Beruflich Dokumente

Kultur Dokumente

Trading Plan Handout Racette1

Hochgeladen von

satish sCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Trading Plan Handout Racette1

Hochgeladen von

satish sCopyright:

Verfügbare Formate

Trading for Success:

Creating a Trading Plan

By: Tim Racette

timracette@gmail.com

Treat trading as a business not a hobby, hobbies cost money, successful businesses make money.

Use the questions below as a prompt for creating your own trading plan, examples are in italics

Mission Statement

The mission statement is simply your overall goal as a trader.

To manage money with 1M assets under management producing net returns of 30% per year.

Market Theory

This is your ideology towards the markets.

The market is ALWAYS right.

Old support becomes new resistance

At any split second the market will take from you, that which you worked hardest and longest to obtain.

Goals

Motive: Why do you want to become a successful trader?

What drives you to succeed as a trader?

What makes you different than the thousands of other traders who wish to become successful?

Time Commitment: How much time are you willing to devote to achieving success as a trader?

Financial Commitment: How much capital are you going to allocate to your trading?

Expenses: Know your current expenses, minimize them.

Monetary Goals: How much money do you wish to make each month? (Dream goal and realistic)

Define Market Specifics: Pick a Market: Stock, Options, Futures or Forex (and a specific market within them)

Time Frame: Day Trader (Intraday trader)

Swing Trader (Overnight positions 2 days to 2 weeks)

Trend Trader (Overnight positions months at a time)

Time to Trade: 5 Sessions of the day (Eastern Standard Time)

Open 9:30 AM to 10:00 AM

Morning 10:00 AM to 12:00 PM

Lunch 12:00 PM to 1:00 PM

Afternoon 1:00 PM to 3:30 PM

Close 3:30 PM to 4:00 PM

Trading Methodologies

Risk--

Loss Limits: Max per Trade loss: $______ (1% of Trading Account Balance)

Max Daily Loss: $______ (2% of Trading Account Balance)

Max Weekly Loss: $______ (4% of Trading Account Balance)

*Cease trading for rest of week if weekly breakpoint is hit. Go on Trading Probation.

Trade Size:

How many contracts or shares will you trade?

Futures: Stick with one contract until you become consistently profitable.

Options: Begin with one contract.

Stock: Number of shares = Risk per trade / Risk per share

Stops: Always use them!

timracette@gmail.com TIM RACETTE www.TJMacTrading.com

Trading for Success:

Creating a Trading Plan

Rules:

It is important to become consistent. Work to develop rules based on learned experiences.

1. Plan your trade and trade your plan.

2. Keep things simple.

3. Remain focused and disciplined.

4. Fully understand the markets in which you are trading.

5. Only place trades when you are in a calm state. Do not trade if youre in a time crunch or frustrated.

6. Be selective with your trades!

7. Place stops at the time you enter a position. A stop can only be tightened, never widened.

8. Keep honest and meticulous records.

9. Dont chase trades.

10. Read rules EVERYDAY!

Systems:

Be selective!

You MUST define your Entry, Exit, Profit Target, and your edge

What market indicators will you use to get a feel for the markets? Internals, moving averages, oscillators, etc.

Business Management & Development

Record Keeping--

Keep meticulous records each day relating to market action, trading account, and your individual trades:

Market: Indices, ES, Gold and Oil Settlement Prices/Volume

Internals Closing Readings

Leading Sectors & Industry Groups

Notes/Comments

Account: Daily, Weekly, and Monthly P/L (Gross and Net)

Trades: # of winning, losing, and scratch trades

Total # of trades

Time spent in trades

Commissions

Calculations: Winning and Losing % # of Winners/Total # of Trades

Losing % = 1 - Winning %

Avg. W & L $ Amount Sum of Profitable Trades/Total # of Winning Trades

Sum of Losing Trades/Total # of Losing Trades

R-Multiple (Reward/Risk Ratio) Avg. W / Avg. Loser

Expectancy (W % x Avg. W) (L % x Avg. L)

Routines:

Develop a trading routine and use checklists.

Pre-Market Routine

Intra-Day Routine: Stick to trading plan! Follow rules!

