Beruflich Dokumente

Kultur Dokumente

Lecture 4A - Basic Finance

Hochgeladen von

Yella Mae Pariña RelosCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Lecture 4A - Basic Finance

Hochgeladen von

Yella Mae Pariña RelosCopyright:

Verfügbare Formate

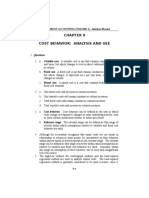

LECTURE

NATIONAL COLLEGE OF BUSINESS AND ARTS 04a

NOTE

Cor. Regalado St. Commonwealth Ave., Fairview, Quezon City

Business Administration Department

BASIC FINANCE

TIME VALUE OF MONEY

The concept of time value of money has many applications in Finance and wealth

accumulation. Of course, we did discuss about investment opportunities where we can place our

extra or surplus funds to earn more income or to accumulate wealth. The classic example is the time

deposit in the bank where time is the very important element and of course the interest rate.

Future Value

A peso in hand today is worth more than a peso to be received in the future because, if you

had it now, you could invest it, earn interest, and end up with more than one peso in the future. The

process of going from todays values, or present values (PVs), to future values (FVs) is called

compounding.

To illustrate, suppose you deposit Php100 in a bank that pays 5 percent interest each year.

How much would you have at the end of one year? To begin, we define the following terms:

PV - Present Value, or beginning amount, in your account. Here PV Php100.

i - Interest Rate the bank pays on the account per year. The interest earned is

based on the balance at the beginning of each year, and we assume that it is paid at

the end of the year. Here i = 5%, or, expressed as a decimal, i = 0.05.

IN - dollars of interest you earn during the year = Beginning amount X i. Here

INT= Php100(0.05) = Php5.

FVn - Future Value, or ending amount, of your account at the end of n years.

Whereas PV is the value now, or the present value, FVn is the value n years into the

future, after the interest earned has been added to the account.

n - Number of periods involved in the analysis. Here n = 1.

In our example, n 1, so FVn can be calculated as follows:

FVn = FV1 = PV +INT

= PV + PV(i)

= PV(1 + i)

=100(1 + 0.05) = 100(1.05) = 105.

Prepared by: Rey G. Parcon, MBA

-1-

LECTURE

NATIONAL COLLEGE OF BUSINESS AND ARTS 04a

NOTE

Cor. Regalado St. Commonwealth Ave., Fairview, Quezon City

Business Administration Department

BASIC FINANCE

Present Value

In general, the present value of a cash flow due in years in the future is the amount which, if

it were on hand today, would grow to equal the future amount. Since 100 would grow to 105 in 1

year at a 5 percent interest rate, 100 is the present value of 105 due in 1 year when the opportunity

cost rate is 5%.

Opportunity cost rate is the rate of return on the best available alternative investment of

equal risk.

Finding present values is called discounting, and it is simply the reverse of compoundingif

you know the PV, you can compound to find the FV, while if you know the FV, you can discount to

find the PV. We can solve for PV using the formula we have earlier with the help of some algebraic

manipulation, thus,

Solving for interest (i) and time (n)

At this point, you should realize that compounding and discounting are related, and that we

have been dealing with one equation that can be solved for either the FV or the PV.

FV Form:

PV Form:

Through algebraic employment, we can solve for (i) this way:

and eventually, we can solve for (n) this way:

Prepared by: Rey G. Parcon, MBA

-2-

LECTURE

NATIONAL COLLEGE OF BUSINESS AND ARTS 04a

NOTE

Cor. Regalado St. Commonwealth Ave., Fairview, Quezon City

Business Administration Department

BASIC FINANCE

Example 1:

Given:

PV = 10,000

i = 10%

n = 5

FV = ?

Using the formula for FV, we can solve:

Example 2:

Given:

PV = 5,000

i = 6.50%

N = ?

FV = 10,000

Using the formula for (n), we can solve:

( )

( )

Prepared by: Rey G. Parcon, MBA

-3-

LECTURE

NATIONAL COLLEGE OF BUSINESS AND ARTS 04a

NOTE

Cor. Regalado St. Commonwealth Ave., Fairview, Quezon City

Business Administration Department

BASIC FINANCE

Example 3:

Given:

PV = 250,000

i = ?

N = 18

FV = 1,000,000

Using the formula for (i), we can solve:

References:

Brigham, E and Houston, J. Fundamentals of Financial Management 10E

Medina, G. (2007). Business Finance, Manila City: Rex Book Store

Wall Street Words: An A to Z Guide to Investment Terms for Today's Investor by David L. Scott.

Copyright 2003 by Houghton Mifflin Company. Published by Houghton Mifflin Company.

