Beruflich Dokumente

Kultur Dokumente

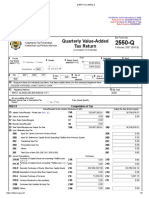

The Year 2 8 in Heisei Era The Final Tax Return of (Form B)

Hochgeladen von

Roze JustinOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Year 2 8 in Heisei Era The Final Tax Return of (Form B)

Hochgeladen von

Roze JustinCopyright:

Verfügbare Formate

To the director of Kushiro tax office

Income tax and

29 year 3 month 1 5 day The year 2 8 in Heisei era The final tax return of (form B)

special tax for restoration

domicile kana

or

0 8 8 1 3 6 0

office, 6 Sen 52, Chanai Nishi, Hamanaka-cho, name ITOU KOUJI

business

place, Akkeshi-gun, Hokkaido sex Occupation trade name name of householder

relationship to

temporary your householder

DAIRY FARMING KOUJI

residence M F SELF

residence as of phone

Jan 1st SAME AS ABOVE birth date

3 5 7 5 1 number 0153-65-2190

specific if you don't need

In Japanese yen type Blue separate loss farmer ID

0 1 2 9 1 5 2 0 this form next year

amendment

farmer

other than agriculture Tax Taxable income

26

business

25or Sheet 3 1 1 8 2 3 0 0 0

amount imposed on column26

agriculture 27

18 9 2 0 0 1 1 0 or column86 in Sheet3 3 5 8 3 0 0

Real estate Credit for dividends 28

E Interest 29

A

type

7 1 6 4 5

Credit for loans

R Dividends type 30

relating to a dwelling

N

Employment Credit for contributions 31

I 33

T Credit for

N Public pensions type

35

Miscella A special housing 37

G Balance of above

neous Others X 38

S 3 2 0 0 27-28-29-30-31-32-33-35-36-37 2 8 6 6 5 5

Capital

Short term Credit for disasters 39

gains A

(aggregate Long term M Balance of above 40

) O

restoration 2 8 6 6 5 5

Total Amount of special tax

Occasional 41

U basis for the special tax38-39 6 0 1 9

N amount of income

other than agriculture 42

business T special tax for restoration 2 9 2 6 7 4

agriculture Credit for foreign taxes type 43

1 6 1 4 1 4 2 4

Real estate Deduction for withholding tax 44

I

Balance of above

Interest 45

N

(Tax amount) 42-43-44 2 9 2 6 0 0

C Estimated tax prepayment

Dividends 46

O ( 1st and 2nd installment)

M Employment Final(3rd) payable 47

E installment

2 9 2 6 0 0

Miscellaneous Refund 48

3 2 0 0 (45-46)

Capital gains&occasional

Total amount of spouse's income 49

1/2

Total Sum of 50

1 6 1 4 4 6 2 4

Salary( exemption) for family employees

D

Casualty loss O Special exemption for Blue return 51

E

T

1 7 6 4 0 0 0 0

Withholding tax for

D Medical expense 52

U

9 5 9 7 0 H miscellaneous/occasional income 6 5 0 0 0 0

Public insurance premiums E Amount of unpaid withholding tax 53

C 2 8 9 0 7 4 0 R

T Carried loss,

Small business mutual aid premiums 54

I

8 4 0 40 0 0 S

which is deducted this year

Income amount

Life insurance premiums 55

O 9 0 0 0 0 subject to the Average taxation

N Fluctuating or

Earthquake insurance premiums 56

2 4 1 2 0 extraordinary income

type

Donations POST Tax amount paid by 3/15 57

F

PONE

0 0

R

Widows / Widowers Tax amount paid by 5/31 58

O 0 0 0 0 MENT 0 0 0

M Working students / Disabled Please note that you shall fill column41, the special tax for

0 0 0 0

Spouses( special ) type

21 restoration

I 22 0 0 0 0

N Dependents 23

0 0 0 0

bank branch

C Where to

ordinary current tax saving

Basic Exemption 24

3 8 0 0 0 0 receive postbank account type

O

M your refund

Total Sum of 24 25

4 3 2 0 8 3 0

account ID

E

name of CPTA 22 Ban Chi 2 Chome Kitamachi, Nakashibetsu-cho, Shibetsu-gun, Hokkaido 086-1152 [Item Regarding Payment]

Tax Counseling Corporation ORENZ Tax Office Financial Agent used for the transfer payment tax

