Beruflich Dokumente

Kultur Dokumente

K (D1/P0) + G: Wockhardt

Hochgeladen von

YYASEER KAGDIOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

K (D1/P0) + G: Wockhardt

Hochgeladen von

YYASEER KAGDICopyright:

Verfügbare Formate

Wockhardt

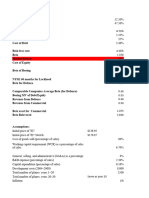

Capital Asset Pricing Model

Book Book Value Market Market

Sources Values (in (%) Value (in Value (%)

Rs. Crores) Weightage Rs. Crores) weightage

Equity 354 12 52114 95

9% Pref Shares 1000 33 1000 2

6% Long Term

Loan 1654 55 1654 3

3008 100 54768 100

Market

Post Tax

Sources Value (%) Pre Tax WACC (%)

Cost (%)

weightage cost (%)

Equity 81 --- 22.28 18

9% Pref Shares 16 --- 0.009 0.144

6% Long Term

Loan 3 6 4.5 13.5

100 31.64

Current Market Price of Share is Rs 734/- per Share

Value = 1.76 Rf = 6.8 (Rm - Rf) = 8.8

Cost of Equity Re = Rf + (Rm -

Rf) Long term Loan i=6% (Pre Tax)

Re = 6.8 + 1.76 (8.8) = 22.28 Post Tax = 0.06 (1-0.35) = 4.5

Cost of Pref Shares = 9/1000 =

0.009 WACC = 31.64%

Dividend Discount Model

K = (D1/P0) + Dividend Yield

g =0 g=bxr

b = % Retained Cost of Equity = K =

Earning = 100% r= ROSE = 8.5% 8.5%

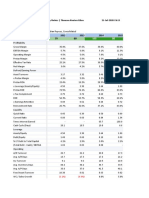

Fortis

Capital Asset Pricing Model

Book Values Book Value Market Value Market Value

Sources (in Rs. (%) (in Rs. (%)

Crores) Weightage Crores) weightage

Equity 463 40 9121 93

14% Pref

Shares 78 7 78 1

10% Long

Term Loan 615 53 615 6

1156 100 9814 100

Market Value

Post Tax Cost

Sources (%) Pre Tax cost WACC (%)

(%)

weightage (%)

Equity 92 --- 14.72 13.5

14% Pref

Shares 1 --- 18 0.18

10% Long

Term Loan 7 10 6.5 0.456

100 14.18

Current Market Price of Share is Rs ____/- per Share

Value = 0.9 Rf = 6.8 (Rm - Rf) = 8.8

Cost of Equity Re = Rf + (Rm - Rf) Long term Loan i=7.5% (Pre Tax)

Re = 6.8 + 0.9 (8.8) = 14.72 Post Tax = 0.1 (1-0.35) = 6.5%

Cost of Pref Shares = 14/78 = 18 WACC = 14.18%

Dividend Discount Model

K = (D1/P0) +

g

Dividend Yield =0 g=bxr

b = % Retained

Earning = -100% r= ROSE = loss = (2%) Cost of Equity = K = -2%

Das könnte Ihnen auch gefallen

- Midland CaseDokument8 SeitenMidland CaseDevansh RaiNoch keine Bewertungen

- DCF ModelDokument6 SeitenDCF ModelKatherine ChouNoch keine Bewertungen

- Exercises On Stock Valuation ModelDokument6 SeitenExercises On Stock Valuation ModelStefven PutraNoch keine Bewertungen

- Finance and Accounting - ALPDokument8 SeitenFinance and Accounting - ALPyamitraNoch keine Bewertungen

- DCF ModellDokument7 SeitenDCF Modellsandeep0604Noch keine Bewertungen

- Tutorial On How To Use The DCF Model. Good Luck!: DateDokument9 SeitenTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNoch keine Bewertungen

- Marriott Cost of Capital DataDokument18 SeitenMarriott Cost of Capital DataSaadatNoch keine Bewertungen

- Task 4 - Template - RevisedDokument1 SeiteTask 4 - Template - RevisedNaturallyNoch keine Bewertungen

- FIN - Chapter 6 - Cost of Capital - PDFDokument14 SeitenFIN - Chapter 6 - Cost of Capital - PDFUtpal BaruaNoch keine Bewertungen

