Beruflich Dokumente

Kultur Dokumente

Cacfp 2016 2017

Hochgeladen von

Amanda's GardenOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cacfp 2016 2017

Hochgeladen von

Amanda's GardenCopyright:

Verfügbare Formate

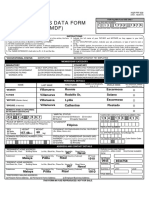

CHILD AND ADULT CARE FOOD PROGRAM: CHILD CARE COMPONENT

]NCOME ELIGIBILITY APPLICATION FOR FREE AND REDUCED PRICE MEALS . FiscaI Year 2016 _ 2017

INSTRUCflONS: To apply for free and reduced-price meals, read the household letter and instructions on backside of this form. Complete application and

retum to the center. In accordance with the NSLA, information on this application may be disclosed to other Child Nutrition Programs or applicable

enforcement agencies. Parents/guardians are not required to consent to this disclosure. Parf 7 is to be completed by all households. Parf 2 is to be used only

for a child living in a household receiving food assistance (SNAP) or Ohio Works First (OWF) benefits. Parf 3 is only for children NOT receiving food

assistance or OWF benefits. Paft 4 an adult household member must sign and date form; the last 4 digits of social security number must be listed if Part 3 is

completed. Parf 5 is ootional. - Asterisks indicate info that must be completed. Form must be completed annually and valid for only 12 mo.

CHECK IF

A FOSTER

PART 2 - LIST EACH CHILD'S FOOD ASSISTANCE

CENTER NAME (sNAp) oR owF CASE NUMBER, rF ANY. A VALTD

CHILD CASE NUMBER CONTAINS 1O OR 12 DIGITS. DO NOI

frhe legal

PART 1 PRINT INFORMATION FOR ALL CHILDREN ENROLLED AT CENTER rc$ponsibility ol LIST SWPE CARD NUMBER. 600... numbers not valid.

- a welfareagehcy checl( type tr t-oou As:irs IANUE (SNAP) or

- NAME OF ENROLLED CHILD(REN) AGE BIRTH DATE

or court)

of benefit: n OHIO WORKS FIRST (OWF)

m CASE NO.

m CASE NO-

rJ

?.

3. CASE NO.

4 * CASE NO.

PART 3- TOTAL HOUSEHOLD SIZE, TOTAL HOUSEHOLD GROSS INCOME AND HOW OFTEN IT WAS RECEIVED: List names of aII household

members. List all gross income: list how much and how often. lf Part 2 is completed, skip to Part 4,

a.LIST NAMES OF ALL b. CHECK c. GROSS INCOME during the last month (amount eamed before taxes & other deductions) and

HOUSEHOLD MEMBERS IF HOW OFTEN lT WAS RECEIVED: Weeklv. Everv 2 Weeks, Twice Per Month, Monthly, Annually

NO/ZERO 4- All Other Inmme

INCLUDING CHILDREN 1. Eamings from work 2. Welfare payments, 3. Pensions, retirement,

INCOME

LISTED ABOVE IN PART 1 before deductions child support, alimony Social Secvrity, SSl, VA

EMMPLE: JANE SMITH $ 200 / weekly $ 150 / twicemonth $ 100 / monthly $/

1 $/ (/

vr_

2.

l $__/_ $/ $/

$/

$______/_

$/

3 $/

4 $/ $_______/__ $____/_

5 $/ $l $/ $/

6. $/ $/ $__/_ $/

PART 4 - SIGNATURE & LAST 4 DIGITS OF SOCIAL SECURITY NUMBER: Adult household member must sign/date form. lf Part 3 is completed,

the adult signing the form must also list last 4 digits of his/her Social Security Number or check the "l do not have a Social Security Numbef' box.

I certify that all information on this form is true and conect and that all income is reported. I understand that the center will get Federal Funds based on the

information. I understand that CACFP officials may verify the information. I understand that if I purposely give false information, I may be prosecuted.

* lf Part3iscompleted,

nT--|T--if

I I I ll I

insert last 4 diqits of Social SecuritY Number I

1----1. (Check if applicable)

SIGNATURE OF ADULT HOUSEHOLD MEMBER DATE LJ t Oo not have a Social Security Number

Print Name: Daytime Phone Number: Work Phone Number:

Street i Apt: CityiState/Zip: County:

PART 5: RACIAUETHNIC IDENTIW (Optional): Please check appropriate boxes to identify the race and ethnicity of enrolled child(ren).

