Beruflich Dokumente

Kultur Dokumente

Equity Weekly Report 8 May To 12 May

Hochgeladen von

zoidresearchOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Equity Weekly Report 8 May To 12 May

Hochgeladen von

zoidresearchCopyright:

Verfügbare Formate

EQUITY TECHNICAL REPORT

WEEKLY

[08 MAY to 12 MAY 2017]

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

08 MAY TO 12 MAY 17

NIFTY 50 9285.30 (-18.75) (0.2%)

On Monday, market was closed due to

Maharashtra Day. The benchmark

Index Nifty opened with a positive bias,

and the Nifty made a high of 9352.55,

Index made a low of 9269.9 and closed

at 9313.8 On Tuesday. On Wednesday,

Market ended on a negative, with the

Nifty holding on to its 9300-mark and

nifty closest at flat note and Nifty

traded in a very narrow range of 48

points throughout the day. On

Thursday, Market closed on a higher

note nifty opened at 9361, 49 points

gap up from its previous day close of

9312. The Index made a high of 9366

and closed at 9360. On Friday, Nifty

traded in a range of 107 points. The

Index made an all time high of 9377.10

and closed at 9285.30 after making a

low of 9272. The benchmark Index

Nifty50 (spot) opened the week at

9339.85 made a high of 9377.1 low of

9269.90 and closed the week at

9285.30. Thus the Nifty closed the

week with a losing of -18.75 points or

0.2%.

Future Outlook:

Formations

The Nifty daily chart is bearish

The 20 days EMA are placed at trend. we advised to sell Nifty future

9240.12 below 9270 then target will be

The 5 days EMA are placed at 9200-9100. Nifty upside weekly

9309.82 Resistance is 9350-9425 level. On

the downside strong support at

9250-9200

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

08 MAY TO 12 MAY 17

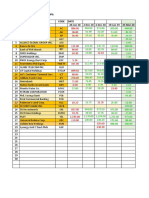

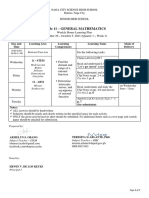

Weekly Pivot Levels for Nifty 50 Stocks

Script Symbol Resistance2 Resistance1 Pivot Support 1 Support 2

NIFTY 50 (SPOT) 9418 9352 9311 9244 9204

AUTOMOBILE

BAJAJ-AUTO 2976.95 2932.30 2902.95 2858.30 2828.95

BOSCHLTD 23907.80 23680.60 23192.80 22965.60 22477.80

EICHERMOT 27383.80 26608.60 25972.70 25197.50 24561.60

HEROMOTOCO 3472.58 3424.57 3364.83 3316.82 3257.08

M&M 1374.68 1347.97 1327.48 1300.77 1280.28

MARUTI 6790.05 6722.10 6662.05 6594.10 6534.05

TATAMTRDVR 286.68 272.82 265.13 251.27 243.58

TATAMOTORS 470.80 445.20 431.60 406.00 392.40

CEMENT & CEMENT PRODUCTS

ACC 1733.32 1696.73 1633.37 1596.78 1533.42

AMBUJACEM 255.68 251.12 243.33 238.77 230.98

GRASIM 1257.87 1224.98 1185.12 1152.23 1112.37

ULTRACEMCO 4481.95 4405.95 4279.00 4203.00 4076.05

CONSTRUCTION

LT 1795.33 1759.87 1731.53 1696.07 1667.73

CONSUMER GOODS

ASIANPAINT 1195.60 1171.20 1135.60 1111.20 1075.60

HINDUNILVR 982.90 968.40 945.50 931.00 908.10

ITC 284.98 281.07 278.28 274.37 271.58

ENERGY

BPCL 766.45 745.60 732.70 711.85 698.95

GAIL 442.10 430.45 422.05 410.40 402.00

NTPC 167.73 163.72 161.58 157.57 155.43

ONGC 199.43 191.62 186.93 179.12 174.43

POWERGRID 218.40 213.70 209.10 204.40 199.80

RELIANCE 1428.75 1378.50 1351.75 1301.50 1274.75

TATAPOWER 86.17 84.78 83.27 81.88 80.37

FINANCIAL SERVICES

AXISBANK 531.37 517.93 508.97 495.53 486.57

BANKBARODA 209.67 198.53 191.37 180.23 173.07

HDFCBANK 1568.00 1550.10 1536.35 1518.45 1504.70

HDFC 1612.15 1579.50 1559.20 1526.55 1506.25

ICICIBANK 321.02 309.78 290.52 279.28 260.02

INDUSINDBK 1473.55 1440.80 1422.25 1389.50 1370.95

KOTAKBANK 931.93 920.12 910.18 898.37 888.43

SBIN 314.67 305.33 295.57 286.23 276.47

YESBANK 1669.08 1638.92 1621.63 1591.47 1574.18

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

08 MAY TO 12 MAY 17

INDUSTRIAL MANUFACTURING

BHEL 180.00 176.40 173.90 170.30 167.80

IT

HCLTECH 861.23 845.42 826.78 810.97 792.33

INFY 953.30 942.40 928.75 917.85 904.20

TCS 2394.50 2357.50 2313.00 2276.00 2231.50

TECHM 430.73 421.87 416.13 407.27 401.53

WIPRO 505.77 502.53 498.07 494.83 490.37

MEDIA & ENTERTAINMENT

ZEEL 550.03 527.82 515.78 493.57 481.53

METALS

COALINDIA 289.53 284.02 278.93 273.42 268.33

HINDALCO 211.53 198.67 191.03 178.17 170.53

TATASTEEL 464.53 449.07 438.53 423.07 412.53

SERVICES

ADANIPORTS 360.98 352.97 338.43 330.42 315.88

PHARMA

AUROPHARMA 630.33 609.67 595.63 574.97 560.93

CIPLA 565.88 557.92 551.03 543.07 536.18

DRREDDY 2657.00 2630.00 2598.00 2571.00 2539.00

LUPIN 1318.78 1285.57 1267.78 1234.57 1216.78

SUNPHARMA 653.33 641.77 632.68 621.12 612.03

TELECOM

BHARTIARTL 360.75 352.75 347.95 339.95 335.15

INFRATEL 382.67 374.63 361.97 353.93 341.27

IDEA 88.13 85.07 83.13 80.07 78.13

Weekly Top gainers stocks

Script Symbol Previous Close Current Price % Change In Points

IBULHSGFIN 1016.95 1098.75 8.04% 81.80

ICICIBANK 278.50 300.10 7.76% 21.60

ADANIPORT 327.70 343.35 4.78% 15.65

INFRATEL 354.70 368.85 3.99% 14.15

GRASIM 1155.05 1185.06 2.60% 30.00

Weekly Top losers stocks

Script Symbol Previous Close Current Price % Change In Points

TATAMOTORS 458.90 419.55 -8.57% -39.35

HINDALCO 199.35 185.85 -6.77% -13.50

