Beruflich Dokumente

Kultur Dokumente

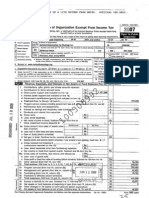

2014 More Good Foundation Form 990

Hochgeladen von

Chino Blanco100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

760 Ansichten22 SeitenMGF Form 990

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenMGF Form 990

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

760 Ansichten22 Seiten2014 More Good Foundation Form 990

Hochgeladen von

Chino BlancoMGF Form 990

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 22

* fom 990-PF

EXTENDED TO FEBRUARY 16

PI 201)

Return of Private Foundation

or Sacton 4047(X1) Trust Treated a vate Foundation

> De notentr social secury ombers on ths form as may be made publi.

>> intron about Frm 900-PF and ts separate mstuctons = at WWW.1s.go¥/oTmOSODL.

6

meus

Forealendhr year 201¢ortaxyear beginning JUL 1, 2014 vandending JUN 30, 2015

Name of foundation [A Employer itenitiction number

MORE GOOD FOUNDATION 20-3385036

Tabane et (xP box urbe a et ered an wo Reece |B Telephone number

1569 N TECHNOLOGY WAY BLDG A 1100 | 801-310-1380

‘iyo: town stale or prownce, county, and 29 or foreign postal code Io veenevnscctane pang omaner PL]

OREM, UT 84097

Checkat thateppiz. — LJ intial return Tia return of former public charity D 4. Foreign organwations, check here P&L]

Final return Ammended return a

Sorermsiagemsanst™ pC]

TF) dress chan (Name change

1 Ohwok ype of xgancateon: — [2X Seoton §01(6\3) exempt pate foundation

[section 4947)aX1} nonexempt chartabie rust_[__] Other taxable private foundation

1 Farrmarket va of al asets at end of year [J Accounting metnoc: LX] Cash Pearval

J other (specity)

(rom Part, cot. (ne 16)

le orate onaaton status was termates

under secbon 507%0) 1}, eneck rere B+]

Frm tundaton sm 60-monthtematn,

uncer schon S078), checchee >}

Ds 112,199 .|(Parti coun oh must be on cash ass) a

(Part fess peReeive atte ann | a)aeeneans, | (yNamesmen | ()Aduedon | (Qaaeeeres

Scinaet coals Seneca Senses pe oa income ineome Eextees

7 Controutons, of, oan, et, reeved 1,298, 585.|

fc (es) niudninamenmeaner |

3 ores etonoaay 1,007.| 1,007. 1,007.\STATEMENT 1

4 Dredd and terest rom scutes

a Grssrents _

1 rite nee to a

| 62 rca dx ton acters nto 1 st

&| > Sicteeninece 2

=e el FI

1 netshort-term capil gan o

Income modtcations: | “AR:

10a deine SY!

1 aes cat ot godt

€ Gross pratt or (ass)

11 ther ncome

12 Tal Add ines 1 trough 11 1,299,592. 1,007, 7,007,

4G) [18 cermenaston of cars, recor, nase, ete 494,610.| 0. 0. 494,610.

25.14. oteremolaye sales and wanes 160,586. 0. o.[ 160,586.

2 |8. Penson plans, employe benefits 111,847, 0. o.[ 111,847.

$B] 16a Legal tees STMT 2 1,505.) — 0. 0. 1,505.

§] » Accouning tees STMT 3 6,081. 1,000. 0. 5,081.

2] omergrotesonal ies

“Shar inert

vi, Site Tans sT™uT 4 230,909, on o.[ 230,505.

+ E}19_ deprecation and ception 2,325. 0. 2,325.

Sf oem 27,248. On 0. 27,248.

2 Slat Teave conerences, and meeings 14,628. 0. 0. 14,828.

y B}ee_ Printing and publeations 1,314, 0. 0. 1,314.

2)28- ier expenses STMT 5 438,438. 500. 0.[ 437,438.

Glo4 otaloperaing and administrative

B| expenses, Add ines 19 hough 23 1,489,691. 1,500. 2,325.| 1,485,366.

©] 28. conrbutons, fs, rans pad 0. On

26. Total expenses and disbursements

Ad ines 24a 25 1,489,691. 1,500. 325.1 1,485,366.

[27 Subtract ne 25 rom ne

ones nd oxen <190, 099.

come ao 2) 0.

¢ Adusednetincome crag we 0 on

‘Viele LHA For Paperwork Reduction Act Notice, see instructions. Form 990-PF (2014)

16230106 133063 MOREGOOD

1

2014.05010 MORE GOOD rounoarzod!” MOREGOO1

* Form 990-06 2014)

MORE GOOD FOUNDATION

20-3385036

Page

Balence Sheets

arate

ee ioe

Beginning over

End of year

(a) Book Vale {) Book Value

(clFax Manat Value

Gl non-nerest- bearing

2. Sawngs and temporary cash vestments

3 Accounts reenable

Less: allowance for doubtful accounts

285,913, 97,210,

97,210.

4 Pledges recevable De

Less allowance for doubtful accounts

5 Grants ecewable

disquahied persons

7 oer ins ccoane >

Less: allowance for doubt accounts

5 Recewables ave rom ote, crestor, rustes, an oer

{8 Iventones forsale or use

9. Prepaid expenses and deterred charges

‘a lavestments- US. and state government obtoatons

® Investments -oxpoat stock

«Investments - corporate bonds

19 sin

Assets

>

>

3,552, 3,552.

3,552.

12 Investments -morigage loans

13. lnvestments - other

as acura enon >

14 Land, baidngs nd equpment bass 60,72

51,389. 283. 9,336.

9,336.

15. Omer asses (deseobe

STATEMENT 6) 1

550. 2,101.)

2,101.

18. Total asses (lobe completed bya fers-see tne

instructions. Alo, se page 1, om

298. 112,199.

112,199.

‘7 Accounts payabe and accrved expenses

18 Grants payable

19. Deteredreverue

21 Mortgages and eter notes payable

22 Other abies (desenbe De

20. Leura tem otows, acts tun, nd ce daunted pce

23 Tota aitties (add bes 17 trough 22)

Foundation that follow SFAS 117, check

24 Unestrced

25 Temporanlyresrcted

26 Permanent resncted

and complete lines 27 through 31

127 Capital sock, tst prncpal, or curent ands

Net Assets or Fund Balances

30 Total act asses or fund balances

—L21_ Tota iiiies and ne

fund balances

and complete ines 24 trough 26 and fines 30 and 3.

Foundations that donot follow SFAS 117, check here

128. aidan o capt surls, ond, bldg, and equipment tnd

'29-Retaned earnings, accumulated income, endowment, orate funds

> od

302,298. 112,199.

>CI

302,298, 112,199.

302,298. 112,199.

Analysis of Changes in Net Assets or Fund Balances

1 Total nat ses or fnd balances at bepinnng of yar - Part, column (a), ine 30,

(trust agree wth end-of-year gure epoted on pr year's turn)

Enter amount om Part ine 27

Ctnermereases net mcluded in ine 2 (remze) Be

302,298.

<190,099.>

Oo.

‘Aca ines 1,2, and 3

Decreases not melded in ine 2 tema) Be

112,199.

o.

Total nel assets or tund blot

lend of yar (ine 4 minus ine 5) = Part column bbe 30

112,199.

