Beruflich Dokumente

Kultur Dokumente

Equity Report 26 June To 30 June

Hochgeladen von

zoidresearchOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Equity Report 26 June To 30 June

Hochgeladen von

zoidresearchCopyright:

Verfügbare Formate

EQUITY TECHNICAL REPORT

WEEKLY

[26 JUN to 30 JUN 2017]

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

26 JUN TO 30 JUN 17

NIFTY 50 9574.95 (-12.10) (-0.13%)

The Market began the week on an extremely

strong note, driven by a rally in banks. The

Bank Nifty ended over a 1% higher, while

the Nifty closes above 9650-mark. On

Tuesday, The Nifty was traded in a narrow

range and the Nifty closed at 9606 down by

4 points. Logistics stocks on Tuesdays

trading session jumped as the Finance

Minister Arun Jaitley during a press

conference, said that the GST switch-over

will happen from June 30 midnight and

rollout on July-1. On Wednesday, Market

closed lower after a range bound trade due

to lack of cues at global as well as domestic

markets. The Nifty fell 20 points to 9633. On

Thursday, The Nifty opened at 9643 and

made a low of 9618 after making a lifetime

high of 9699. A bout of higher volatility was

witnessed in the market. And the Nifty

closed at 9630 levels down by 4 points. On

Friday, The last Trading day of the week;

The Nifty showed profit booking as FII

created sell position in the options. Nifty

had loss over 55 points The Nifty closed

below at 9575. The benchmark Index

Nifty50 (spot) opened the week at 9626.4

made a high of 9698.85. low of 9565.30 and

closed the week at 9574.95. Thus the Nifty

closed the week with a losing of -12.10

points or -0.13%. Future Outlook:

