Beruflich Dokumente

Kultur Dokumente

Edwin G Holler Complainant V Robert B Pirie JR Acting Secretary Department of TH

Hochgeladen von

Anonymous Lh8oSm8Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Edwin G Holler Complainant V Robert B Pirie JR Acting Secretary Department of TH

Hochgeladen von

Anonymous Lh8oSm8Copyright:

Verfügbare Formate

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

EEOC DOC 01990407 (E.E.O.C.), EEOC DOC 01982627, 2001 WL 991924

E.E.O.C.

EDWIN G. HOLLER, COMPLAINANT,

v.

ROBERT B. PIRIE, JR., ACTING SECRETARY, DEPARTMENT OF THE NAVY, AGENCY.

Appeal Nos. 01982627 & 01990407

Agency No. 94-60050-N04

Hearing No. 340-95-3739X

August 22, 2001

DECISION

*1 On January 17, 1998, the complainant filed Appeal 1 with this Commission from a final agency decision (FAD)

dated December 10, 1997. It adopted the recommended decision of an Equal Employment Opportunity Commission

Administrative Judge (AJ) which found discrimination in violation of Title VII of the Civil Rights Act of 1964, as

amended, 42 U.S.C. 2000e et seq. and the Age Discrimination in Employment Act of 1967 (ADEA), as amended, 29

U.S.C. 621 et seq. The FAD ordered equitable remedies, and gave the complainant an opportunity to submit evidence

of damages to the agency. Thereafter, the complainant timely filed Appeal 2 with this Commission from a FAD dated

September 2, 1998 which awarded and denied claimed compensatory damages. Appeals 1 and 2 are accepted under 29

C.F.R. 1614.405.

ISSUES PRESENTED

Whether (1) the complainant timely filed Appeal 1, (2) the agency properly calculated back pay, (3) the complainant

is entitled to compensation for the adverse tax consequences of receiving a lump sum back pay award, (4) the agency

properly denied front pay, (4) certain information should be expunged from the complainant's personnel file, (5) proper

relief included agency officials being counseled and trained, (6) the complainant timely submitted certain evidence on

pecuniary compensatory damages, and (7) the agency properly calculated damages.

BACKGROUND

The complainant formerly worked at the Marine Corps Air Station in El Toro, California. He was the Manager of

the Accounting Branch, NF-4, in the Support Division of the Morale, Welfare & Recreation (MWR) Department.

In August 1992, the agency issued notices of removal effective October 2, 1992 by means of a Business Based Action

(BBA) to all members of the Support Division. This included the complainant and its four highest level managers. These

managers filed EEO complaints alleging discrimination, in part, on the bases of their sex (male) and age when they were

discharged. 1 Following a consolidated investigation of the discharge claim and separate investigations of other claims,

the complainants had a consolidated hearing before an Equal Employment Opportunity Commission Administrative

Judge (AJ). The AJ issued separate recommended decisions for each active complainant, which the agency adopted.

The AJ and the agency found that the complainant was discriminated against on the bases of age and sex when he was

terminated by means of a BBA, and when he was not selected for the position of Supervisor of General Accounting,

NF-4 in September 1992. This position was located in the MWR at El Toro. It was created in anticipation of the BBA.

2017 Thomson Reuters. No claim to original U.S. Government Works. 1

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

On appeal, the complainant argues that he is entitled to further relief. In response, the agency argues that complainant's

Appeal 1 is untimely, that he untimely submitted certain evidence on pecuniary damages, and that he is not entitled to

further relief. 2

ANALYSIS AND FINDINGS

Timeliness

*2 The first FAD was issued on December 10, 1997. It was mailed to the complainant, with a copy to his attorney.

By letter postmarked January 17, 1998, the complainant filed a document at the address to file an appeal with the

Commission entitled Submission of Damages for the Claimant, Edwin G. Holler. It argued for certain calculations of

back pay and interest and compensatory damages, and for front pay rather than reinstatement. We construe this to be

an appeal of the December 10, 1997 FAD. Because the FAD does not contain a certificate or other proof verifying when

it was mailed and the record does not show when the complainant's attorney received the decision, we deem Appeal 1 to

be timely under 29 C.F.R. 1614.402(b). 3 Some issues have been resolved since the filing of this appeal. The unresolved

issues are discussed below.

BACK PAY

The FAD ordered, in part, reinstatement and back pay up to the date of reinstatement. By letter dated January 14,

1998, the agency offered the complainant reinstatement to the position of Director, General Accounting Division. The

complainant rejected the offer on February 9, 1998. The agency paid back pay from October 3, 1992 through February

9, 1998, and this period is undisputed. The subsequent period is addressed in the front pay discussion below.

In March 1998, the agency issued the complainant a check for back pay and interest thereon in the amount of $61,643.77.

But the parties continued to engage in negotiations on the calculation of back pay and interest. This resulted in the

agency issuing a check to the complainant in June 1998 in the amount of $31,587.57, and a final check in late October

1998 for $6,240.65. In October 1998, the complainant sent correspondence to the Commission delineating his concerns.

Salary rate, including bonuses, is the only back pay dispute remaining.

For the back pay period up to May 1996, the agency derived the complainant's rate of back pay based on the

compensation comparative employees received during this time. This included bonuses. From May 1996 onward, the

agency's back pay calculations were based on the complainant being a GS-12, with saved pay. The complainant was

discriminatorily not selected to the position of Supervisor of General Accounting, NF-4 in September 1992, which

succeeded the job from which he was removed. The successor job was converted to a GS-12 level pay position in May

1996.

The complainant avers that the back pay should be based on an extrapolation of his historic pay from 1987 to October

2, 1992. He argues that the financial condition of the MWR at El Toro Exchange deteriorated because of the removal

of himself and the other older male complainants.

The AJ found the agency discriminated against three of the four active complainants when it removed them from their

positions. The AJ found unrebutted the complainants' testimony that their jobs largely consisted of financial oversight

and their absence greatly contributed to the financial problems of the MWR at El Toro Exchange. The AJ also found

that testimony the MWR at El Toro was having financial problems before the BBA was generally undisputed.

*3 The agency argues that salary history is not a good measure because the pay system changed. In approximately

May 1991, the MWR switched the complainant and others from the universal annual (UA) salary plan to the pay band

system. The UA plan was nondiscretionary and mirrored the federal government's general schedule (GS) pay plan. The

2017 Thomson Reuters. No claim to original U.S. Government Works. 2

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

new pay band system had a large discretionary component. Because of this change in pay systems, we find that making

extrapolations from the complainant's historic pay is not an appropriate method to determine salary assumptions during

most of the back pay period. Moreover, making extrapolations from salary levels dating to 1987 is too far removed to

be a good measure.