16230106 133063 MOREGOOD

2

2014.05010 MORE GOOD FOUNDATION

Form 990-PF (2014)

MOREGOO1

Fo 99096014) _ MORE GOOD FOUNDATION

(Part IV[ Capital Gains and Losses for Tax on Investment Income

20-3385036 Pages

(wustand deste ends) propery si (9, realestate, OPFRTRERET | (ejoneaceues | _ dues

«___Deavterlaed amen 0s me eh mesa | Commas’ [amass

i

. NONE_

rl

cease {HDipecaon awed {o) ost robs Genera)

Oh ecalowahiy ls epee te ches mans (0)

: —

¢ -_

~ c S n a y GoTDETD Cesare

i) Aut as, 25 fe edt tu nates a) 02

(EM. aso 173189 ery Orecol than) Losses aml (h)

» T =

« }

‘

W gaa ent n Part?

2 Catalan et eameor(etaptatos) {ifs enter -0-n Pat ee 7

2: estat capt gan (ssa ean tts 12215) 296

Han, ao en mPar ne coun }

es ee -¢-nPet eb 2

[Part V | Gusliication Under Section 4540(@) for Reduced Tax on Net Investment Income

{For optional use by domeste prvae foundations subet to the secon 4940(a) tax on net vestmentncome.)

ston 4940(2) pos, ave pt bk.

Waste ountsbon tbl fore secon 4942 tx onthe stbualeamout try yer te es peo? Cvs Heme

Ys he feuds oe ot quit unger ecb 640, Do not colts pot

{Etre poeple amount exch colnet er eestor bl ag ane

fase pia years » 0 pete a

colonia SEEPS enna) | _ Aisle quid dstrovtons | Neva ofnonchrabese asses | ca. BVBHAAHE, ay

2013 1,284,327, 309,302. 4.152340

2012 572,712. 296,613. 1.930839

2011 788,224.| 155,823, 5.058457

2010 585,568. 92,471.| 6.332450

2009. 575,094.) 74,931 7.674981

2. Total of line 1, column (2) 2 25.149067

2. Average dsrbuton rao fore Sear base penod- dene tolalon ine 2y 5, orb he umber fers

‘the foundabon has been in existence ifless than 5 years 3 5.029813

4 Enter the net value of noncharitable-use assets for 2014 trom Part X, line § 4 215,722.

5 Multiply line 4 by bne 3. 5 1,085,041.

6 Enter 1% of net investment income (1% of Part | ine 27b) & Oo.

7 Add ines 5 and 6 7 1,085,041.

8 Enter qualifying distributions from Part XI, hne 4 8 1,485,366.

Wine 8s equal oor greater han ine 7, check the boxin Pat Vi, ne Yo, and complete that part sing a 1% tax ate

See the Pat Vi nstucions

16231

3

Form 990-PF (2014)

0106 133063 MOREGOOD 2014.05010 MORE GOOD FOUNDATION MOREGOO1

* Formgs0-PF 018) __MORE_GOOD FOUNDATION 20-3385036 pages

Part VI Excise Tax Baséd on Investment Income (Section 4040(a), 4040(b), 4940(@), or 4946 - see instructions)

“ta Exempt operating foundatons descnbed in section 4840(4)(2), check here B> L_] and enter "WA on ine 1.

Oat tug or determeaton te (atae coy eer cessation)

» Domeste oud: bt eet ne satan 440] eaaremeis a Pa, ches Ll ander H 0.

oiPantine 270

€ ote daneste unatos ert 2 one 27. Ext ag anasto ene of Pa ne 12,

2 Tax under sechon 511 (domestic section 4947(a)1) trusts and taxable foundations only. Others enter -0-) 2 oO.

8 Aad ies 1and2 2 Oo:

4 Subtitle A (income) tax (domestic section 4947(a)( 1) trusts and taxable foundations only. Others enter -0-) Lal 0

5 Taxbased on investment income Sudtract line 4 trom line 3. It zero or less, enter -O- 5 oO.

6 CrestsPaymens

22014 xia tx payments nd 213 overpayment rede 102014 &

B Erol oan ganna wi aso e

¢ Taxpn wih pletion or entenson of toe Form e059) fe

¢ Bacup minting eroneuewineld rm

1 Toalcadssanpomans. a nes rough 7 0.

8 Ener any geal or underpayment festa ax Osekere—] rrm 200 ated rel

8 Taxéue ite tl ofines ad moran ne 7, en aout owe rte

10 Overpayment fine 7s mare anh tal ots San 8 etre amount everais > [0

1. Evern amount ofa 10104 Cadte w 215 estimated tx Be [nenndea> [is

[Par VI-A| Statements Regarding Activites =

1a Oung te xyer, othe foundation atl onc an Tabor ae Toc Wgon GS pepe renee Yes[ No"

anypotialcaneaan? x

Dust pend mae than $10 dung te yar ether ety riety fr pola purposes (easton re detnon? x

ifthe answer's "West ao 1b, attach @delaieddesenaton ofthe acttes and copes of ny aterls publated or

distnied by the funcatonn connecton mh te aces

« Ot unten ae 1200. ore es? wl [x

{Enter amout any) of tx npltcal exendues (ctor 4955) mood cung te yer

(1) On the foundation, D> $. 0... (2) On foundation managers. B $ 0

«Erie reborn a) pay undone err peitealependre xpos union

managers. > $ 0

2 asthe undaton eano ay aves at ave evo een repro ie RS? 2| {x

i1-¥e, attach a dealeddescnpon othe acts

4, ast unto nade any changes ol revo ope he IS, govern evune ks capecten

byavs, or oer smisrnstumens? "Ye, each a conformed copy othe changes | |x

4a Dee undton hav une buses ross come of $1.00 more dung ey? | [x

D Yess tase atxceumon arm S90 for nya? w/a [a

5 Wasttereahquten,rmnaton,dslito, or ist contacbon dung ta ya? s{ 1x

11 ¥es," attach the statement requred by Genera Instructon T

6 Bre the equrements of secton 50) relang to sections 4941 through 4945) satshed eter:

‘By language nthe goverringestrument, or

‘By state legistton that ettecvly amends the governing instrument so hat no mandatory ection ha confit with he state aw

‘ean inthe govering msturent? 8 x

7 Did te foundation have at east $5,000 m assets a any tne during the year? “Yes,* complete Par I, cof (), ancl Part XV 71x

‘8 Ente the states to whch te foundation reports or wih whch ts registered (see mstuctons)

ur.

it the anewer Yes fo ine 7, fas the Toundahion fwrised a copy of Form 980-PF othe Atrnay General or designate)

cof each sate as equred by Ganeral instruction G? If No, attach explanation » |x

9 Isthe foundation mung status as a prnate operating foundation wit the meaning of secon 4942(49) or 4942()5) fr calendar

year 2014 or the taxable year begenng m 2014 (see nstctons for Pat XIV)? if "Yes," complete Part XIV o|x

10. Did any persons become substantial contributors dunn the tax Year? ve tae acne sng hs nant eases 10 x

Form 990-PF (2014)

4

16230106 133063 MOREGOOD 2014.05010 MORE GOOD FOUNDATION MOREGOO1

Form 9907 oi) _MORE_GOOD FOUNDATION 20-3385)

