glasses Epson Oculus Avegant ($35M) MindMaze ($109M) 10

Number of Deals

Headsets Google Qualcomm DAQRI ($15M) ODG ($58M) 8

Hardware

Motion Sensors HTC Samsung Digilens ($22M) Nod ($16M) 6

Semiconductors Intel Snap Fove ($11M) Survios ($54M) 4

Magic Leap ($1.4B) Sony Leap Motion ($45M) Thalmic Labs ($136M) 2

Microsoft Vuzix Lumus ($57M) Technical Illusions ($15m) 0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

Lytro ($211M) uSens ($27M)

Mantis Vision ($22M) Virtuix ($16M) 2015 2016 2017

Matterport ($61M)

= $1.6B = 44 financings

* Magic Leap raised $794mm in Q1 2016

Note: includes investments over $10M from 2015 to today

Das könnte Ihnen auch gefallen

- 23 - Technology and Innovation Report 2021Dokument1 Seite23 - Technology and Innovation Report 2021Aprndz AprendizNoch keine Bewertungen

- Landscape AnalyticsDokument110 SeitenLandscape AnalyticsRajatNoch keine Bewertungen

- Atomic WalletDokument37 SeitenAtomic WalletFarooq MizaNoch keine Bewertungen

- Study Id59297 Artificial-Intelligence-Ai PDFDokument99 SeitenStudy Id59297 Artificial-Intelligence-Ai PDFRishi KumarNoch keine Bewertungen

- Background: Initial Report December 29th, 2008 Initial Report December 29th, 2008Dokument6 SeitenBackground: Initial Report December 29th, 2008 Initial Report December 29th, 2008beacon-docsNoch keine Bewertungen

- Therata Inverter DCDokument25 SeitenTherata Inverter DCsaid essadNoch keine Bewertungen

- 2022 Annual ReviewDokument207 Seiten2022 Annual ReviewNebeleben100% (1)

- MetaomaticDokument33 SeitenMetaomaticMeta MaticNoch keine Bewertungen

- Launching Soon: Join The Movement: #Ultiarena #UltimoonDokument28 SeitenLaunching Soon: Join The Movement: #Ultiarena #UltimoonMuhammad RahmadaniNoch keine Bewertungen

- Launching Soon: Join The Movement: #Ultiarena #UltimoonDokument28 SeitenLaunching Soon: Join The Movement: #Ultiarena #UltimoonVergara Collao ErnestinaNoch keine Bewertungen

- Launching Soon: Join The Movement: #Ultiarena #UltimoonDokument28 SeitenLaunching Soon: Join The Movement: #Ultiarena #UltimoonMuhammad RahmadaniNoch keine Bewertungen

- Launching Soon: Join The Movement: #Ultiarena #UltimoonDokument28 SeitenLaunching Soon: Join The Movement: #Ultiarena #UltimoonMuhammad RahmadaniNoch keine Bewertungen

- NOW - Q1-16 ServiceNow Investor PresentationDokument24 SeitenNOW - Q1-16 ServiceNow Investor Presentationfa fdsagsNoch keine Bewertungen

- CB Insights - Tech Trends 2024Dokument129 SeitenCB Insights - Tech Trends 2024tanase.octavian2561Noch keine Bewertungen

- STORM Token Whitepaper and Market Research DRAFT v2.19 NewDokument47 SeitenSTORM Token Whitepaper and Market Research DRAFT v2.19 NewEdison DuránNoch keine Bewertungen

- Litepaper YpredictDokument1 SeiteLitepaper YpredictSharon NwozaNoch keine Bewertungen

- 18 - Technology and Innovation Report 2021Dokument1 Seite18 - Technology and Innovation Report 2021Aprndz AprendizNoch keine Bewertungen

- Mind TreeDokument25 SeitenMind TreerahulinspaceNoch keine Bewertungen

- LTTS IPO Note Analyzes Engineering Firm's FinancialsDokument18 SeitenLTTS IPO Note Analyzes Engineering Firm's FinancialsdurgasainathNoch keine Bewertungen

- Case1 Big Bull CapitalDokument75 SeitenCase1 Big Bull CapitalSakshi SharmaNoch keine Bewertungen

- List of ERP VendorsDokument3 SeitenList of ERP Vendorsanilbe_tpt100% (3)

- Amrita SDE (CSE) Companies 2023 VisitedDokument5 SeitenAmrita SDE (CSE) Companies 2023 Visitedindian-college-guideNoch keine Bewertungen

- Hitachi AIDokument10 SeitenHitachi AINAZANINNoch keine Bewertungen

- Shareholder-Letter Block 1Q23Dokument32 SeitenShareholder-Letter Block 1Q23Tim MooreNoch keine Bewertungen

- Arista UCN 2021Dokument72 SeitenArista UCN 2021test testNoch keine Bewertungen

- DR Tech Company PresentationDokument38 SeitenDR Tech Company PresentationPopescu ValiNoch keine Bewertungen