After Hours Routine

Checklist:

Reboot computer each day

Get at least one hour of exercise or physical activity every day

Eat quality meals on and around trading days

Check account balance each night

Back up hard drive each night

Contingencies:

Brokerage Trade Desk, Clearing Firm, Computer Repair, Internet provider, Electric Company

timracette@gmail.com TIM RACETTE www.TJMacTrading.com

Das könnte Ihnen auch gefallen

- Blueprint For Options Success - Strategic TraderDokument17 SeitenBlueprint For Options Success - Strategic TraderRosNoch keine Bewertungen

- The Trend Trader Nick Radge On Demand PDFDokument8 SeitenThe Trend Trader Nick Radge On Demand PDFDedi Tri LaksonoNoch keine Bewertungen

- The Sketch GenDokument8 SeitenThe Sketch GenEd williamsonNoch keine Bewertungen

- Market Internals SeminarDokument191 SeitenMarket Internals Seminarjmborde100% (1)

- The Complete Tick Chart Guide - EminiMindDokument12 SeitenThe Complete Tick Chart Guide - EminiMindcsanchezpty33% (3)

- Dual Momentum Gary AntonacciDokument6 SeitenDual Momentum Gary AntonacciNiraj KumarNoch keine Bewertungen

- Ota CoreStrategy PDFDokument5 SeitenOta CoreStrategy PDFvirusNoch keine Bewertungen

- The Best in YouDokument33 SeitenThe Best in YouEgwim Ifeanyi100% (4)

- Real Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksVon EverandReal Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksNoch keine Bewertungen

- Maximizing Gains With Trade ManagementDokument11 SeitenMaximizing Gains With Trade Managementhafis82Noch keine Bewertungen

- Diversified Pitchbook 2015Dokument14 SeitenDiversified Pitchbook 2015Tempest SpinNoch keine Bewertungen

- Option Profit AcceleratorDokument129 SeitenOption Profit AcceleratorlordNoch keine Bewertungen

- The Quest For Reliable CrossoversDokument5 SeitenThe Quest For Reliable Crossoverssids_dchNoch keine Bewertungen

- Traders ChecklistDokument17 SeitenTraders ChecklistManojkumar NairNoch keine Bewertungen

- A New Look at Exit Strategies: A Presentation by Charles Lebeau For The Melbourne, Australia - October, 2006Dokument33 SeitenA New Look at Exit Strategies: A Presentation by Charles Lebeau For The Melbourne, Australia - October, 2006pthomas82Noch keine Bewertungen

- Forex FlashcardsDokument63 SeitenForex Flashcardssting74100% (2)

- Self Sabotage Reexamined: by Van K. Tharp, PH.DDokument8 SeitenSelf Sabotage Reexamined: by Van K. Tharp, PH.DYashkumar JainNoch keine Bewertungen

- Jason Fielder 60-30-10 PDFDokument22 SeitenJason Fielder 60-30-10 PDFBảo KhánhNoch keine Bewertungen

- The 10 Commandments PDFDokument11 SeitenThe 10 Commandments PDFad11010010100% (1)

- Business Trading PlanDokument5 SeitenBusiness Trading Planalltrdes13574100% (1)

- Day Trader Business: Trader Entities With Steve Ribble (ShrinkMyTaxes - Com) Presentation SlidesDokument54 SeitenDay Trader Business: Trader Entities With Steve Ribble (ShrinkMyTaxes - Com) Presentation SlidesMarketHEIST.comNoch keine Bewertungen

- BYND ReversalDokument12 SeitenBYND ReversalRavi RamanNoch keine Bewertungen

- JulianDokument4 SeitenJulianBhavesh GelaniNoch keine Bewertungen

- Reversal Trading - A Beginner's Guide Forex4noobsDokument8 SeitenReversal Trading - A Beginner's Guide Forex4noobsVasco JosephNoch keine Bewertungen

- 10 Rules For Successful Long Term Investment 270112Dokument2 Seiten10 Rules For Successful Long Term Investment 270112Ganesh Subramanian100% (1)

- How To Conduct An Effective Trading Session Review: by Lance BeggsDokument13 SeitenHow To Conduct An Effective Trading Session Review: by Lance BeggsNishantNoch keine Bewertungen

- The Next Apple ChecklistDokument7 SeitenThe Next Apple ChecklistShubham siddhpuriaNoch keine Bewertungen

- Penny Stocks 01.2005Dokument16 SeitenPenny Stocks 01.2005PrinceNoch keine Bewertungen

