Beruflich Dokumente

Kultur Dokumente

Right Issue

Hochgeladen von

Mudit SinghCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Right Issue

Hochgeladen von

Mudit SinghCopyright:

Verfügbare Formate

Right Issue/ Preferential Allotment

Rule 13 Companies (Share Capital and Debentures) Rules, 2014 -

Meaning of Preferential Allotment/Right Issue - Preferential Offer means an issue

of shares or other securities, by a Company to any select person or group of persons on a

preferential basis and does not include shares or other securities offered through a public

issue, rights issue, employee stock option scheme, employee stock purchase scheme or an

issue of sweat equity shares or bonus shares or depository receipts issued in a country

outside India or foreign securities.

Following Points to be considered while making before making Preferential

Offer:

i) Authorised by its AOA.

ii) Special Resolution is passed.

iii) Securities allotted should be fully paid up.

iv)Need to make certain disclosure in Explanatory Statement.

v) Allotment should be completed within 12 months.

vi) Valuation Report from Registered Valuer.

Private Placement

Private Placement means any offer of securities or invitation to subscribe securities

(equity or securities that convert to equity) to a select group of persons by a company, other

than by way of public offer, through issue of a private placement offer letter. (Section 42 of

Companies Act 2013 and Rule 14 under Companies (Prospectus and Allotment of Securities)

Rules 2014)

These guidelines are applicable if the offer is made to a person who is currently not an equity

shareholder in the company.

However, the Company has to comply the following mentioned 7 points even in case

of Preferential Allotment.

Following Points to be considered while making Private Placement:

1. Share Application money should be kept in separate bank account.

2. The names of subscribers to issue should be recorded before making invitation to

Subscribe.

3. Allotment should not be made exceeding 200 persons in a FY (excluding QIB or

Employee under ESOPs)

4. Allotment must be made for not less than Rs 20000/ of face value of the securities for

each allotee.

5.Mode of Payment: Share application money should be paid through Cheque or DD

or other Banking Channels.

6. Time period of Allotment: Allotment of securities should be made within 60 days from

receiving the application money. If not able to allot, then repay SAM within 15 days.

7. Default: If default is made in repayment, then pay with interest rate of 12% p.a.

The major difference between Preferential Allotment and Private Placement are:

Das könnte Ihnen auch gefallen

- Dharmendra Prasad Sah v. Life Insurance Corpn. of India & OrsDokument3 SeitenDharmendra Prasad Sah v. Life Insurance Corpn. of India & OrsMudit SinghNoch keine Bewertungen

- Right Issue and Private PlacementDokument6 SeitenRight Issue and Private PlacementMudit SinghNoch keine Bewertungen

- Unregistered Trademarks in IndiaDokument4 SeitenUnregistered Trademarks in IndiaMudit SinghNoch keine Bewertungen

- Security EquipmentDokument3 SeitenSecurity EquipmentMudit SinghNoch keine Bewertungen

- GS Yuasa CorporationDokument2 SeitenGS Yuasa CorporationMudit SinghNoch keine Bewertungen

- Foreign Portfolio Investments in IndiaDokument8 SeitenForeign Portfolio Investments in IndiaMudit SinghNoch keine Bewertungen

- Whether The Election of MRDokument8 SeitenWhether The Election of MRMudit SinghNoch keine Bewertungen

- Himadri Watchout SearchDokument18 SeitenHimadri Watchout SearchMudit SinghNoch keine Bewertungen

- Confidentiality in Mediation and Arbitration': RECEIVED BY: - ON DATE: - TIMEDokument6 SeitenConfidentiality in Mediation and Arbitration': RECEIVED BY: - ON DATE: - TIMEMudit SinghNoch keine Bewertungen

- Synopsis Comp Law2Dokument4 SeitenSynopsis Comp Law2Mudit SinghNoch keine Bewertungen

- 2Dokument12 Seiten2Mudit SinghNoch keine Bewertungen

- 13Dokument4 Seiten13Mudit SinghNoch keine Bewertungen

- Final Air & Space Law SyllabusDokument2 SeitenFinal Air & Space Law SyllabusMudit SinghNoch keine Bewertungen

- Law-firm-Application Template CV ResumeDokument3 SeitenLaw-firm-Application Template CV ResumeHarshSuryavanshiNoch keine Bewertungen

- Accounts Project Trimester 3Dokument22 SeitenAccounts Project Trimester 3Mudit SinghNoch keine Bewertungen

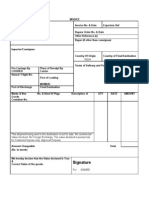

- Invoice Format Through Courier ModeDokument1 SeiteInvoice Format Through Courier Modeshatrughan loveNoch keine Bewertungen

- Synopsis Comp Law2Dokument5 SeitenSynopsis Comp Law2Mudit SinghNoch keine Bewertungen

- Sample Purchase OrderDokument9 SeitenSample Purchase OrderMudit SinghNoch keine Bewertungen

- Procedure For Resignation of PartnerDokument2 SeitenProcedure For Resignation of PartnerMudit Singh0% (1)

- UNGMDokument1 SeiteUNGMMudit SinghNoch keine Bewertungen

- Research Question For Transfer of Property ActDokument31 SeitenResearch Question For Transfer of Property ActMudit Singh100% (1)

- Rough Draft (TPA)Dokument21 SeitenRough Draft (TPA)Mudit SinghNoch keine Bewertungen

- Love Jihad StoryDokument15 SeitenLove Jihad StoryMudit SinghNoch keine Bewertungen

- Contracts Project Trimester 3Dokument22 SeitenContracts Project Trimester 3Mudit SinghNoch keine Bewertungen

- Agreement For SaleDokument4 SeitenAgreement For SaleSandeep BelurNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)