Beruflich Dokumente

Kultur Dokumente

AUG-02 Mizuho Technical Analysis GBP USD

Hochgeladen von

Miir ViirOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

AUG-02 Mizuho Technical Analysis GBP USD

Hochgeladen von

Miir ViirCopyright:

Verfügbare Formate

Mizuho Corporate Bank

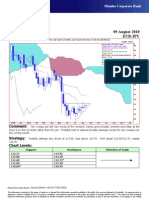

Technical Analysis 02 August 2010

GBP

GBP=D3, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Weekly

17Oct09 - 06Feb11

Pr

GBP=D3 , Last Quote, Candle

08Aug10 1.5728 1.5743 1.5695 1.5735 1.68

GBP=D3 , Last Quote, Tenkan Sen 9

08Aug10 1.5045

GBP=D3 , Last Quote, Kijun Sen 26

1.66

08Aug10 1.5022

GBP=D3 , Last Quote, Senkou Span(a) 52

30Jan11 1.5033

1.64

GBP=D3 , Last Quote, Senkou Span(b) 52

30Jan11 1.5554

GBP=D3 , Last Quote, Chikou Span 26

1.62

14Feb10 1.5735

1.6

1.58

1.56

1.54

1.52

1.5

1.48

1.46

1.44

1.42

Nov09 Dec Jan10 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan11 Feb

Comment: Another strong weekly rally, Cable has retraced over half of 2010’s decline, 9 and 26-week moving

averages just about to cross to bullish. Note that July’s best performer was the Australian dollar up 8.00% against

the greenback. With consensus forecasts of 1.4800 in 12 months’ time there is probably still a lot more short-

covering to be done. Sterling is overbought but bullish momentum is stronger than it has been in a year. The best

monthly close in five puts this pair in line to test more important resistance at 1.6000.

Strategy: Attempt small longs at 1.5730 but only if prepared to add to 1.5600; stop well below 1.5500. First

target 1.5775, then 1.5875.

Chart Levels:

Support Resistance Direction of Trade

1.5695/1.5680 1.5743

1.5600 1.5775*

1.5545 1.5820

1.5500 1.5875*

1.5400* 1.5900

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

Das könnte Ihnen auch gefallen

- AUG 11 UOB Global MarketsDokument3 SeitenAUG 11 UOB Global MarketsMiir ViirNoch keine Bewertungen

- Westpack AUG 11 Mornng ReportDokument1 SeiteWestpack AUG 11 Mornng ReportMiir ViirNoch keine Bewertungen

- AUG-10 Mizuho Technical Analysis EUR JPYDokument1 SeiteAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNoch keine Bewertungen

- AUG 11 DBS Daily Breakfast SpreadDokument6 SeitenAUG 11 DBS Daily Breakfast SpreadMiir ViirNoch keine Bewertungen

- AUG-10 Mizuho Technical Analysis GBP USDDokument1 SeiteAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNoch keine Bewertungen

- AUG 10 UOB Global MarketsDokument3 SeitenAUG 10 UOB Global MarketsMiir ViirNoch keine Bewertungen

- AUG 10 UOB Asian MarketsDokument2 SeitenAUG 10 UOB Asian MarketsMiir ViirNoch keine Bewertungen

- Danske Daily: Key NewsDokument4 SeitenDanske Daily: Key NewsMiir ViirNoch keine Bewertungen

- JYSKE Bank AUG 10 Corp Orates DailyDokument2 SeitenJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNoch keine Bewertungen

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDokument5 SeitenMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNoch keine Bewertungen

- JYSKE Bank AUG 09 Market Drivers CurrenciesDokument5 SeitenJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNoch keine Bewertungen

- AUG 10 DBS Daily Breakfast SpreadDokument8 SeitenAUG 10 DBS Daily Breakfast SpreadMiir ViirNoch keine Bewertungen

- AUG 10 Danske EMEADailyDokument3 SeitenAUG 10 Danske EMEADailyMiir ViirNoch keine Bewertungen

- Westpack AUG 10 Mornng ReportDokument1 SeiteWestpack AUG 10 Mornng ReportMiir ViirNoch keine Bewertungen

- AUG 10 Danske FlashCommentFOMC PreviewDokument7 SeitenAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNoch keine Bewertungen

- AUG-09 Mizuho Technical Analysis EUR JPYDokument1 SeiteAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNoch keine Bewertungen

- AUG-09-DJ European Forex TechnicalsDokument3 SeitenAUG-09-DJ European Forex TechnicalsMiir ViirNoch keine Bewertungen

- ScotiaBank AUG 09 Daily FX UpdateDokument3 SeitenScotiaBank AUG 09 Daily FX UpdateMiir ViirNoch keine Bewertungen

- JYSKE Bank AUG 09 Corp Orates DailyDokument2 SeitenJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNoch keine Bewertungen

