Beruflich Dokumente

Kultur Dokumente

Bcip PDF

Hochgeladen von

yohannestampubolonOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bcip PDF

Hochgeladen von

yohannestampubolonCopyright:

Verfügbare Formate

BCIP Bumi Citra Permai Tbk.

[S]

COMPANY REPORT : FEBRUARY 2013 As of 28 February 2013

Development Board Individual Index : 181.818

Industry Sector : Property, Real Estate And Building Construction (6) Listed Shares : 1,429,915,525

Industry Sub Sector : Property And Real Estate (61) Market Capitalization : 285,983,105,000

341 | 0.32T | 0.008% | 99.61%

279 | 0.10T | 0.009% | 99.63%

COMPANY HISTORY SHAREHOLDERS (February 2013)

Established Date : 03-May-2000 1. PT Bumi Citra Investindo 749,750,000 : 52.43%

Listing Date : 11-Dec-2009 2. Minna Padi Property Plus 111,128,500 : 7.77%

Under Writer IPO : 3. Heru Hidayat 87,929,000 : 6.15%

PT Pacific Cacpital 4. Reksa Dana Millenium Equity 85,368,500 : 5.97%

PT Panca Global Securities 5. Public (<5%) 395,739,525 : 27.68%

PT Universal Broker Indonesia

Securities Administration Bureau : DIVIDEND ANNOUNCEMENT

PT Adimitra Transferindo Bonus Cash Recording Payment

F/I

Plaza Property 2nd Fl. Komp. Pertokoan Pulomas Blok VIII No. 1 Year Shares Dividend Cum Date Ex Date Date Date

Jln. Perintis Kemerdekaan Jakarta 13210 -

Phone : 478-81515 (Hunting)