0153-72-1212

of Income Tax and Restoration Special Income Tax

Hamanaka Machi Nogyo Kyodo Kumiai Office

with the form prescribed with the form prescribed

on article33-2 of CPTA

Transfer Date: March 20, 2017 (Thurs)

on article30 of CPTA

Das könnte Ihnen auch gefallen

- 2018 W-2 and Earnings SummaryDokument2 Seiten2018 W-2 and Earnings SummaryAdam Olsen100% (1)

- StubsDokument2 SeitenStubsAnonymous 8C2bCutL0100% (2)

- Ayyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112Dokument3 SeitenAyyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112swaroopg mphasisNoch keine Bewertungen

- Sana MabagoDokument1 SeiteSana MabagojoystambaNoch keine Bewertungen

- Tan vs. People Case DigestDokument3 SeitenTan vs. People Case DigestMichael Rentoza100% (2)

- 4 Level 6 - Unit 13 Law of Tort Suggested Answers - June 2013Dokument18 Seiten4 Level 6 - Unit 13 Law of Tort Suggested Answers - June 2013Rossz FiúNoch keine Bewertungen

- Larry Waldie v. County of Los Angeles - First Amended ComplaintDokument14 SeitenLarry Waldie v. County of Los Angeles - First Amended ComplaintAlan RomeroNoch keine Bewertungen

- Electronic Filling FA2200Dokument5 SeitenElectronic Filling FA2200Prakash Sagar GhisingNoch keine Bewertungen

- GURUGRAM PROPERTY TAXDokument2 SeitenGURUGRAM PROPERTY TAXJayCharleysNoch keine Bewertungen

- 1701Q BIR Form PDFDokument3 Seiten1701Q BIR Form PDFJihani A. SalicNoch keine Bewertungen

- Monthly Percentage Tax Return: 12 - December 06 - JuneDokument1 SeiteMonthly Percentage Tax Return: 12 - December 06 - JuneDana PardeNoch keine Bewertungen

- 1701qjuly2008 (ENCS) q22019Dokument5 Seiten1701qjuly2008 (ENCS) q22019Andrew AndalNoch keine Bewertungen

- US Internal Revenue Service: f1065 AccessibleDokument4 SeitenUS Internal Revenue Service: f1065 AccessibleIRSNoch keine Bewertungen

- Private Income statement and supplementary information for Natural Persons and Net Successions of ResidentsDokument1 SeitePrivate Income statement and supplementary information for Natural Persons and Net Successions of ResidentsSofía Martínez GómezNoch keine Bewertungen

- CONNECT INDIA - NELLORE - WR (XXIII) - May 2022Dokument1 SeiteCONNECT INDIA - NELLORE - WR (XXIII) - May 2022Pragnaa ShreeNoch keine Bewertungen

- Juliet's FormDokument1 SeiteJuliet's Formbibiana muhiaNoch keine Bewertungen

- MMRW06 02 2023Dokument20 SeitenMMRW06 02 2023businessdevelopment.corpNoch keine Bewertungen

- Uxj Fuxe Xq:Xzke Leifrrdj Fcy O"Kz: 2020-21 Municipal Corporation Gurugram Property Tax Bill 2020-21Dokument2 SeitenUxj Fuxe Xq:Xzke Leifrrdj Fcy O"Kz: 2020-21 Municipal Corporation Gurugram Property Tax Bill 2020-21JayCharleysNoch keine Bewertungen

- Income Tax Fundamentals 2013 Whittenburg 31st Edition Solutions ManualDokument6 SeitenIncome Tax Fundamentals 2013 Whittenburg 31st Edition Solutions Manualbrianbradyogztekbndm100% (46)

- Self Assessment System GuideDokument3 SeitenSelf Assessment System GuideHafiz MusannefNoch keine Bewertungen

- LNL Iklcqd /: Grand Total 11,539 3,531 0 0 7,992Dokument1 SeiteLNL Iklcqd /: Grand Total 11,539 3,531 0 0 7,992ShambadityaNoch keine Bewertungen

- U.S. Corporation Income Tax Return: Sign HereDokument4 SeitenU.S. Corporation Income Tax Return: Sign HeresweetchaeNoch keine Bewertungen

- 1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnDokument6 Seiten1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnIRSNoch keine Bewertungen

- Form BDokument2 SeitenForm BPower MuruganNoch keine Bewertungen

- Purchase - InvoiceDokument2 SeitenPurchase - InvoiceIsaque CarlosNoch keine Bewertungen

- US Internal Revenue Service: F5500se - 1999Dokument3 SeitenUS Internal Revenue Service: F5500se - 1999IRSNoch keine Bewertungen

