Beruflich Dokumente

Kultur Dokumente

10validation Modules

Hochgeladen von

Monique CabreraOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

10validation Modules

Hochgeladen von

Monique CabreraCopyright:

Verfügbare Formate

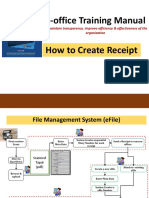

Electronic Filing and Payment System Job Aid

Validation Modules Download

CHAPTER

10 Validation Modules

Download

The file attachment capability of the eFPS allows the taxpayer to attach zip files to

the return that is being filed. Most forms will accept ordinary files that compressed

in zip format. There are, however, some forms that require files with special

validation codes. These codes are provided by modules available for download

from the BIR website. The following forms require the special modules:

Forms Using eRelief Modules:

2550Q

2550M

1601-C

Forms Using eAlphalist Modules:

1604-CF

1604-E

Bureau of Internal Revenue Version 1 November 2003

Electronic Filing and Payment System Job Aid

Validation Modules Download

Scenario 1: Accessing BIR website to download Validation

Modules

To download the Validation Modules, the taxpayer must access the BIR website and

navigate to the Validation Module download screen.

To Access the BIR website, open the URL http://www.bir.gov.ph with

your browser. This will bring up the following screen:

Click on the link labeled BIR Forms. This will bring you to the screen

where all major forms are listed.

Bureau of Internal Revenue Version 1 November 2003

Electronic Filing and Payment System Job Aid

Validation Modules Download

1604 Forms The List of Major Forms will be displayed.

eAlphalist

Once In this screen, scroll down to the form 1604CF. and click on the

link.

Bureau of Internal Revenue Version 1 November 2003

Electronic Filing and Payment System Job Aid

Validation Modules Download

This will bring you to the 1604-CF Download screen. Here, you will be

able to download the Validation Module and Job Aids for the 1604

forms, namely 1604-CF and 1604-E.

Once the Module is installed on your computer, you may use it to

generate the DAT files for the 1604 Forms. Upon completing the

process of creation of the DAT file, the DAT file will have to be

compressed in zip format before being uploaded to the eFPS server as

an attachment to the forms being filed.

Bureau of Internal Revenue Version 1 November 2003

Electronic Filing and Payment System Job Aid

Validation Modules Download

2550 and 1601-C Navigate to the List of Major Forms.

Forms - eRelief

Once In this screen, click the VAT / Percentage Tax Returns link.

Bureau of Internal Revenue Version 1 November 2003

Electronic Filing and Payment System Job Aid

Validation Modules Download

This will bring you to the Value Added Tax and Percentage Tax return

Download screen. Here, you will be able to download the Validation

Module and Job Aids for the 2550 forms.

Bureau of Internal Revenue Version 1 November 2003

Electronic Filing and Payment System Job Aid

Validation Modules Download

Scroll down and click on the download links to download the desired

files.

Once the Module is installed on your computer, you may use it to

generate the DAT files for the 2550. Upon completing the process of

creation of the DAT file, the DAT file will have to be compressed in zip

format before being uploaded to the eFPS server as an attachment to

the forms being filed.

Bureau of Internal Revenue Version 1 November 2003

Das könnte Ihnen auch gefallen

- Securing Communication of Legacy Applications with IPSec: Step-by-Step Guide to Protecting “Data in Transit” without Changes in Your Existing SoftwareVon EverandSecuring Communication of Legacy Applications with IPSec: Step-by-Step Guide to Protecting “Data in Transit” without Changes in Your Existing SoftwareNoch keine Bewertungen

- Payment Integration in Oracle FusionDokument4 SeitenPayment Integration in Oracle FusionMd MuzaffarNoch keine Bewertungen

- The iSeries and AS/400 Programmer's Guide to Cool ThingsVon EverandThe iSeries and AS/400 Programmer's Guide to Cool ThingsBewertung: 2.5 von 5 Sternen2.5/5 (2)

- E Filing of Returns in India 1203676190415692 4Dokument29 SeitenE Filing of Returns in India 1203676190415692 4sourav kumar dasNoch keine Bewertungen

