Beruflich Dokumente

Kultur Dokumente

Proposed Bureau of Customs Order On Security To Guarantee Payment of Duties and Taxes

Hochgeladen von

PortCallsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Proposed Bureau of Customs Order On Security To Guarantee Payment of Duties and Taxes

Hochgeladen von

PortCallsCopyright:

Verfügbare Formate

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF CUSTOMS

MANILA 1099

CUSTOMS ADMINISTRATIVE ORDER (CAO)

NO. ________________

SUBJECT: SECURITY TO GUARANTEE PAYMENT OF DUTIES AND TAXES

AND OTHER OBLIGATIONS

INTRODUCTION. This Customs Administrative Order (CAO) implements Sections

1506 and 1507, Chapter 2 of Title XV; other related provisions of Republic Act No.

10863, otherwise known as the Customs Modernization and Tariff Act (CMTA), and

all other pertinent laws, rules and regulations.

Section 1. Scope. This CAO applies to all forms of security required to guarantee

payment of duties and taxes and other obligations provided for under the CMTA and

other existing rules and regulations.

Section 2. Objectives.

2.1. To provide the guidelines in the posting and utilization of security to

guarantee the payment of duties and taxes and other obligations

provided for under the CMTA and other existing rules and regulations.

2.2. To ensure that the interest of the government are amply protected with

the securities posted.

2.3. To provide a mechanism for the monitoring, accounting, enforcement

and prompt settlement of bonded obligations.

2.4. To establish and implement a security management and control system

making full use of information and communications technology (ICT).

Section 3. Definition of Terms. For purposes of this CAO, the following terms

shall be defined as follows:

3.1. Co-loading shall refer to agreement between two (2) or more

international or domestic sea carriers whereby a sea carrier bound for a

Page 1 of 14 CAO No.______

specified destination agrees to load, transport, and unload the container

van or cargo of another carrier bound for the same destination.1

3.2. Express Consignment shall refer to consolidated air shipments of

articles/goods which are time-sensitive in character, usually under a

door-to-door service arrangement with on-time delivery commitment,

which are shipped under a master air waybill (MAWB) consigned to

Express Cargo Operator (ECO).2

3.3. Free Zones shall refer to special economic zones registered with the

Philippine Economic Zone Authority (PEZA) under Republic Act No. 7916,

as amended, duly chartered or legislated special economic zones and

freeports such as Clark Freeport Zone; Poro Point Freeport Zone; John

Hay Special Economic Zone and Subic Bay Freeport Zone under Republic

Act No. 7227, as amended by Republic Act No. 9400; the Aurora Special

Economic Zone under Republic Act No, 9490, as amended; the Cagayan

Special Economic Zone and Freeport under Republic Act No. 7922; the

Zamboanga City Special Economic Zone under Republic Act No. 7903;

the Freeport Area of Bataan under Republic Act No. 9728; and such other

freeports as established or may be created by law.3

3.4. Free Zone Locator shall refer to a sole proprietorship, partnership

corporation or entity duly registered with the Free Zone Authorities and

issued a Certificate of Registration and/or Tax Exemption that is not

expired or has not been revoked, suspended or cancelled.4

3.5. Irrevocable Letter of Credit shall refer to a Letter of credit in which

the specified payment is guaranteed by the bank if all terms and

conditions are met by the drawee and which cannot be revoked without

joint agreement of both the buyer and the seller.5

3.6. Provisional Goods Declaration shall refer to the lodgment of goods

by a declarant who does not have all the information or supporting

documents required to complete the goods declaration. Provided, that it

substantially contains the necessary information required by the Bureau

and the declarant undertakes to complete the information or submit the

supporting documents within forty-five (45) days from the filing of the

1

RA No. 10668 An Act Allowing Foreign Vessels To Transport And Co-Load Foreign Cargoes For Domestic

Transshipment And For Other Purposes, Section 2 (a)

2

Customs Memorandum Order 46-1998, Section 3.1.1

3

CMTA, Title I, Chapter 2, Section 102 (w)

4

Draft CAO on Rules and Regulations on the Admission, Movement and Withdrawal of Goods in Free Zones

5

cf. Glossary of Customs and Trade Terms

Page 2 of 14 CAO No.______

provisional goods declaration, which period may be extended by the

Bureau for another forty five (45) days for valid reasons.6

3.7. Security shall refer to any form of guaranty such as surety bond, cash

bond and standby letter of credit or irrevocable letter of credit which

ensures the satisfaction of an obligation to the Bureau.7

3.8. Standby Letter of Credit shall refer to any arrangement, however

named or described whereby a bank (the Issuing Bank) acting at the

request and on the instructions of a customer (the Applicant) or on its

own behalf to make a payment to or to the order of a third party (the

Beneficiary), or is to accept and pay bills of exchange (Draft) drawn by

the Beneficiary or authorizes another bank to effect such payment, or to

accept and pay such bills of exchange or authorizes another bank to

negotiate against stipulated document(s), provided that the terms and

conditions of the Credit are complied with.8

3.9. Tentative Assessment shall refer to the assessment of a provisional

goods declaration pending final readjustment and submission by the

declarant of the additional information or documentation required to

complete the declaration within the period provided in Section 403 of

the CMTA.9

3.10. Transit shall refer to the customs procedure under which goods, in

its original form, are transported under customs control from one

customs office to another, or to a free zone.10

Section 4. General Provisions.

4.1. Form of Security. Unless specifically prescribed under this CAO or

other existing rules and regulations, any party required to provide

security to guaranty the payment of duties and taxes and other

obligations shall have the option to choose from any of the following

forms of security:11

4.1.1. Surety bond

4.1.2. Cash bond

4.1.3. Standby letter of credit or irrevocable letter of credit

4.1.4. Any other acceptable forms of security.

6

cf. CMTA, Title IV, Chapter 1, Section 403

7

CMTA, Title I, Chapter 2, Section 102 (mm)

8

cf. The Uniform Customs and Practice, Article 2, UCP 500

9

cf. CMTA, Title IV, Chapter 3, Section 426.

