Beruflich Dokumente

Kultur Dokumente

!2049492 C 3130312 C 2048572032

Hochgeladen von

Aarti JOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

!2049492 C 3130312 C 2048572032

Hochgeladen von

Aarti JCopyright:

Verfügbare Formate

E13-4

(a) December 31, 2003

Unrealized Holding Gain or LossIncome................ 1,400

Securities Fair Value Adjustment (Trading).......

1,400

(b) During 2004

Cash.............................................................................. 9,400

Loss on Sale of Securities........................................... 600

Trading Securities................................................

10,000

(c) December 31, 2004

Unrealized

Securities Cost Fair Value Gain (Loss)

Clemson Corp. stock $20,000 $19,100 ($ (900)

Buffaloes Co. stock 20,000 20,500 ( 500)

Total of portfolio $40,000 $39,600 ( (400)

Previous securities fair value ( (1,400)

adjustment balanceCr.

Securities fair value ($1,000)

adjustmentDr.

Securities Fair Value Adjustment (Trading)............... 1,000

Unrealized Holding Gain or Loss

Income...............................................................

E 13-6

(a) The portfolio should be reported at the fair value of $54,500.

Since the cost of the portfolio is $53,000, the unrealized holding

gain is $1,500, of which $400 is already recognized. Therefore,

the December 31, 2003 adjusting entry should be:

Securities Fair Value Adjustment

(Available-for-Sale)...................................................... 1,100

Unrealized Holding Gain or LossEquity.............

1,100

(b) The unrealized holding gain of $1,500 (including the previous

balance of $400) should be reported as an addition to

stockholders equity and the Securities Fair Value Adjustment

(Available-for-Sale) account balance of $1,500 should be added to

the cost of the securities account.

STEFFI GRAF, INC.

Balance Sheet

As of December 31, 2003

______________________________________________________________

Current assets:

Available-for-sale securities $54,500

Stockholders equity:

Common stock xxx,xxx

Additional paid-in capital xxx,xxx

Retained earnings xxx,xxx

xxx,xxx

Add: Accumulated other comprehensive income 1,500*

Total stockholders equity $xxx,xxx

*Note: The unrealized holding gain could also be disclosed.

(c) Computation of realized gain or loss on sale of stock:

Net proceeds from sale of security A $15,100

Cost of security A 17,500

Loss on sale of stock ($ 2,400

January 20, 2004

Cash............................................................................. 15,100

Loss on Sale of Securities......................................... 2,400

Available-for-Sale Securities..............................

17,500

Das könnte Ihnen auch gefallen

- American Finance Association, Wiley The Journal of FinanceDokument8 SeitenAmerican Finance Association, Wiley The Journal of FinanceAarti JNoch keine Bewertungen

- Accounting Homework Help IliskimeDokument1 SeiteAccounting Homework Help IliskimeAarti JNoch keine Bewertungen

- CostingDokument3 SeitenCostingAarti JNoch keine Bewertungen

- Deegan Chapter 10Dokument18 SeitenDeegan Chapter 10Aarti JNoch keine Bewertungen

- 6 Capital Market Intermediaries and Their RegulationDokument8 Seiten6 Capital Market Intermediaries and Their RegulationTushar PatilNoch keine Bewertungen

- Hi5019 Individual Assignment t1 2019 Qyuykqw5Dokument5 SeitenHi5019 Individual Assignment t1 2019 Qyuykqw5Aarti J50% (2)

- NCK - Annual Report 2017 PDFDokument56 SeitenNCK - Annual Report 2017 PDFAarti JNoch keine Bewertungen

- CR 1845Dokument90 SeitenCR 1845Aarti JNoch keine Bewertungen

- Saudi Vision2030Dokument85 SeitenSaudi Vision2030ryx11Noch keine Bewertungen

- 1 - Sis40215 CPT Case Studies 3Dokument61 Seiten1 - Sis40215 CPT Case Studies 3Aarti J0% (2)

- Caltex Australia CTX 2017 Annual ReportDokument127 SeitenCaltex Australia CTX 2017 Annual ReportAarti JNoch keine Bewertungen

- Mgt201 Solved Subjective Questions Vuzs TeamDokument12 SeitenMgt201 Solved Subjective Questions Vuzs TeamAarti JNoch keine Bewertungen

- Investment Decision MethodDokument44 SeitenInvestment Decision MethodashwathNoch keine Bewertungen

- TFTH C 636639530213947535 31700 2Dokument55 SeitenTFTH C 636639530213947535 31700 2Aarti JNoch keine Bewertungen

- CH 07 SMDokument11 SeitenCH 07 SMAarti JNoch keine Bewertungen

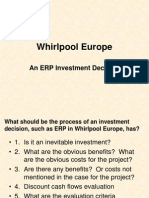

- The Whirlpool Europe Case: Investment On ERPDokument8 SeitenThe Whirlpool Europe Case: Investment On ERPAarti JNoch keine Bewertungen

- Chapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Dokument32 SeitenChapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Judith DelRosario De RoxasNoch keine Bewertungen

- Ch03 Prob3-6ADokument9 SeitenCh03 Prob3-6AAarti J100% (1)

- Coles Year in Review 2017Dokument28 SeitenColes Year in Review 2017Aarti JNoch keine Bewertungen

- Mergers Don't Always Lead To Culture Clashes.Dokument3 SeitenMergers Don't Always Lead To Culture Clashes.Lahiyru100% (3)

- Organizational CultureDokument21 SeitenOrganizational CultureAarti JNoch keine Bewertungen