- Jyske Bank Aug 09 em DailyDokument5 SeitenJyske Bank Aug 09 em DailyMiir ViirNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Restoring PH Balance in The BodyDokument6 SeitenRestoring PH Balance in The Bodycinefil70Noch keine Bewertungen

- Continuous Improvement SYMPOSIUM SCRIPTDokument3 SeitenContinuous Improvement SYMPOSIUM SCRIPTChanda Marie AsedillaNoch keine Bewertungen

- January 2014 QP - Paper 1 Edexcel (B) Maths IGCSEDokument24 SeitenJanuary 2014 QP - Paper 1 Edexcel (B) Maths IGCSEStevenstrange001 CattyNoch keine Bewertungen

- Gender Inequality and Its Impact On Mental HealthDokument20 SeitenGender Inequality and Its Impact On Mental Healthbanipreet kaurNoch keine Bewertungen

- New York LifeDokument38 SeitenNew York LifeDaniel SineusNoch keine Bewertungen

- 06 Renr5908 08 01 All PDFDokument108 Seiten06 Renr5908 08 01 All PDFFrancisco Ospino Arrieta100% (2)

- A. Erfurth, P. Hoff. Mad Scenes in Early 19th-Century Opera PDFDokument4 SeitenA. Erfurth, P. Hoff. Mad Scenes in Early 19th-Century Opera PDFbiarrodNoch keine Bewertungen

- Shaheed Suhrawardy Medical College HospitalDokument3 SeitenShaheed Suhrawardy Medical College HospitalDr. Mohammad Nazrul IslamNoch keine Bewertungen

- New Arrivals 17 - 08 - 2021Dokument16 SeitenNew Arrivals 17 - 08 - 2021polar necksonNoch keine Bewertungen

- Nursing Care Plan Diabetes Mellitus Type 1Dokument2 SeitenNursing Care Plan Diabetes Mellitus Type 1deric85% (46)

- An1914 PDFDokument56 SeitenAn1914 PDFUpama Das100% (1)

- Warranties Liabilities Patents Bids and InsuranceDokument39 SeitenWarranties Liabilities Patents Bids and InsuranceIVAN JOHN BITONNoch keine Bewertungen

- Preparatory Newsletter No 3 2013Dokument22 SeitenPreparatory Newsletter No 3 2013SJC AdminNoch keine Bewertungen

- Paper 3 FrinqDokument4 SeitenPaper 3 Frinqapi-301975170Noch keine Bewertungen

- BLDG Permit Form (Back To Back)Dokument2 SeitenBLDG Permit Form (Back To Back)ar desNoch keine Bewertungen

- Lean Six SigmaDokument5 SeitenLean Six SigmavinNoch keine Bewertungen

- EASA Part-66 Module 17 QBDokument53 SeitenEASA Part-66 Module 17 QBFaisal Ahmed Newon80% (5)

- I. Errors, Mistakes, Accuracy and Precision of Data Surveyed. A. ErrorsDokument53 SeitenI. Errors, Mistakes, Accuracy and Precision of Data Surveyed. A. ErrorsJETT WAPNoch keine Bewertungen

- Azure Arc DoccumentDokument143 SeitenAzure Arc Doccumentg.jithendarNoch keine Bewertungen

- File Server Resource ManagerDokument9 SeitenFile Server Resource ManagerBùi Đình NhuNoch keine Bewertungen

- Minuto hd8761Dokument64 SeitenMinuto hd8761Eugen Vicentiu StricatuNoch keine Bewertungen

- ĐÁP ÁN ĐỀ THI THỬ SỐ 03 (2019-2020)Dokument8 SeitenĐÁP ÁN ĐỀ THI THỬ SỐ 03 (2019-2020)Đào VânNoch keine Bewertungen

- GE Elec 7 UNIT-3 NoDokument22 SeitenGE Elec 7 UNIT-3 NoLyleNoch keine Bewertungen

- Ellis Lived ExperiencesDokument31 SeitenEllis Lived ExperiencesJeanny Mae PesebreNoch keine Bewertungen

- Physics Cheat SheetDokument8 SeitenPhysics Cheat SheetJeremiah MoussaNoch keine Bewertungen

- VukcevicEtAl GhostFluidMethodInPolyhedralFV AnnotatedDokument19 SeitenVukcevicEtAl GhostFluidMethodInPolyhedralFV AnnotatedputhenkulamNoch keine Bewertungen

- Water Quality MonitoringDokument3 SeitenWater Quality MonitoringJoa YupNoch keine Bewertungen

- Sensory Play Activities Kids Will LoveDokument5 SeitenSensory Play Activities Kids Will LoveGoh KokMingNoch keine Bewertungen

- Transfer CaseDokument46 SeitenTransfer Casebantuan.dtNoch keine Bewertungen

- Internet in My LifeDokument4 SeitenInternet in My LifeАндріана ПрусNoch keine Bewertungen