10

cf. CMTA, Title I, Chapter 2, Section 102 (rr)

11

cf. CMTA, Title XV, Section 1507

Page 3 of 14 CAO No.______

4.2. Amount of Security to be Posted. Unless otherwise provided under

this CAO or other existing rules and regulations, the required amount of

security shall be the lowest possible and shall not exceed the imposable

duties, taxes and other charges.12 For purposes of posting of security

required under this CAO charges as used herein shall be limited to the

administrative charges being collected e.g. IPF, CDS, CSF, etc.

4.3. General Security. In cases where securities are required to be given

under the provisions of this Order and related customs laws, the District

Collector, instead of requiring separate special security where

transactions of a particular party are numerous, may accept general

security extending over such periods of time and covering such

transactions of the party in question as may be satisfactory to the District

Collector.13

The District Collector may accept only a general security from declarants

who regularly declare goods at different offices in customs territory if

satisfied that an obligation to the Bureau will be fulfilled and under such

terms and conditions as may be prescribed by regulation.14

4.4. Cancellation of Security. When the obligations under which the

security was required has been satisfied, the security shall be cancelled

immediately.15

Section 5. When Security is Required. To guarantee the payment of duties

and taxes and other obligations to the Bureau, the District Collector shall require the

posting of security under the following:

5.1. Release of Shipment under Provisional Declaration. Goods under

provisional goods declaration may be released upon posting of the

required security equivalent to the amount ascertained to the applicable

duties and taxes.16

5.2. Release of Goods subject to Dispute Settlement. The District

Collector may allow the release of the shipment under tentative

assessment upon posting of security equivalent to the duties and taxes

due on goods.17

5.3. Release of Shipment pending Laboratory Analysis. When the

Bureau requires laboratory analysis of samples, detailed technical

documents or expert advice, it may release the goods before the results

12

cf. CMTA, Title XV, Section 1507

13

CMTA, Title XV, Chapter 2, Section 1506

14

cf. CMTA, Title XV, Chapter 2, Section 1507, 2nd paragraph

15

cf. CMTA, Title XV, Chapter 2, Section 1507, 3rd paragraph

16

cf. CMTA, Title IV, Chapter 1, Section 403 and Chapter 3, Section 426

17

CMTA, Title IV, Chapter 3, Section 425 in relation to Section 102 (qq)

Page 4 of 14 CAO No.______

of such examination are known after posting of sufficient security by the

importer. Provided, that the goods are not prohibited or restricted.18

5.4. Express Consignment. Express shipments of accredited air express

cargo operators may be released prior to the payment of the duty, tax

and other charges upon posting of a sufficient security.19

5.5. Shipment under Warehousing Entries. For goods declared in the

entry for warehousing in CBWs, the District Collector shall require the

importer to post a sufficient security equivalent to the computed duties

and taxes and other charges conditioned upon the withdrawal of the

goods within the period prescribed under Section 811 of the CMTA or

the payment of the duties and taxes and other charges and compliance

with all the importation requirements.20

5.6. Transit of Goods to Free Zone Locators. For goods intended for

transit to Free Zones, the District Collector of the port of discharge shall

require Free Zone Locators to post a General Transportation Surety Bond

(GTSB) for the immediate and faithful delivery of the goods covered by

the Goods Declaration for transit to its destination.21

5.7. Carrier's Security. Carriers that transport imported goods that shall be

placed under customs transit from a port of entry to other ports, shall

post a general transportation security amounting to at least fifty

thousand pesos (50,000.00). Such security shall ensure the complete

and immediate delivery of goods to the customs officer at the port of

destination and the payment of pertinent customs charges and expenses

and other transfer costs. The amount of the security may be adjusted

by the Commissioner, upon approval of the Secretary of Finance.22

5.8. Transit of Goods under Co-loading Act. Goods intended for transit

covered by Republic Act No. 10668, otherwise known as An Act Allowing

Foreign Vessels to Transport and Co-Load Foreign Cargoes for Domestic

Transshipment and for Other Purposes, shall not be subject to the

payment of duties and taxes at the port of entry. Provided, that any

conditions and security required by the Bureau are complied with.23

5.9. Release of Goods pending Ascertainment of the Accuracy of the

Declared Value. If in the course of determining the dutiable value of

imported goods, it becomes necessary to delay the final determination

of such dutiable value, the importer shall nevertheless be able to secure

the release of the imported goods upon posting of a sufficient security

18

cf. CMTA, Title IV, Chapter 3, Section 431

19

cf. CMTA, Title IV, Chapter 4, Section 439

20

CMTA, Title VIII, Chapter 2, Section 808

21

cf. BOC-PEZA JMO No. 1-2015, 7 subsection (a)

22

cf. CMTA, Title VI, Chapter 1, Section 602

23

cf. CMTA, Title VI, Chapter 1, Section 601

Page 5 of 14 CAO No.______

in an amount equivalent to the duties and taxes in dispute conditioned

on the payment of additional duties and taxes, if any, as may be

determined: Provided, That prohibited goods shall not be released under

any circumstance.24

5.10. Release of Goods pending Ascertainment of the Accuracy of the

Declared Value. If in the course of determining the dutiable value of

imported goods, it becomes necessary to delay the final determination

of such dutiable value, the importer shall nevertheless be able to secure

the release of the imported goods upon posting of a sufficient security

in an amount equivalent to the duties and taxes in dispute conditioned

on the payment of additional duties and taxes, if any, as may be

determined: Provided, That prohibited goods shall not be released under

any circumstance.25

5.11. Release of Conditionally Tax and/or Duty Free Importations.

Upon favorable recommendation of the DOF, conditionally free

importations under Section 800 paragraphs (b), (d), (h), (j), (k), (n),

(r), and (z) may be released upon posting of security in an amount equal

to one hundred percent (100%) of the ascertained duties and taxes

and other charges thereon conditioned upon the re-exportation thereof

within period stated therein or payment of duties and taxes and other

charges and compliance with other conditions required therein.26

However, in case of importations under Section 800 paragraph (h), the

Bureau may allow the importer to submit a written commitment to re-

export the goods within three (3) months from the date of acceptance

of the goods declaration.

