Beruflich Dokumente

Kultur Dokumente

TD BANK-JUL-28-TD Economic-Teranet-National Bank House Price Index

Hochgeladen von

Miir ViirCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TD BANK-JUL-28-TD Economic-Teranet-National Bank House Price Index

Hochgeladen von

Miir ViirCopyright:

Verfügbare Formate

TD Economics

July 28, 2010

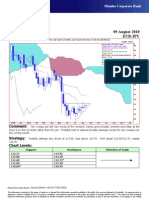

Data Release: CANADIAN HOME PRICES STILL STRONG IN Q2

• Canadian home prices rose by 1.3% M/M (or 17.0% annualized) in May, according to the composite

Teranet-NB House Price Index (HPI). The trailing 3-month M/M annualized trend pickup up to 10.1% in

May, from 5.2% in April.

• This represents the 13th consecutive rise in the index, which tracks repeat home sales in six major

metropolitan areas across the country. (The combination of these six markets accounted for 53% of the

Canadian housing stock as of Census 2006.).

• For a second consecutive month, all six cities surveyed reported monthly price gains in May. This was

led by Ottawa, where prices advanced by 2.3% M/M. On the flipside, the smallest monthly increase was

recorded in Halifax (0.7%).

• On a Y/Y basis, Canadian home prices were 13.6% higher, showing continued price acceleration in the

annual pace after the 12.9% Y/Y gain posted in April.

• After dropping by 8.9% peak-to-trough from August 2008 to April 2009 and rebounding by 14.4%

thereafter, the Teranet HPI stood 4.2% above its pre-recession peak as of May 2010. Five of the six

markets surveyed show prices have passed beyond – in a 3% to 9% range –their respective pre-

recession peak. On the flipside, while on a steady uptrend over the last 10 months, the Calgary HPI

remained 8.6% below its August 2007 peak.

Key Implications

• While it provides an accurate picture of the evolution of specific home values over time, the Teranet HPI

lags the standard average home price tabulated by the Canadian Real Estate Association (CREA). This

is mostly because the latter is directly sensitive to the volume of sales, and sales lead prices. Given its

track record vis-à-vis the CREA average price, we expect the Teranet HPI to ease a bit but still hover in

a 10-12% Y/Y band over the June-September period before easing to a mid-single digit pace by Q4. As

such, it should help confirm that Canadian home prices are stabilizing not only on a standard average

basis, but also on an individual unit (repeat sales) basis – reflecting a market balance shifting in favour

of potential buyers.

Pascal Gauthier, Senior Economist

416-944-5730

DISCLAIMER

This report is provided by TD Economics for customers of TD Bank Financial Group. It is for information purposes only and may not be appropriate for

other purposes. The report does not provide material information about the business and affairs of TD Bank Financial Group and the members of TD

Economics are not spokespersons for TD Bank Financial Group with respect to its business and affairs. The information contained in this report has

been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. The report contains economic analysis and views,

including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to

inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that

comprise TD Bank Financial Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any

loss or damage suffered.

Das könnte Ihnen auch gefallen

- Clear Capital Reports National Double DipDokument8 SeitenClear Capital Reports National Double DipLori Horton LincolnNoch keine Bewertungen

- April 2010 U.S. Building Market Intelligence Report: Building Stats For The Real Estate Market For This MonthDokument9 SeitenApril 2010 U.S. Building Market Intelligence Report: Building Stats For The Real Estate Market For This MonthdbeisnerNoch keine Bewertungen

- Freddie Mac August 2012 Economic OutlookDokument5 SeitenFreddie Mac August 2012 Economic OutlookTamara InzunzaNoch keine Bewertungen

- Morningstar - RobertDokument7 SeitenMorningstar - Robertcfasr_programsNoch keine Bewertungen

- 2010 0113 EconomicDataDokument11 Seiten2010 0113 EconomicDataArikKanasNoch keine Bewertungen

- Zero Hedge - A Look Back at The WeekDokument5 SeitenZero Hedge - A Look Back at The Weekzezorro100% (1)