- D-Mart's Next Phase of GrowthDokument13 SeitenD-Mart's Next Phase of GrowthHarshit BansalNoch keine Bewertungen

- SophiaTX Whitepaper v1.6Dokument42 SeitenSophiaTX Whitepaper v1.6james007spyNoch keine Bewertungen

- 3i INFOTECH AR 2020 21Dokument296 Seiten3i INFOTECH AR 2020 21Manish DaulaniNoch keine Bewertungen

- Revenue Strategy For Gamestop: Nyu Adc Team New York UniversityDokument24 SeitenRevenue Strategy For Gamestop: Nyu Adc Team New York Universityargha48126Noch keine Bewertungen

- eiCAB keynote overview of A&R TECH railway technologyDokument47 SeiteneiCAB keynote overview of A&R TECH railway technologyPankaj SethiaNoch keine Bewertungen

- Atlas NaviDokument51 SeitenAtlas NaviAdrian StoicaNoch keine Bewertungen

- Crypto: Cryptocurrency Price Tracking ApplicationDokument22 SeitenCrypto: Cryptocurrency Price Tracking ApplicationVrushaliNoch keine Bewertungen

- Code of Civil Procedure (CPC) solved MCQs with PDF Download set-4Dokument3 SeitenCode of Civil Procedure (CPC) solved MCQs with PDF Download set-4SomyaNoch keine Bewertungen

- MNTG Farming ProjectDokument22 SeitenMNTG Farming Projecttim berglinNoch keine Bewertungen

- MARKSTRATDokument2 SeitenMARKSTRATShyamlee KanojiaNoch keine Bewertungen

- Nutanix PresantationDokument34 SeitenNutanix PresantationRhushikesh100% (1)

- Spider Dao One PagerDokument1 SeiteSpider Dao One PagerB latedNoch keine Bewertungen

- Microsoft Case Study: Based End-To-End Supply Chain SolutionDokument43 SeitenMicrosoft Case Study: Based End-To-End Supply Chain SolutionJelena FedurkoNoch keine Bewertungen

- Cloud ComputingDokument19 SeitenCloud ComputingSri Silpa PadmanbhuniNoch keine Bewertungen

- Parameter 3A.Gphe S.No.: Pacement Report For The Session 2013-14 Programme: B.Tech & B.DesDokument30 SeitenParameter 3A.Gphe S.No.: Pacement Report For The Session 2013-14 Programme: B.Tech & B.DesSiddharth TyagiNoch keine Bewertungen

- White Star Capital 2020 Industrial Technology Sector ReportDokument47 SeitenWhite Star Capital 2020 Industrial Technology Sector ReportWhite Star CapitalNoch keine Bewertungen

- Arc 19 Capacity Planning 0201Dokument24 SeitenArc 19 Capacity Planning 0201Muhamad Ramdhani FajriNoch keine Bewertungen

- Leading The Future: Sep. - Oct., 2003Dokument40 SeitenLeading The Future: Sep. - Oct., 2003trustno_11Noch keine Bewertungen

- Chingari - The Future of InternetDokument40 SeitenChingari - The Future of InternetErigmoNoch keine Bewertungen

- Hyundai E&CDokument17 SeitenHyundai E&CabergeenNoch keine Bewertungen

- Industrial Investment Opportunities in Saudi Electricity CompanyDokument94 SeitenIndustrial Investment Opportunities in Saudi Electricity CompanyAmin AzadNoch keine Bewertungen

- Ai For Business LeadersDokument25 SeitenAi For Business LeadersAndre Muscat (Holivia)100% (1)

- 2020-06-02 MeitY Launch Presentation Final-V3Dokument18 Seiten2020-06-02 MeitY Launch Presentation Final-V3Shubham Sharma100% (1)

- TV Distribution - Jul10Dokument57 SeitenTV Distribution - Jul10nitin2khNoch keine Bewertungen

- PIC18Fxxx Comprehensive Tutorial Containing 7Mb of InfoDokument278 SeitenPIC18Fxxx Comprehensive Tutorial Containing 7Mb of Infodaoquocdung07100% (4)

- Engineering Research Methodology – MakerBot Replicator Z18Dokument7 SeitenEngineering Research Methodology – MakerBot Replicator Z18Feras MehmoodNoch keine Bewertungen

- Gartner Magic Quadrant For SIEM Products (2010-2020) - Info Security MemoDokument7 SeitenGartner Magic Quadrant For SIEM Products (2010-2020) - Info Security MemoAlek GrbavicaNoch keine Bewertungen

- The Into The Gateway Metaverse: Ultra-HD Metascanning Technology X $HERO TokenDokument27 SeitenThe Into The Gateway Metaverse: Ultra-HD Metascanning Technology X $HERO TokenGnomeiraNoch keine Bewertungen