LUPIN 1338.35 1251.00 -6.53% -87.35

RELIANCE 1395.20 1332.90 -4.47% -62.30

ZEEL 526.85 507.50 -3.67% -19.35

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

08 MAY TO 12 MAY 17

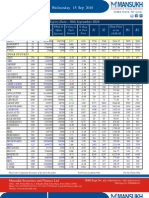

Weekly FIIS Statistics*

DATE Buy Value Sell Value Net Value

05/MAY/2017 4839.14 520312 -363.98

04/MAY/2017 5618.82 6219.94 -601.12

03/MAY/2017 3968.93 4486.67 -517.74

02/MAY/2017 5494.72 6106.54 -611.82

Weekly DIIS Statistics*

DATE Buy Value Sell Value Net Value

05/MAY/2017 2967.24 2669.13 298.11

04/MAY/2017 3929.12 3003.02 926.10

03/MAY/2017 2603.01 2490.65 112.36

02/MAY/2017 2530.28 1988.89 541.39

MOST ACTIVE NIFTY CALLS & PUTS

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

25/MAY/2017 CE 9400 197257 5540400

25/MAY/2017 CE 9500 167858 5510750

25/MAY/2017 CE 9600 139906 3139875

25/MAY/2017 PE 9300 189059 4989600

25/MAY/2017 PE 9200 145866 4638750

25/MAY/2017 PE 9100 102409 4524000

MOST ACTIVE BANK NIFTY CALLS & PUTS

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

04/MAY/2017 CE 23000 160461 677640

04/MAY/2017 CE 22800 147077 418160

04/MAY/2017 CE 22900 127998 276800

04/MAY/2017 PE 22500 155935 333680

04/MAY/2017 PE 22400 98962 213720

04/MAY/2017 PE 22600 96390 192920

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

08 MAY TO 12 MAY 17

Weekly Recommendations:-

DATE SYMBOL STRATEGY ENTRY TARGET STATUS

6 MAY 17 VOLTAS BUY ON DEEP 422 439-456 OPEN

29 APR 17 IDFC BUY ON DEEP 62 65-68 OPEN

1ST TARGET

22 APR 17 RELIANCE BUY ON DEEP 1400 1455-1525

ACHIEVED

BOOK AT

14 APR 17 TATAELXSI BUY ABOVE 1550 1612-1675

1603

1ST TARGET

8 APR 17 AXISBANK BUY ON DEEP 505-503 525-560

ACHIEVED

1ST TARGET

1 APR 17 ACC BUY ON DEEP 1440 1498-1558

ACHIEVED

25 MAR 17 COALINDIA BUY ON DEEP 295-290 307-320 EXIT AT 282.7

18 MAR 17 AUROPHARMA BUY ON DEEP 698 727-760 EXIT AT 670

11 MAR 17 SUNTV BUY ABOVE 745 775-805 BOOK AT 770

ALLTARGET

4 MAR 17 APOLLOTYRE BUY ON DEEP 182-183 190-198

ACHIEVED

1ST TARGET

25 FEB 17 HEXAWARE BUY ON DEEP 221-220 229-240

ACHIEVED

1ST TARGET

18 FEB 17 SIEMENS BUY ON DEEP 1212-1205 1260-1315

ACHIEVED

1ST TARGET

11 FEB 17 MOTHERSUMI BUY ON DEEP 350-352 365-380

ACHIEVED

4 FEB 17 LICHSGFIN BUY ON DEEP 550-555 577-605 BOOK AT 569

* FII & DII trading activity on NSE, BSE, and MCXSX in Capital Market Segment (in Rs. Crores)

DISCLAIMER

Stock trading involves high risk and one can lose Substantial amount of money. The recommendations made herein do

not constitute an offer to sell or solicitation to buy any of the Securities mentioned. No representations can be made

that recommendations contained herein will be profitable or they will not result in losses. Readers using the

information contained herein are solely responsible for their actions. The information is obtained from sources deemed

to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on

technical analysis only. NOTE WE HAVE NO HOLDINGS IN ANY OF STOCKS RECOMMENDED ABOVE

Zoid Research

Office 101, Shagun Tower

A.B. Commercial Road, Indore

452001

Mobile: +91 9039073611

Email: info@zoidresearch.com

Website: www.zoidresearch.com

www.zoidresearch.com ZOID RESEARCH TEAM

Das könnte Ihnen auch gefallen

- Equity Report 22 May To 26 MayDokument6 SeitenEquity Report 22 May To 26 MayzoidresearchNoch keine Bewertungen

- Equity Report 21 Aug To 25 AugDokument6 SeitenEquity Report 21 Aug To 25 AugzoidresearchNoch keine Bewertungen

- Equity Report 26 June To 30 JuneDokument6 SeitenEquity Report 26 June To 30 JunezoidresearchNoch keine Bewertungen

- Equity Weekly ReportDokument6 SeitenEquity Weekly ReportzoidresearchNoch keine Bewertungen