036 Pages

[Part VII-A [ Statements Regarding Activities (continued)

‘1 Atany me dunng te yar, the foundebo, decor marty, own a cone ety win the meaning of

sechon 512(0 13) "Yes tach schedule (see structions) " x

12. Ddthe lountaton make 2 csrbuton to @ donor ase fund over whch the foundation or aisquafed person had sory preges?

tes: tach statement (see structons) 2 x

12 iéthe foundation comely wth ne pute nspecton reurerent forts annual returns end exemption aphcain? 1X

Websteadécess b _WWW.MOREGOODFOUNDATION. ORG

14 Thebooks aoincare ol DAVID GRANT. —Teephone no. 801-70

Locaedat » 1569 N TECHNOLOGY WAY BLDG A, SUITE 1100, OREM, U zPs pB4i

18 Secuon 4947(a(1)nonexam chartable trusts fling Form 990-F hou of Form 1041 - Check here

‘and enter the amount of tax-exempt interest recewed or accrued during the year mL |

16 ALany ume during calendar yer 2014, da the foundation Kaveanmterest nora signature or oer athonty aver a bank,

secures rote rancal account aforegn county?

See the nstuctons for excepbons and fing equirements fr FinGEN Form 114, formerly TOF 90-221), "Ves, enter the name ofthe

fovergn country D>

id

[Part Vil-B | Statements Regarding Activities for Which Form 4720 May Be Requi

File Form 4720 if any item is checked in the "Yes" column, unless an exception applies.

‘a Ourng the year the foundation ether deny or ndnecty:

(1) mages ot xchange, ssng of ropey wha axis pest? Civ Gene

(2) Brew many toned money aor oer exe eet aor arp om)

2 daqaied person? ves Ge no

(8) Fars ood, sees, tes io (oat tem roma dsabied pon? ves GX ne

(0) Payeapensiton ar pay or rembrse te exerts a duatedesir? (ves Cl ne

(8) Trans ary ncome casts data pecan (oak ayo ether ale

tortenetr ust ofa detualiedprson)? ve Eelne

(6) Acree to pay money ox property toa government ofc? (Exception Check'Wot

if te foundation agreed to make a grant oor 1 employ the ofa fra penod ater

[Yes[ No

termination of government seruce, terminating within 80 days.) Co yes Cx) no

b Hany ancwer "Yes a(1}-(6), is any of te acs fa to qulfy under the exceptons desobedm Regulabons

section 53.4941(6)3 orma current notice regarding disaster assstance (se stuctons)? N/A |»

Organeations relying on current notice regarding disaster assistance check here eC

«Dd the foundation engage a pir year many of he acs described na, oter tan excepted acts, thal were not corrected

bore the rst ay of he tax year begining n 20147 te ra

2 Taxes on alure to distraute near (sectan 4942) (does nat apply fr years the foundation was a prwate operating foundation

Aetinedn section 494243) or 494218):

{At the end of tax year 204, di the foundation have any undistributed ncome (ines 6d and Ge, Par XI) for tx year(s) begmning

before 20147 CO ves Gx) no

IPs, ist the years —__,___

Are there any year ited 9 2a Tor which he foundaton nt applying the provsons of sachon 4942(a)(2)(réutng to meorect

‘valuation of asses) ote year's undistributed come? (i aplyngsecton €842{2}2) oll years sted, answer Not and attach

slatement- see nstuctons.) N/A | 2»

€ Ifthe prowsons of secon 4842{a}2 are beng apphed to any of he years ited 2a, ist te years ere.

> :

‘9 Did he foundation held more than a ie det or maroc intrest any Buses enterprise at ary me

‘during the year? Cores CX] no

11-Ye57 ct have exess business Nolkings mn 201425 a result of 1) any purchase by he foundation or dsquaited persons ater

"May 25, 1969; (2) Ie lapse ofthe Sear penod (or longer prod approved by the Commissioner under secton 4343(¢\7)) 10 spose

of hokdings aequrad by itor bequest a (2) the lapse of th 10,1, or 20-ea rst phase hang peed? (Use Schedule C,

Form 4720, to determine i the foundation had excess business holaings 2014) N/A | a

4 Did the foundation vest during te year any amount ma manner hat woul opardze ts chatabe purposes? 4 x

id tne foundation ake any investnen ma por yar (ut ater Oecambe 31, 1969) that could weopardae ts charable purpose that

‘ha not been reriovd trom jeopardy before te rst ay of he tax year enn in 20147 ns x

Form 990-PF (2018)

5

MOREGOOL

16230106 133063 MOREGOOD 2014.05010 MORE GOOD FOUNDATION

forget 2014) _MORE GOOD FOUNDATION 20-3385036

* [Part Vil-B | Statements Regarding Activities for Which Form 4720 May Be Required continued)

54 Dung he utd the foundation pay or neu any amount

(1) Garry on propaganda, or othermse attempt to influence lepsiation (section 4945(2))? Co ves Cx] no

(2) uence the cuteoneof ary sec pubke election (se secon 4955); ofa cay on, decor meth,

‘any voter registrabon deve? Cives Gil no

¢2)Promde a rant oan nda rae sty, ober sr purposes? vee Gx ne

(4) Protea grant to an organization ter hana charset, ergancebon dseraed steven

4845 (4YAY? (se estructons) Cre Bi no

(6) Prone fran purpose oer ten egos, chal scent tarry, oedvetorl purposes, oor

the prevention of crvety ta children or animals? Cres Cx] no

1 any anser "esto S115), any othe ransacbons flo quay under excestonsdeszedn Requaons

sacton 4945 ora utente rearing dase essence (see mstuctons)? n/a |

Ciganzatons eng ona cet notes paring sat asssiance chek ee oO

¢ the anewer "Yes to questo 5), does he ounesten cm exempta rom te ox because wate

expenditure responsi forthe grant? N/A CJyes C1 no

1°Yes,atach the statement requred by Regulations secton 59 4945-5(0)

4 Di the foundaon, dung th yer, eee ary nds, ety ore pay pemums on

personal bentt contrast? Ove Gino

Di tne foundation dung the yer, py premiums, ent or mdesty, on personal ent contact? w| |x

1F¥es" to 6, he For 8970

7a any tne dunn tax yea, wast foundaton a pry toa pohived tx shel uansachon? Cove Ene Z

3 "es" del the oundaton cen any proceeds oc have ay nel come atibuabe othe ransachon? nua le

Part Vill_ | Information About Officers, Directors, Trustees, Foundation Managers,

Paid Employees, and Contractors

“TU at oticers, rectors, ruses, foundation manager and War compensation

ighly

(oie ania | OEmomEROT| SRE | —e\foas

sme and addee nuts pat week devaled notpaid, | 7 atf4cenag” | accu, other

tle fposon Cone cians | “slownges

494,610. 0

2 Compensation of five Fighestpald employees (other Wan tose neladed on ine 7 Wnone,enier NONE

iad aa bese

(2) ame and address ofeach employee pad more than $50,000 ONES ese” | ey conoersaten | 8 ath oer

coat en ‘iad, | “slomnae

NONE,

‘Total numberof other employees paid over $50,000 >I 0

Form 900-PF (2074)

6

16230106 133063 MOREGOOD 2014.05010 MORE GOOD FOUNDATION MOREGOO1

Fm 990-6 (201) _MORE_GOOD FOUNDATION 20-3385036 Paver

Part Vili_] Information About Officers, Directors, Trustees, Foundation Managers, Highly

Paid Employees, and Contractors contnued)

3 Five highest-paid independent contractors for professional services. Wnone, enter "NONE"

(2) are and adress of ach person pax mare than $50,000, (by Type of saves

{(e) Compensation

NONE

“otal numberof hers recwnng ove $50,000 for profesional serves

Part IX-A|_ Summary of Direct Charitable Activities

ist the foundations fur pest cect chartable actives during te tax yea. elude relevant statsal formation such as the

umber of arganaatons an oter bene served conferences convened esearch papers produced

SEE STATEMENT 6

2

Expenses

1,485,366.

