Beruflich Dokumente

Kultur Dokumente

ch14

Hochgeladen von

Ann SerratoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ch14

Hochgeladen von

Ann SerratoCopyright:

Verfügbare Formate

Fundamentals of Financial Management, 12/e

Chapter 14: Risk and Managerial Options in Capital Budgeting

After studying Chapter 14,

Chapter 14 you should be able to:

Define the "riskiness" of a capital investment project.

Understand how cash-flow riskiness for a particular

Risk

Risk and

and Managerial

Managerial period is measured, including the concepts of

expected value, standard deviation, and coefficient of

variation.

(Real)

(Real) Options

Options in

in Describe methods for assessing total project risk,

including a probability approach and a simulation

approach.

Capital

Capital Budgeting

Budgeting Judge projects with respect to their contribution to

total firm risk (a firm-portfolio approach).

Pearson Education Limited 2004

Understand how the presence of managerial (real)

Fundamentals of Financial Management, 12/e

options enhances the worth of an investment project.

Created by: Gregory A. Kuhlemeyer, Ph.D. List, discuss, and value different types of managerial

14-1

Carroll College, Waukesha, WI

14-2

(real) options.

Risk and Managerial (Real) An Illustration of Total

Options in Capital Budgeting Risk (Discrete Distribution)

ANNUAL CASH FLOWS: YEAR 1

The Problem of Project Risk

PROPOSAL A

Total Project Risk State Probability Cash Flow

Contribution to Total Firm Risk: Deep Recession .05 $ -3,000

Mild Recession .25 1,000

Firm-Portfolio Approach

Normal .40 5,000

Managerial (Real) Options Minor Boom .25 9,000

Major Boom .05 13,000

14-3 14-4

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

XIV - 1

Pearson Education Limited 2004 Carroll College, Waukesha, WI

Fundamentals of Financial Management, 12/e

Chapter 14: Risk and Managerial Options in Capital Budgeting

Probability Distribution Expected Value of Year 1

of Year 1 Cash Flows Cash Flows ((Proposal

Proposal A

A))

Proposal A

Probability .40 CF1 P1 ((CF

CF1)(P

)(P1)

$ -3,000 .05 $ -150

.25

1,000 .25 250

5,000 .40 2,000

.05 9,000 .25 2,250

-3,000 1,000 5,000 9,000 13,000

13,000 .05 650

Cash Flow ($) =1.00

=1.00 CF1=

=$5,000

$5,000

14-5 14-6

Variance of Year 1 Variance of Year 1

Cash Flows ((Proposal

Proposal A

A)) Cash Flows ((Proposal

Proposal A

A))

((CF

CF1)(P

)(P1) (CF1 - CF1)2(P

(CF (P1) ((CF

CF1)(P

)(P1) (CF1 - CF1)2*(P

(CF *(P1)

$ -150 ( -3,000 - 5,000)2 (.05)

(.05) $ -150 3,200,000

250 ( 1,000 - 5,000)2 (.25)

(.25) 250 4,000,000

2,000 2

( 5,000 - 5,000) (.40)

(.40) 2,000 0

2,250 ( 9,000 - 5,000)2 (.25)

(.25) 2,250 4,000,000

650 2

(13,000 - 5,000) (.05)

(.05) 650 3,200,000

$5,000 $5,000 14,400,000

14-7 14-8

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

XIV - 2

Pearson Education Limited 2004 Carroll College, Waukesha, WI

Fundamentals of Financial Management, 12/e

Chapter 14: Risk and Managerial Options in Capital Budgeting

An Illustration of Total

Summary of Proposal A Risk (Discrete Distribution)