- DoesTrendFollowingWorkOnStocks 120513Dokument22 SeitenDoesTrendFollowingWorkOnStocks 120513apoinjnNoch keine Bewertungen

- Dan Zanger Trader's LogDokument1 SeiteDan Zanger Trader's LogLNoch keine Bewertungen

- A.C.E. Investing: Course InstructorsDokument17 SeitenA.C.E. Investing: Course Instructorsbigtrends100% (1)

- How To Place Stop Losses Like A Pro TraderDokument6 SeitenHow To Place Stop Losses Like A Pro Tradernrepramita100% (2)

- Soybean Trading SystemDokument38 SeitenSoybean Trading SystemjamesNoch keine Bewertungen

- 3 Little Pig StrategyDokument28 Seiten3 Little Pig StrategykhanNoch keine Bewertungen

- 03 MAR MAR2014: Weekly Stock Weekly Stock AnalysisDokument8 Seiten03 MAR MAR2014: Weekly Stock Weekly Stock AnalysisDewayne PuckettNoch keine Bewertungen

- Maximum Profit Targets: Trader Makes $18 BillionDokument4 SeitenMaximum Profit Targets: Trader Makes $18 BillionIan Moncrieffe100% (2)

- Doji Sandwich Ebook PDFDokument11 SeitenDoji Sandwich Ebook PDFSergio Adrián NesiNoch keine Bewertungen

- How To Read The Market Like A Book PDFDokument15 SeitenHow To Read The Market Like A Book PDFznhtogexNoch keine Bewertungen

- Al Brooks - Taking Action in The E-MiniDokument23 SeitenAl Brooks - Taking Action in The E-Minigrimweasel47100% (1)

- Two Bar Rule ExplanationDokument4 SeitenTwo Bar Rule ExplanationAlister MackinnonNoch keine Bewertungen

- BILL POULOS - Safe Trade Options FormulaDokument8 SeitenBILL POULOS - Safe Trade Options Formulaelisa100% (1)

- Idt Penny StocksDokument51 SeitenIdt Penny Stocksearnrockz0% (1)

- Stop Losses Are For Sissies PDFDokument11 SeitenStop Losses Are For Sissies PDFXRM0909Noch keine Bewertungen

- HTTP WWW - Tradingmarkets.c..8Dokument5 SeitenHTTP WWW - Tradingmarkets.c..8pderby1Noch keine Bewertungen

- A Day Trading Strategy: The Gap System: Michael Tan, PH.D., CFADokument13 SeitenA Day Trading Strategy: The Gap System: Michael Tan, PH.D., CFAtudorNoch keine Bewertungen

- Money Management Controlling Risk and Capturing ProfitsDokument20 SeitenMoney Management Controlling Risk and Capturing ProfitsIan Moncrieffe100% (10)

- Elite PDFDokument29 SeitenElite PDFRaja RajNoch keine Bewertungen

- Stop Losses: Help or Hindrance?: Dr. Bruce VanstoneDokument16 SeitenStop Losses: Help or Hindrance?: Dr. Bruce VanstoneAleksandrNoch keine Bewertungen

- Forecasting The Future With Momentum Divergence & Mastering MomentumDokument3 SeitenForecasting The Future With Momentum Divergence & Mastering MomentumanyzenNoch keine Bewertungen

- The Art of Tape ReadingDokument2 SeitenThe Art of Tape ReadingAnupam BhardwajNoch keine Bewertungen

- Tsunami Trading Educators Trading ManualDokument20 SeitenTsunami Trading Educators Trading Manualanon-82974675% (4)

- John Carter - Trading The Euro Box It, Squeeze It, Love It, Leave It (Article)Dokument8 SeitenJohn Carter - Trading The Euro Box It, Squeeze It, Love It, Leave It (Article)brufpotNoch keine Bewertungen

- Active Trader Magazine - Article - Focusing On Volatility - August 2005Dokument5 SeitenActive Trader Magazine - Article - Focusing On Volatility - August 2005fmntime100% (1)

- Developing A Mechanical Trading SystemDokument4 SeitenDeveloping A Mechanical Trading SystemKathiravan R100% (1)

- Williams %R - The BigTrends WayDokument7 SeitenWilliams %R - The BigTrends WaybigtrendsNoch keine Bewertungen

