Beruflich Dokumente

Kultur Dokumente

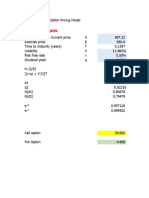

Black-Scholes Option Pricing Model Black-Scholes Option Pricing Model (With Dilution)

Hochgeladen von

Chukwunoso NwonyeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Black-Scholes Option Pricing Model Black-Scholes Option Pricing Model (With Dilution)

Hochgeladen von

Chukwunoso NwonyeCopyright:

Verfügbare Formate

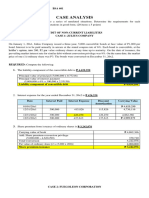

Option Value based on the Black-Scholes Model:

Black-Scholes Option Pricing Model Black-Scholes Option Pricing Model (with dilution)

Inputs: Inputs (with dilution effects):

Stock Price (S) $10.00 Stock Price (S) $10.00

Strike Price (X) $10.00 Strike Price (X) $10.00

Volatility (s) 40.00% Volatility (s) 40.00%

Risk-free Rate 4.27% Risk-free Rate 4.27%

Time to expiration (T) 10 yrs Time to expiration (T) 10 yrs

Dividend Yield 0.00% Dividend Yield 0.00%

# of Options (000) 10,000 # of Options (000) 10,000

# Shares Outstanding (000) 100,000 # Shares Outstanding (000) 100,000

Tax Rate 40.00% Tax Rate 40.00%

Output: \

Adjusted S (dilution) $9.59

D1 0.97003 D1 0.93696

D2 -0.29488 D2 -0.32795

N(D1) 0.83398 N(D1) 0.82561

N(D2) 0.38404 N(D2) 0.37148

Call Price $5.83411 Call Price $5.49418

Put Price $2.35874 Put Price $2.42844

Value of Call Options (000) $58,341 Value of Call Options (000) $54,942

After-tax Option Value (000) $35,005 After-tax Option Value (000) $32,965

*Note: This spreadsheet requires iterative calculations which may result in circular references.

To correct this problem, go to "Tools" - "Options" - Calculation and check the "iteration" box.

Das könnte Ihnen auch gefallen

- JD Sdn. BHD Study CaseDokument5 SeitenJD Sdn. BHD Study CaseSuperFlyFlyers100% (2)

- Valuing Capital Investment ProjectsDokument16 SeitenValuing Capital Investment ProjectsMetta AprilianaNoch keine Bewertungen

- How We Trade OptionsDokument21 SeitenHow We Trade Optionslecee01100% (1)

- IPMVP Core ConceptsDokument28 SeitenIPMVP Core ConceptsWaleed A. Shreim100% (1)

- Roche Site Redevelopment AnalysisDokument56 SeitenRoche Site Redevelopment AnalysisNJBIZNoch keine Bewertungen

- Implied Volatility Formula Excel TemplateDokument7 SeitenImplied Volatility Formula Excel Templateheisenburg0510Noch keine Bewertungen

- 100 % 36 Units Per Day 50 Trucks Per Day 100 % 100 % 36 Units Per Day 40 Trucks Per Day 100 %Dokument6 Seiten100 % 36 Units Per Day 50 Trucks Per Day 100 % 100 % 36 Units Per Day 40 Trucks Per Day 100 %Cherie Soriano AnanayoNoch keine Bewertungen

- Capital Investment/Net Present Value: Interest Rate DataDokument9 SeitenCapital Investment/Net Present Value: Interest Rate DataWILLAM FABIAN PASTUÑA CAISAGUANONoch keine Bewertungen

- Pasicolan, Mark Joshua BSA 3206: Absorption CostingDokument6 SeitenPasicolan, Mark Joshua BSA 3206: Absorption CostingMark Joshua PasicolanNoch keine Bewertungen

- Managerial Accounting NotesDokument6 SeitenManagerial Accounting NotesMarilou GabayaNoch keine Bewertungen

- B - S ModelDokument3 SeitenB - S ModelMos MasNoch keine Bewertungen

- Black Scholes Option Pricing ModelDokument20 SeitenBlack Scholes Option Pricing Modelsze0920Noch keine Bewertungen