- RMC No 5-2014 Clarification RR 1-2014Dokument18 SeitenRMC No 5-2014 Clarification RR 1-2014cherish belle calubNoch keine Bewertungen

- Applies To:: Payment File Stuck in Status 'Created and Ready For Formatting' (Doc ID 2755741.1)Dokument2 SeitenApplies To:: Payment File Stuck in Status 'Created and Ready For Formatting' (Doc ID 2755741.1)JanardhanNoch keine Bewertungen

- 2019 SAP E-Document Mexico (E-Invoice + E-Payment)Dokument25 Seiten2019 SAP E-Document Mexico (E-Invoice + E-Payment)suryaNoch keine Bewertungen

- SEZOnline Release Notes V2 48 UnitsDokument27 SeitenSEZOnline Release Notes V2 48 Unitsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNoch keine Bewertungen

- E OfficeDokument22 SeitenE Officesumandas1963Noch keine Bewertungen

- ENPS - Contribution ManualDokument31 SeitenENPS - Contribution ManualSwati Rohan JadhavNoch keine Bewertungen

- Description: Tags: 0304CODVol5Sec1ImplementationGuidevSept03Dokument54 SeitenDescription: Tags: 0304CODVol5Sec1ImplementationGuidevSept03anon-96172Noch keine Bewertungen

- IFMISDokument41 SeitenIFMISstudentinfo121Noch keine Bewertungen

- T1 Netfile: 2020 Tax YearDokument34 SeitenT1 Netfile: 2020 Tax YearHimanshu MohtaNoch keine Bewertungen

- IRS Publication 4262Dokument312 SeitenIRS Publication 4262Francis Wolfgang UrbanNoch keine Bewertungen

- Latam: E-Invoicing and Vat ReportingDokument12 SeitenLatam: E-Invoicing and Vat ReportingJavier Spieler RomerolNoch keine Bewertungen

- EOffice Implementation Handbook NewDokument26 SeitenEOffice Implementation Handbook NewSuraj Singh RathoreNoch keine Bewertungen

- RMC No 5-2014 - Clarifying The Provisions of RR 1-2014Dokument18 SeitenRMC No 5-2014 - Clarifying The Provisions of RR 1-2014sj_adenipNoch keine Bewertungen

- Inroduction & Receipt CreationDokument22 SeitenInroduction & Receipt CreationM VIDYASAGARNoch keine Bewertungen

- Features of TaxDokument13 SeitenFeatures of TaxkarthikeyanwebtelNoch keine Bewertungen

- A Short Overview of The Technical ArchitectureDokument4 SeitenA Short Overview of The Technical ArchitectureNidhish VenuNoch keine Bewertungen

- 4 Eoffice Presentation Jammu ConferenceDokument21 Seiten4 Eoffice Presentation Jammu ConferencechjsbabuNoch keine Bewertungen

- User Guide FOR Electronic Filing of Tax Returns: ISO 9001:2015 CERTIFIEDDokument38 SeitenUser Guide FOR Electronic Filing of Tax Returns: ISO 9001:2015 CERTIFIEDJoseph PhaustineNoch keine Bewertungen

- EOffice EFile-PPT v.8Dokument38 SeitenEOffice EFile-PPT v.8lalitNoch keine Bewertungen

- EBIR Forms GuidelinesDokument103 SeitenEBIR Forms Guidelinescutiejen2167% (3)

- Aug 0048 00 Poll Data From Siemens PLC Using Ethernet ProtocolDokument20 SeitenAug 0048 00 Poll Data From Siemens PLC Using Ethernet ProtocolcementsaimNoch keine Bewertungen

- Oracle Hospitality Simphony: Installation GuideDokument68 SeitenOracle Hospitality Simphony: Installation Guidehaleem LastNoch keine Bewertungen

- Incorporation-SPICe+ AoA HelpDokument7 SeitenIncorporation-SPICe+ AoA HelpRamachandranPonnaguNoch keine Bewertungen