Prepared by: Rey G. Parcon, MBA

-4-

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- BE2 Good Governance and Social ResponsibilityDokument25 SeitenBE2 Good Governance and Social ResponsibilityYella Mae Pariña RelosNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Cost Behavior: Analysis and Use: Management Accounting (Volume I) - Solutions ManualDokument19 SeitenCost Behavior: Analysis and Use: Management Accounting (Volume I) - Solutions ManualYella Mae Pariña RelosNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Database AdministratorDokument18 SeitenThe Database AdministratorYella Mae Pariña RelosNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Transfer and Business Tax 2014 Ballada PDFDokument26 SeitenTransfer and Business Tax 2014 Ballada PDFCamzwell Kleinne HalyieNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- This Is The Parts of Air Compressor After DismantlingDokument5 SeitenThis Is The Parts of Air Compressor After DismantlingYella Mae Pariña RelosNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- MARE 201A Auxiliary Machinery 1Dokument22 SeitenMARE 201A Auxiliary Machinery 1Yella Mae Pariña RelosNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- MARE 201A Auxiliary Machinery 1Dokument22 SeitenMARE 201A Auxiliary Machinery 1Yella Mae Pariña RelosNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Mary Elijah P. Relos VI-Matatag Q1 Q2 Q3 Q4 Q5 Total 20% First 10 7 8 6 10 41 8.2 Second 9 10 7 10 7 43 8.6 Third 7 8 6 9 10 40 8 Fourth 8 9 6 10 9 42 8.4Dokument2 SeitenMary Elijah P. Relos VI-Matatag Q1 Q2 Q3 Q4 Q5 Total 20% First 10 7 8 6 10 41 8.2 Second 9 10 7 10 7 43 8.6 Third 7 8 6 9 10 40 8 Fourth 8 9 6 10 9 42 8.4Yella Mae Pariña RelosNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- EngDokument4 SeitenEngYella Mae Pariña RelosNoch keine Bewertungen

- Cost-Volume-Profit Analysis: in BriefDokument42 SeitenCost-Volume-Profit Analysis: in Briefanshgoel62100% (1)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- That Is The Casing of The Gear PumpDokument3 SeitenThat Is The Casing of The Gear PumpYella Mae Pariña RelosNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- This Is The Parts of Air Compressor After DismantlingDokument5 SeitenThis Is The Parts of Air Compressor After DismantlingYella Mae Pariña RelosNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Derivatives & Hedging: RequiredDokument1 SeiteDerivatives & Hedging: RequiredYella Mae Pariña RelosNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- NewsDokument1 SeiteNewsYella Mae Pariña RelosNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Acquisition of Net AssetsDokument1 SeiteAcquisition of Net AssetsYella Mae Pariña RelosNoch keine Bewertungen

- Aux FinalDokument32 SeitenAux FinalYella Mae Pariña RelosNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Law NotesDokument21 SeitenLaw NotesVic FabeNoch keine Bewertungen

- Ascension Auditing Services TTHDokument14 SeitenAscension Auditing Services TTHYella Mae Pariña RelosNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- ElectroDokument22 SeitenElectroYella Mae Pariña RelosNoch keine Bewertungen

- Mary Elijah P. Relos Vi-Matatag MR - Romando Vedra Math TeacherDokument1 SeiteMary Elijah P. Relos Vi-Matatag MR - Romando Vedra Math TeacherYella Mae Pariña RelosNoch keine Bewertungen

- NewsDokument1 SeiteNewsYella Mae Pariña RelosNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- EngDokument4 SeitenEngYella Mae Pariña RelosNoch keine Bewertungen

- Eco 3Dokument2 SeitenEco 3Yella Mae Pariña RelosNoch keine Bewertungen

- Scientific Management: Scientific Management Studies and Tests Methods To Identify The Best, Most Efficient WaysDokument20 SeitenScientific Management: Scientific Management Studies and Tests Methods To Identify The Best, Most Efficient WaysYella Mae Pariña RelosNoch keine Bewertungen

- Scientific Management: Scientific Management Studies and Tests Methods To Identify The Best, Most Efficient WaysDokument20 SeitenScientific Management: Scientific Management Studies and Tests Methods To Identify The Best, Most Efficient WaysYella Mae Pariña RelosNoch keine Bewertungen

- Lecture 4A - Basic FinanceDokument4 SeitenLecture 4A - Basic FinanceYella Mae Pariña RelosNoch keine Bewertungen

- Chap1 Introduction To ManagementDokument27 SeitenChap1 Introduction To Managementnight mareNoch keine Bewertungen

- Eco 3Dokument2 SeitenEco 3Yella Mae Pariña RelosNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Aline Aprille C. Mendez, MBA: Bachelor of Science in Business Administration Department Fairview, Quezon CityDokument9 SeitenAline Aprille C. Mendez, MBA: Bachelor of Science in Business Administration Department Fairview, Quezon CityYella Mae Pariña RelosNoch keine Bewertungen

- Scientific Management: Scientific Management Studies and Tests Methods To Identify The Best, Most Efficient WaysDokument20 SeitenScientific Management: Scientific Management Studies and Tests Methods To Identify The Best, Most Efficient WaysYella Mae Pariña RelosNoch keine Bewertungen