- Developing An Annual Trading PlanDokument28 SeitenDeveloping An Annual Trading PlanjNoch keine Bewertungen

- Battle Tested Forex Trading StrategiesDokument73 SeitenBattle Tested Forex Trading Strategieskanteron6443Noch keine Bewertungen

- Serial ScalperDokument17 SeitenSerial ScalperfxquickNoch keine Bewertungen

- Ds Iron Condor StrategiaDokument43 SeitenDs Iron Condor StrategiaFernando ColomerNoch keine Bewertungen

- A Trader CheckList - ActiveTraderIQ ArticleDokument3 SeitenA Trader CheckList - ActiveTraderIQ ArticleHussan MisthNoch keine Bewertungen

- Tim Bourquin InterviewDokument8 SeitenTim Bourquin Interviewartus14Noch keine Bewertungen

- Unusual Options Activity Halftime Report - : There Is A Risk of Loss in All TradingDokument3 SeitenUnusual Options Activity Halftime Report - : There Is A Risk of Loss in All Tradingsatish sNoch keine Bewertungen

- Es130617 1Dokument4 SeitenEs130617 1satish sNoch keine Bewertungen

- 1208452Dokument4 Seiten1208452satish sNoch keine Bewertungen

- News Release: Nomura Individual Investor SurveyDokument17 SeitenNews Release: Nomura Individual Investor Surveysatish sNoch keine Bewertungen

- Simple Supper Trading SystemDokument3 SeitenSimple Supper Trading Systemsatish sNoch keine Bewertungen

- Dig Ppo: Percentage Price OscillatorDokument4 SeitenDig Ppo: Percentage Price Oscillatorsatish sNoch keine Bewertungen

- Crystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural InformationDokument3 SeitenCrystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural Informationsatish sNoch keine Bewertungen

- Sharpening Skills WyckoffDokument16 SeitenSharpening Skills Wyckoffsatish s100% (1)

- The Stock Market Update: September 11, 2012 © David H. WeisDokument1 SeiteThe Stock Market Update: September 11, 2012 © David H. Weissatish sNoch keine Bewertungen

- The Art of Timing The TradeDokument1 SeiteThe Art of Timing The Tradesatish s0% (3)

- ETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst FundsDokument5 SeitenETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst Fundssatish sNoch keine Bewertungen

- Smartbuild - Smart Design For Smart SystemsDokument1 SeiteSmartbuild - Smart Design For Smart Systemssatish sNoch keine Bewertungen

- Uniti Group Inc UNIT: Last Close Fair Value Market CapDokument4 SeitenUniti Group Inc UNIT: Last Close Fair Value Market Capsatish sNoch keine Bewertungen

- Trading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLDokument8 SeitenTrading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLsatish sNoch keine Bewertungen

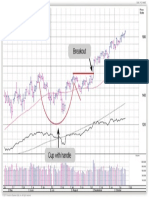

- How To Buy Common Patterns1 2Dokument1 SeiteHow To Buy Common Patterns1 2satish sNoch keine Bewertungen

- Wabash National Corp WNC: Last Close Fair Value Market CapDokument4 SeitenWabash National Corp WNC: Last Close Fair Value Market Capsatish sNoch keine Bewertungen

- An Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange MarketDokument7 SeitenAn Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange Marketsatish sNoch keine Bewertungen

- Fast Track 6 2 ILT Datasheet 1Dokument1 SeiteFast Track 6 2 ILT Datasheet 1Swapnil BankarNoch keine Bewertungen

- Medication Deferral ListDokument2 SeitenMedication Deferral Listsatish sNoch keine Bewertungen

- Questions and Answers May 2013: Morningstar's Quantitative Equity RatingsDokument3 SeitenQuestions and Answers May 2013: Morningstar's Quantitative Equity Ratingssatish sNoch keine Bewertungen

- Are Institutions Momentum Traders?: Timothy R. Burch Bhaskaran SwaminathanDokument39 SeitenAre Institutions Momentum Traders?: Timothy R. Burch Bhaskaran Swaminathansatish sNoch keine Bewertungen

- Looking For Short Term Signals in Stock Market Data: A. BocharovDokument10 SeitenLooking For Short Term Signals in Stock Market Data: A. Bocharovsatish sNoch keine Bewertungen

- Claire Churchwell - rhetORICALDokument7 SeitenClaire Churchwell - rhetORICALchurchcpNoch keine Bewertungen

