Beruflich Dokumente

Kultur Dokumente

Financial analysis and NPV calculation of a company over 5 years

Hochgeladen von

Mohit0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten3 SeitenThis document presents financial projections for a company over 4 years including sales, costs, expenses, cash flows, and a net present value calculation. Sales increase each year from $12.4M to $40.3M while costs remain around 65% of sales. Expenses also rise slightly each year. Despite losses the first two years, positive cash flows occur in years 3 and 4, leading to a positive net present value of $36M when discounted at 14%.

Originalbeschreibung:

CH_21042017_5

Originaltitel

CH_21042017_5

Copyright

© © All Rights Reserved

Verfügbare Formate

XLSX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document presents financial projections for a company over 4 years including sales, costs, expenses, cash flows, and a net present value calculation. Sales increase each year from $12.4M to $40.3M while costs remain around 65% of sales. Expenses also rise slightly each year. Despite losses the first two years, positive cash flows occur in years 3 and 4, leading to a positive net present value of $36M when discounted at 14%.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten3 SeitenFinancial analysis and NPV calculation of a company over 5 years

Hochgeladen von

MohitThis document presents financial projections for a company over 4 years including sales, costs, expenses, cash flows, and a net present value calculation. Sales increase each year from $12.4M to $40.3M while costs remain around 65% of sales. Expenses also rise slightly each year. Despite losses the first two years, positive cash flows occur in years 3 and 4, leading to a positive net present value of $36M when discounted at 14%.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

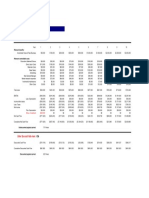

Year 0 1 2 3 4

Sales $ 13,750,000.00 $ 23,500,000.00 $ 40,250,000.00 $ 44,750,000.00

Cost of goods sold (65% of Sales) $ 8,937,500.00 $ 15,275,000.00 $ 26,162,500.00 $ 29,087,500.00

Selling, General and Administrative expenses $ 1,500,000.00 $ 1,750,000.00 $ 2,000,000.00 $ 2,200,000.00

Depreciation ($50,000,000/4 years) $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00

Income before taxes -$ 9,187,500.00 -$ 6,025,000.00 -$ 412,500.00 $ 962,500.00

Tax expense/benefit @ 39% -$ 3,583,125.00 -$ 2,349,750.00 -$ 160,875.00 $ 375,375.00

Income after taxes -$ 5,604,375.00 -$ 3,675,250.00 -$ 251,625.00 $ 587,125.00

Add: Depreciation $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00

Operating cash flows (A) $ 6,895,625.00 $ 8,824,750.00 $ 12,248,375.00 $ 13,087,125.00

Initial capital expenditure -$ 50,000,000.00

Investment in net working capital investment -$ 1,250,000.00 -$ 100,000.00 -$ 100,000.00 -$ 100,000.00 -$ 100,000.00

Opportunity of unused equipment -$ 25,000.00

Non operating cash flows (B) -$ 51,275,000.00 -$ 100,000.00 -$ 100,000.00 -$ 100,000.00 -$ 100,000.00

Net cash flows (A+B) -$ 51,275,000.00 $ 6,795,625.00 $ 8,724,750.00 $ 12,148,375.00 $ 12,987,125.00

Rate of Inflation after Year 4 2%

Cost of capital 14%

Terminal value of project at the end of year 4 $ 110,390,562.50

Present value of terminal value of project $ 65,360,074.86

Add: Present value of annual cash inflows $ 28,563,714.05

Less: Initial cash outlay -$ 51,275,000.00

Net present value $ 42,648,788.91

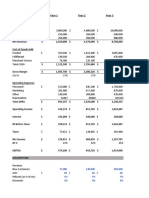

Year 0 1 2 3 4

Sales $ 15,125,000.00 $ 25,850,000.00 $ 44,275,000.00 $ 49,225,000.00

Cost of goods sold (65% of Sales) $ 9,831,250.00 $ 16,802,500.00 $ 28,778,750.00 $ 31,996,250.00