The standard deviation = SQRT (14,400,000) ANNUAL CASH FLOWS: YEAR 1

= $3,795 PROPOSAL B

The expected cash flow State Probability Cash Flow

= $5,000

Deep Recession .05 $ -1,000

Coefficient of Variation (CV) = $3,795 / $5,000

Mild Recession .25 2,000

= 0.759

Normal .40 5,000

CV is a measure of relative risk and is the ratio of Minor Boom .25 8,000

standard deviation to the mean of the distribution. Major Boom .05 11,000

14-9 14-10

Probability Distribution Expected Value of Year 1

of Year 1 Cash Flows Cash Flows ((Proposal

Proposal B

B))

Proposal B

.40 CF1 P1 ((CF

CF1)(P

)(P1)

Probability

$ -1,000 .05 $ -50

.25

2,000 .25 500

5,000 .40 2,000

.05 8,000 .25 2,000

-3,000 1,000 5,000 9,000 13,000

11,000 .05 550

Cash Flow ($) =1.00

=1.00 CF1=

=$5,000

$5,000

14-11 14-12

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

XIV - 3

Pearson Education Limited 2004 Carroll College, Waukesha, WI

Fundamentals of Financial Management, 12/e

Chapter 14: Risk and Managerial Options in Capital Budgeting

Variance of Year 1 Variance of Year 1

Cash Flows ((Proposal

Proposal B

B)) Cash Flows ((Proposal

Proposal B

B))

((CF

CF1)(P

)(P1) (CF1 - CF1)2(P

(CF (P1) ((CF

CF1)(P

)(P1) (CF1 - CF1)2(P

(CF (P1)

$ -50 ( -1,000 - 5,000)2 (.05)

(.05) $ -50 1,800,000

500 ( 2,000 - 5,000)2 (.25)

(.25) 500 2,250,000

2,000 2

( 5,000 - 5,000) (.40)

(.40) 2,000 0

2,000 ( 8,000 - 5,000)2 (.25)

(.25) 2,000 2,250,000

550 2

(11,000 - 5,000) (.05)

(.05) 550 1,800,000

$5,000 $5,000 8,100,000

14-13 14-14

Summary of Proposal B Total Project Risk

The standard deviation = SQRT (8,100,000)

Projects have risk

= $2,846 that may change

The expected cash flow = $5,000 from period to

Cash Flow ($)

Coefficient of Variation (CV) = $2,846 / $5,000 period.

= 0.569 Projects are more

likely to have

The standard deviation of B < A ($2,846<

$2,846< $3,795),

$3,795), so B

is less risky than A.

continuous, rather

than discrete

The coefficient of variation of B < A (0.569

(0.569<

<0.759),

0.759), so B distributions.

has less relative risk than A.

1 2 3

14-15 14-16 Year

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

XIV - 4

Pearson Education Limited 2004 Carroll College, Waukesha, WI

Fundamentals of Financial Management, 12/e

Chapter 14: Risk and Managerial Options in Capital Budgeting

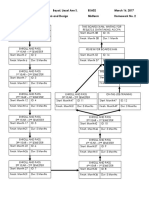

Probability Tree Approach Probability Tree Approach

A graphic or tabular approach for Basket Wonders is

organizing the possible cash-flow examining a project that will

streams generated by an have an initial cost today of

investment. The presentation -$900 $900.

$900 Uncertainty

resembles the branches of a tree. surrounding the first year

Each complete branch represents cash flows creates three

one possible cash-flow sequence. possible cash-flow

scenarios in Year 1.

1

14-17 14-18

Probability Tree Approach Probability Tree Approach

(.10) $2,200

Each node in

(.20) $1,200 1 Node 1: 20% chance of a (.20

.20) $1,200 1 (.60) $1,200 Year 2

$1,200 cash-flow. (.30) $ 900 represents a

branch of our

(.35) $ 900 probability

(.60) $450 Node 2: 60% chance of a (.60

60) $450 (.40) $ 600 tree.