- Equity Technical Weekly ReportDokument6 SeitenEquity Technical Weekly ReportzoidresearchNoch keine Bewertungen

- Equity Report 10 July To 14 JulyDokument6 SeitenEquity Report 10 July To 14 JulyzoidresearchNoch keine Bewertungen

- Equity Outlook 13 Feb To 17 FebDokument6 SeitenEquity Outlook 13 Feb To 17 FebzoidresearchNoch keine Bewertungen

- Equity Report 15 May To 19 MayDokument6 SeitenEquity Report 15 May To 19 MayzoidresearchNoch keine Bewertungen

- Equity Report 19 June To 23 JuneDokument6 SeitenEquity Report 19 June To 23 JunezoidresearchNoch keine Bewertungen

- Equity Report 16 - 20 OctDokument6 SeitenEquity Report 16 - 20 OctzoidresearchNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument36 SeitenIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaNoch keine Bewertungen

- Equity Report 6 To 10 NovDokument6 SeitenEquity Report 6 To 10 NovzoidresearchNoch keine Bewertungen

- Symbol Open Dayhigh Daylow Lastprice Previousclose ChangeDokument4 SeitenSymbol Open Dayhigh Daylow Lastprice Previousclose ChangeVijayNoch keine Bewertungen

- Orb Plus Excel Call Generator1Dokument8 SeitenOrb Plus Excel Call Generator1dewanibipin0% (2)

- Index Movement:: National Stock Exchange of India LimitedDokument37 SeitenIndex Movement:: National Stock Exchange of India LimitedJayant SharmaNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument36 SeitenIndex Movement:: National Stock Exchange of India Limitedanilkhubchandani9744Noch keine Bewertungen

- Term PaperDokument9 SeitenTerm Paperkavya surapureddy100% (1)

- Open High Low LTP CHNG TradeDokument33 SeitenOpen High Low LTP CHNG TradeAnand ChineyNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument27 SeitenIndex Movement:: National Stock Exchange of India LimitedjanuianNoch keine Bewertungen

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDokument12 SeitenSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliNoch keine Bewertungen

- NIFTYCALCULATOROctober2018www - Nooreshtech.co .InDokument13 SeitenNIFTYCALCULATOROctober2018www - Nooreshtech.co .InbrijsingNoch keine Bewertungen

- Stock Symbol 4/24 Price Current Spread 52 Week Low 52 Week High 52 Week SpreadDokument3 SeitenStock Symbol 4/24 Price Current Spread 52 Week Low 52 Week High 52 Week SpreadJohn MonroseNoch keine Bewertungen

- Technical Morning - Call - 120922 PDFDokument5 SeitenTechnical Morning - Call - 120922 PDFSomeone 4780Noch keine Bewertungen

- Nifty 100 - Expected Returns (Holding Period of 6-8weeks)Dokument2 SeitenNifty 100 - Expected Returns (Holding Period of 6-8weeks)Sathv100% (1)

- Bel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeDokument8 SeitenBel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeVijayNoch keine Bewertungen

- Equity StockDokument4 SeitenEquity StockChaitanya EnterprisesNoch keine Bewertungen

- Client Portfolio Statement: %mkvalDokument2 SeitenClient Portfolio Statement: %mkvalMonjur MorshedNoch keine Bewertungen

- New Microsoft Excel WorksheetDokument9 SeitenNew Microsoft Excel WorksheetSneha JadhavNoch keine Bewertungen

- Intraday Trading System 1Dokument4 SeitenIntraday Trading System 1Rajesh Chowdary ParaNoch keine Bewertungen

- Porfolio List For 2070152499 As On: 2018/12/11 00:38:53 Symbol Quantity Average Cost Price Current Market PriceDokument2 SeitenPorfolio List For 2070152499 As On: 2018/12/11 00:38:53 Symbol Quantity Average Cost Price Current Market PriceAnshul GuptaNoch keine Bewertungen