- Job Aid For Taxpayers How To Use The EBIRForms PackageDokument51 SeitenJob Aid For Taxpayers How To Use The EBIRForms PackagerhonamundoNoch keine Bewertungen

- 01 - Company Profile With ProductsDokument65 Seiten01 - Company Profile With ProductskarthikeyanwebtelNoch keine Bewertungen

- Eoffice - PresentationDokument26 SeitenEoffice - Presentationron19cNoch keine Bewertungen

- OBIEE SSO Concept and ConfigDokument12 SeitenOBIEE SSO Concept and ConfigRachel MathewNoch keine Bewertungen

- Email Services Deployment Administrator GuideDokument25 SeitenEmail Services Deployment Administrator GuideBrâHim HmNoch keine Bewertungen

- Elfiq Link Balancer Quick Web Guide v1 1Dokument39 SeitenElfiq Link Balancer Quick Web Guide v1 1rpluto100% (1)

- Oracle® MICROS Simphony Installation GuideDokument71 SeitenOracle® MICROS Simphony Installation GuideKo Ko AungNoch keine Bewertungen

- TaxProof UserManualDokument15 SeitenTaxProof UserManualSayam RoyNoch keine Bewertungen

- AP Document Parking FV60Dokument8 SeitenAP Document Parking FV60openid_XrRh7DTbNoch keine Bewertungen

- IVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1Dokument135 SeitenIVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1Sahidul Islam KhanNoch keine Bewertungen

- Pacer User GuideDokument7 SeitenPacer User GuideYolanda LewisNoch keine Bewertungen

- Template - TaxProof Submission Manual - 201819 PDFDokument15 SeitenTemplate - TaxProof Submission Manual - 201819 PDFJeet GogoiNoch keine Bewertungen

- EBIRForms-Job AidsDokument103 SeitenEBIRForms-Job AidsAdyNoch keine Bewertungen

- Features of TDSDokument13 SeitenFeatures of TDSkarthikeyanwebtelNoch keine Bewertungen

- E-Form Brochure PDFDokument2 SeitenE-Form Brochure PDFWajdi AlissawiNoch keine Bewertungen

- 15358-EN 09-21 LRDokument2 Seiten15358-EN 09-21 LRLuis Carlos VeraNoch keine Bewertungen

- Osn Punchout GuideDokument8 SeitenOsn Punchout GuideAmNe BizNoch keine Bewertungen

- Philhealth System-EPRSDokument44 SeitenPhilhealth System-EPRSadobopinikpikan40% (5)

- Technical Insight of AP Invoice With ImagingDokument9 SeitenTechnical Insight of AP Invoice With ImagingSwapNoch keine Bewertungen

- Faqs On EnetDokument26 SeitenFaqs On EnetNishit MarvaniaNoch keine Bewertungen

- PPAY MD070 Application Extensions Technical Design V1.0Dokument20 SeitenPPAY MD070 Application Extensions Technical Design V1.0Seenu DonNoch keine Bewertungen

- Description: Tags: 04SpringSession27Dokument12 SeitenDescription: Tags: 04SpringSession27anon-743325Noch keine Bewertungen

- Oracle Hospitality Simphony Fiscal Layer - Norway - Installation Manual 4.0.1.3Dokument41 SeitenOracle Hospitality Simphony Fiscal Layer - Norway - Installation Manual 4.0.1.3Ferdiyan Maulana Pratama100% (1)

- AP Invoice Wizard: BenefitsDokument6 SeitenAP Invoice Wizard: BenefitsMohammedMustafaNoch keine Bewertungen

- Fusion Finacials Cloud IntegrationDokument8 SeitenFusion Finacials Cloud IntegrationKRAVIPRANoch keine Bewertungen

- EPRS2.4 PresentationDokument80 SeitenEPRS2.4 PresentationjenelexNoch keine Bewertungen

- Authentication - What's New: Channels TechnologyDokument7 SeitenAuthentication - What's New: Channels TechnologyZakaria AlmamariNoch keine Bewertungen