- RCS Investments February Economic NotablesDokument2 SeitenRCS Investments February Economic NotablesRCS_CFANoch keine Bewertungen

- Quarterly Review NOV11Dokument22 SeitenQuarterly Review NOV11ftforee2Noch keine Bewertungen

- The World Economy... - 15/04/2010Dokument3 SeitenThe World Economy... - 15/04/2010Rhb InvestNoch keine Bewertungen

- Q2 2012 Charlottesville Nest ReportDokument9 SeitenQ2 2012 Charlottesville Nest ReportJim DuncanNoch keine Bewertungen

- Housing Report David Berson NationwideDokument8 SeitenHousing Report David Berson NationwideMike CroninNoch keine Bewertungen

- Property Barometer - Area-Value-Bands August 2015Dokument2 SeitenProperty Barometer - Area-Value-Bands August 2015Francois-Noch keine Bewertungen

- Breakfast With Dave - 052709Dokument8 SeitenBreakfast With Dave - 052709jobby jobNoch keine Bewertungen

- CRISIL SME Connect June 09Dokument28 SeitenCRISIL SME Connect June 09shikha1982Noch keine Bewertungen

- TD Bank-Aug-04-Cfib Sme Business Outlook SurveyDokument1 SeiteTD Bank-Aug-04-Cfib Sme Business Outlook SurveyMiir ViirNoch keine Bewertungen

- Nationwide'S Health of Housing Markets (Hohm) ReportDokument8 SeitenNationwide'S Health of Housing Markets (Hohm) ReportBarbara MillerNoch keine Bewertungen

- WMC 090427Dokument2 SeitenWMC 090427FlametreeNoch keine Bewertungen

- Pending Home SalesDokument2 SeitenPending Home SalesAmber TaufenNoch keine Bewertungen

- BMO Focus - 01-20-2012Dokument13 SeitenBMO Focus - 01-20-2012jrdawg88Noch keine Bewertungen

- Strategy 0518Dokument30 SeitenStrategy 0518derek_2010Noch keine Bewertungen

- Economics Group: Weekly Economic & Financial CommentaryDokument9 SeitenEconomics Group: Weekly Economic & Financial CommentaryRio PrestonniNoch keine Bewertungen

- Foxhall Capital Management, Inc.: The Foxhall Global OutlookDokument5 SeitenFoxhall Capital Management, Inc.: The Foxhall Global OutlookRoger LingleNoch keine Bewertungen

- Is It Up, Up, and Away For The Housing Industry?Dokument10 SeitenIs It Up, Up, and Away For The Housing Industry?jjy1234Noch keine Bewertungen

- Edmonton Home Values, July 2015Dokument2 SeitenEdmonton Home Values, July 2015Edmonton SunNoch keine Bewertungen

- Lane Asset Management Market Commentary For Q3 2017Dokument15 SeitenLane Asset Management Market Commentary For Q3 2017Edward C LaneNoch keine Bewertungen

- TD BANK-JUL-30-TD Economic-Canadian Real GDP CommentaryDokument1 SeiteTD BANK-JUL-30-TD Economic-Canadian Real GDP CommentaryMiir ViirNoch keine Bewertungen

- What Is GDP?: Kimberly AmadeoDokument44 SeitenWhat Is GDP?: Kimberly AmadeobhupenderkamraNoch keine Bewertungen

- Er20120413BullPhat Dragon ADokument1 SeiteEr20120413BullPhat Dragon AChrisBeckerNoch keine Bewertungen

- Housing Market IndexDokument7 SeitenHousing Market IndexVijay SwamiNoch keine Bewertungen

- Weekly Economic Commentar 10-17-11Dokument4 SeitenWeekly Economic Commentar 10-17-11monarchadvisorygroupNoch keine Bewertungen

- U.S. Weekly Financial Notes: Still Holding On: Economic ResearchDokument14 SeitenU.S. Weekly Financial Notes: Still Holding On: Economic Researchapi-227433089Noch keine Bewertungen

