Beruflich Dokumente

Kultur Dokumente

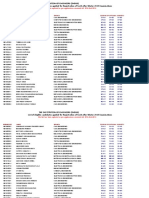

Unbilled Revenue Report

Hochgeladen von

shyamvs2002Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Unbilled Revenue Report

Hochgeladen von

shyamvs2002Copyright:

Verfügbare Formate

Unbilled Revenue Report

Unbilled revenue reporting is used to determine and evaluate billed and extrapolated quantities for the balance

sheet of the closing accounting period. This may involve the companys fiscal year or monthly balance sheet. Utility

companies have special requirements when preparing their balance sheet. This is because when the balance sheet is

prepared, not all customers have been billed and entered in the accounts on the key date.

Procedure for Unbilled Revenue Reporting

There are three procedures to use the unbilled revenue reporting they are individual procedure, Sampling procedure

& the Flat0Rate procedure.

In the individual procedure, all contracts are analyzed individually. For each contract, the period is determined in the

accounting period for which the contract remains to be billed. A billing simulation occurs for this period. During the

billing simulation, consumption is extrapolated for each contract in compliance with the weighting procedure. The

data from the actual documents, along with the data from the simulated documents, provides an estimated value

for the consumption and revenues of the period under analysis. The advantage of the individual procedure is that it

considers all changes made to rates, prices, meter reading results, registers, and so on, with maximum accuracy. The

disadvantage of this method is the long runtime.

In the sampling procedure, many the available contracts are selected for a sample. The sample is simulated for the

unbilled period. The system writes the amounts and quantities from the sample to the statistics and then

extrapolates the results for all contracts.

The flat-rate procedure primarily consists Determination of the quantities that remain to be billed, Distribution of

these quantities to rates, Evaluation of the distributed quantities using average prices and Determination of the

basic prices of contracts that remain to be billed

Das könnte Ihnen auch gefallen

- ISU BillingDokument1 SeiteISU BillingaffanNoch keine Bewertungen

- Assessment (IS-Utilities) : Questions: 50 Time Limit: 60 MinsDokument9 SeitenAssessment (IS-Utilities) : Questions: 50 Time Limit: 60 MinsNeeraj GuptaNoch keine Bewertungen

- Sap - C - Fsutil - 60 SAP Certified Associate - Utilities With SAP ERP 6.0Dokument5 SeitenSap - C - Fsutil - 60 SAP Certified Associate - Utilities With SAP ERP 6.0Sachin SinghNoch keine Bewertungen

- Vidya Niwas MishraDokument7 SeitenVidya Niwas MishraVidya Niwas MishraNoch keine Bewertungen

- And Distribution (SD) Component and From External Systems (For ExampleDokument4 SeitenAnd Distribution (SD) Component and From External Systems (For ExampleEvelyn TinkaNoch keine Bewertungen

- BeCertify C_FSUTIL_60 Exam Preparation Pack with 80 Q&ADokument7 SeitenBeCertify C_FSUTIL_60 Exam Preparation Pack with 80 Q&AivicarezicNoch keine Bewertungen

- C Fsutil 60Dokument5 SeitenC Fsutil 60power1001Noch keine Bewertungen

- Estimation Procedure in SAP ISUDokument6 SeitenEstimation Procedure in SAP ISUMUKESHNoch keine Bewertungen

- C FSUTIL 60 Sample Items PDFDokument5 SeitenC FSUTIL 60 Sample Items PDFDaniel Medina0% (1)

- Collective Bill: Creation of Posting DocumentsDokument1 SeiteCollective Bill: Creation of Posting DocumentsErika AraujoNoch keine Bewertungen

- EDM - Screen Shot For Profile CreationDokument20 SeitenEDM - Screen Shot For Profile Creationsoumyajit1986Noch keine Bewertungen

- Exam C - FSUTIL - 60: SAP Certified Associate - Utilities With SAP ERP 6.0Dokument7 SeitenExam C - FSUTIL - 60: SAP Certified Associate - Utilities With SAP ERP 6.0ivicarezicNoch keine Bewertungen