- Investment and Security Laws ProjectDokument3 SeitenInvestment and Security Laws ProjectUmesh Kumar33% (3)

- Britannia Financial ReportsDokument18 SeitenBritannia Financial Reportsjithin20202020Noch keine Bewertungen

- W-9 Tax FormDokument4 SeitenW-9 Tax FormMika DjokaNoch keine Bewertungen

- City Limits Magazine, March 1985 IssueDokument24 SeitenCity Limits Magazine, March 1985 IssueCity Limits (New York)Noch keine Bewertungen

- Howey Test For Ayin Token Securities Assessment Rev. 1Dokument10 SeitenHowey Test For Ayin Token Securities Assessment Rev. 1AYIN International, Inc.Noch keine Bewertungen

- GOVERNMENT SERVICE INSURANCE SYSTEM vs. COURT OF APPEALS & MR. AND MRS. ISABELO R. RACHODokument2 SeitenGOVERNMENT SERVICE INSURANCE SYSTEM vs. COURT OF APPEALS & MR. AND MRS. ISABELO R. RACHOTrudgeOnNoch keine Bewertungen

- Land Titles and Deeds ReportDokument10 SeitenLand Titles and Deeds ReportBrent TorresNoch keine Bewertungen

- Suggested Answers Exercises: Exercise 11 - 1Dokument16 SeitenSuggested Answers Exercises: Exercise 11 - 1Crestu JinNoch keine Bewertungen

- Economics DefinitionsDokument21 SeitenEconomics Definitionssmg26thmayNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Chapter 4Dokument37 SeitenChapter 4Harshit MasterNoch keine Bewertungen

- Law of Distressed Real EstateDokument120 SeitenLaw of Distressed Real Estatemoshe3636Noch keine Bewertungen

- Determinants of Interest Rate Spreads in Sub-Saharan African Countries A Dynamic Panel AnalysisDokument26 SeitenDeterminants of Interest Rate Spreads in Sub-Saharan African Countries A Dynamic Panel AnalysisEdson AlmeidaNoch keine Bewertungen

- RMO No 19-2015Dokument10 SeitenRMO No 19-2015gelskNoch keine Bewertungen

- Lecture 3 2015Dokument31 SeitenLecture 3 2015Ashish MathewNoch keine Bewertungen

- RR 12 - 99 DigestDokument5 SeitenRR 12 - 99 DigestrodolfoverdidajrNoch keine Bewertungen

- Banking Law SyllabusDokument5 SeitenBanking Law SyllabusVicky DNoch keine Bewertungen

- Chapter 30 - Working Capital ManagementDokument61 SeitenChapter 30 - Working Capital ManagementNguyễn T.Thanh HươngNoch keine Bewertungen

- The Vintage Bazaar 2013 Vendor ApplicationDokument7 SeitenThe Vintage Bazaar 2013 Vendor ApplicationthevintagebazaarNoch keine Bewertungen

- Special Commercial Laws Complete and Updated Course SyllabusDokument8 SeitenSpecial Commercial Laws Complete and Updated Course SyllabusRandy LopezNoch keine Bewertungen

- Book Keeping & AccountsDokument390 SeitenBook Keeping & AccountsAAISHA AHMED75% (4)

- Engels PresentatieDokument2 SeitenEngels PresentatieNadieThorborgNoch keine Bewertungen

- Extra Payment CalculatorDokument12 SeitenExtra Payment CalculatorZafar AhmedNoch keine Bewertungen

- Course Title: MICRO FINANCE Course Code: FIBA203 Credit Units: 3 Level: UGDokument3 SeitenCourse Title: MICRO FINANCE Course Code: FIBA203 Credit Units: 3 Level: UGchhaayaachitran akshuNoch keine Bewertungen

- Ted Murphy and Eric Weiss Financial Crises and CongressDokument28 SeitenTed Murphy and Eric Weiss Financial Crises and CongressR Street InstituteNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument3 SeitenNew Microsoft Office Word DocumentRemNoch keine Bewertungen

- 1 Republic v. Security Credit and Acceptance Corp.Dokument2 Seiten1 Republic v. Security Credit and Acceptance Corp.Word MavenNoch keine Bewertungen

- Bank of The Philippine Islands About BPIDokument14 SeitenBank of The Philippine Islands About BPIEizzel SamsonNoch keine Bewertungen

- Types of Dividends Overview of DividendsDokument5 SeitenTypes of Dividends Overview of DividendsEllieNoch keine Bewertungen

- Format - Sole Trader Final AccountsDokument4 SeitenFormat - Sole Trader Final AccountsachalaNoch keine Bewertungen

- Notes Banking For 2nd Year (Commerce)Dokument72 SeitenNotes Banking For 2nd Year (Commerce)pariworld65100% (4)