Beruflich Dokumente

Kultur Dokumente

06 Securities Settlement Systems

Hochgeladen von

Satish BabuOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

06 Securities Settlement Systems

Hochgeladen von

Satish BabuCopyright:

Verfügbare Formate

SECURITIES SETTLEMENT SYSTEM

INTRODUCTION

Securities settlement systems (SSSs) are a critical component of the infrastructure

of global financial markets. In recent year securities markets have become an

increasingly important channel for intermediating flows of funds between borrowers

and lenders and Volumes of cross-border trades and settlements have grown

especially rapidly, reflecting the increasing integration of global markets.

Weaknesses in SSSs can be a source of systemic disturbances to securities

markets and to other payment and settlement systems. Given the close links

between markets and the common set of participants across markets, a financial or

operational problem at any of the institutions that perform critical functions in the

settlement process or at a major user of an SSS could result in significant liquidity

pressures or credit losses for other participants and also disruptions in other

segments of payment systems as well.

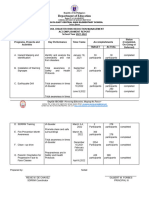

KEY STEPS IN CLEARING & SETTLEMENT OF SECURITIES TRANSACTIONS

The process of clearing and settling a securities trade includes several key steps:

1. the confirmation of the terms of the trade by the direct market participants

2. the calculation of the obligations of the counterparties resulting from the

confirmation process, known as clearance

3. the final transfer of securities (delivery) in exchange for final transfer of funds

(payment) in order to settle the obligations

Confirmation – once a trade is executed, the first step in the settlement process

involves confirmation of the couterparties to the terms of the trade, that is, the

security involved, the price, the amount to be exchanged, the settlement date and

the counterparty. An electronic trading system automatically produces a confirmed

trade between the two counterparties. Other trades are confirmed by exchanges,

Electronic Banking and Payment System – Reading Material 54

clearing corporations, trade associations, etc, based on data submitted to them by

the counterparties. Because the counterparties to trades are often acting on behalf

of others, an important ancillary part of the trade confirmation process is the

transmission of trade information to these ultimate investors. In order for settlement

to be completed, investors must confirm trade details and issue instructions for the

proper positioning of funds and securities.

Clearance - the next step in the process is clearance, that is, the computation of the

obligations of the counterparties to make deliveries or to make payments on the

settlement date. Clearance may be on gross basis (trade by trade basis) or may be

netted. In some markets, a central counterparty (CCP) interposes itself between the

counterparties to a securities trade, taking on each party’s obligation in relation to

the other. Netting arrangements are increasingly common in securities markets with

high volumes of trades because properly designed netting produces very significant

reductions in gross exposures in such markets.

Settlement – this step involves the final transfer of the securities from the seller to

the buyer and the final transfer of funds from the buyer to the seller. The earlier

movement of physical certificates has now been increasingly replaced by settlement

taking place in dematerialized / book entry form. This process has been facilitated

greatly with the development of Central Securities Depositories (CSDs) catering to

single domestic securities markets and also International Central Securities

Depositories (ICSDs) that serve multiple markets. The settlement process involves

processing of transfer instructions by a securities transfer system and a funds

transfer system. Final transfer of a security by the seller to the buyer constitutes

delivery, and final transfer of funds from the buyer to the seller constitutes

payment. When delivery and payment have occurred, the settlement process is

complete. Many settlement systems have associated registries in which ownership

of securities is listed in the records of the issuer. The efficiency of the registration

system has implications for the clearing and settlement process because it

determines the ease and speed with which full legal title to securities can be

Electronic Banking and Payment System – Reading Material 55

transferred. Full legal title may not be obtained until ownership is listed in a registry,

and thus finality in the settlement process may not be achieved until registration is

complete.

RISKS IN SECURITIES SETTLEMENT SYSTEMS

Participants in securities settlement systems are confronted with a variety of risks

that must be identified and understood if they are to be controlled effectively. Some

of these risks are explained below.