Selling, General and Administrative expenses $ 1,500,000.00 $ 1,750,000.00 $ 2,000,000.00 $ 2,200,000.00

Depreciation ($50,000,000/4 years) $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00

Income before taxes -$ 8,706,250.00 -$ 5,202,500.00 $ 996,250.00 $ 2,528,750.00

Tax expense/benefit @ 39% -$ 3,395,437.50 -$ 2,028,975.00 $ 388,537.50 $ 986,212.50

Income after taxes -$ 5,310,812.50 -$ 3,173,525.00 $ 607,712.50 $ 1,542,537.50

Add: Depreciation $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00

Operating cash flows (A) $ 7,189,187.50 $ 9,326,475.00 ### ###

Initial capital expenditure -$ 50,000,000.00

Investment in net working capital investment -$ 1,250,000.00 -$ 100,000.00 -$ 100,000.00 -$ 100,000.00 -$ 100,000.00

Opportunity of unused equipment -$ 25,000.00

Non operating cash flows (B) ### -$ 100,000.00 -$ 100,000.00 -$ 100,000.00 -$ 100,000.00

Net cash flows (A+B) ### $ 7,089,187.50 $ 9,226,475.00 ### ###

Rate of Inflation after Year 4 2%

Cost of capital 14%

Terminal value of project at the end of year 4 $ 118,511,568.75

Present value of terminal value of project $ 70,168,362.50

Add: Present value of annual cash inflows $ 30,352,995.34

Less: Initial cash outlay -$ 51,275,000.00

Net present value $ 49,246,357.84

Year 0 1 2 3 4

Sales $ 12,375,000.00 $ 21,150,000.00 $ 36,225,000.00 $ 40,275,000.00

Cost of goods sold (65% of Sales) $ 8,043,750.00 $ 13,747,500.00 $ 23,546,250.00 $ 26,178,750.00

Selling, General and Administrative expenses $ 1,500,000.00 $ 1,750,000.00 $ 2,000,000.00 $ 2,200,000.00

Depreciation ($50,000,000/4 years) $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00

Income before taxes -$ 9,668,750.00 -$ 6,847,500.00 -$ 1,821,250.00 -$ 603,750.00

Tax expense/benefit @ 39% -$ 3,770,812.50 -$ 2,670,525.00 -$ 710,287.50 -$ 235,462.50

Income after taxes -$ 5,897,937.50 -$ 4,176,975.00 -$ 1,110,962.50 -$ 368,287.50

Add: Depreciation $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00 $ 12,500,000.00

Operating cash flows (A) $ 6,602,062.50 $ 8,323,025.00 ### ###

Initial capital expenditure -$ 50,000,000.00

Investment in net working capital investment -$ 1,250,000.00 -$ 100,000.00 -$ 100,000.00 -$ 100,000.00 -$ 100,000.00

Opportunity of unused equipment -$ 25,000.00

Non operating cash flows (B) ### -$ 100,000.00 -$ 100,000.00 -$ 100,000.00 -$ 100,000.00

Net cash flows (A+B) ### $ 6,502,062.50 $ 8,223,025.00 ### ###

Rate of Inflation after Year 4 2%

Cost of capital 14%

Terminal value of project at the end of year 4 $ 102,269,556.25

Present value of terminal value of project $ 60,551,787.23

Add: Present value of annual cash inflows $ 26,774,432.75

Less: Initial cash outlay -$ 51,275,000.00

Net present value $ 36,051,219.98

Das könnte Ihnen auch gefallen

- Pickins Mining Case Analysis - NPV, IRR, PaybackDokument5 SeitenPickins Mining Case Analysis - NPV, IRR, PaybackWarda AhsanNoch keine Bewertungen

- Solutions Guide: Capital Budgeting Case StudyDokument5 SeitenSolutions Guide: Capital Budgeting Case StudySri SardiyantiNoch keine Bewertungen

- Sneakers 2013Dokument5 SeitenSneakers 2013priyaa0364% (11)

- Sneakers 2013Dokument5 SeitenSneakers 2013Felicia FrancisNoch keine Bewertungen