5.12. Conditional Release of Shipments Arriving in Advance.

Shipments of Returning Resident or returning OFW arriving in advance

of their actual date of arrival and without a request for pre-verification

shall be tentatively assessed and conditionally released upon the posting

of a cash bond equivalent to one hundred percent (100%) of the

assessed duties and taxes due, unless the shipment is entered under

Section 800 (g) Chapter I, Title VIII, of the CMTA.

The Returning Resident or OFW must, within forty-five (45) days from

his arrival but not to exceed sixty (60) days from the release of the

shipment, submit to the Bureau the TEC issued by the DOF to support

his entitlement to the privilege. Failure to do so shall cause the Bureau

24

cf. CMTA, Title VII, Chapter 1, Section 707

25

cf. CMTA, Title VII, Chapter 1, Section 707

26

cf. CMTA, Title VIII, Chapter 1, Section 800

Page 6 of 14 CAO No.______

to forfeit the bond to answer for the payment of the duties and taxes

due thereon.

The same procedure may be availed of for accompanied baggage or

those arriving after the date of return if the clearance is not yet secured

from the Commissioner.27

5.13. Posting of Performance Bond with the Bureau. To protect the

interest of the government the District Collector may require any party

to post security for the faithful compliance of their obligations with the

Bureau under existing laws rules and regulations.28

Section 6. Cash bond as a Form of Security.

6.1. Treatment of Cash Bond. Deposited Cash Bond shall be proceeded

against as follows:

6.1.1. If upon completion of the assessment or final decision results in

adjustments of the duties and taxes and other charges in favor

of the government, or when the importer fails to comply with the

conditions of the security, the following shall be observed: 29

a. If the amount of the cash bond is equal to the amount of

duties and taxes due, the same shall be receipted and

remitted to the General Fund.

b. If the amount of the cash bond is more than the amount of

duties and taxes due, the same shall be receipted and

remitted to the General Fund while the excess shall be

refunded to the importer in the form of a check issued by

the Bureau.

c. If the amount of the cash bond is less than the amount of

duties and taxes due, the same shall be receipted and

remitted to the General Fund and a demand letter shall be

issued for the balance thereof.

6.1.2. If the completed assessment or the final decision is in favor of

the importer, or when the conditions under which the cash bond

was required has been satisfied, the amount shall be refunded

to the importer in the form of a check issued by the Bureau.30

27

cf. CAO 6-2016, Section 9

28

cf. CMTA, Title VIII, Chapter 2, Section 801

29

cf. CMO 4-99, Section 3.2.1

30

cf. CMO 4-99, Section 3.2.4

Page 7 of 14 CAO No.______

6.2. Accounting and Monitoring.

6.2.1. The Administrative Division or equivalent office in the port shall

establish and maintain a system for the proper accounting and

monitoring of all cash bonds posted as guaranty.

6.2.2. The District Collector shall institute and implement internal

control mechanisms for the maintenance and disposition of cash

bonds and submit periodic reports to the office of the

Commissioner on the status thereof.

6.3. Special Trust Fund Account. Cash bonds shall be deposited in a

Special Trust Fund Account to be managed by the Bureau of Treasury.31

6.4. General Fund. All final payments of additional duties and taxes and

other charges shall be receipted and remitted to the General Fund of the

Bureau of the Treasury through authorized government banks following

the accounting and auditing rules and regulations on revenue

collections.32

Section 7. Standby Letter of Credit or Irrevocable Letter of Credit as a

Form of Security.

7.1. Authorized Banking Institutions. Only Authorized Agent Banks

Banking Institutions duly accredited by the Bureau are authorized to

issue letter of credit or Irrevocable Letter of Credit.

7.2. Treatment of Standby letter of Credit or Irrevocable Letter of

Credit.

7.2.1. If upon completion of the assessment or final decision results in

adjustments of the duties and taxes and other charges in favor

of the government, or when the importer fails to comply with

the conditions of the security, the amount shall be immediately

settled by the bank upon notice without the need of a demand

letter from the District Collector.

7.2.2. If the completed assessment or the final decision in favor of the

importer, or when the conditions under which the Standby

Letter of Credit or Irrevocable Letter of Credit was required has

been satisfied, the same shall be cancelled.

7.3. Accounting and Monitoring.

31

CMO 4-99, Section 3.1

32

CMO 4-99, Section 3.4

Page 8 of 14 CAO No.______

7.3.1. The Bonds Division or equivalent office in the port shall establish

and maintain a system for the proper accounting and

monitoring of all Standby Letter of Credit or Irrevocable Letter

of Credit posted as guaranty.33

7.3.2. The District Collector shall institute and implement internal

control mechanisms for the maintenance and disposition of

Standby Letter of Credit or Irrevocable Letter of Credit and

submit periodic reports to the office of the Commissioner on the

status thereof.34

Section 8. Surety Bonds as a Form of Security.

8.1. Authority to Transact Business as Surety Company (ATBAS) -

Only surety companies granted ATBAS shall be allowed to issue surety

bonds with the Bureau.

