Beruflich Dokumente

Kultur Dokumente

12 Altprob 7e

Hochgeladen von

Aarti JOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

12 Altprob 7e

Hochgeladen von

Aarti JCopyright:

Verfügbare Formate

Exercise 12-1

EXERCISES Exercise 12-2

Various Various investment

transactions related securities

to securities

available for sale LO 1-3

LO 3

Parnell Industries buys securities to be available for sale when

circumstances warrant, not to profit from short-term differences in price and

not necessarily to hold debt securities to maturity. The following selected

transactions relate to investment activities of Parnell Industries whose fiscal

year ends on December 31. No investments were held by Parnell at the

beginning of the year.

2013

March 1 Purchased 2 million Platinum Gems, Inc. common shares for

$124 million, including brokerage fees and commissions.

April 13 Purchased $200 million of 10% bonds at face value from

Oracle Wholesale Corporation.

July 20 Received cash dividends of $3 million on the investment in

Platinum Gems, Inc. common shares.

October 13 Received semiannual interest of $10 million on the investment

in Oracle bonds.

October 14 Sold the Oracle bonds for $205 million.

November 1 Purchased 500,000 SPI International preferred shares for $40

million, including brokerage fees and commissions.

December 31 Recorded the necessary adjusting entry(s) relating to the

investments. The market prices of the investments are $64 per

share for Platinum Gems, Inc. and $74 per share for SPI

International preferred shares.

2014

January 25 Sold half the Platinum Gems, Inc. shares for $65 per share.

March 1 Sold the SPI International preferred shares for $78 per share.

December 31 Recorded the necessary adjusting entry(s) relating to the

investments. The market price of the investments is $65 per

share for Platinum Gems, Inc.

Required:

1. Prepare the appropriate journal entry for each transaction or event.

2. Show the amounts that would be reported on the companys 2013 income

statement relative to these investments.

At December 31, 2013, McKnight Brothers Corp. had the following

investments that were purchased during 2000, its first year of operations:

The McGraw-Hill Companies, Inc., 2013

Alternate Exercises and Problems 12-1

13-1

Exercise 12-3

Equity method;

purchase; investee

income; dividends

LO 5

Cost Fair Value

Trading Securities:

Security A $ 700,000 $ 725,000

B 210,000 200,000

Totals $ 910,000 $ 925,000

Securities Available for Sale:

Security C $ 500,000 $ 560,000

D 850,000 865,000

Totals $1,350,000 $1,425,000

Securities to Be Held to Maturity:

Security E $ 970,000 $ 980,000

F 412,000 409,000

Totals $1,382,000 $1,389,000

No investments were sold during 2013. All securities except Security D

and Security F are considered short-term investments. None of the market

changes is considered permanent.

Required:

Determine the following amounts at December 31, 2013:

1. Investments reported as current assets.

2. Investments reported as noncurrent assets.

3. Unrealized gain (or loss) component of income before taxes.

4. Unrealized gain (or loss) component of other comprehensive income.

As a long-term investment at the beginning of the fiscal year, Paper

Products International purchased 35% of Reeds Restaurant Supplies, Inc.s 12

million shares for $73 million. The fair value and book value of the shares

were the same at that time. During the year, Reeds Restaurant Supplies

earned net income of $20 million and distributed cash dividends of $1.10 per

share. At the end of the year, the fair value of the shares is $59 million.

Required:

Prepare the appropriate journal entries from the purchase through the end of

the year.

The McGraw-Hill Companies, Inc., 2013

Alternate Exercises and Problems 12-2

13-2

Exercise 12-4Exercise

Exercise

126 125

Equity method; Accounting

Accounting

for debtfor debt

investments under the

adjustments for investments under the

proposed

proposed ASU ASU

depreciation

LO 6

J & W Leasing paid $76 million on January 4, 2013, for 5 million shares of

Conley Trucks common stock. The investment represents a 25% interest in

the net assets of Conley and gave J & W the ability to exercise significant

influence over Conleys operations. J & W received dividends of $1.20 per

share on December 27, 2013, and Conley reported net income of $60 million

for the year ended December 31, 2013. The market value of Conleys

common stock at December 31, 2013, was $22.25 per share.

The book value of Conleys net assets was $212 million.

The fair market value of Conleys depreciable assets exceeded their book

value by $40 million. These assets had an average remaining useful life

of 5 years.