American lndian or Alaska Native Asian Black or African American

Native Hawaiian or Other Pacific lslander White Other

Please mark one ethnic identifu: f Hispanic or Latino f] Not Hispanic or Latino

Privacy Act Statement: The Richard B. Russell National School Lunch Act requires the infomation on do not have to qive the infomation, but if you do not,

we cannot approve the participant for iee or reduced-price meals. You must include ihe last four digits of the Sodal Security Number of the adult household member who signs the

application. The Social Security Number is not required when you apply on behalf of a foster child or you list a Supplemental Nutrition Assistance Program (SNAP), Temporary

Assistance for Needy Families (TANF) Program or Food Distribution Program on lndian Reseruations (FDPIR) case number for the participant or other (FDPIR) identifier or when

for free or reduced-price meals, and for administration and enforcement of the Program.

State Distri butaoni 7 l'l 5l20l 6

BY CENTER. Note: All information above this sectSon is to

information below only if qualifying child(ren) by household income from Part 3. Application Certified/Categorized as:

Per the total household size, compare total household income to the USDA lncome Eligibility tr FREE, based on o Food Assistance/OwF Case No.

Guidelines to determine correct categorization. When income is listed in different frequencies

n Household Size & lncome

of pay in Part 3, you must convert all income to annual income before determination. Use the

following Annual lncome Conversion :

a Foster Child

Weekly x 52, Every 2 Weeks Oi-reekry) x 26, Twice per Month (smi-monrhry) x 24, Monthly x 12 tr REDUCED, based on Household Size & lncome

tr PAID, based on o lncome Too High

n lncomplete

Per: n Week n Every 2 Weeks o Twice Per Month r Month n Year n lnvalid case number or information

e Date Sponsor Certifiedrcategorized Form Expimtion Date

Note: Effective date is detemined by parent or sponss signature date as seleded on CRRS applimtion- (Valid until last day of rcnth in which

lf date ot parent signature is not within month of certifimtion or immediately preceding month, form was signed one year eaiier)

OCN Revised 7ll/2076 10

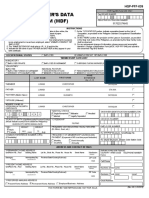

HOUSEHOLD LETTER - Dear Parent or Guardian:

Please help us comply with the reguirements of the United States Department of Agriculture's Child and Adult Care Food Program (CACFP by completing the

attached income eligibility application for free and reduced-price meals. All information will be treated with strict confidentiality. The CACFP provides

reimbursement to the child care center for healthy meals and snacks served to children enrolled in child care. The completion of the income eliglbllity

application is optional. Complete the application on the reverse side using the instructions below for your type of household. You or your children do not

have to be U.S. citizens to qualify for meal benefits offered at the child care center. Households with incomes less than or equal to the reduced-price values

listed on the chart at the bottom of this page are eligible for free meal benefits. An application must contain complete information to be considered for free or

reduced-price meals. Households are no longer required to report changes regarding the increase or decrease of income or household size or when the

household is no longer certified eligible for food assistance (SNAP) or Ohio Works First (OWF). Once approved for free or reduced-price benefits, a

household will remain eligible for these benelits for a period not to exceed 12 months. During periods of unemploynent, your child(ren) is eligible for meal

reimbursement provided the loss of income during this time causes the family to be within eligibility standards for meals. ln operation of the CACFP, no

person will be discriminated against because of race, color, national origin, sex, age or disability $226.23(e)(2)(iv). lf you have questions regarding the

completion of this application, contact the child care center.

PART I - CHILD INFORiIATION: ALL HOUSEHOLDS COiIPLETE THIS PART ('denotes required info)

o * Print the name of the child(ren) enrolled at the child care center. All children (including foster children)can be listed on the same application.

o List the enrolled child's age and birth date.

. Check box indicating if the child is a foster child. Foster children that are under the legal responsibility of the foster care agency or court are eligible

for free meals. Any foster child in the household is eligible for free meals regardless of income.