Fax : 470-9697 ISSUED HISTORY

Listing Trading

BOARD OF COMMISSIONERS No. Type of Listing Shares Date Date

1. Tahir Ferdian 1. First Issue 500,000,000 11-Dec-09 11-Dec-09

2. Agoestiar Zoebier *) 2. Company Listing 700,000,000 11-Dec-09 11-Dec-09

3. Kwek Kie Jen 3. Warrant 25,000 23-Jun-10 23-Jun-10

*) Independent Commissioners 4. Warrant 250,000 25-Jun-10 25-Jun-10

5. Warrant 25,000 28-Jun-10 28-Jun-10

BOARD OF DIRECTORS 6. Warrant 50,000 02-Jul-10 02-Jul-10

1. Annie Halim 7. Warrant 250,000 07-Jul-10 07-Jul-10

2. Budi Purwanto 8. Warrant 75,000 03-Sep-10 03-Sep-10

3. Charly Widjaja 9. Warrant 26,500 04-Oct-10 04-Oct-10

4. Edward Halim 10. Warrant 62,500 26-Oct-10 26-Oct-10

5. Rudi Wijaya 11. Warrant 250,000 03-Nov-10 03-Nov-10

12. Warrant 50,000 10-Nov-10 10-Nov-10

AUDIT COMMITTEE 13. Warrant 226,953,500 28-Oct-11 28-Oct-11

1. Agoestiar Zoebier 14. Warrant 1,000 10-Nov-11 10-Nov-11

2. Erwin Junesco Saragih 15. Warrant 500 23-Nov-11 23-Nov-11

3. Suhendra 16. Warrant 2,500 28-Nov-11 28-Nov-11

17. Warrant 125,000 01-Dec-11 01-Dec-11

CORPORATE SECRETARY 18. Warrant 166,500 07-Dec-11 07-Dec-11

Yusly 19. Warrant 459,500 08-Dec-11 08-Dec-11

20. Warrant 46,000 12-Dec-11 12-Dec-11

HEAD OFFICE 21. Warrant 30,000 13-Dec-11 13-Dec-11

Jln. Kramat Raya No. 32 - 34 22. Warrant 5,000 15-Dec-11 15-Dec-11

Jakarta - 10450 23. Warrant 24,000 16-Dec-11 16-Dec-11

Phone : (021) 391-6338 24. Warrant 5,000 19-Dec-11 19-Dec-11

Fax : (021) 319-35557 25. Warrant 50,000 21-Dec-11 21-Dec-11

26. Warrant 2,500 30-Dec-11 30-Dec-11

Homepage : www.bumicitrapermai.com 27. Warrant 20,000 18-Jan-12 18-Jan-12

Email : yusly_l@yahoo.com 28. Warrant 25 05-Mar-12 05-Mar-12

info@bumicitrapermai.com 29. Warrant 44,000 06-Aug-12 06-Aug-12

30. Warrant 500 18-Sep-12 18-Sep-12

31. Warrant 100,000 01-Nov-12 01-Nov-12

32. Warrant 28,000 07-Nov-12 07-Nov-12

33. Warrant 28,500 27-Nov-12 27-Nov-12

34. Warrant 26,500 30-Nov-12 30-Nov-12

35. Warrant 29,000 04-Dec-12 04-Dec-12

36. Warrant 147,500 07-Dec-12 07-Dec-12

37. Warrant 182,500 11-Dec-12 11-Dec-12

38. Warrant 374,000 13-Dec-12 13-Dec-12

BCIP Bumi Citra Permai Tbk. [S]

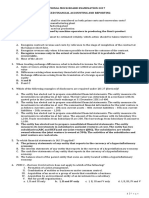

Closing Price* and Trading Volume

TRADING ACTIVITIES

Bumi Citra Permai Tbk. [S] Closing Price Freq. Volume Value

Day

Closing Volume

Price* December 2009 - February 2013 (Mill. Sh) Month High Low Close (X) (Thou. Sh.) (Million Rp)

640 320 Dec-09 310 140 235 21,899 890,558 194,374 11

560 280 Jan-10 300 220 280 10,923 356,885 92,777 20

Feb-10 355 255 315 11,085 411,446 132,019 19

Mar-10 325 285 305 9,545 281,840 86,247 22

480 240

Apr-10 320 290 295 4,026 123,625 37,817 21

May-10 290 245 255 1,472 67,797 17,524 19

400 200

Jun-10 280 245 250 820 35,879 9,410 22

Jul-10 250 240 245 354 18,835 4,774 22

320 160 Aug-10 250 240 240 132 6,457 1,588 20

Sep-10 255 225 245 366 17,077 4,237 16

240 120 Oct-10 260 240 245 1,295 72,167 18,349 17

Nov-10 260 235 235 916 62,667 15,547 21

160 80 Dec-10 255 230 245 1,488 74,227 17,865 20

80 40 Jan-11 255 210 210 972 99,513 23,233 21

Feb-11 245 210 235 995 58,881 13,310 18

Mar-11 250 210 230 1,143 75,507 17,336 23

Dec-09 Dec-10 Dec-11 Dec-12 Apr-11 235 220 230 366 27,933 6,421 20

May-11 235 210 215 306 26,220 5,780 21

Jun-11 225 205 220 357 40,950 8,810 20

Jul-11 235 210 220 325 46,556 10,150 21

Closing Price*, Jakarta Composite Index (IHSG) and Aug-11 230 199 210 119 6,208 1,312 18

Property, Real Estate and Bulding Construction Index Sep-11 215 199 199 13 18,257 3,842 9

December 2009 - February 2013 Oct-11 300 198 260 350 2,014 507 7

280% Nov-11 610 199 590 1,499 149,583 35,308 16

Dec-11 670 590 620 194 1,424 894 2

240%

Jan-12 - - 620 14 45,147 26,994 8

200% Feb-12 - - 620 1 13,368 8,021 1

184.7% Mar-12 - - 620 7 9,461 5,670 5

160% Apr-12 - - 620 1 7,350 4,410 1

May-12 - - 620 1 1,051 578 1

Jun-12 - - 620 2 18 10 2

120%

Jul-12 - - 620 - - - -

90.4% Aug-12 - - 620 1 30 17 1

80%

Sep-12 - - 620 1 5 2 1

Oct-12 - - 620 - - - -

40% Nov-12 - - 620 1 7,611 3,653 1

15.6% Dec-12 610 250 250 588 179,785 49,991 12

-

Jan-13 270 196 225 125 34,341 8,256 17

-40% Feb-13 245 200 200 72 18,278 4,109 12

Dec 09 Dec 10 Dec 11 Dec 12

SHARES TRADED 2009 2010 2011 2012 Feb-13

Volume (Million Sh.) 891 1,529 553 264 53

Value (Billion Rp) 194 438 127 99 12

Frequency (Thou. X) 22 42 7 0.6 0.2

Days 11 239 196 33 29

Price (Rupiah)