- 01-04-11 Breakfast With DaveDokument15 Seiten01-04-11 Breakfast With DavetngarrettNoch keine Bewertungen

- Nest Report Charlottesville: Q4 2011Dokument9 SeitenNest Report Charlottesville: Q4 2011Jonathan KauffmannNoch keine Bewertungen

- U.S. Housing Starts: The Downward Correction Continues: Rge Alert 21.7.2010 1Dokument34 SeitenU.S. Housing Starts: The Downward Correction Continues: Rge Alert 21.7.2010 1Raman MokhaNoch keine Bewertungen

- Losing Patience With Market's Fed Obsession: Better To Spend Your Time Focusing On Underlying Economic FundamentalsDokument7 SeitenLosing Patience With Market's Fed Obsession: Better To Spend Your Time Focusing On Underlying Economic Fundamentalsjjy1234Noch keine Bewertungen

- Less Even Expansion, Rising Trade Tensions: For ReleaseDokument9 SeitenLess Even Expansion, Rising Trade Tensions: For ReleaseTroyNoch keine Bewertungen

- The World Economy... - 21/5/2010Dokument3 SeitenThe World Economy... - 21/5/2010Rhb InvestNoch keine Bewertungen

- CRE Chartbook 4Q 2012Dokument11 SeitenCRE Chartbook 4Q 2012subwayguyNoch keine Bewertungen

- Jul 16 Erste Group Macro Markets UsaDokument6 SeitenJul 16 Erste Group Macro Markets UsaMiir ViirNoch keine Bewertungen

- The World Economy - 01/03/2010Dokument3 SeitenThe World Economy - 01/03/2010Rhb InvestNoch keine Bewertungen

- Ipommarch 15Dokument46 SeitenIpommarch 15Carolina RiveraNoch keine Bewertungen

- Eekly Conomic Pdate: Housing Market Cools Down in FebruaryDokument2 SeitenEekly Conomic Pdate: Housing Market Cools Down in Februaryapi-118535366Noch keine Bewertungen

- The World Economy... - 26/05/2010Dokument3 SeitenThe World Economy... - 26/05/2010Rhb InvestNoch keine Bewertungen

- Piper Report Q2Dokument11 SeitenPiper Report Q2JohnNoch keine Bewertungen

- U.S. Economic Forecast: The Summer WindDokument13 SeitenU.S. Economic Forecast: The Summer Windapi-227433089Noch keine Bewertungen

- Breakfast With Dave June 5Dokument8 SeitenBreakfast With Dave June 5variantperception100% (2)

- A Quarterly Forecast of U.S. Trade in Services and The Current Account, 2000-2003Dokument14 SeitenA Quarterly Forecast of U.S. Trade in Services and The Current Account, 2000-2003George PailyNoch keine Bewertungen

- Nedbank Se Rentekoers-Barometer Vir Mei 2015Dokument4 SeitenNedbank Se Rentekoers-Barometer Vir Mei 2015Netwerk24SakeNoch keine Bewertungen

- US Equity Strategy Q2 11Dokument8 SeitenUS Equity Strategy Q2 11dpbasicNoch keine Bewertungen

- Economic Snapshot For June 2011Dokument4 SeitenEconomic Snapshot For June 2011Center for American ProgressNoch keine Bewertungen

- Monthly Review of Indian Economy: April 2011Dokument36 SeitenMonthly Review of Indian Economy: April 2011Rahul SainiNoch keine Bewertungen

- Swiss Re Canada Economic Outlook 3Q19Dokument2 SeitenSwiss Re Canada Economic Outlook 3Q19Fox WalkerNoch keine Bewertungen

- 2016 Commercial Lending Trends SurveyDokument31 Seiten2016 Commercial Lending Trends SurveyNational Association of REALTORS®Noch keine Bewertungen

- Weekly Economic Commentary 3-26-12Dokument6 SeitenWeekly Economic Commentary 3-26-12monarchadvisorygroupNoch keine Bewertungen