PART 2 - HOUSEHOLDS RECEIVING FOOD ASSISTANCE OR OHIO WORKS FIRST: COMPLETE THIS PART AND PART 4 - lf a child is a member of

a food assistance (SNAP) or OWF household, they are automatically ellglble to receive free CACFP meal benefits.

Circle the type of benefit received: Food Assistance (Sl,lAP) or Ohio Works First (OWF).

o List a current food assistance or OWF case number for each child. This will be a 10 or 12{igit number. Do not list a swipe card number.

SKIP PART 3 - Do not list names of household members or income if you listed a valid Food Assistance (SNAP) or OWF case number for each child in Part 2.

PART 3 - TOTAL HOUSEHOLD SIZE, GROSS INCOME AND HOW OFTEN RECEIVED: ALL OTHER HOUSEHOLDS COMPLETE PARTS 3 & 4.

a) Write the names of all household members including yourself and the child(ren) that attends the child care center, noting any income received. A

household is defined as a group of related or unrelated individuals who are living as one economic unit that share housing and/or significant income

and expenses of its members. This might include grandparents, olher relatives, or friends who live with you. Aftach another piece of paper if you need

more space to list all household members"

b) Check the box for any person listed as a household member (including children) that has no income.

c) For each household member, list each type of income received during the last month and list how often the money was received.

1) Eamings from work before deductions: Write the amount of total gross income each household member received the last month, before

taxes/deductions or anything else is taken out (not the take-home pay) and how often it was received (weekly, every two weeks, twice per

month, monthly, annually). lncome is any money received on a recuring basis, including gross eamed income. Households are not required to

include payments received for a foster child as income. lf any amount during the previous month was more or less than usual, write that person's

usual monthly income. lf you normally get overtime, include it, but not if you only get it sometimes. lf you are in the military and your housing is

part of the Military Housing Privatization lnitiative and you receive the Family Subsistence Supplemental Allowance, do not include these

allowances as income. Also, in regard to deployed service members, only that portion of a deployed service membe/s income made available

by them or on their behalf to the household will be counted as income to the household. Combat pay, including Deployment Extension lncentive

Pay (DEIP) is also excluded and will not be counted as income to the household. All other allowances must be included in your gross income.

2) List the amount each person got the last month from welfare, child support or alimony and list how often the money was received.

3) List the amount each person got the last month from pensions, retirement, Social Security, Supplemental Security lncome (SSl), Veteran's (VA)

benefits or disability benefits and list how often the money was neceived.

4) List all other income sources. Examples include: Worte/s Compensation, strike benefits, unemployment compensation, regular contributions

from people who do not live in your household, cash withdrawn from savings, interesudividends, income from estateytrusts/investments, net

royalties/annuities or any other income, Self-employed applicants should report income after expenses (net income) in column 1 under eamings

from work. Business, fam or rental property report income should be enterEd in column 4. Do not include food assistance payments.

PART 4 - SIGNATURE AND LAST 4 DIGITS OF SOCIAL SECURITY NUTBER: ALL HOUSEHOLDS COilPLETE THIS PART (' denotes required inio)

al * All

applications must have the signature of an adult household member.

b) * The adult signing the application must also date the form.

c) * Only an application that lists income in Part 3 must have the last four digits of the social security number of the adult who signs. lf the adult does not

have a social security number, check the box marked, "l do not have a Social Security Number." lf you listed a food assistance or OWF number for

each child or if you are applying for a foster child, the last four digits of the social security number are not required.

PART 5 - RACIAUETHilIC IDEiITITY - OPTIONAL

You are not required to answer this part in order for the application to be considered crmplete. This information is collected to make sure that everyone is

trealed fairly and will be kept confidential. No child will be discriminated against because of race, crlor, national origin, gender, age or disability.