Further, the complainant failed to establish that salary assumptions should be recalculated, to the extent his removal

was responsible for the financial deterioration of the Exchange. The complainant failed to establish that the financial

condition of the MWR at El Toro adversely impacted salary levels. The Commission notes that in closing argument

before the AJ, the complainant argued that despite the claimed deteriorating financial condition of the MWR at El Toro

and the BBA, there were multiple promotions, raises and bonuses. 4

TAX CONSEQUENCES

The complainant was terminated and not selected for a position in violation of Title VII and the ADEA. He argues

that he should be compensated for the alleged adverse tax consequence of receiving a lump sum back pay award. He

cites Kalra v. Department of Transportation, EEOC Appeal No. 01924002 (February 25, 1994) (increased tax liability

stemming from a lump sum back pay award, to the extent proven, is awardable as consequential pecuniary compensatory

damages). The Commission later vacated the portion of Kalra awarding damages on the grounds that they were not

available for acts of discrimination that occurred prior to November 21, 1991. 5 Effective November 21, 1991, Title

VII was amended to allow the award of compensatory damages against the federal government. Section 102(a) of the

Civil Rights Act of 1991, codified as 42 U.S.C. 1981a. The purpose of compensatory damages under Title VII is to

compensate an employee for the proximate injury caused by employment discrimination. Compensation for the adverse

tax consequences of receiving a lump sum back pay award meets this criteria. 6

The agency argues that the equitable remedy of an award to cover additional tax liability of receiving back pay in a lump

sum is not available. In light of the cases below, we disagree. The complainant argues that he should be compensated

for the alleged adverse tax consequence of receiving a lump sum back pay award. Sears v. Atchison, Topeka & Santa Fe

Railway, Company, 749 F.2d 1451, 1456 (1984), a Title VII employment discrimination case, found that a district court

may include a tax component in a back pay award (an equitable remedy) to compensate class members for their increased

taxes as a result of receiving over 17 years of back pay in one lump sum. The court in O'Neill v. Sears, Roebuck and

Company, 108 F. Supp.2d 443, 446-47 (E.D. Penn. 2000) found that make whole relief under the ADEA for a terminated

employee included an award for the tax consequences of receiving back and front pay all in one year rather than income

being earned over time. The court explained that the goal of the ADEA is to allow a plaintiff to keep the same amount

of money he would have earned had he not been unlawfully terminated.

*4 We need not categorize whether the potential award to the instant complainant for the adverse tax consequences of

receiving lump sum back pay is a legal or equitable remedy since it is available under at least one of these theories.

The complainant avers that he paid an additional $7,116.09 in taxes as a result of the lump sum back pay award in March

1998. He averred that the 1997 total combined federal and state tax rate was 23.5% and the average combined tax rate

from 1989 to 1992 was 12.8%. He argues that the lump sum back pay with interest payment was subject to the higher

rate, and he is entitled to reimbursement for the difference between these rates. He also indicated that subsequent lump

sum payments resulted in some additional tax liability.

But the earlier lower rate, for the most part, is not derived from the correct years, i.e., those during the back pay period.

Further, the complainant used the 1997 tax rates for back pay received in 1998. The complainant's calculations do not

take into account deductions and other factors that would affect his taxes, and are not broken down by year. Courts

that discuss claims for compensation for additional tax liability stemming from a lump sum payment have demanded

2017 Thomson Reuters. No claim to original U.S. Government Works. 3

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

probative calculations by complainants. Barbour v. Medlantic Management Corp., 952 F.Supp. 857, 865 (D.C. 1997)

(denied award due to failure to provide evidence on difference between taxes paid on lump sum front pay award and

amount of taxes that would have been paid had the salary been earned over time); Hukkanen v. International Union of

Operating Engineers, 3 F.3d 281, 287 (8 th Cir. 1993) (district court may deny award where the plaintiff failed to provide

evidence on the tax enhancement amount or convenient way for the court to calculate it).

The complainant has the burden of establishing the amount of increased tax liability. Id. at 287. This matter is remanded

to the Hearings Unit of the Los Angeles EEOC district office in accordance with the order below.

FRONT PAY

Reinstatement into an appropriate position generally is preferred to an award of front pay. When placement into an

appropriate position is not possible, the employer must make whole the victim of the discrimination until such placement

is possible. Front pay may be awarded in lieu of reinstatement when: (1) no position is available; (2) a subsequent working

relationship between the parties would be antagonistic; or (3) the employer has a record of long-term resistance to anti-

discrimination efforts. The fact that front pay is awarded in lieu of reinstatement implies that the complainant is able to

work but cannot do so because of circumstances external to the complainant. Brinkley v. United States Postal Service,

EEOC Request No. 05980429 (August 12, 1999).

The complainant argued that reinstatement was improper because he would have to work with agency employees who

were involved in his removal and defended his removal during the EEO process, which would be hostile. There was no

finding, however, that the complainant worked in a hostile environment prior to his removal, and his argument about

returning to antagonistic relationships was not supported by the record.

*5 In July 1998, the Director of MWR at El Toro affirmed that the Marine Corps Air Station in El Toro was being

scaled back and was scheduled to close in July 1999. He affirmed this would be mirrored at the MWR at El Toro, with

closure prior to July 1999, and that the complainant's position was expected to continue at least until early 1999, and

perhaps later. The complainant argued that given the impending base closure and concomitant cessation of the offered

job, reinstatement was not appropriate. We disagree. The offered job was expected to last a year or more, enough to

make it a reasonable offer. Accordingly, the Commission denies front pay.

PERSONNEL FILE

The complainant argues that because his removal was discriminatory and reinstatement was ordered, his personnel file

should be expunged of references to his removal. We agree. The order of reinstatement with back pay implicitly included

the requirement that references to the removal be expunged from the complainant's personnel file. If the agency has not

already done so, it must do so.

COUNSELING AND TRAINING AGENCY OFFICIALS

The complainant argues that we should order agency officials involved in his discriminatory removal be counseled and

trained. The AJ did not recommend this relief, and it was not ordered by the agency. Such relief is discretionary, and we

find the AJ used proper discretion. Moreover, the facility where the discrimination occurred has been closed.