- Weekly Economic Commentary 3-26-12Dokument11 SeitenWeekly Economic Commentary 3-26-12monarchadvisorygroupNoch keine Bewertungen

- 2015.10 Q3 CMC Efficient Frontier NewsletterDokument8 Seiten2015.10 Q3 CMC Efficient Frontier NewsletterJohn MathiasNoch keine Bewertungen

- The World Economy ... - 11/03/2010Dokument2 SeitenThe World Economy ... - 11/03/2010Rhb InvestNoch keine Bewertungen

- Quantum Strategy II: Winning Strategies of Professional InvestmentVon EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNoch keine Bewertungen

- AUG 11 UOB Global MarketsDokument3 SeitenAUG 11 UOB Global MarketsMiir ViirNoch keine Bewertungen

- Westpack AUG 11 Mornng ReportDokument1 SeiteWestpack AUG 11 Mornng ReportMiir ViirNoch keine Bewertungen

- AUG 11 DBS Daily Breakfast SpreadDokument6 SeitenAUG 11 DBS Daily Breakfast SpreadMiir ViirNoch keine Bewertungen

- AUG 10 UOB Global MarketsDokument3 SeitenAUG 10 UOB Global MarketsMiir ViirNoch keine Bewertungen

- AUG-10 Mizuho Technical Analysis EUR JPYDokument1 SeiteAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNoch keine Bewertungen

- AUG 10 UOB Asian MarketsDokument2 SeitenAUG 10 UOB Asian MarketsMiir ViirNoch keine Bewertungen

- AUG-10 Mizuho Technical Analysis GBP USDDokument1 SeiteAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNoch keine Bewertungen

- Danske Daily: Key NewsDokument4 SeitenDanske Daily: Key NewsMiir ViirNoch keine Bewertungen

- JYSKE Bank AUG 10 Corp Orates DailyDokument2 SeitenJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNoch keine Bewertungen

- AUG 10 DBS Daily Breakfast SpreadDokument8 SeitenAUG 10 DBS Daily Breakfast SpreadMiir ViirNoch keine Bewertungen

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDokument5 SeitenMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNoch keine Bewertungen

- AUG 10 Danske EMEADailyDokument3 SeitenAUG 10 Danske EMEADailyMiir ViirNoch keine Bewertungen

- JYSKE Bank AUG 09 Corp Orates DailyDokument2 SeitenJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNoch keine Bewertungen

- AUG-09-DJ European Forex TechnicalsDokument3 SeitenAUG-09-DJ European Forex TechnicalsMiir ViirNoch keine Bewertungen

- AUG 10 Danske FlashCommentFOMC PreviewDokument7 SeitenAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNoch keine Bewertungen

- Westpack AUG 10 Mornng ReportDokument1 SeiteWestpack AUG 10 Mornng ReportMiir ViirNoch keine Bewertungen

- ScotiaBank AUG 09 Daily FX UpdateDokument3 SeitenScotiaBank AUG 09 Daily FX UpdateMiir ViirNoch keine Bewertungen

- AUG-09 Mizuho Technical Analysis EUR JPYDokument1 SeiteAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNoch keine Bewertungen

- JYSKE Bank AUG 09 Market Drivers CurrenciesDokument5 SeitenJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNoch keine Bewertungen

- Jyske Bank Aug 09 em DailyDokument5 SeitenJyske Bank Aug 09 em DailyMiir ViirNoch keine Bewertungen

- A Profitable Fibonacci Retracement Trading Strategy PDFDokument8 SeitenA Profitable Fibonacci Retracement Trading Strategy PDFBasharat AliNoch keine Bewertungen

- Microeconomics ProjectDokument26 SeitenMicroeconomics ProjectMd. Asif ZamanNoch keine Bewertungen

- Aggregate PlanningDokument29 SeitenAggregate Planningj04preetNoch keine Bewertungen