- C - FSUTIL - 60 Free Demo DownloadDokument5 SeitenC - FSUTIL - 60 Free Demo Downloadcert24exampracticeNoch keine Bewertungen

- Varient Details1Dokument119 SeitenVarient Details1soumyajit1986100% (1)

- FICA Training - Day 2 (Updated)Dokument3 SeitenFICA Training - Day 2 (Updated)yalamanchili111Noch keine Bewertungen

- Final Workshop Session Slides - FICA V 1 1Dokument34 SeitenFinal Workshop Session Slides - FICA V 1 1yalamanchili111Noch keine Bewertungen

- Sap Fi Ques N AnswersDokument67 SeitenSap Fi Ques N AnswersRANAGADONGA100% (1)

- An Overview by Sap Coe Energy & Utilities KDC: Industry Solution For Utilities/ Customer Care & ServiceDokument48 SeitenAn Overview by Sap Coe Energy & Utilities KDC: Industry Solution For Utilities/ Customer Care & ServiceAcharya DakshaNoch keine Bewertungen

- ITCertMaster - SAP C_FSUTIL_60 Exam Practice QuestionsDokument5 SeitenITCertMaster - SAP C_FSUTIL_60 Exam Practice QuestionsSudipta GhoshNoch keine Bewertungen

- Academy: Managerial and Financial Accounting Fi Paper: 8Dokument4 SeitenAcademy: Managerial and Financial Accounting Fi Paper: 8baburamNoch keine Bewertungen

- Sap Ami PDFDokument20 SeitenSap Ami PDFJetNoch keine Bewertungen

- Utilities C - FSUTIL - 60 Certification Sample Questions With KeyDokument6 SeitenUtilities C - FSUTIL - 60 Certification Sample Questions With KeyMadhukar Reddy SuramNoch keine Bewertungen

- External Tax with warranty configurationDokument80 SeitenExternal Tax with warranty configurationpilsbierNoch keine Bewertungen

- Advanced Meter Technical Features in Under 40Dokument2 SeitenAdvanced Meter Technical Features in Under 40Rohit SAPNoch keine Bewertungen

- Sap Is-U: What Are The Different Types of ERP's ?Dokument4 SeitenSap Is-U: What Are The Different Types of ERP's ?affanNoch keine Bewertungen

- Activity Based Costing in S4 HanaDokument9 SeitenActivity Based Costing in S4 HanaAtul MadhusudanNoch keine Bewertungen

- Payments (Promise To Pay)Dokument19 SeitenPayments (Promise To Pay)Srinu GourishettyNoch keine Bewertungen

- SAP ISU - Bapi Mtrreaddoc Upload - OverviewDokument4 SeitenSAP ISU - Bapi Mtrreaddoc Upload - OverviewjaxwinsNoch keine Bewertungen

- EBF Overview enDokument30 SeitenEBF Overview enSuresh Babu.kNoch keine Bewertungen

- Introduction of EmigallDokument2 SeitenIntroduction of EmigallJetNoch keine Bewertungen

- Sap Uces 1.0Dokument2 SeitenSap Uces 1.0junaidkapadiaNoch keine Bewertungen

- Internal Order What Is The Purpose of Internal Order?Dokument3 SeitenInternal Order What Is The Purpose of Internal Order?hanumaNoch keine Bewertungen

- Revenue Accounting and Reporting (RAR) - Concept and ConfigurationDokument33 SeitenRevenue Accounting and Reporting (RAR) - Concept and ConfigurationAnand prakashNoch keine Bewertungen

- Plan Reconciliation of Internal ActivitiesDokument7 SeitenPlan Reconciliation of Internal ActivitiesZakir ChowdhuryNoch keine Bewertungen

- Streamlining The Financial Close With The SAP Financial Closing CockpitDokument4 SeitenStreamlining The Financial Close With The SAP Financial Closing Cockpitpravnb4u634Noch keine Bewertungen

- OneSource BrochureDokument6 SeitenOneSource BrochureJames WallNoch keine Bewertungen

- TSV Tnew Page Alloc Failed AnalysisDokument5 SeitenTSV Tnew Page Alloc Failed AnalysiscontactapsNoch keine Bewertungen