- Equity Valuation: Models from Leading Investment BanksVon EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNoch keine Bewertungen

- Microsoft ValuationDokument4 SeitenMicrosoft ValuationcorvettejrwNoch keine Bewertungen

- Power Markets and Economics: Energy Costs, Trading, EmissionsVon EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNoch keine Bewertungen

- Lex CaseDokument8 SeitenLex CaseAshlesh MangrulkarNoch keine Bewertungen

- Solutions Manual To Accompany Engineering Economy 6th Edition 9780073205342Dokument7 SeitenSolutions Manual To Accompany Engineering Economy 6th Edition 9780073205342CrystalDavisntgrw100% (75)

- Chapter-2 Economic Value Added (Eva) - A Theoretical PerspectiveDokument21 SeitenChapter-2 Economic Value Added (Eva) - A Theoretical PerspectiveAbhishek DhanolaNoch keine Bewertungen

- WACC Summary SlidesDokument29 SeitenWACC Summary SlidesclaeNoch keine Bewertungen

- tb11 FinmanDokument48 Seitentb11 FinmanJully Gonzales100% (5)

- Cost of CapitalDokument114 SeitenCost of CapitalNamra ImranNoch keine Bewertungen

- Strategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideVon EverandStrategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideNoch keine Bewertungen

- DCF ModellDokument7 SeitenDCF ModellziuziNoch keine Bewertungen

- Net Income ($M) 8382 EBIT ($M) 13224 Income Tax Expense ($M) 5016 Return On EquityDokument21 SeitenNet Income ($M) 8382 EBIT ($M) 13224 Income Tax Expense ($M) 5016 Return On EquityRahil VermaNoch keine Bewertungen

- DCF ModellDokument7 SeitenDCF ModellVishal BhanushaliNoch keine Bewertungen

- LP Income 3252 - 201216171418Dokument27 SeitenLP Income 3252 - 201216171418theredcornerNoch keine Bewertungen

- Project Management Chapter 10 THE COST OF CAPITAL Math SolutionsDokument4 SeitenProject Management Chapter 10 THE COST OF CAPITAL Math Solutionszordan rizvyNoch keine Bewertungen

- 2019 Westpac Group Full Year TablesDokument25 Seiten2019 Westpac Group Full Year TablesAbs PangaderNoch keine Bewertungen

- PayTM FinancialsDokument43 SeitenPayTM FinancialststNoch keine Bewertungen

- CH 9 Problems-1Dokument16 SeitenCH 9 Problems-1Çisem HakyimezNoch keine Bewertungen

- DCF Guide ExampleDokument4 SeitenDCF Guide ExampleAlexander RiosNoch keine Bewertungen

- Microsoft Vs Intuit ValuationDokument4 SeitenMicrosoft Vs Intuit ValuationcorvettejrwNoch keine Bewertungen

- Solved Problem 14.1: The Above Is Obtained Using The Following StepsDokument3 SeitenSolved Problem 14.1: The Above Is Obtained Using The Following StepsArjun Jaideep BhatnagarNoch keine Bewertungen

- MFA Homework 8 - With With Equity and Multiple DebtDokument3 SeitenMFA Homework 8 - With With Equity and Multiple DebtRehan AsifNoch keine Bewertungen

- Apple - Free Cash Flow Valuation - MemoDokument3 SeitenApple - Free Cash Flow Valuation - Memocollen.osidonNoch keine Bewertungen

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDokument13 SeitenHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNoch keine Bewertungen

- Financial Management 2018Dokument12 SeitenFinancial Management 2018Prince HangulaNoch keine Bewertungen

- 543L7 2 (Wacc 2)Dokument9 Seiten543L7 2 (Wacc 2)Äyušheë TŸagïNoch keine Bewertungen

- Corporate Restructuring, Mergers and Acquisitions: Assignment (Internal Test)Dokument10 SeitenCorporate Restructuring, Mergers and Acquisitions: Assignment (Internal Test)Shashank ShekharNoch keine Bewertungen

- Managements Discussion Analysis 2022Dokument111 SeitenManagements Discussion Analysis 2022arvind sharmaNoch keine Bewertungen