-$900 2 -$900 2

$450 cash-flow. (.25) $ 300

The

(.10) $ 500 probabilities

(.20) -$600 3 Node 3: 20% chance of a (.20

.20) -$600 3 (.50) -$ 100 are said to be

-$600 cash-flow. (.40) -$ 700 conditional

probabilities.

probabilities

Year 1 Year 1 Year 2

14-19 14-20

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

XIV - 5

Pearson Education Limited 2004 Carroll College, Waukesha, WI

Fundamentals of Financial Management, 12/e

Chapter 14: Risk and Managerial Options in Capital Budgeting

Project NPV Based on

Joint Probabilities [P(1,2)] Probability Tree Usage

(.10) $2,200

.02 Branch 1 z

(.20

.20) $1,200 1 (.60) $1,200

.12 Branch 2 The probability NPV = i= 1 (NPVi)(Pi)

(.30) $ 900 tree accounts for

.06 Branch 3

(.35) $ 900 the distribution

.21 Branch 4 The NPV for branch i of

(.60

60) $450 (.40) $ 600 of cash flows.

-$900 2 .24 Branch 5 the probability tree for two

(.25) $ 300 Therefore,

.15 Branch 6 discount all cash years of cash flows is

(.10) $ 500

.02 Branch 7 flows at only the CF1 CF2

(.20

.20) -$600 3 (.50) -$ 100 NPVi =

.10 Branch 8 risk-

risk-free rate of +

(.40) -$ 700 (1 + Rf ) (1 + Rf )2

1

.08 Branch 9 return.

Year 1 Year 2

- ICO

14-21 14-22

NPV for Each Cash-Flow

Stream at 5% Risk-Free Rate NPV on the Calculator

(.10) $2,200

$ 2,238.32

(.20

.20) $1,200 1 (.60) $1,200 Remember, we can

$ 1,331.29

(.30) $ 900

$ 1,059.18 use the cash flow

(.35) $ 900

registry to solve

$ 344.90 these NPV problems

(.60

60) $450 (.40) $ 600

-$900 2 $ 72.79 quickly and

(.25) $ 300 accurately!

-$ 199.32

(.10) $ 500

-$ 1,017.91

(.20

.20) -$600 3 (.50) -$ 100

-$ 1,562.13

(.40) -$ 700

-$ 2,106.35

Year 1 Year 2

14-23 14-24

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

XIV - 6

Pearson Education Limited 2004 Carroll College, Waukesha, WI

Fundamentals of Financial Management, 12/e

Chapter 14: Risk and Managerial Options in Capital Budgeting

Actual NPV Solution Using Actual NPV Solution Using

Your Financial Calculator Your Financial Calculator

Solving for Branch #3:

Solving for Branch #3: Step 8: Press keys

Step 1: Press CF key Step 9: Press NPV key

Step 2: Press 2nd CLR Work keys Step 10: For I=, Enter 5 Enter keys

Step 3: For CF0 Press -900 Enter keys

Step 11: Press CPT key

Step 4: For C01 Press 1200 Enter keys

Step 5: For F01 Press 1 Enter keys

Result: Net Present Value = $1,059.18

Step 6: For C02 Press 900 Enter keys

Step 7: For F02 Press 1 Enter keys

You would complete this for EACH branch!

14-25 14-26

Calculating the Expected Calculating the Variance

Net Present Value (NPV) of the Net Present Value

Branch NPVi P(1,2) NPVi * P(1,2) NPVi P(1,2) (NPVi - NPV )2[P(1,2)

P(1,2)]