Credit risk - Credit risk is the risk of loss from default by a participant, typically as a

consequence of its insolvency. Two types of credit risk are usefully distinguished -

pre-settlement risk and settlement risk. Pre-settlement risk (also called replacement

cost risk) is the risk of loss of unrealised gains on unsettled contracts with the

defaulting participant. Settlement risk (sometimes termed principal risk) is the risk

that the seller of a security could deliver but not receive payment or that the buyer

could make payment but not receive delivery. The magnitude of replacement cost

risk depends on the volatility of the security price and the amount of time that

elapses between the trade date and the settlement date. The replacement cost

component of credit risk can be reduced by compressing the time between trade

execution and settlement. Principal risk is of particular importance because it

involves the full value of securities transferred, and in the event of default it may

entail credit losses so sizeable as to create systemic problems. Principal risk can be

eliminated through use of a delivery versus payment (DVP) mechanism. A DVP

mechanism links a funds transfer (payment) system and a securities transfer

(delivery) system to ensure delivery occurs if and only if payment occurs. Central

counterparties (CCPs) are sometimes used to mitigate principal risk.

Liquidity risk - Liquidity risk includes the risk that the seller of a security who does

not receive payment when due may have to borrow or liquidate assets to complete

other payments. It also includes the risk that the buyer of the security does not

receive delivery when due and may have to borrow the security in order to complete

Electronic Banking and Payment System – Reading Material 56

its own delivery obligation. Liquidity problems have the potential to create systemic

problems, particularly if they occur at a time when securities prices are changing

rapidly and failures to meet obligations when due are more likely to create concerns

about solvency.

Risk of settlement bank failure – the participants in a securities settlement system

may face the risk of a settlement bank failure that provides cash accounts to settle

payment obligations. This could disrupt settlement and result in significant losses

and liquidity pressures for those members. Thus, when use of a single settlement

bank is required, it is usually the central bank of issue or a limited purpose bank with

strong risk controls and access to sizeable financial resources.

Custody risk - Risk may also arise from the safekeeping and administration of

securities and financial instruments on behalf of others. Users of custodial services

face risk from the potential loss of securities in the event that the holder of the

securities becomes insolvent, acts negligently or commits fraud. Even if there is no

loss of the value of the securities held by the custodian or subcustodian, the ability of

participants to transfer the securities might temporarily be impaired. Custody risk is

particularly important for indirect participants in securities settlement systems whose

securities are held in custody by direct participants.

Operational risk - Operational risk is the risk of unexpected losses as a result of

deficiencies in systems and controls, human error or management failure. It can

reduce the effectiveness of other measures the settlement system takes to manage

other risks. Possible operational failures include errors or delays in processing,

system outages, insufficient capacity or fraud by staff.

Legal risk - Legal risk is the risk that a party will suffer a loss because laws or

regulations do not support the rules of the securities settlement system, the

performance of related settlement arrangements, or the property rights and other

interests held through the settlement system.

Electronic Banking and Payment System – Reading Material 57

Systemic risk - Systemic risk is the risk that the inability of one institution to meet its

obligations when due will cause other institutions to fail to meet their obligations

when due. Securities settlement systems can create significant credit, liquidity and

other risks for their participants. Payment systems and clearing systems for other

financial instruments often depend critically on securities settlement systems

because of their use of securities as collateral in their own risk management

procedures.

Market liquidity in securities markets is dependent on confidence in the safety and

reliability of settlement systems because traders will be reluctant to deal if they doubt

that the trade will settle. Thus it is important that the risks in securities settlement

systems be appropriately managed in order that securities settlement systems are

not a source of systemic disturbances to securities markets and other payment and

settlement systems.

