Beruflich Dokumente

Kultur Dokumente

Latest Islamic Banking Industry

Hochgeladen von

TeeJyyCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Latest Islamic Banking Industry

Hochgeladen von

TeeJyyCopyright:

Verfügbare Formate

IBI assets grow 15 percent in CY16

R I Z WA N B H AT T I

MA R 18T H , 20 17

K A R ACH I

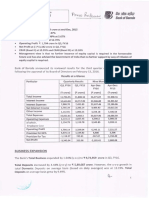

The assets of Islamic Banking Industry (IBI) recorded a growth of 15 percent during the last calendar

year (CY16). According to State Bank of Pakistan (SBP), assets of IBI surged to Rs 1.853 trillion as

on December 31, 2016 compared to Rs 1.610 trillion on December 31, 2015, depicting an increase of

Rs 243 billion. This increase in assets was mainly contributed by financing that witnessed a healthy

growth. During the period under review, deposits of IBI also increased by 14.4 percent or Rs 198

billion to reach Rs 1.573 trillion at the end of December.

The market share of Islamic banking assets and deposits in the overall banking industry stood at 11.7

percent and 13.3 percent, respectively by end-December, 2016 compared to 11.4 percent and 13.2

percent, respectively in December 2015. The network of IBI consisted of 21 Islamic Banking

Institutions (IBIs), including five full-fledged Islamic banks and 16 conventional banks having

standalone Islamic banking branches (IBBs) by end-December, 2016. Branch network of IBI reached

2,322 branches (spread across 112 districts) by end-December, 2016 up from 2,075 branches at the

end of December 2015.

Province/region-wise break-up of branches reveals that Punjab and Sindh jointly account for almost

80 percent share in overall IBI branch network. The number of Islamic banking windows operated by

conventional banks having Islamic banking branches stood at 1,220 by end-December, 2016. During

the period under review, Burj Bank Limited merged into AlBaraka Bank (Pakistan) Limited.

Bifurcation of assets among IBs and IBBs reveal that assets of both IBs and IBBs increased by Rs 57

billion and Rs 8 billion, respectively during the last quarter (Oct-Dec) of CY16. The share of IBs (61.9

percent) remained higher than that of IBBs (38.1 percent) in the overall assets of IBI.

During the last quarter, profit after tax (PAT) of IBI was recorded at Rs 11.8 billion at the end of the

quarter under review. Among other profitability indicators, Return on Assets (RoA) and Return on

Equity (RoE) were recorded at 0.7 percent and 10.6 percent, respectively.

Deposits of IBI witnessed a growth of Rs 97 billion during the quarter ended December, 2016.

Deposits were recorded at Rs 1,573 billion compared to Rs 1,476 billion in the previous quarter. The

category-wise break-up of deposits shows that current (non-remunerative) and fixed deposits

increased by Rs 61 billion and Rs 18 billion, respectively during the review quarter.

Investments (net) of IBI were recorded at Rs 490 billion by end-December, 2016 compared to Rs 663

billion in the previous quarter. This decrease in investments was mainly attributed by maturity of Bai

Muajjal of Sukuk transaction of IBIs with GoP. Asset quality indicators of IBI, including non-performing

finances (NPFs) to financing (gross) and net NPFs to net-financing were better than those of overall

banking industry's averages. Provisions to NPFs ratio was recorded at 84.7 percent by end-

December, 2016.

Das könnte Ihnen auch gefallen

- Denso CR Injector & Pump Repair Kits 2016Dokument24 SeitenDenso CR Injector & Pump Repair Kits 2016Euro Diesel100% (7)

- Belgian Ale by Pierre Rajotte (1992)Dokument182 SeitenBelgian Ale by Pierre Rajotte (1992)Ricardo Gonzalez50% (2)

- How To Remove Ink From Clothes - 11 Steps - Wikihow PDFDokument8 SeitenHow To Remove Ink From Clothes - 11 Steps - Wikihow PDFmilan_lahiruNoch keine Bewertungen

- Sector Analysis Architecture Building and Construction 2014Dokument9 SeitenSector Analysis Architecture Building and Construction 2014PritNoch keine Bewertungen

- Valuation of Asset For The Purpose of InsuranceDokument13 SeitenValuation of Asset For The Purpose of InsuranceAhmedAli100% (1)

- Catalog EnglezaDokument16 SeitenCatalog EnglezaCosty Trans100% (1)

