Beruflich Dokumente

Kultur Dokumente

Smith Group Tax Summary 2016 2016 Tax Summary

Hochgeladen von

api-358201396Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Smith Group Tax Summary 2016 2016 Tax Summary

Hochgeladen von

api-358201396Copyright:

Verfügbare Formate

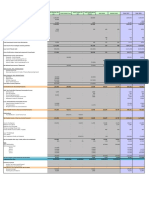

SMITH

FAMILY

GROUP

TAX

SUMMARY

FOR

THE

YEAR

30

JUNE

2016

Smith

Constructions

Smith

Investment

Smith

Consulting

Pty

Smith

Family

Trust

Smith

Finance

Pty

Ltd Nathan

Smith

Laura

Smith Total

2016

Pty

Ltd

Trust

Ltd

Income

from

trading

- Fees

Received

7,000,000

-

-

-

400,000

7,400,000

- FX

Profit/(Loss)

(644)

-

-

-

-

(644)

- Other

Income

2,000

-

-

-

-

2,000

Total

trading

income

7,001,356

-

-

-

400,000

-

-

7,401,356

Income from deposits with banks

- Interest Received on deposits with banks 7,814 - 230

20 233 8,297

- Interest Received - ATO - - - - - -

Dividends

Received

- Telstra

Limited

118

- Coca

Cola

Amatil

Limited

51

51

Total investment income from third parties 7,814 - - - 230

189

233

8,348

Total income from trading & investing activities 7,009,170 - - - 400,230

189

233

7,409,704

Less: Cost Of Goods Sold (5,900,000) (274,235)

(5,900,000)

Gross

Profit

before

related

party

payments

&

overheads

1,109,170

-

-

-

125,995

189

233

1,509,704

Related Party Income and expenses -

- Dividends - Smith Constructions - 28,000 28,000

- Dividends -Smith Consulting Pty Ltd - - - - - - -

- Salary & Wage - Smith Constructions Pty Ltd 149,999 149,999

- Salary & Wage - Smith Consulting Pty Ltd (47,747)

47,747 -

Net Related Party Income / (Expenses) - 28,000 - - (47,747)

149,999 47,747 177,999

Other Income - Non - Related Parties

- Parental Leave Pay 11,281 11,281

- Balancing Adjustment For Sale of Ford (Depreciating Asset) 1,012

Other Expenses - Non- Related Parties

- Rent Paid (29,494)

- - - (5,376) (29,494)

- Depreciation (20,064)

- - - (20,064)

- All Other Expenses (803,284)

- - - (56,127)

(865) (12)

(803,284)

- Motor Vehicle Expenses (8,622) -

Total Other Income/ Expenses (852,842)

- - - (61,503)

147

2,647 (911,551)

Income/(Loss) For Accounting Purposes 256,328

28,000 - - 16,745 150,335

50,627 776,152

Add: Non Deductible Expenses/Assessable Income

- Entertainment 5,390 1,896 7,286

- Fines & Penalties - - - - 456

- - 456

- Accounting Depreciation - - - - 482

- - 482

- Superannuation Payable Current Year 11,018 11,018

- Imputation credits on Dividends 12,000

-

Less: Deductible/Non Assessable Income -

- Superannuation Payable Prior Year (2,055) (2,055)

- Tax Depreciation (482) (482)

- Brought Forward Tax Losses Deducted - - - - (496) - - (496)

-

Gross Taxable Income / (Tax Loss Carried Forward) 270,681

40,000 - - 18,601 150,335

50,627 792,361

-

Distributions -

- Trust Distribution - Smith Family Trust (40,000)

40,000 -

-

Net Taxable Income / (Tax Loss Carried Forward) 270,681

40,000 - - 18,601 150,335

90,627 1,584,722

Income Tax Expense 81,204 - - - 5,580 43,650 21,479 151,913

Medicare Levy - - - - - 3,011 1,813 4,824

Medicare Levy Surcharge - - - - - - - -

Temporary Budget Reapir Levy - - - - - - - -

Private Health Insurance Offset - Payable 415

415

830

-

Less: TFN Withheld - - - - - - - -

Less: Offsets - - - - - - - -

Less: Imputation Credits on Dividends - - - - (9) (12,000) (12,009)

-

Net Tax Payable after Imp. Credits, before tax instalments 81,204 - - - 5,580 47,067 11,707 145,558

30% 0% 0% 0% 30% 29% 24% 9.19%

Less:

PAYG Withholding - - - - - (46,488)

(9,205) (55,693)

PAYG Instalment Paid: - - - - - - - -

Sep-15 - - - - - - - -

Dec-15 (1,945) (900) (2,845)

Mar-16 (10,167)

(900) (11,067)

Jun-16 (60,120)

(900) (61,020)

- - - - - - - -

(72,232)

- - - (2,700) (46,488)

(9,205) (130,625)

Net Tax Payable / (Refundable) @ 30 June 2016 8,972 - - - 2,880 579

2,502 14,933

Lodgement Due Date 15/05/17 15/05/17 15/05/17 15/05/17 15/05/17 15/05/17 15/05/17

Summary

of

losses

Income

Tax

Losses

carried

forward

-

-

-

-

-

-

-

-

Capital

Losses

carried

forward

-

-

-

-

-

-

-

-

Total

losses

to

carry

forward

from

30

June

2016

-

-

-

-

-

-

-

-

Retained

Earnings

450,000

3,146

453,146

Franking

Account

Balance

40,000

1,664

41,664

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Date Details (R) AMOUNT (Excl. Vat) (R) Vat (R) AMOUNT (Incl. Vat)Dokument2 SeitenDate Details (R) AMOUNT (Excl. Vat) (R) Vat (R) AMOUNT (Incl. Vat)NinaNoch keine Bewertungen