INTERNATIONAL STANDARDS RELATING TO SSS

The relevant international standard-setting bodies are the Committee on Payment

and Settlement Systems (CPSS) of the central banks of the Group of Ten countries

and the International Organization of Securities Commissions (IOSCO). In

December 1999 the CPSS and the Technical Committee of IOSCO created the Task

Force on Securities Settlement Systems. The Task Force is comprised of 28 central

bankers and securities regulators from 18 countries and regions and the European

Union. The mandate given to the Task Force required it to promote the measures to

be implemented by SSSs that enhance international financial stability, reduce risks,

increase efficiency and provide adequate safeguards for investors. This was to be

achieved by developing recommendations for the design, operation and oversight of

SSSs in the form of minimum standards that the systems should meet. The Task

Force not only defined an SSS broadly to include the full set of institutional

arrangements for confirmation, clearance and settlement of securities trades and

safekeeping of securities, but also ensured that the recommendations covered SSSs

Electronic Banking and Payment System – Reading Material 58

for all securities, including equities and corporate and government bonds and money

market instruments, and securities issued in countries in different stages of

development.

The list of 19 recommendations for SSS given by the Task Force in November 2001

are given below, classified on the basis of the risk that they seek to address.

Legal risk

1. Legal framework - Securities settlement systems should have a well founded,

clear and transparent legal basis in the relevant jurisdictions.

Pre-settlement risk

2. Trade confirmation - Confirmation of trades between direct market participants

should occur as soon as possible after trade execution, but no later than trade date

(T+0). Where confirmation of trades by indirect market participants (such as

institutional investors) is required, it should occur as soon as possible after trade

execution, preferably on T+0, but no later than T+1.

3. Settlement cycles - Rolling settlement should be adopted in all securities markets.

Final settlement should occur no later than T+3. The benefits and costs of a

settlement cycle shorter than T+3 should be evaluated.

4. Central counterparties (CCPs) - The benefits and costs of a CCP should be

evaluated. Where such a mechanism is introduced, the CCP should rigorously

control the risks it assumes.

5. Securities lending - Securities lending and borrowing (or repurchase agreements

and other economically equivalent transactions) should be encouraged as a method

for expediting the settlement of securities transactions. Barriers that inhibit the

practice of lending securities for this purpose should be removed.

Settlement risk

Electronic Banking and Payment System – Reading Material 59

6. Central securities depositories (CSDs) - Securities should be immobilised or

dematerialised and transferred by book entry in CSDs to the greatest extent

possible.

7. Delivery versus payment (DVP) - CSDs should eliminate principal risk by linking

securities transfers to funds transfers in a way that achieves delivery versus

payment.

8. Timing of settlement finality - Final settlement should occur no later than the end

of the settlement day. Intraday or real-time finality should be provided where

necessary to reduce risks.

9. CSD risk controls to address participants’ failures to settle - CSDs that extend

intraday credit to participants, including CSDs that operate net settlement systems,

should institute risk controls that, at a minimum, ensure timely settlement in the

event that the participant with the largest payment obligation is unable to settle. The

most reliable set of controls is a combination of collateral requirements and limits.

10. Cash settlement assets - Assets used to settle the ultimate payment obligations

arising from securities transactions should carry little or no credit or liquidity risk. If

central bank money is not used, steps must be taken to protect CSD members from

potential losses and liquidity pressures arising from the failure of the cash settlement

agent whose assets are used for that purpose.

Operational risk

11. Operational reliability - Sources of operational risk arising in the clearing and

settlement process should be identified and minimised through the development of

appropriate systems, controls and procedures. Systems should be reliable and

secure, and have adequate, scalable capacity. Contingency plans and backup

facilities should be established to allow for timely recovery of operations and

completion of the settlement process.

Electronic Banking and Payment System – Reading Material 60

Custody risk

12. Protection of customers’ securities - Entities holding securities in custody should

employ accounting practices and safekeeping procedures that fully protect

customers’ securities. It is essential that customers’ securities be protected against

the claims of a custodian’s creditors.

Other issues

13. Governance - Governance arrangements for CSDs and CCPs should be

designed to fulfil public interest requirements and to promote the objectives of

owners and users.

14. Access - CSDs and CCPs should have objective and publicly disclosed criteria

for participation that permit fair and open access.