- Financial Soundness Indicators for Financial Sector Stability in BangladeshVon EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNoch keine Bewertungen

- ICICI Bank Reports 18% Credit Growth in 2010-11Dokument5 SeitenICICI Bank Reports 18% Credit Growth in 2010-11arshsing143Noch keine Bewertungen

- United Bank Limited: Unconsolidated Condensed Interim Financial StatementsDokument20 SeitenUnited Bank Limited: Unconsolidated Condensed Interim Financial StatementsYasir SheikhNoch keine Bewertungen

- Icici Bank: CMP: INR396 TP: INR520 (+31%)Dokument22 SeitenIcici Bank: CMP: INR396 TP: INR520 (+31%)saran21Noch keine Bewertungen

- Paper of Sir Zahid SolveDokument17 SeitenPaper of Sir Zahid Solvepak digitalNoch keine Bewertungen

- Pak Eco. Fig.Dokument2 SeitenPak Eco. Fig.Ahsan MehmoodNoch keine Bewertungen

- Fsa 2006 10Dokument880 SeitenFsa 2006 10Mahmood KhanNoch keine Bewertungen

- Current Macroeconomic Situation: Gross Domestic ProductDokument8 SeitenCurrent Macroeconomic Situation: Gross Domestic ProductMonkey.D. LuffyNoch keine Bewertungen

- Outlook of Bank Industry in PakistanDokument3 SeitenOutlook of Bank Industry in PakistanghazalaNoch keine Bewertungen

- Bop Q1fy12Dokument4 SeitenBop Q1fy12Amol PhadaleNoch keine Bewertungen

- Financial sector analysis 2013-2017Dokument250 SeitenFinancial sector analysis 2013-2017I Tech Services Kamran0% (1)

- ICRA Financial Markets and Banking Update Vol 2Dokument13 SeitenICRA Financial Markets and Banking Update Vol 2Sitaram SwaroopNoch keine Bewertungen

- Provincial Fiscal Operatins: Iqrar AhmadDokument11 SeitenProvincial Fiscal Operatins: Iqrar AhmadDani QureshiNoch keine Bewertungen

- Results Press Release For December 31, 2015 (Result)Dokument3 SeitenResults Press Release For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- (Based On The First Eleven Months' Data of 2008/09) : Current Macroeconomic SituationDokument9 Seiten(Based On The First Eleven Months' Data of 2008/09) : Current Macroeconomic SituationMonkey.D. LuffyNoch keine Bewertungen

- IBB BuletinDokument27 SeitenIBB Buletindaily liveNoch keine Bewertungen

- Economic Indicators (2019-2020)Dokument2 SeitenEconomic Indicators (2019-2020)Huzaifa IrfanNoch keine Bewertungen

- Major Economic Indicator 2016Dokument27 SeitenMajor Economic Indicator 2016Ashiq HossainNoch keine Bewertungen

- Current Macroeconomic Situation in Nepal Based on Five Months' DataDokument9 SeitenCurrent Macroeconomic Situation in Nepal Based on Five Months' DataMonkey.D. LuffyNoch keine Bewertungen

- Occ Quarterly Us Bank Derivatives ReportDokument50 SeitenOcc Quarterly Us Bank Derivatives Reportjohn7451Noch keine Bewertungen

- BOP, CAD and Fiscal Deficit Analysis: Task - 5Dokument13 SeitenBOP, CAD and Fiscal Deficit Analysis: Task - 5shubhamNoch keine Bewertungen

- Phl BOP surplus grows 33% in Aug, 7th straight monthDokument3 SeitenPhl BOP surplus grows 33% in Aug, 7th straight monthChristal Jam LaureNoch keine Bewertungen

- Banking: Last Updated: July 2011Dokument4 SeitenBanking: Last Updated: July 2011shalini26Noch keine Bewertungen

- Fundamental AnalysisDokument20 SeitenFundamental AnalysisHarinandhakumar NatarajanNoch keine Bewertungen

- Current Macroeconomic SituationDokument9 SeitenCurrent Macroeconomic SituationMonkey.D. LuffyNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument9 SeitenNew Microsoft Office Word DocumentgauravgorkhaNoch keine Bewertungen

- Analysis of Q4 2011 Banking CompanysDokument7 SeitenAnalysis of Q4 2011 Banking CompanysparmardhawalNoch keine Bewertungen