- Value Catogory, SKF, Progress Evaluation EVMDokument9 SeitenValue Catogory, SKF, Progress Evaluation EVMGeorge BabuNoch keine Bewertungen

- Splitting Structure CreationDokument9 SeitenSplitting Structure CreationSharad IngleNoch keine Bewertungen

- Experienced SAP FICA Consultant Seeking New ChallengesDokument3 SeitenExperienced SAP FICA Consultant Seeking New ChallengesNAGARAJU BOJJAGANINoch keine Bewertungen

- Base Method-FI AADokument4 SeitenBase Method-FI AAGanesh RameshNoch keine Bewertungen

- Budget BillingDokument10 SeitenBudget BillingMinh KhoaNoch keine Bewertungen

- Product Costing Custom Is at IonDokument31 SeitenProduct Costing Custom Is at IonPavankumar Ramnarayan SaxenaNoch keine Bewertungen

- RCT ConfigurationsDokument14 SeitenRCT ConfigurationsMohsin NabeelNoch keine Bewertungen

- SAP HELP Device ManagementDokument76 SeitenSAP HELP Device ManagementKev VoNoch keine Bewertungen

- Q. 01 Explain The Client Concept of SAP?Dokument35 SeitenQ. 01 Explain The Client Concept of SAP?Nithin JosephNoch keine Bewertungen

- Map relationships between utility registersDokument18 SeitenMap relationships between utility registerssoumyajit1986Noch keine Bewertungen

- Contract Accounting.47141849Dokument5 SeitenContract Accounting.47141849vipilchandranNoch keine Bewertungen

- ISU Data ModelDokument3 SeitenISU Data ModelRajiv JoyNoch keine Bewertungen

- A Project Report ON Derivatives: Submitted ToDokument34 SeitenA Project Report ON Derivatives: Submitted ToAnu PillaiNoch keine Bewertungen

- List of ISU Function ModulesDokument4 SeitenList of ISU Function ModulesMonis ShakeelNoch keine Bewertungen

- Intro ISU 0009Dokument62 SeitenIntro ISU 0009Sachin SinghNoch keine Bewertungen

- FI IntegrationDokument36 SeitenFI IntegrationAkash GhulghuleNoch keine Bewertungen

- Bankreconciliationconfiguration PDFDokument7 SeitenBankreconciliationconfiguration PDFJan HarvestNoch keine Bewertungen

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsVon EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNoch keine Bewertungen

- Two-Tier ERP Strategy A Clear and Concise ReferenceVon EverandTwo-Tier ERP Strategy A Clear and Concise ReferenceNoch keine Bewertungen

- IDOC-Basics-SENDING AND RECEIVING IDOCSDokument6 SeitenIDOC-Basics-SENDING AND RECEIVING IDOCSshyamvs2002Noch keine Bewertungen

- PARTNER PROFILE MAINTENANCE (WE20Dokument6 SeitenPARTNER PROFILE MAINTENANCE (WE20shyamvs2002Noch keine Bewertungen

- IDoc Basics For Functional ConsultantsDokument5 SeitenIDoc Basics For Functional Consultantsshyamvs2002Noch keine Bewertungen

- Account DeterminationDokument2 SeitenAccount Determinationshyamvs2002Noch keine Bewertungen

- Adjustment Reversal ProcessDokument4 SeitenAdjustment Reversal Processshyamvs2002Noch keine Bewertungen

- Idoc Validations, Common Idoc Errors and SolutionDokument3 SeitenIdoc Validations, Common Idoc Errors and Solutionshyamvs2002Noch keine Bewertungen

- IDOC-Basics-IDOC STRUCTURE AND RECORDSDokument5 SeitenIDOC-Basics-IDOC STRUCTURE AND RECORDSshyamvs2002Noch keine Bewertungen

- Franchise Fee: Psum (Price Summary) Field in The Relevant Schema Steps. A Billing Line Item Is Generated ThatDokument8 SeitenFranchise Fee: Psum (Price Summary) Field in The Relevant Schema Steps. A Billing Line Item Is Generated Thatshyamvs2002Noch keine Bewertungen

