Beruflich Dokumente

Kultur Dokumente

Wasting Assets Corporations

Hochgeladen von

Von VelascoCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Wasting Assets Corporations

Hochgeladen von

Von VelascoCopyright:

Verfügbare Formate

VELASCO, Von Laurentz Corporation Law

3G Sat. 10:00-3:30

I. What are Wasting Assets Corporations, and why

are they allowed to declare dividends out of

Capital?

Wasting Assets Corporations are those corporations engaged solely or principally in the

exploitation of wasting assets to distribute the net proceeds derived from the exploitation of

their holdings such as mines, oil wells, patents, and leaseholds, without allowance or reduction

for depletion. Wasting Assets Corporations are exempted from the general rule though what is

otherwise known as the Wasting Assets Doctrine, which has been adopted and applied by

Philippine jurists but given scant discussion or consideration. The Wasting Assets Doctrines

development began when an English court in the case of Lee v. Neuchantel Asphalte Company1

made a distinction between depreciation of assets in the case of ordinary corporations, and the

depletion of assets suffered by wasting assets corporations. The American case of Excelsior v.

Pierce2, citing Neichantel gave birth to the Doctrine when it held that the rule which forbade

the withdrawal of capital or capital stock, and confined divideds to surplus profits arising from

business did not forbid mining corporations (wasting asset corporations) from distributing net

proceeds. Jovito Salonga notes in the Philippine Law Journal3 that the Pierce case was decided

on a statute identical with the Philippine dividend section, hence the application in this

Jurisdiction. Scholars4 argue that the Doctrine finds no basis in law, there being no sufficient

statutory factual and statutory authority for the ruling, and hence falling dangerously close to

Judicial Legislation. Grimes5 notes that both the Lee and Excelsion cases had sufficiently proven

that the respective corporations had surplus income for which dividends could be declared.

However, both Grimes and Salonga are in agreement that the Wasting Assets Doctrine is more

an expression of policy rather than statutory pronouncement.

The rationale for the Doctrine seems to arise from the nature of Wasting Asset

Corporations, or particularly from the fact that they deal with wasting assets. It would seem

that the consensus is that investors and creditors of corporations involved in such business are

aware of the temporary nature of such enterprises, rather than being for long-term purposes 6.

Arguments for the doctrine therefore, state that an investor or stockholder for Wasting Asset

Corporations, being aware of their nature, are not interested in having its capital kept intact or

held for further investment. He is, therefore, interested in the capital being exhausted for profit,

rather than kept for long term investment.

Despite being a critic of the doctrine himself, Salonga notes that there is an absence of

any statory or jurisprudential authority to hold the inapplicability of the said Doctrine in our

jurisdiction7 But he also concedes to the fact that mining is a vital sector to the Philippine

economy. It could be logically inferred that if such case arose, the Wasting Assets Doctrine

would likely be upheld.

1 41 Ch. Div. 1. (1899).

2 90 Cal. 131.

3 Vol. 28, No. 4; Sept 1953.

4 Corporations: Liquidating Dividends by Wasting Assets Corporations in California; California

Law Review; Vol. 34, No. 1; Mar. 1946.

5 Ibid.

6 Note (1926) 12 Cornell L.Q. 79, 83.

7 Ibid.

II. Why can a Treasury Share be issued as a property

dividend, but not as a cash or stock dividend?

Treasury shares cannot be declared as stock dividends or cash dividends for the reason

that they are not considered as part of the earned or surplus profits8. In the case of cash

dividends, the declaration of such would run counter to the nature of dividends and the nature

of the treasury stocks. Treasury stocks are those reacquired by the corporation at a cost, and to

re-issue them as cash would not only be burdensome (the cost of re-acquisition in addition to

being declared as cash dividends) but also results in the absurd situation of the corporation

being the creditor, and debtor of itself by pulling out money in one pocket and placing it in the

other9. The same goes for stock dividends. The purpose of the issue of stock dividends is for the

increase of the capitalization of the corporation. The same creditor-debtor absurdity applies in

the case of issuing stock dividends out of treasury shares. By issuing stock dividends out of

treasury shares, the corporation would be in effect incurring additional liability to its

stockholders without the corresponding increase in capitalization, and would instead be

incurring a loss due to the costs of the re-acquisition of the treasury shares. But in the case of

property dividends, property dividends may be declared out of the retained earnings previously

used to support their acquisition provided that the amount of the said retained earnings has not

been subsequently impaired by losses.