Branch 1 $ 2,238.32 .02 $ 44.77 $ 2,238.32 .02 $ 101,730.27

Branch 2 $ 1,331.29 .12 $159.75 $ 1,331.29 .12 $ 218,149.55

Branch 3 $ 1,059.18 .06 $ 63.55 $ 1,059.18 .06 $ 69,491.09

Branch 4 $ 344.90 .21 $ 72.43 $ 344.90 .21 $ 27,505.56

Branch 5 $ 72.79 .24 $ 17.47 $ 72.79 .24 $ 1,935.37

Branch 6 -$ 199.32 .15 -$ 29.90 -$ 199.32 .15 $ 4,985.54

Branch 7 -$ 1,017.91 .02 -$ 20.36 -$ 1,017.91 .02 $ 20,036.02

Branch 8 -$ 1,562.13 .10 -$156.21 -$ 1,562.13 .10 $ 238,739.58

Branch 9 -$ 2,106.35 .08 -$168.51 -$ 2,106.35 .08 $ 349,227.33

Expected Net Present Value = -$ 17.01 Variance = $1,031,800.31

14-27 14-28

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

XIV - 7

Pearson Education Limited 2004 Carroll College, Waukesha, WI

Fundamentals of Financial Management, 12/e

Chapter 14: Risk and Managerial Options in Capital Budgeting

Summary of the

Decision Tree Analysis Simulation Approach

The standard deviation = An approach that allows us to test

SQRT ($1,031,800) = $1,015.78 the possible results of an

investment proposal before it is

The expected NPV = -$ 17.01 accepted. Testing is based on a

model coupled with probabilistic

information.

14-29 14-30

Simulation Approach Simulation Approach

Factors we might consider in a model: Each variable is assigned an appropriate

Market analysis probability distribution. The distribution for

Market size, selling price, market the selling price of baskets created by

growth rate, and market share Basket Wonders might look like:

Investment cost analysis $20 $25 $30 $35 $40 $45 $50

Investment required, useful life of .02 .08 .22 .36 .22 .08 .02

facilities, and residual value The resulting proposal value is dependent

Operating and fixed costs

on the distribution and interaction of

Operating costs and fixed costs EVERY variable listed on slide 14-30.

14-31 14-32

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

XIV - 8

Pearson Education Limited 2004 Carroll College, Waukesha, WI

Fundamentals of Financial Management, 12/e

Chapter 14: Risk and Managerial Options in Capital Budgeting

Contribution

Contribution to

to Total

Total Firm

Firm Risk:

Risk:

Simulation Approach Firm-Portfolio Approach

Firm-Portfolio Approach

Each proposal will generate an internal rate of

Combination of

return.

return The process of generating many, many Proposal A Proposal B Proposals A and B

simulations results in a large set of internal

CASH FLOW

rates of return. The distribution might look like

the following:

OF OCCURRENCE

PROBABILITY

TIME TIME TIME

Combining projects in this manner reduces

INTERNAL RATE OF RETURN (%) the firm risk due to diversification.

diversification

14-33 14-34

Determining

Determining the

the Expected

Expected Determining Portfolio

NPV

NPV for

for aa Portfolio

Portfolio of

of Projects

Projects Standard Deviation

m

NPVP = ( NPVj )

m m

j=1

P =

j=1 k=1 jk

NPVP is the expected portfolio NPV, jk is the covariance between possible

NPVs for projects j and k,

NPVj is the expected NPV of the jth

jk = j k r jk .

NPV that the firm undertakes,

j is the standard deviation of project j,

m is the total number of projects in k is the standard deviation of project k,

the firm portfolio. rjk is the correlation coefficient between

14-35 14-36 projects j and k.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

XIV - 9

Pearson Education Limited 2004 Carroll College, Waukesha, WI

Fundamentals of Financial Management, 12/e

Chapter 14: Risk and Managerial Options in Capital Budgeting

Combinations of

Risky Investments Managerial (Real) Options

E: Existing Projects Management flexibility to make

Expected Value of NPV

C

8 Combinations future decisions that affect a

B

E E+1 E+1+2 projects expected cash flows, life,

E+2 E+1+3

E+3 E+2+3

E or future acceptance.

E+1+2+3 Project Worth = NPV +

A

A, B, and C are Option(s) Value

dominating combinations

from the eight possible. Standard Deviation

14-37 14-38

Previous Example with

Managerial (Real) Options Project Abandonment

(.10) $2,200

Expand (or contract) Assume that

(.20

.20) $1,200 1 (.60) $1,200 this project

Allows the firm to expand (contract) production (.30) $ 900 can be

if conditions become favorable (unfavorable). abandoned at

(.35) $ 900 the end of the

Abandon (.60

60) $450 (.40) $ 600 first year for

-$900 2

Allows the project to be terminated early. (.25) $ 300 $200.