8.1.1. Requirements/Qualifications. Only surety companies in

good standing with the Bureau of Customs (BOC) shall qualify

for ATBAS in accordance with this Order.35 To be in good

standing, a surety company:36

a. Must have an authority from the Office of the President to

engage in surety business;37

b. Must be a holder of a Certificate of Authority duly issued by

the Insurance Commission, which must be valid and

effective at the time of application/renewal and for the

duration of the period applied for;38

c. Must not have, as an entity by itself, any due and

demandable liabilities with BOC at the time of the

application/renewal;39

d. Must have settled at least 70% of its outstanding obligations

as a surety company of persons/entities having transactions

with BOC, if any, as of the first day of the immediately

preceding quarter (e.g., as of July 1 for application for

accreditation for the 4th Quarter).40

33

cf. CAO 1-1999, Section 2.4

34

CAO 1-1999, Section 2.5

35

CMO 22-2003, Section 3.1

36

CMO 22-2003, Section 3.2

37

CMO 22-2003, Section3.2.1

38

CMO 22-2003, Section 3.2.2

39

CMO 22-2003, Section 3.2.3

40

CMO 22-2003, Section 3.2.4

Page 9 of 14 CAO No.______

In the computation of the 30% threshold of unsettled

obligations, all accounts on bonds of a surety firm shall be

considered up to the extent of the amount unpaid or unsettled,

including but not limited to accounts on bonds:

i. That are subject of existing compromise or

staggered payment arrangements;

ii. That are subject of pending court litigation;

iii. That have been sequestered from bond principals,

importers or consignees;

iv. That have been issued involving valuation and

classification issues/cases.41

8.1.2. Applications for ATBAS. Applications of surety companies

shall be filed with and processed by the Bonds Division of the

Port where the surety companies wish to be accredited,

reviewed by the Collection Service, and upon the latter's

recommendation shall be approved by the District Collector

concerned.42

No bonds shall be honored or accepted by any port unless

issued by a surety company accredited in accordance with this

Order, covering transactions falling within the jurisdiction of the

collection district of the port where it is accredited, and within

the period covered by its accreditation.43

8.1.3. Period of Validity of ATBAS; Renewal. The accreditation of

the surety company shall be good and effective for a period of

one quarter, renewable every quarter thereafter in accordance

with this Order. For this purpose, a calendar year is divided as

follows: 1st Quarter, January-March; 2nd Quarter, April-June;

3rd Quarter, July-September; 4th Quarter, October-

December.44

8.2. Treatment of Surety Bond.

8.2.1. If upon completion of the assessment or final decision results in

adjustments of the duties and taxes and other charges in favor

of the government, or when the importer fails to comply with

the conditions of the security, the Chief Bonds Division or

equivalent office shall cause the issuance of the Demand Letter

41

CMO 22-2003, Section 4.1.3

42

CMO 22-2003, Section 3.4

43

CMO 22-2003, Section 3.5

44

CMO 22-2003, Section 3.3

Page 10 of 14 CAO No.______

addressed to the importer and surety company to be signed by

the District Collector.

8.2.2. If the completed assessment or the final decision in favor of the

importer, or when the conditions under which the Surety Bond

was required has been satisfied, the Surety Bond shall be

cancelled.

8.3. Penalties for Breach of Bonds.45

8.3.1. Late Re-exportation:

8.3.1.1. P 20,000.00 or 2% per month of the collectible duties,

taxes and other charges whichever is higher counted

from the date of expiration of the bond to the date of

re-exportation.

8.3.1.2. After the lapse, of six (6) months from expiry date,

the penal amount of the bond shall be collected if no

re-exportation is made, and in addition thereto 2%

per month of the collectible duties and taxes shall be

collected.

8.3.2. Late payment of duties and taxes. P 20,000.00 or 2% per

month whichever is higher of the collectible duties, taxes and

other charges, counted from date of expiration of the

chargeable bond or bonds, up to the date of actual payment of

duties and taxes. Nothing herein specified shall preclude the

Collector of Customs concerned to proceed against the bond

after expiration of the period stipulated if he deemed it

necessary to protect the interest of the government.

8.3.3. Late extension of re-export bonds under Section 800

CMTA and other existing laws, rules and regulations.

Surcharge for late filing of request for extension to re-export

after the first six (6) months period has lapsed shall be imposed:

8.3.3.1. P 20,000.00 or 2% per month of the collectible duties

and taxes whichever is higher, counted from the date

of expiration of bond up to the date of filing and

acceptance of the request for extension;

8.3.3.2. The penal amount of the bond shall be imposed if

there is no payment of duties and taxes or re-

exportation after six (6) months from the expiration

45

cf. CAO 5-1991 with modification, amount of penalty adjusted in accordance with GAAP (Generally Accepted

Accounting Principle :12% per annum compounded annually)

Page 11 of 14 CAO No.______

date of the bond, and in addition thereto 2% per

month of the collectible duties and taxes shall be

collected.

8.4. Accounting and Monitoring.

8.4.1. The Bonds Division or equivalent office in the port shall establish

and maintain a system for the proper accounting and

monitoring of all surety bonds posted as guaranty.

8.4.2. The District Collector shall institute and implement internal

control mechanisms for the maintenance and disposition of

surety bonds and submit periodic reports to the office of the

Commissioner on the status thereof.

8.5. Forfeiture of Bonds. Upon failure to settle the bonded obligations

despite issuance of demand letters the Chief, Bonds Division or its

equivalent unit thru the District Collector concerned shall recommend

the immediate issuance of the order of forfeiture of the bonds to the

Commissioner of Customs.46

8.6. Other Actions/Sanctions. The District Collector shall recommend to

the Commissioner of Customs through the Legal Service a course of

action to ensure payment of the obligation of the importer and may take

such other action for this purpose, including the filing of the collection

case and/or forfeiture of the bonds, suspension/cancellation of

accreditation, or non-renewal of the accreditation of the surety

company.47

Section 9. Periodic Review. Unless otherwise provided, this CAO shall be

reviewed every three (3) years and be amended or revised, if necessary.