8 Reviewer on Commercial Law; Aquino and Sundiang (2014)

9 Ibid.

Das könnte Ihnen auch gefallen

- Corporation Code Reviewer Corporation Code Reviewer: Law (University of Nueva Caceres) Law (University of Nueva Caceres)Dokument4 SeitenCorporation Code Reviewer Corporation Code Reviewer: Law (University of Nueva Caceres) Law (University of Nueva Caceres)chingchongNoch keine Bewertungen

- Revised Corporation Code highlightsDokument22 SeitenRevised Corporation Code highlightsLuigi JaroNoch keine Bewertungen

- CHAPTER 2 - Nature and Effect of Obligations (Arts. 1163-1178)Dokument35 SeitenCHAPTER 2 - Nature and Effect of Obligations (Arts. 1163-1178)abigael severino100% (1)

- Dissolution and Winding UpDokument22 SeitenDissolution and Winding UpRic Vince100% (1)

- Corporate Law Essay QuestionsDokument1 SeiteCorporate Law Essay QuestionsPamela L. FallerNoch keine Bewertungen

- Introduction to Donor's TaxDokument22 SeitenIntroduction to Donor's TaxKezNoch keine Bewertungen

- A Comparison Between Batas Pambansa Bilang 68Dokument66 SeitenA Comparison Between Batas Pambansa Bilang 68Elson Talotalo0% (1)

- Obligations of The PartnersDokument3 SeitenObligations of The PartnersBasri JayNoch keine Bewertungen

- Types of Business: Sole ProprietorshipDokument4 SeitenTypes of Business: Sole ProprietorshipedrianclydeNoch keine Bewertungen

- Rakham's loan to Alfonso deemed non-deductible bad debtDokument17 SeitenRakham's loan to Alfonso deemed non-deductible bad debtClarince Joyce Lao DoroyNoch keine Bewertungen

- Revised Corporation Code ReviewerDokument19 SeitenRevised Corporation Code ReviewerMau BaytingNoch keine Bewertungen

- Estrada v. SandiganbayanDokument9 SeitenEstrada v. SandiganbayanAB AgostoNoch keine Bewertungen

- Salient Features of The Revised Corporation CodeDokument3 SeitenSalient Features of The Revised Corporation CodeDel Rosario Marian100% (1)

- Public International Law: By: Atty. CandelariaDokument2 SeitenPublic International Law: By: Atty. CandelariaEan PaladanNoch keine Bewertungen

- Grandfather RuleDokument5 SeitenGrandfather RuleRobynne LopezNoch keine Bewertungen

- Corporate Law DoctrinesDokument4 SeitenCorporate Law DoctrinesTiofilo Villanueva75% (8)

- Far East Bank vs. TentmakersDokument2 SeitenFar East Bank vs. Tentmakersxx_stripped52Noch keine Bewertungen

- WON A Corp Is Entitled To Moral DamagesDokument6 SeitenWON A Corp Is Entitled To Moral DamagesShane Edrosolano100% (1)

- The Law Pertaining To Private Personal and Commercial RelationsDokument8 SeitenThe Law Pertaining To Private Personal and Commercial RelationsBoenYatorNoch keine Bewertungen

- LAW Chapter II (1791 - 1809)Dokument14 SeitenLAW Chapter II (1791 - 1809)JaimeMorNoch keine Bewertungen

- Pre-Week General Principles TaxationDokument6 SeitenPre-Week General Principles Taxationjharik23Noch keine Bewertungen

- Midterms Case Study Week 8Dokument3 SeitenMidterms Case Study Week 8Dimple Mae CarilloNoch keine Bewertungen

- UST Central Student Council Central Board v. UST Central Commission On ElectionsDokument6 SeitenUST Central Student Council Central Board v. UST Central Commission On ElectionsTomasinoWebNoch keine Bewertungen

- Study Guide 1 Questions and AnswersDokument5 SeitenStudy Guide 1 Questions and AnswersVincent Quiña PigaNoch keine Bewertungen

- Classes of Corporation: Definition and ExampleDokument2 SeitenClasses of Corporation: Definition and ExampleAisa SajolNoch keine Bewertungen

- Title Iii Board of Directors - Trustees and OfficersDokument7 SeitenTitle Iii Board of Directors - Trustees and OfficersMeAnn TumbagaNoch keine Bewertungen

- PDIC and FRIADokument7 SeitenPDIC and FRIAabc xyzNoch keine Bewertungen

- Notes in Business Organization Ii Remedial RightsDokument4 SeitenNotes in Business Organization Ii Remedial RightsshelNoch keine Bewertungen

- Special CorporationsDokument1 SeiteSpecial CorporationsSerene Nicole Villena50% (2)