- Year 0 1 Costs Benefits Cost of Capital Terminal ValueDokument4 SeitenYear 0 1 Costs Benefits Cost of Capital Terminal ValueSanjna ChimnaniNoch keine Bewertungen

- Financial Management Bruce HonniballDokument3 SeitenFinancial Management Bruce HonniballjanelleNoch keine Bewertungen

- Apparent Dip Calculator: Stereographic ProjectionDokument14 SeitenApparent Dip Calculator: Stereographic Projectionashfa ulyaNoch keine Bewertungen

- Case 6-1 (ANDI DIAN AULIA-46117022)Dokument5 SeitenCase 6-1 (ANDI DIAN AULIA-46117022)dianNoch keine Bewertungen

- CH 10 SolDokument7 SeitenCH 10 SolNotty SingerNoch keine Bewertungen

- SL No Y (X-RD) (1-T) : Problem Given That CalculateDokument2 SeitenSL No Y (X-RD) (1-T) : Problem Given That Calculatehasanarif0257Noch keine Bewertungen

- Inclass Solutions 5Dokument2 SeitenInclass Solutions 5AceNoch keine Bewertungen

- Breakeven Analysis Cost vs. RevenueDokument1 SeiteBreakeven Analysis Cost vs. RevenueDanielNoch keine Bewertungen

- Assign 4 Natividad BSA 2-13Dokument5 SeitenAssign 4 Natividad BSA 2-13Natividad, Kered ZilyoNoch keine Bewertungen

- Cost Accounting Y - Group A - Assignment11Dokument3 SeitenCost Accounting Y - Group A - Assignment11aldira jasmineNoch keine Bewertungen

- Accounting For Competitive Marketing A Case Study in Marketing Accounting Roxor Watch Company Pty LTDDokument7 SeitenAccounting For Competitive Marketing A Case Study in Marketing Accounting Roxor Watch Company Pty LTDKrystel Joie Caraig ChangNoch keine Bewertungen

- CoffeeCube SampleDokument13 SeitenCoffeeCube Samplelthanhhuyen15Noch keine Bewertungen

- 1 Manufacturing Units Cost Saving Versus Unit Purchase CostDokument5 Seiten1 Manufacturing Units Cost Saving Versus Unit Purchase CostPunkruk McentNoch keine Bewertungen

- Practical Problems & Solutions Class Work Upto IL.10Dokument20 SeitenPractical Problems & Solutions Class Work Upto IL.10Dhanishta PramodNoch keine Bewertungen

- Derivatives Test 3 SolnDokument12 SeitenDerivatives Test 3 SolnHetviNoch keine Bewertungen

- P13-20 (A) Probability 20% 60% 20%: Expexted EPS EPS XPRDokument3 SeitenP13-20 (A) Probability 20% 60% 20%: Expexted EPS EPS XPRJPNoch keine Bewertungen

- CS Topic 02 Marketing Accounting Roxor Watch CompanyDokument5 SeitenCS Topic 02 Marketing Accounting Roxor Watch CompanyIdham Idham IdhamNoch keine Bewertungen

- Corporate Tax Return Project Book-Tax Reconciliation (Adrian Purnama)Dokument6 SeitenCorporate Tax Return Project Book-Tax Reconciliation (Adrian Purnama)akpNoch keine Bewertungen

- Target - 320+87+114 (521) /2 261Dokument4 SeitenTarget - 320+87+114 (521) /2 261sneha patelNoch keine Bewertungen

- Break Even AnalysisDokument1 SeiteBreak Even AnalysisRama KrishnaNoch keine Bewertungen

- Chapter 13 ExcelDokument42 SeitenChapter 13 ExcelMd Al Alif Hossain 2121155630Noch keine Bewertungen

- CVP AnalysisDokument40 SeitenCVP Analysissbjafri0Noch keine Bewertungen

- Chapter 6 Example Trips LogisticsDokument10 SeitenChapter 6 Example Trips LogisticsYUSHIHUINoch keine Bewertungen