Section 10. Repealing Clause. This CAO specifically amends or repeals previously

issued CAOs and CMOs which are inconsistent with the provisions therein.

Section 11. Separability Clause. If any part of this CAO is declared

unconstitutional or contrary to existing laws, other parts not so declared shall remain

in full force or effect.

Section 12. Effectivity. This CAO shall take effect after fifteen (15) days after its

publication at the Official Gazette or a newspaper of national circulation.

The Office of National Administrative Register (ONAR) of the UP Law center shall be

provided three (3) certified copies of this CAO.

46

cf. CMO 8-2007, (I) 1st paragraph

47

CAO 12-2003, Section 8

Page 12 of 14 CAO No.______

NICANOR E. FAELDON

Commissioner

Approved:

CARLOS G. DOMINGUEZ III

Secretary

Informational Section. As the title denotes this section only provides information

and does not give rise to any substantive or formal rights or obligations.

1. History. This is the first CAO dealing exclusively to all forms of security required

to guarantee payment of duties and taxes and other charges.

2. Related Policies.

Page 13 of 14 CAO No.______

Customs Administrative Order No. 5-91 Amended Rate Schedule on

the Imposition of Surcharges for Breach of Bond.

Customs Administrative Order 1-1999 "Utilizing Domestic Letters of

Credit issued by Reputable Financial Institutions as Guarantee for

imports subject to Re-Exportation amending CAO No. 5-98".

Customs Administrative Order No. 4-1999 Treatment of Cash/Check

Guarantee for Tentatively Released Shipment or Submission of Required

Documents to secure Payment of Duties and Taxes and Other Charges

Customs Administrative Order 12-2003 "Performance of Obligation

under Warehousing Bond and Liquidation of the Warehousing Entry,

providing Penalties therefore".

Customs Memorandum Order 22-2003 Quarterly Accreditation of

Surety Companies and Renewal of Accreditation.

Customs Memorandum Order 7-2007 Supplemental Provisions to CMO

22-2003, Quarterly Accreditation of Surety Companies and Renewal of

Accreditation.

Customs Memorandum Order 8-2007 "Addendum to CMO No. 28-90,

Procedure in Forfeiture of Bonds".

3. Webpage, Forms, Handbooks and other References.

Republic Act No. 10863 Customs Modernization and Tariff Act

www.customs.gov.ph

Page 14 of 14 CAO No.______

Das könnte Ihnen auch gefallen

- Entry Lodgement and Cargo Clearance ProcessDokument36 SeitenEntry Lodgement and Cargo Clearance ProcessNina Bianca Espino100% (1)

- Cao-01-2019 Post Clearance Audit and Prior Disclosure ProgramDokument32 SeitenCao-01-2019 Post Clearance Audit and Prior Disclosure Programlaila ursabiaNoch keine Bewertungen

- Entry Lodgement and Cargo Clearance Process PDFDokument36 SeitenEntry Lodgement and Cargo Clearance Process PDFHiro TanamotoNoch keine Bewertungen

- Section 1Dokument46 SeitenSection 1Luke CruzNoch keine Bewertungen

- VALUATION METHOD 1 Part 1Dokument5 SeitenVALUATION METHOD 1 Part 1Lloyd AniñonNoch keine Bewertungen

- CDP Long QuizDokument26 SeitenCDP Long QuizElaine Antonette RositaNoch keine Bewertungen

- TAR2Dokument4 SeitenTAR2Angelica RoseNoch keine Bewertungen

- Alert and Hold OrderDokument3 SeitenAlert and Hold OrderMary SapphireNoch keine Bewertungen

- Request For Release Under Tentative AssessmentDokument1 SeiteRequest For Release Under Tentative AssessmentRusiel PanchoNoch keine Bewertungen

- BOC CMO 32-2017 Reactivation of The Post Clearance Audit Group of The Bureau of CustomsDokument3 SeitenBOC CMO 32-2017 Reactivation of The Post Clearance Audit Group of The Bureau of CustomsPortCalls100% (2)

- Cao 1-2009 - Revised Rules For The Estab. of CBWDokument10 SeitenCao 1-2009 - Revised Rules For The Estab. of CBWBertGeronMindanao100% (3)

- Goods Subject For Consumption Under Formal Entry ProcessDokument13 SeitenGoods Subject For Consumption Under Formal Entry ProcessElaine Antonette RositaNoch keine Bewertungen

- Post Clearance Audit QuizDokument10 SeitenPost Clearance Audit QuizJeammuel ConopioNoch keine Bewertungen

- Quick Notes PezaDokument8 SeitenQuick Notes PezaAlexandra GarciaNoch keine Bewertungen

- INSTRUCTION: Select The Correct Answer For Each of The Following Questions. Mark Only One Answer For Each Item by 1X40 40 Points Multiple ChoiceDokument5 SeitenINSTRUCTION: Select The Correct Answer For Each of The Following Questions. Mark Only One Answer For Each Item by 1X40 40 Points Multiple ChoiceCherry GalosmoNoch keine Bewertungen

- Tariff and Customs Code of The Philippines - Test BankDokument3 SeitenTariff and Customs Code of The Philippines - Test BankTyrelle CastilloNoch keine Bewertungen

- Free Zones and TransitDokument8 SeitenFree Zones and TransitCelestino Sabela Peralta Jr.Noch keine Bewertungen

- RA 7916 - The Special Economic Zone Act of 1995 (IRR)Dokument23 SeitenRA 7916 - The Special Economic Zone Act of 1995 (IRR)Jen AnchetaNoch keine Bewertungen