- Financial Analysis of Ebay IncDokument8 SeitenFinancial Analysis of Ebay Incshepherd junior masasiNoch keine Bewertungen

- Financial ManagementDokument12 SeitenFinancial ManagementValeria MartinezNoch keine Bewertungen

- Mini Case: Bethesda Mining Company: Disusun OlehDokument5 SeitenMini Case: Bethesda Mining Company: Disusun Olehrica100% (2)

- MK Cap Budgeting CH 9 - 10 Ross PDFDokument17 SeitenMK Cap Budgeting CH 9 - 10 Ross PDFSajidah PutriNoch keine Bewertungen

- Manufacturing Financial PlanDokument8 SeitenManufacturing Financial Plantulalit008Noch keine Bewertungen

- Jaxworks PaybackAnalysis1Dokument1 SeiteJaxworks PaybackAnalysis1Jo Ann RangelNoch keine Bewertungen

- Example Sensitivity AnalysisDokument4 SeitenExample Sensitivity Analysismc lim100% (1)

- Financial Plan: 7.1 Important AssumptionsDokument21 SeitenFinancial Plan: 7.1 Important Assumptionsaira eau claire orbeNoch keine Bewertungen

- JaletaDokument8 SeitenJaletaአረጋዊ ሐይለማርያምNoch keine Bewertungen

- 3 Statement Financial Model: How To Build From Start To FinishDokument9 Seiten3 Statement Financial Model: How To Build From Start To FinishMiks EnriquezNoch keine Bewertungen

- Setup and Financial Information for Current, Hi-Tech and Broker ScenariosDokument6 SeitenSetup and Financial Information for Current, Hi-Tech and Broker ScenariosGabiNoch keine Bewertungen

- Making Capital Investment DecisionsDokument42 SeitenMaking Capital Investment Decisionsgabisan1087Noch keine Bewertungen

- FM Assaignment Second SemisterDokument9 SeitenFM Assaignment Second SemisterMotuma Abebe100% (1)

- Assignment Dataset 1Dokument19 SeitenAssignment Dataset 1Chip choiNoch keine Bewertungen

- FDDGDokument7 SeitenFDDGlistenkidNoch keine Bewertungen

- Lec 3 After Mid TermDokument11 SeitenLec 3 After Mid TermsherygafaarNoch keine Bewertungen

- Quiz 3Dokument14 SeitenQuiz 3K L YEONoch keine Bewertungen

- Assignment Part OneDokument3 SeitenAssignment Part Onetovi0821Noch keine Bewertungen

- Fin 600 - Radio One-Team 3 - Final SlidesDokument20 SeitenFin 600 - Radio One-Team 3 - Final SlidesCarlosNoch keine Bewertungen

- Matheson ElectronicsDokument2 SeitenMatheson ElectronicsReg Lagarteja80% (5)

- M C R E ,: Inicase: Onch Epublic LectronicsDokument4 SeitenM C R E ,: Inicase: Onch Epublic Lectronicsnara100% (3)

- Annual Income Statement and Financial Ratios ReportDokument6 SeitenAnnual Income Statement and Financial Ratios ReportAnwar Ul HaqNoch keine Bewertungen

- CFI FMVA Final Assessment Case Study 1ADokument12 SeitenCFI FMVA Final Assessment Case Study 1Apadre pio kone100% (1)

- Developing Financial Insights Using Present and Future Value ApproachesDokument3 SeitenDeveloping Financial Insights Using Present and Future Value ApproachesRahma Putri HapsariNoch keine Bewertungen

- CH 11Dokument35 SeitenCH 11তি মিNoch keine Bewertungen

- Financial PlanDokument12 SeitenFinancial PlanNico BoialterNoch keine Bewertungen

- It App - WorkbookDokument8 SeitenIt App - WorkbookAsi Cas JavNoch keine Bewertungen

- CH 13Dokument14 SeitenCH 13Trang VânNoch keine Bewertungen

- Strategic planning budget and financial projectionsDokument14 SeitenStrategic planning budget and financial projectionsDamaris MoralesNoch keine Bewertungen

