Beruflich Dokumente

Kultur Dokumente

S-Reits Offer Sustainable Income - Schroders, Companies & Markets - The BUSINESS TIMES

Hochgeladen von

phuawlOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

S-Reits Offer Sustainable Income - Schroders, Companies & Markets - The BUSINESS TIMES

Hochgeladen von

phuawlCopyright:

Verfügbare Formate

HI A11483705829ESHOPNSUB!

| LOG OUT

http://www.businesstimes.com.sg/companies-markets/s-reits-oer-sustainable-income-schroders

SReitsoffersustainableincome:Schroders

Singapore real estate investment trusts seen having a role to play in investors' portfolios over longer time horizons

Thursday, April 13, 2017 - 05:50

by

ANGELA TAN angelat@sph.com.sg

Singapore

INVESTORS seeking a sustainable income source should consider Singapore real estate investment trusts (S-Reits) as part of their

investment portfolio, Schroders suggested on Wednesday.

Schroders said Reits had been a popular way for investors to invest in property while at the same time receiving an income. However,

they have lost favour amid concerns over rising US interest rates. This was because as bond yields rise, the yield dierence between a

"safer" bond and a more "risky" income stock narrows, making the latter less attractive.

"But if we take a look at longer- term performance and see how Reits in Singapore compare to the broader equity market, we can see

that they could still have a role to play in investors' portfolios over longer time horizons and for anyone looking for a source of

sustainable income," Schroders said.

For many S-Reits, dividends are paid out quarterly. Investors stand to reap long-term returns from re-investing dividends earned back

into the market.

SEE ALSO: Ascott sets its sights on South America

"Utilising the power of compounding, the eect of dividends on overall performance is often understated," Schroders said.

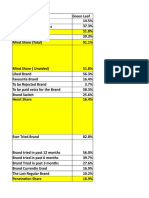

It cited an example where the benchmark FTSE ST Reit Index (FTSREI) in Singapore has returned 19.7 per cent over ve years on a purely

price return basis versus the broader Straits Times Index's (STI) 3.2 per cent gain.

"However, if we take into account re-invested dividends and look at this in terms of total returns, then the FTSREI's numbers are that

much stronger - returning just over 60 per cent over ve years against a rather less impressive 19.2 per cent for the STI."

The FTSREI's current dividend yield is also at an attractive level of 6.2 per cent against the STI's 3.5 per cent.

Schroders further argued that S-Reits also oer a dividend yield that still possesses a signicant yield spread over the government's 10-

year bond yield.

Patrick Brenner, Schroders's head of Multi-Asset Investments in Asia, believes that Reits could be an important component of an income-

oriented strategy. However, he warned that it is a broad category and dierent sub-sector Reits behave dierently in a market cycle.

"For example, Reits with a larger exposure to the consumer staples sector tend to perform better during a slowdown, while Reits with a

bias towards the discretionary or industrials sector will more likely move in tandem with economic cycles.

"Therefore, it is important for investors to distinguish and understand the true exposure in their Reits holdings."

Das könnte Ihnen auch gefallen

- SBRSeptember2013 LR 16Dokument1 SeiteSBRSeptember2013 LR 16Kyaw Kyaw AungNoch keine Bewertungen

- Reit ThesisDokument4 SeitenReit Thesisfjgqdmne100% (2)

- Sharekhan's Top SIP Fund PicksDokument4 SeitenSharekhan's Top SIP Fund PicksKabeer ChawlaNoch keine Bewertungen

- Asset Allocation and Effective Portfolio Management: Part OneVon EverandAsset Allocation and Effective Portfolio Management: Part OneBewertung: 4 von 5 Sternen4/5 (3)

- 2048065828final MF FACT SHEET November 2015Dokument13 Seiten2048065828final MF FACT SHEET November 2015Dhiraj AhujaNoch keine Bewertungen

- Fact Sheet STTFDokument2 SeitenFact Sheet STTFCasper Wong Wai HangNoch keine Bewertungen

- Investment Strategies and Motivational Factors Among Small Investors A Stud-with-cover-page-V2Dokument16 SeitenInvestment Strategies and Motivational Factors Among Small Investors A Stud-with-cover-page-V2Rohini VNoch keine Bewertungen

- Dalal Street Investment Journal - August 07 2018 PDFDokument84 SeitenDalal Street Investment Journal - August 07 2018 PDFGanapati HegdeNoch keine Bewertungen

- Why Invest?: Tools To Make Compound Interest WorkDokument3 SeitenWhy Invest?: Tools To Make Compound Interest WorkThebe SetshediNoch keine Bewertungen

- Alset International LimitedDokument13 SeitenAlset International LimitedSieng MenghongNoch keine Bewertungen