COMPENSATORY DAMAGES

Compensatory damages may be awarded for past pecuniary losses, future pecuniary losses, and nonpecuniary losses that

are directly or proximately caused by the agency's discriminatory conduct. Compensatory and Punitive Damages Available

Under Section 102 of the Civil Rights Act of 1991, EEOC Notice No. N 915.002 (July 14, 1992), at 8. This guidance is

2017 Thomson Reuters. No claim to original U.S. Government Works. 4

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

on the Commission's website at www.eeoc.gov. Pecuniary losses are out-of-pocket expenses incurred as a result of the

employer's unlawful action, including medical and other quantifiable out-of-pocket expenses. Id. Past pecuniary losses

are pecuniary losses incurred prior to the date of the resolution of the damage claim. Id. at 8-9. Future pecuniary losses

are losses that are likely to occur after the resolution of litigation. Id. at 9. Nonpecuniary losses are losses that are not

subject to precise quantification including emotional pain and loss of health. Id. at 10.

Past Pecuniary Damages

As an initial matter, the agency denied some claims for pecuniary damages due to a lack of documentation. On appeal,

the complainant submits additional documentation. The agency argues that it should not be considered because it was

untimely submitted. We disagree. At the appellate level, the Commission has discretion to consider such additional

documentation. Cf. 29 C.F.R. 1614.404(a) (the Commission may supplement the record by investigation) and 29 C.F.R.

1614.405(a) (with the exception of factual findings by an AJ, appellate review is de novo). After the agency asked the

complainant to submit proof of compensatory damages, he complied in good faith, and credibly states it took additional

time to obtain some of the documentation he submitted on appeal. Accordingly, the Commission exercises its discretion

to consider the additional documentation.

*6 To continue earning an income after he was removed, the complainant took a job as a Controller, NF-4, from

November 1992 until his retirement in May 1997. The agency deducted the salary the complainant earned as mitigation

from back pay. The job was located at the Marine Corps Air Ground Combat Center in Twentynine Palms, California,

145 miles from his home. The complainant stated his effort to find a closer job was unsuccessful. His family continued to

reside in the family home. While working, the complainant initially stayed in temporary housing at Twentynine Palms,

then moved to a trailer home there. The agency concedes that it is liable for damages for the costs of maintaining a second

residence since this resulted from the termination, but denied most of these damages due to lack of documentation.

Job Search Expenses

Prior to securing his new job, the complainant incurred job search expenses. The complainant submitted to the agency

a list of job search expenses that were derived from personal checks written, plus mileage. On appeal, the complainant

submits photocopies of the underlying canceled checks. The expenses were primarily for office supplies, stamps, paying

for typing, and an employer listing. Because these expenses of $444 were adequately documented and proximately caused

by the removal, they are awarded. The complainant credibly represented that between August 1992 and November

1992, he drove 1,370 miles searching for jobs and 20 miles looking for housing. The Commission takes official notice

that the reimbursement rate the federal government paid its employees when conducting official business in a privately

owned vehicle in 1992 was 25. The complainant is entitled to $348 (1,390 miles @ 25 per mile). He also paid $93 for

a telephone answering machine. This expense is prorated by 50% (prorated to $47) because it also has many other uses.

The complainant is awarded the sum of the above three expenses, i.e., $839.

Temporary housing

Almost all the complainant's temporary housing was military lodging, i.e., billeting. The complainant averred that he

used this lodging from December 1992 to June 1993. As documentation, he submitted to the agency a list of individual

charge entries derived from his personal credit card bills. On appeal, the complainant submits photocopies of these bills.

For the months of December to February, the bills contain charges by the Twentynine Palms Marine Corps Exchange

which the complainant attributed to billeting, i.e., temporary MWR lodging. With the exception of charges on December

8, February 8, and February 12, the charges were both recurring in nature and had even dollar amounts, consistent with

rent. Less the above three dates, the Commission finds the rent of $638 is adequately substantiated. For the months

of February though June, the bills reflect charges in the amount of $1,167 to a billeting fund and one night in a motel

2017 Thomson Reuters. No claim to original U.S. Government Works. 5

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

located in Twentynine Palms. This additional rent of $1,167 is adequately substantiated. Accordingly, the Commission

awards the sum total of $1,805 in rent the period of December 1992 to June 1993.

Trailer home

*7 The complainant indicated that he rented a trailer home from June 21, 1993 to July 21, 1993, paying a $100 rent

deposit and $385 more in rent. On appeal, he adequately documented this expense with evidence of payment to the RV

resort by check and a credit card. Hence the sum of $485 is awarded by the Commission.

The complainant purchased a trailer home for use at Twentynine Palms in July 1993, and sold it in June 1997, less than

a month after retiring from his job there. He submitted computations to the agency, supported by receipts, indicating

that with the cost of purchase, including fees, taxes and financing, less the resale price, he lost $3,573.08 on the sale of

the trailer. The agency awarded this amount. On appeal, the complainant contends that he is entitled to an additional

$1,786.54 for the balance on the loss of selling the trailer plus interest. Less the claim for interest, the complainant does

not explain these additional losses. We are unable to find any, with the exception of $87.40 for classified advertising to

sell the trailer, and $232 for trailer towing and title soon before its sale. Accordingly, the Commission awards the sum

additional expense of $319. The claim for interest will be addressed below.

The complainant submitted to the agency a list of trailer expenses, including the $319.40 expense above, that were

derived from documentation of personal checks. On appeal, the complainant submits photocopies of the canceled checks.

The expenses covered the almost four years the complainant lived in the trailer. For the most part, they constituted

monthly rent for a trailer lot, which varied between $225 to $245, trailer license fees, trailer insurance, gas and electric,

maintenance and repair to the actual trailer and appliances within. They also included small expenses such as a ladder

for the trailer exterior, hoses and cleaning and household supplies. The above expenses total $14,470, and are adequately

documented and proximately caused by the complainant's termination. Accordingly, the Commission awards these

expenses of $14,470.

The requested trailer expenses also included furnishings, including trailer linens, a television and space heater. The

complainant spent $1,099 for furnishings. Assuming the fair market value of these items upon sale of the trailer was

about one third of this, the Commission finds the complainant lost $733 on these furnishings, and awards this amount.

He also claimed an American Automobile Association (AAA) expense for added mileage coverage. The Commission

denies this because the complainant did not show AAA had such a surcharge.

The complainant asks for reimbursement for trailer items on hand after the sale of the trailer. He provided estimated

values of these items. The first group are disposable household supplies and cleaners. Other trailer items on hand included

small kitchen items, bedding, tools, a vacuum, and the like. Some trailer items on hand were already covered above as

trailer expenses. Also, to the extent trailer items could be sold for their estimated value or merged with household items

in the primary residence, there was no loss. Moreover, some of these items, such as small kitchen items and the like,

may have been borrowed from the family home. The Commission is unpersuaded that the complainant is entitled to an

additional award for trailer items on hand.