- Form e 2022 Bi 16012023Dokument8 SeitenForm e 2022 Bi 16012023HR Dept Urban Seafood SBNoch keine Bewertungen

- Mail To LornaDokument27 SeitenMail To Lornaapi-3740993Noch keine Bewertungen

- 12 Itr1 10 11Dokument6 Seiten12 Itr1 10 11ramanwweNoch keine Bewertungen

- Ferrer 0000 12312022Dokument1 SeiteFerrer 0000 12312022Vincent FerrerNoch keine Bewertungen

- Nicolae Greurus - p60 (2023-24)Dokument1 SeiteNicolae Greurus - p60 (2023-24)danielagonciulea6Noch keine Bewertungen

- US Internal Revenue Service: f1065 - 2000Dokument4 SeitenUS Internal Revenue Service: f1065 - 2000IRSNoch keine Bewertungen

- US Internal Revenue Service: f1065 - 1997Dokument4 SeitenUS Internal Revenue Service: f1065 - 1997IRSNoch keine Bewertungen

- Annual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 1 I I 0 1 2 I I 0 1 3Dokument5 SeitenAnnual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 1 I I 0 1 2 I I 0 1 3Jhanrich MatalaNoch keine Bewertungen

- Annual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3Dokument9 SeitenAnnual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3albertNoch keine Bewertungen

- Calendar of Activities 2018Dokument12 SeitenCalendar of Activities 2018Umar Hafez Anni SahiraniNoch keine Bewertungen

- US Internal Revenue Service: f1065 - 1996Dokument4 SeitenUS Internal Revenue Service: f1065 - 1996IRSNoch keine Bewertungen

- US Internal Revenue Service: F1120ric - 1996Dokument4 SeitenUS Internal Revenue Service: F1120ric - 1996IRSNoch keine Bewertungen

- US Internal Revenue Service: f1120s - 1992Dokument4 SeitenUS Internal Revenue Service: f1120s - 1992IRSNoch keine Bewertungen

- AEV SEC Form 23-B - (02.17.2020) Jojo S. GuingaoDokument6 SeitenAEV SEC Form 23-B - (02.17.2020) Jojo S. GuingaoOIdjnawoifhaoifNoch keine Bewertungen

- US Internal Revenue Service: f943 - 1995Dokument4 SeitenUS Internal Revenue Service: f943 - 1995IRSNoch keine Bewertungen

- Bir GinaDokument1 SeiteBir GinaApril ManjaresNoch keine Bewertungen

- 49 A Exp RegisterDokument309 Seiten49 A Exp RegistersajedulNoch keine Bewertungen

- Form No. 24 in Excel Format of Income Tax Annual Statement - XLDokument25 SeitenForm No. 24 in Excel Format of Income Tax Annual Statement - XLPranab BanerjeeNoch keine Bewertungen

- Receipt No/ Date Seal and Signature of Receiving OfficialDokument10 SeitenReceipt No/ Date Seal and Signature of Receiving OfficialRAMAPPA100% (2)

- US Internal Revenue Service: f5500sr - 2000Dokument2 SeitenUS Internal Revenue Service: f5500sr - 2000IRSNoch keine Bewertungen

- W2 FinalDokument1 SeiteW2 FinalWaqar Hussain100% (1)

- Monthly Percentage Tax Return: 12 - December 04 - AprilDokument1 SeiteMonthly Percentage Tax Return: 12 - December 04 - AprilTamara HamiltonNoch keine Bewertungen

- Mcgraw Hills Essentials of Federal Taxation 2019 10th Edition Spilker Solutions ManualDokument19 SeitenMcgraw Hills Essentials of Federal Taxation 2019 10th Edition Spilker Solutions Manualairpoiseanalyzernt5t100% (20)

- Gts 1stDokument2 SeitenGts 1stGOLDEN TOPSTEEL CONSTRUCTION SUPPLYNoch keine Bewertungen

- Smartcomplexmeter9 0Dokument2 SeitenSmartcomplexmeter9 0patelluck0071Noch keine Bewertungen

- 2020 Partnership Tax ReturnDokument18 Seiten2020 Partnership Tax ReturnEdwin Altamiranda100% (2)

- Kunci Jawab Sesi 1 - Bateeq CanteqDokument11 SeitenKunci Jawab Sesi 1 - Bateeq CanteqSuara HatiKitaNoch keine Bewertungen

- Certificate of Compensation Payment/Tax WithheldDokument2 SeitenCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNoch keine Bewertungen

- Revised SWORN STATEMENT OF ASSETS, LIABILITIES AND NET WORTHDokument3 SeitenRevised SWORN STATEMENT OF ASSETS, LIABILITIES AND NET WORTHSheryl FaelnarNoch keine Bewertungen