- Complete Guide to Configuring IDOCs in SAPDokument26 SeitenComplete Guide to Configuring IDOCs in SAPshyamvs2002Noch keine Bewertungen

- A Configuring SAP For Inbound and Outbound ProcessingDokument26 SeitenA Configuring SAP For Inbound and Outbound Processingshyamvs2002Noch keine Bewertungen

- RTP 1Dokument25 SeitenRTP 1shyamvs2002Noch keine Bewertungen

- RTP BILLING - Master Data Creation DocumentDokument21 SeitenRTP BILLING - Master Data Creation Documentshyamvs2002Noch keine Bewertungen

- Sap BookDokument445 SeitenSap BookSai ChivukulaNoch keine Bewertungen

- Budgetbilling 141008141602 Conversion Gate02Dokument6 SeitenBudgetbilling 141008141602 Conversion Gate02Kanakarao GumpinaNoch keine Bewertungen

- Study of Discounts-I: M?frameset /en/45/556a3591541f67e10000009b38f889/frameset - HTMDokument3 SeitenStudy of Discounts-I: M?frameset /en/45/556a3591541f67e10000009b38f889/frameset - HTMshyamvs2002Noch keine Bewertungen

- SD&ISUDokument4 SeitenSD&ISUshyamvs2002Noch keine Bewertungen

- Budgetbilling 141008141602 Conversion Gate02Dokument6 SeitenBudgetbilling 141008141602 Conversion Gate02Kanakarao GumpinaNoch keine Bewertungen

- Accesscontrolsforoperands 150217065851 Conversion Gate01 PDFDokument12 SeitenAccesscontrolsforoperands 150217065851 Conversion Gate01 PDFshyamvs2002Noch keine Bewertungen

- Supply Scenario Grid UsageDokument6 SeitenSupply Scenario Grid Usageshyamvs2002Noch keine Bewertungen

- Why It Is Important To Consider "Fiori Design Guidelines" To Develop SAP Fiori Apps?Dokument2 SeitenWhy It Is Important To Consider "Fiori Design Guidelines" To Develop SAP Fiori Apps?shyamvs2002Noch keine Bewertungen

- Step-by-Step Archiving in SAPDokument41 SeitenStep-by-Step Archiving in SAPshyamvs2002Noch keine Bewertungen

- RTP 1Dokument25 SeitenRTP 1shyamvs2002Noch keine Bewertungen

- SAP Data Archiving: by Gayatri Narendra Patil, InfosysDokument31 SeitenSAP Data Archiving: by Gayatri Narendra Patil, Infosysshyamvs2002Noch keine Bewertungen

- Point of Delivery (Pod) : Example 1: Installation With Load Shape Measurement For Reactive and Active ConsumptionDokument3 SeitenPoint of Delivery (Pod) : Example 1: Installation With Load Shape Measurement For Reactive and Active Consumptionshyamvs2002Noch keine Bewertungen

- SAP Business One Data Archive PDFDokument51 SeitenSAP Business One Data Archive PDFshyamvs2002100% (2)

- Sap Ci PDFDokument314 SeitenSap Ci PDFranjankrishna100% (3)

- Archiving PDFDokument41 SeitenArchiving PDFshyamvs2002Noch keine Bewertungen

- Sap Ci PDFDokument314 SeitenSap Ci PDFranjankrishna100% (3)

- Complete Fico ManualDokument374 SeitenComplete Fico ManualJigar Shah96% (23)

- Air Suspension Benefits Over Steel SpringsDokument3 SeitenAir Suspension Benefits Over Steel SpringsBejoy G NairNoch keine Bewertungen

- ModelDokument3 SeitenModelCarlo ThornappleNoch keine Bewertungen

- Name Source Description Syntax Par, Frequency, Basis)Dokument12 SeitenName Source Description Syntax Par, Frequency, Basis)alsaban_7Noch keine Bewertungen

- Manual Fuji TemperaturaDokument40 SeitenManual Fuji TemperaturaMartínNoch keine Bewertungen

- Efectele Pe Termen Lung Ale Alaptatului OMSDokument74 SeitenEfectele Pe Termen Lung Ale Alaptatului OMSbobocraiNoch keine Bewertungen