- When, What and How of Insurance Contract (Perfection) When Is It Perfected?Dokument9 SeitenWhen, What and How of Insurance Contract (Perfection) When Is It Perfected?Jexelle Marteen Tumibay PestañoNoch keine Bewertungen

- Financial Rehabilitation and Insolvency Act of 2010Dokument29 SeitenFinancial Rehabilitation and Insolvency Act of 2010ethelandicoNoch keine Bewertungen

- Commercial Law Review 1 - Corporation Law QuestionsDokument3 SeitenCommercial Law Review 1 - Corporation Law QuestionsVictoria EscobalNoch keine Bewertungen

- Requisites of A Valid TaxDokument1 SeiteRequisites of A Valid TaxJason Bas Balindong100% (4)

- Exceptions To The Secrecy of Bank DepositsDokument1 SeiteExceptions To The Secrecy of Bank DepositsIlanieMalinisNoch keine Bewertungen

- Corpo NotesDokument13 SeitenCorpo NotesGabrielNoch keine Bewertungen

- Partnership obligations and liability under 40 charactersDokument7 SeitenPartnership obligations and liability under 40 charactersDan LocsinNoch keine Bewertungen

- 2016 BAR EXAMINATIONS Suggested AnswersDokument11 Seiten2016 BAR EXAMINATIONS Suggested AnswersAudreyNoch keine Bewertungen

- Panglao.Today Corporation By-LawsDokument3 SeitenPanglao.Today Corporation By-LawsdenisNoch keine Bewertungen

- Corporation Law RECENT JURISPRUDENCEDokument57 SeitenCorporation Law RECENT JURISPRUDENCEhmn_scribdNoch keine Bewertungen

- Partnership Dissolution and Winding UpDokument3 SeitenPartnership Dissolution and Winding UpPedro Jr SantosNoch keine Bewertungen

- Taxation Review Midterm ExamDokument19 SeitenTaxation Review Midterm ExamGreggy Law100% (1)

- Securities Regulation Code. QuestionsDokument3 SeitenSecurities Regulation Code. QuestionsIELTS100% (1)

- What Is A Quasi BankDokument2 SeitenWhat Is A Quasi BankMarian Santos50% (2)

- 2009 Bar Examination in Mercantile Law (NIL)Dokument3 Seiten2009 Bar Examination in Mercantile Law (NIL)Anonymous gG0tLI99S2Noch keine Bewertungen

- Instances When A Stockholder Can Exercise His Appraisal RightDokument2 SeitenInstances When A Stockholder Can Exercise His Appraisal RightKaren RabadonNoch keine Bewertungen

- Double Taxation in The Strict Sense v. Double Taxation in The Broad SenseDokument2 SeitenDouble Taxation in The Strict Sense v. Double Taxation in The Broad SenseRoschelle MiguelNoch keine Bewertungen

- Revised Corporation Code guideDokument22 SeitenRevised Corporation Code guideDashtin Erasmo100% (2)

- Reflection of A Few Good MenDokument1 SeiteReflection of A Few Good MenMaila PacsonNoch keine Bewertungen

- Everything You Need to Know About Limited PartnershipsDokument15 SeitenEverything You Need to Know About Limited Partnershipsattyaarongocpa9645Noch keine Bewertungen

- Salient Features of The RCC (MZRVC)Dokument6 SeitenSalient Features of The RCC (MZRVC)KristineNoch keine Bewertungen

- Advance Tax Review - AlabangDokument10 SeitenAdvance Tax Review - Alabangwrecker40Noch keine Bewertungen

- Understanding NegotiationDokument1 SeiteUnderstanding NegotiationDanielle Elesterio100% (1)

- Rights of buyers in installment sales of personal and real property under the Recto and Maceda LawsDokument7 SeitenRights of buyers in installment sales of personal and real property under the Recto and Maceda LawsRheinhart PahilaNoch keine Bewertungen

- Philippine Business Organization LawsDokument27 SeitenPhilippine Business Organization LawsJoanne Gonzales JuntillaNoch keine Bewertungen

- Ateneo Central Bar Operations 2007 Civil Law Summer ReviewerDokument15 SeitenAteneo Central Bar Operations 2007 Civil Law Summer ReviewerMiGay Tan-Pelaez85% (13)

- Doctrines of Separate Personality & Piercing the VeilDokument5 SeitenDoctrines of Separate Personality & Piercing the VeilAllan PatulotNoch keine Bewertungen

- Corporation Law Case OutlineDokument13 SeitenCorporation Law Case OutlineSammy HammyNoch keine Bewertungen