High 310 355 670 610 270

Low 140 220 198 250 196

Close 235 245 620 250 200

Close* 235 245 620 250 200

PER (X) 32.73 15.78 371.05 28.05 22.44

PER Industry (X) 18.12 9.97 11.09 17.34 19.09

PBV (X) 2.09 1.92 4.84 1.86 1.48

* Adjusted price after corporate action

BCIP Bumi Citra Permai Tbk. [S]

Financial Data and Ratios Book End : December

Public Accountant : Jamaludin, Aria, Sukimto & Rekan

BALANCE SHEET Dec-08 Dec-09 Dec-10 Dec-11 Sep-12 TOTAL ASSETS AND LIABILITIES (Bill. Rp)

(Million Rp except Par Value) Assets Liabilities

Cash & Cash Equivalents 20,952 918 1,846 3,375 325

Receivable 20,717 9,682 13,374 12,028

260

Inventories 58,297 74,377 98,341 102,420

195

Investment - - -

Fixed Assets 9,141 12,062 13,623 5,442

130

Other Assets - 12 2,224 9,570

Total Assets 166,677 191,717 237,542 315,203 65

Growth (%) 15.02% 23.90% 32.69%

-

Trade Payable 2,790 1,959 2,098 4,186 2009 2010 2011 Sep-12

Total Liabilities 31,834 38,143 54,509 122,604

Growth (%) 19.82% 42.91% 124.93%

TOTAL EQUITY (Billion Rupiah)

Minority Interest - 3 - - 193

200,000 200,000 280,000 280,000 183

Authorized Capital 193

Paid up Capital 120,000 120,000 142,894 142,896 154

Paid up Capital (Shares) 1,200 1,200 1,429 1,429

153

135

Par Value 100 100 100 100

114

Retained Earnings 12,302 30,946 33,307 42,921

Total Equity 134,843 153,571 183,033 192,600 75

Growth (%) 13.89% 19.18% 5.23%

35

Dec-08 Dec-09 Dec-10 Dec-11 Sep-12

-4

INCOME STATEMENTS

2009 2010 2011 Sep-12

Total Revenues 73,941 84,192 55,369 64,383

Growth (%) 13.86% -34.24%

TOTAL REVENUES (Billion Rupiah)

Expenses 47,893 39,855 29,955 32,197

Gross Profit 26,049 44,337 25,414 32,186 84

84

Operating Expenses 11,323 19,050 16,759 17,280 74

Operating Profit 14,726 25,287 8,656 14,905 64

67

Growth (%) 71.72% -65.77% 55

50

Other Income (Expenses) -2,416 -2,200 -3,246 -1,912

Income before Tax 12,310 23,087 5,410 12,993 33

Tax 3,696 4,445 3,022 3,434

15

Minority Interest - 2 - -

Net Income 8,615 18,644 2,388 9,560 -2

Growth (%) 116.42% -87.19% 2009 2010 2011 Sep-12

RATIOS Dec-08 Dec-09 Dec-10 Dec-11 Sep-12 NET INCOME (Billion Rupiah)

Dividend (Rp) - - - -

19

EPS (Rp) 7.18 15.54 1.67 6.69 19

BV (Rp) 112.37 127.98 128.09 134.78

DAR (X) 0.19 0.20 0.23 0.39 15

DER(X) 0.24 0.25 0.30 0.64

11

9.6

ROA (%) 7.39 12.04 2.28 4.12 8.6

ROE (%) 9.13 15.03 2.96 6.75 7

GPM (%) 35.23 52.66 45.90 49.99

OPM (%) 19.92 30.03 15.63 23.15 3

2.4

NPM (%) 11.65 22.14 4.31 14.85

- - - -

-0

Payout Ratio (%)

