Beruflich Dokumente

Kultur Dokumente

AUG-03 Mizuho Technical Analysis EUR JPY

Hochgeladen von

Miir ViirOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

AUG-03 Mizuho Technical Analysis EUR JPY

Hochgeladen von

Miir ViirCopyright:

Verfügbare Formate

Mizuho Corporate Bank

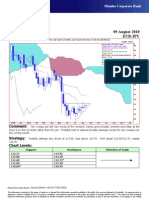

Technical Analysis 03 August 2010

EUR/JPY

EURJPY=EBS, Last Quote [Candle], Last Quote [Ichimoku 9, 26, 52, 26] Daily

05May10 - 08Sep10

Pr

EURJPY=EBS , Last Quote, Candle

123

03Aug10 114.00 114.14 113.58 113.78

EURJPY=EBS , Last Quote, Tenkan Sen 9

03Aug10 112.38 122

EURJPY=EBS , Last Quote, Kijun Sen 26

03Aug10 111.02

121

EURJPY=EBS , Last Quote, Senkou Span(a) 52

07Sep10 111.70

EURJPY=EBS , Last Quote, Senkou Span(b) 52 120

07Sep10 111.02

EURJPY=EBS , Last Quote, Chikou Span 26

29Jun10 113.78 119

118

117

116

115

114

113

112

111

110

109

108

10May10 17May 24May 31May 07Jun 14Jun 21Jun 28Jun 05Jul 12Jul 19Jul 26Jul 02Aug 09Aug 16Aug 23Aug 30Aug 06Sep

Comment: Some are getting excited about a potential break above 114.50, the highest levels since May, and

the potential bullish implications for stock markets were this to be the case. We are not so sure about either of these

two ideas. Probably best to assume broadly sideways moves for yen crosses over the coming month.

Strategy: Attempt small shorts at 113.65/114.00; stop above 114.75. First target 112.70, probably 112.00.

Chart Levels:

Support Resistance Direction of Trade

113.20 114.25

112.70 114.75*

112.00 115.00

111.00 115.50

110.00* 116.85

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Torque Converter Lock-Up FunctionDokument2 SeitenTorque Converter Lock-Up Functioncorie132100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- SchlumbergerDokument29 SeitenSchlumbergerAitazaz Ahsan100% (5)

- Pain Audit ToolsDokument10 SeitenPain Audit ToolsIrmela CoricNoch keine Bewertungen

- Manual Honda CivicDokument469 SeitenManual Honda CivicshikinNoch keine Bewertungen

- 05 - SRX NatDokument44 Seiten05 - SRX NatLuc TranNoch keine Bewertungen

- Analyzing Sri Lankan Ceramic IndustryDokument18 SeitenAnalyzing Sri Lankan Ceramic Industryrasithapradeep50% (4)

- 20779A ENU CompanionDokument86 Seiten20779A ENU Companionmiamikk204Noch keine Bewertungen

- GDN-206 - Guidelines On Safety Management System in Petroleum IndustryDokument49 SeitenGDN-206 - Guidelines On Safety Management System in Petroleum IndustrykarpanaiNoch keine Bewertungen

- AUG 11 UOB Global MarketsDokument3 SeitenAUG 11 UOB Global MarketsMiir ViirNoch keine Bewertungen

- AUG-10 Mizuho Technical Analysis EUR JPYDokument1 SeiteAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNoch keine Bewertungen

- AUG 11 DBS Daily Breakfast SpreadDokument6 SeitenAUG 11 DBS Daily Breakfast SpreadMiir ViirNoch keine Bewertungen

- Westpack AUG 11 Mornng ReportDokument1 SeiteWestpack AUG 11 Mornng ReportMiir ViirNoch keine Bewertungen

- AUG-10 Mizuho Technical Analysis GBP USDDokument1 SeiteAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNoch keine Bewertungen

- AUG 10 UOB Asian MarketsDokument2 SeitenAUG 10 UOB Asian MarketsMiir ViirNoch keine Bewertungen

- AUG 10 UOB Global MarketsDokument3 SeitenAUG 10 UOB Global MarketsMiir ViirNoch keine Bewertungen

- Westpack AUG 10 Mornng ReportDokument1 SeiteWestpack AUG 10 Mornng ReportMiir ViirNoch keine Bewertungen

- AUG 10 DBS Daily Breakfast SpreadDokument8 SeitenAUG 10 DBS Daily Breakfast SpreadMiir ViirNoch keine Bewertungen

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDokument5 SeitenMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNoch keine Bewertungen

- JYSKE Bank AUG 10 Corp Orates DailyDokument2 SeitenJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNoch keine Bewertungen

- Danske Daily: Key NewsDokument4 SeitenDanske Daily: Key NewsMiir ViirNoch keine Bewertungen