- Pay SlipDokument1 SeitePay SlipSaiful IslamNoch keine Bewertungen

- Corona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Dokument1 SeiteCorona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Emmanuel melvinNoch keine Bewertungen

- Chapt 11+Income+Tax+ +individuals2013fDokument13 SeitenChapt 11+Income+Tax+ +individuals2013fiamjan_10180% (15)

- Payslip-34 (Lankalapalli Durga Prasad) Jul 2022Dokument2 SeitenPayslip-34 (Lankalapalli Durga Prasad) Jul 2022Durga PrasadNoch keine Bewertungen

- SMChap004 PDFDokument57 SeitenSMChap004 PDFhshNoch keine Bewertungen

- Udhemy CourcesDokument1 SeiteUdhemy CourcesRam Sri100% (1)

- Cover LetterDokument3 SeitenCover Letterapi-358201396Noch keine Bewertungen

- Letter To Ato Re Superannuation Gurarantee AuditDokument2 SeitenLetter To Ato Re Superannuation Gurarantee Auditapi-358201396Noch keine Bewertungen

- Projected Income Tax PaymentsDokument1 SeiteProjected Income Tax Paymentsapi-358201396Noch keine Bewertungen

- Tax Planning 2017Dokument1 SeiteTax Planning 2017api-358201396Noch keine Bewertungen

- HP Schedule PDF Holden UteDokument1 SeiteHP Schedule PDF Holden Uteapi-358201396Noch keine Bewertungen

- Meeting Outlook PDFDokument1 SeiteMeeting Outlook PDFapi-358201396Noch keine Bewertungen

- Deductablity of Expenses TableDokument1 SeiteDeductablity of Expenses Tableapi-358201396Noch keine Bewertungen

- Email Correspondance - Ato Payment PlanDokument2 SeitenEmail Correspondance - Ato Payment Planapi-358201396Noch keine Bewertungen

- Email Correspondance - Ato Payment PlanDokument2 SeitenEmail Correspondance - Ato Payment Planapi-358201396Noch keine Bewertungen

- Vanishing Deductions X Estate Tax ComputationDokument2 SeitenVanishing Deductions X Estate Tax ComputationShiela Mae OblanNoch keine Bewertungen

- Provident FundDokument5 SeitenProvident FundG MadhuriNoch keine Bewertungen

- Slip Accomodation Dan TransportationDokument5 SeitenSlip Accomodation Dan Transportationbovan28Noch keine Bewertungen

- Master Budget QuizDokument1 SeiteMaster Budget QuizAbegail RafolsNoch keine Bewertungen

- Excel Salary Slip Format DownloadDokument2 SeitenExcel Salary Slip Format DownloadFARAZ KHANNoch keine Bewertungen

- 579unting Voucher GyvvDokument1 Seite579unting Voucher GyvvNimesh PatelNoch keine Bewertungen

- Basic Concepts MCQs by CA Pranav ChandakDokument11 SeitenBasic Concepts MCQs by CA Pranav ChandakJoginder shahNoch keine Bewertungen

- Train LawDokument3 SeitenTrain LawRONNEL SECADRONNoch keine Bewertungen

- CIR Vs Suter Case DigestDokument3 SeitenCIR Vs Suter Case DigestEfi of the IsleNoch keine Bewertungen

- Quarterly Remittance Return: of Creditable Income Taxes Withheld (Expanded)Dokument1 SeiteQuarterly Remittance Return: of Creditable Income Taxes Withheld (Expanded)Jun Jr FloresNoch keine Bewertungen

- Arun Kumar Salary 2019-10Dokument1 SeiteArun Kumar Salary 2019-10Rizwan AhmadNoch keine Bewertungen

- TAX Quiz 30Dokument2 SeitenTAX Quiz 30LanceNoch keine Bewertungen

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokument1 SeiteBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSHREYA MANDALNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokument1 SeiteIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahendra PatilNoch keine Bewertungen

- Advance Payment of TaxDokument11 SeitenAdvance Payment of TaxParul Bhardwaj VaidyaNoch keine Bewertungen

- Company Info - Print FinancialsDokument2 SeitenCompany Info - Print FinancialsBhawani CreationsNoch keine Bewertungen

- Uma Salary Slip JulyDokument1 SeiteUma Salary Slip Julyjyothi sNoch keine Bewertungen

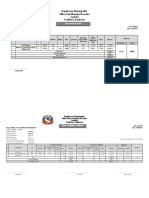

- Ward 9 - Kulo Shreenagar PurvaDokument5 SeitenWard 9 - Kulo Shreenagar PurvaPMEP Kapilvastu MunicipalityNoch keine Bewertungen

- Tax 2 Sec 113Dokument2 SeitenTax 2 Sec 113Aron LoboNoch keine Bewertungen

- Bir Form 2306Dokument3 SeitenBir Form 2306Rebecca McdowellNoch keine Bewertungen

- Invoice: Email Info@greensoul - Online Website Greensoul - OnlineDokument1 SeiteInvoice: Email Info@greensoul - Online Website Greensoul - OnlineANIL KUMAR REDDYNoch keine Bewertungen

- Apollo Medicine InvoiceNov 8 2022-19-03Dokument1 SeiteApollo Medicine InvoiceNov 8 2022-19-03Rajesh GandhiNoch keine Bewertungen

- Clarificaton Regarding Applicability of GST On The Activity of Constuction of Road Where Considerations Are Received in Defered Payment HAM Regarding27082021Dokument2 SeitenClarificaton Regarding Applicability of GST On The Activity of Constuction of Road Where Considerations Are Received in Defered Payment HAM Regarding27082021santosh yevvariNoch keine Bewertungen