- CFI - FMVA Practice Exam Case Study ADokument18 SeitenCFI - FMVA Practice Exam Case Study AWerfelli MaramNoch keine Bewertungen

- Alifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcDokument9 SeitenAlifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcFaldo DaffaNoch keine Bewertungen

- The ABC Company: Balance SheetDokument10 SeitenThe ABC Company: Balance SheetFahad AliNoch keine Bewertungen

- Variance Analysis: Assignment Line ItemDokument18 SeitenVariance Analysis: Assignment Line Itemfatima khurramNoch keine Bewertungen

- Capital Budgeting Techniques AnalysisDokument5 SeitenCapital Budgeting Techniques AnalysisChristopher KipsangNoch keine Bewertungen

- FINC 721 Project 2Dokument2 SeitenFINC 721 Project 2Sameer BhattaraiNoch keine Bewertungen

- PEANUT FINANCIALSDokument4 SeitenPEANUT FINANCIALSTertius Du ToitNoch keine Bewertungen

- Chapter 9 Making Capital Investment DecisionsDokument32 SeitenChapter 9 Making Capital Investment Decisionsiyun KNNoch keine Bewertungen

- InstructionsDokument3 SeitenInstructionsmohitgaba19Noch keine Bewertungen

- Group 2 - Answers To QuestionsDokument2 SeitenGroup 2 - Answers To QuestionsJr Roque100% (4)

- Practice Problems Chapter 12 Corporate Cash Flow and Project AnalysisDokument57 SeitenPractice Problems Chapter 12 Corporate Cash Flow and Project AnalysiszoeyNoch keine Bewertungen

- Financial Analysis of Amazom - Inc CompanyDokument9 SeitenFinancial Analysis of Amazom - Inc Companyshepherd junior masasiNoch keine Bewertungen

- FM11 CH 11 Mini CaseDokument16 SeitenFM11 CH 11 Mini CaseDora VidevaNoch keine Bewertungen

- JD Sdn. BHD Study CaseDokument5 SeitenJD Sdn. BHD Study CaseSuperFlyFlyers100% (2)

- Calculation of NPV: WorkingsDokument3 SeitenCalculation of NPV: WorkingsTapiwa Kurungamakwashe NgungunyaniNoch keine Bewertungen

- Manajemen Keuangan: Chapter 6: Making Capital Investment DecisionDokument9 SeitenManajemen Keuangan: Chapter 6: Making Capital Investment Decision21. Syafira Indi KhoirunisaNoch keine Bewertungen

- Making Capital Investment DecisionsDokument48 SeitenMaking Capital Investment DecisionsJerico ClarosNoch keine Bewertungen

- Construction Contract Revenue and CostsDokument30 SeitenConstruction Contract Revenue and CostsAhmedNoch keine Bewertungen

- Website Budget1Dokument2 SeitenWebsite Budget1febri hanifNoch keine Bewertungen

- Gitman IM Ch03Dokument15 SeitenGitman IM Ch03tarekffNoch keine Bewertungen

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Dokument10 SeitenSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNoch keine Bewertungen

- Some Solved Problems and Statement From Tabular AnalysisDokument9 SeitenSome Solved Problems and Statement From Tabular AnalysisSubrata RoyNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Fast-Track Tax Reform: Lessons from the MaldivesVon EverandFast-Track Tax Reform: Lessons from the MaldivesNoch keine Bewertungen

- Remodelers' Cost of Doing Business Study, 2020 EditionVon EverandRemodelers' Cost of Doing Business Study, 2020 EditionNoch keine Bewertungen

- CH 30092017 1Dokument1 SeiteCH 30092017 1MohitNoch keine Bewertungen

- Requirement A.: Year Cash Flows 0 - $ 8,210.00 1 $ 6,220.00 2 $ 20,400.00Dokument1 SeiteRequirement A.: Year Cash Flows 0 - $ 8,210.00 1 $ 6,220.00 2 $ 20,400.00MohitNoch keine Bewertungen