NON-DlSCRlirlNAnON STATEIIEi{T: ln accordance with Federal civil rights law and U.S. Department of Agriculture (USDA) civil rights regulations and policies,

the USDA, its agencies, ofiices, and employees, and institutions participating in or administering USDA programs are prohibited from discriminating based on race,

color, national origin, sex, disability, age, or reprisal or retaliation for prior civil rights activity in any program or activity conducled or funded by USDA. Persons with

disabilities who require altemative means of communication for program information (e.9, Braille, large print, audiotape, American Sign Language, etc.), should

contact the agency (state or local) where they applied for benefib. lndividuals who are deaf, hard of hearing or have speech disabilities may contact USDA

through the Federal Relay Service at (800) 877-8339. Additionally, program information may be made available in languages other than English. To file a program

complaint of discrimination, complete the USDA Proqram Discrimination Complaint Form, (AD-3027) found at http://www.ascr.usda.qov/complaint filins cust.html,

and at any USDA office, or write a letter addressed to USDA and provide in the letter all of the information requested in the form. To request a copy of the

complaint form, call (866) 632-9992. Submit your completed form or letter to USDA either by mail at U.S. Department of Agriculture, Offce of the Assistant

Secretary for Civil Rights,1400 lndependence Avenue, S.W.,Washington, D.C. 20250-9410, by fax (2021690-7442, or email to USDA

is an equal opportunity provider.

REDUCED INCO]f,E ELIGIBILIW GUIDELINES. I85%

Guidelines to be effectlve from July 1, 2016 through June 30, 2017

Households with incomes less than or equal to the reduced price values below are eligible for free or reduced-prlce meal benefits.

I{OUSEHOLD SIZE YEAR MONTH TwlCE PER MONTTI EVERY TWO WEEKS WEEK

1 2't,978 1,832 916 846 423

2 29,637 2,470 1,235 1,140 570

3 37,256 3,108 '1,554 1,435 718

4 44,955 3,747 1,874 1,730 865

5 52,614 4,385 2,193 2,O24 1,O12

b 60,273 5,023 2,512 2.319 1,160

7 67,951 5,663 2,832 2,614 1,307

I 75,647 6,s04 3,152 2,910 1,455

For each additional

family member, add 7,696 642 321 296 148

OCN Revised 7 /U2076

L7

Das könnte Ihnen auch gefallen

- Lisa Lowe - The Intimacies of Four Continents-Duke University Press (2015) PDFDokument329 SeitenLisa Lowe - The Intimacies of Four Continents-Duke University Press (2015) PDFAndré Fogliano100% (4)

- G Ssa 8011 F3 1Dokument3 SeitenG Ssa 8011 F3 1Anime300Noch keine Bewertungen

- Fee ScheduleDokument1 SeiteFee ScheduleAmanda's GardenNoch keine Bewertungen

- Contoh MOU EnglishDokument3 SeitenContoh MOU EnglishElvina ArapahNoch keine Bewertungen

- Appeasementandthe Munich Conference ActivityDokument6 SeitenAppeasementandthe Munich Conference ActivityIonel Enache50% (2)

- Brief in Support of Motion To Appoint CounselDokument11 SeitenBrief in Support of Motion To Appoint CounselJanet and James100% (1)

- Doe v. Clenchy DecisionDokument23 SeitenDoe v. Clenchy Decisionjsnow489Noch keine Bewertungen

- Weill Cornell Medicine International Tax QuestionaireDokument2 SeitenWeill Cornell Medicine International Tax QuestionaireboxeritoNoch keine Bewertungen

- Scholarship Application 09 CorrectDokument1 SeiteScholarship Application 09 Correctbrianyoung2074Noch keine Bewertungen

- List of Enrollees FormDokument2 SeitenList of Enrollees Formmariegold mortola fabelaNoch keine Bewertungen

- Senior High School Voucher Program: Annex 1b VAF-1 For ALS A&E and PEPT PassersDokument5 SeitenSenior High School Voucher Program: Annex 1b VAF-1 For ALS A&E and PEPT PassersFitz BaniquedNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryAdrian Zack ArcillaNoch keine Bewertungen

- PFF039 MembersDataForm V05Dokument5 SeitenPFF039 MembersDataForm V05VENICE WORLDNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryLlana, Yna TablizoNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryArnel Lajo FulgencioNoch keine Bewertungen

- Member'S Data Form (MDF) : InstructionsDokument2 SeitenMember'S Data Form (MDF) : InstructionsjetNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryNathan Austin DauzNoch keine Bewertungen

- Asmph Fa Application-Newstudent Ver 10.2018Dokument45 SeitenAsmph Fa Application-Newstudent Ver 10.2018MickeyNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryRo ChelNoch keine Bewertungen

- Will Get Free Meals.: Written DuringDokument6 SeitenWill Get Free Meals.: Written Duringanon-579447Noch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryCrishea Lean C. NaingueNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryEd ChelNoch keine Bewertungen