The remainder of the excess of the cost of the investment over the book

value of net assets purchased was attributable to goodwill.

Required:

Prepare all appropriate journal entries related to the investment during

2013.

Fredpurchased$10,000of8%BlakelybondsatparonJuly1,2013. The

bondspayinterestsemiannually.FredintendstoholdtheBlakelybondsfor

thelifeofthebonds.Duringthesecondhalfof2013,andecreaseininterest

rates increased the fair value of the bonds to $12,000. Fred reports

investmentsundertheproposedASU.

Required:

1. Prepare a journal entry to record Freds receipt of six months of interest

revenue.

2. Prepare a journal entry (if any is required) to record any unrealized gains

or losses on the Blakely bonds during 2013.

AssumethesamefactsasinE126,butthatFredintendstosellhalfofthe

Blakelybondsimmediatelyandtoholdtheotherhalfofthebondstosellonce

The McGraw-Hill Companies, Inc., 2013

Alternate Exercises and Problems 12-3

13-3

thepriceofthebondsappreciatessufficiently.Fredreportsinvestmentsunder

theproposedASU.

Required:

1. Prepare a journal entry to record Freds receipt of six months of interest

revenue.

2. Prepare a journal entry (if any is required) to record any unrealized gains

or losses on the Blakely bonds during 2013.

The McGraw-Hill Companies, Inc., 2013

Alternate Exercises and Problems 12-4

13-4

Problem 12-1

Investment

securities and

PROBLEMS

equity method

investments

compared

LO 3, 4, 5

On January 4, 2013, RTN Industries paid $648,000 for 20,000 shares of

Austin Cattle Company common stock. The investment represents a 30%

interest in the net assets of Austin and gave RTN the ability to exercise

significant influence over Austins operations. RTN received dividends of

$3.00 per share on December 6, 2013, and Austin reported net income of

$320,000 for the year ended December 31, 2013. The market value of

Austins common stock at December 31, 2013, was $32 per share. The book

value of Austins net assets was $1,600,000 and:

a. The fair market value of Austins depreciable assets, with an average

remaining useful life of 8 years, exceeded their book value by $160,000.

b. The remainder of the excess of the cost of the investment over the book

value of net assets purchased was attributable to goodwill.

Required:

1. Prepare all appropriate journal entries related to the investment during

2013, assuming RTN accounts for this investment by the equity method.

2. Prepare the journal entries required by RTN, assuming that the 20,000

shares represent a 10% interest in the net assets of Austin rather than a 30%

interest, and that RTN anticipates holding their investment in Austin for the

foreseeable future.

The McGraw-Hill Companies, Inc., 2013

Alternate Exercises and Problems 12-5

13-5

Problem 12-2 Southeast Pulp and Paper, a paper and allied products

Equity method manufacturer, was seeking to gain a foothold in Mexico.

Toward that end, the company bought 40% of the

LO 4, 5

outstanding common shares of Monterrey Milling, Inc. on

January 3, 2013, for $80 million.

At the date of purchase, the book value of Monterreys net assets was $155

million. The book values and fair values for all balance sheet items were the

same except for inventory and plant facilities. The fair value exceeded book

value by $1 million for the inventory and by $4 million for the plant facilities.

The estimated useful life of the plant facilities is 8 years. All inventory

acquired was sold during 2013.

Monterrey reported net income of $28 million for the year ended

December 31, 2013. Monterrey paid a cash dividend of $6 million.

Required:

1. Prepare all appropriate journal entries related to the investment during

2013.

2. What amount should Southeast report as its income from its investment in

Monterrey for the year ended December 31, 2013?

3. What amount should Southeast report on its balance sheet as its investment

in Monterrey?

4. What should Southeast report on its statement of cash flows regarding its

investment in Monterrey?