Communications Expenses

*8 The complainant affirmed that he was motivated to save money, so he used a pager to receive notice of family calls

rather than have a telephone in his trailer. The complainant submitted a request for reimbursement to the agency, and

on appeal provides photocopies of the checks he wrote that verify the cost. This documentation indicates that he started

pager service on January 17, 1994, and purchased the pager at that time. The service was paid on an annual basis. The

cost of the pager, and pager service through May 1997 when the complainant left Twentynine Palms, was proximately

2017 Thomson Reuters. No claim to original U.S. Government Works. 6

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

caused by his removal since he used the pager for communication in the trailer rather than a telephone. Accordingly, the

Commission awards the complainant the documented expense of $462, which does not include service past May 1997.

Based on an estimate of $35 a month in long distance calls while living in Twentynine Palms, the complainant requested

the agency reimburse him $1,890. This covered the 54 months the complainant lived in Twentynine Palms. To make

outgoing long distance calls in Twentynine Palms, the complainant used a calling card.

On appeal, the complainant submits long distance telephone bills to document his expense. This covered long distance

calls made from his primary residence and calling card calls from October 1992 to November 1998. The complainant

stated he included long distance calls made to lawyers, doctors, dentists, co-complainants, family and so forth, and

requests $1,699.20. The documentation of calls is hundreds of pages.

Because the documentation is voluminous and the parties have not yet attempted to determine together which calls are to

be reimbursed, the matter of long distance calls will be remanded to the Hearings Unit of the Los Angeles EEOC district

office. The Commission provides the following guidance. Prior to moving to Twentynine Palms, only long distance calls

for job searching and making arrangements in Twentynine Palms can be reimbursed. Up to November 4, 1998, calls to

lawyers and co-complainants are not reimbursable because they were connected to cost of litigation, which was separately

settled by the parties on that date. Generally, the agency is responsible for reimbursement of long distance calls that are

proximately caused by the removal. Obvious examples are calls from the complainant's family home to his pager, and

calling card calls by the complainant to his family home.

Mileage

The complainant's family residence was 145 miles from Twentynine Palms. He worked and lived in Twentynine Palms

during the week. Family members of the complainant continued to live in his family residence, where he returned each

weekend. Because the complainant's weekly mileage between his two residences was proximately caused by his removal,

it is reimbursable.

The complainant's reimbursement request indicated that he made 49 round trips a year between his two residences. This

is credible. The Commission takes official notice that the reimbursement rate the federal government paid its employees

when conducting official business in a privately owned vehicle in 1992 though 1994 was 25, and that this increased to

30 in January 1995 and to 31 in June 1996.

*9 For the two years and one month period of December 1992 through December 1994, the complainant is entitled

to $7,395 in mileage reimbursement (102 weeks--- 29,580 miles @ 25 per mile). For the year and five month period of

January 1995 through May 1996, the complainant is entitled to $6,003 (69 weeks---20,010 miles @ 30 per mile). For the

one year period of June 1996 through May 1997, the complainant is entitled to $4,405 (49 weeks--14,210 miles @ 31 per

mile. The total mileage reimbursement for commuting between the two residences is $17,803, and this amount is awarded.

Miscellaneous expenses

Much of these expenses were for using a gardener to take care of the yard at the family home between November 1995

to February 1997. They also included the complainant's car being painted and the purchasing a winter coat. Despite

the complainant's arguments, we are not persuaded these expenses were proximately connected to his termination, and

hence deny them.

Cost of suit

2017 Thomson Reuters. No claim to original U.S. Government Works. 7

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

As noted above, all costs of pursuing the instant claim up to November 4, 1998 are not reimbursable because attorney's

fees and costs were settled by the parties on that date. Subsequent costs incurred by the complainant should be submitted

with his attorney's next petition for fees and costs.

Interest

The complainant requests interest on all past pecuniary damages. But interest on damages does not accrue until the

agency incurs the underlying liability, i.e., when this decision becomes final. Hogeland v. Department of Agriculture,

EEOC Appeal No. 01976440 (June 14, 1999).

Nonpecuniary Damages

The complainant stated that when he learned he lost his job, he felt very scared, angry, and remorseful, and memories of

the removal still upset him from time to time. His self confidence and morale were hurt when he was repeatedly turned

down for jobs, and the complainant felt like a failure when people asked him why he was no longer at his old job and

had not found employment. For sometime, he emotionally withdrew.

The complainant explained that he lived in his community for 26 years and did not want to uproot his family for an

unknown period of time. He stated that moving would have created a major impact on him because he would have to

find new services for his daughter with a severe disability, and disruption of her life would be traumatic to her and more

so to everyone around her. The complainant affirmed that the conditions of his temporary housing were unpleasant,

and it was stressful because he had to pack and unpack each week and was never guaranteed a space during the week.

Further, life in the trailer was cramped and lonely, and he routinely felt depressed. The complainant complained that

while living in the trailer it was quite unpleasant in the winter because he had to walk outside to a bath house to shower.

Further, over a 4 year period the complainant was tired from the long trips between the two residences and largely

deprived of family except on weekends. In fact, a reading of affidavits by the complainant and family members reveals

that the complainant arrived home exhausted on Friday evenings after working all day and driving 2 hours, and went

to bed early Sunday evenings to prepare for the long drive Monday mornings. He was in his 60s. He missed birthdays

and wedding anniversaries, and the relationship with his wife became strained. The complainant stated that he finally

resigned from his job at Twentynine Palms due to the stress caused by the separation.

*10 The complainant's wife and grown children also attested about this time. A daughter with a severe mental disability

who lived in the family home cried every Sunday before the complainant made his trip back to Twentynine Palms, and

this was stressful for the complainant. Instead of being with his family and pets during the week and eating home cooked

meals, the complainant lived alone and ate frozen meals. As already noted, the complainant was tired on weekends

and short on time. This created conflict between the complainant and his wife because the complainant wanted to stay

home and his wife, who did not drive, wanted to go out. They argued more. Their relationship was injured, i.e., did not

talk as much, hold hands, or take walks together. The complainant became irritable and impatient. Family members

also attested to the suffering they went through because the complainant was unavailable. Compensatory damages are

available to federal sector complainants, not their family members under the Civil Rights Act of 1991. Carpenter v.

Department of Agriculture, EEOC Appeal No. 01945652, footnote 4 (July 17, 1995). But pain and suffering caused to

the complainant because his family members suffered is compensable.

The agency found that the complainant sustained $50,000 in nonpecuniary damages, and reduced this amount to $25,000.