The Nifty daily chart is bearish

Formations

trend. we advised to sell Nifty future

The 20 days EMA are placed at below 9575 then target will be

9612.71 9500-9400. Nifty upside weekly

The 5 days EMA are placed at Resistance is 9650-9750 level. On

9594.34 the downside strong support at

9525-9475

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

26 JUN TO 30 JUN 17

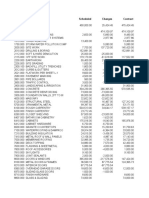

Weekly Pivot Levels for Nifty 50 Stocks

Script Symbol Resistance2 Resistance1 Pivot Support 1 Support 2

NIFTY 50 (SPOT) 9747 9661 9613 9527 9480

AUTOMOBILE

BAJAJ-AUTO 2939.77 2882.03 2836.27 2778.53 2732.77

BOSCHLTD 25807.40 24801.45 24234.05 23228.10 22660.70

EICHERMOT 29507.53 28337.12 27693.58 26523.17 25879.63

HEROMOTOCO 3915.90 3788.00 3719.00 3591.10 3522.10

M&M 1436.33 1406.27 1388.18 1358.12 1340.03

MARUTI 7440.18 7329.67 7241.48 7130.97 7042.78

TATAMTRDVR 294.58 285.42 280.33 271.17 266.08

TATAMOTORS 480.45 461.80 452.10 433.45 423.75

CEMENT & CEMENT PRODUCTS

ACC 1693.50 1665.10 1645.75 1617.35 1598.00

AMBUJACEM 252.63 247.97 242.23 237.57 231.83

GRASIM 1235.25 1203.45 1157.90 1126.10 1080.55

ULTRACEMCO 4204.80 4101.90 4046.45 3943.55 3888.10

CONSTRUCTION

LT 1804.23 1763.47 1741.23 1700.47 1678.23

CONSUMER GOODS

ASIANPAINT 1187.25 1170.45 1154.20 1137.40 1121.15

HINDUNILVR 1154.63 1126.27 1100.63 1072.27 1046.63

ITC 316.07 313.53 310.37 307.83 304.67

ENERGY

BPCL 696.12 663.43 646.02 613.33 595.92

GAIL 395.25 374.70 362.85 342.30 330.45

NTPC 163.38 160.62 158.93 156.17 154.48

ONGC 174.97 166.53 161.92 153.48 148.87

POWERGRID 222.00 214.00 207.00 199.00 192.00

RELIANCE 1479.02 1457.43 1423.82 1402.23 1368.62

TATAPOWER 86.93 84.22 80.68 77.97 74.43

FINANCIAL SERVICES

AXISBANK 532.92 518.78 511.22 497.08 489.52

BANKBARODA 173.02 166.93 163.72 157.63 154.42

HDFCBANK 1735.28 1706.97 1687.68 1659.37 1640.08

HDFC 1688.12 1669.73 1642.62 1624.23 1597.12

ICICIBANK 300.08 295.97 290.28 286.17 280.48

INDUSINDBK 1535.60 1513.50 1499.40 1477.30 1463.20

KOTAKBANK 1015.17 1000.18 989.67 974.68 964.17

SBIN 300.65 294.80 290.05 284.20 279.45

YESBANK 1488.07 1461.73 1443.67 1417.33 1399.27

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

26 JUN TO 30 JUN 17

INDUSTRIAL MANUFACTURING

BHEL 142.77 138.88 135.52 131.63 128.27

IT

HCLTECH 874.42 863.13 846.72 835.43 819.02

INFY 987.35 965.30 946.65 924.60 905.95

TCS 2483.23 2422.47 2388.23 2327.47 2293.23

TECHM 402.87 391.78 385.82 374.73 368.77

WIPRO 264.15 260.50 256.25 252.60 248.35

MEDIA & ENTERTAINMENT

ZEEL 526.68 518.22 508.43 499.97 490.18

METALS

COALINDIA 262.10 253.50 248.30 239.70 234.50

HINDALCO 207.10 197.90 192.25 183.05 177.40

TATASTEEL 534.82 521.03 511.87 498.08 488.92

SERVICES

ADANIPORTS 384.32 374.88 368.27 358.83 352.22

PHARMA

AUROPHARMA 695.95 684.10 663.15 651.30 630.35

CIPLA 563.72 552.43 538.22 526.93 512.72

DRREDDY 2737.90 2690.80 2652.80 2605.70 2567.70

LUPIN 1169.97 1114.98 1086.52 1031.53 1003.07

SUNPHARMA 562.10 552.95 536.35 527.20 510.60

TELECOM

BHARTIARTL 374.87 370.53 366.52 362.18 358.17

INFRATEL 377.62 374.88 372.97 370.23 368.32

IDEA 85.65 82.50 80.00 76.85 74.35

Weekly Top gainers stocks

Script Symbol Previous Close Current Price % Change In Points

TATAPOWER 77.90 81.50 4.62% 3.60

RELIANCE 1388.8 1435.85 3.39% 47.05

AUROPHARMA 653.70 672.25 2.84% 18.55

SUNPHARMA 529.15 543.80 2.77% 14.65

AMBUJACEM 237.25 243.30 2.55% 6.05

Weekly Top losers stocks

Script Symbol Previous Close Current Price % Change In Points

ICICIBANK 316.50 291.85 -7.79% -24.65

GAIL 378.35 354.15 -6.40% -24.20

BPCL 673.80 630.75 -6.39% -43.05