- Revised Corporation Code and Trust Fund DoctrineDokument4 SeitenRevised Corporation Code and Trust Fund DoctrineGab NaparatoNoch keine Bewertungen

- Qualifications To The Rule On The Pre-Emptive Right of Shareholders PDFDokument17 SeitenQualifications To The Rule On The Pre-Emptive Right of Shareholders PDFRona RubinosNoch keine Bewertungen

- The Mutual Funds Book: How to Invest in Mutual Funds & Earn High Rates of Returns SafelyVon EverandThe Mutual Funds Book: How to Invest in Mutual Funds & Earn High Rates of Returns SafelyBewertung: 5 von 5 Sternen5/5 (1)

- CIAC jurisdiction over construction disputesDokument2 SeitenCIAC jurisdiction over construction disputesVon VelascoNoch keine Bewertungen

- 8-University of Mindanao v. Bangko Sentral-2016Dokument4 Seiten8-University of Mindanao v. Bangko Sentral-2016Von VelascoNoch keine Bewertungen

- 54-Laude v. Ginez-Jabalde-2015Dokument2 Seiten54-Laude v. Ginez-Jabalde-2015Von Velasco0% (1)

- People v. Go - For RecitationDokument2 SeitenPeople v. Go - For RecitationVon VelascoNoch keine Bewertungen

- Finals Notes 2 Corpo PDFDokument14 SeitenFinals Notes 2 Corpo PDFVon VelascoNoch keine Bewertungen

- 8-University of Mindanao v. Bangko Sentral-2016Dokument4 Seiten8-University of Mindanao v. Bangko Sentral-2016Von VelascoNoch keine Bewertungen

- 42-Luna v. Galarrit-2015Dokument3 Seiten42-Luna v. Galarrit-2015Von VelascoNoch keine Bewertungen

- Art. 212 Go v. SandiganbayanDokument2 SeitenArt. 212 Go v. SandiganbayanVon Velasco100% (2)

- 45-Santamaria V Cleary-2016Dokument3 Seiten45-Santamaria V Cleary-2016Von VelascoNoch keine Bewertungen

- 20-Nonay V Bahia Shipping-2016Dokument4 Seiten20-Nonay V Bahia Shipping-2016Von VelascoNoch keine Bewertungen

- For Decriminalization of LibelDokument4 SeitenFor Decriminalization of LibelVon VelascoNoch keine Bewertungen

- Novena To St. Jude ThaddeusDokument1 SeiteNovena To St. Jude ThaddeusVon VelascoNoch keine Bewertungen

- Chapter 16 - 19 International LawDokument9 SeitenChapter 16 - 19 International LawVon VelascoNoch keine Bewertungen

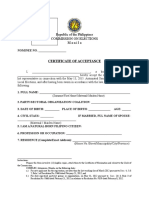

- Republic of The Philippines Commission On Elections ManilaDokument2 SeitenRepublic of The Philippines Commission On Elections ManilaVon VelascoNoch keine Bewertungen

- Politics and Governance in Spanish Colonial PhilippinesDokument15 SeitenPolitics and Governance in Spanish Colonial PhilippinesVon VelascoNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledVon VelascoNoch keine Bewertungen

- Philippines Court Motion for Gag OrderDokument3 SeitenPhilippines Court Motion for Gag OrderVon VelascoNoch keine Bewertungen

- Quarry Resources2Dokument3 SeitenQuarry Resources2Von VelascoNoch keine Bewertungen

- Footnoting and Legal CitationDokument32 SeitenFootnoting and Legal CitationVon VelascoNoch keine Bewertungen

- Latest Jurprudence On Divorce Granted by Foreign CourtsDokument2 SeitenLatest Jurprudence On Divorce Granted by Foreign CourtsVon VelascoNoch keine Bewertungen

- Legal OpinionDokument3 SeitenLegal OpinionVon VelascoNoch keine Bewertungen

- Finals Reviewer Bruce Rivera Public International LawDokument10 SeitenFinals Reviewer Bruce Rivera Public International LawVon VelascoNoch keine Bewertungen

- Finals Reviewer Bruce Rivera Public International LawDokument10 SeitenFinals Reviewer Bruce Rivera Public International LawVon VelascoNoch keine Bewertungen

- SC rules trial court erred in allowing intervention in finalized caseDokument1 SeiteSC rules trial court erred in allowing intervention in finalized caseVon VelascoNoch keine Bewertungen

- Digests ConstiDokument3 SeitenDigests ConstiVon VelascoNoch keine Bewertungen

- Statutory Construction NotesDokument32 SeitenStatutory Construction Notespriam gabriel d salidaga95% (102)