- Guidelines To Fill in Health Examination: Borang RME / IPT Malaysia/HELPDokument5 SeitenGuidelines To Fill in Health Examination: Borang RME / IPT Malaysia/HELPaizadashkaNoch keine Bewertungen

- CDHP ApplicationDokument1 SeiteCDHP ApplicationJesse SaysonNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategorySHEENANoch keine Bewertungen

- Sample FormDokument2 SeitenSample FormTeddybear LiarsNoch keine Bewertungen

- CHED TDP Application FormDokument2 SeitenCHED TDP Application FormAphol Joyce Mortel0% (1)

- Casualty CardsDokument26 SeitenCasualty CardsfritzAugNoch keine Bewertungen

- Gujarat: Ffietal CastDokument4 SeitenGujarat: Ffietal Castthe truthNoch keine Bewertungen

- PFF108 LoyaltyCardPlusApplicationForm V07Dokument2 SeitenPFF108 LoyaltyCardPlusApplicationForm V07GPM, 560ABGNoch keine Bewertungen

- Pag IbigDokument2 SeitenPag Ibiglilly carbonNoch keine Bewertungen

- PFF108 LoyaltyCardPlusApplicationForm V06Dokument2 SeitenPFF108 LoyaltyCardPlusApplicationForm V06Gian Nes Beldad ArceNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryAnjieh LabiogoNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryJewo CanterasNoch keine Bewertungen

- Owwa Ofw Information SheetDokument1 SeiteOwwa Ofw Information SheetHarold monroyoNoch keine Bewertungen

- Phic-Payment SlipDokument2 SeitenPhic-Payment SlipP.J. JulianNoch keine Bewertungen

- Joshua Pancho MDFDokument2 SeitenJoshua Pancho MDFPatrick RodriguezNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryArsee HermidillaNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership Categorybelly nillyNoch keine Bewertungen

- PFF108 - LoyaltyCardPlusApplicationForm - V06 (1) - RODNEL MAYCACAYANDokument2 SeitenPFF108 - LoyaltyCardPlusApplicationForm - V06 (1) - RODNEL MAYCACAYANDoris BuencilloNoch keine Bewertungen

- PFF039 MembersDataForm V10Dokument6 SeitenPFF039 MembersDataForm V10rc gamboaNoch keine Bewertungen

- Pag IbigDokument2 SeitenPag IbigOlrick Brigoli100% (1)

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryRonstar Molina TanateNoch keine Bewertungen

- 2010-2011 Financial Aid Verification Worksheet/Independent: A. Student InformationDokument2 Seiten2010-2011 Financial Aid Verification Worksheet/Independent: A. Student Informationoliver4269Noch keine Bewertungen

- Pag Ibig Form H2 20022Dokument5 SeitenPag Ibig Form H2 20022cLaire aLcaLaNoch keine Bewertungen

- MDFlyviejaneDokument2 SeitenMDFlyviejanelyviejaneyeongNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryuiopNoch keine Bewertungen

- Application FormDokument2 SeitenApplication FormGanyfer DoradoNoch keine Bewertungen

- Arizona Court Rules: Home Table of ContentsDokument4 SeitenArizona Court Rules: Home Table of ContentsMr CutsforthNoch keine Bewertungen

- MDF (3) SubiaDokument2 SeitenMDF (3) SubiaeconarNoch keine Bewertungen

- MDFDokument3 SeitenMDFMalagant EscuderoNoch keine Bewertungen

- Member'S Data Form (MDF) : HQP-PFF-039Dokument2 SeitenMember'S Data Form (MDF) : HQP-PFF-039LiDdy Cebrero BelenNoch keine Bewertungen

- Dost-Sei Science and Technology Scholarships For 2009: Form ADokument4 SeitenDost-Sei Science and Technology Scholarships For 2009: Form A0330199403301994Noch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership Categoryedison CarcuevaNoch keine Bewertungen

- Read Aloud To The Recipient and Collect Approval: Yes NoDokument2 SeitenRead Aloud To The Recipient and Collect Approval: Yes NoAmr BASOWAIDANNoch keine Bewertungen

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryCyanide048Noch keine Bewertungen