- Quarterly Performance Review of The Banking Sector: (July-September, 2017)Dokument20 SeitenQuarterly Performance Review of The Banking Sector: (July-September, 2017)Anonymous gHNNoRTNoch keine Bewertungen

- Credit Crunch: Beyond A Wake Up Call For Banking Sector - New Business Age - Monthly Business MagazDokument22 SeitenCredit Crunch: Beyond A Wake Up Call For Banking Sector - New Business Age - Monthly Business MagazSajan ShresthaNoch keine Bewertungen

- BM Cia 1Dokument21 SeitenBM Cia 1SAHILNoch keine Bewertungen

- Islamic Banking Bulletin: Oct-Dec 2018 HighlightsDokument27 SeitenIslamic Banking Bulletin: Oct-Dec 2018 HighlightsDharmajaya SoetotoNoch keine Bewertungen

- Current Macroeconomic SituationDokument10 SeitenCurrent Macroeconomic SituationMonkey.D. LuffyNoch keine Bewertungen

- p200522 PDFDokument50 Seitenp200522 PDFJ. BangjakNoch keine Bewertungen

- Balacesheet Analysis: Sbi Bank and Axis Bank: Vinay V. PatilDokument16 SeitenBalacesheet Analysis: Sbi Bank and Axis Bank: Vinay V. PatilVinay PatilNoch keine Bewertungen

- Press Release - 20 January, 2012: ST STDokument7 SeitenPress Release - 20 January, 2012: ST STNimesh MomayaNoch keine Bewertungen

- Current Macroeconomic SituationDokument9 SeitenCurrent Macroeconomic SituationMonkey.D. LuffyNoch keine Bewertungen

- Ixambee Monthly December CapsuleDokument48 SeitenIxambee Monthly December CapsulejoydsNoch keine Bewertungen

- Crisil Bop First Cut - March 2015Dokument4 SeitenCrisil Bop First Cut - March 2015Saptarishi SenNoch keine Bewertungen

- Current - Macroeconomic - Situation - English 2009 04 - Text - Based On First Seven Month Data of 2008 09Dokument8 SeitenCurrent - Macroeconomic - Situation - English 2009 04 - Text - Based On First Seven Month Data of 2008 09Monkey.D. LuffyNoch keine Bewertungen

- Current Macroeconomic SituationDokument9 SeitenCurrent Macroeconomic SituationMonkey.D. LuffyNoch keine Bewertungen

- Org Study Canara BankDokument43 SeitenOrg Study Canara BankRaghavendraNoch keine Bewertungen

- Comparing BOP of India and ChinaDokument14 SeitenComparing BOP of India and ChinaPrashanth Prabhakar68% (19)

- Current Macroeconomic SituationDokument9 SeitenCurrent Macroeconomic SituationMonkey.D. LuffyNoch keine Bewertungen

- Indian Banking Industry-1253Dokument37 SeitenIndian Banking Industry-1253ch.nagarjunaNoch keine Bewertungen

- Fdisurveyjanjun2016 PDFDokument57 SeitenFdisurveyjanjun2016 PDFMonir HossainNoch keine Bewertungen

- QTR ReportDokument98 SeitenQTR ReportMichael AshenafiNoch keine Bewertungen

- MUTUAL FUNDS AUM RISES 1% TO RS 15.8 LAKH CRORE IN SEPDokument17 SeitenMUTUAL FUNDS AUM RISES 1% TO RS 15.8 LAKH CRORE IN SEPumaganNoch keine Bewertungen

- Current Macroeconomic SituationDokument8 SeitenCurrent Macroeconomic SituationMonkey.D. LuffyNoch keine Bewertungen

- UBL Standalone Financial Statements 2021 With DR ReportDokument122 SeitenUBL Standalone Financial Statements 2021 With DR ReportAftab JamilNoch keine Bewertungen

- Financial Analysis of Indusind BankDokument2 SeitenFinancial Analysis of Indusind BankAnkitNoch keine Bewertungen

- Icici Subsidiaries Ar 2015 16Dokument492 SeitenIcici Subsidiaries Ar 2015 16RAHIM KHANNoch keine Bewertungen

- Banking Finance and Insurance: A Report On Financial Analysis of IDBI BankDokument8 SeitenBanking Finance and Insurance: A Report On Financial Analysis of IDBI BankRaven FormourneNoch keine Bewertungen

