Beruflich Dokumente

Kultur Dokumente

Final Exam - Coverage

Hochgeladen von

Charlie Brown0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten3 Seitencoverage.

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldencoverage.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten3 SeitenFinal Exam - Coverage

Hochgeladen von

Charlie Browncoverage.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

Final Exam Coverage

Following table summarizes the key aspects of what will be covered on

the midterm exam. There may be a small portion of the exam that

covers areas not listed below.

Class 1 Overview of Auditing Definition, CAS

Different Levels of Assurance

Audits, reviews, compilations

Audit of Financial Information other than F/S (5805)

Audit for compliance with a Contract, Agreement (5815)

Class 2 Auditor Reporting

Components

Types of Audit Reports 5 types

Ethics & Rules/Code of Professional Conduct

listed in lecture notes and covered in homework

5 facets/pillars of independence

Class 3 Legal liability

Focus on lecture notes

Due Care

Business Failure, Audit Failure, Audit Risk

Negligence

Assertions

Class 4 Evidence

Tree of SAAE

Analytical Procedures

Class 5 Audit Risk Model

Class 6 Materiality

Audit Planning I

Client Acceptance Issues Preplanning

Risk assessment, Tests of Controls, Substantive Tests

Class 7 Midterm

Class 8 Internal Controls & Control Risk

Definition of Internal Control

Practical/Inherent Limitations

Components of Internal Control

Control Environment

Substantive Procedures

Audit Approaches

Class 9 Fraud

Fraud versus Error

Fraud Triangle

Auditors Role, Responsibilities, Responses

Sampling Concepts

Considerations for sample size

Methodologies

Class 10 Business Functions and Documents in the RRR Cycle

Sales Class

Cash Receipts Class

Class 11 RRR Cycle continued Receivables

Link between Classes of Transactions and Account

Balances

Confirmation Process

Alternative Procedures

Business Functions and Documents in the PPP Cycle

Acquisitions Class

Cash Disbursements Class

Class 12 Inventory Cycle

Class 13 Completing the Audit

Quantitative and Qualitative considerations

Summarize errors, compare to materiality

1. Multiple Choice

2. Short Answer

3. Longer Answer

Bring UBC Student Card, calculator

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Clinical Trials in A Nut ShellDokument23 SeitenClinical Trials in A Nut ShellSuryamohan SurampudiNoch keine Bewertungen

- Historical Development in Science and TechnologyDokument31 SeitenHistorical Development in Science and TechnologyMecaella Bondoc100% (7)

- ISO 27005 Presentation SlideDokument25 SeitenISO 27005 Presentation SlideSon Tran Hong Nam100% (1)

- Community Language LearningDokument19 SeitenCommunity Language LearningfullhausNoch keine Bewertungen

- Introduction TP Strategic ManagementDokument15 SeitenIntroduction TP Strategic ManagementParth ShahNoch keine Bewertungen

- Emergence of Female Preachers and Shaping of Islamic Authority: Case of Institutional Change or Persistence1?Dokument19 SeitenEmergence of Female Preachers and Shaping of Islamic Authority: Case of Institutional Change or Persistence1?showerfalls100% (1)

- 3D Surface Mapping Using Ultrasonic SensorsDokument3 Seiten3D Surface Mapping Using Ultrasonic SensorsInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- A Project Report On A Study On Customer Satisfaction On Pizza Hut Rishi PDFDokument47 SeitenA Project Report On A Study On Customer Satisfaction On Pizza Hut Rishi PDFanshpatel9932Noch keine Bewertungen

- Advertising Structures - CI-BusinessDokument3 SeitenAdvertising Structures - CI-BusinessTerry FlewNoch keine Bewertungen

- QSO 645 Milestone Two Guidelines and RubricDokument3 SeitenQSO 645 Milestone Two Guidelines and Rubric3Q Junior Taman MidahNoch keine Bewertungen

- Garrard Health Sciences Literature Review Made EasyDokument8 SeitenGarrard Health Sciences Literature Review Made Easygw10ka6sNoch keine Bewertungen

- Analisis Peran Guru Dalam Meningkatkan Minat Baca Peserta Didik Di Sekolah DasarDokument6 SeitenAnalisis Peran Guru Dalam Meningkatkan Minat Baca Peserta Didik Di Sekolah Dasarsiti humairoqNoch keine Bewertungen

- How To Do One-Way ANOVA Using PythonDokument15 SeitenHow To Do One-Way ANOVA Using PythonFredrik Nilsson100% (1)

- Honors Competency RubricDokument3 SeitenHonors Competency Rubricapi-460848826Noch keine Bewertungen

- BeFo Rapport 147 Webb (1wer)Dokument64 SeitenBeFo Rapport 147 Webb (1wer)Kaleeswari GNoch keine Bewertungen

- A Field Test Two StepDokument15 SeitenA Field Test Two Stepcarlos eduardoNoch keine Bewertungen

- Daftar Pustaka Employee EngagementDokument3 SeitenDaftar Pustaka Employee EngagementekaNoch keine Bewertungen

- CBA Proficiency Scale Student Report Final Draft-2Dokument8 SeitenCBA Proficiency Scale Student Report Final Draft-2Keith AugustineNoch keine Bewertungen

- 3.2.b-Technological ChangeDokument23 Seiten3.2.b-Technological Changejjamppong09Noch keine Bewertungen

- How Do Adolescent See Their Future? A Review of The Development of Future Orientation and PlanningDokument44 SeitenHow Do Adolescent See Their Future? A Review of The Development of Future Orientation and PlanningMayzuroh Sip100% (1)

- A Comprehensive Modeling Framework For Trans 2016 Transportation Research PaDokument20 SeitenA Comprehensive Modeling Framework For Trans 2016 Transportation Research PaChương Thiện NguyễnNoch keine Bewertungen

- FFR FinalDokument832 SeitenFFR FinalajoilhamNoch keine Bewertungen

- Dissertation PoliceDokument5 SeitenDissertation PoliceWhereToBuyResumePaperLosAngeles100% (1)

- Ubd Lesson Plan Multigenre ResearchDokument4 SeitenUbd Lesson Plan Multigenre Researchapi-270010595Noch keine Bewertungen

- Wang 2021 IOP Conf. Ser. Earth Environ. Sci. 693 012103Dokument8 SeitenWang 2021 IOP Conf. Ser. Earth Environ. Sci. 693 012103pecinta dakwah IslamNoch keine Bewertungen

- Green BehaviourDokument11 SeitenGreen Behaviourjehana_bethNoch keine Bewertungen

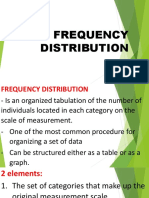

- Frequency DistributionDokument19 SeitenFrequency DistributionRhaine EstebanNoch keine Bewertungen

- Effectiveness of Technology in Improving One's Learning Skills (G1)Dokument12 SeitenEffectiveness of Technology in Improving One's Learning Skills (G1)JeremiahNoch keine Bewertungen

- ArticleDokument6 SeitenArticlePakeeza JavedNoch keine Bewertungen

- Flows of Ideas - Tamara - Research MethodDokument6 SeitenFlows of Ideas - Tamara - Research MethodTamaraNoch keine Bewertungen