It reasoned that discrimination was found on the bases of sex and age, and compensatory damages are not available

under the ADEA, which prohibits age discrimination. This reduction was improper because all the actions that were

discriminatory violated Title VII. Santiago v. Department of the Army, EEOC Appeal No. 01955684, footnote 1 (October

14, 1998).

2017 Thomson Reuters. No claim to original U.S. Government Works. 8

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

The Commission's policy is to make damage awards for emotional harm consistent with awards in similar cases. In

Bernard v. Department of Veterans Affairs, EEOC Appeal No. 01966861 (July 17, 1998), the Commission awarded

$80,000 in nonpecuniary damages to an employee who was denied a reassignment and not reasonably accommodated

where he presented evidence through his own testimony and that of this friends and family that over a five years he became

depressed, withdrawn, hopeless about his ability to work independently, cynical, angry, and during part of this time

had ringing in the ears, headaches, teeth grinding and insomnia. In Ward-Jenkins v. Department of the Interior, EEOC

Appeal No. 01961483 (March 4, 1999), the Commission awarded $50,000 in nonpecuniary damages to an employee

who after being detailed and reassigned suffered a diagnosed acute distress disorder, and aggravation of her depressive

condition which was expected to last five years. During the approximately first two years, the employee lost energy,

enjoyment in activities, ceased recreating and socializing, became unkempt in appearance, was anxious, had difficulty

concentrating, had insomnia and nightmares, and gained 100 pounds. After this time, she entered a Master's degree

which she successfully completed and got a new job where she got along with co-workers and her superiors were satisfied

with her work.

*11 The Commission finds that the complainant sustained $75,000 in nonpecuniary damages. Evidence by a health care

provider is not required to prove nonpecuniary damages, but the absence of such evidence can impact the amount of the

award. Lawrence v. United States Postal Service, EEOC Appeal No. 01952288 (April 18, 1996). While the complainant

did not submit medical evidence of psychological damages, his description of his injury is persuasively corroborated by

the statements of family members and is consistent with being separated from his family during the week for 4 years

and long weekend commutes. Moreover, the complainant has established a causal nexus between the discrimination

found and his injuries, i.e., over a 4 year period living alone in sparse conditions, separation from his family, weekly

long trips causing physical exhaustion, and damage to his marital relationship. The severity and length of this hardship

warrants nonpecuniary damages of $75,000.

As the complainant is a prevailing party, he is entitled to additional attorney fees. See the order below.

CONCLUSION

Based upon a review of the record, and for the foregoing reasons, it is the decision of the Commission to modify the

relief provided by the agency.

ORDER

(1) The agency must issue the complainant a check for $115,489.08 for pecuniary and nonpecuniary damages awarded

in this decision, less any damages already paid, within 90 calendar days of the date this decision becomes final.

(2) The agency is ordered to expunge the complainant's official personnel file of references to his removal by means of

a BBA in October 1992.

(3) The issues of compensation for the increased tax liability that the complainant sustained as a result of being paid

lump sum back pay awards in 1998, if any, past pecuniary damages for long distance telephone calls, and attorney's

fees and costs are REMANDED to the Hearings Unit of the Los Angeles EEOC district office. Thereafter, the AJ

shall issue a decision on these issues in accordance with 29 C.F.R. 1614.109, and the agency shall issue a final action

in accordance with 29 C.F.R. 1614.110 within forty (40) days of receipt of the AJ's decision. This decision provides

guidance regarding how to calculate reimbursable long distance telephone expenses. The burden of proof to establish

the amount of additional tax liability, if any, created by the lump sum back pay awards is on the complainant. The

calculation of additional tax liability must be based on the taxes the complainant would have paid had he received the

back pay in the form of regular salary during the back pay period, versus the additional taxes he paid due to receiving

2017 Thomson Reuters. No claim to original U.S. Government Works. 9

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

the back pay lump sum awards in 1998. The agency shall submit copies of the AJ decision and the final agency action

to the Compliance Officer at the address set forth below.

(4) The complainant may petition for enforcement or clarification of this order under 29 C.F.R. 1614.503. The petition

for clarification or enforcement must be filed with the Compliance Officer, at the address referenced in the paragraph

entitled Implementation of the Commission's Decision.

*12 The agency is directed to submit a report of compliance, as provided in the paragraph entitled Implementation of

the Commission's Decision. The report must include evidence that the corrective actions have been implemented. The

agency shall send a copy of the report and all its enclosures to the complainant.

IMPLEMENTATION OF THE COMMISSION'S DECISION (K0501)

Compliance with the Commission's corrective action is mandatory. The agency shall submit its compliance report

within thirty (30) calendar days of the completion of all ordered corrective action. The report shall be submitted to

the Compliance Officer, Office of Federal Operations, Equal Employment Opportunity Commission, P.O. Box 19848,

Washington, D.C. 20036. The agency's report must contain supporting documentation, and the agency must send a copy

of all submissions to the complainant. If the agency does not comply with the Commission's order, the complainant may

petition the Commission for enforcement of the order. 29 C.F.R. 1614.503(a). The complainant also has the right to

file a civil action to enforce compliance with the Commission's order prior to or following an administrative petition for

enforcement. See 29 C.F.R. 1614.407, 1614.408, and 29 C.F.R. 1614.503(g). Alternatively, the complainant has the

right to file a civil action on the underlying complaint in accordance with the paragraph below entitled Right to File

A Civil Action. 29 C.F.R. 1614.407 and 1614.408. A civil action for enforcement or a civil action on the underlying

complaint is subject to the deadline stated in 42 U.S.C. 2000e-16(c) (1994 & Supp. IV 1999). If the complainant files a

civil action, the administrative processing of the complaint, including any petition for enforcement, will be terminated.

See 29 C.F.R. 1614.409.

STATEMENT OF RIGHTS - ON APPEAL RECONSIDERATION (M0900)

The Commission may, in its discretion, reconsider the decision in this case if the complainant or the agency submits a

written request containing arguments or evidence which tend to establish that:

1. The appellate decision involved a clearly erroneous interpretation of material fact or law; or

2. The appellate decision will have a substantial impact on the policies, practices, or operations of the agency.

Requests to reconsider, with supporting statement or brief, must be filed with the office of federal operations (OFO)

within thirty (30) calendar days of receipt of this decision or within twenty (20) calendar days of receipt of another party's

timely request for reconsideration. See 29 C.F.R. 1614.405; Equal Employment Opportunity Management Directive

for 29 C.F.R. Part 1614 (EEO MD-110), 9-18 (November 9, 1999). All requests and arguments must be submitted to the

Director, Office of Federal Operations, Equal Employment Opportunity Commission, P.O. Box 19848, Washington,

D.C. 20036. In the absence of a legible postmark, the request to reconsider shall be deemed timely filed if it is received by

mail within five days of the expiration of the applicable filing period. See 29 C.F.R. 1614.604. The request or opposition

must also include proof of service on the other party.