- PDF FileDokument2 SeitenPDF FileAdventist Hospital DavaoNoch keine Bewertungen

- Member'S Data Form (MDF) : InstructionsDokument2 SeitenMember'S Data Form (MDF) : InstructionsEloisa CornelNoch keine Bewertungen

- Member'S Data Form (MDF) : InstructionsDokument5 SeitenMember'S Data Form (MDF) : InstructionsAbdelrashid Datucamil0% (1)

- Member'S Data Form (MDF) : Membership CategoryDokument2 SeitenMember'S Data Form (MDF) : Membership CategoryRiza VillariasNoch keine Bewertungen

- Demorming MasterListDokument2 SeitenDemorming MasterListRosalie NopalNoch keine Bewertungen

- MDF PDFDokument2 SeitenMDF PDFKyle HernandezNoch keine Bewertungen

- Member'S Data Form (MDF) : HQP-PFF-039Dokument2 SeitenMember'S Data Form (MDF) : HQP-PFF-039Maria Leonisa Sencil-TristezaNoch keine Bewertungen

- The Wages Question (Barnes & Noble Digital Library): A Treatise on Wages and the Wages ClassVon EverandThe Wages Question (Barnes & Noble Digital Library): A Treatise on Wages and the Wages ClassNoch keine Bewertungen

- Amanda's Garden Childcare & Learning Center Parent Handbook: Our Goals and PurposeDokument18 SeitenAmanda's Garden Childcare & Learning Center Parent Handbook: Our Goals and PurposeAmanda's GardenNoch keine Bewertungen

- CACFP App. 2018-2019Dokument2 SeitenCACFP App. 2018-2019Amanda's GardenNoch keine Bewertungen

- Garden Gram: July 2020: From The OfficeDokument1 SeiteGarden Gram: July 2020: From The OfficeAmanda's GardenNoch keine Bewertungen

- Pick Up PolicyDokument1 SeitePick Up PolicyAmanda's GardenNoch keine Bewertungen

- Parent Handbook CurrentDokument17 SeitenParent Handbook CurrentAmanda's GardenNoch keine Bewertungen

- Sample Weekly Menu: Monday Tuesday Wednesday Thursday FridayDokument1 SeiteSample Weekly Menu: Monday Tuesday Wednesday Thursday FridayAmanda's GardenNoch keine Bewertungen

- Medical Physical Care PlanDokument1 SeiteMedical Physical Care PlanAmanda's GardenNoch keine Bewertungen

- Child MedicalDokument1 SeiteChild MedicalAmanda's GardenNoch keine Bewertungen

- Sample Menu: Monday Tuesday Wednesday Thursday Friday BreakfastDokument1 SeiteSample Menu: Monday Tuesday Wednesday Thursday Friday BreakfastAmanda's GardenNoch keine Bewertungen

- ODJFS Care PlanDokument0 SeitenODJFS Care PlanAmanda's GardenNoch keine Bewertungen

- Photo Permission FormDokument1 SeitePhoto Permission FormAmanda's GardenNoch keine Bewertungen

- Ravenna School District Alternate Bus Stop FormDokument1 SeiteRavenna School District Alternate Bus Stop FormAmanda's GardenNoch keine Bewertungen

- Basic Infant InfoDokument2 SeitenBasic Infant InfoAmanda's GardenNoch keine Bewertungen

- SIDS Prevention PolicyDokument1 SeiteSIDS Prevention PolicyAmanda's GardenNoch keine Bewertungen

- Ravenna School District Alternate Bus Stop Form: Please PrintDokument1 SeiteRavenna School District Alternate Bus Stop Form: Please PrintAmanda's GardenNoch keine Bewertungen

- SUTQ Family InfoDokument2 SeitenSUTQ Family InfoAmanda's GardenNoch keine Bewertungen

- ODJFS Care PlanDokument0 SeitenODJFS Care PlanAmanda's GardenNoch keine Bewertungen

- Administration of MedicationDokument0 SeitenAdministration of MedicationAmanda's GardenNoch keine Bewertungen

- Sleep Position WaiverDokument0 SeitenSleep Position WaiverAmanda's GardenNoch keine Bewertungen

- Pick Up PolicyDokument1 SeitePick Up PolicyAmanda's GardenNoch keine Bewertungen