- Black Scholes Option Pricing - Dynamic ChartDokument2 SeitenBlack Scholes Option Pricing - Dynamic ChartRock11Noch keine Bewertungen

- Apparent DipDokument14 SeitenApparent Dipmarcos abalNoch keine Bewertungen

- Courtney Down April 06Dokument176 SeitenCourtney Down April 06MarcyNoch keine Bewertungen

- Principles of Corporate Finance: 6th EditionDokument4 SeitenPrinciples of Corporate Finance: 6th EditionParin MaruNoch keine Bewertungen

- Constructing A Downtown Parking Lot in DraperDokument7 SeitenConstructing A Downtown Parking Lot in DraperWater MelonNoch keine Bewertungen

- Solutions To End-Of-Chapter ProblemsDokument4 SeitenSolutions To End-Of-Chapter ProblemsRab RakhaNoch keine Bewertungen

- Task 5 - Pengantar Praktik PengauditanDokument3 SeitenTask 5 - Pengantar Praktik Pengauditanbriliant agengNoch keine Bewertungen

- Waterfall Analysis - 1X Liquidation PreferenceDokument9 SeitenWaterfall Analysis - 1X Liquidation PreferenceMonish KartheekNoch keine Bewertungen

- Sensitivity Analysis Excel TemplateDokument5 SeitenSensitivity Analysis Excel TemplateCele MthokoNoch keine Bewertungen

- FDNACCT - Quiz #2 - Problem Solving - Solutions-2Dokument4 SeitenFDNACCT - Quiz #2 - Problem Solving - Solutions-2Ichi HasukiNoch keine Bewertungen

- 06 Incremental AnalysisDokument11 Seiten06 Incremental AnalysisannarheaNoch keine Bewertungen

- Courtney Downs July 06Dokument51 SeitenCourtney Downs July 06MarcyNoch keine Bewertungen

- Roxor Case Study ComputationDokument4 SeitenRoxor Case Study ComputationAkun koreaNoch keine Bewertungen

- 02 - Oferta Vs DemandaDokument4 Seiten02 - Oferta Vs DemandaMiguel Angel Patiño AntonioliNoch keine Bewertungen

- Two Way Slab-SystemDokument7 SeitenTwo Way Slab-SystemMesfinNoch keine Bewertungen

- Assignment3 WorksheetDokument5 SeitenAssignment3 Worksheetjuri kimNoch keine Bewertungen

- Chapter 26. Tool Kit For Analysis of Capital Structure TheoryDokument11 SeitenChapter 26. Tool Kit For Analysis of Capital Structure TheoryJITIN ARORANoch keine Bewertungen

- Breakeven Analysis CalculatorDokument5 SeitenBreakeven Analysis CalculatoreibeffebieNoch keine Bewertungen

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Dokument4 SeitenBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNoch keine Bewertungen

- Lab # 4-Head Loss in Pipes - FillableDokument4 SeitenLab # 4-Head Loss in Pipes - FillableSarah HaiderNoch keine Bewertungen

- Valuing Capital Investment ProjectsDokument13 SeitenValuing Capital Investment ProjectsSiddhesh MahadikNoch keine Bewertungen

- CVP AnalysisDokument6 SeitenCVP AnalysisSherilyn BunagNoch keine Bewertungen

- Fully Convertible Debenture:: Chapter 21: Convertible Debentures and WarrantsDokument2 SeitenFully Convertible Debenture:: Chapter 21: Convertible Debentures and WarrantsMukul KadyanNoch keine Bewertungen

- ORQUIA AssignmentDokument4 SeitenORQUIA AssignmentClint RoblesNoch keine Bewertungen

- Satistical Process Control Study: Data Collections:-Sample D2 A2 D4Dokument1 SeiteSatistical Process Control Study: Data Collections:-Sample D2 A2 D4cqi9nNoch keine Bewertungen

- Hilton 11e Chap007 StudentsDokument38 SeitenHilton 11e Chap007 StudentsMelix SianturiNoch keine Bewertungen