- TCCP v. CMTADokument40 SeitenTCCP v. CMTAIvan LuzuriagaNoch keine Bewertungen

- Actual Port ChargesDokument2 SeitenActual Port ChargesWelvic B. TagodNoch keine Bewertungen

- 11-T-11 Admin & Judicial ProceduresDokument22 Seiten11-T-11 Admin & Judicial ProceduresCherrylyn CaliwanNoch keine Bewertungen

- BSCA Refresher Quiz 1Dokument23 SeitenBSCA Refresher Quiz 1Jomar Catapang VitoNoch keine Bewertungen

- CHAPTER 12 - BOI and PEZA Registered EntitiesDokument19 SeitenCHAPTER 12 - BOI and PEZA Registered EntitiesEmerwin Dela PeňaNoch keine Bewertungen

- Price Tag Laws in The PhilippinesDokument2 SeitenPrice Tag Laws in The PhilippinesCjhay MarcosNoch keine Bewertungen

- Chap-1 The Global Economy: What Is Trade?Dokument38 SeitenChap-1 The Global Economy: What Is Trade?Bjay BartolomENoch keine Bewertungen

- Ra 9280Dokument7 SeitenRa 9280Jay-arr ValdezNoch keine Bewertungen

- Revenue Regulations No 02-40Dokument19 SeitenRevenue Regulations No 02-40corky01Noch keine Bewertungen

- Taxation Sia/Tabag TAX.2814-Community Tax MAY 2020: Lecture Notes A. IndividualsDokument1 SeiteTaxation Sia/Tabag TAX.2814-Community Tax MAY 2020: Lecture Notes A. IndividualsMay Grethel Joy PeranteNoch keine Bewertungen

- TCC Cases Digests 2014-2015Dokument16 SeitenTCC Cases Digests 2014-2015praning125Noch keine Bewertungen

- CMO 09-2015 - Strict Enforcement of Rules Concerning Regulated ImportsDokument8 SeitenCMO 09-2015 - Strict Enforcement of Rules Concerning Regulated ImportsDeb BagaporoNoch keine Bewertungen

- Lecture Notes (Sec. 801-813)Dokument3 SeitenLecture Notes (Sec. 801-813)Roselle BautroNoch keine Bewertungen

- A Primer On AHTNDokument3 SeitenA Primer On AHTNJojo Aboyme CorcillesNoch keine Bewertungen

- Ra 9135Dokument20 SeitenRa 9135Daley CatugdaNoch keine Bewertungen

- RA 9280 Customs Broker Act of 2004Dokument12 SeitenRA 9280 Customs Broker Act of 2004Roy GonzaNoch keine Bewertungen

- INDIVIDUALSDokument6 SeitenINDIVIDUALSAnne KimNoch keine Bewertungen

- Vat-Exempt Transactions (Under TRAIN Law)Dokument2 SeitenVat-Exempt Transactions (Under TRAIN Law)Fabiano JoeyNoch keine Bewertungen

- Taxation On Corporations (CREATE Law)Dokument1 SeiteTaxation On Corporations (CREATE Law)leejongsukNoch keine Bewertungen

- GROSS INCOME and DEDUCTIONSDokument10 SeitenGROSS INCOME and DEDUCTIONSMHERITZ LYN LIM MAYOLANoch keine Bewertungen

- Basic Features of The New Government Accounting SystemDokument4 SeitenBasic Features of The New Government Accounting SystemabbiecdefgNoch keine Bewertungen

- NegoIn Section 1-10Dokument13 SeitenNegoIn Section 1-10Aries James67% (3)

- The Basics of Tariff & Customs Laws in The PhilippinesDokument8 SeitenThe Basics of Tariff & Customs Laws in The PhilippinesRaymond AndesNoch keine Bewertungen

- RA 7916 PEZA LawDokument26 SeitenRA 7916 PEZA LawBert AquinoNoch keine Bewertungen

- CDP LONG QUIZ - With AnswersDokument28 SeitenCDP LONG QUIZ - With AnswersElaine Antonette RositaNoch keine Bewertungen

- Cao 1-1990Dokument7 SeitenCao 1-1990Elaine Villafuerte AchayNoch keine Bewertungen

- Ethics SaDokument10 SeitenEthics SaJes MinNoch keine Bewertungen

- Tentative Release Is The Process Where A Shipment Is Released To The ImporterDokument1 SeiteTentative Release Is The Process Where A Shipment Is Released To The Importerben TheignNoch keine Bewertungen

- Assignment - ETHICS AND STANDARDS OF THE CUSTOMS BROKERAGEDokument6 SeitenAssignment - ETHICS AND STANDARDS OF THE CUSTOMS BROKERAGEcris addunNoch keine Bewertungen

- PHILEXPORT & PCCI Position On Terminal Appointment Booking SystemDokument2 SeitenPHILEXPORT & PCCI Position On Terminal Appointment Booking SystemPortCallsNoch keine Bewertungen

- Under What Conditions May A Foreigner Be Allowed TDokument3 SeitenUnder What Conditions May A Foreigner Be Allowed TANGELU RANE BAGARES INTOLNoch keine Bewertungen

- Tariff ClassificationDokument50 SeitenTariff ClassificationguerradhonaelizaNoch keine Bewertungen

- TITLE VI Administrative and Judicial ProceedingsDokument21 SeitenTITLE VI Administrative and Judicial ProceedingsJoy RaguindinNoch keine Bewertungen

- Module Customs Operations and Cargo HandlingDokument170 SeitenModule Customs Operations and Cargo HandlingRosette RocoNoch keine Bewertungen

- Donor's Tax A) Basic Principles, Concept and DefinitionDokument4 SeitenDonor's Tax A) Basic Principles, Concept and DefinitionAnonymous YNTVcDNoch keine Bewertungen