[Part X-B] Summary of Program-Related Investments

Describe te wo largest progam:elated vestments made by the foundaten dunng the ox yar on nes 1 and

‘meu

1 N/A

‘Al other program-related investments Se mstuchons.

3

Total Ada ines 1 Housh 3

7

16230106 133063 MOREGOOD 2014.05010 MORE GOOD FOUNDATION

0

Form 990-PF (2014)

MOREGOO1

fom 990-66 914) MORE GOOD FOUNDATION

Part X

20-3385036 Pages

Minimum investment Return (as domeste foundatons must complete this part Foreign foundations, see instructons }

11 Far mvt va of sss not usd (orld or use rely carrying out chara, ee, purposes,

Average monthly far markt value of secures 0

Average of monthly cash balances 219,007.

«Far market value of alloter assets 4

4 Total (a es tab, and) 16 219,007.

«Reduction clamed for blockage or other factors reported an nes ta and

‘(attach cetaled explanation) te

2 Acqusiton indebtedness applicable tone 1 asels Oo.

3 Subtract ine 2 kom ine 16 219,007.

4 Cash deemed hed fo chantale acts, Enter 112% of ne 3 (for greater amount, se structions) 3,285.

5 Netvalue of monchariable-uee assets, Subtract ine 4 from he Enter nee and on Part ne 4 215,722.

Minimum investment return Ente 5% ot ine 5 10,786.

Part XI_| Distributable Amount (see mstructions) (Section 4942()3) and (5) prval operating foundations and ceian

foreign organcations check here tm» [3k] and do not complete ths part.)

1 Mirmum mvestment tun from PartX, ie 6

2a Taxon mvestment score for 2014 rom Part VI, hne 5 2

'b Income tax for 2014 (This doesnot nelude he tx om Pant VL) 2b

Add ines 2a and

Distibutable amount betoreadustments. Subtract ne 2 rom bine 1

Recovenes of amounts weted as qualiyng dstibubons

Ad lines dana ¢

Deducton kom dstibutable amount (S68 nstrucbons)

Disuibutble amounts adusted, Sublracl ne 6 from ng 5. Enter here and on Part XI, in 1

Part XI] qualifying Distributions sse:nstuctons)

1 Amounts pad (including adriistatve expenses) to accomplish chantable, et. purposes:

1 Expenses, conibutons, gist. total om Part | column (8), ine 26

Programalaad mvesiments toll Pat X-B

2 Amounts pa to acqure assets used (old or use) det carrying out chara, ee. purposes

8 Amounts set aie for spect chartable projets tal sty the

Suita tes (prior 1S approval que)

'b Cash dstibution test (attach tne requred schedule)

4 Oualtying distributions Ad ines Ya through 3b. Enter here and on Part, ne 8 and Par Xi, ne &

5 Foundabons hat qualify under secon 494D() forthe reduces rte of tx on nt nvestment

Income. Ener 1% of Partie 27

6 Adjusted qualiying distributions. Subtract ine § trom ine 4

ta | 1,485,366

» 0.

3a

2

4 1,485,366.

5 0

6 1,485,366.

Note, The amount on in 6 wallbe used m Part V, column (b),subsequent years when clelting wheter the foundation quai for he secon |

4840(e) reducton of taxi hase yrs.

Form 990-PF (2014)

16230106 133063 MOREGOOD 2014.05010 MORE GOOD FOUNDATION MOREGOO1

Form 960-0 (2018)

Page

Undistributed Income (see nstructons)

1 Dsstributable amount for 2014 rom Part x,

te 7

2 Unsomtutes come, a8 a endo 2014

4 Enter amount for 2013 only

1 Total for pr years:

(@) ©

corpus ‘Years par to 2018 2013

@

2014

2 Becess dsrbutons carry

‘From 2009,

any to 2014:

‘From 2010

From2011

aFrom 2012

From 2013

1 Total of ines 3a through e

4 Qualying distroutons for 2014 fom

Part Xl ined:

a Apphed to 2013, but aot more than ne 28

‘Applied to undstibute income of pee

wars (Elechonrequred- see nstructons)

¢ Treated as distrbutions out of corpus

(Glectionequred - see mstructons)

‘Xophed 2014 distributable amount

‘eReraming amount dstibued out of cxpus

can sopewsen cus ha ean

trattestown'ncunnia

6 Entorthe netiotl of each column a8

indicated below:

‘bPuor years’ undistributed come, Subtract

nea trom ne 20

‘Enter the aout of prox years

‘undstrouteé income fr which a nete of

aiency has bean sed, or on whch

the secon 4942(a tx hes been prenously

assessed

Subtract ine Ge from he 0. Taxable

‘amount - see msvuctons

eUndistrouted income for 2018, Subvact ine

4a om he 2. Taxable amount - sev mst

‘ Undistributed ncome for 2014. Subtract

nes 42nd 5 trom hae 1. Ths amount must

be distributed m 2015

7 Amounts treated as dstnbutons out of

corpus to sats requrements imposed by

secon 170) 1} F) or 4942(0),9(Eecton

may be equred - se structions)

{Excess dstnbutions aryove from 2008

‘not apped on ne S or ine 7

9 Excess disuibutions carryover to 2086.

Subtract ines 7 and 8 tom ine 62

10. Analysis one 9:

acess rom 2010

excess rom 2011

ce bxcss from 2012

‘xcs rom 2013

pes tom2014

16230106 133063 MOREGOOD

9

2014.05010 MORE GOOD FOUNDATION

Form 990-PF (2014)

MOREGOO1

form 990-2014) _MORE_GOOD_FOUNDATION 20-3385036 ave 10

[Part XIV Private Operating Foundations (see nstructons and Pan VIA, queshon 9)

“a Ihe foundation fas receved arg or determination tar that sa prwate operating

{exindaton, and the ruling sefctve for 2014, enter the date of the rung >

' Checkbox to adcate whether he foundation a pate operating foundation described n secon s942qyi9) or TT 9026)

2 a Enter the lesser of the adusted net Taxyeat _ Por 3 years

income from Part |r the minimum a)2014 wae (aie wan {e) Tow!

rvesiment tur rom Part for

each year ited _ 0, 9,252.) 14,831, 7,791.| _31,874.

b 85% oftine 2a 0, 7,864.| 12, 606. 6,622.| 27,093

«¢ Qualfyng distrbvbons rom Pat Xl,

line 4 foreach year ised 1,485, 366.| 1,284,327.| 572,712. _788,224.| 4,130,629.

4 Aout elu ne 20

sed ret for act const of

exempt acotes

¢ Quaiting dstrautons made drety

fr ete condctofexpt actus.

