Beruflich Dokumente

Kultur Dokumente

Tax Planning

Hochgeladen von

Hay JirenyaaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax Planning

Hochgeladen von

Hay JirenyaaCopyright:

Verfügbare Formate

Tax Planning

Tax Planning is taking the advantage of all eligible tax exemptions, deductions,

concessions, rebates allowances permitted under the law. Reduction in tax by tax

planning is called tax saving in hand of taxpayer without violating any law which is

desirable and moral. Tax planning is investing in available permissible avenues eligible

for deduction u/s 80C of Income Tax Act or investment in SEZ units. It is legitimate as

our legislature intends proper utilization of these deductions and exemption for the

promotion of economic activities of our country. The Supreme Court, in M/s McDowell

and Co Ltd Vs Commercial Tax officer, 1985, (154 ITR 148(SC), held that for tax

planning to be legitimate it must be within the legal framework and colourable devices

cannot be part of tax planning.

.

Tax Avoidance

Tax avoidance is reducing tax liability in legally permissible ways by structuring ones

affairs, valid only if it has commercial substance and is not a colourable device. Tax

avoidance is taking the advantage of any loopholes in the law. To identify whether a

transaction is a colourable device tax authorities can go behind the transaction to

examine the substance and not only the form. The Vodafone controversy is an

attempt of tax authorities to identify whether the sale of shares of a foreign company by

one non-resident to another non-resident is genuine or colourable device where the only

principal asset of foreign company was shareholding in the underlying Indian company.

In brief Tax avoidance is complying with the provisions of law but defeating the

intention of the law. There is a thin line separating Tax Planning and Tax Avoidance

which results in lots of litigations and government takes measures to remove that

loophole in law. Dividend Stripping is an example of Tax avoidance which was restricted

or curbed by the government by introducing section 94(7) of Income Tax Act in Finance

Act 2001.

.

Tax Evasion

In Tax evasion tax is illegally avoided through unacceptable means, by deliberately

suppressing the income or by inflating the expenditure, recording fictitious transactions,

etc. Tax evasion is reducing tax liability by applying unfair means. It overrules the law,

its concealment of tax, objectionable, immoral in nature. It is blatant fraud and done

when tax liability arises. Defaulter is get punished with penalty. Tax evasion is reduction

in tax with malafide intention.

.

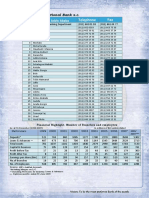

Difference between Tax Planning, Tax avoidance and Tax Evasion

Particulars Tax Planning Tax Avoidance Tax Evasion

Illegally reducing tax

deliberately suppressi

Taking full advantage Taking advantage of income or enhancin

Definition provided by Law. loopholes of Law. expense.

Object Reducing tax by applying Reducing tax liability by Reducing tax liability

script and moral of law. applying script of law applying unfair mean

only.

Treatment Uses benefit of law Uses loophole Overrule the law

Practice Tax Saving Tax hedging Tax concealment

Causes penalty and

Benefit Arises in long run. Arises in short run. prosecution.

Need Desirable Avoidance Objectionable

.

Das könnte Ihnen auch gefallen

- Introduction To Tax PlanningDokument92 SeitenIntroduction To Tax PlanningTanvir HossainNoch keine Bewertungen

- Reduce Taxes Through Planning, AvoidanceDokument6 SeitenReduce Taxes Through Planning, AvoidanceAryan SharmaNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tax Planning - Tax Avoidance - Tax EvasionDokument4 SeitenTax Planning - Tax Avoidance - Tax EvasionDr Linda Mary Simon67% (3)

- Corporate Tax Planning & ManagemenDokument94 SeitenCorporate Tax Planning & ManagemenArshit PatelNoch keine Bewertungen

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthVon EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNoch keine Bewertungen

- Advanced Tax Laws CS Professional, YES AcademyDokument33 SeitenAdvanced Tax Laws CS Professional, YES AcademyKaran AroraNoch keine Bewertungen

- Chapter FourDokument88 SeitenChapter FourHay Jirenyaa100% (3)

- Tax Planning and Managerial DecisionDokument163 SeitenTax Planning and Managerial DecisionDr Linda Mary Simon100% (2)

- Bo's Coffee AprmDokument24 SeitenBo's Coffee Aprmalliquemina100% (1)