- Let's Practise: Maths Workbook Coursebook 7Von EverandLet's Practise: Maths Workbook Coursebook 7Noch keine Bewertungen

- Okay Okay OkayDokument1 SeiteOkay Okay OkayChukwunoso NwonyeNoch keine Bewertungen

- Beginners Guide To Candlestick TradingDokument87 SeitenBeginners Guide To Candlestick TradingChukwunoso Nwonye100% (1)

- Arrival TimesDokument4 SeitenArrival TimesChukwunoso NwonyeNoch keine Bewertungen

- Tek 9Dokument1 SeiteTek 9Iya CordilleraNoch keine Bewertungen

- 10 1 1 460 5807Dokument17 Seiten10 1 1 460 5807Chukwunoso NwonyeNoch keine Bewertungen

- Price Action Can Be A Pretty Vague Term.Dokument20 SeitenPrice Action Can Be A Pretty Vague Term.Chukwunoso NwonyeNoch keine Bewertungen

- EclipseDokument134 SeitenEclipseChukwunoso Nwonye100% (3)

- Contoh Format Apa StyleDokument8 SeitenContoh Format Apa StyleFutri F. FauziahNoch keine Bewertungen

- Favourite MenuDokument1 SeiteFavourite MenuChukwunoso NwonyeNoch keine Bewertungen

- Get StartDokument108 SeitenGet StartChukwunoso NwonyeNoch keine Bewertungen

- Title MultiZoneDryGasProducerDokument1 SeiteTitle MultiZoneDryGasProducerChukwunoso NwonyeNoch keine Bewertungen

- Examples - Heavy Oil Reservoirs Field Development PlanDokument4 SeitenExamples - Heavy Oil Reservoirs Field Development PlanChukwunoso NwonyeNoch keine Bewertungen

- Title: How To Use This TemplateDokument8 SeitenTitle: How To Use This TemplatejaydeeNoch keine Bewertungen

- Introduction To Reservoir PetrophysicsDokument115 SeitenIntroduction To Reservoir PetrophysicsChukwunoso Nwonye100% (5)

- CalculationDokument9 SeitenCalculationChukwunoso NwonyeNoch keine Bewertungen

- Abbreviation Type of Valve: NPT National Pipe Taper ThreadDokument1 SeiteAbbreviation Type of Valve: NPT National Pipe Taper Threadrinjalb7752Noch keine Bewertungen

- WJETDokument9 SeitenWJETChukwunoso NwonyeNoch keine Bewertungen

- Abbreviations and AcronymsDokument1 SeiteAbbreviations and AcronymsChukwunoso NwonyeNoch keine Bewertungen

- Abbreviations and AcronymsDokument1 SeiteAbbreviations and AcronymsChukwunoso NwonyeNoch keine Bewertungen

- Abbreviations and AcronymsDokument1 SeiteAbbreviations and AcronymsChukwunoso NwonyeNoch keine Bewertungen

- NAPE Presentaion Time Table 2014Dokument1 SeiteNAPE Presentaion Time Table 2014Chukwunoso NwonyeNoch keine Bewertungen

- NAPE Presentaion Time Table 2014Dokument1 SeiteNAPE Presentaion Time Table 2014Chukwunoso NwonyeNoch keine Bewertungen

- Petrel - 2 Days Introduction Courseell DesignDokument7 SeitenPetrel - 2 Days Introduction Courseell DesignChukwunoso NwonyeNoch keine Bewertungen

- Five Exploration Blocks Farm-In Opportunities in Chad - FLYERDokument4 SeitenFive Exploration Blocks Farm-In Opportunities in Chad - FLYERChukwunoso NwonyeNoch keine Bewertungen

- Introduction To Static Model DevelopmentDokument34 SeitenIntroduction To Static Model DevelopmentChukwunoso Nwonye100% (2)

- Numerical Methods in WE-HomeWork 02Dokument1 SeiteNumerical Methods in WE-HomeWork 02Chukwunoso NwonyeNoch keine Bewertungen