*13 Failure to file within the time period will result in dismissal of your request for reconsideration as untimely, unless

extenuating circumstances prevented the timely filing of the request. Any supporting documentation must be submitted

with your request for reconsideration. The Commission will consider requests for reconsideration filed after the deadline

only in very limited circumstances. See 29 C.F.R. 1614.604(c).

COMPLAINANT'S RIGHT TO FILE A CIVIL ACTION (R0900)

2017 Thomson Reuters. No claim to original U.S. Government Works. 10

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

This is a decision requiring the agency to continue its administrative processing of your complaint. However, if you wish

to file a civil action, you have the right to file such action in an appropriate United States District Court within ninety

(90) calendar days from the date that you receive this decision. In the alternative, you may file a civil action after one

hundred and eighty (180) calendar days of the date you filed your complaint with the agency, or filed your appeal with

the Commission. If you file a civil action, you must name as the defendant in the complaint the person who is the official

agency head or department head, identifying that person by his or her full name and official title. Failure to do so may

result in the dismissal of your case in court. Agency or department means the national organization, and not the

local office, facility or department in which you work. Filing a civil action will terminate the administrative processing

of your complaint.

RIGHT TO REQUEST COUNSEL (Z1199)

If you decide to file a civil action, and if you do not have or cannot afford the services of an attorney, you may request

that the Court appoint an attorney to represent you and that the Court permit you to file the action without payment

of fees, costs, or other security. See Title VII of the Civil Rights Act of 1964, as amended, 42 U.S.C. 2000e et seq.;

the Rehabilitation Act of 1973, as amended, 29 U.S.C. 791, 794(c). The grant or denial of the request is within the sole

discretion of the Court. Filing a request for an attorney does not extend your time in which to file a civil action. Both

the request and the civil action must be filed within the time limits as stated in the paragraph above (Right to File A

Civil Action).

For the Commission:

Frances M. Hart

Executive Officer

Executive Secretariat

Footnotes

1 They are Van Hoose, Director of the Support Division; Goetze, Manager of the Maintenance Branch, and Lutrell, Manager

of the Operations and Compliance Branch. They have appeals pending before this Commission. The fifth manager was a

former complainant who died during the pendency of his claim. He was Manager of the Property and Prepaid Branch.

2 All four active complainants are represented by the same attorney. As already noted, parts of their cases were processed

together. Documents applying to all the complainants can be found in different appeal files. Hence, the records of all the

complainants were reviewed. They are Holler, 01982627 and 01990407; Goetze, 01991530; Lutrell, 01981988; and Van Hoose,

01982628 and 01990455.

3 By letter postmarked February 14, 1998, the complainant filed another appeal on the first FAD pursuant to 29 C.F.R.

1614.504(b). The appeal argued that the agency was not in compliance with the FAD since it miscalculated back pay,

and included materials requesting front pay. This appeal was timely because it was filed within 30 days of the agency's

determinations of January 29, 1998 and February 3, 1998 that it was in compliance with its FAD. It is merged with Appeal 1.

4 After being asked about the financial crises, the Deputy Director of the MWR at El Toro was asked why employees received

significant raises and bonuses. He responded that outstanding performers must be recognized and rewarded. (Hearing

Transcript, H.T. 306). When asked about economic concerns, the Deputy Director testified that outstanding performers must

be rewarded because they are the ones who will work hard to improve the situation. (H.T. 321).

5 Kalra v. Department of Transportation, EEOC Request No. 05940516 (May 31, 1996).

6 Compensatory damages are not available against the federal government under the ADEA. Falks v. Department of the

Treasury, 05960250 (September 5, 1995).

EEOC DOC 01990407 (E.E.O.C.), EEOC DOC 01982627, 2001 WL 991924

2017 Thomson Reuters. No claim to original U.S. Government Works. 11

EDWIN G. HOLLER, COMPLAINANT, v. ROBERT B...., EEOC DOC 01990407...

End of Document 2017 Thomson Reuters. No claim to original U.S. Government Works.

2017 Thomson Reuters. No claim to original U.S. Government Works. 12

Das könnte Ihnen auch gefallen

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionVon EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNoch keine Bewertungen

- CSEC Jan 2011 Paper 1Dokument8 SeitenCSEC Jan 2011 Paper 1R.D. KhanNoch keine Bewertungen

- Condition Monitoring of Steam Turbines by Performance AnalysisDokument25 SeitenCondition Monitoring of Steam Turbines by Performance Analysisabuhurairaqazi100% (1)

- Electrical ConnectorsDokument5 SeitenElectrical ConnectorsRodrigo SantibañezNoch keine Bewertungen

- BMC Vs FantonialDokument14 SeitenBMC Vs FantonialMae Anne PioquintoNoch keine Bewertungen

- CIR Vs GonzalesDokument16 SeitenCIR Vs GonzalesnorieNoch keine Bewertungen

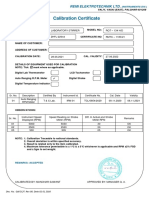

- Calibration CertificateDokument1 SeiteCalibration CertificateSales GoldClassNoch keine Bewertungen

- Commissioner of Internal Revenue v. Transfield PhilippinesDokument9 SeitenCommissioner of Internal Revenue v. Transfield PhilippinesBeltran KathNoch keine Bewertungen

- The Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageDokument5 SeitenThe Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageHenny ZahranyNoch keine Bewertungen

- On CatiaDokument42 SeitenOn Catiahimanshuvermac3053100% (1)

- Fil-Estate Properties Inc. v. Spouses GoDokument5 SeitenFil-Estate Properties Inc. v. Spouses GoTheresa MurilloNoch keine Bewertungen

- ACIS - Auditing Computer Information SystemDokument10 SeitenACIS - Auditing Computer Information SystemErwin Labayog MedinaNoch keine Bewertungen

- Stefan H., Petitioner, v. Loretta E. Lynch, Attorney General, Department of Justice (Federal Bureau of Prisons), AgencyDokument6 SeitenStefan H., Petitioner, v. Loretta E. Lynch, Attorney General, Department of Justice (Federal Bureau of Prisons), AgencyJasmine FrazierNoch keine Bewertungen

- 6) Consolidated - Broadcasting - System - Inc. - v.20180315-6791-1wmm6pq PDFDokument8 Seiten6) Consolidated - Broadcasting - System - Inc. - v.20180315-6791-1wmm6pq PDFVictoria EscobalNoch keine Bewertungen