‘Sac 2a rom ine 20 1,485,366.| 1,264,327. 572,712.| _788,224.| 4,130,629.

4 Complete, or ore

rnb estas upon

a isc’ emt eto

(1) Va ofa

(2) Val of assets qualifying

Under schon 48¢2)¢101)

1 Endowment aternave ester

Soimnenummesnet ern

ShowninPart Xb 60 ach year

ies a 7,191.| 10,310. 9,887. 5,194.| 32,582.

Support orate t-te: }

(1) Tat support ote than gross

‘nestor noms est

fends, et payments on |

Secunte ans Seton

qa) oye)

Sapgr rom genera pub

indormoreeenpt

digaaznton ae proesin

Sedton aSHaUn KON

(3) Largest amount super rom

an xenstoranaaton o.

(4) Ges avexinet neon Oe

Part XV_| Supplementary Information (Complete this part only if the foundation had $5,000 or more in assets

at any time during the year-see instructions.)

1 Information Regarding Foundation Managers:

2 Litany managers fhe foncaon ah hav onrted more han 2 ote etal eontebuons

Yea bute ny fave conte mos han 85000) (e econ 07(K2))

NONE -

® Ustany mara one oondaton wo own 0 ernare eect a apart (ora uly he parton he ouneshp ofa panne or

‘er ety) of wn he foundation has 0% or reso terest.

NONE

2. Information Regarding Contribution, Gant, Gi, Loan, Scholarship, ete, Programs:

Check nere > [XC] tne foundation only makes contributions to preselected chartable organizations and does not accept unsobcited requests for funds.

tne Tounson makes gs, ams ee. se nsbucns) onda ar erganaaons unde ber conden, compete ams 2,0, ¢, and.

1 The name, adress, and telephone number or e-mail address of he person to whom appicatons shouldbe adcressed:

0. 0. o

oO.

2)

ved bythe foundation before he clove of any tox

3 The form m whieh appcations shouldbe submited and ntormaton and malerals they shoud meu

¢ Any submsiondeadines

«Any restecvons or ition on awards, such as by geographcal areas, chartable fs, nds of mstttons, or oe ators:

er ae Form 990-PF (2014)

10

16230106 133063 MOREGOOD 2014.05010 MORE GOOD FOUNDATION MOREGOO1

om 9909F 2014) __MORE_GOOD FOUNDATION

Part XV] Supplementary Information (ontnued)

20-3385036 _Pagett

‘or Approved for Future Payment

'3_Grants and Contributions Paid During the Ye

2 Recipient

‘Name and adress (nome or business)

ecient san ndimoua,

show any relatenshp (0

any foundation manager

reubstantel conor

Foundaven

sas of

recpient

Purpose of grantor

onion

‘Amount

1 Pad dunng the year

NONE

Tous Ps 2

Approved for future payment

NONE

Toul > a

16230106 133063 MOREGOOD

11

2014.05010 MORE GOOD FOUNDATION

Form 990-PF (2014)

MOREGOOL

Foxm 990-9 2014)

MORE GOOD FOUNDATION

‘Analysis of Income-Producing Activities

20-3385036 Paw

ter grossamounls unless oterwese dicated

1 Program sere revenue

Taree buses coe

Ticeac iene SE 7!

aulfhss

ove

Cy

ount

‘¢) Related or exert

Avount function neome

t

1. Fees and conrats rom government agences

2 Membership dues and assessments

3 Interest on savings and temporary cash

sovestnants

4 Dyedends ang meres fom secures

'5 Nat rental income or (ss rom real estate:

2 Debt fnanced propery

Not ebe-snanced property

6 tt rental come o (oss) rom personal

propery

7 Other vestnent ncome

8 Gano (oss) fom sales of assets other

than ventory

9 Netncome or (ss) rom special events

10 Gross profit or (ss) rom sles of ventory

17 Other avenue:

a

14

1,007,

+42 Subtotal Aaa cous (0) (0), 06 (@)

18 Total. Addie 12, colons (0), 6), a8)

1,00 oO.

(Seo worksheet n ng 13 ntructons to very cultons.)

ies to the Accomplishment of Exempt Purposes

Relationship of Acti

13__1, 007,

Tine Wo, | _ Explan below how each acy for which come reported column 2) o Part XVFA conrbuted importantly to the accomplishment of

¥__|__ ta toundaton's exempt purposes (oer than by ponding funds for such purposes).

16230106 133063 MOREGOOD

12

2014.05010 MORE GOOD FOUNDATION

Form 990-PF (2014)

MOREGOO1

Form 990. (2014) __MORE_GOOD FOUNDATION 20-3385036 Pagers

[Part XVII Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations

1 Dede ergancatin dey ordre enage may of Town wit any ae organaton desorbed secon 1(0 01 [Yes] No

the Coe (ober han secon 501())organaatons) ein secon 527, ret to poltalrganatons?

4 Trartrs tom the reporingfountaton to 2 nonchartal exempt oroanaaton of

(1 Cash ray | x

(2) Oe assets taral |X

1 Otheruansactons:

(1) Sales oases to nonctaribl exempt rganzaton nl | x

{2} Purchases assnts tom a sonal exempt eganzabon yf [x

(9) Rental facies, equipment roe assets ay! [x

(4) Rembursementsrangerents ol |X

(6) Loans roan guarantees ws] [x

(6) Paormanc of serves or mamersh ound sootaons swe x

6. Starag of fants, equpment, mating ists oer asses, or pa employees [Stat ene

4 the answer tay ofthe above 8s" compete flown Schau, Colum () should aay show he fa markt vate ofthe ood, ass,

cx serves gen bythe reporing funda. te foundation recened ess than fr make ae nary ansachon rshng arangemeny, show

alu (the vale ofthe gooss, other assets, sarees rece

(irene | _ 8) Amount noted (c) ame of nonharabe earp rganaon (ape al raion eon me vare rR

N/A

2a Is te foundabon Geay or nest afiated wi, or ated o, one or noe eampl oganzatons dscnbed

i seaton $016) fhe Coe (ote than secon 50.) ot secon 527? Cves Gil o

1 1%05"complt te long schedule

(a) Name of exgancaton (WT organzaon (e)Deserpnon ofreakershp

N/A

Sign | 002 f Seseson teow et rye) tendon tomate whch epee has sy ows”

ign

| [-27-/¢ ) presrpenr

Sarai z ae Te

Pant ivBe prepares Mane” Pregpfers signature Date Crack Ct YP

Y steno

Paid tile P00501855

Frn’sEN ® 20-0079323

poled

Preparer |Fim name & STEVENSON suriy CPA'S(Li

Use Only

DR-#375

Famsesoress ® 5255 NORTH EDGEWOOD

PROVO, UT 84604 Prone no, 801-234-4200

Foim 990-PF (2014)

13

16230106 133063 MOREGOOD 2014,05010 MORE GOOD FOUNDATION MOREGOO1

Schedule B Schedule of Contributors eee

(ores, 90, 980-2, > Attach to Form 990, Form 890-EZ, or Form 990-PF. \_mnnaa

Information about Schedule 8 (Form 960, 990-E2, or 960-PF) and 2014

ier eur ove its instructions is at www.is.c0v/iom980

Name of the organization ‘Employer identification number

MORE GOOD FOUNDATION 20-3385036

‘Organization type(check one)

Filers of: Section:

Form 990 or 990-EZ 1 sovex enter number organization

1 49471aX1) nonexempt chantable trust not treated as a pavate foundation

1 £27 pottical organization

Form S90F C1 501/21) exempt prvate foundation

1 48471@)(1) nonexempt chartable trust treated as a prvate foundation

7 501(¢13) taxable prvate foundation

CCheck your organization covered by the General Rule oF & Special Rule.