- AUG 10 Danske EMEADailyDokument3 SeitenAUG 10 Danske EMEADailyMiir ViirNoch keine Bewertungen

- AUG 10 Danske FlashCommentFOMC PreviewDokument7 SeitenAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNoch keine Bewertungen

- ScotiaBank AUG 09 Daily FX UpdateDokument3 SeitenScotiaBank AUG 09 Daily FX UpdateMiir ViirNoch keine Bewertungen

- AUG-09-DJ European Forex TechnicalsDokument3 SeitenAUG-09-DJ European Forex TechnicalsMiir ViirNoch keine Bewertungen

- AUG-09 Mizuho Technical Analysis EUR JPYDokument1 SeiteAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNoch keine Bewertungen

- JYSKE Bank AUG 09 Market Drivers CurrenciesDokument5 SeitenJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNoch keine Bewertungen

- Jyske Bank Aug 09 em DailyDokument5 SeitenJyske Bank Aug 09 em DailyMiir ViirNoch keine Bewertungen

- JYSKE Bank AUG 09 Corp Orates DailyDokument2 SeitenJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNoch keine Bewertungen

- HP-exampleDokument30 SeitenHP-exampleAnonymous 105zV1Noch keine Bewertungen

- 1 Conflict in NG - Report - 28FEB2018Dokument46 Seiten1 Conflict in NG - Report - 28FEB2018KrishnaNoch keine Bewertungen

- Taiwan Petroleum Facilities (1945)Dokument85 SeitenTaiwan Petroleum Facilities (1945)CAP History LibraryNoch keine Bewertungen

- STAAD Seismic AnalysisDokument5 SeitenSTAAD Seismic AnalysismabuhamdNoch keine Bewertungen

- Book Shop InventoryDokument21 SeitenBook Shop InventoryAli AnsariNoch keine Bewertungen

- Resume 202309040934Dokument5 SeitenResume 202309040934dubai eyeNoch keine Bewertungen

- Video Case 1.1 Burke: Learning and Growing Through Marketing ResearchDokument3 SeitenVideo Case 1.1 Burke: Learning and Growing Through Marketing ResearchAdeeba 1Noch keine Bewertungen

- DoctorTecar Brochure MECTRONIC2016 EngDokument16 SeitenDoctorTecar Brochure MECTRONIC2016 EngSergio OlivaNoch keine Bewertungen

- Inteligen NT BB - NTC BB Datasheet PDFDokument4 SeitenInteligen NT BB - NTC BB Datasheet PDFfrancis erl ligsayNoch keine Bewertungen

- Sworn Statement of Assets, Liabilities and Net WorthDokument2 SeitenSworn Statement of Assets, Liabilities and Net WorthFaidah Palawan AlawiNoch keine Bewertungen

- Ch-3 BUFFETDokument9 SeitenCh-3 BUFFETJanith prakash567Noch keine Bewertungen

- ScriptDokument7 SeitenScriptAllen Delacruz100% (1)

- Ca50c584 MAYTAGE00011 1 2Dokument2 SeitenCa50c584 MAYTAGE00011 1 2Michael MartinNoch keine Bewertungen

- Expanded Breastfeeding ActDokument9 SeitenExpanded Breastfeeding ActJohn Michael CamposNoch keine Bewertungen

- Rule 63Dokument43 SeitenRule 63Lady Paul SyNoch keine Bewertungen

- CreatorsXO JuneDokument9 SeitenCreatorsXO JuneGaurav KarnaniNoch keine Bewertungen

- Cassava Starch Granule Structure-Function Properties - Influence of Time and Conditions at Harvest On Four Cultivars of Cassava StarchDokument10 SeitenCassava Starch Granule Structure-Function Properties - Influence of Time and Conditions at Harvest On Four Cultivars of Cassava Starchwahyuthp43Noch keine Bewertungen

- The 8051 Microcontroller & Embedded Systems: Muhammad Ali Mazidi, Janice Mazidi & Rolin MckinlayDokument15 SeitenThe 8051 Microcontroller & Embedded Systems: Muhammad Ali Mazidi, Janice Mazidi & Rolin MckinlayAkshwin KisoreNoch keine Bewertungen

- C++ & Object Oriented Programming: Dr. Alekha Kumar MishraDokument23 SeitenC++ & Object Oriented Programming: Dr. Alekha Kumar MishraPriyanshu Kumar KeshriNoch keine Bewertungen

- PX4211 2Dokument3 SeitenPX4211 2kalpanaNoch keine Bewertungen

- 1962 BEECHCRAFT P35 Bonanza - Specifications, Performance, Operating Cost, Valuation, BrokersDokument12 Seiten1962 BEECHCRAFT P35 Bonanza - Specifications, Performance, Operating Cost, Valuation, BrokersRichard LundNoch keine Bewertungen

- Usb - PoliDokument502 SeitenUsb - PoliNyl AnerNoch keine Bewertungen