LUPIN 1131.05 1060.00 -6.28% -71.05

EICHERMOT 28746.90 27166.70 -5.50% -1580.20

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

26 JUN TO 30 JUN 17

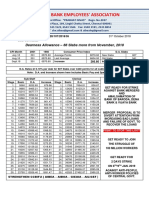

Weekly FIIS Statistics*

DATE Buy Value Sell Value Net Value

23/JUN/2017 4875.82 4605.87 269.95

22/JUN/2017 6372.36 6179.68 192.68

21/JUN/2017 4834.65 4987.47 -152.82

20/JUN/2017 4296.89 4609.73 -312.84

19/JUN/2017 3843.21 4093.60 -250.39

Weekly DIIS Statistics*

DATE Buy Value Sell Value Net Value

23/JUN/2017 2537.14 2582.92 -45.78

22/JUN/2017 3449.68 2994.47 455.21

21/JUN/2017 6553.95 6595.34 -41.39

20/JUN/2017 2580.21 2103.08 477.13

19/JUN/2017 2539.58 2009.68 529.90

MOST ACTIVE NIFTY CALLS & PUTS

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

29/JUN/2017 CE 9700 473772 8431350

29/JUN/2017 CE 9600 373173 5288025

29/JUN/2017 CE 9650 164404 2239650

29/JUN/2017 PE 9600 392063 4994700

29/JUN/2017 PE 9500 315974 6193050

29/JUN/2017 PE 9400 189533 3491250

MOST ACTIVE BANK NIFTY CALLS & PUTS

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

29/JUN/2017 CE 23800 141060 641680

29/JUN/2017 CE 24000 130704 1197200

29/JUN/2017 CE 23700 129432 588480

29/JUN/2017 PE 23500 174651 1417200

29/JUN/2017 PE 23400 113794 427080

29/JUN/2017 PE 23600 110750 242760

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

26 JUN TO 30 JUN 17

Weekly Recommendations:-

DATE SYMBOL STRATEGY ENTRY TARGET STATUS

23 JUN 17 SUNPHARMA BUY AROUND 540-545 562-605 OPEN

17 JUN 17 TVSMOTORS BUY AROUND 550 572-600 OPEN

ALL TARGET

3 JUN 17 AUROPHARMA BUY AROUND 590 614-640

ACHIEVED

20 MAY 17 BHARTIARTL BUY AROUND 372 388-402 OPEN

13 MAY 17 AXISBANK SELL BELOW 500 480-450 OPEN

1ST TARGET

6 MAY 17 VOLTAS BUY ON DEEP 422 439-456

ACHIEVED

1ST TARGET

29 APR 17 IDFC BUY ON DEEP 62 65-68

ACHIEVED

1ST TARGET

22 APR 17 RELIANCE BUY ON DEEP 1400 1455-1525

ACHIEVED

BOOK AT

14 APR 17 TATAELXSI BUY ABOVE 1550 1612-1675

1603

1ST TARGET

8 APR 17 AXISBANK BUY ON DEEP 505-503 525-560

ACHIEVED

1ST TARGET

1 APR 17 ACC BUY ON DEEP 1440 1498-1558

ACHIEVED

25 MAR 17 COALINDIA BUY ON DEEP 295-290 307-320 EXIT AT 282.7

18 MAR 17 AUROPHARMA BUY ON DEEP 698 727-760 EXIT AT 670

11 MAR 17 SUNTV BUY ABOVE 745 775-805 BOOK AT 770

* FII & DII trading activity on NSE, BSE, and MCXSX in Capital Market Segment (in Rs. Crores)

DISCLAIMER

Stock trading involves high risk and one can lose Substantial amount of money. The recommendations made herein do

not constitute an offer to sell or solicitation to buy any of the Securities mentioned. No representations can be made

that recommendations contained herein will be profitable or they will not result in losses. Readers using the

information contained herein are solely responsible for their actions. The information is obtained from sources deemed

to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on

technical analysis only. NOTE WE HAVE NO HOLDINGS IN ANY OF STOCKS RECOMMENDED ABOVE

Zoid Research

Office 101, Shagun Tower

A.B. Commercial Road, Indore

452001

Mobile: +91 9039073611

Email: info@zoidresearch.com

Website: www.zoidresearch.com

www.zoidresearch.com ZOID RESEARCH TEAM

Das könnte Ihnen auch gefallen

- Rules of Debits and CreditsDokument6 SeitenRules of Debits and CreditsJubelle Tacusalme Punzalan100% (1)

- 212 The Complete Trader by Rohan Mehta PDFDokument173 Seiten212 The Complete Trader by Rohan Mehta PDFAvinash Warke100% (3)

- Project FRA Milestone1 JPY Nikita Chaturvedi 05.05.2022 Jupyter Notebook PDFDokument102 SeitenProject FRA Milestone1 JPY Nikita Chaturvedi 05.05.2022 Jupyter Notebook PDFRekha Rajaram74% (19)