- Annual Report Can Reveal The Secrets A Company Wants To Hide - Here's How To Uncover - The Economic TimesDokument6 SeitenAnnual Report Can Reveal The Secrets A Company Wants To Hide - Here's How To Uncover - The Economic TimesambujgNoch keine Bewertungen

- Most Funds Are Outperformers: MutualDokument1 SeiteMost Funds Are Outperformers: MutualkrjuluNoch keine Bewertungen

- Saratoga Presentation Aug 2014 PDFDokument33 SeitenSaratoga Presentation Aug 2014 PDFYudhi HuseinNoch keine Bewertungen

- Reits DissertationDokument5 SeitenReits DissertationDoMyPaperForMeCanada100% (1)

- Portfolio Management - Part 2: Portfolio Management, #2Von EverandPortfolio Management - Part 2: Portfolio Management, #2Bewertung: 5 von 5 Sternen5/5 (9)

- Capital Letter May 2011Dokument6 SeitenCapital Letter May 2011marketingNoch keine Bewertungen

- InvestmentDokument78 SeitenInvestmentSanchita NaikNoch keine Bewertungen

- Think FundsIndia July 2014Dokument10 SeitenThink FundsIndia July 2014marketingNoch keine Bewertungen

- Sharekhan's Top SIP Fund PicksDokument4 SeitenSharekhan's Top SIP Fund PicksrajdeeppawarNoch keine Bewertungen

- Analysis and Study of The Mutual Fund Industry: Prepared byDokument36 SeitenAnalysis and Study of The Mutual Fund Industry: Prepared byshashank nutiNoch keine Bewertungen

- Literature ReviewDokument8 SeitenLiterature ReviewDiwakar SinghNoch keine Bewertungen

- Top 10 Investment Options: Public Provident Fund Real EstateDokument3 SeitenTop 10 Investment Options: Public Provident Fund Real EstateleninbapujiNoch keine Bewertungen

- Annual Report Can Reveal The Secrets A Company Wants To Hide: Here's How To UncoverDokument15 SeitenAnnual Report Can Reveal The Secrets A Company Wants To Hide: Here's How To UncovernnsriniNoch keine Bewertungen

- Sundaram Select MidcapDokument2 SeitenSundaram Select Midcapredchillies7Noch keine Bewertungen

- June 2019 Investor LetterDokument7 SeitenJune 2019 Investor LetterMohit AgarwalNoch keine Bewertungen

- Pershing SQR 1Q 2Q 2014 Investor Letter 1Dokument20 SeitenPershing SQR 1Q 2Q 2014 Investor Letter 1ValueWalk50% (2)

- Capital Letter December 2011Dokument5 SeitenCapital Letter December 2011marketingNoch keine Bewertungen

- Long Term InvestingDokument8 SeitenLong Term InvestingkrishchellaNoch keine Bewertungen

- Singapore Property Weekly Issue 170Dokument16 SeitenSingapore Property Weekly Issue 170Propwise.sgNoch keine Bewertungen

- A Summer Internship Project On Investment Pattern On The Basis of Risk Profile of InvestorsDokument84 SeitenA Summer Internship Project On Investment Pattern On The Basis of Risk Profile of InvestorsprashantNoch keine Bewertungen

- How To Build WealthDokument12 SeitenHow To Build WealthAshishNoch keine Bewertungen

- Sgreits 020911Dokument18 SeitenSgreits 020911Royston Tan Keng SanNoch keine Bewertungen

- The Exciting World of Indian Mutual FundsVon EverandThe Exciting World of Indian Mutual FundsBewertung: 5 von 5 Sternen5/5 (1)

- New Strategy: Mutual Funds Turn Focus On Retail Investors: IndiaDokument9 SeitenNew Strategy: Mutual Funds Turn Focus On Retail Investors: IndiaSumana ChukkiNoch keine Bewertungen

- One Sheeter Cpof5y4sDokument2 SeitenOne Sheeter Cpof5y4sRoshaan MahbubaniNoch keine Bewertungen

- Comparative Analysis of Mutual Fund Schemes and Major Investment AvenuesDokument52 SeitenComparative Analysis of Mutual Fund Schemes and Major Investment AvenuesPrithvi Raj SinghNoch keine Bewertungen

- Future of Reits in India: From A Retail Investor PerspectiveDokument3 SeitenFuture of Reits in India: From A Retail Investor PerspectivePagar PagarNoch keine Bewertungen

- The Fidelity SIP Guide: We're Here To HelpDokument12 SeitenThe Fidelity SIP Guide: We're Here To HelpkrishchellaNoch keine Bewertungen

- Mutual Funds: Systematic Investment Plan: S.Srimaan Ramachandra Raja Sohail HiraniDokument8 SeitenMutual Funds: Systematic Investment Plan: S.Srimaan Ramachandra Raja Sohail HiraniStudent ProjectsNoch keine Bewertungen