- Team Roles EssayDokument7 SeitenTeam Roles EssayCecilie Elisabeth KristensenNoch keine Bewertungen

- CARET Programme1 Bennett-1Dokument10 SeitenCARET Programme1 Bennett-1TerraVault100% (3)

- Classwork Notes and Pointers Statutory Construction - TABORDA, CHRISTINE ANNDokument47 SeitenClasswork Notes and Pointers Statutory Construction - TABORDA, CHRISTINE ANNChristine Ann TabordaNoch keine Bewertungen

- Meaning of Tax PlanningDokument5 SeitenMeaning of Tax PlanningTanmoy ChakrabortyNoch keine Bewertungen

- Tax PalnningDokument25 SeitenTax PalnningVish Nu VichuNoch keine Bewertungen

- Sterilization and DisinfectionDokument100 SeitenSterilization and DisinfectionReenaChauhanNoch keine Bewertungen

- Escape From TaxationDokument3 SeitenEscape From TaxationQueen Valle100% (1)

- Tax Planning Tax Avoidance &tax EvasionDokument8 SeitenTax Planning Tax Avoidance &tax EvasionIshpreet Singh BaggaNoch keine Bewertungen

- Difference Between Tax PlanningDokument2 SeitenDifference Between Tax PlanningBiswaranjan Satpathy100% (1)

- AIS Best Teaching MaterialDokument121 SeitenAIS Best Teaching MaterialHay Jirenyaa100% (1)

- FS2 Learning Experience 1Dokument11 SeitenFS2 Learning Experience 1Jona May BastidaNoch keine Bewertungen

- AX Lanning: by Anup K SuchakDokument27 SeitenAX Lanning: by Anup K SuchakanupsuchakNoch keine Bewertungen

- Difference Between Tax Avoidance and Tax EvasionDokument3 SeitenDifference Between Tax Avoidance and Tax EvasionHay Jirenyaa100% (1)

- Tax PlanningDokument21 SeitenTax Planningpriyani0% (1)

- Auditors Report: Financial Result 2005-2006Dokument11 SeitenAuditors Report: Financial Result 2005-2006Hay JirenyaaNoch keine Bewertungen

- Auditors Report: Financial Result 2005-2006Dokument11 SeitenAuditors Report: Financial Result 2005-2006Hay JirenyaaNoch keine Bewertungen

- Villadolid, Thea Marie J - 1st CENTURY SKILLS CATEGORIESDokument4 SeitenVilladolid, Thea Marie J - 1st CENTURY SKILLS CATEGORIESThea Marie Villadolid100% (1)

- Bjectives of Tax PlanningDokument6 SeitenBjectives of Tax PlanningSruthiDeetiNoch keine Bewertungen

- Cost AccountingDokument21 SeitenCost AccountingXandarnova corpsNoch keine Bewertungen

- B.COM 6th Sem. Corporate Tax Planning FundamentalsDokument26 SeitenB.COM 6th Sem. Corporate Tax Planning FundamentalsAbinash PrustyNoch keine Bewertungen

- Introduction of Tax PlanningDokument17 SeitenIntroduction of Tax PlanningNurmanNoch keine Bewertungen

- Unit VDokument18 SeitenUnit VdepeshsnehaNoch keine Bewertungen

- 19P0310314 - Corporate Tax Planning - Meaning, Objectives and ScopeDokument8 Seiten19P0310314 - Corporate Tax Planning - Meaning, Objectives and ScopePriya KudnekarNoch keine Bewertungen

- CS Pro DT New (05.06.20) PDFDokument175 SeitenCS Pro DT New (05.06.20) PDFKapil KaroliyaNoch keine Bewertungen

- Tax Planning Concepts and StrategiesDokument29 SeitenTax Planning Concepts and StrategiesYash JainNoch keine Bewertungen

- Legal & Ethical Dimension of Tax EvasionDokument12 SeitenLegal & Ethical Dimension of Tax EvasionshehabkhankulawNoch keine Bewertungen

- Tax PlanningDokument16 SeitenTax PlanningAddis YawkalNoch keine Bewertungen

- Tax Planning Tax Avoidance AND Tax EvasionDokument17 SeitenTax Planning Tax Avoidance AND Tax EvasionSpUnky RohitNoch keine Bewertungen