- Java Practice Test 1Dokument6 SeitenJava Practice Test 1Harsha VardhanaNoch keine Bewertungen

- Elec4602 NotesDokument34 SeitenElec4602 NotesDavid VangNoch keine Bewertungen

- 12 Translations PDFDokument4 Seiten12 Translations PDFTeo Lee Hong0% (1)

- Geometri Ruang File 1Dokument4 SeitenGeometri Ruang File 1Muhammad Isna SumaatmajaNoch keine Bewertungen

- The Role of Pets in PreadolescentDokument17 SeitenThe Role of Pets in PreadolescentshimmyNoch keine Bewertungen

- Sybase Basic & Advanced T-SQL ProgrammingDokument3 SeitenSybase Basic & Advanced T-SQL Programmingmehukr0% (1)

- Migrating Your SQL Server Workloads To PostgreSQL - Part 3 - CodeProjectDokument6 SeitenMigrating Your SQL Server Workloads To PostgreSQL - Part 3 - CodeProjectgfgomesNoch keine Bewertungen

- Norstar ICS Remote Tools, NRU Software Version 11Dokument1 SeiteNorstar ICS Remote Tools, NRU Software Version 11Brendan KeithNoch keine Bewertungen

- List of Eligible Candidates Applied For Registration of Secb After Winter 2015 Examinations The Institution of Engineers (India)Dokument9 SeitenList of Eligible Candidates Applied For Registration of Secb After Winter 2015 Examinations The Institution of Engineers (India)Sateesh NayaniNoch keine Bewertungen

- EE6010-High Voltage Direct Current TransmissionDokument12 SeitenEE6010-High Voltage Direct Current Transmissionabish abish0% (1)

- The Structure of MatterDokument3 SeitenThe Structure of MatterFull StudyNoch keine Bewertungen

- Matematika BookDokument335 SeitenMatematika BookDidit Gencar Laksana100% (1)

- Report Navigation Prashanth RamadossDokument1 SeiteReport Navigation Prashanth RamadossaustinvishalNoch keine Bewertungen

- Sambungan Chapter 2.2Dokument57 SeitenSambungan Chapter 2.2iffahNoch keine Bewertungen

- Ring Spinning MachineDokument25 SeitenRing Spinning Machinemahmuda chowdhuryNoch keine Bewertungen

- Adobe After Effects CS3 Keyboard Shortcuts GuideDokument14 SeitenAdobe After Effects CS3 Keyboard Shortcuts GuideBrandon Sirota100% (1)

- Equipment DetailsDokument10 SeitenEquipment Detailsimranjani.skNoch keine Bewertungen

- Criteria Cogni+Ve Ap+Tude Style Free Test: AssessmentdayDokument15 SeitenCriteria Cogni+Ve Ap+Tude Style Free Test: AssessmentdayRahul SharmaNoch keine Bewertungen

- Automate Distribution of Quantity in MIGODokument8 SeitenAutomate Distribution of Quantity in MIGOyougesh100% (2)

- Experiment 1 - Friction Losses in PipesDokument34 SeitenExperiment 1 - Friction Losses in PipesKhairil Ikram33% (3)

- Carbon FibreDokument25 SeitenCarbon Fibrejagadish.kvNoch keine Bewertungen

- Association of Genetic Variant Linked To Hemochromatosis With Brain Magnetic Resonance Imaging Measures of Iron and Movement DisordersDokument10 SeitenAssociation of Genetic Variant Linked To Hemochromatosis With Brain Magnetic Resonance Imaging Measures of Iron and Movement DisordersavinNoch keine Bewertungen

- Js4n2nat 4Dokument2 SeitenJs4n2nat 4tingNoch keine Bewertungen

- CRC Csharp and Game Programming 2nd Edition 1138428108Dokument530 SeitenCRC Csharp and Game Programming 2nd Edition 1138428108harimotoNoch keine Bewertungen

- NX Advanced Simulation坐标系Dokument12 SeitenNX Advanced Simulation坐标系jingyong123Noch keine Bewertungen