$200

Postpone (.10) $ 500 What is the

(.20

.20) -$600 3 (.50) -$ 100 project

Allows the firm to delay undertaking a project

(.40) -$ 700 worth?

worth

(reduces uncertainty via new information).

Year 1 Year 2

14-39 14-40

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

XIV - 10

Pearson Education Limited 2004 Carroll College, Waukesha, WI

Fundamentals of Financial Management, 12/e

Chapter 14: Risk and Managerial Options in Capital Budgeting

Project Abandonment Project Abandonment

(.10) $2,200 (.10) $2,200

Node 3:

3 The optimal

(.20

.20) $1,200 1 (.60) $1,200 (.20

.20) $1,200 1 (.60) $1,200 decision at the

(.30) $ 900 (500

500/1.05)(.1)+ (.30) $ 900 end of Year 1

(--100/1.05)(.5)+

100 is to abandon

(.35) $ 900 (--700/1.05)(.4)=

700 (.35) $ 900 the project for

(.60

60) $450 (.40) $ 600 (.60

60) $450 (.40) $ 600 $200.

$200

-$900 2 -$900 2

(.25) $ 300 ($476.19)(.1)+ (.25) $ 300 $200 >

-($ 95.24)(.5)+

(.10) $ 500 -($666.67)(.4)= (.10) $ 500 -($266.67)

(.20

.20) -$600 3 (.50) -$ 100 (.20

.20) -$600 3 (.50) -$ 100 What is the

(.40) -$ 700 -($266.67) (.40) -$ 700 new

new project

value?

Year 1 Year 2 Year 1 Year 2

14-41 14-42

Summary of the Addition

Project Abandonment of the Abandonment Option

(.10) $2,200

$ 2,238.32 The standard deviation* =

(.20

.20) $1,200 1 (.60) $1,200

$ 1,331.29 SQRT (740,326) = $857.56

(.30) $ 900

$ 1,059.18 The expected NPV* = $ 71.88

(.35) $ 900

$ 344.90

-$900

(.60

60) $450

2

(.40) $ 600

$ 72.79

NPV* = Original NPV +

(.25) $ 300

-$ 199.32

Abandonment Option

(.20

.20) -$400* 3 (1.0) $ 0 Thus, $71.88 = -$17.01 + Option

-$ 1,280.95

*-$600 + $200 abandonment Abandonment Option = $ 88.89

Year 1 Year 2 * For True Project considering abandonment option

14-43 14-44

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

XIV - 11

Pearson Education Limited 2004 Carroll College, Waukesha, WI

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Cheat Sheet For AccountingDokument4 SeitenCheat Sheet For AccountingshihuiNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- PAG IBIG Home Development Mutual FundDokument13 SeitenPAG IBIG Home Development Mutual FundAnn Serrato100% (1)

- What is a Forward Rate Agreement (FRADokument2 SeitenWhat is a Forward Rate Agreement (FRAmuzzamil123Noch keine Bewertungen

- Demand AnalysisDokument65 SeitenDemand AnalysisJoshua Stalin SelvarajNoch keine Bewertungen

- Chapter 01 - DayagDokument16 SeitenChapter 01 - DayagPrincessAngelaDeLeon80% (5)

- Inter Company UserguideDokument32 SeitenInter Company Userguidemshabnam0% (2)

- Wage and SalaryDokument30 SeitenWage and Salaryaloha12345680% (5)

- Chapter 11 Relevant Costs For Non Routine Decision MakingDokument24 SeitenChapter 11 Relevant Costs For Non Routine Decision MakingCristine Jane Moreno Camba50% (2)