The McGraw-Hill Companies, Inc., 2013

Alternate Exercises and Problems 12-6

13-6

Das könnte Ihnen auch gefallen

- AMA Manual 10th Edition PDFDokument1.014 SeitenAMA Manual 10th Edition PDFKannan Fangs S100% (2)

- 1 - Sis40215 CPT Case Studies 3Dokument61 Seiten1 - Sis40215 CPT Case Studies 3Aarti J0% (2)

- ACCO320Midterm Fall2013FNDokument14 SeitenACCO320Midterm Fall2013FNzzNoch keine Bewertungen

- Performance Requirements For Organic Coatings Applied To Under Hood and Chassis ComponentsDokument31 SeitenPerformance Requirements For Organic Coatings Applied To Under Hood and Chassis ComponentsIBR100% (2)

- Acc 308 - Week4-4-2 Homework - Chapter 13Dokument6 SeitenAcc 308 - Week4-4-2 Homework - Chapter 13Lilian L100% (1)

- Test Bank For Advanced Accounting 2nd Edition by HamlenDokument40 SeitenTest Bank For Advanced Accounting 2nd Edition by HamlenAngelique Kate Tanding Duguiang100% (1)

- Objection Letter - 5Dokument3 SeitenObjection Letter - 5stockboardguyNoch keine Bewertungen

- Organizational CultureDokument21 SeitenOrganizational CultureAarti JNoch keine Bewertungen

- Chapter 02 Stock Investment Investor Accounting and ReportingDokument3 SeitenChapter 02 Stock Investment Investor Accounting and Reportingprins kyla SaboyNoch keine Bewertungen

- Journalentries 3437769Dokument3 SeitenJournalentries 3437769Astha GoplaniNoch keine Bewertungen

- Chapter 17 In-Class Exercises Intermediate AccountingDokument2 SeitenChapter 17 In-Class Exercises Intermediate AccountingFoodlovesJNoch keine Bewertungen

- F2 Sept 2013 QPDokument20 SeitenF2 Sept 2013 QPFahadNoch keine Bewertungen

- SBR Mock QuestionsDokument9 SeitenSBR Mock QuestionsAnnaNoch keine Bewertungen

- ACCT551 - Week 7 HomeworkDokument10 SeitenACCT551 - Week 7 HomeworkDominickdadNoch keine Bewertungen

- IFRS-9 Financial Instruments Journal EntriesDokument69 SeitenIFRS-9 Financial Instruments Journal Entriesrafid aliNoch keine Bewertungen

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDokument71 SeitenIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeRizki NurwikanNoch keine Bewertungen

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDokument78 SeitenIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeSiyedong Ardi100% (1)

- Intermediate Accounting I - Investment Part 1Dokument3 SeitenIntermediate Accounting I - Investment Part 1Joovs Joovho0% (3)

- Quiz 2Dokument10 SeitenQuiz 2simcity23Noch keine Bewertungen

- Problem 1: Take Home Quiz Mid Term Advanced Accounting 2Dokument3 SeitenProblem 1: Take Home Quiz Mid Term Advanced Accounting 2Mohamad Nurreza RachmanNoch keine Bewertungen

- Test 1Dokument4 SeitenTest 1Abdul Majid Ghanjera0% (1)

- Invest or Not in Oil & Gas Based on WACCDokument10 SeitenInvest or Not in Oil & Gas Based on WACCKaso MuseNoch keine Bewertungen

- F2 - Financial ManagementDokument20 SeitenF2 - Financial ManagementRobert MunyaradziNoch keine Bewertungen

- Quiz 3 UploadDokument6 SeitenQuiz 3 UploadandreamrieNoch keine Bewertungen

- Unit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Dokument9 SeitenUnit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Alyna JNoch keine Bewertungen

- Financial Reporting & AnalysisDokument11 SeitenFinancial Reporting & AnalysisSalman FarooqNoch keine Bewertungen

- Traveler Group consolidated SoFPDokument6 SeitenTraveler Group consolidated SoFPNeel ShahNoch keine Bewertungen

- 12 Altprob 8eDokument4 Seiten12 Altprob 8eRama DulceNoch keine Bewertungen

- AUD.2024-5.-Substantive-Tests-of-InvestmentsDokument4 SeitenAUD.2024-5.-Substantive-Tests-of-InvestmentskrizmyrelatadoNoch keine Bewertungen

- Assignment - FSAB - Submission 06 May 2023Dokument4 SeitenAssignment - FSAB - Submission 06 May 2023Amisha BoolkanNoch keine Bewertungen

- Lecture 2Dokument85 SeitenLecture 2Bintang David SusantoNoch keine Bewertungen

- Lecture 2Dokument85 SeitenLecture 2Lee Li HengNoch keine Bewertungen

- AF210 ASSIGMENTDokument14 SeitenAF210 ASSIGMENTdiristiNoch keine Bewertungen

- Chapter 4Dokument31 SeitenChapter 4Kristina Kitty100% (1)

- TEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Dokument5 SeitenTEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Mike HerreraNoch keine Bewertungen

- IF2FInalExamSampleQuestions 1-12Dokument12 SeitenIF2FInalExamSampleQuestions 1-12Percy IFNNoch keine Bewertungen

- Capital Markets & Investments - BGK Chapter 1Dokument46 SeitenCapital Markets & Investments - BGK Chapter 1张泷颢Noch keine Bewertungen

- ACCT 201 Pre-Quiz Number 6 F09Dokument7 SeitenACCT 201 Pre-Quiz Number 6 F09bob_lahblawNoch keine Bewertungen

- Long-Term Investments Quiz AnswersDokument2 SeitenLong-Term Investments Quiz AnswersKrissa Mae LongosNoch keine Bewertungen

- ACCT 3312 Chapter 17 Practice ProblemsDokument5 SeitenACCT 3312 Chapter 17 Practice ProblemsVernon Dwanye LewisNoch keine Bewertungen

- Quiz 2 Study GuideDokument2 SeitenQuiz 2 Study GuidebeccafabbriNoch keine Bewertungen

- 3-6int 2002 Dec QDokument9 Seiten3-6int 2002 Dec Qadrianlee0107Noch keine Bewertungen

- Applied Auditing Audit of Intangibles: Problem No. 1Dokument2 SeitenApplied Auditing Audit of Intangibles: Problem No. 1danix929Noch keine Bewertungen

- FAR-2 Mock September 2021 FinalDokument8 SeitenFAR-2 Mock September 2021 FinalMuhammad RahimNoch keine Bewertungen

- Marketable Securities Example 2021Dokument2 SeitenMarketable Securities Example 2021Nouman AliNoch keine Bewertungen

- AIOU Advanced Financial Accounting Assignment GuideDokument5 SeitenAIOU Advanced Financial Accounting Assignment GuideAbdullah ShahNoch keine Bewertungen

- 9222 - JointDokument4 Seiten9222 - JointLee DlwlrmaNoch keine Bewertungen

- UCDokument2 SeitenUCJohn Alden NatividadNoch keine Bewertungen

- ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFDokument11 SeitenACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFPiyal HossainNoch keine Bewertungen

- CH 12Dokument71 SeitenCH 12Sahar YehiaNoch keine Bewertungen

- TBchap 008Dokument81 SeitenTBchap 008DemianNoch keine Bewertungen

- IAS 23 Borrowing Costs ExplainedDokument4 SeitenIAS 23 Borrowing Costs ExplainednishanthanNoch keine Bewertungen

- Audit of InvestmentsDokument3 SeitenAudit of InvestmentsJasmine Marie Ng Cheong50% (2)

- Investments Problems Ch12Dokument30 SeitenInvestments Problems Ch12Mohammad UmeerNoch keine Bewertungen

- Bond InvestmentDokument24 SeitenBond InvestmentPRINCESS ANGELA LABRONoch keine Bewertungen

- Investments and Fair Value Accounting: Principles of Financial Accounting With Conceptual Emphasis On IFRSDokument137 SeitenInvestments and Fair Value Accounting: Principles of Financial Accounting With Conceptual Emphasis On IFRSallfi basirohNoch keine Bewertungen

- PAS 23 Borrowing Costs CapitalizationDokument4 SeitenPAS 23 Borrowing Costs CapitalizationAila Mae SuarezNoch keine Bewertungen

- Spring2022 (July) Exam-Fin Part1Dokument8 SeitenSpring2022 (July) Exam-Fin Part1Ahmed TharwatNoch keine Bewertungen

- Homework 6 - Long-Term Financial LiabilitiesDokument2 SeitenHomework 6 - Long-Term Financial LiabilitiesCha PampolinaNoch keine Bewertungen

- ACC 422case ExamDokument11 SeitenACC 422case ExamYutaka KomatsuzakiNoch keine Bewertungen

- Private Equity: Access for All: Investing in Private Equity through the Stock MarketsVon EverandPrivate Equity: Access for All: Investing in Private Equity through the Stock MarketsNoch keine Bewertungen

- Summary of David Einhorn's Fooling Some of the People All of the TimeVon EverandSummary of David Einhorn's Fooling Some of the People All of the TimeNoch keine Bewertungen