2009 2010 2011 Sep-12

Yield (%) - - - -

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Buva PDFDokument3 SeitenBuva PDFyohannestampubolonNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- BSWD PDFDokument3 SeitenBSWD PDFyohannestampubolonNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Bull PDFDokument3 SeitenBull PDFyohannestampubolonNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Bton PDFDokument3 SeitenBton PDFyohannestampubolonNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- BSSR PDFDokument3 SeitenBSSR PDFyohannestampubolonNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Bsim PDFDokument3 SeitenBsim PDFyohannestampubolonNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Btek PDFDokument3 SeitenBtek PDFyohannestampubolonNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Btel PDFDokument3 SeitenBtel PDFyohannestampubolonNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- BRMS PDFDokument3 SeitenBRMS PDFyohannestampubolonNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Brna PDFDokument3 SeitenBrna PDFyohannestampubolonNoch keine Bewertungen

- BRPT PDFDokument3 SeitenBRPT PDFyohannestampubolonNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Bumi Serpong Damai TBK.: January 2014Dokument4 SeitenBumi Serpong Damai TBK.: January 2014yohannestampubolonNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Bram PDFDokument3 SeitenBram PDFyohannestampubolonNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Brau PDFDokument3 SeitenBrau PDFyohannestampubolonNoch keine Bewertungen

- Bank CIMB Niaga TBK.: Company Report: January 2014 As of 30 January 2014Dokument3 SeitenBank CIMB Niaga TBK.: Company Report: January 2014 As of 30 January 2014yohannestampubolonNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- BNBR PDFDokument3 SeitenBNBR PDFyohannestampubolonNoch keine Bewertungen

- Bnli PDFDokument3 SeitenBnli PDFyohannestampubolonNoch keine Bewertungen

- Bpfi PDFDokument3 SeitenBpfi PDFyohannestampubolonNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Born PDFDokument3 SeitenBorn PDFyohannestampubolonNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Bnii PDFDokument3 SeitenBnii PDFyohannestampubolonNoch keine Bewertungen

- Bank Mandiri (Persero) TBK.: January 2014Dokument4 SeitenBank Mandiri (Persero) TBK.: January 2014yohannestampubolonNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- BMTR PDFDokument4 SeitenBMTR PDFyohannestampubolonNoch keine Bewertungen

- Bank Bumi Arta TBK.: Company Report: January 2014 As of 30 January 2014Dokument3 SeitenBank Bumi Arta TBK.: Company Report: January 2014 As of 30 January 2014yohannestampubolonNoch keine Bewertungen

- Blta PDFDokument3 SeitenBlta PDFyohannestampubolonNoch keine Bewertungen

- BKDP PDFDokument3 SeitenBKDP PDFyohannestampubolonNoch keine Bewertungen

- BMSR PDFDokument3 SeitenBMSR PDFyohannestampubolonNoch keine Bewertungen

- BKSL PDFDokument4 SeitenBKSL PDFyohannestampubolonNoch keine Bewertungen

- BKSW PDFDokument3 SeitenBKSW PDFyohannestampubolonNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- BJTM PDFDokument3 SeitenBJTM PDFyohannestampubolonNoch keine Bewertungen

- BJBR PDFDokument3 SeitenBJBR PDFyohannestampubolonNoch keine Bewertungen

- HQ01 Partnership Formation and OperationDokument9 SeitenHQ01 Partnership Formation and OperationJean Ysrael Marquez50% (4)

- Nfjpia Nmbe Afar 2017 AnsDokument12 SeitenNfjpia Nmbe Afar 2017 AnsSamiee0% (1)

- BKM 10e Chap014Dokument8 SeitenBKM 10e Chap014jl123123Noch keine Bewertungen

- Université Paris Dauphine 2019-20 Professor Tamara Nefedova / Julien AlvarezDokument27 SeitenUniversité Paris Dauphine 2019-20 Professor Tamara Nefedova / Julien Alvarezomar zafadNoch keine Bewertungen