- Financial Statement Analysis and Valuation 4th Edition Easton Test BankDokument44 SeitenFinancial Statement Analysis and Valuation 4th Edition Easton Test Bankmrsbrianajonesmdkgzxyiatoq100% (30)

- CRSPDokument17 SeitenCRSPMichel KamelNoch keine Bewertungen

- Week 4 - ch16Dokument52 SeitenWeek 4 - ch16bafsvideo4Noch keine Bewertungen

- Chapter-1: PanasoDokument34 SeitenChapter-1: PanasoKamal Gupta100% (1)

- Hup Seng AR 2018Dokument322 SeitenHup Seng AR 2018Saleh HashimNoch keine Bewertungen

- Ch11 Corporations - Organization, Share Transactions, Dividends, and Retained EarningsDokument101 SeitenCh11 Corporations - Organization, Share Transactions, Dividends, and Retained EarningsAhlan Jufri AbdullahNoch keine Bewertungen

- 5301 Ch. 7-14 Additional Multiple Choice QuestionsDokument9 Seiten5301 Ch. 7-14 Additional Multiple Choice QuestionsZhou Tian YangNoch keine Bewertungen

- Mini Test 3Dokument14 SeitenMini Test 3Quyen Thanh NguyenNoch keine Bewertungen

- FAR16 Share Capital Transactions - For PrintDokument9 SeitenFAR16 Share Capital Transactions - For PrintAJ CresmundoNoch keine Bewertungen

- Accounting exam key answersDokument8 SeitenAccounting exam key answersClint AbenojaNoch keine Bewertungen

- UST Golden Notes - Corporation LawDokument75 SeitenUST Golden Notes - Corporation Lawaugustofficials100% (8)

- Acctg 104 Equity FinancingDokument54 SeitenAcctg 104 Equity FinancingskzstayhavenNoch keine Bewertungen

- ACCT 101 Pre-Quiz Number Five - F - 2017Dokument8 SeitenACCT 101 Pre-Quiz Number Five - F - 2017Rics GabrielNoch keine Bewertungen

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Dokument18 SeitenStatement of Financial Position Basic Problems Problem 1-1 (IFRS)student80% (5)

- Far 410: Chapter 4: EquityDokument44 SeitenFar 410: Chapter 4: EquityJung KookieNoch keine Bewertungen

- Investments in Financial Instruments: Problem 1Dokument10 SeitenInvestments in Financial Instruments: Problem 1Johanna Vidad100% (1)

- 8553Dokument6 Seiten8553AbdullahNoch keine Bewertungen

- Shareholders' Equity - : Measure of The Consideration ReceivedDokument3 SeitenShareholders' Equity - : Measure of The Consideration ReceivedChinchin Ilagan DatayloNoch keine Bewertungen

- Chapter 19: Audit of Owners' Equity: Review QuestionsDokument18 SeitenChapter 19: Audit of Owners' Equity: Review QuestionsReznakNoch keine Bewertungen

- Topic 3 FirstRate Company Excel SolutionDokument10 SeitenTopic 3 FirstRate Company Excel SolutionJoseph P. McDeejoz100% (1)

- 04 Quiz 1 - Ca2Dokument8 Seiten04 Quiz 1 - Ca2Jen DeloyNoch keine Bewertungen

- Auditing Exam Part IDokument2 SeitenAuditing Exam Part Ianna19 lopezNoch keine Bewertungen

- Far Pet Class - Mock Quiz CorporationDokument11 SeitenFar Pet Class - Mock Quiz CorporationNia BranzuelaNoch keine Bewertungen

- RESA TOA Special Handouts MAY2015Dokument11 SeitenRESA TOA Special Handouts MAY2015Jeffrey CardonaNoch keine Bewertungen

- Common and Preferred Stock TypesDokument12 SeitenCommon and Preferred Stock TypesAmna ImranNoch keine Bewertungen

- Practical Accounting 1 ReviewerDokument13 SeitenPractical Accounting 1 ReviewerKimberly RamosNoch keine Bewertungen

- RFBT-05 Atty. Capuno Corporations Atty. Villegas: C. Appraisal RightDokument5 SeitenRFBT-05 Atty. Capuno Corporations Atty. Villegas: C. Appraisal RightSean SanchezNoch keine Bewertungen

- Retained Earnings Lecture NotesDokument2 SeitenRetained Earnings Lecture Notesbum_24100% (2)

- Corporation Test BankDokument8 SeitenCorporation Test BankAJ Gaspar57% (7)

- AccountingClinic Corpo2Dokument40 SeitenAccountingClinic Corpo2Charize YebanNoch keine Bewertungen