- SIP PresentationDokument21 SeitenSIP PresentationSheikh AaishanNoch keine Bewertungen

- ELHF Jun'18 Investor CommuniquéDokument6 SeitenELHF Jun'18 Investor CommuniquéHarsh GandhiNoch keine Bewertungen

- Factor InvestingDokument16 SeitenFactor InvestingRicardo BregaldaNoch keine Bewertungen

- Capital Letter August 2011Dokument5 SeitenCapital Letter August 2011marketingNoch keine Bewertungen

- 3 MultibraggersDokument22 Seiten3 MultibraggersGyana Prakash Nayak100% (1)

- Dissertation ReitDokument7 SeitenDissertation Reitendulrave1986100% (1)

- Index Fund PresentationDokument11 SeitenIndex Fund Presentationjagruti narkarNoch keine Bewertungen

- Investment Ideas: SmartDokument2 SeitenInvestment Ideas: SmartGhafar AzmanNoch keine Bewertungen

- Singtel - : No Myanmar, No ProblemDokument4 SeitenSingtel - : No Myanmar, No Problemscrib07Noch keine Bewertungen

- Equity Research On Paint and FMCG SectorDokument47 SeitenEquity Research On Paint and FMCG SectornehagadgeNoch keine Bewertungen

- Market Watch Daily 28.06.2013Dokument1 SeiteMarket Watch Daily 28.06.2013Randora LkNoch keine Bewertungen

- Final ProjectDokument43 SeitenFinal Projectkanchanmahato_jsrNoch keine Bewertungen

- VCC Edge - LP Report - 2019Dokument14 SeitenVCC Edge - LP Report - 2019BaniNoch keine Bewertungen

- Review of LiteratureDokument12 SeitenReview of LiteratureRanjit Superanjit100% (1)

- Schroder Dana Istimewa: Fund FactsheetDokument1 SeiteSchroder Dana Istimewa: Fund FactsheetWacadd OfcaipiNoch keine Bewertungen

- Reliance Industries Limited: Team Members Ragavi Priyanka Kirthika Suhitaa Rajee SuganyaDokument8 SeitenReliance Industries Limited: Team Members Ragavi Priyanka Kirthika Suhitaa Rajee Suganyachitu1992Noch keine Bewertungen

- Mutual Fund Category Analysis - Equity Diversified Small-Cap FundsDokument6 SeitenMutual Fund Category Analysis - Equity Diversified Small-Cap FundsGauriGanNoch keine Bewertungen

- REIT Investing for Beginners: Mastering Wealth in Real Estate Without Direct Property Ownership + Overcoming Inflation with Reliable 9% DividendsVon EverandREIT Investing for Beginners: Mastering Wealth in Real Estate Without Direct Property Ownership + Overcoming Inflation with Reliable 9% DividendsNoch keine Bewertungen

- Risk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveVon EverandRisk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveNoch keine Bewertungen

- Gulf Ar2017 en PDFDokument226 SeitenGulf Ar2017 en PDFphuawlNoch keine Bewertungen

- Private Home Resale Prices Rise For 5th Straight Month To 2 - Year High in March - SRX Property, Property News & Top Stories - The Straits TimesDokument2 SeitenPrivate Home Resale Prices Rise For 5th Straight Month To 2 - Year High in March - SRX Property, Property News & Top Stories - The Straits TimesphuawlNoch keine Bewertungen

- SGXNET FY2016 - 21feb17Dokument12 SeitenSGXNET FY2016 - 21feb17phuawlNoch keine Bewertungen

- SGX+Securities+Market+Direct+Feed+ (SMDF) +factsheet+ (Eng) +-+mar+2015 D2Dokument1 SeiteSGX+Securities+Market+Direct+Feed+ (SMDF) +factsheet+ (Eng) +-+mar+2015 D2phuawlNoch keine Bewertungen

- Form 6 - KDCRM 27022017 FinalDokument5 SeitenForm 6 - KDCRM 27022017 FinalphuawlNoch keine Bewertungen

- S Reits Tracker 170131 OirDokument4 SeitenS Reits Tracker 170131 OirphuawlNoch keine Bewertungen

- Ascendas Reit - : Growing Its Portfolio InorganicallyDokument4 SeitenAscendas Reit - : Growing Its Portfolio InorganicallyphuawlNoch keine Bewertungen

- Chip Eng Seng: Alexandra Central Profit Is Lower Than EstimatedDokument5 SeitenChip Eng Seng: Alexandra Central Profit Is Lower Than EstimatedphuawlNoch keine Bewertungen