- COA Circular 2012-003Dokument14 SeitenCOA Circular 2012-003rhyz_13Noch keine Bewertungen

- TCCP Section 105 SummaryDokument3 SeitenTCCP Section 105 SummaryJohn M75% (4)

- Presidential Decree NO.930Dokument9 SeitenPresidential Decree NO.930Lj CadeNoch keine Bewertungen

- Draft PH Order On Establishment of Customs Facilities and WarehousesDokument22 SeitenDraft PH Order On Establishment of Customs Facilities and WarehousesPortCallsNoch keine Bewertungen

- Draft Clearance Process For Goods Entered Under PH Customs Bonded Warehousing (CBW) SystemDokument12 SeitenDraft Clearance Process For Goods Entered Under PH Customs Bonded Warehousing (CBW) SystemPortCallsNoch keine Bewertungen

- Seizure and Forfeiture ProceedingsDokument20 SeitenSeizure and Forfeiture ProceedingsBadong SilvaNoch keine Bewertungen

- Draft CAO On Fees and Charges For Implied Abandonment July 9, 2020 - 1594013843Dokument10 SeitenDraft CAO On Fees and Charges For Implied Abandonment July 9, 2020 - 1594013843Clinton SamsonNoch keine Bewertungen

- Civil Aviation Authority of The Philippines Memorandum Circular No. 03 2021Dokument3 SeitenCivil Aviation Authority of The Philippines Memorandum Circular No. 03 2021PortCallsNoch keine Bewertungen

- Philippine Ports Authority Administrative Order No. 11 - 2020Dokument4 SeitenPhilippine Ports Authority Administrative Order No. 11 - 2020PortCallsNoch keine Bewertungen

- Philippine Ports Authority Administrative Order No. 02-2021Dokument8 SeitenPhilippine Ports Authority Administrative Order No. 02-2021PortCallsNoch keine Bewertungen

- Draft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021Dokument10 SeitenDraft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021PortCallsNoch keine Bewertungen

- Bureau of Customs Customs Memorandum Order 28-2021Dokument2 SeitenBureau of Customs Customs Memorandum Order 28-2021PortCalls100% (1)

- Bureau of Customs Customs Memorandum Order No. 09-2021Dokument32 SeitenBureau of Customs Customs Memorandum Order No. 09-2021PortCallsNoch keine Bewertungen

- Philippine Ports Authority Administrative Order No. 13-2020Dokument3 SeitenPhilippine Ports Authority Administrative Order No. 13-2020PortCallsNoch keine Bewertungen

- Bureau of Customs - Customs Administrative Order 12-2020Dokument5 SeitenBureau of Customs - Customs Administrative Order 12-2020PortCallsNoch keine Bewertungen

- Bureau of Customs Memo Activating The Orange LaneDokument1 SeiteBureau of Customs Memo Activating The Orange LanePortCallsNoch keine Bewertungen

- Joint Memorandum Circular No. 2021-01Dokument3 SeitenJoint Memorandum Circular No. 2021-01PortCallsNoch keine Bewertungen

- Shippers' Protection Office Rules of ProceduresDokument10 SeitenShippers' Protection Office Rules of ProceduresPortCallsNoch keine Bewertungen

- Department of Transportation Department Order No. 2020-007Dokument4 SeitenDepartment of Transportation Department Order No. 2020-007PortCallsNoch keine Bewertungen

- PortCalls (September 7, 2020)Dokument14 SeitenPortCalls (September 7, 2020)PortCalls100% (1)

- Philippine Ports Authority Administrative Order No. 05-2020Dokument5 SeitenPhilippine Ports Authority Administrative Order No. 05-2020PortCallsNoch keine Bewertungen

- Ds Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedDokument33 SeitenDs Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedPortCallsNoch keine Bewertungen

- BOC AOCG Memo Dated September 11Dokument1 SeiteBOC AOCG Memo Dated September 11PortCallsNoch keine Bewertungen

- BOC AOCG Memo Dated September 11Dokument2 SeitenBOC AOCG Memo Dated September 11PortCalls100% (1)

- SBMA Seaport Memorandum On Anti Pilferage SealDokument1 SeiteSBMA Seaport Memorandum On Anti Pilferage SealPortCallsNoch keine Bewertungen

- Department of Trade and Industry Advisory No. 20-02Dokument1 SeiteDepartment of Trade and Industry Advisory No. 20-02PortCallsNoch keine Bewertungen

- Department of Transportation Department Order No. 2020-008Dokument6 SeitenDepartment of Transportation Department Order No. 2020-008PortCallsNoch keine Bewertungen

- Department of Transportation Department Order No. 2020-009Dokument4 SeitenDepartment of Transportation Department Order No. 2020-009PortCallsNoch keine Bewertungen

- Department of Transportation Department Order No. 2020-007Dokument4 SeitenDepartment of Transportation Department Order No. 2020-007PortCallsNoch keine Bewertungen

- The Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020Dokument14 SeitenThe Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020PortCallsNoch keine Bewertungen

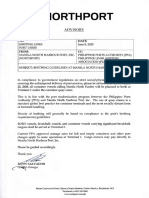

- NorthPort Advisory - June 8, 2020Dokument1 SeiteNorthPort Advisory - June 8, 2020PortCallsNoch keine Bewertungen

- Department of Trade and Industry Memorandum Circular No. 20-22 Series of 2020Dokument8 SeitenDepartment of Trade and Industry Memorandum Circular No. 20-22 Series of 2020PortCalls0% (2)

- Now Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuideDokument12 SeitenNow Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuidePortCallsNoch keine Bewertungen

- PortCalls April 13, 2020 IssueDokument14 SeitenPortCalls April 13, 2020 IssuePortCallsNoch keine Bewertungen