- Tax Planning, Tax Evasion, Tax Avoidance, Tax ManagementDokument7 SeitenTax Planning, Tax Evasion, Tax Avoidance, Tax Managementmuskansethi2001Noch keine Bewertungen

- Unit 4 LAB FairDokument15 SeitenUnit 4 LAB Fairmurugesan.NNoch keine Bewertungen

- Tax Law Assignment Final DraftDokument5 SeitenTax Law Assignment Final DraftTatenda MudyanevanaNoch keine Bewertungen

- Short Answers: Submitted To: Prof.K.K.Bajpai Simran Gupta Mba (FC) 4 Sem ROLLNO.8131051Dokument22 SeitenShort Answers: Submitted To: Prof.K.K.Bajpai Simran Gupta Mba (FC) 4 Sem ROLLNO.8131051Satvik MishraNoch keine Bewertungen

- Corporate Tax Planning and ManagemantDokument11 SeitenCorporate Tax Planning and ManagemantVijay KumarNoch keine Bewertungen

- SHORT ANSWERS ChaurasiaDokument22 SeitenSHORT ANSWERS ChaurasiaSatvik MishraNoch keine Bewertungen

- Tax PlanningDokument8 SeitenTax Planninghgoyal190Noch keine Bewertungen

- Topic 3a - Tax Evasion Tax AvoidanceDokument33 SeitenTopic 3a - Tax Evasion Tax AvoidanceaplacetokeepmynotesNoch keine Bewertungen

- Concepts of Tax PlanningDokument1 SeiteConcepts of Tax PlanningKshetriyas Mass PrdiveNoch keine Bewertungen

- Corporate Tax Planning and Management ConceptsDokument35 SeitenCorporate Tax Planning and Management Conceptsnandan velankarNoch keine Bewertungen

- 9110Dokument42 Seiten9110Him DigitalsNoch keine Bewertungen

- In Come Tax PlanningDokument9 SeitenIn Come Tax PlanningHitesh GuptaNoch keine Bewertungen

- Tax Evasion and Tax AvoidanceDokument1 SeiteTax Evasion and Tax AvoidanceCristine EstreraNoch keine Bewertungen

- Tax Evasion and AvoidanceDokument11 SeitenTax Evasion and AvoidanceMerlita TuralbaNoch keine Bewertungen

- Tax - Planning - and - Managerial - Decisions 4th ChapterDokument16 SeitenTax - Planning - and - Managerial - Decisions 4th ChapterVidya VidyaNoch keine Bewertungen

- Three Methods of Tax MinimizationDokument5 SeitenThree Methods of Tax MinimizationDiwakar AnandNoch keine Bewertungen

- Properly by A Business and On A Timely Basis.: Final Withholding TaxDokument5 SeitenProperly by A Business and On A Timely Basis.: Final Withholding TaxStephanie PublicoNoch keine Bewertungen

- HC Deb 24 May 2006 Ccwa111-2 Irc V Willoughby & Another (1997)Dokument4 SeitenHC Deb 24 May 2006 Ccwa111-2 Irc V Willoughby & Another (1997)qwerty asNoch keine Bewertungen

- Tax Efficiency Financial Plan Tax Liability: DEFINITION of 'Tax Planning'Dokument4 SeitenTax Efficiency Financial Plan Tax Liability: DEFINITION of 'Tax Planning'mba departmentNoch keine Bewertungen

- Tax Planning, Avoidance, Tax EvasionDokument40 SeitenTax Planning, Avoidance, Tax Evasionsimm170226Noch keine Bewertungen

- Tax Avoidance and Tax EvasionDokument3 SeitenTax Avoidance and Tax EvasionAman GuptaNoch keine Bewertungen

- Personal Tax PlanningDokument15 SeitenPersonal Tax PlanningSanah SahniNoch keine Bewertungen

- Tax Planning: Most Adopted Instruments are LIC & PFDokument28 SeitenTax Planning: Most Adopted Instruments are LIC & PFAtul GuptaNoch keine Bewertungen

- 1.7 Doctrines of TaxationDokument2 Seiten1.7 Doctrines of TaxationLuis GuerreroNoch keine Bewertungen

- Tax Planning Strategies for Individuals and BusinessesDokument11 SeitenTax Planning Strategies for Individuals and BusinessesManas MaheshwariNoch keine Bewertungen