- Next 50Dokument631 SeitenNext 50Kasthuri CoimbatoreNoch keine Bewertungen

- February 16-17, 2011 - UpdateDokument2 SeitenFebruary 16-17, 2011 - UpdateJC CalaycayNoch keine Bewertungen

- MW NIFTY MIDCAP 150 03 Apr 2023Dokument8 SeitenMW NIFTY MIDCAP 150 03 Apr 2023SumitNoch keine Bewertungen

- Ipo Allotment Shares Returns (As On 05/01/2022)Dokument3 SeitenIpo Allotment Shares Returns (As On 05/01/2022)Arpit jainNoch keine Bewertungen

- Stocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Dokument3 SeitenStocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Marcus AmabaNoch keine Bewertungen

- Narration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Dokument11 SeitenNarration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Manan ToganiNoch keine Bewertungen

- Kingston Educational Institute: Ratio AnalysisDokument1 SeiteKingston Educational Institute: Ratio Analysisdhimanbasu1975Noch keine Bewertungen

- Nifty 500 COMPANY WITH ANALYSISDokument3 SeitenNifty 500 COMPANY WITH ANALYSISVILAS KORKENoch keine Bewertungen

- Private LTD CompaniesDokument16 SeitenPrivate LTD CompaniesanjankatamNoch keine Bewertungen

- दैनि क नि क्री क र्य नि ष्पा दै DAILY MONITORING OF SALES PERFORMANCE (kl)Dokument9 Seitenदैनि क नि क्री क र्य नि ष्पा दै DAILY MONITORING OF SALES PERFORMANCE (kl)Kumar Vaibhav AwasthiNoch keine Bewertungen

- Daily-Equity 17 Sep 2010Dokument3 SeitenDaily-Equity 17 Sep 2010Vikram JunejaNoch keine Bewertungen

- Weekly 12082017Dokument5 SeitenWeekly 12082017Thiyaga RajanNoch keine Bewertungen

- Historic Data Nifty50 9THJULYDokument3 SeitenHistoric Data Nifty50 9THJULYsriniaithaNoch keine Bewertungen

- B2Dokument14 SeitenB2marathi techNoch keine Bewertungen

- Exportadores Periodo 2012 1 2013 2 2014 3 2015 4 2016 5: Demanda en El MundoDokument6 SeitenExportadores Periodo 2012 1 2013 2 2014 3 2015 4 2016 5: Demanda en El MundoJenryAvalosNoch keine Bewertungen

- 300zx 1991 FSM SearchableDokument1.248 Seiten300zx 1991 FSM SearchableMilka Tesla100% (2)

- Kategori Lapangan Usaha 2000 2001 2002: Tabel 1. Produk Domestik Bruto Atas Dasar Harga Berlaku (Miliar Rupiah)Dokument6 SeitenKategori Lapangan Usaha 2000 2001 2002: Tabel 1. Produk Domestik Bruto Atas Dasar Harga Berlaku (Miliar Rupiah)Fauzan AhmadNoch keine Bewertungen

- ZerodhaDokument89 SeitenZerodhaAarti ParmarNoch keine Bewertungen

- Intraday Trading System v3.0Dokument6 SeitenIntraday Trading System v3.0Altaf KhanNoch keine Bewertungen

- Zamboanga Peninsula Regional Development Investment Program 2017-2022Dokument544 SeitenZamboanga Peninsula Regional Development Investment Program 2017-2022DONNAVEL ROSALESNoch keine Bewertungen

- Angel SuggestedDokument4 SeitenAngel Suggestedmangalraj900Noch keine Bewertungen

- Project FRA Milestone1 JPY Nikita Chaturvedi 05.05.2022 Jupyter Notebook PDFDokument102 SeitenProject FRA Milestone1 JPY Nikita Chaturvedi 05.05.2022 Jupyter Notebook PDFRekha Rajaram74% (19)

- Your Holding Details - B53270969Dokument4 SeitenYour Holding Details - B53270969Jai DwarikadhisNoch keine Bewertungen