Note. Only a section $0116), (8) of (10) organaation can check boxes for both the General Rule and a Special Rule See instructions

General Rule

EX Foran oganaton ng Form 99, 990 £2, o $0 hat acd, dung the year, controutons totaling $5,000 or morn monty oF

propery tom anyone coninbutor Complete Part land See nstuctons for deteminng a contnbuors total contabutene

Special Rules

FZ Foran organzation described in section 501(c)(3} fing Form $90 or 990-7 that met the 33 1/3% suppor test ofthe regulations under

sections 509(aK1) and 170(e}KAXUI, that checked Schedule A (Form 990 or 99042}, Par I, ine 13, 16a, or 16b, and that recewed from

any one contnbutr, dung the year, total contnbution ofthe greater of (1) $5,000 or (2)2%6 ofthe amount on () Form $90, Pat Vl, ine 1h,

or (e) Form 990-62, tne 1 Complete Parts | and I

(Foran organcation descnbed in section 501(c)(7), (8), oF (10) fling Form 990 or 980-E2 that recewed from any one contnbutor, dunng the

year, total contnbutions of more than $1,000 exclusvely for religious, chantable, scientific, ierary or educational purposes, oF for

the prevention of erally to chidren or animals Complete Pats I and Il

71 Foran organcation descnbed in section 501(c)7), (8), oF (10) fling Form 990 or $90-£Z that recewed from any one contributor, dunng the

year, contributions exclusively fo elgious, chartable, etc, purposes, but no such contributions totaled more than $1,000 I ths box

's checked, eter here the total contnibutions that were received dunng the year for an excluswaly relgous, chantabl, otc,

‘purpose, Do not complete any ofthe pats unless the General Rule apples to ths organzation because recowed nonexchusively

religious, chantable, ot , contnbutons totaling $5,000 or more dunng the year ms

Caution, An organzaton that not covered by the General Rule and/or the Special Rules does not fle Schedule B Form $90, 990-62, or 990-PF).

Dut must answer "No" on Part WV, ine 2, of ts Form 990, or check the box on lino Hof ts Form 980-E2 or on ts Form S80PF, Part | ine 2,10

Ceortly that does not mest the fing requrements of Schedule B Farm $90, 990£2, or 990PF)

LAA For Paperwork Reduction Act Notice, ee the Instructions for Form 990, 990-EZ, or 900-PF. Schedule B (Farm 890, 890-F2, or 990-PF) (2014)

‘Schedule 8 Form 880, 990-67, o 890.PR) (2014)

Name of organization

Page 2

Employer identcation aumber

MORE GOOD FOUNDATION 20-3385036

Part | Contributors (see nstuctons) Use dupicate copies of Pat additonal space ¢ needed

cae : ao 2 @ ©

No. Name, address, and ZIP + 4 ‘Total contributions __| Type of contribution

1 | ASHTON FAMILY FOUNDATION Person LX]

Payot = L_]

9 N 290 W, STE 100 _ 240,000. | Noncash [_]

(Complete Par i for

LINDON, UT 84042

rnoncash contributions)

@) © @ @

No. Name, adress, and ZIP + 4 ‘otal convibutions | Type of contribution

2 | K-TEC a Person [X)

Payot)

1206 SOUTH 1680 WEST 140,000. | Noneash [—}

(Compete Part for

OREM, UT 84058

roneash contrbutons)

@) ©) te a

No. Name, address, and ZIP + 4 _ Total contributions ‘Type of contribution

3 | KEN WOOLLEY Person (X]

Payot = (_]

2795 E COTTONWOOD PKWY #400

SALT LAKE CITY, UT 84121 __

200,000. | Noncash []

(Complete Part itor

noncash contributions)

@ @ @

No. Name, address, and ZIP + 4 ‘Total contributions __| Type of contribution

4 | LDS FOUNDATION OF THE LDS CHURCH | Person GX)

Payot = (_]

150 SOCIAL HALL AVE, STE 500

SALT LAKE CITY, UT 84145

s 150,000. | Noncash [—]

(Complete Part tor

‘eneath contabutions )

@ —e)

© @

No. Name, address, and ZIP + 4 Total contributions Type of contribution

5 | MINHAVIDA LLC - DAVID LISONBEE. Person 2X)

Payot (_]

304 EAST 1600 NORTH

OREM, UT 84057

96,000. | Noncasn [—]

(Complete Par ior

rnoneath contnbutions)

(a) (0) ©) (@

No. Name, address, and ZIP + 4 Total contributions Type of contribution

6 | PEERY FOUNDATION Person CX]

Payot (_]

30 EAST 100 SOUTH, STE 900

SALT_LAKE CITY, UT 84111

25,000. | Noncash []

(Complete Pat for

oncash contnbutions)

15

‘Schedule B (Form 990, 980-EZ, or 990-PF) (2014)

16230106 133063 MOREGOOD 2014.05010 MORE GOOD FOUNDATION MOREGOO1

‘Schedule B (Form 980, 990E2. or 980F) (2014)

Name of organization

Page 2

Employer identification umber

MORE GOOD FOUNDATION 20-3385036

Part | Contributors (see nstructions) Uso duplicate copes of Par | adcitional spaces needed

@ ® ; @ @

No. Name, address, and ZIP + 4 Total contributions __| Type of contribution

7 | STEVEN LUND. Person CX)

Payrot’ — (_)

86_N UNIVERSITY AVE STE 420 8 60,000. | Noncasn (—)

(Complete Part for

PROVO, UT 84601 ‘oneash contnbutons)

(a = o © @

No. Name, adeross, and ZIP + 4 Total contributions | Type o contribution

8 | ORG DEN Person EX]

1569 N TECHNOLOGY WAY BLDG A NO.1100__| s 65,000.

(Compete Pat itor

OREM, UT 84097 roneash contnbutons)

@ eo @ @

No. Total contributions __| Type of contribution

9 | THE ONE FOUNDATION Person OX]

Payot]

86 _N UNIVERSITY AVE STE 420 s 240,000. | Noncash (_]

(Complete Part for

PROVO, UT 84604 __ ‘noncash contnbutions )

(@) ® @ @

No. Nome, address, and ZIP + 4 Total contributions | Type of contribution

10 | TIM LAYTON Person [X)

Payot)

1569 N TECHNOLOGY WAY BLDG A NO.1100__| s 20,000. | Noncash [}

(Compete Pati for

OREM, UT 84097 ‘oneash contabutons )

@ ° @ ‘a

No. Name, adéress, and ZIP + 4 Total contributions _| Type of contribution

11 | DUANE AND MARCI SHAW Person EX]

Payot! = (_]

1220 B 7800 $ s 50,000. | Noncasn []

: (Compote Patt for

SANDY, UT 84094 roneash contabutons)

@ ” @ @

No. Name, adeross, and ZIP + 4 Total contibutions | _ Type of contribution

12 | SOUND DESIGN Person XI

Payot! = (_}

1569 N TECHNOLOGY WAY BLDG A NO.1100

OREM, UT 84097

Noncash [=]

(Complete Part itor

naneath contnbutions)

8 9,000.