- 2 Case - 2Dokument10 Seiten2 Case - 2Aarti JNoch keine Bewertungen

- Case Study Ch03Dokument3 SeitenCase Study Ch03Munya Chawana0% (1)

- Relevant Cost Examples EMBA-garrison Ch.13Dokument13 SeitenRelevant Cost Examples EMBA-garrison Ch.13Aarti JNoch keine Bewertungen

- Philanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Dokument2 SeitenPhilanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Aarti JNoch keine Bewertungen

- 2010 06 13 - 091545 - Case13 30Dokument6 Seiten2010 06 13 - 091545 - Case13 30Sheila Mae Llamada Saycon IINoch keine Bewertungen

- Accounting Changes and Errors: HapterDokument46 SeitenAccounting Changes and Errors: HapterAarti JNoch keine Bewertungen

- ACCG315Dokument4 SeitenACCG315Joannah Blue0% (1)

- Whirlpool EuropeDokument19 SeitenWhirlpool Europejoelgzm0% (1)

- MCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Dokument139 SeitenMCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Aarti J100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- TCHE 303 - Money and Banking Tutorial QuestionsDokument2 SeitenTCHE 303 - Money and Banking Tutorial QuestionsTường ThuậtNoch keine Bewertungen

- Call Money MarketDokument21 SeitenCall Money MarketAakanksha SanctisNoch keine Bewertungen

- Debdatta Das Roll No:-521029844 Centre Code:-02783 Master of Business Administration - Semester III Project ReportDokument16 SeitenDebdatta Das Roll No:-521029844 Centre Code:-02783 Master of Business Administration - Semester III Project ReportDebdatta DasNoch keine Bewertungen

- Competition and Business Strategy in Historical Perspective PankajDokument32 SeitenCompetition and Business Strategy in Historical Perspective PankajK VNoch keine Bewertungen

- PMF 2017 02 MadzivanyikaDokument12 SeitenPMF 2017 02 MadzivanyikaTatenda MakurumidzeNoch keine Bewertungen

- Marketing Research - Customers LoyaltyDokument83 SeitenMarketing Research - Customers LoyaltyMARIAN CLAIRE DELA TORRENoch keine Bewertungen

- Issues and Concerns of Commodity Derivative MarketDokument18 SeitenIssues and Concerns of Commodity Derivative MarketAmit HingoraniNoch keine Bewertungen

- Edge Ratio of Nifty For Last 15 Years On Donchian ChannelDokument8 SeitenEdge Ratio of Nifty For Last 15 Years On Donchian ChannelthesijNoch keine Bewertungen

- Michael Porter'S Five Competitive Forces Analysis For "Bhor Led TV"Dokument10 SeitenMichael Porter'S Five Competitive Forces Analysis For "Bhor Led TV"Md Nazmus SakibNoch keine Bewertungen

- Complete Week9 FX Mkt scoring 13/14Dokument9 SeitenComplete Week9 FX Mkt scoring 13/14Derek LowNoch keine Bewertungen

- Standardization vs Adaptation in Global MarketsDokument26 SeitenStandardization vs Adaptation in Global Marketssangram96100% (1)

- BICDokument18 SeitenBICLita IonutNoch keine Bewertungen

- Case Analysis Celebritics Kelvin OngDokument3 SeitenCase Analysis Celebritics Kelvin OngKelvin Andrew OngNoch keine Bewertungen

- Corporate Finance ModuleDokument153 SeitenCorporate Finance ModuleKaso Muse100% (1)

- OF Strategic Management ON: Corporate Strategy: H. Igor AnsoffDokument29 SeitenOF Strategic Management ON: Corporate Strategy: H. Igor AnsoffBrilliant ManglaNoch keine Bewertungen

- Brand Analysis Into ActionDokument2 SeitenBrand Analysis Into Actionashish_phadNoch keine Bewertungen

- Assignment 1 - TerraCogDokument6 SeitenAssignment 1 - TerraCogEina GuptaNoch keine Bewertungen

- Chapter 2. Tool Kit For Financial Statements, Cash Flows, and TaxesDokument14 SeitenChapter 2. Tool Kit For Financial Statements, Cash Flows, and TaxesAnshumaan SinghNoch keine Bewertungen

- Pas 12Dokument5 SeitenPas 12elle friasNoch keine Bewertungen

- Strategic management-S/W PrintingDokument76 SeitenStrategic management-S/W PrintingamirrajaNoch keine Bewertungen

- Ketan Parekh Scam MergedDokument48 SeitenKetan Parekh Scam MergedKaushal RautNoch keine Bewertungen

- 0812 Daniel Camacho Capital Markets FinalDokument20 Seiten0812 Daniel Camacho Capital Markets FinalJonathan AguilarNoch keine Bewertungen

- Merger and Acquisition FinalsDokument3 SeitenMerger and Acquisition FinalsLeevya GeethanjaliNoch keine Bewertungen

- Merger Factsheet 030716Dokument1 SeiteMerger Factsheet 030716yannisxylasNoch keine Bewertungen

- Value Chain Analysis of CokeDokument4 SeitenValue Chain Analysis of CokeDeepak YadavNoch keine Bewertungen

- B2B Group 6 Section A PaytmDokument17 SeitenB2B Group 6 Section A PaytmNeha RoyNoch keine Bewertungen

- Marketing ManagementDokument90 SeitenMarketing Managementmech430Noch keine Bewertungen

- Chapter 1-Basic Economic Ideas and Resource AllocationDokument13 SeitenChapter 1-Basic Economic Ideas and Resource AllocationKeya NandiNoch keine Bewertungen

- Airtel Bill PaymentDokument1 SeiteAirtel Bill PaymentVipin SinghNoch keine Bewertungen