Beruflich Dokumente

Kultur Dokumente

Can Slim1

Hochgeladen von

satish sCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Can Slim1

Hochgeladen von

satish sCopyright:

Verfügbare Formate

The CANSLIM method for long term investing

No one style of investing fits all people, but I subscribe to the 45/45/10

Investing Method. 45% of your investing should in CASH FLOW strategies,

45% growth strategies, 10% (or less) in high risk, high reward strategies.

One of the first "systems" I learned in my twenties, was the CANSLIM

method of investing. A system developed by the founder of IBD, Investors

Business Daily. This system works very well in an up-trending market, OK

in a flat market, and poorly in a down trending market.

All stocks, are companies, and have financials. Some good, some bad, but

never equal. O'Neil found that just before a company did very well

financially, and in terms of stock growth, there were common

characteristics. Common elements, in their financial statistics, that often

can predict, stock growth. In addition, he noted some more subjective, but

measurable activates, that were good indicators of future stock growth. A

very strong indicator of gains.

Many of these indicators are pure financial bench marks; we can look for in

a company, such as: sales growth, and earnings over time. Some a little

more subjective, but still quantifiable. For example: product development,

being a leader or laggard in the sector (industry) and institutional buying.

Thus O'Neil developed the CAN SLIM method of picking stocks, which has

served me and many other investors very well. A checklist for the seven

common elements that indicate a stock is going to have solid gains in the

future. This strategy can reduce risk and increase returns when picking

stocks.

CANSLIM is an acronym that stands for:

C. Current Earnings.

A. Annual Earnings.

N. New Products.

S. Supply and Demand.

L. Leader or Laggard.

I. Institutional Investing.

M. Market Direction.

The system uses key numbers, and characteristics of the company to

evaluate a stock before you buy.

C= Current earnings per share should be up 25%. Accelerating in recent

quarters. Quarterly sales should also be up 25% or more.

A= Annual earnings should be up 25% or more in each of the last three

years. Annual return on equity should be at least 17% or more.

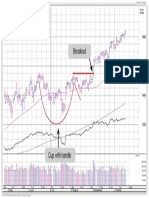

N= The company should have new products or services that drive

earnings. At this point, you might check the chart of the stock, and see if

there is new upward trending or positive pattern (breaking resistance for

example or new highs).

S= Supply and demand. Shares outstanding can be large or small. But as

the stock price increases, there should be increase in the trading volume

too.

L= Leader or laggard. The stock should be in the top 20 percent of the

industry or sector analysis. Therefore, you need a Relative Price Strength

Rating of 80 or higher.

I= Institutional buying (mutual funds, investment houses) should be

increasing. The big boys are buying more of the stock, and therefore,

demand is increasing, and supply decreasing.

M= The market need to be going up. Indexes: Dow, S&P 500, RUT and

NASDAQ are positive and moving up. Remember three out of four stocks

trend with the market.

This is a solid strategy for long term growth. Enjoy. Jim Francis

www.jimfrancis.

Das könnte Ihnen auch gefallen

- 1208452Dokument4 Seiten1208452satish sNoch keine Bewertungen

- Simple Supper Trading SystemDokument3 SeitenSimple Supper Trading Systemsatish sNoch keine Bewertungen

- Unusual Options Activity Halftime Report - : There Is A Risk of Loss in All TradingDokument3 SeitenUnusual Options Activity Halftime Report - : There Is A Risk of Loss in All Tradingsatish sNoch keine Bewertungen

- News Release: Nomura Individual Investor SurveyDokument17 SeitenNews Release: Nomura Individual Investor Surveysatish sNoch keine Bewertungen

- Dig Ppo: Percentage Price OscillatorDokument4 SeitenDig Ppo: Percentage Price Oscillatorsatish sNoch keine Bewertungen

- The Stock Market Update: September 11, 2012 © David H. WeisDokument1 SeiteThe Stock Market Update: September 11, 2012 © David H. Weissatish sNoch keine Bewertungen

- Crystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural InformationDokument3 SeitenCrystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural Informationsatish sNoch keine Bewertungen

- Trading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLDokument8 SeitenTrading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLsatish sNoch keine Bewertungen

- Es130617 1Dokument4 SeitenEs130617 1satish sNoch keine Bewertungen

- Sharpening Skills WyckoffDokument16 SeitenSharpening Skills Wyckoffsatish s100% (1)

- The Art of Timing The TradeDokument1 SeiteThe Art of Timing The Tradesatish s0% (3)

- Wabash National Corp WNC: Last Close Fair Value Market CapDokument4 SeitenWabash National Corp WNC: Last Close Fair Value Market Capsatish sNoch keine Bewertungen

- ETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst FundsDokument5 SeitenETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst Fundssatish sNoch keine Bewertungen

- Uniti Group Inc UNIT: Last Close Fair Value Market CapDokument4 SeitenUniti Group Inc UNIT: Last Close Fair Value Market Capsatish sNoch keine Bewertungen

- How To Buy Common Patterns1 2Dokument1 SeiteHow To Buy Common Patterns1 2satish sNoch keine Bewertungen

- Smartbuild - Smart Design For Smart SystemsDokument1 SeiteSmartbuild - Smart Design For Smart Systemssatish sNoch keine Bewertungen

- An Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange MarketDokument7 SeitenAn Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange Marketsatish sNoch keine Bewertungen

- Medication Deferral ListDokument2 SeitenMedication Deferral Listsatish sNoch keine Bewertungen

- Questions and Answers May 2013: Morningstar's Quantitative Equity RatingsDokument3 SeitenQuestions and Answers May 2013: Morningstar's Quantitative Equity Ratingssatish sNoch keine Bewertungen