- Arab Americans and Political ActivismDokument4 SeitenArab Americans and Political ActivismRaouia ZouariNoch keine Bewertungen

- RemarksDokument1 SeiteRemarksRey Alcera AlejoNoch keine Bewertungen

- Natural Law: St. Thomas AquinasDokument50 SeitenNatural Law: St. Thomas AquinasGabriel PanganibanNoch keine Bewertungen

- OBE - Student Presentation 2021 - V1Dokument18 SeitenOBE - Student Presentation 2021 - V1Mubashir KhanNoch keine Bewertungen

- Chapter 2 - Globalization, Diversity and EthicsDokument10 SeitenChapter 2 - Globalization, Diversity and EthicsPhee JhayNoch keine Bewertungen

- English Silver BookDokument24 SeitenEnglish Silver BookQamar Asghar Ara'inNoch keine Bewertungen

- Module 2Dokument30 SeitenModule 2RarajNoch keine Bewertungen

- Kashmir DisputeDokument13 SeitenKashmir DisputeAmmar ShahNoch keine Bewertungen

- University of Perpetual Help System DALTA: "Unforgettable Retreat "Dokument5 SeitenUniversity of Perpetual Help System DALTA: "Unforgettable Retreat "Christine Angela MamarilNoch keine Bewertungen

- Majestic Writings of Promised Messiah (As) in View of Some Renowned Muslim Scholars by Hazrat Mirza Tahir Ahmad (Ra)Dokument56 SeitenMajestic Writings of Promised Messiah (As) in View of Some Renowned Muslim Scholars by Hazrat Mirza Tahir Ahmad (Ra)Haseeb AhmadNoch keine Bewertungen

- Training and DevelopmentDokument46 SeitenTraining and DevelopmentRavi JoshiNoch keine Bewertungen

- Glo 20is 2017 PDFDokument317 SeitenGlo 20is 2017 PDFKristine LlamasNoch keine Bewertungen

- Padma Awards 2024Dokument132 SeitenPadma Awards 2024NDTV100% (1)

- SAMPLE AR Narrative Word FormatDokument12 SeitenSAMPLE AR Narrative Word FormatElle Sta TeresaNoch keine Bewertungen

- DDI - Company Profile 2024Dokument9 SeitenDDI - Company Profile 2024NAUFAL RUZAINNoch keine Bewertungen

- Comprehensive Study of Digital Forensics Branches and ToolsDokument7 SeitenComprehensive Study of Digital Forensics Branches and ToolsDwiki MaulanaNoch keine Bewertungen

- Panel Hospital ListDokument4 SeitenPanel Hospital ListNoman_Saeed_1520100% (1)

- Chapter 6 Suspense Practice Q HDokument5 SeitenChapter 6 Suspense Practice Q HSuy YanghearNoch keine Bewertungen

- LorealDokument2 SeitenLorealviaraNoch keine Bewertungen

- Manchester University Press: de Stijl and Dutch ModernismDokument1 SeiteManchester University Press: de Stijl and Dutch ModernismHoàng YếnNoch keine Bewertungen

- Chapter One: Perspectives On The History of Education in Nigeria, 2008Dokument26 SeitenChapter One: Perspectives On The History of Education in Nigeria, 2008Laura ClarkNoch keine Bewertungen

- Review of The 2010 11 Flood Warnings and Reponse INTERIM REPORTDokument32 SeitenReview of The 2010 11 Flood Warnings and Reponse INTERIM REPORTABC VictoriaNoch keine Bewertungen

- Kove Food MenuDokument6 SeitenKove Food MenusafinditNoch keine Bewertungen

- AH 0109 AlphaStarsDokument1 SeiteAH 0109 AlphaStarsNagesh WaghNoch keine Bewertungen

- NCC23 EngDokument174 SeitenNCC23 EngAONoch keine Bewertungen

- Wireless Sensor NetworkDokument13 SeitenWireless Sensor NetworkRanjit PanigrahiNoch keine Bewertungen

- Choice of Law RulesDokument23 SeitenChoice of Law RulesKranthi Kiran TalluriNoch keine Bewertungen

- PC63 - Leviat - 17 SkriptDokument28 SeitenPC63 - Leviat - 17 SkriptGordan CelarNoch keine Bewertungen