- Red BullDokument3 SeitenRed BullsnehaoctNoch keine Bewertungen

- Letter To CM Two Pages 18th Nov 2019Dokument2 SeitenLetter To CM Two Pages 18th Nov 2019Das YalamanchiliNoch keine Bewertungen

- CSR Strategy For Sustainable Business Samy Odemilin and BamptonDokument16 SeitenCSR Strategy For Sustainable Business Samy Odemilin and BamptonabbakaNoch keine Bewertungen

- Chapter. 1 p1 Personal FinanceDokument12 SeitenChapter. 1 p1 Personal FinanceMPCINoch keine Bewertungen

- Chapter 1-5Dokument6 SeitenChapter 1-5Bien BibasNoch keine Bewertungen

- Business Combinations?: Multiple-Choice QuestionsDokument4 SeitenBusiness Combinations?: Multiple-Choice QuestionsEych Mendoza100% (1)

- 2.time Value of MoneyDokument17 Seiten2.time Value of MoneyaaNoch keine Bewertungen

- Chapter 1 IAPM-IntroductionDokument15 SeitenChapter 1 IAPM-IntroductionPrachi KulkarniNoch keine Bewertungen

- Hetzner 2021-02-09 R0012797297Dokument1 SeiteHetzner 2021-02-09 R0012797297Eduardo FilhoNoch keine Bewertungen

- Gated Communities and Property ValuesDokument36 SeitenGated Communities and Property ValuesScott Schaefer75% (4)

- Case Study in MarketingDokument4 SeitenCase Study in Marketingjay daveNoch keine Bewertungen

- Balance Sheet ExamplesDokument10 SeitenBalance Sheet Examples9036673667Noch keine Bewertungen

- Theory of Financial Risk and Derivative Pricing - From Statistical Physics To Risk Management (S-B) ™Dokument6 SeitenTheory of Financial Risk and Derivative Pricing - From Statistical Physics To Risk Management (S-B) ™jezNoch keine Bewertungen

- 1 Ch. 19 Strategic Performance ProblemDokument1 Seite1 Ch. 19 Strategic Performance ProblemAartiNoch keine Bewertungen

- Far - 1st Quiz Midterm - Ay 2019-2020Dokument1 SeiteFar - 1st Quiz Midterm - Ay 2019-2020Renalyn Paras33% (3)

- Project Report Cost of CapitalDokument37 SeitenProject Report Cost of CapitalHarmanDeepNoch keine Bewertungen

- 7399352Dokument30 Seiten7399352Amit BhagatNoch keine Bewertungen

- Strategic Management of Market Niches A Model FrameworkDokument240 SeitenStrategic Management of Market Niches A Model FrameworksobhaNoch keine Bewertungen

- Indenting (HM)Dokument3 SeitenIndenting (HM)Mani JatanaNoch keine Bewertungen

- Elementary Entry Test PDFDokument5 SeitenElementary Entry Test PDFMadalina BusoiNoch keine Bewertungen

- Irr, NPV, PB, ArrDokument54 SeitenIrr, NPV, PB, ArrSushma Jeswani Talreja100% (3)

- Cost Volume Profit AnalysisDokument23 SeitenCost Volume Profit Analysismanchinial2Noch keine Bewertungen

- Excalibur Royale and Pantera Privé Announce Formation of A Strategic Alliance in Natural Color Diamond IndustryDokument4 SeitenExcalibur Royale and Pantera Privé Announce Formation of A Strategic Alliance in Natural Color Diamond IndustryPR.comNoch keine Bewertungen

- Chapter 1: Financial Management and Financial ObjectivesDokument15 SeitenChapter 1: Financial Management and Financial ObjectivesAmir ArifNoch keine Bewertungen

- Perfect MarketDokument3 SeitenPerfect MarketArooj FatimaNoch keine Bewertungen

- Tata Chemicals FinalDokument38 SeitenTata Chemicals FinalAshutosh Kumar100% (1)

- Product Project Report On Gesh LighterDokument68 SeitenProduct Project Report On Gesh LighterRohit Sevra50% (2)