- Fast Track 6 2 ILT Datasheet 1Dokument1 SeiteFast Track 6 2 ILT Datasheet 1Swapnil BankarNoch keine Bewertungen

- Looking For Short Term Signals in Stock Market Data: A. BocharovDokument10 SeitenLooking For Short Term Signals in Stock Market Data: A. Bocharovsatish sNoch keine Bewertungen

- Are Institutions Momentum Traders?: Timothy R. Burch Bhaskaran SwaminathanDokument39 SeitenAre Institutions Momentum Traders?: Timothy R. Burch Bhaskaran Swaminathansatish sNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 1 The Nature and Forms of Business OrganizationDokument4 Seiten1 The Nature and Forms of Business OrganizationCARLO PRIGONoch keine Bewertungen

- OpTransactionHistory23 07 2022Dokument12 SeitenOpTransactionHistory23 07 2022Rakesh KumarNoch keine Bewertungen

- Assignment On Business Law, Jannatul Ferdous, ID-201011133, BUS208, Sec 05Dokument6 SeitenAssignment On Business Law, Jannatul Ferdous, ID-201011133, BUS208, Sec 05Jannatul FerdausNoch keine Bewertungen

- Business PlanDokument24 SeitenBusiness PlanMuhammad Arsalan Akram90% (10)

- Leasing Presentation Atrium MallDokument31 SeitenLeasing Presentation Atrium MallSahaj anandNoch keine Bewertungen

- Lockout/ Tag Out ProceduresDokument46 SeitenLockout/ Tag Out Proceduresahmed mostafaNoch keine Bewertungen

- Taxation of Partnerships, Estates and Trusts Classification of Partnerships 1. General Professional PartnershipDokument11 SeitenTaxation of Partnerships, Estates and Trusts Classification of Partnerships 1. General Professional PartnershipErika DioquinoNoch keine Bewertungen

- LV03 Effective Working RelationshipsDokument39 SeitenLV03 Effective Working Relationshipssenen aguilarNoch keine Bewertungen

- NSS Exploring Economics 5 (3 Edition) : Revision NotesDokument2 SeitenNSS Exploring Economics 5 (3 Edition) : Revision NotesinkeNoch keine Bewertungen

- Paper I & 11 Answer All Questions: (E) Explain The Use of Correlation and Regression Studies in Busainess?Dokument5 SeitenPaper I & 11 Answer All Questions: (E) Explain The Use of Correlation and Regression Studies in Busainess?Suthaharan PerampalamNoch keine Bewertungen

- Becg - 5-Units PDFDokument111 SeitenBecg - 5-Units PDFABINAYANoch keine Bewertungen

- Ebay - SE Asia Report-2022 - A4-LowDokument17 SeitenEbay - SE Asia Report-2022 - A4-LowBenjaminNoch keine Bewertungen

- Enterpreneurship and ManagmentDokument28 SeitenEnterpreneurship and ManagmentSAYEENoch keine Bewertungen

- Boy Scouts of The Philippines Vs NLRCDokument2 SeitenBoy Scouts of The Philippines Vs NLRCMarielle ReynosoNoch keine Bewertungen

- CPA FastbreakDokument26 SeitenCPA FastbreakRamadhan Yunus100% (2)

- Introduction-Two Wheeler IndustryDokument1 SeiteIntroduction-Two Wheeler Industryandrew723Noch keine Bewertungen

- Mcdonald and KFCDokument39 SeitenMcdonald and KFCHitesh Chand0% (1)

- Forms of MarketDokument41 SeitenForms of MarketAparajita SinghNoch keine Bewertungen

- Account Statement 030523 021123Dokument37 SeitenAccount Statement 030523 021123manish thakurNoch keine Bewertungen

- Quantitative Recession PredictionDokument10 SeitenQuantitative Recession PredictionRd PatelNoch keine Bewertungen

- Faculty of Commerce and Administration Prospectus 2021: Walter Sisulu UniversityDokument83 SeitenFaculty of Commerce and Administration Prospectus 2021: Walter Sisulu UniversitySithabile NdlovuNoch keine Bewertungen

- PD Insurers Takaful Operators Repairers Code of Conduct Dec23Dokument31 SeitenPD Insurers Takaful Operators Repairers Code of Conduct Dec23alpha speculationNoch keine Bewertungen

- Finance: Studying Controllership: by Frank G. H. HartmannDokument6 SeitenFinance: Studying Controllership: by Frank G. H. HartmannshanifNoch keine Bewertungen

- The Only Technical Analysis Book You Will Ever Need (Brian Hale) (Z-Library)Dokument153 SeitenThe Only Technical Analysis Book You Will Ever Need (Brian Hale) (Z-Library)Vijay Krishna Patra50% (2)

- HR LeadDokument11 SeitenHR LeadSurbhiSharmaNoch keine Bewertungen

- BINUS University: Academic Career: Class ProgramDokument3 SeitenBINUS University: Academic Career: Class ProgramJohan fetoNoch keine Bewertungen

- Resume Nur Syaza 2021Dokument2 SeitenResume Nur Syaza 2021syazasuhaimyNoch keine Bewertungen

- Reservoir Souring Control Action ItemDokument1 SeiteReservoir Souring Control Action ItemSathia ShekarNoch keine Bewertungen

- Allotment Letter Sale Agreement Deed of Conveyance For Vinayak Golden AcresDokument96 SeitenAllotment Letter Sale Agreement Deed of Conveyance For Vinayak Golden AcresAshok Kumar ChaudharyNoch keine Bewertungen

- Extinguishment OF Obligations Extinguishment OF ObligationsDokument39 SeitenExtinguishment OF Obligations Extinguishment OF ObligationsCamillus Carillo AngelesNoch keine Bewertungen