- Introduction To R ProgrammingDokument22 SeitenIntroduction To R ProgrammingSwayamtrupta PandaNoch keine Bewertungen

- Best First RTutorialDokument17 SeitenBest First RTutorialfrancobeckham23Noch keine Bewertungen

- Topic 2 ActivitiesDokument2 SeitenTopic 2 ActivitiesPhuong DoNoch keine Bewertungen

- Chapter09 IfDokument10 SeitenChapter09 IfPatricia PamelaNoch keine Bewertungen

- Case Study: Collapse of Long-Term Capital ManagementDokument20 SeitenCase Study: Collapse of Long-Term Capital ManagementVaibhav KharadeNoch keine Bewertungen

- Abbie Merry VecinaBSA 6011Dokument7 SeitenAbbie Merry VecinaBSA 6011elleeeewoodssssNoch keine Bewertungen

- Advace CH 2Dokument43 SeitenAdvace CH 2Bikila MalasaNoch keine Bewertungen

- Audit of PPE Initial MeasurementDokument2 SeitenAudit of PPE Initial MeasurementGwyneth TorrefloresNoch keine Bewertungen

- Assignment 3Dokument2 SeitenAssignment 3smartmanoj0% (1)

- Uber Vs GrabDokument10 SeitenUber Vs GrabZijian ZhuangNoch keine Bewertungen

- Dizon Vs CADokument1 SeiteDizon Vs CAGirin Pantangco NuqueNoch keine Bewertungen

- LM08 Equity Valuation Concepts and Basic Tools IFT NotesDokument19 SeitenLM08 Equity Valuation Concepts and Basic Tools IFT NotesClaptrapjackNoch keine Bewertungen

- Long Call Condor: Montréal ExchangeDokument3 SeitenLong Call Condor: Montréal ExchangepkkothariNoch keine Bewertungen

- Derivatives FT YtDokument28 SeitenDerivatives FT YtSuchit Backup1Noch keine Bewertungen

- Short Patriot One (TSX-PAT) - RousselDokument5 SeitenShort Patriot One (TSX-PAT) - RousselMichael Roussel60% (5)

- Chapter 2Dokument7 SeitenChapter 2Prakash SinghNoch keine Bewertungen

- What Is Double Diagonal Spread - FidelityDokument8 SeitenWhat Is Double Diagonal Spread - FidelityanalystbankNoch keine Bewertungen

- Chap III Off Balance Sheet ActivitiesDokument20 SeitenChap III Off Balance Sheet ActivitiesGing freexNoch keine Bewertungen

- CH 17Dokument39 SeitenCH 17IreneNoch keine Bewertungen

- Dizon v. CA 302 SCRA 288 (1999)Dokument16 SeitenDizon v. CA 302 SCRA 288 (1999)citizenNoch keine Bewertungen

- DR Singh Options 121616-011016NewsletterBinder3 PDFDokument106 SeitenDR Singh Options 121616-011016NewsletterBinder3 PDFsilvofNoch keine Bewertungen

- Ch26 Tool KitADokument21 SeitenCh26 Tool KitARoy HemenwayNoch keine Bewertungen

- SS&C Technologies Certificate in Alternative Investment IndustryDokument45 SeitenSS&C Technologies Certificate in Alternative Investment IndustryUday MugalNoch keine Bewertungen

- Why Do We Need DerivativesDokument4 SeitenWhy Do We Need DerivativesAnkit AroraNoch keine Bewertungen

- Pleadings Docket No 7671-19 PDFDokument71 SeitenPleadings Docket No 7671-19 PDFMarkRossNoch keine Bewertungen

- Adikavi Nannaya University Mba 4TH Sem SyllabusDokument4 SeitenAdikavi Nannaya University Mba 4TH Sem Syllabusnkkiranmai0% (2)

- Unit 7Dokument18 SeitenUnit 7Nenevah AngelNoch keine Bewertungen

- Dhani Stocks User Manual - v.1.0Dokument15 SeitenDhani Stocks User Manual - v.1.0Pratap SinghNoch keine Bewertungen