- FCT Annual Report FY2016Dokument188 SeitenFCT Annual Report FY2016phuawlNoch keine Bewertungen

- 2013-02-18 - Getting Started On Trust or Estate PlanningDokument4 Seiten2013-02-18 - Getting Started On Trust or Estate PlanningphuawlNoch keine Bewertungen

- mPassBook 591xxxx45975 05012023 133513 PDFDokument2 SeitenmPassBook 591xxxx45975 05012023 133513 PDFJasvinder Singh67% (3)

- Brand Health Analysis TemplateDokument4 SeitenBrand Health Analysis Templateanon_493704527Noch keine Bewertungen

- Investments, 8 Edition: Equity Valuation ModelsDokument45 SeitenInvestments, 8 Edition: Equity Valuation ModelsErryNoch keine Bewertungen

- Chapter 25: Step by Step Murabaha Financing: Bank ClientDokument3 SeitenChapter 25: Step by Step Murabaha Financing: Bank ClientAlton JurahNoch keine Bewertungen

- Call Outs For Blade HQDokument73 SeitenCall Outs For Blade HQSnöBer GardenNoch keine Bewertungen

- Derivatives - 8 - Binomial Option Pricing ModelDokument73 SeitenDerivatives - 8 - Binomial Option Pricing ModelHins LeeNoch keine Bewertungen

- Ia PPT 7Dokument18 SeitenIa PPT 7lorriejaneNoch keine Bewertungen

- RBI/2007-2008/22 Master Circular No./6 /2007-08 July 2, 2007Dokument53 SeitenRBI/2007-2008/22 Master Circular No./6 /2007-08 July 2, 2007Makarand LonkarNoch keine Bewertungen

- Consumers' Behaviour Towards Online Purchases: January 2015Dokument16 SeitenConsumers' Behaviour Towards Online Purchases: January 2015Son AdamNoch keine Bewertungen

- USA State-Wise Email Leads PDFDokument6 SeitenUSA State-Wise Email Leads PDFSimeon Dwight100% (1)

- Role of CRM in MarketingDokument19 SeitenRole of CRM in MarketingVivek Kumar Gupta86% (14)

- 56 Brand Management at HCL (Vishal)Dokument77 Seiten56 Brand Management at HCL (Vishal)sheemankhanNoch keine Bewertungen

- Distressed Debt InvestingDokument10 SeitenDistressed Debt Investing233344554545100% (2)

- A Study On Foreign Exchage and Its Risk ManagementDokument45 SeitenA Study On Foreign Exchage and Its Risk ManagementBhushan100% (1)

- 5 Important Principles of Modern AccountingDokument2 Seiten5 Important Principles of Modern AccountingBilal SiddiqueNoch keine Bewertungen

- Business Plan ReportDokument37 SeitenBusiness Plan ReportClark AgbanNoch keine Bewertungen

- Chap 001Dokument21 SeitenChap 001Ch Rajkamal100% (1)

- Lecture 3 - Chapter 3Dokument13 SeitenLecture 3 - Chapter 3Ayesha LatifNoch keine Bewertungen

- Swot AnalysisDokument4 SeitenSwot AnalysisAhmad ShahNoch keine Bewertungen

- Marketing Marketing - Rural Marketing Budget Brands Back With A BangDokument7 SeitenMarketing Marketing - Rural Marketing Budget Brands Back With A BangrohandefinedNoch keine Bewertungen

- Advertising ObjectiveDokument35 SeitenAdvertising ObjectiveAshmumNoch keine Bewertungen

- Smart Seller GuideDokument33 SeitenSmart Seller GuideYa WenNoch keine Bewertungen

- Study On Venture CapitalDokument31 SeitenStudy On Venture CapitalShaheen Books50% (2)

- Forever KnowledgeDokument2 SeitenForever KnowledgeminariiNoch keine Bewertungen

- WACC EthiopiaDokument4 SeitenWACC EthiopiaPandS BoiNoch keine Bewertungen

- Marketing Principles and Strategies: Mdm. Lorne Mae MalabarbasDokument42 SeitenMarketing Principles and Strategies: Mdm. Lorne Mae MalabarbasNoby Ann Vargas LobeteNoch keine Bewertungen

- Merger and AcquisitionDokument4 SeitenMerger and Acquisitionshady emadNoch keine Bewertungen

- Gardenia Marketing PlanDokument18 SeitenGardenia Marketing PlanpikaNoch keine Bewertungen

- MODULE 1 AFNA ACT2A AnswersDokument2 SeitenMODULE 1 AFNA ACT2A AnswersRowena Serrano100% (3)

- Assignment On Launching Aarong in Canada: Submitted ToDokument14 SeitenAssignment On Launching Aarong in Canada: Submitted ToEnaiya IslamNoch keine Bewertungen