- HP-Compaq Merger AnalysisDokument15 SeitenHP-Compaq Merger AnalysisAnubhav AroraNoch keine Bewertungen

- Stress Testing On Janata BankDokument17 SeitenStress Testing On Janata Bankrzannat940% (1)

- PL M18 FM Student Mark Plan WebDokument9 SeitenPL M18 FM Student Mark Plan WebIQBAL MAHMUDNoch keine Bewertungen

- Competitors Bajaj MotorsDokument11 SeitenCompetitors Bajaj MotorsdeepaksikriNoch keine Bewertungen

- Intuit ValuationDokument4 SeitenIntuit ValuationcorvettejrwNoch keine Bewertungen

- WACC NikeDokument5 SeitenWACC Nikenatya lakshitaNoch keine Bewertungen

- WACC NikeDokument5 SeitenWACC NikeDevia SuswodijoyoNoch keine Bewertungen

- Managerial Economics 3rd Assignment Bratu Carina Maria EXCELDokument11 SeitenManagerial Economics 3rd Assignment Bratu Carina Maria EXCELCarina MariaNoch keine Bewertungen

- CS FSM Excecutive Revision Series by CA CMA Suraj TatiyaDokument38 SeitenCS FSM Excecutive Revision Series by CA CMA Suraj TatiyaAbhay WritesNoch keine Bewertungen

- Regression Statistics: Assignment-1: Hero Motorcorp 1) Calculation of BetaDokument2 SeitenRegression Statistics: Assignment-1: Hero Motorcorp 1) Calculation of BetaDivyansh SinghNoch keine Bewertungen

- Cxannual Result enDokument34 SeitenCxannual Result endescent3dNoch keine Bewertungen

- Cost ofDokument14 SeitenCost ofrajjoNoch keine Bewertungen

- Calculation of Return and WACC: Wacc E D+ E × + D D+E × RDDokument3 SeitenCalculation of Return and WACC: Wacc E D+ E × + D D+E × RDTamim ChowdhuryNoch keine Bewertungen

- P15.MK. Cost of Capital-1Dokument52 SeitenP15.MK. Cost of Capital-1ZahraNoch keine Bewertungen

- Nike Inc Cost of Capital Blaine KitchenwDokument11 SeitenNike Inc Cost of Capital Blaine KitchenwAlvaro Gallardo FernandezNoch keine Bewertungen

- Nerolac - Solution PDFDokument5 SeitenNerolac - Solution PDFricha krishnaNoch keine Bewertungen

- Narration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18Dokument38 SeitenNarration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18AbhijitChandraNoch keine Bewertungen

- Pembahasan Exercise CH 9 Cost of CapitalDokument4 SeitenPembahasan Exercise CH 9 Cost of CapitalGhina NabilaNoch keine Bewertungen

- BoeingDokument11 SeitenBoeingPreksha GulatiNoch keine Bewertungen

- LexDokument9 SeitenLexKaustav DeyNoch keine Bewertungen

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDokument5 SeitenIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNoch keine Bewertungen

- (A) Calculation of WACC V R VR $ $ $: Dinla CoDokument8 Seiten(A) Calculation of WACC V R VR $ $ $: Dinla CoWan NubliNoch keine Bewertungen

- EPS (TTM) 11.89 Growth Rate 12% Minimum Rate of Return 15% Margin of Safety 50%Dokument19 SeitenEPS (TTM) 11.89 Growth Rate 12% Minimum Rate of Return 15% Margin of Safety 50%Neeraj PaliwalNoch keine Bewertungen

- Colgate Palmolive ModelDokument51 SeitenColgate Palmolive ModelAde FajarNoch keine Bewertungen

- Book1 (AutoRecovered)Dokument5 SeitenBook1 (AutoRecovered)Tayba AwanNoch keine Bewertungen

- NPV Annuity PlansDokument10 SeitenNPV Annuity PlansmayankNoch keine Bewertungen

- Risk Equity Share PM Capital Preference Shares PVT Sector Bonds Govt Risk Securities Free Int. RiskDokument12 SeitenRisk Equity Share PM Capital Preference Shares PVT Sector Bonds Govt Risk Securities Free Int. RiskrajjoNoch keine Bewertungen