15. Efficiency - While maintaining safe and secure operations, securities settlement

systems should be cost-effective in meeting the requirements of users.

16. Communication procedures and standards - Securities settlement systems

should use or accommodate the relevant international communication procedures

and standards in order to facilitate efficient settlement of cross-border transactions.

17. Transparency - CSDs and CCPs should provide market participants with

sufficient information for them to identify and evaluate accurately the risks and costs

associated with using the CSD or CCP services.

18. Regulation and oversight - Securities settlement systems should be subject to

transparent and effective regulation and oversight. Central banks and securities

regulators should cooperate with each other and with other relevant authorities.

Electronic Banking and Payment System – Reading Material 61

19. Risks in cross-border links - CSDs that establish links to settle cross-border

trades should design and operate such links to reduce effectively the risks

associated with cross-border settlements.

Before we take a look at the Indian Scenario in so far as settlement of securities

transactions is concerned, it is necessary to also understand the role a significant

institutional arrangement in the form of Central Counter Parties (CCPs) that has

been established to facilitate smooth settlement of securities transactions as also

mitigate a few of the risks explained earlier.

CENTRAL COUNTER PARTY

A central counterparty (CCP) interposes itself between counterparties to financial

contracts traded in one or more markets, becoming the buyer to every seller and the

seller to every buyer. In some markets a CCP extends an “open offer” to act as

counterparty to market participants and is interposed between participants at the

time trades are executed. In other markets, the participants themselves initially are

the counterparties. Subsequently the trades may be submitted to a CCP, which is

substituted as the seller to the buyer and the buyer to the seller. Substituting a CCP

discharges the original obligations between market participants.

CCPs were first introduced for trading on exchanges. Exchange rules often require

that trades be executed at the best bid or offer, regardless of the creditworthiness of

the party making the best bid or offer. Market participants in such exchanges cannot

effectively manage their counterparty credit and liquidity risks with other participants.

The use of a CCP makes such bilateral risk management unnecessary because the

CCP is counterparty to every trade. In over-the-counter (OTC) markets, in which

CCP services have been introduced more recently, use of those services is typically

optional. Counterparties may agree to submit their trades to a CCP, thereby

substituting the CCP as counterparty, or they may not agree to do so, in which case

they must manage their counterparty risks with each other.

Electronic Banking and Payment System – Reading Material 62

A CCP has the potential to reduce significantly risks to market participants by

imposing more robust risk controls on all participants. It also facilitates greater

liquidity in markets by promoting anonymous trading and by achieving multilateral

netting of trades. However, a CCP also concentrates risks and responsibility for risk

management in the CCP. A risk management failure by a CCP has the potential to

disrupt the markets that it serves and also other components of the payment and

settlement systems. Those disruptions may spill over to payment systems and to

other settlement systems. Because of the potential for such disruptions, securities

regulators and central banks have a strong interest in CCP risk management.

The November 2001 Report on Recommendations for SSS of the CPSS and

IOSCO, that set out and discussed 19 recommendations (listed earlier in this

chapter) for promoting the safety and efficiency of securities settlement systems,

had also addressed the issue of CCPs but did not set out detailed or comprehensive

standards for CCP risk management. In view of the increasingly important place

that CCPs occupy in securities settlement systems, the Task Force of the CPSS and

IOSCO also examined the role of CCPs, the facilities they provide and the risks they

mitigate and also take upon themselves. The Recommendations for Central

Counterparties brought out by the Task Force in its report in November 2004, aims

to set out comprehensive standards for risk management of a central counterparty.

The list of 14 recommendations, with brief explanation, is given below.

Recommendations for Central Counterparties (CCPs)

1. Legal risk - CCP should have a well founded, transparent and enforceable legal

framework for each aspect of its activities in all relevant jurisdictions.

2. Participation requirements - A CCP should require participants to have

sufficient financial resources and robust operational capacity to meet obligations

arising from participation in the CCP. A CCP should have procedures in place to

monitor that participation requirements are met on an ongoing basis. A CCP’s

Electronic Banking and Payment System – Reading Material 63

participation requirements should be objective, publicly disclosed, and permit fair

and open access.