16230106 133063 MOREGOOD

16

‘Beedle B (Form 890, B0-EZ, or 950-PF) (2014)

2014.05010 MORE GOOD FOUNDATION MOREGOOL

* Schedule 8 (Form 990, 9902, or 980PF) 2014) Page 3

Name of organization Employer eneation sunber

MORE GOOD FOUNDATION 20-3385036

Part ll Noncash Property (see mstructons) Use duplicate copes of Pat If addtional space s needed.

re ® ria

from Description of nancash property given ene Date received

Part!

s

@ — 7

@

No. ” 51 eatin 2

ton ee ee Fae rete bata ovahed

ta (ee instructions)

: s

@) 7

©

No. © @

fen Deserptn et ronan propery en Fy etna bate rected

art

“| s

@) ” |

© i

No. © ‘

FMV (or estimate)

trom Description of noncash property given Date received

fon, (see instructions)

~|s

re a Fr retinas @

from Description of noneash property given Date received

ait {see inswuctions)

s

x. ® Fv oreatmat) 2

from Description of nancash property given Date received

Path (eee instructions)

s

‘aaa ose Tenedre 8 (orm 99,990, or BUPA) OTA)

17

16230106 133063 MOREGOOD 2014.05010 MORE GOOD FOUNDATION MOREGOO1

" Scheduia 8 Form 980, $90£2, 0 880-PA) (2014)

Name of organization

ry be, et. coniibuton Te orpaniatos

‘the year rom anyone contributor. Complete columns (a) tv-ough (e,

contnng Pett hal ese

Use dupicate copies of Part It adsiuonal space is needed

vt, cnbbitens of $100Dar ee neers BSD)

Page 4

Employer entenon somber

20-3385036

ZoBed a secT on SOTEWTY TO, 0 (10) that al mare han $7,000 Ter

the toowng ine ey. enone

Tne.

fer, (©) Purpose of gift (6) Use of gitt (€) Description of how gis hela

(@) Transter of git e ~ _

‘Transteree's name, address, and ZIP + 4 Relationship of transferor to wansteree

TaN.

fer, (©) Purpose of gift (6) Use of git (4) Description of how gifts held

(@) Transter of gift

‘Teanctereo's name, address, and ZIP +4

{lationship of tonsferor to wansteree.

Ne.

from, (©) Purpose of git {(c) Use of git (4) Description of how gifts held

(@) Transfer of gift,

‘Teansferee's name, address, and ZIP + 4 Relationship of wansteror to transferee

od we

fm, (©) Purpose of gitt (6) Use of att (@) Description of how gitt is held

Teansteree's name, address, and ZIP +4

(@) Transfer of gift,

Relationship of tansteror to wanstoree

16230106 133063 MOREGOOD

2014.05010 MORE GOOD FOUNDATION

Sehe

(Form 990, 990-£2, or 90-PF) (2014)

18

MOREGOOL

_MORB GOOD FOUNDATION 20-3385036

FORM 990-PF INTEREST ON SAVINGS AND TEMPORARY CASH INVESTMENTS STATEMENT 1

(ay (B) (c)

REVENUE NET INVESTMENT ADJUSTED

SOURCE PER BOOKS INCOME NET INCOME

BANK INTEREST 1,007. 1,007. 1,007.

TOTAL TO PART I, LINE 3 1,007. 1,007. 1,007.

FORM 990-PF LEGAL FEES STATEMENT 2

(a) (B) (c) (D)

EXPENSES NET INVEST- ADJUSTED CHARITABLE

DESCRIPTION PER BOOKS MENT INCOME NET INCOME § PURPOSES

LEGAL FEES 1,505. o. 0 1,505.

TO FM 990-PF, PG 1, LN 16A 1,505. 0 0 1,505.

FORM 990-PF ACCOUNTING FEES STATEMENT 3

(A) (B) (c) (D)

EXPENSES NET INVEST- ADJUSTED CHARITABLE

DESCRIPTION PER BOOKS MENT INCOME NET INCOME = PURPOSES

ACCCOUNTING 1,797. 1,000. oO. 197.

AUDIT FEES 4,284. 0. 0. 4,284.

TO FORM 990-PF, PG 1, LN 16B 6,081. 1,000. 0 5,081

FORM 990-PF TAXES STATEMENT 4

(A) (B) (c) (D)

EXPENSES NET INVEST- ADJUSTED CHARITABLE

DESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES

PAYROLL TAXES 230,909. 0. 0. 230,909.

TO FORM 990-PF, PG 1, LN 18 230,909. 0 0. 230,909.

19 STATEMENT(S) 1, 2, 3, 4

16230106 133063 MOREGOOD 2014.05010 MORE GOOD FOUNDATION MOREGOO1

_MORE GOOD FOUNDATION

20-3385036

FORM 990-PF OTHER EXPENSES STATEMENT 5

(A) (B) (Cc) (D)

EXPENSES NET INVEST- ADJUSTED = CHARITABLE

DESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES

TELEPHONE 12,638. 0. o. 12,638.

OFFICE EXPENSES 6,091. 0. 0. 6,091.

BANK CHARGES 1,049. 0. 0. 1,049.

LANGUAGE CONTRACT WRITERS 330,914. O. 0. 330,914.

MISCELLANEOUS 14,370. 500. 0. 13,370.

DOMAIN REGISTRATION 5,567. O. 0. 5,567.

HOSTING FEES 29,663. o. 0. 29,663.

SUPPLIES 18,179. oO. oO. 18,179.

WEBSITES 16,968. 0. oO. 16,968.

SOPTWARE 10,075. 0. Oo. 10,075.

DUES 1,764. 0. oO. 1,764.

MISCELLANEOUS REIMBURSEMENTS = <13,511.> 0. 0. 9 <13,511.>

FILING FEES 10. 0. O. 10.

ADVERTISING 2,985. 0. o. 2,985.

WORKMENS COMP 1,676. oO. o. 1,676.

TO FORM 990-PF, PG 1, LN 23 438,438 500 437,438

FORM 990-PF OTHER ASSETS STATEMENT 6

BEGINNING OF END OF YEAR FAIR MARKET

DESCRIPTION YR BOOK VALUE = BOOK VALUE VALUE

INTANGIBLE ASSETS LESS

ACCUMULATED AMORTIZATION 1,550. 2,101. 2,101.

TO FORM 990-PF, PART II, LINE 15 1,550 2,101 2,101

16230106 133063 MOREGOOD

20

2014.05010 MORE GOOD FOUNDATION

STATEMENT(S) 5, 6

MOREGOOL

MORE GOOD FOUNDATION

20-3385036

FORM 990-PF

PART VIII - LIST OF OFFICERS, DIRECTORS

TRUSTEES AND FOUNDATION MANAGERS

STATEMENT 7

NAME AND ADDRESS

JONATHAN JOHNSON

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

DAVID WIRTHLIN

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

ALAN ASHTON

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

JIM ENGEBRETSEN

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

KENNETH MUSSER WOOLLEY

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

CHARLES CRANNEY

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

TOM DICKSON

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

DAVID LISONBEE

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

DAVID GRANT

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

16230106 133063 MOREGOOD

EMPLOYEE:

TITLE AND COMPEN- BEN PLAN EXPENSE

AVRG HRS/WK SATION CONTRIB ACCOUNT

CEO AND BOARD MEMBER

SUITE

40.00 150,000. 0. o.