- Whitepaper v2.0 enDokument27 SeitenWhitepaper v2.0 enPratheep PurujitNoch keine Bewertungen

- first oculusDokument2 Seitenfirst oculusRichard González LunaNoch keine Bewertungen

- Nubank: Valued at US$25bn in A Series G Raise of US$400mn IPO Ever CloserDokument5 SeitenNubank: Valued at US$25bn in A Series G Raise of US$400mn IPO Ever CloserFelipe AreiaNoch keine Bewertungen

- The Tale of Two Worlds Data Chart FINALDokument1 SeiteThe Tale of Two Worlds Data Chart FINALArchitectPartnersNoch keine Bewertungen

- Q2 2017 M&A SnapshotDokument19 SeitenQ2 2017 M&A SnapshotArchitectPartnersNoch keine Bewertungen

- Blockchain M&A Snapshot - June 9th 2017Dokument11 SeitenBlockchain M&A Snapshot - June 9th 2017ArchitectPartnersNoch keine Bewertungen

- Mobile Data Insights - May 2017Dokument24 SeitenMobile Data Insights - May 2017ArchitectPartnersNoch keine Bewertungen

- AP M&A Q1 2017 SnapshotDokument18 SeitenAP M&A Q1 2017 SnapshotArchitectPartnersNoch keine Bewertungen

- Mobile Data Insights - June 6th, 2017 - LATESTDokument24 SeitenMobile Data Insights - June 6th, 2017 - LATESTArchitectPartnersNoch keine Bewertungen

- Mobile Data Insights - June 6th, 2017 - LATESTDokument24 SeitenMobile Data Insights - June 6th, 2017 - LATESTArchitectPartnersNoch keine Bewertungen

- Mobile Data Insights - May 2017Dokument24 SeitenMobile Data Insights - May 2017ArchitectPartnersNoch keine Bewertungen

- Mobile Data Insights - May 2017Dokument24 SeitenMobile Data Insights - May 2017ArchitectPartnersNoch keine Bewertungen

- Mobile Data Insights - May 2017Dokument24 SeitenMobile Data Insights - May 2017ArchitectPartnersNoch keine Bewertungen

- Mobile Data Insights - May 2017Dokument24 SeitenMobile Data Insights - May 2017ArchitectPartnersNoch keine Bewertungen

- Mobile Data Insights - May 2017Dokument24 SeitenMobile Data Insights - May 2017ArchitectPartnersNoch keine Bewertungen

- AP Q1 2016 M&A SnapshotDokument14 SeitenAP Q1 2016 M&A SnapshotArchitectPartnersNoch keine Bewertungen

- AR:VR Ecosystem SlideDokument1 SeiteAR:VR Ecosystem SlideArchitectPartnersNoch keine Bewertungen

- AP M&A Q1 2017 SnapshotDokument18 SeitenAP M&A Q1 2017 SnapshotArchitectPartnersNoch keine Bewertungen

- Q2 2015 SnapshotDokument15 SeitenQ2 2015 SnapshotArchitectPartnersNoch keine Bewertungen

- Q4 2016 SnapshotDokument18 SeitenQ4 2016 SnapshotArchitectPartnersNoch keine Bewertungen

- AR:VR Ecosystem SlideDokument1 SeiteAR:VR Ecosystem SlideArchitectPartnersNoch keine Bewertungen

- Mobile Data Analytics EcosystemDokument1 SeiteMobile Data Analytics EcosystemArchitectPartnersNoch keine Bewertungen

- Q1 2016 SnapshotDokument14 SeitenQ1 2016 SnapshotArchitectPartnersNoch keine Bewertungen

- AP Q3 2016 M&A SnapshotDokument16 SeitenAP Q3 2016 M&A SnapshotArchitectPartnersNoch keine Bewertungen

- Q1 2016 SnapshotDokument14 SeitenQ1 2016 SnapshotArchitectPartnersNoch keine Bewertungen

- Q2 2015 SnapshotDokument15 SeitenQ2 2015 SnapshotArchitectPartnersNoch keine Bewertungen

- Q4 2015 SnapshotDokument16 SeitenQ4 2015 SnapshotArchitectPartnersNoch keine Bewertungen

- Q2 2015 Snapshot - Key v.2Dokument15 SeitenQ2 2015 Snapshot - Key v.2ArchitectPartnersNoch keine Bewertungen

- M&A Snapshot Q3 2015Dokument15 SeitenM&A Snapshot Q3 2015ArchitectPartnersNoch keine Bewertungen

- Q2 2015 SnapshotDokument15 SeitenQ2 2015 SnapshotArchitectPartnersNoch keine Bewertungen

- M&A Snapshot Q1 2015Dokument13 SeitenM&A Snapshot Q1 2015ArchitectPartnersNoch keine Bewertungen