3. Collateral requirements - A CCP should calculate its credit exposures to

participants on a daily basis and hold collateral that in normal market conditions

covers its potential losses from closing out positions held by a defaulting participant.

4. Financial resources - A CCP should maintain sufficient financial resources to

withstand a default by the participant to which it has the largest exposure in extreme

but plausible market conditions that produces losses not fully covered by collateral

requirements.

5. Default procedures - A CCP’s default procedures should be clear and

transparent, and they should ensure that the CCP can take timely action to contain

losses and liquidity pressures and to continue meeting its obligations.

6. Custody and investment risks - A CCP should hold assets in a manner whereby

risk of loss or of delay in its access to them is minimised. Assets invested by a CCP

should be held in instruments with minimal credit, market and liquidity risks.

7. Operational risk - A CCP should identify sources of operational risk and minimise

them through the development of appropriate systems, control and procedures.

Systems should be reliable and secure, and have adequate, scalable capacity.

Business continuity plans should allow for timely recovery of operations and

fulfilment of a CCP’s obligations.

8. Money settlements - A CCP should employ money settlement arrangements that

eliminate or strictly limit its settlement bank risks, that is, its credit and liquidity risks

from the use of banks to effect money settlements with its participants. Funds

transfers to the CCP should be final when effected.

Electronic Banking and Payment System – Reading Material 64

9. Physical deliveries - A CCP should clearly state its obligations with respect to

physical deliveries. The risks from these obligations should be identified and

managed.

10. Risks in links between CCPs - CCPs that establish links either cross-border or

domestically to clear trades should design and operate such links in ways that

observe the other recommendations in this report.

11. Efficiency - While maintaining safe and secure operations, CCPs should be

cost-effective in meeting the requirements of users.

12. Governance - Governance arrangements for a CCP should be effective, clear

and transparent to fulfil public interest requirements and to support the objectives of

owners and users. In particular, they should promote the effectiveness of the CCP’s

risk management procedures.

13. Transparency - A CCP should provide market participants with sufficient

information for them to identify and evaluate accurately the risks and costs

associated with using its services.

14. Regulation and oversight - A CCP should be subject to transparent and

effective regulation and oversight. In both a domestic and an international context,

central banks and securities regulators should cooperate with each other and with

other relevant authorities.

(Prepared by Smt.C.S.Kar, Member of Faculty, RBSC)

Electronic Banking and Payment System – Reading Material 65

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- IP & Science Product Portfolio: Life Sciences Product QuizDokument2 SeitenIP & Science Product Portfolio: Life Sciences Product QuizSatish BabuNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- National Geographic Magazine - Sugar LoveDokument4 SeitenNational Geographic Magazine - Sugar LoveSatish BabuNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Quantified Process Improvement Goals:: - Improve Productivity by 10%Dokument1 SeiteQuantified Process Improvement Goals:: - Improve Productivity by 10%Satish BabuNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- ObstaclesDokument1 SeiteObstaclesSatish BabuNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Investing in 2012Dokument5 SeitenInvesting in 2012Satish BabuNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Sbi Rar 2014 Part 1Dokument45 SeitenSbi Rar 2014 Part 1Moneylife Foundation100% (2)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hazard MapDokument3 SeitenHazard MapPrincess Gladhel NatividadNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Agriculture Value ChainDokument10 SeitenAgriculture Value ChainYahaya LwindeNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- ABS Drops Guide E-Sept17Dokument85 SeitenABS Drops Guide E-Sept17Max BeeksNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Activity Template - Risk Management PlanDokument3 SeitenActivity Template - Risk Management PlanNidhi ShettyNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Petronas Risk Matrix ProcedureDokument16 SeitenPetronas Risk Matrix Procedureme_lokie100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Erm ScoringDokument5 SeitenErm ScoringihsanNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Unit 2 Disaster Management Cycle: 2.0 Learning OutcomeDokument23 SeitenUnit 2 Disaster Management Cycle: 2.0 Learning OutcomeMHA IH 1921 MAKAUT WBNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- What Does The Charter Document?: Get A Free Project Charter Template!Dokument10 SeitenWhat Does The Charter Document?: Get A Free Project Charter Template!Marubadi SKNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- "Event Management": Bharati Vidyapeeth University School of Distance EducationDokument19 Seiten"Event Management": Bharati Vidyapeeth University School of Distance EducationkammyNoch keine Bewertungen