- Caltex Australia CTX 2017 Annual ReportDokument127 SeitenCaltex Australia CTX 2017 Annual ReportAarti JNoch keine Bewertungen

- Accounting Homework Help IliskimeDokument1 SeiteAccounting Homework Help IliskimeAarti JNoch keine Bewertungen

- CostingDokument3 SeitenCostingAarti JNoch keine Bewertungen

- American Finance Association, Wiley The Journal of FinanceDokument8 SeitenAmerican Finance Association, Wiley The Journal of FinanceAarti JNoch keine Bewertungen

- Hi5019 Individual Assignment t1 2019 Qyuykqw5Dokument5 SeitenHi5019 Individual Assignment t1 2019 Qyuykqw5Aarti J50% (2)

- CR 1845Dokument90 SeitenCR 1845Aarti JNoch keine Bewertungen

- NCK - Annual Report 2017 PDFDokument56 SeitenNCK - Annual Report 2017 PDFAarti JNoch keine Bewertungen

- Saudi Vision2030Dokument85 SeitenSaudi Vision2030ryx11Noch keine Bewertungen

- 2 Case - 2Dokument10 Seiten2 Case - 2Aarti JNoch keine Bewertungen

- Deegan Chapter 10Dokument18 SeitenDeegan Chapter 10Aarti JNoch keine Bewertungen

- Mgt201 Solved Subjective Questions Vuzs TeamDokument12 SeitenMgt201 Solved Subjective Questions Vuzs TeamAarti JNoch keine Bewertungen

- CH 07 SMDokument11 SeitenCH 07 SMAarti JNoch keine Bewertungen

- 6 Capital Market Intermediaries and Their RegulationDokument8 Seiten6 Capital Market Intermediaries and Their RegulationTushar PatilNoch keine Bewertungen

- TFTH C 636639530213947535 31700 2Dokument55 SeitenTFTH C 636639530213947535 31700 2Aarti JNoch keine Bewertungen

- Chapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Dokument32 SeitenChapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Judith DelRosario De RoxasNoch keine Bewertungen

- Ch03 Prob3-6ADokument9 SeitenCh03 Prob3-6AAarti J100% (1)

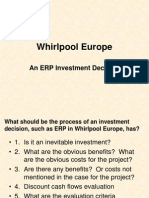

- The Whirlpool Europe Case: Investment On ERPDokument8 SeitenThe Whirlpool Europe Case: Investment On ERPAarti JNoch keine Bewertungen

- Mergers Don't Always Lead To Culture Clashes.Dokument3 SeitenMergers Don't Always Lead To Culture Clashes.Lahiyru100% (3)

- Case Study Ch03Dokument3 SeitenCase Study Ch03Munya Chawana0% (1)

- Investment Decision MethodDokument44 SeitenInvestment Decision MethodashwathNoch keine Bewertungen

- Coles Year in Review 2017Dokument28 SeitenColes Year in Review 2017Aarti JNoch keine Bewertungen

- Philanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Dokument2 SeitenPhilanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Aarti JNoch keine Bewertungen

- Relevant Cost Examples EMBA-garrison Ch.13Dokument13 SeitenRelevant Cost Examples EMBA-garrison Ch.13Aarti JNoch keine Bewertungen

- Whirlpool EuropeDokument19 SeitenWhirlpool Europejoelgzm0% (1)

- Accounting Changes and Errors: HapterDokument46 SeitenAccounting Changes and Errors: HapterAarti JNoch keine Bewertungen

- 2010 06 13 - 091545 - Case13 30Dokument6 Seiten2010 06 13 - 091545 - Case13 30Sheila Mae Llamada Saycon IINoch keine Bewertungen

- MCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Dokument139 SeitenMCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Aarti J100% (1)

- ACCG315Dokument4 SeitenACCG315Joannah Blue0% (1)

- Theory of Karma ExplainedDokument42 SeitenTheory of Karma ExplainedAKASH100% (1)

- Role of Islamic Crypto Currency in Supporting Malaysia's Economic GrowthDokument6 SeitenRole of Islamic Crypto Currency in Supporting Malaysia's Economic GrowthMarco MallamaciNoch keine Bewertungen

- PDFDokument2 SeitenPDFJahi100% (3)

- Food Processing & ClassificationDokument3 SeitenFood Processing & ClassificationAzrielle JaydeNoch keine Bewertungen