- Dispersion Trade Option CorrelationDokument27 SeitenDispersion Trade Option Correlationmaf2014100% (2)

- Mock Exam A Morning Session PDFDokument23 SeitenMock Exam A Morning Session PDFNguyệtt HươnggNoch keine Bewertungen

- Case Study For CFP Final ModuleDokument3 SeitenCase Study For CFP Final ModuleImran Ansari0% (2)

- 300zx 1991 FSM SearchableDokument1.248 Seiten300zx 1991 FSM SearchableMilka Tesla100% (2)

- B4T07STOCKSDokument4 SeitenB4T07STOCKSPrakash BatwalNoch keine Bewertungen

- 03 Understanding Single Period Chart PatternsDokument6 Seiten03 Understanding Single Period Chart PatternsWinson A. B.0% (1)

- Volatility in Indian Stock MarketDokument6 SeitenVolatility in Indian Stock MarketUpender GoelNoch keine Bewertungen

- Benjamin GrahamDokument50 SeitenBenjamin GrahamTeddy RusliNoch keine Bewertungen

- Equity Report 22 May To 26 MayDokument6 SeitenEquity Report 22 May To 26 MayzoidresearchNoch keine Bewertungen

- Equity Report 21 Aug To 25 AugDokument6 SeitenEquity Report 21 Aug To 25 AugzoidresearchNoch keine Bewertungen

- Equity Report 19 June To 23 JuneDokument6 SeitenEquity Report 19 June To 23 JunezoidresearchNoch keine Bewertungen

- Equity Weekly Report 8 May To 12 MayDokument6 SeitenEquity Weekly Report 8 May To 12 MayzoidresearchNoch keine Bewertungen

- Equity Report 10 July To 14 JulyDokument6 SeitenEquity Report 10 July To 14 JulyzoidresearchNoch keine Bewertungen

- Equity Weekly ReportDokument6 SeitenEquity Weekly ReportzoidresearchNoch keine Bewertungen

- Equity Report 15 May To 19 MayDokument6 SeitenEquity Report 15 May To 19 MayzoidresearchNoch keine Bewertungen

- Equity Technical Weekly ReportDokument6 SeitenEquity Technical Weekly ReportzoidresearchNoch keine Bewertungen

- Equity Report 16 - 20 OctDokument6 SeitenEquity Report 16 - 20 OctzoidresearchNoch keine Bewertungen

- Equity Outlook 13 Feb To 17 FebDokument6 SeitenEquity Outlook 13 Feb To 17 FebzoidresearchNoch keine Bewertungen

- Equity Report 6 To 10 NovDokument6 SeitenEquity Report 6 To 10 NovzoidresearchNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument37 SeitenIndex Movement:: National Stock Exchange of India LimitedJayant SharmaNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument36 SeitenIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument27 SeitenIndex Movement:: National Stock Exchange of India LimitedjanuianNoch keine Bewertungen

- Index Movement:: National Stock Exchange of India LimitedDokument36 SeitenIndex Movement:: National Stock Exchange of India Limitedanilkhubchandani9744Noch keine Bewertungen

- Symbol Open Dayhigh Daylow Lastprice Previousclose ChangeDokument4 SeitenSymbol Open Dayhigh Daylow Lastprice Previousclose ChangeVijayNoch keine Bewertungen

- NSE TOP GAINERSDokument8 SeitenNSE TOP GAINERSdewanibipin0% (2)

- Term PaperDokument9 SeitenTerm Paperkavya surapureddy100% (1)

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDokument12 SeitenSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliNoch keine Bewertungen

- Technical Morning - Call - 120922 PDFDokument5 SeitenTechnical Morning - Call - 120922 PDFSomeone 4780Noch keine Bewertungen

- Nifty range calculator with expected price changesDokument13 SeitenNifty range calculator with expected price changesbrijsingNoch keine Bewertungen

- New Microsoft Excel WorksheetDokument9 SeitenNew Microsoft Excel WorksheetSneha JadhavNoch keine Bewertungen