CHAIRMAN

SUITE

0.00 0. 0. 0.

BOARD MEMBER

SUITE

0.00 O. oO. 0.

BOARD MEMBER

SUITE

0.00 oO. oO. oO.

CHAIRMAN

SUITE

0.00 oO. 0 oO.

BOARD MEMBER

SUITE

0.00 oO. 0 0

BOARD MEMBER

SUITE

0.00 0. 0. 0.

BOARD MEMBER

SUITE

0.00 oO. oO. oO.

CHIEF OPERATING OFFICER

SUITE

40.00 105,060. o. oO.

21 STATEMENT(S) 7

2014.05010 MORE GOOD FOUNDATION MOREGOO1

MORB GOOD FOUNDATION

WARREN OSBORN

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

GARFIELD COOK

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

RON DAVIES

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

DUANE SHAW

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

HEATHER NEWALL

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

SEREMY VICK

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

HWA LEE

1569 N TECHNOLOGY WAY BLDG

1100

OREM, UT 84097

TOTALS INCLUDED ON 990-PF,

A SUITE

A SUITE

A SUITE

A SUITE

A SUITE

A SUITE

A SUITE

PAGE 6,

BOARD MEMBER

0.00 oO.

BOARD MEMBER

0.00 0

BOARD MEMBER

0.00 0

BOARD MEMBER

0.00 oO.

DIRECTOR OF TECHNOLOGY

40.00 92,000.

DIRECTOR OF OUTREACH

40.00 87,550.

DIRECTOR OF INTERNATIONAL

40.00 60,000.

PART VIII 494,610.

20-3385036

FORM 990-PF SUMMARY,

OF DIRECT CHARITABLE ACTIVITIES

STATEMENT 8

ACTIVITY ONE

THE MORE GOOD FOUNDATION IS DEDICATED TO PROVIDING TOOLS,

SUPPORT, EDUCATION, AND CONTENT TO HELP LDS-ORIENTED WEB

BE. THE ORGANIZATION HELPS WITH

PROGRAMMING, CONTENT

DEVELOPMENT, HOSTING AND A WIDE RANGE OF OTHER SERVICES

SITES BE THE BEST THEY CAN

GRAPHIC DESIGN, WEB DESIGN,

TO FORM 990-PF, PART IX-A,

16230106 133063 MOREGOOD

LINE 1

2014.05010 MORE GOOD FOUNDATION

22

EXPENSES

1,485,366.

STATEMENT(S) 7, 8

MOREGOOL

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- "Pursue, Retake & Punish": The 1857 Santa Clara AmbushDokument23 Seiten"Pursue, Retake & Punish": The 1857 Santa Clara AmbushChino BlancoNoch keine Bewertungen

- Prop8 Trial Exhibit - Chino BlancoDokument1 SeiteProp8 Trial Exhibit - Chino BlancoChino BlancoNoch keine Bewertungen

- Lds Mormon Oct 8 Prop 8 BroadcastDokument19 SeitenLds Mormon Oct 8 Prop 8 BroadcastSamuel the UtahniteNoch keine Bewertungen

- FLDS Leader Warren Jeffs: A Warning To The NationDokument10 SeitenFLDS Leader Warren Jeffs: A Warning To The NationChino BlancoNoch keine Bewertungen

- FPPC LDS Church Prop 8 FineDokument5 SeitenFPPC LDS Church Prop 8 FineChino BlancoNoch keine Bewertungen

- CA9Doc 21Dokument134 SeitenCA9Doc 21Kathleen PerrinNoch keine Bewertungen

- NOM 2009 Tax Returns (Form 990)Dokument36 SeitenNOM 2009 Tax Returns (Form 990)Chino BlancoNoch keine Bewertungen

- NOM v. MaineDokument20 SeitenNOM v. MaineChino BlancoNoch keine Bewertungen

- National Organization For Marriage Education Fund, 2008 Form 990Dokument9 SeitenNational Organization For Marriage Education Fund, 2008 Form 990Chino BlancoNoch keine Bewertungen

- The Secular Transition: The Worldwide Growth of Mormons, Jehovah's Witnesses, and Seventh-Day AdventistsDokument25 SeitenThe Secular Transition: The Worldwide Growth of Mormons, Jehovah's Witnesses, and Seventh-Day AdventistsChino BlancoNoch keine Bewertungen

- National Organization For Marriage Education Fund, 2007 Form 990Dokument16 SeitenNational Organization For Marriage Education Fund, 2007 Form 990Chino BlancoNoch keine Bewertungen

- The Secular Transition: The Worldwide Growth of Mormons, Jehovah's Witnesses, and Seventh-Day Adventists (Appendix)Dokument9 SeitenThe Secular Transition: The Worldwide Growth of Mormons, Jehovah's Witnesses, and Seventh-Day Adventists (Appendix)Chino BlancoNoch keine Bewertungen

- Fred Karger Profile in Mother JonesDokument4 SeitenFred Karger Profile in Mother JonesChino BlancoNoch keine Bewertungen

- The 1968 Presidential Decline of George Romney: Mormonism or Politics?Dokument22 SeitenThe 1968 Presidential Decline of George Romney: Mormonism or Politics?Chino BlancoNoch keine Bewertungen

- Richard Malone and Paul Miceli Joint MortgageDokument1 SeiteRichard Malone and Paul Miceli Joint MortgageChino BlancoNoch keine Bewertungen

- Paul E. Miceli Massachusetts HomesteadDokument1 SeitePaul E. Miceli Massachusetts HomesteadChino BlancoNoch keine Bewertungen

- Richard Malone and Paul Miceli Quitclaim DeedDokument1 SeiteRichard Malone and Paul Miceli Quitclaim DeedChino BlancoNoch keine Bewertungen

- Foucault MarriageDokument6 SeitenFoucault MarriageChino BlancoNoch keine Bewertungen

- United States District Court District of Maine National Organization ForDokument32 SeitenUnited States District Court District of Maine National Organization ForChino BlancoNoch keine Bewertungen

- Richard J. Malone Massachusetts HomesteadDokument1 SeiteRichard J. Malone Massachusetts HomesteadChino BlancoNoch keine Bewertungen

- NOM 2008 Form 990Dokument25 SeitenNOM 2008 Form 990Chino BlancoNoch keine Bewertungen

- Stand For Marriage Maine - Yes On 1 - Walking ScriptDokument2 SeitenStand For Marriage Maine - Yes On 1 - Walking ScriptChino BlancoNoch keine Bewertungen

- New York Times: Book of Abraham Mormon FraudDokument2 SeitenNew York Times: Book of Abraham Mormon FraudChino BlancoNoch keine Bewertungen

- Reminder To NOM From Iowa OfficialsDokument1 SeiteReminder To NOM From Iowa OfficialsChino BlancoNoch keine Bewertungen

- NOM 2007 Form 990Dokument17 SeitenNOM 2007 Form 990Chino Blanco100% (1)