- 104 - FEBTC Vs CIRDokument8 Seiten104 - FEBTC Vs CIRCollen Anne PagaduanNoch keine Bewertungen

- 116595-2007-Fil-Estate Properties Inc. v. Spouses Go PDFDokument5 Seiten116595-2007-Fil-Estate Properties Inc. v. Spouses Go PDFVittorio EzraNoch keine Bewertungen

- Echoo 2000 Commercial CorporationDokument9 SeitenEchoo 2000 Commercial CorporationCarlie MaeNoch keine Bewertungen

- Sevillana vs. IT CorpDokument11 SeitenSevillana vs. IT CorpArtemis HoltNoch keine Bewertungen

- Tax LONNIE H Tax ReliefDokument9 SeitenTax LONNIE H Tax ReliefJasmine Frazier100% (1)

- Leonardo V NLRCDokument9 SeitenLeonardo V NLRCjohnmiggyNoch keine Bewertungen

- Bright MaritimeDokument5 SeitenBright MaritimeBig BoysNoch keine Bewertungen

- Pens. Plan Guide P 23915h John L. Kemmerer James H. Jordan, in No. 95-1071 v. Ici Americas Inc. John L. Kemmerer James H. Jordan v. Ici Americas Inc., in No. 95-1098, 70 F.3d 281, 3rd Cir. (1995)Dokument12 SeitenPens. Plan Guide P 23915h John L. Kemmerer James H. Jordan, in No. 95-1071 v. Ici Americas Inc. John L. Kemmerer James H. Jordan v. Ici Americas Inc., in No. 95-1098, 70 F.3d 281, 3rd Cir. (1995)Scribd Government DocsNoch keine Bewertungen

- Anino V NLRCDokument10 SeitenAnino V NLRCMp CasNoch keine Bewertungen

- Domondon - v. - National - Labor - Relations PDFDokument7 SeitenDomondon - v. - National - Labor - Relations PDFBaring CTCNoch keine Bewertungen

- Government Service Insurance System v.20160322-9941-567bb6Dokument10 SeitenGovernment Service Insurance System v.20160322-9941-567bb6neil borjaNoch keine Bewertungen

- Labor CasesDokument101 SeitenLabor CasesRobert Paul A MorenoNoch keine Bewertungen

- BRB Nos. 01-0941 and 01-0941A: Associates, Inc., 380 U.S. 359 (1965) 33 U.S.C. '921 (B)Dokument6 SeitenBRB Nos. 01-0941 and 01-0941A: Associates, Inc., 380 U.S. 359 (1965) 33 U.S.C. '921 (B)Ngân Hàng Ngô Mạnh TiếnNoch keine Bewertungen

- E.4. SMC Vs Angel Pontillas, G.R. No. 155178, May 7. 2008Dokument7 SeitenE.4. SMC Vs Angel Pontillas, G.R. No. 155178, May 7. 2008LawrenceAltezaNoch keine Bewertungen

- Domondon V NLRC GR 154376Dokument9 SeitenDomondon V NLRC GR 154376naldsdomingoNoch keine Bewertungen

- G.R. No. 146530. January 17, 2005Dokument9 SeitenG.R. No. 146530. January 17, 2005Michelle Dulce Mariano CandelariaNoch keine Bewertungen

- Second Division (G.R. NO. 146530, January 17, 2005)Dokument11 SeitenSecond Division (G.R. NO. 146530, January 17, 2005)ecinue guirreisaNoch keine Bewertungen

- Dansart Security Force v. BagoyDokument4 SeitenDansart Security Force v. BagoyAyo LapidNoch keine Bewertungen

- BRIGHT MARITIME CORPORATION v. RICARDO B. FANTONIALDokument17 SeitenBRIGHT MARITIME CORPORATION v. RICARDO B. FANTONIALmarkhan18Noch keine Bewertungen

- Domasig vs. NLRCDokument3 SeitenDomasig vs. NLRCTinersNoch keine Bewertungen

- UntitledDokument3 SeitenUntitledSheila Mae LlandelarNoch keine Bewertungen

- Jurisdiction of CourtsDokument113 SeitenJurisdiction of CourtsJ Era DaleonNoch keine Bewertungen

- Jobel Enterprises vs. NLRCDokument7 SeitenJobel Enterprises vs. NLRCammeNoch keine Bewertungen

- Richard N. Rivera V. Genesis Transport Service, Inc. FactsDokument2 SeitenRichard N. Rivera V. Genesis Transport Service, Inc. Factsdaily interactNoch keine Bewertungen

- Telesat v. CIRDokument12 SeitenTelesat v. CIRRandy BelloNoch keine Bewertungen

- Fil-Estate Properties v. Sps GonzaloDokument6 SeitenFil-Estate Properties v. Sps GonzaloJoana ReyesNoch keine Bewertungen

- Fil-Estate Properties Vs Spouses Go (GR No 185798, 13 Jan 2014)Dokument3 SeitenFil-Estate Properties Vs Spouses Go (GR No 185798, 13 Jan 2014)Wilfred MartinezNoch keine Bewertungen

- Eren v. Commissioner, 4th Cir. (1999)Dokument7 SeitenEren v. Commissioner, 4th Cir. (1999)Scribd Government DocsNoch keine Bewertungen

- Peter Elama Vs UBA PLCDokument22 SeitenPeter Elama Vs UBA PLCNjoku ChinenyeNoch keine Bewertungen

- Digests of Cases Decided by CTADokument3 SeitenDigests of Cases Decided by CTARuth Genevieve LumibaoNoch keine Bewertungen

- Full CaseDokument6 SeitenFull CaseLara ConcepcionNoch keine Bewertungen

- Harpoon Marine Services Inc, Et - Al v. Fernan FranciscoDokument12 SeitenHarpoon Marine Services Inc, Et - Al v. Fernan FranciscoPepper PottsNoch keine Bewertungen

- Fernandez VS NLRCDokument3 SeitenFernandez VS NLRCshariabordoNoch keine Bewertungen

- La CaseDokument18 SeitenLa CaseCamille Yasmeen SamsonNoch keine Bewertungen

- Republic of The Philippines: Supreme CourtDokument17 SeitenRepublic of The Philippines: Supreme CourtMatthew DiazNoch keine Bewertungen

- Case - EDI-STAFFBUILDERS INTERNATIONAL, INC., Petitioner, vs. NATIONAL LABOR RELATIONS COMMISSION and ELEAZAR S. GRAN, PDFDokument19 SeitenCase - EDI-STAFFBUILDERS INTERNATIONAL, INC., Petitioner, vs. NATIONAL LABOR RELATIONS COMMISSION and ELEAZAR S. GRAN, PDFKristine Martinez-Uy TiocoNoch keine Bewertungen