- Nifty 100 - Expected Returns (Holding Period of 6-8weeks)Dokument2 SeitenNifty 100 - Expected Returns (Holding Period of 6-8weeks)Sathv100% (1)

- Equity StockDokument4 SeitenEquity StockChaitanya EnterprisesNoch keine Bewertungen

- Top Performing Stocks on NSEDokument33 SeitenTop Performing Stocks on NSEAnand ChineyNoch keine Bewertungen

- Bel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeDokument8 SeitenBel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeVijayNoch keine Bewertungen

- Shareable Sheet-Protected-UnlockedDokument2 SeitenShareable Sheet-Protected-UnlockedTrading TrainingNoch keine Bewertungen

- MARKET CORRECTIONDokument5 SeitenMARKET CORRECTIONThiyaga RajanNoch keine Bewertungen

- B2Dokument14 SeitenB2marathi techNoch keine Bewertungen

- Intraday Trading System v3.0Dokument6 SeitenIntraday Trading System v3.0Altaf KhanNoch keine Bewertungen

- MW NIFTY MIDCAP 150 03 Apr 2023Dokument8 SeitenMW NIFTY MIDCAP 150 03 Apr 2023SumitNoch keine Bewertungen

- Historic Data Nifty50 9THJULYDokument3 SeitenHistoric Data Nifty50 9THJULYsriniaithaNoch keine Bewertungen

- Daily Market Update OF 25 APRIL 2023-202304251728143358428Dokument4 SeitenDaily Market Update OF 25 APRIL 2023-202304251728143358428Pratik ShingareNoch keine Bewertungen

- MOS Rate of HPL and HREL-UpdatedDokument31 SeitenMOS Rate of HPL and HREL-UpdatedDebasmita DasNoch keine Bewertungen

- Incurred - Claims - RatioDokument20 SeitenIncurred - Claims - RatioPravin YeluriNoch keine Bewertungen

- 802 PB 20 Pages 2 3 and 4Dokument4 Seiten802 PB 20 Pages 2 3 and 4stephanie1665Noch keine Bewertungen

- Les Indices BoursierDokument6 SeitenLes Indices BoursierkhalifatoNoch keine Bewertungen

- Angel SuggestedDokument4 SeitenAngel Suggestedmangalraj900Noch keine Bewertungen

- Equity Summary DetailsDokument5 SeitenEquity Summary DetailsNadeem AhmadNoch keine Bewertungen

- Analisis Sensitivitas Sensitivity AnalysisDokument26 SeitenAnalisis Sensitivitas Sensitivity AnalysisardiNoch keine Bewertungen

- NiftyDokument14 SeitenNiftyAnshuman GuptaNoch keine Bewertungen

- Daily-Equity 17 Sep 2010Dokument3 SeitenDaily-Equity 17 Sep 2010Vikram JunejaNoch keine Bewertungen

- Stock market indices and daily price changesDokument138 SeitenStock market indices and daily price changesajinkya deshmukhNoch keine Bewertungen

- CPR STRATEGY TITLEDokument4 SeitenCPR STRATEGY TITLENeet Aipg newstipsNoch keine Bewertungen

- Symbol 52 Week High 52 Week Low 365 Days % Change 30 Days % ChangeDokument6 SeitenSymbol 52 Week High 52 Week Low 365 Days % Change 30 Days % ChangeshaileshNoch keine Bewertungen

- Tech Report 08.12Dokument3 SeitenTech Report 08.12bnr534Noch keine Bewertungen

- STOCK PRICE MOVEMENTSDokument631 SeitenSTOCK PRICE MOVEMENTSKasthuri CoimbatoreNoch keine Bewertungen

- BSE PSU Energy StocksDokument3 SeitenBSE PSU Energy StocksYatrikNoch keine Bewertungen

- 05 03 2019anDokument120 Seiten05 03 2019anNarnolia'sNoch keine Bewertungen

- CookieDokument9 SeitenCookieprasannapharaohNoch keine Bewertungen

- Project Name: Al Shahad Tower Consultant: MZP W.L.L Main Contractor: Al Bandary EngineeringDokument6 SeitenProject Name: Al Shahad Tower Consultant: MZP W.L.L Main Contractor: Al Bandary EngineeringFranklyn GenoveNoch keine Bewertungen