- Business Functions, Accounting Cycles & Information SystemsDokument70 SeitenBusiness Functions, Accounting Cycles & Information SystemsAnn SerratoNoch keine Bewertungen

- Ca Final Compiler Paper 5 Advanced Management Accounting PDFDokument432 SeitenCa Final Compiler Paper 5 Advanced Management Accounting PDFAnn SerratoNoch keine Bewertungen

- Chap 27Dokument7 SeitenChap 27Ann SerratoNoch keine Bewertungen

- Chapter 2 Individual Differences, Mental AbilityDokument19 SeitenChapter 2 Individual Differences, Mental AbilityAnn SerratoNoch keine Bewertungen

- Hilton - Maher - SeltoDokument34 SeitenHilton - Maher - SeltoSandip BansalNoch keine Bewertungen

- The Tax Reform For Acceleration and Inclusion or Train LawDokument3 SeitenThe Tax Reform For Acceleration and Inclusion or Train LawAnn SerratoNoch keine Bewertungen

- Chap2 The External EnvironmentDokument2 SeitenChap2 The External EnvironmentAnn SerratoNoch keine Bewertungen

- BenefitsDokument47 SeitenBenefitsAnn SerratoNoch keine Bewertungen

- Hilton CH 10 Select SolutionsDokument25 SeitenHilton CH 10 Select Solutionsmanthana9950% (2)

- Question 6Dokument4 SeitenQuestion 6Ann SerratoNoch keine Bewertungen

- Chapter 1 The Nature and ScopeDokument12 SeitenChapter 1 The Nature and ScopeAnn Serrato100% (1)

- SorryDokument1 SeiteSorryAnn SerratoNoch keine Bewertungen

- BasicDokument3 SeitenBasicAnn SerratoNoch keine Bewertungen

- Environment: Interpersonal CommunicationDokument6 SeitenEnvironment: Interpersonal CommunicationAnn SerratoNoch keine Bewertungen

- HR407 T2 Wevs KeyDokument3 SeitenHR407 T2 Wevs KeyAnn SerratoNoch keine Bewertungen

- SD: Month 1 ID: 1 SD: Month 2 FD: Month 1 DUR: 1 Month FD: Month 6Dokument9 SeitenSD: Month 1 ID: 1 SD: Month 2 FD: Month 1 DUR: 1 Month FD: Month 6Ann SerratoNoch keine Bewertungen

- Arens Auditing and Assurance Services 13eDokument9 SeitenArens Auditing and Assurance Services 13eintanfidztiraNoch keine Bewertungen

- Convertible Preferred Market Value and Equity Value CalculationDokument22 SeitenConvertible Preferred Market Value and Equity Value CalculationAnn SerratoNoch keine Bewertungen

- Advacc 2 - Chapter 16Dokument1 SeiteAdvacc 2 - Chapter 16Ann SerratoNoch keine Bewertungen

- Chapter 1 - General Provisions Article 1767Dokument5 SeitenChapter 1 - General Provisions Article 1767Ann SerratoNoch keine Bewertungen

- TO, TOO and TWODokument2 SeitenTO, TOO and TWOAnn SerratoNoch keine Bewertungen

- Sercu Solutions PDFDokument155 SeitenSercu Solutions PDFAnn SerratoNoch keine Bewertungen

- Narrative Report 1Dokument1 SeiteNarrative Report 1Ann SerratoNoch keine Bewertungen

- Barican, Danica Sweet Bayal, Liezel Ann S. BSA32 March 16, 2017 IT Concepts and Systems Analysis and Design Midterm Homework No. 2Dokument1 SeiteBarican, Danica Sweet Bayal, Liezel Ann S. BSA32 March 16, 2017 IT Concepts and Systems Analysis and Design Midterm Homework No. 2Ann SerratoNoch keine Bewertungen

- Adv Dis TableDokument2 SeitenAdv Dis TablerambergNoch keine Bewertungen

- What A Beautiful Name LCCDokument1 SeiteWhat A Beautiful Name LCCAnn SerratoNoch keine Bewertungen