- LEGAL PERSPECTIVES ON TAX AVOIDANCEDokument23 SeitenLEGAL PERSPECTIVES ON TAX AVOIDANCEBarjoyai BardaiNoch keine Bewertungen

- Module VIII Tax Evasion, Tax Avoidance and Tax PlanningDokument7 SeitenModule VIII Tax Evasion, Tax Avoidance and Tax PlanningrahulNoch keine Bewertungen

- Tax Planning, Tax Evasion, Tax Avoidance & Tax ManagementDokument2 SeitenTax Planning, Tax Evasion, Tax Avoidance & Tax ManagementAkhil RajNoch keine Bewertungen

- Vanshita Gupta - ProjectTaxationDokument18 SeitenVanshita Gupta - ProjectTaxationVanshita GuptaNoch keine Bewertungen

- Taxation ProjectDokument12 SeitenTaxation ProjectSagar DhanakNoch keine Bewertungen

- Concepts of Tax PlanningDokument1 SeiteConcepts of Tax PlanningKalidindi Vamsi Krishna Varma100% (1)

- 1 TaxplanningchapterDokument60 Seiten1 TaxplanningchapterGieanne Prudence Venculado100% (1)

- Aggressive Tax Planning Article For LHDNDokument3 SeitenAggressive Tax Planning Article For LHDNBarjoyai BardaiNoch keine Bewertungen

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024Von EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024Noch keine Bewertungen

- Assignment For Evening Class StudentsDokument1 SeiteAssignment For Evening Class StudentsHay JirenyaaNoch keine Bewertungen

- Comm - Ica Asa510 App1ill1Dokument3 SeitenComm - Ica Asa510 App1ill1Hay JirenyaaNoch keine Bewertungen

- Determinants of Tax Revenue Efforts in Developing Countries: Abhijit Sen GuptaDokument41 SeitenDeterminants of Tax Revenue Efforts in Developing Countries: Abhijit Sen GuptaHay JirenyaaNoch keine Bewertungen

- Assignment For Evening Class StudentsDokument2 SeitenAssignment For Evening Class StudentsHay JirenyaaNoch keine Bewertungen

- Auditing in Ethiopia: An Historical OverviewDokument20 SeitenAuditing in Ethiopia: An Historical Overviewh84% (19)

- Ahmaric Annual ReportDokument23 SeitenAhmaric Annual ReportHay JirenyaaNoch keine Bewertungen

- Principle MaterialDokument35 SeitenPrinciple MaterialHay JirenyaaNoch keine Bewertungen

- Acma Assignment MaterialDokument12 SeitenAcma Assignment MaterialHay Jirenyaa100% (8)

- No Telephone Fax: Branches in Addis AbabaDokument35 SeitenNo Telephone Fax: Branches in Addis AbabaHay Jirenyaa100% (1)

- 2016 2017 PDFDokument44 Seiten2016 2017 PDFHay Jirenyaa100% (1)

- Example of An Engagement LetterDokument3 SeitenExample of An Engagement LettermaryxtelNoch keine Bewertungen

- 2016 2017 PDFDokument44 Seiten2016 2017 PDFHay Jirenyaa100% (1)

- Chap 1 Mic IDokument37 SeitenChap 1 Mic IHay JirenyaaNoch keine Bewertungen

- Accounting Information Systems: AnDokument333 SeitenAccounting Information Systems: AnHay JirenyaaNoch keine Bewertungen

- Chapter - 22B - Auditor's ReportsDokument12 SeitenChapter - 22B - Auditor's ReportsHay JirenyaaNoch keine Bewertungen

- Chapter 5 SlidesDokument110 SeitenChapter 5 SlidesHay JirenyaaNoch keine Bewertungen

- Chapter 4 SlidesDokument66 SeitenChapter 4 SlidesHay Jirenyaa100% (1)

- Example of An Engagement LetterDokument3 SeitenExample of An Engagement LettermaryxtelNoch keine Bewertungen

- E-Business Complaint PDFDokument8 SeitenE-Business Complaint PDFHay JirenyaaNoch keine Bewertungen

- Continuous Auditing in Internal Audit PDFDokument15 SeitenContinuous Auditing in Internal Audit PDFHay Jirenyaa0% (1)

- Overview of Business ProcessesDokument68 SeitenOverview of Business ProcessesHay JirenyaaNoch keine Bewertungen