- All India Bank Employees' Association releases 66th DA slab hike detailsDokument2 SeitenAll India Bank Employees' Association releases 66th DA slab hike detailsnellaimathivel4489Noch keine Bewertungen

- Kingston Educational Institute: Ratio AnalysisDokument1 SeiteKingston Educational Institute: Ratio Analysisdhimanbasu1975Noch keine Bewertungen

- Category Date Buy Value Sell Value Net ValueDokument7 SeitenCategory Date Buy Value Sell Value Net ValueMohd FarazNoch keine Bewertungen

- United States Census Figures Back to 1630Von EverandUnited States Census Figures Back to 1630Noch keine Bewertungen

- Equity Weekly Report 19-23 NovDokument10 SeitenEquity Weekly Report 19-23 NovzoidresearchNoch keine Bewertungen

- Equity Report 16 - 20 OctDokument6 SeitenEquity Report 16 - 20 OctzoidresearchNoch keine Bewertungen

- Equity Weekly Report - Zoid ResearchDokument9 SeitenEquity Weekly Report - Zoid ResearchzoidresearchNoch keine Bewertungen

- Nifty Technical Report (31july - 4aug)Dokument6 SeitenNifty Technical Report (31july - 4aug)zoidresearchNoch keine Bewertungen

- Equity Report 6 To 10 NovDokument6 SeitenEquity Report 6 To 10 NovzoidresearchNoch keine Bewertungen

- Nifty Weekly Report 17 Apr To 21 AprDokument6 SeitenNifty Weekly Report 17 Apr To 21 AprzoidresearchNoch keine Bewertungen

- Equity Report 3 July To 7 JulyDokument6 SeitenEquity Report 3 July To 7 JulyzoidresearchNoch keine Bewertungen

- Equity Report 24 Apr To 28 AprDokument6 SeitenEquity Report 24 Apr To 28 AprzoidresearchNoch keine Bewertungen

- Equity Report 15 May To 19 MayDokument6 SeitenEquity Report 15 May To 19 MayzoidresearchNoch keine Bewertungen

- Equity Report 5 Jun To 9 JunDokument6 SeitenEquity Report 5 Jun To 9 JunzoidresearchNoch keine Bewertungen

- Equity Weekly Report 20 Feb To 24 FebDokument6 SeitenEquity Weekly Report 20 Feb To 24 FebzoidresearchNoch keine Bewertungen

- Outlook On Equity Report 1 MAY To 5 MAYDokument6 SeitenOutlook On Equity Report 1 MAY To 5 MAYzoidresearchNoch keine Bewertungen

- Equity Technical Report 10 Apr To 14 AprDokument6 SeitenEquity Technical Report 10 Apr To 14 AprzoidresearchNoch keine Bewertungen

- Equity Technical Report 2 Jan To 6 JanDokument6 SeitenEquity Technical Report 2 Jan To 6 JanzoidresearchNoch keine Bewertungen

- Equity Market Outlook (3-7 April)Dokument6 SeitenEquity Market Outlook (3-7 April)zoidresearchNoch keine Bewertungen

- Equity Weekly ReportDokument6 SeitenEquity Weekly ReportzoidresearchNoch keine Bewertungen

- Equity Technical Report 5 Dec To 9 DecDokument6 SeitenEquity Technical Report 5 Dec To 9 DeczoidresearchNoch keine Bewertungen

- Equity Technical Report 30 Jan To 3 FebDokument6 SeitenEquity Technical Report 30 Jan To 3 FebzoidresearchNoch keine Bewertungen

- Equity Technical Weekly ReportDokument6 SeitenEquity Technical Weekly ReportzoidresearchNoch keine Bewertungen

- Equity Outlook 13 Feb To 17 FebDokument6 SeitenEquity Outlook 13 Feb To 17 FebzoidresearchNoch keine Bewertungen