- Erp Fusion Finacials Cloud Integration DsDokument8 SeitenErp Fusion Finacials Cloud Integration DsRajeshNoch keine Bewertungen

- Temenos Programing2022-04-19 at 7.30.41 PMDokument8 SeitenTemenos Programing2022-04-19 at 7.30.41 PMosamah abkar100% (1)

- Electronic Documents Brazil For UtilitiesDokument14 SeitenElectronic Documents Brazil For UtilitiesGleison RodriguesNoch keine Bewertungen

- 3kvdERP US en WP IntegrationwithOracleFusionDokument8 Seiten3kvdERP US en WP IntegrationwithOracleFusion1lvlup UpmanNoch keine Bewertungen

- 1b CH 12 Quiz&ansDokument9 Seiten1b CH 12 Quiz&ansMonique CabreraNoch keine Bewertungen

- Advanced Accounting Baker Test Bank - Chap015Dokument55 SeitenAdvanced Accounting Baker Test Bank - Chap015donkazotey89% (9)

- 1966annex G - I (RMO30-03) CONFIRMATION CERTIFICATEDokument6 Seiten1966annex G - I (RMO30-03) CONFIRMATION CERTIFICATEMonique CabreraNoch keine Bewertungen

- Contributions Payment Form-SSSDokument6 SeitenContributions Payment Form-SSSrhev63% (8)

- Basic Concepts (Cost Accounting)Dokument9 SeitenBasic Concepts (Cost Accounting)alexandro_novora6396Noch keine Bewertungen

- First Partn - Answer 2Dokument5 SeitenFirst Partn - Answer 2Monique CabreraNoch keine Bewertungen

- Basic Concepts (Cost Accounting)Dokument9 SeitenBasic Concepts (Cost Accounting)alexandro_novora6396Noch keine Bewertungen

- 1966annex G - I (RMO30-03) CONFIRMATION CERTIFICATEDokument6 Seiten1966annex G - I (RMO30-03) CONFIRMATION CERTIFICATEMonique CabreraNoch keine Bewertungen

- Incremental AnalysisDokument18 SeitenIncremental AnalysisMonique CabreraNoch keine Bewertungen

- Government AccountingDokument13 SeitenGovernment AccountingMonique Cabrera100% (1)

- The Demand For Audit and Other Assurance Services: Review Questions 1-1Dokument13 SeitenThe Demand For Audit and Other Assurance Services: Review Questions 1-1Monique CabreraNoch keine Bewertungen

- Batch 17 1st Preboard (P1) No AnswerDokument9 SeitenBatch 17 1st Preboard (P1) No AnswerMonique CabreraNoch keine Bewertungen

- Chapter 1 To 4Dokument27 SeitenChapter 1 To 4Karla Barbacena100% (1)

- Chapter 1 To 4Dokument27 SeitenChapter 1 To 4Karla Barbacena100% (1)

- AffidavitDokument1 SeiteAffidavitHanna PentiñoNoch keine Bewertungen

- New Syllabus For Executive and Professional ProgrammesDokument25 SeitenNew Syllabus For Executive and Professional ProgrammesRakeshNoch keine Bewertungen

- Department of Commerce: Sri Dev Suman Uttarakhand University Tehri GarhwalDokument29 SeitenDepartment of Commerce: Sri Dev Suman Uttarakhand University Tehri Garhwalpsychopath peopleNoch keine Bewertungen

- Indian Four Wheeler Segment - A ReportDokument6 SeitenIndian Four Wheeler Segment - A Reportsrini.srk83Noch keine Bewertungen

- Prelim Exam - Mac 421Dokument5 SeitenPrelim Exam - Mac 421Ezzz VeriNoch keine Bewertungen

- Bar Q and ADokument20 SeitenBar Q and AshakiraNoch keine Bewertungen

- RMC No. 35-2012 On Taxability of ClubsDokument1 SeiteRMC No. 35-2012 On Taxability of ClubsPilyang SweetNoch keine Bewertungen