- Appendix 1 Conservative Approach: (In FFR Million)Dokument6 SeitenAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaNoch keine Bewertungen

- Weighted Average Cost of Capital C N 5 6.4.20Dokument3 SeitenWeighted Average Cost of Capital C N 5 6.4.20Topi ShuklaNoch keine Bewertungen

- Ejercicios Del Cap. 11.Dokument10 SeitenEjercicios Del Cap. 11.BRYAN ALEXIS ALFARO CONTRERASNoch keine Bewertungen

- RatioDokument11 SeitenRatioAnant BothraNoch keine Bewertungen

- Chapter09 SMDokument17 SeitenChapter09 SMkert1234Noch keine Bewertungen

- Soln Cost of CapitalDokument11 SeitenSoln Cost of Capitalanshul dyundiNoch keine Bewertungen

- MAF 3 Exam 2020 SolutionDokument7 SeitenMAF 3 Exam 2020 SolutionMihlali MfakuNoch keine Bewertungen

- Corporate Finance Interview Questions PDFDokument6 SeitenCorporate Finance Interview Questions PDFNidhi SurveNoch keine Bewertungen

- Jun18l1cfi-C01 QaDokument3 SeitenJun18l1cfi-C01 QaJuan Pablo Flores QuirozNoch keine Bewertungen

- Financial ManagementDokument51 SeitenFinancial Managementamish rajNoch keine Bewertungen

- American Home Products EssayDokument7 SeitenAmerican Home Products EssayYanbin CaoNoch keine Bewertungen

- JPM Talaat Mostafa Group 2010-06!06!422705Dokument52 SeitenJPM Talaat Mostafa Group 2010-06!06!422705Waleed ThapetNoch keine Bewertungen

- Financing Decisions - Practice QuestionsDokument3 SeitenFinancing Decisions - Practice QuestionsAbrarNoch keine Bewertungen

- WACC Calculations (With Solution)Dokument8 SeitenWACC Calculations (With Solution)Shreyans GirathNoch keine Bewertungen

- RJR Nabisco ValuationDokument33 SeitenRJR Nabisco ValuationKrishna Chaitanya KothapalliNoch keine Bewertungen

- China Railway Construction Corporation Attaining Globalization Via HighDokument18 SeitenChina Railway Construction Corporation Attaining Globalization Via HighCyril Ang-numbaalaNoch keine Bewertungen

- 10 The Cost of Capital XXDokument53 Seiten10 The Cost of Capital XXAnonymous z6NCP5JlPnNoch keine Bewertungen

- (2015 S2) FINS1613 TutorialSlides Week09 RiskandReturn CostofCapitalDokument68 Seiten(2015 S2) FINS1613 TutorialSlides Week09 RiskandReturn CostofCapitalSmartunblurrNoch keine Bewertungen

- Addl Notes - FCFF Model PDFDokument17 SeitenAddl Notes - FCFF Model PDFRoyLadiasanNoch keine Bewertungen

- Equity pptx-1Dokument18 SeitenEquity pptx-1Fatima KhandwalaNoch keine Bewertungen

- Strategic Management PDFDokument7 SeitenStrategic Management PDFSyrel SantosNoch keine Bewertungen

- GRC FinMan Cost of Capital ModuleDokument13 SeitenGRC FinMan Cost of Capital ModuleJasmine FiguraNoch keine Bewertungen

- Equation List - COMM 308 - Booth Et Al Text, 4 Edition: FV FV PV KDokument3 SeitenEquation List - COMM 308 - Booth Et Al Text, 4 Edition: FV FV PV Kadcyechicon123Noch keine Bewertungen

- Corporate Finance - PRACTICE EXAM: (1 Point) Future Value of Annuity FVA 377 006Dokument4 SeitenCorporate Finance - PRACTICE EXAM: (1 Point) Future Value of Annuity FVA 377 006Yuge FanNoch keine Bewertungen

- Gujarat Technological UniversityDokument3 SeitenGujarat Technological Universitysiddharth devnaniNoch keine Bewertungen

- Fin Model of Hydro Power PlantDokument7 SeitenFin Model of Hydro Power PlantVivek SinghalNoch keine Bewertungen