- 10Dokument24 Seiten10JDNoch keine Bewertungen

- Business Valuations: Net Asset Value (Nav)Dokument9 SeitenBusiness Valuations: Net Asset Value (Nav)Artwell ZuluNoch keine Bewertungen

- Wika 1Q2017 PDFDokument159 SeitenWika 1Q2017 PDFngadimenNoch keine Bewertungen

- FA Notes ReviewDokument85 SeitenFA Notes ReviewIrina StrizhkovaNoch keine Bewertungen

- Answer To MTP - Final - Syllabus 2012 - Dec2015 - Set 1: Paper - 18 - Corporate Financial ReportingDokument26 SeitenAnswer To MTP - Final - Syllabus 2012 - Dec2015 - Set 1: Paper - 18 - Corporate Financial ReportingBasant OjhaNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Prelim Exam - Special TopicsDokument9 SeitenPrelim Exam - Special TopicsCaelah Jamie TubleNoch keine Bewertungen

- Full Download Fundamental Accounting Principles 22nd Edition Wild Solutions ManualDokument35 SeitenFull Download Fundamental Accounting Principles 22nd Edition Wild Solutions Manualzax.algerian.tco4gNoch keine Bewertungen

- 0452 s03 Ms 1+2+3Dokument20 Seiten0452 s03 Ms 1+2+3marwa109100% (4)

- Foreign ExchangeDokument12 SeitenForeign ExchangeMadhurGuptaNoch keine Bewertungen

- Relic Spotter StatementsDokument6 SeitenRelic Spotter StatementsArpit AgarwalNoch keine Bewertungen

- SM 13Dokument29 SeitenSM 13wtfNoch keine Bewertungen

- NamaDokument4 SeitenNamaputri ekaNoch keine Bewertungen

- What Is Goodwill?: Key TakeawaysDokument4 SeitenWhat Is Goodwill?: Key TakeawaysTin PangilinanNoch keine Bewertungen

- Must Do Sample Paper Solved and Un Solved With Pre Board PaperDokument47 SeitenMust Do Sample Paper Solved and Un Solved With Pre Board PaperBhangu PreetNoch keine Bewertungen

- SQA Accounting Assignment 1Dokument7 SeitenSQA Accounting Assignment 1SENITH J100% (1)

- AFST Practice Set 04 Corporate LiquidationDokument4 SeitenAFST Practice Set 04 Corporate LiquidationAlain CopperNoch keine Bewertungen

- Engineering Economics Lect 5Dokument38 SeitenEngineering Economics Lect 5Furqan ChaudhryNoch keine Bewertungen

- Christine Bianca Chua - M3 S3.2 Learning TasksDokument14 SeitenChristine Bianca Chua - M3 S3.2 Learning TasksChristine Bianca ChuaNoch keine Bewertungen

- General Discussion of Balance Sheet: Accounting Principles AssetsDokument15 SeitenGeneral Discussion of Balance Sheet: Accounting Principles AssetsNazmul Hossain RahatNoch keine Bewertungen

- Abdul Wasay Roll No 53. Sec ADokument51 SeitenAbdul Wasay Roll No 53. Sec AMuhammad Hammad RajputNoch keine Bewertungen

- Final Accounts of CompaniesDokument30 SeitenFinal Accounts of CompaniesAkanksha GanveerNoch keine Bewertungen

- NYSF Practice TemplateDokument22 SeitenNYSF Practice TemplaterapsjadeNoch keine Bewertungen

- Taxguru - In-Guide To Approved Gratuity FundDokument12 SeitenTaxguru - In-Guide To Approved Gratuity FundnanuNoch keine Bewertungen

- Chapter 13Dokument8 SeitenChapter 13ks1043210Noch keine Bewertungen

- PT Intanwijaya Internasional TBK 2016 - Revised PDFDokument67 SeitenPT Intanwijaya Internasional TBK 2016 - Revised PDFHarry RayNoch keine Bewertungen

- Keterangan Penghapusan Aktiva Tetap: Fixed Assets Write-Off Request FormDokument3 SeitenKeterangan Penghapusan Aktiva Tetap: Fixed Assets Write-Off Request FormCak GambustNoch keine Bewertungen