- Lectura 4 - KPMG Avoiding Major Project FailureDokument8 SeitenLectura 4 - KPMG Avoiding Major Project FailureMayra GálvezNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- AML - Non-Financial Sector in GermanyDokument39 SeitenAML - Non-Financial Sector in Germanymensur.zoleticNoch keine Bewertungen

- Chapter 13 Risk Analysis and ManagementDokument30 SeitenChapter 13 Risk Analysis and Managementsanket100% (2)

- Study Machine Safety For Reduced Speed R-956Dokument114 SeitenStudy Machine Safety For Reduced Speed R-956Margin SorinNoch keine Bewertungen

- SDDRM Accomplishment Report 21-22Dokument4 SeitenSDDRM Accomplishment Report 21-22rexie de chavezNoch keine Bewertungen

- Strategy & Innovation: Case Study of Efu (Eastern Federal Union)Dokument26 SeitenStrategy & Innovation: Case Study of Efu (Eastern Federal Union)Rahul NankaniNoch keine Bewertungen

- Agriculture ResumeDokument7 SeitenAgriculture Resumezpxjybifg100% (2)

- SCB Annual Report 2013 FinalDokument178 SeitenSCB Annual Report 2013 FinalAbrar KhanNoch keine Bewertungen

- Disaster Management (Role of Social Workers) 1Dokument20 SeitenDisaster Management (Role of Social Workers) 1Neethu AbrahamNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Comparative Study of Cost and Risk Management in RCC and Prefabricated BuildingDokument29 SeitenComparative Study of Cost and Risk Management in RCC and Prefabricated BuildingParag PalNoch keine Bewertungen

- Cleaning Standards For Victorian Health Facilities 20110831 PDFDokument56 SeitenCleaning Standards For Victorian Health Facilities 20110831 PDFTanishq KalraNoch keine Bewertungen

- Comprehensive School Safety Monitoring ToolDokument8 SeitenComprehensive School Safety Monitoring ToolJane Lhyn Villaflor100% (1)

- DNV RBI System OffshoreDokument35 SeitenDNV RBI System OffshoreDaniel SombeNoch keine Bewertungen

- Capitulo 8 - Supply Chain Management RiskDokument11 SeitenCapitulo 8 - Supply Chain Management Riskanna ortizNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Mooring Integrity Management: Guidance Notes OnDokument26 SeitenMooring Integrity Management: Guidance Notes OnArdy MansNoch keine Bewertungen

- Principle of Risk PartnershipDokument7 SeitenPrinciple of Risk PartnershipRaj KumarNoch keine Bewertungen

- MSC 101-4-1 - The Industry Guidelines On Cyber Security On Board Ships, Version 3 (ICS, IUMI, BIMCO, OCIMF,.)Dokument3 SeitenMSC 101-4-1 - The Industry Guidelines On Cyber Security On Board Ships, Version 3 (ICS, IUMI, BIMCO, OCIMF,.)Batman KasarungNoch keine Bewertungen

- Case Study 3: Managed Pressure DrillingDokument151 SeitenCase Study 3: Managed Pressure DrillingBalkis FatihaNoch keine Bewertungen

- Volunteer Management System Manual: City of HobartDokument126 SeitenVolunteer Management System Manual: City of HobartIzhel Yuri RoqueNoch keine Bewertungen

- Risk Management Task 4Dokument8 SeitenRisk Management Task 4Naushal SachaniyaNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)