- Fundamentals of Accounting - I FinallDokument124 SeitenFundamentals of Accounting - I Finallyitbarek MNoch keine Bewertungen

- Creating Early Learning Environments PDFDokument25 SeitenCreating Early Learning Environments PDFkrisnahNoch keine Bewertungen

- Motivate! 2 End-Of-Term Test Standard: Units 1-3Dokument6 SeitenMotivate! 2 End-Of-Term Test Standard: Units 1-3Oum Vibol SatyaNoch keine Bewertungen

- Apexocardiograma Precizari PracticeDokument12 SeitenApexocardiograma Precizari PracticeDaniel VelciuNoch keine Bewertungen

- Assessment: Bipolar DisorderDokument2 SeitenAssessment: Bipolar DisorderMirjana StevanovicNoch keine Bewertungen

- Safe Handling of Solid Ammonium Nitrate: Recommendations For The Environmental Management of Commercial ExplosivesDokument48 SeitenSafe Handling of Solid Ammonium Nitrate: Recommendations For The Environmental Management of Commercial ExplosivesCuesta AndresNoch keine Bewertungen

- Drainage Pipe Unit Price AnalysisDokument9 SeitenDrainage Pipe Unit Price Analysis朱叶凡Noch keine Bewertungen

- Remnan TIIDokument68 SeitenRemnan TIIJOSE MIGUEL SARABIANoch keine Bewertungen

- TIA Portal v11 - HMI ConnectionDokument4 SeitenTIA Portal v11 - HMI ConnectionasdasdasdasdasdasdasadaNoch keine Bewertungen

- 8086 ProgramsDokument61 Seiten8086 ProgramsBmanNoch keine Bewertungen

- BSP Memorandum No. M-2022-035Dokument1 SeiteBSP Memorandum No. M-2022-035Gleim Brean EranNoch keine Bewertungen

- Fact-Sheet Pupils With Asperger SyndromeDokument4 SeitenFact-Sheet Pupils With Asperger SyndromeAnonymous Pj6OdjNoch keine Bewertungen

- 5528 L1 L2 Business Admin Unit Pack v4Dokument199 Seiten5528 L1 L2 Business Admin Unit Pack v4Yousef OlabiNoch keine Bewertungen

- Understanding electromagnetic waves and radioactivityDokument7 SeitenUnderstanding electromagnetic waves and radioactivityJayesh VermaNoch keine Bewertungen

- Essay Sustainable Development GoalsDokument6 SeitenEssay Sustainable Development GoalsBima Dwi Nur Aziz100% (1)

- Lecture 9-EVENT BUDGETDokument19 SeitenLecture 9-EVENT BUDGETAlbina AbilkairNoch keine Bewertungen

- The Emergence of India's Pharmaceutical IndustryDokument41 SeitenThe Emergence of India's Pharmaceutical Industryvivekgupta2jNoch keine Bewertungen

- Soal Ulangan Harian Smester 1 Kelas 8 SMP BAHASA INGGRISDokument59 SeitenSoal Ulangan Harian Smester 1 Kelas 8 SMP BAHASA INGGRISsdn6waykhilauNoch keine Bewertungen

- 14 XS DLX 15 - 11039691Dokument22 Seiten14 XS DLX 15 - 11039691Ramdek Ramdek100% (1)

- Relation of Sociology with other social sciencesDokument4 SeitenRelation of Sociology with other social sciencesBheeya BhatiNoch keine Bewertungen

- Aromatic Saturation Catalysts: CRI's Nickel Catalysts KL6564, KL6565, KL6515, KL6516Dokument2 SeitenAromatic Saturation Catalysts: CRI's Nickel Catalysts KL6564, KL6565, KL6515, KL6516Ahmed SaidNoch keine Bewertungen

- Bravo Jr. v. BorjaDokument2 SeitenBravo Jr. v. BorjaMaria AnalynNoch keine Bewertungen

- Masters of Death: The Assassin ClassDokument5 SeitenMasters of Death: The Assassin Classjbt_1234Noch keine Bewertungen

- SKILLS TRANSFER PLAN FOR MAINTENANCE OF NAVAL EQUIPMENTDokument2 SeitenSKILLS TRANSFER PLAN FOR MAINTENANCE OF NAVAL EQUIPMENTZaid NordienNoch keine Bewertungen