- Chapter 3 SlidesDokument43 SeitenChapter 3 SlidesHay JirenyaaNoch keine Bewertungen

- COSO Internal Control Model ExplainedDokument31 SeitenCOSO Internal Control Model ExplainedHay JirenyaaNoch keine Bewertungen

- MD 2CDokument34 SeitenMD 2CIbraheem KhressNoch keine Bewertungen

- Centre's Letter To States On DigiLockerDokument21 SeitenCentre's Letter To States On DigiLockerNDTVNoch keine Bewertungen

- Managing a Patient with Pneumonia and SepsisDokument15 SeitenManaging a Patient with Pneumonia and SepsisGareth McKnight100% (2)

- Interpersonal Communication LPDokument3 SeitenInterpersonal Communication LPprincesslove.taduraNoch keine Bewertungen

- Zsoka PDFDokument13 SeitenZsoka PDFMasliana SahadNoch keine Bewertungen

- Khandelwal Intern ReportDokument64 SeitenKhandelwal Intern ReporttusgNoch keine Bewertungen

- App Inventor + Iot: Setting Up Your Arduino: Can Close It Once You Open The Aim-For-Things-Arduino101 File.)Dokument7 SeitenApp Inventor + Iot: Setting Up Your Arduino: Can Close It Once You Open The Aim-For-Things-Arduino101 File.)Alex GuzNoch keine Bewertungen

- Opportunity Seeking, Screening, and SeizingDokument24 SeitenOpportunity Seeking, Screening, and SeizingHLeigh Nietes-GabutanNoch keine Bewertungen

- Platform Tests Forj Udging Quality of MilkDokument10 SeitenPlatform Tests Forj Udging Quality of MilkAbubaker IbrahimNoch keine Bewertungen

- Price and Volume Effects of Devaluation of CurrencyDokument3 SeitenPrice and Volume Effects of Devaluation of Currencymutale besaNoch keine Bewertungen

- Gambaran Kebersihan Mulut Dan Karies Gigi Pada Vegetarian Lacto-Ovo Di Jurusan Keperawatan Universitas Klabat AirmadidiDokument6 SeitenGambaran Kebersihan Mulut Dan Karies Gigi Pada Vegetarian Lacto-Ovo Di Jurusan Keperawatan Universitas Klabat AirmadidiPRADNJA SURYA PARAMITHANoch keine Bewertungen

- Airforce Group Y: Previous Y Ear P AperDokument14 SeitenAirforce Group Y: Previous Y Ear P Aperajay16duni8Noch keine Bewertungen

- SyllabusDokument8 SeitenSyllabusrickyangnwNoch keine Bewertungen

- Arcmap and PythonDokument29 SeitenArcmap and PythonMiguel AngelNoch keine Bewertungen

- Virtuoso 2011Dokument424 SeitenVirtuoso 2011rraaccNoch keine Bewertungen

- Absenteeism: It'S Effect On The Academic Performance On The Selected Shs Students Literature ReviewDokument7 SeitenAbsenteeism: It'S Effect On The Academic Performance On The Selected Shs Students Literature Reviewapi-349927558Noch keine Bewertungen

- Barnett Elizabeth 2011Dokument128 SeitenBarnett Elizabeth 2011Liz BarnettNoch keine Bewertungen

- DODAR Analyse DiagramDokument2 SeitenDODAR Analyse DiagramDavidNoch keine Bewertungen

- Other Project Content-1 To 8Dokument8 SeitenOther Project Content-1 To 8Amit PasiNoch keine Bewertungen

- APPSC Assistant Forest Officer Walking Test NotificationDokument1 SeiteAPPSC Assistant Forest Officer Walking Test NotificationsekkharNoch keine Bewertungen

- Category Theory For Programmers by Bartosz MilewskiDokument565 SeitenCategory Theory For Programmers by Bartosz MilewskiJohn DowNoch keine Bewertungen

- City Government of San Juan: Business Permits and License OfficeDokument3 SeitenCity Government of San Juan: Business Permits and License Officeaihr.campNoch keine Bewertungen

- Diabetic Foot InfectionDokument26 SeitenDiabetic Foot InfectionAmanda Abdat100% (1)

- Entrepreneurship and Small Business ManagementDokument29 SeitenEntrepreneurship and Small Business Managementji min100% (1)