- CH 11072017 1Dokument2 SeitenCH 11072017 1MohitNoch keine Bewertungen

- CH 11072017 1Dokument2 SeitenCH 11072017 1MohitNoch keine Bewertungen

- Cash Flows From Operating ActivitiesDokument1 SeiteCash Flows From Operating ActivitiesMohitNoch keine Bewertungen

- CH 08072017 1Dokument1 SeiteCH 08072017 1MohitNoch keine Bewertungen

- CH 11082017 5Dokument2 SeitenCH 11082017 5MohitNoch keine Bewertungen

- Item Discount Factor Workings PVDokument2 SeitenItem Discount Factor Workings PVMohitNoch keine Bewertungen

- CH 09082017 1Dokument4 SeitenCH 09082017 1MohitNoch keine Bewertungen

- CH 03072017 1Dokument1 SeiteCH 03072017 1MohitNoch keine Bewertungen

- CH 18072017 1Dokument1 SeiteCH 18072017 1MohitNoch keine Bewertungen

- CH 18072017 1Dokument1 SeiteCH 18072017 1MohitNoch keine Bewertungen

- CH 22062017 1Dokument9 SeitenCH 22062017 1MohitNoch keine Bewertungen

- Requirement (A) : Post Tax Operating Cash Flows (A) 165.75Dokument3 SeitenRequirement (A) : Post Tax Operating Cash Flows (A) 165.75MohitNoch keine Bewertungen

- Statement of Problem With The Trial Balance Still Balance? What Is The Amount of Difference? Which Trial Balance Column Have The Larger Total?Dokument1 SeiteStatement of Problem With The Trial Balance Still Balance? What Is The Amount of Difference? Which Trial Balance Column Have The Larger Total?MohitNoch keine Bewertungen

- Requirement (A) : Post Tax Operating Cash Flows (A) 165.75Dokument3 SeitenRequirement (A) : Post Tax Operating Cash Flows (A) 165.75MohitNoch keine Bewertungen

- Alternative A Alternative B Alternative CDokument9 SeitenAlternative A Alternative B Alternative CMohitNoch keine Bewertungen

- CH 19062017 5Dokument1 SeiteCH 19062017 5MohitNoch keine Bewertungen

- CH 22042017 2Dokument10 SeitenCH 22042017 2MohitNoch keine Bewertungen

- CH 04042017 3Dokument1 SeiteCH 04042017 3MohitNoch keine Bewertungen

- CH 06032017 2Dokument1 SeiteCH 06032017 2MohitNoch keine Bewertungen

- CH 26032017 7Dokument2 SeitenCH 26032017 7MohitNoch keine Bewertungen

- CH 05032017 7Dokument1 SeiteCH 05032017 7MohitNoch keine Bewertungen

- CH 25032017 3Dokument1 SeiteCH 25032017 3MohitNoch keine Bewertungen

- CH 06032017 11Dokument1 SeiteCH 06032017 11MohitNoch keine Bewertungen

- ElmwoodDokument3 SeitenElmwoodMohitNoch keine Bewertungen

- CH 01022017 6Dokument3 SeitenCH 01022017 6MohitNoch keine Bewertungen

- Calculating variable overhead, fixed overhead, estimated costs, work in process, and material costsDokument1 SeiteCalculating variable overhead, fixed overhead, estimated costs, work in process, and material costsMohitNoch keine Bewertungen

- CH 30012017 6 1Dokument2 SeitenCH 30012017 6 1MohitNoch keine Bewertungen

- Chapter 4Dokument40 SeitenChapter 4prashantgargindia_93Noch keine Bewertungen

- Internship Report: Performance (A Case Study From Pubali Bank Limited) ."Dokument51 SeitenInternship Report: Performance (A Case Study From Pubali Bank Limited) ."Mominul MominNoch keine Bewertungen

- 10 STG WelcomeToYourEngagement LM 02 UC Financial Statements PY-IsADokument12 Seiten10 STG WelcomeToYourEngagement LM 02 UC Financial Statements PY-IsAHumbertNoch keine Bewertungen