- ICICI Bank's total assets reach US$ 156.8 billionDokument1 SeiteICICI Bank's total assets reach US$ 156.8 billionPULKIT KAURA 2127621Noch keine Bewertungen

- Financial ProfileDokument1 SeiteFinancial ProfileSuresh KumarNoch keine Bewertungen

- Recent Trends in India's BopDokument6 SeitenRecent Trends in India's BopAashi JainNoch keine Bewertungen

- Presentation On Analysis of Annual Report of State Bank of IndiaDokument18 SeitenPresentation On Analysis of Annual Report of State Bank of IndiaRudra PratapNoch keine Bewertungen

- Org Study Canara Bank 150904183048 Lva1 App6892Dokument81 SeitenOrg Study Canara Bank 150904183048 Lva1 App6892shivaraj p yNoch keine Bewertungen

- Current Macroeconomic SituationDokument9 SeitenCurrent Macroeconomic SituationMonkey.D. LuffyNoch keine Bewertungen

- Report On Banking IndustryDokument91 SeitenReport On Banking IndustrySachin MittalNoch keine Bewertungen

- Indian Banking Industry Evolution and Current ScenarioDokument55 SeitenIndian Banking Industry Evolution and Current ScenarioShikha TrehanNoch keine Bewertungen

- GraphsDokument23 SeitenGraphsTeeJyyNoch keine Bewertungen

- The Pakistan TehreekDokument3 SeitenThe Pakistan TehreekTeeJyyNoch keine Bewertungen

- Documentary CollectionDokument1 SeiteDocumentary CollectionTeeJyyNoch keine Bewertungen

- Feed Back1Dokument22 SeitenFeed Back1TeeJyyNoch keine Bewertungen

- Pak Italy LNGDokument2 SeitenPak Italy LNGTeeJyyNoch keine Bewertungen

- AFS - Indus MotorsDokument73 SeitenAFS - Indus Motorstsam181618Noch keine Bewertungen

- Priced To Brent: Article Continues After AdDokument2 SeitenPriced To Brent: Article Continues After AdTeeJyyNoch keine Bewertungen

- Priced To Brent: Article Continues After AdDokument2 SeitenPriced To Brent: Article Continues After AdTeeJyyNoch keine Bewertungen

- Ital Structure Decision)Dokument1 SeiteItal Structure Decision)TeeJyyNoch keine Bewertungen

- Pakistan's IMF Program Requires Largest Fiscal Adjustment in HistoryDokument1 SeitePakistan's IMF Program Requires Largest Fiscal Adjustment in HistoryTeeJyyNoch keine Bewertungen

- CH 14 Prac Quest DividendDokument1 SeiteCH 14 Prac Quest DividendTeeJyyNoch keine Bewertungen

- Health CareDokument1 SeiteHealth CareTeeJyyNoch keine Bewertungen

- DuPont ModelDokument1 SeiteDuPont ModelTeeJyyNoch keine Bewertungen

- ReturnsDokument1 SeiteReturnsTeeJyyNoch keine Bewertungen

- ContinuedDokument1 SeiteContinuedTeeJyyNoch keine Bewertungen

- CategoryDokument1 SeiteCategoryTeeJyyNoch keine Bewertungen

- Article On Pakistan Economy: Taruj TariqDokument29 SeitenArticle On Pakistan Economy: Taruj TariqTeeJyy0% (1)

- Pro Forma AnalysisDokument1 SeitePro Forma AnalysisTeeJyyNoch keine Bewertungen

- What Is The Difference Between IstisnaDokument1 SeiteWhat Is The Difference Between IstisnaTeeJyyNoch keine Bewertungen

- IntermediariesDokument1 SeiteIntermediariesTeeJyyNoch keine Bewertungen

- CategoryDokument1 SeiteCategoryTeeJyyNoch keine Bewertungen

- Agriculture innovation tech transfer ChinaDokument1 SeiteAgriculture innovation tech transfer ChinaTeeJyyNoch keine Bewertungen

- Soiology Presentatioon 4jjDokument44 SeitenSoiology Presentatioon 4jjTeeJyyNoch keine Bewertungen

- The Five Steps of Lean ImplementationDokument1 SeiteThe Five Steps of Lean ImplementationTeeJyyNoch keine Bewertungen