- 15 Sep FutureDokument6 Seiten15 Sep FutureMansukhNoch keine Bewertungen

- Future Levels For Thu, 25th Mar 2010: Expiry Date - 25th March 2010Dokument6 SeitenFuture Levels For Thu, 25th Mar 2010: Expiry Date - 25th March 2010MansukhNoch keine Bewertungen

- MD (FTKB) Incl (°) Azm (°) TVD (FTKB) Vs (FT) Ns (FT) Ew (FT) Dls (°/100ft)Dokument7 SeitenMD (FTKB) Incl (°) Azm (°) TVD (FTKB) Vs (FT) Ns (FT) Ew (FT) Dls (°/100ft)jfernandez_estelaNoch keine Bewertungen

- Sr. No Security Symbol Security NameDokument7 SeitenSr. No Security Symbol Security Nameankit1302Noch keine Bewertungen

- Equity Weekly Report 19-23 NovDokument10 SeitenEquity Weekly Report 19-23 NovzoidresearchNoch keine Bewertungen

- Equity Report 6 To 10 NovDokument6 SeitenEquity Report 6 To 10 NovzoidresearchNoch keine Bewertungen

- Equity Report 16 - 20 OctDokument6 SeitenEquity Report 16 - 20 OctzoidresearchNoch keine Bewertungen

- Equity Report 15 May To 19 MayDokument6 SeitenEquity Report 15 May To 19 MayzoidresearchNoch keine Bewertungen

- Equity Report 10 July To 14 JulyDokument6 SeitenEquity Report 10 July To 14 JulyzoidresearchNoch keine Bewertungen

- Equity Report 19 June To 23 JuneDokument6 SeitenEquity Report 19 June To 23 JunezoidresearchNoch keine Bewertungen

- Equity Report 16 Aug To 19 AugDokument6 SeitenEquity Report 16 Aug To 19 AugzoidresearchNoch keine Bewertungen

- Equity Report 31 Oct To 4 NovDokument6 SeitenEquity Report 31 Oct To 4 NovzoidresearchNoch keine Bewertungen

- Equity Outlook 13 Feb To 17 FebDokument6 SeitenEquity Outlook 13 Feb To 17 FebzoidresearchNoch keine Bewertungen

- Equity Report 14 Nov To 18 NovDokument6 SeitenEquity Report 14 Nov To 18 NovzoidresearchNoch keine Bewertungen

- Equity Report 12 Dec To 16 DecDokument6 SeitenEquity Report 12 Dec To 16 DeczoidresearchNoch keine Bewertungen

- Equity Technical Report (08 - 12 Aug)Dokument6 SeitenEquity Technical Report (08 - 12 Aug)zoidresearchNoch keine Bewertungen

- Equity Technical Report 10 - 14 OctDokument6 SeitenEquity Technical Report 10 - 14 OctzoidresearchNoch keine Bewertungen

- Equity Technical Report 25 To 29 July - ZoidresearchDokument6 SeitenEquity Technical Report 25 To 29 July - ZoidresearchzoidresearchNoch keine Bewertungen

- Equity (Nifty50) Technical Report (11 - 15 July)Dokument6 SeitenEquity (Nifty50) Technical Report (11 - 15 July)zoidresearchNoch keine Bewertungen

- Slides - Simple Linear RegressionDokument35 SeitenSlides - Simple Linear RegressionJarir AhmedNoch keine Bewertungen

- General Mathematics - Module #3Dokument7 SeitenGeneral Mathematics - Module #3Archie Artemis NoblezaNoch keine Bewertungen

- Numerical Analysis: Prof. Dr. Süheyla ÇEHRELİDokument15 SeitenNumerical Analysis: Prof. Dr. Süheyla ÇEHRELİEzgi GeyikNoch keine Bewertungen

- Meralco v. CastilloDokument2 SeitenMeralco v. CastilloJoven CamusNoch keine Bewertungen

- Chapter 4 - Transfer FunctionsDokument36 SeitenChapter 4 - Transfer FunctionsFakhrulShahrilEzanie100% (1)