- MasDokument13 SeitenMasHiroshi Wakato50% (2)

- Auditing 1 Final ExamDokument8 SeitenAuditing 1 Final ExamEdemson NavalesNoch keine Bewertungen

- Chart of AccountsDokument14 SeitenChart of AccountsEmir Ademovic100% (1)

- REYNOSO MBBA507 Final AssessmentDokument7 SeitenREYNOSO MBBA507 Final AssessmentGianne Denise ReynosoNoch keine Bewertungen

- IAS 40 - Investment Properties - SVDokument18 SeitenIAS 40 - Investment Properties - SVJiji NguyễnNoch keine Bewertungen

- MnA ValuationDokument47 SeitenMnA ValuationKemal AlNoch keine Bewertungen

- Correction of ErrorsDokument9 SeitenCorrection of ErrorsJaneNoch keine Bewertungen

- SM-06-new CHAPTER 6Dokument59 SeitenSM-06-new CHAPTER 6psbacloud94% (16)

- F7INTFR Study Question Bank Sample D14 J15Dokument53 SeitenF7INTFR Study Question Bank Sample D14 J15Onaderu Oluwagbenga Enoch100% (3)

- CH 05Dokument23 SeitenCH 05Damy RoseNoch keine Bewertungen

- Correction of ErrorsDokument15 SeitenCorrection of ErrorsEliyah Jhonson100% (1)

- Data Center Modernization Financial Business CaseDokument17 SeitenData Center Modernization Financial Business CaseLucenzo LeeNoch keine Bewertungen

- CH 11Dokument12 SeitenCH 11ShelviDyanPrastiwiNoch keine Bewertungen

- Accounting Transaction, Services CompanyDokument3 SeitenAccounting Transaction, Services CompanyCahyani PrastutiNoch keine Bewertungen

- Intermediate Accounting - MidtermsDokument9 SeitenIntermediate Accounting - MidtermsKim Cristian MaañoNoch keine Bewertungen

- Corporate AccountingDokument32 SeitenCorporate AccountingSaran Ranny100% (1)

- Infrastructure Assets Registry Procedure ManualDokument182 SeitenInfrastructure Assets Registry Procedure ManualrubydelacruzNoch keine Bewertungen

- Diploma in Accountancy Programme December 2019 Examination Qa PDFDokument217 SeitenDiploma in Accountancy Programme December 2019 Examination Qa PDFethelNoch keine Bewertungen

- Egyptian International Pharmaceutical Industries Company (EIPICO)Dokument1 SeiteEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryNoch keine Bewertungen

- Question PSPM AA015 1011 by QuestionDokument6 SeitenQuestion PSPM AA015 1011 by Questionnur athirahNoch keine Bewertungen

- Advanced Financial Accounting Canadian Canadian 7Th Edition Beechy Solutions Manual Full Chapter PDFDokument36 SeitenAdvanced Financial Accounting Canadian Canadian 7Th Edition Beechy Solutions Manual Full Chapter PDFpaul.colapietro194100% (13)

- Ind As 7Dokument5 SeitenInd As 7qwertyNoch keine Bewertungen

- MAS 14 Capital Budgeting With Investment Risks ReturnsDokument16 SeitenMAS 14 Capital Budgeting With Investment Risks ReturnsPRINCESS ANN GENEROSO ALINGIGNoch keine Bewertungen

- Accounting at MacCloud and Financial ReportingDokument3 SeitenAccounting at MacCloud and Financial Reporting0p00Noch keine Bewertungen

- Project Report On Financial Analysis of Nestle India Limited ProjectDokument65 SeitenProject Report On Financial Analysis of Nestle India Limited ProjectSonu Dhangar77% (57)

- HOA SEN GROUP BALANCE SHEETDokument61 SeitenHOA SEN GROUP BALANCE SHEETHợp NguyễnNoch keine Bewertungen

- Test Bank Aa Part 2 2015 EdDokument90 SeitenTest Bank Aa Part 2 2015 EdTricia Mae FernandezNoch keine Bewertungen