- Federal cabinet lifts gas moratorium after Sindh objectionDokument1 SeiteFederal cabinet lifts gas moratorium after Sindh objectionTeeJyyNoch keine Bewertungen

- Computer Application For Business IIDokument48 SeitenComputer Application For Business IITeeJyyNoch keine Bewertungen

- Is Child Work Necessary PDFDokument72 SeitenIs Child Work Necessary PDFTeeJyyNoch keine Bewertungen

- MGT 1Dokument25 SeitenMGT 1TeeJyyNoch keine Bewertungen

- Questionnaire For Evaluating The Education Systems in IndiaDokument5 SeitenQuestionnaire For Evaluating The Education Systems in IndiaTeeJyyNoch keine Bewertungen

- Business Development Manager Research in Chicago IL Resume Christine HorwitzDokument2 SeitenBusiness Development Manager Research in Chicago IL Resume Christine HorwitzChristineHorwitzNoch keine Bewertungen

- Answers To Second Midterm Summer 2011Dokument11 SeitenAnswers To Second Midterm Summer 2011ds3057Noch keine Bewertungen

- An Overview of SMEDokument3 SeitenAn Overview of SMENina HooperNoch keine Bewertungen

- Chapter 3 - Project SelectionDokument15 SeitenChapter 3 - Project SelectionFatin Nabihah100% (2)

- Small Business & Entrepreneurship - Chapter 14Dokument28 SeitenSmall Business & Entrepreneurship - Chapter 14Muhammad Zulhilmi Wak JongNoch keine Bewertungen

- Case Study on Prime Bank's Customer Service StrategyDokument8 SeitenCase Study on Prime Bank's Customer Service StrategyjeankoplerNoch keine Bewertungen

- Fashion Cycle - Steps of Fashion CyclesDokument3 SeitenFashion Cycle - Steps of Fashion CyclesSubrata Mahapatra100% (1)

- Case StudyDokument16 SeitenCase Studysagrikakhandka100% (1)

- Print Control PageDokument1 SeitePrint Control PageCool Friend GksNoch keine Bewertungen

- Pocket ClothierDokument30 SeitenPocket ClothierBhisma SuryamanggalaNoch keine Bewertungen

- 4 Case Studies at 15% 60% 1 Article Report 10% 1 Country Notebook 25% 1 Participation Factor 5% Total 100%Dokument4 Seiten4 Case Studies at 15% 60% 1 Article Report 10% 1 Country Notebook 25% 1 Participation Factor 5% Total 100%cmarasco15Noch keine Bewertungen

- Renaming of The Dept. of Geology, Univ. of Kerala.Dokument6 SeitenRenaming of The Dept. of Geology, Univ. of Kerala.DrThrivikramji KythNoch keine Bewertungen

- A Preliminary Feasibility Study About High-Speed Rail in CanadaDokument16 SeitenA Preliminary Feasibility Study About High-Speed Rail in CanadamaxlentiNoch keine Bewertungen

- Garantias Copikon VenezuelaDokument3 SeitenGarantias Copikon VenezuelaMaria SanzNoch keine Bewertungen

- Statistic SolutionsDokument53 SeitenStatistic SolutionsRahmati Rahmatullah100% (2)

- WWW EconomicsdiscussionDokument12 SeitenWWW EconomicsdiscussionMorrison Omokiniovo Jessa SnrNoch keine Bewertungen

- Keto Diet PlanDokument5 SeitenKeto Diet PlanSouharda MukherjeeNoch keine Bewertungen

- Peace Corps FINANCIAL ASSISTANTDokument1 SeitePeace Corps FINANCIAL ASSISTANTAccessible Journal Media: Peace Corps DocumentsNoch keine Bewertungen

- Production Possibility Frontier ("PPF")Dokument6 SeitenProduction Possibility Frontier ("PPF")New1122Noch keine Bewertungen

- Regina+SD+No +4+2021-22+Annual+ReportDokument117 SeitenRegina+SD+No +4+2021-22+Annual+ReportpomNoch keine Bewertungen

- BILAX BrochureDokument8 SeitenBILAX BrochureJeremy GordonNoch keine Bewertungen

- Managing Account PortfoliosDokument14 SeitenManaging Account PortfoliosDiarra LionelNoch keine Bewertungen

- El Trimestre Económico - Índice XXX AniversarioDokument100 SeitenEl Trimestre Económico - Índice XXX AniversarioJuanNoch keine Bewertungen