- ODJFS Infant InformationDokument0 SeitenODJFS Infant InformationAmanda's GardenNoch keine Bewertungen

- Backyard Gardening Using Recycled MaterialsDokument4 SeitenBackyard Gardening Using Recycled MaterialsPamela Joyce RiambonNoch keine Bewertungen

- Aplication E-Government Through The Sidoarjo RegenDokument11 SeitenAplication E-Government Through The Sidoarjo RegenAriska DamayantiNoch keine Bewertungen

- Sources of LawDokument4 SeitenSources of LawBaskaran ManogaranNoch keine Bewertungen

- Circularsclass X Science Sample Paper-Converted - CompressedDokument29 SeitenCircularsclass X Science Sample Paper-Converted - CompressedkrishnaNoch keine Bewertungen

- The Postal History of ICAODokument1 SeiteThe Postal History of ICAO:Oshane :PetersNoch keine Bewertungen

- Presidents Address-Final 31 August 2017 For PrintingDokument10 SeitenPresidents Address-Final 31 August 2017 For PrintingDavid OuldNoch keine Bewertungen

- Ute Tribe Jurisdiction LetterDokument3 SeitenUte Tribe Jurisdiction LetterGeoff LiesikNoch keine Bewertungen

- All Articles Listed Below by Week Are Available at UCSD Electronic ReservesDokument4 SeitenAll Articles Listed Below by Week Are Available at UCSD Electronic ReservesvictorvienNoch keine Bewertungen

- Environmental Science: STS: Science, Technology and SocietyDokument3 SeitenEnvironmental Science: STS: Science, Technology and SocietyStephen Mark Garcellano DalisayNoch keine Bewertungen

- 2010he RT974Dokument2 Seiten2010he RT974Ravi TejaNoch keine Bewertungen

- Law Thesis MaltaDokument4 SeitenLaw Thesis MaltaEssayHelperWashington100% (2)

- AcceptableformslistDokument8 SeitenAcceptableformslistNeeraj ChaudharyNoch keine Bewertungen

- Misc SignalDokument74 SeitenMisc SignalAnonymous wbhG5IdmFNoch keine Bewertungen

- Facial ChallengeDokument2 SeitenFacial ChallengepinkprincessayinNoch keine Bewertungen

- Wickham. The Other Transition. From The Ancient World To FeudalismDokument34 SeitenWickham. The Other Transition. From The Ancient World To FeudalismMariano SchlezNoch keine Bewertungen

- Emile Armand Anarchist Individualism and Amorous ComradeshipDokument84 SeitenEmile Armand Anarchist Individualism and Amorous ComradeshipRogerio Duarte Do Pateo Guarani KaiowáNoch keine Bewertungen

- DRILLLSSSDokument2 SeitenDRILLLSSSdeanyangg25Noch keine Bewertungen

- Investigation Finds Driver in Fatal Bronx Bus Crash Exploited Flaws in Licensing ProcessDokument7 SeitenInvestigation Finds Driver in Fatal Bronx Bus Crash Exploited Flaws in Licensing ProcessNick ReismanNoch keine Bewertungen

- Critical Social Constructivism - "Culturing" Identity, (In) Security, and The State in International Relations TheoryDokument23 SeitenCritical Social Constructivism - "Culturing" Identity, (In) Security, and The State in International Relations TheorywinarNoch keine Bewertungen

- Law and Justice in Globalized World Manish Confirm PDFDokument33 SeitenLaw and Justice in Globalized World Manish Confirm PDFKamlesh RojNoch keine Bewertungen

- North Korea Through The Looking GlassDokument273 SeitenNorth Korea Through The Looking GlassLiz T.100% (3)

- The Role of Alliances in World War IDokument11 SeitenThe Role of Alliances in World War IDarien LoNoch keine Bewertungen

- Calalang Vs Williams Digested CaseDokument2 SeitenCalalang Vs Williams Digested CaseKristanne Louise Yu100% (1)

- India's Political Take-Off: Rajni KothariDokument6 SeitenIndia's Political Take-Off: Rajni KothariSachin ChavanNoch keine Bewertungen

- J.H. Ankron vs. The Government of The Philippine Islands DigestDokument1 SeiteJ.H. Ankron vs. The Government of The Philippine Islands DigestPatrick John NiervesNoch keine Bewertungen