- Acom Arranged Chapter 3Dokument10 SeitenAcom Arranged Chapter 3Ann SerratoNoch keine Bewertungen

- Tutorial Topic 6 Week 10 PDFDokument5 SeitenTutorial Topic 6 Week 10 PDFAnonymous KovGERSNoch keine Bewertungen

- NewsDokument393 SeitenNewsapi-3771259Noch keine Bewertungen

- A Study of FactorsDokument142 SeitenA Study of FactorsDarwyn MendozaNoch keine Bewertungen

- Consumer Buying Behaviour and Perception in Small Car SegmentDokument17 SeitenConsumer Buying Behaviour and Perception in Small Car SegmentRohit SharmaNoch keine Bewertungen

- Pangase MakingDokument11 SeitenPangase MakingJulius Pada ObusNoch keine Bewertungen

- Distributed Generation - Definition, Benefits and IssuesDokument12 SeitenDistributed Generation - Definition, Benefits and Issuesapi-3697505100% (1)

- Customer Satisfaction and ServiceDokument38 SeitenCustomer Satisfaction and ServiceMukeshNoch keine Bewertungen

- Tesla Motors January 2014 Investor PresentationDokument33 SeitenTesla Motors January 2014 Investor PresentationotteromNoch keine Bewertungen

- IS - LM ModelDokument5 SeitenIS - LM ModelAbhishek SinhaNoch keine Bewertungen

- GPDokument20 SeitenGPron_bdNoch keine Bewertungen

- Laundry Category PresentationDokument13 SeitenLaundry Category PresentationNitya SrivastavaNoch keine Bewertungen

- Ejemplos MúltiplosDokument2 SeitenEjemplos MúltiplosFernando QuispeNoch keine Bewertungen

- ITOP Quotation For Kebab Maker Box To Wiwih.17.9.13Dokument1 SeiteITOP Quotation For Kebab Maker Box To Wiwih.17.9.13Wiwih WahyuNoch keine Bewertungen

- Consti2Digest - Manila Prince Hotel Vs GSIS, 267 SCRA 408, G.R. No. 122156 (3 Feb 1997)Dokument1 SeiteConsti2Digest - Manila Prince Hotel Vs GSIS, 267 SCRA 408, G.R. No. 122156 (3 Feb 1997)Lu CasNoch keine Bewertungen

- Benefits, Costs & Decisions by SRDokument28 SeitenBenefits, Costs & Decisions by SRKurt RuizNoch keine Bewertungen

- Foundation Course in Managerial Economics: DR Barnali Nag IIT Kharagpur Lecture 25: MonopolyDokument19 SeitenFoundation Course in Managerial Economics: DR Barnali Nag IIT Kharagpur Lecture 25: MonopolyDebesh GhoshNoch keine Bewertungen

- 7 External AuditDokument28 Seiten7 External Auditcuteserese roseNoch keine Bewertungen

- Special Updates From The Strategic Investment Conference: Day 1Dokument4 SeitenSpecial Updates From The Strategic Investment Conference: Day 1richardck61Noch keine Bewertungen

- Columbus's First VoyageDokument16 SeitenColumbus's First VoyagepiyuNoch keine Bewertungen

- Econ IntroDokument9 SeitenEcon Introsakura_khyle100% (1)

- ISS22 ShababiDokument36 SeitenISS22 ShababiAderito Raimundo MazuzeNoch keine Bewertungen

- Commercial Vehicles Market Analysis and Segment Forecasts To 2025Dokument58 SeitenCommercial Vehicles Market Analysis and Segment Forecasts To 2025pinku13Noch keine Bewertungen

- Ic38 Q&a-2Dokument29 SeitenIc38 Q&a-2Anonymous O82vX350% (2)

- Y5 Topic 5 - MoneyDokument23 SeitenY5 Topic 5 - MoneyAhmad ShukriNoch keine Bewertungen