- Ar2010 IrelandDokument76 SeitenAr2010 IrelandhenfaNoch keine Bewertungen

- Nature and Scope of GST: by Amandeep DrallDokument8 SeitenNature and Scope of GST: by Amandeep DrallAman SinghNoch keine Bewertungen

- GST Summary by Cma Tharun RajDokument122 SeitenGST Summary by Cma Tharun Rajrock rollNoch keine Bewertungen

- DARAZ PRICE CALCULATIONS (Fulfillment by Daraz) : Profit Margin AnalysisDokument5 SeitenDARAZ PRICE CALCULATIONS (Fulfillment by Daraz) : Profit Margin AnalysisAhsanNoch keine Bewertungen

- Edc V CirDokument40 SeitenEdc V CirLably ReuyanNoch keine Bewertungen

- Prelim. Module 2. Lesson 5 - 8 Rate, Tax, and Expenses (Legal Aspects) PDFDokument6 SeitenPrelim. Module 2. Lesson 5 - 8 Rate, Tax, and Expenses (Legal Aspects) PDFMARITONI MEDALLANoch keine Bewertungen

- Beza KebedeDokument113 SeitenBeza Kebedeabenezer nardiyasNoch keine Bewertungen

- HaveSumFunDokument16 SeitenHaveSumFunhantarto5844Noch keine Bewertungen

- ABAKADA GURO PARTY LIST V ERMITA DigestDokument4 SeitenABAKADA GURO PARTY LIST V ERMITA DigestAndrea Tiu100% (3)

- Agrani Bank LTD.: Statement of AccountDokument2 SeitenAgrani Bank LTD.: Statement of AccountBeximco Computers LTDNoch keine Bewertungen

- MATH6 - Q2 - Week 4 Finally Approved For PrintingDokument11 SeitenMATH6 - Q2 - Week 4 Finally Approved For PrintingMariel SalazarNoch keine Bewertungen

- Monthly VAT Return SampleDokument35 SeitenMonthly VAT Return SampleJohnHKyeyuneNoch keine Bewertungen

- TAX ANPC vs. BIR (FULL TEXT)Dokument11 SeitenTAX ANPC vs. BIR (FULL TEXT)Elle Alorra RubenfieldNoch keine Bewertungen

- Messers Destination: 1 645 Bank Transfer Before Shipment 30/03/2017 1 ofDokument1 SeiteMessers Destination: 1 645 Bank Transfer Before Shipment 30/03/2017 1 ofIdrissa MeiteNoch keine Bewertungen

- McDonald's Philippines Realty Corp. v. Commissioner of Internal RevenueDokument37 SeitenMcDonald's Philippines Realty Corp. v. Commissioner of Internal Revenueedcbess23Noch keine Bewertungen

- Almeda Vs CaDokument5 SeitenAlmeda Vs CaCamille GrandeNoch keine Bewertungen

- f6 Uk Specimen s16Dokument28 Seitenf6 Uk Specimen s16Waleed QasimNoch keine Bewertungen

- Tally Course Syllabus PDFDokument8 SeitenTally Course Syllabus PDFकरण साळुंकेNoch keine Bewertungen

- Bsa 2105 Atty. F. R. Soriano Value-Added TaxDokument2 SeitenBsa 2105 Atty. F. R. Soriano Value-Added Taxela kikayNoch keine Bewertungen

- 52 Recent Judgements STDokument131 Seiten52 Recent Judgements STvudatalj123Noch keine Bewertungen

- TaiwanCommercialGuide2011 Latest Eg TW 051449Dokument112 SeitenTaiwanCommercialGuide2011 Latest Eg TW 051449suksukNoch keine Bewertungen

- Ariba-Commerce Automation S4HANA2020 Set-Up EN XXDokument142 SeitenAriba-Commerce Automation S4HANA2020 Set-Up EN XXsivakven100% (1)

- GST Class Presentation SlidesDokument109 SeitenGST Class Presentation Slidesredbutterfly_766Noch keine Bewertungen

- International Commercial Invoice TemplateDokument3 SeitenInternational Commercial Invoice TemplatePhilip WathenNoch keine Bewertungen