- The Philippines' Only Shipping and Transport Guide: Forex Rate As of Friday, 17 April 2020Dokument12 SeitenThe Philippines' Only Shipping and Transport Guide: Forex Rate As of Friday, 17 April 2020PortCallsNoch keine Bewertungen

- Soon Available Soon Available Soon Available Soon Available: The Philippines' Only Shipping and Transport GuideDokument11 SeitenSoon Available Soon Available Soon Available Soon Available: The Philippines' Only Shipping and Transport GuidePortCallsNoch keine Bewertungen

- Omnibus Guidelines On COVID-19 Quarantine MeasuresDokument22 SeitenOmnibus Guidelines On COVID-19 Quarantine MeasuresRappler95% (19)

- Secretary CertificateDokument3 SeitenSecretary Certificatenoel.c.francisco100% (1)

- Body of NarrativeDokument14 SeitenBody of NarrativeMusa Batugan Jr.Noch keine Bewertungen

- Tax Bar QA 2013-2017Dokument62 SeitenTax Bar QA 2013-2017Victor LimNoch keine Bewertungen

- Cmo 40-98Dokument10 SeitenCmo 40-98Rafael JuicoNoch keine Bewertungen

- Commissioner of Customs vs. ReluniaDokument5 SeitenCommissioner of Customs vs. Reluniaelna ocampoNoch keine Bewertungen

- (PRESS RELEASE) P75-M Fake IPhones, Smartphones, and Tablets Busted in BinondoDokument2 Seiten(PRESS RELEASE) P75-M Fake IPhones, Smartphones, and Tablets Busted in BinondoAntonio Aylemer PercelaNoch keine Bewertungen

- BULLETIN OF VACANT POSITIONS IN THE BUREAU OF CUSTOMS AS OF JUNE 11, 2020 - Bureau of CustomsDokument1 SeiteBULLETIN OF VACANT POSITIONS IN THE BUREAU OF CUSTOMS AS OF JUNE 11, 2020 - Bureau of CustomsmeerahNoch keine Bewertungen

- Joselito RallosDokument20 SeitenJoselito RallosRoy Rafer AnaasNoch keine Bewertungen

- W2 Module 2 Tax Administration Part IDokument53 SeitenW2 Module 2 Tax Administration Part IElmeerajh JudavarNoch keine Bewertungen

- Ra 10863Dokument33 SeitenRa 10863Joel TisaraNoch keine Bewertungen

- Lopez & Sons INC v. CTADokument7 SeitenLopez & Sons INC v. CTAfabsfabsNoch keine Bewertungen

- Draft PH Customs Jurisdiction and Exercise of Police Authority (Deputization) OrderDokument22 SeitenDraft PH Customs Jurisdiction and Exercise of Police Authority (Deputization) OrderPortCallsNoch keine Bewertungen

- 024 Villavicencio Republic v. UnimexDokument2 Seiten024 Villavicencio Republic v. UnimexSalve VillavicencioNoch keine Bewertungen

- 036 Sy Man v. Jacinto PDFDokument2 Seiten036 Sy Man v. Jacinto PDFJuno GeronimoNoch keine Bewertungen

- Farolan Vs CTADokument1 SeiteFarolan Vs CTAKat Jolejole100% (2)

- The Tariff and Customs Code of 1978Dokument2 SeitenThe Tariff and Customs Code of 1978usjrlaw2011Noch keine Bewertungen

- Mobil Philippines Exploration Inc Vs Customs Arrastre ServiceDokument2 SeitenMobil Philippines Exploration Inc Vs Customs Arrastre Servicerodel_odz100% (2)

- Assali vs. Commissioner of CustomsDokument5 SeitenAssali vs. Commissioner of CustomsSharon Marie PinarocNoch keine Bewertungen

- Cmo 10-06Dokument13 SeitenCmo 10-06Karen Fortaleza100% (1)

- Reviewer On Tariff and Customs DutiesDokument48 SeitenReviewer On Tariff and Customs DutiesMiguel Anas Jr.100% (6)

- Sarmiento II Vs Mison 156 SCRA 549Dokument10 SeitenSarmiento II Vs Mison 156 SCRA 549joshemmancarinoNoch keine Bewertungen

- Draft Bureau of Customs Order On Pre-Shipment InspectionDokument6 SeitenDraft Bureau of Customs Order On Pre-Shipment InspectionPortCallsNoch keine Bewertungen

- Intended Learning Outcomes: Principles of Customs Administration LESSON 1: Profile of The Bureau of CustomsDokument10 SeitenIntended Learning Outcomes: Principles of Customs Administration LESSON 1: Profile of The Bureau of CustomsAbdurahman shuaibNoch keine Bewertungen

- Bureau of CustomsDokument5 SeitenBureau of CustomsPINEDA, REINA ALLYZA P.Noch keine Bewertungen

- Constitutional Law 1-Case Digests-Article 7 Executive DepartmentDokument43 SeitenConstitutional Law 1-Case Digests-Article 7 Executive DepartmentPauline August Fernandez100% (1)

- Thesis RechieDokument3 SeitenThesis RechieMei Antonette UntalanNoch keine Bewertungen

- TM121C Project 1Dokument10 SeitenTM121C Project 1Rovena Mc HenryNoch keine Bewertungen

- Didto Sa Layong BukidDokument9 SeitenDidto Sa Layong BukidcandiceNoch keine Bewertungen

- Secretary of The Department of Finance vs. Court of Tax Appeals (Second Division)Dokument12 SeitenSecretary of The Department of Finance vs. Court of Tax Appeals (Second Division)KeiNoch keine Bewertungen

- Caridad Cruz de Syquia V. Board of Power and Water WorksDokument5 SeitenCaridad Cruz de Syquia V. Board of Power and Water WorksZaireXandraReyesNoch keine Bewertungen