- Equity Report Outlook 6 Feb To 10 FebDokument6 SeitenEquity Report Outlook 6 Feb To 10 FebzoidresearchNoch keine Bewertungen

- Equity Technical Report 23 Jan To 27 JanDokument6 SeitenEquity Technical Report 23 Jan To 27 JanzoidresearchNoch keine Bewertungen

- Equity Technical Report 28 Nov To 2 DecDokument6 SeitenEquity Technical Report 28 Nov To 2 DeczoidresearchNoch keine Bewertungen

- Equity Report 12 Dec To 16 DecDokument6 SeitenEquity Report 12 Dec To 16 DeczoidresearchNoch keine Bewertungen

- IL&FS crisis explained: Causes, impact, solutions</TITLEDokument6 SeitenIL&FS crisis explained: Causes, impact, solutions</TITLEPrakash SundaramNoch keine Bewertungen

- Ball 2006 Acctg and Bus ResearchDokument24 SeitenBall 2006 Acctg and Bus ResearchAgusdiwana SuarniNoch keine Bewertungen

- Case Study On Tea Time: Submitted byDokument14 SeitenCase Study On Tea Time: Submitted byFaysal Ahmed TalukderNoch keine Bewertungen

- t3b Leaflet LRDokument2 Seitent3b Leaflet LRsjmuneer9389Noch keine Bewertungen

- What Causes A Currency CrisisDokument3 SeitenWhat Causes A Currency CrisisDon Pelicio NgohoNoch keine Bewertungen

- Unit 7 - Written Assignment - AccountingDokument4 SeitenUnit 7 - Written Assignment - AccountingCharles IrikefeNoch keine Bewertungen

- Study of Bangladesh Bond MarketDokument120 SeitenStudy of Bangladesh Bond Marketkhaledmasud82Noch keine Bewertungen

- Chapter 10 Equity Part 2Dokument27 SeitenChapter 10 Equity Part 2LEE WEI LONGNoch keine Bewertungen

- BW Plantation PDFDokument253 SeitenBW Plantation PDFPutriani utamiNoch keine Bewertungen

- Garp MarchDokument5 SeitenGarp MarchZerohedgeNoch keine Bewertungen

- Citibank CFO PresentationDokument29 SeitenCitibank CFO PresentationDiego de AragãoNoch keine Bewertungen

- WhiskeySauer Budget 3.0 For RedditDokument23 SeitenWhiskeySauer Budget 3.0 For RedditСинишаNoch keine Bewertungen

- J. InternasionalDokument93 SeitenJ. Internasionalriski ramadhanNoch keine Bewertungen

- Attorney StatementDokument15 SeitenAttorney Statementshaprioliar666Noch keine Bewertungen

- Full Annual Report 2016Dokument154 SeitenFull Annual Report 2016asdfsdjhNoch keine Bewertungen

- Ambuja Cement Ratio AnalysisDokument8 SeitenAmbuja Cement Ratio AnalysisvikassinghnirwanNoch keine Bewertungen

- MANAGEMENT ACCOUNTING ASSIGNMENT NimeelithaDokument11 SeitenMANAGEMENT ACCOUNTING ASSIGNMENT NimeelithaNimeelitha GelliNoch keine Bewertungen

- The Efficient Markets Hypothesis: Mohammad Ali SaeedDokument21 SeitenThe Efficient Markets Hypothesis: Mohammad Ali SaeedBalach MalikNoch keine Bewertungen

- Latihan Tugas ALK - Prospective AnalysisDokument3 SeitenLatihan Tugas ALK - Prospective AnalysisSelvy MonibollyNoch keine Bewertungen

- Ratio Analysis of Selected Insurance Co: Rupali LifeDokument3 SeitenRatio Analysis of Selected Insurance Co: Rupali LifeAmitNoch keine Bewertungen

- Case CDokument3 SeitenCase Cnaveen0037Noch keine Bewertungen

- Financial Instruments OverviewDokument38 SeitenFinancial Instruments OverviewManraj LidharNoch keine Bewertungen