- Protacio v. Laya MananghayaDokument17 SeitenProtacio v. Laya MananghayaEmma Ruby Aguilar-ApradoNoch keine Bewertungen

- GSIS VS COA GR No. 138381Dokument10 SeitenGSIS VS COA GR No. 138381shiena88Noch keine Bewertungen

- Filestate Vs RonquilloDokument3 SeitenFilestate Vs RonquilloAnna BautistaNoch keine Bewertungen

- Philsa vs. CADokument12 SeitenPhilsa vs. CAD MonioNoch keine Bewertungen

- Swagman Hotels and Travel v. CA, G.R. No. 161135 (2005)Dokument13 SeitenSwagman Hotels and Travel v. CA, G.R. No. 161135 (2005)rafaeligdanesNoch keine Bewertungen

- Leonardo v. NLRC, Et Al., G.R. No. 125303, June 16, 2000Dokument8 SeitenLeonardo v. NLRC, Et Al., G.R. No. 125303, June 16, 2000Martin SNoch keine Bewertungen

- G.R. No. 186621 March 12, 2014 South East International Rattan, Inc. And/Or Estanislao AgbayDokument41 SeitenG.R. No. 186621 March 12, 2014 South East International Rattan, Inc. And/Or Estanislao AgbayBrigitte PocsolNoch keine Bewertungen

- Newport News Shipbld v. DOWCP, 4th Cir. (2004)Dokument9 SeitenNewport News Shipbld v. DOWCP, 4th Cir. (2004)Scribd Government DocsNoch keine Bewertungen

- Cogan v. Phoenix Life, 1st Cir. (2002)Dokument8 SeitenCogan v. Phoenix Life, 1st Cir. (2002)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument9 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- Exodus International Vs BiscochoDokument10 SeitenExodus International Vs BiscochoEricson Sarmiento Dela CruzNoch keine Bewertungen

- Protacio Vs Laya MananghayaDokument5 SeitenProtacio Vs Laya MananghayaDeniseEstebanNoch keine Bewertungen

- In Re Tanaka Brothers Farms, Inc., Debtor, United States of America, and Its Agency The Internal Revenue Service v. Andrea S. Berger, Trustee Boulder Creek Farms, Inc., 36 F.3d 996, 10th Cir. (1994)Dokument9 SeitenIn Re Tanaka Brothers Farms, Inc., Debtor, United States of America, and Its Agency The Internal Revenue Service v. Andrea S. Berger, Trustee Boulder Creek Farms, Inc., 36 F.3d 996, 10th Cir. (1994)Scribd Government DocsNoch keine Bewertungen

- All Decisions - Gary ThibodeauDokument346 SeitenAll Decisions - Gary ThibodeauJustine AshleyNoch keine Bewertungen

- EDI Staffbuilders International Inc Vs National Labor Relations Commission (NLRC) PDFDokument17 SeitenEDI Staffbuilders International Inc Vs National Labor Relations Commission (NLRC) PDFMelfay ErminoNoch keine Bewertungen

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Von EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Noch keine Bewertungen

- Cabling and Connection System PDFDokument16 SeitenCabling and Connection System PDFLyndryl ProvidoNoch keine Bewertungen

- LMU-2100™ Gprs/Cdmahspa Series: Insurance Tracking Unit With Leading TechnologiesDokument2 SeitenLMU-2100™ Gprs/Cdmahspa Series: Insurance Tracking Unit With Leading TechnologiesRobert MateoNoch keine Bewertungen

- Job Description For QAQC EngineerDokument2 SeitenJob Description For QAQC EngineerSafriza ZaidiNoch keine Bewertungen

- TEVTA Fin Pay 1 107Dokument3 SeitenTEVTA Fin Pay 1 107Abdul BasitNoch keine Bewertungen

- Role of The Government in HealthDokument6 SeitenRole of The Government in Healthptv7105Noch keine Bewertungen

- Innovations in Land AdministrationDokument66 SeitenInnovations in Land AdministrationSanjawe KbNoch keine Bewertungen

- Hip NormDokument35 SeitenHip NormAiman ArifinNoch keine Bewertungen

- 18 - PPAG-100-HD-C-001 - s018 (VBA03C013) - 0 PDFDokument1 Seite18 - PPAG-100-HD-C-001 - s018 (VBA03C013) - 0 PDFSantiago GarciaNoch keine Bewertungen

- 2021S-EPM 1163 - Day-11-Unit-8 ProcMgmt-AODADokument13 Seiten2021S-EPM 1163 - Day-11-Unit-8 ProcMgmt-AODAehsan ershadNoch keine Bewertungen

- TSR KuDokument16 SeitenTSR KuAngsaNoch keine Bewertungen

- Ingles Avanzado 1 Trabajo FinalDokument4 SeitenIngles Avanzado 1 Trabajo FinalFrancis GarciaNoch keine Bewertungen

- Micron Interview Questions Summary # Question 1 Parsing The HTML WebpagesDokument2 SeitenMicron Interview Questions Summary # Question 1 Parsing The HTML WebpagesKartik SharmaNoch keine Bewertungen

- Income Statement, Its Elements, Usefulness and LimitationsDokument5 SeitenIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNoch keine Bewertungen

- Himachal Pradesh Important NumbersDokument3 SeitenHimachal Pradesh Important NumbersRaghav RahinwalNoch keine Bewertungen

- Social Media Marketing Advice To Get You StartedmhogmDokument2 SeitenSocial Media Marketing Advice To Get You StartedmhogmSanchezCowan8Noch keine Bewertungen

- Using Boss Tone Studio For Me-25Dokument4 SeitenUsing Boss Tone Studio For Me-25Oskar WojciechowskiNoch keine Bewertungen

- MRT Mrte MRTFDokument24 SeitenMRT Mrte MRTFJonathan MoraNoch keine Bewertungen

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyDokument2 SeitenAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfNoch keine Bewertungen

- Final ExamSOMFinal 2016 FinalDokument11 SeitenFinal ExamSOMFinal 2016 Finalkhalil alhatabNoch keine Bewertungen

- Sky ChemicalsDokument1 SeiteSky ChemicalsfishNoch keine Bewertungen

- Fake PDFDokument2 SeitenFake PDFJessicaNoch keine Bewertungen

- Getting StartedDokument45 SeitenGetting StartedMuhammad Owais Bilal AwanNoch keine Bewertungen

- Lab 6 PicoblazeDokument6 SeitenLab 6 PicoblazeMadalin NeaguNoch keine Bewertungen