- Not PrecedentialDokument5 SeitenNot PrecedentialScribd Government DocsNoch keine Bewertungen

- Quiz Simple Present Simple For Elementary To Pre-IntermediateDokument2 SeitenQuiz Simple Present Simple For Elementary To Pre-IntermediateLoreinNoch keine Bewertungen

- 1st Annual Charity Golf Tournament For ChloeDokument2 Seiten1st Annual Charity Golf Tournament For ChloeM.G. PerezNoch keine Bewertungen

- How To Live A Healthy LifestyleDokument2 SeitenHow To Live A Healthy LifestyleJocelynNoch keine Bewertungen

- (OCM) Chapter 1 Principles of ManagementDokument23 Seiten(OCM) Chapter 1 Principles of ManagementMehfooz PathanNoch keine Bewertungen

- Cranial Deformity in The Pueblo AreaDokument3 SeitenCranial Deformity in The Pueblo AreaSlavica JovanovicNoch keine Bewertungen

- Sir Rizwan Ghani AssignmentDokument5 SeitenSir Rizwan Ghani AssignmentSara SyedNoch keine Bewertungen

- Bago Project CharterDokument6 SeitenBago Project CharterLarize BautistaNoch keine Bewertungen

- Script - Macbeth A La MafiosiDokument27 SeitenScript - Macbeth A La MafiosiMohd Afiq Mat RazaiNoch keine Bewertungen

- Credit Transactions Case Digestpdf PDFDokument241 SeitenCredit Transactions Case Digestpdf PDFLexa L. DotyalNoch keine Bewertungen

- NotesDokument2 SeitenNotesNoella Marie BaronNoch keine Bewertungen

- Cri 192Dokument5 SeitenCri 192Reyn CagmatNoch keine Bewertungen

- SMF Update Barang 05 Desember 2022Dokument58 SeitenSMF Update Barang 05 Desember 2022Apotek Ibnu RusydNoch keine Bewertungen

- Maria Da Piedade Ferreira - Embodied Emotions - Observations and Experiments in Architecture and Corporeality - Chapter 11Dokument21 SeitenMaria Da Piedade Ferreira - Embodied Emotions - Observations and Experiments in Architecture and Corporeality - Chapter 11Maria Da Piedade FerreiraNoch keine Bewertungen

- Firewatch in The History of Walking SimsDokument5 SeitenFirewatch in The History of Walking SimsZarahbeth Claire G. ArcederaNoch keine Bewertungen

- "The Grace Period Has Ended": An Approach To Operationalize GDPR RequirementsDokument11 Seiten"The Grace Period Has Ended": An Approach To Operationalize GDPR RequirementsDriff SedikNoch keine Bewertungen

- Thompson VarelaDokument18 SeitenThompson VarelaGiannis NinosNoch keine Bewertungen

- Vocabulary ListDokument2 SeitenVocabulary List謝明浩Noch keine Bewertungen

- Aqeedah TahawiyyahDokument151 SeitenAqeedah Tahawiyyahguyii86100% (1)

- DragonflyDokument65 SeitenDragonflyDavidNoch keine Bewertungen

- Birth and Growth of Semiotics: November 2020Dokument9 SeitenBirth and Growth of Semiotics: November 2020Maria del Carmen Alvarado AcevedoNoch keine Bewertungen

- Sample Letter of Request To Validate The QuestionnaireDokument2 SeitenSample Letter of Request To Validate The QuestionnaireSamantha AceraNoch keine Bewertungen

- Unit 9:: What Did You See at The Zoo?Dokument11 SeitenUnit 9:: What Did You See at The Zoo?ARiFin MoHaMedNoch keine Bewertungen

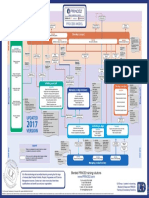

- p2 Process Model 2017Dokument1 Seitep2 Process Model 2017Miguel Fernandes0% (1)

- Technology in EducationDokument3 SeitenTechnology in EducationDinesh MadhavanNoch keine Bewertungen