- US Internal Revenue Service: F1120ric - 2000Dokument4 SeitenUS Internal Revenue Service: F1120ric - 2000IRSNoch keine Bewertungen

- 2GO Group, Inc. - SMIC SEC Form 19-1 (Tender Offer Report) (Copy Furnished 2GO) 22march2021Dokument69 Seiten2GO Group, Inc. - SMIC SEC Form 19-1 (Tender Offer Report) (Copy Furnished 2GO) 22march2021Roze JustinNoch keine Bewertungen

- 68 Subic Bay Legend v. FernandezDokument8 Seiten68 Subic Bay Legend v. FernandezPaolo Enrino PascualNoch keine Bewertungen

- G.R. No. L-32328Dokument3 SeitenG.R. No. L-32328Roze JustinNoch keine Bewertungen

- Today's Supreme Court Decision on Contingent Claims in Probate ProceedingsDokument5 SeitenToday's Supreme Court Decision on Contingent Claims in Probate ProceedingsRoze JustinNoch keine Bewertungen

- G.R. No. L-24742Dokument8 SeitenG.R. No. L-24742Roze JustinNoch keine Bewertungen

- PLDT vs. City of Davao and Adelaida B. Barcelona, in Her Capacity As City Treasurer of Davao Gr. No. 143867, March 25, 2003 - Pinay JuristDokument7 SeitenPLDT vs. City of Davao and Adelaida B. Barcelona, in Her Capacity As City Treasurer of Davao Gr. No. 143867, March 25, 2003 - Pinay JuristRoze JustinNoch keine Bewertungen

- G.R. No. 106646Dokument3 SeitenG.R. No. 106646Roze JustinNoch keine Bewertungen

- Supreme Court: Efrain B. Trenas For Plaintiff-Appellee. Diosdado Garingalao For Defendant-AppellantDokument4 SeitenSupreme Court: Efrain B. Trenas For Plaintiff-Appellee. Diosdado Garingalao For Defendant-AppellantRoze JustinNoch keine Bewertungen

- G.R. No. 106646Dokument3 SeitenG.R. No. 106646Roze JustinNoch keine Bewertungen

- A vs. Bautista, G.R. No. 160556, Aug. 3, 20Dokument4 SeitenA vs. Bautista, G.R. No. 160556, Aug. 3, 20Roze JustinNoch keine Bewertungen

- Supreme Court: Efrain B. Trenas For Plaintiff-Appellee. Diosdado Garingalao For Defendant-AppellantDokument4 SeitenSupreme Court: Efrain B. Trenas For Plaintiff-Appellee. Diosdado Garingalao For Defendant-AppellantRoze JustinNoch keine Bewertungen

- PLDT vs. City of Davao and Adelaida B. Barcelona, in Her Capacity As City Treasurer of Davao Gr. No. 143867, March 25, 2003 - Pinay JuristDokument7 SeitenPLDT vs. City of Davao and Adelaida B. Barcelona, in Her Capacity As City Treasurer of Davao Gr. No. 143867, March 25, 2003 - Pinay JuristRoze JustinNoch keine Bewertungen

- Specpro 011521Dokument3 SeitenSpecpro 011521Roze JustinNoch keine Bewertungen

- Rem Rev 012621Dokument2 SeitenRem Rev 012621Roze JustinNoch keine Bewertungen

- Tax Rev 011421Dokument1 SeiteTax Rev 011421Roze JustinNoch keine Bewertungen

- CivRev 012521Dokument4 SeitenCivRev 012521Roze JustinNoch keine Bewertungen

- 021 Tucay Vs Tucay - AC 5170 - November 17, 1999 - Per Curiam - en BancDokument2 Seiten021 Tucay Vs Tucay - AC 5170 - November 17, 1999 - Per Curiam - en BancRoze JustinNoch keine Bewertungen

- Specpro 013021Dokument5 SeitenSpecpro 013021Roze JustinNoch keine Bewertungen

- G.R. No. L-24440Dokument5 SeitenG.R. No. L-24440Roze JustinNoch keine Bewertungen

- RemRev2 011221Dokument7 SeitenRemRev2 011221Roze JustinNoch keine Bewertungen

- RemRev2 011921Dokument8 SeitenRemRev2 011921Roze JustinNoch keine Bewertungen

- The Quick Brown Fox Jumps Over MyDokument1 SeiteThe Quick Brown Fox Jumps Over MyRoze JustinNoch keine Bewertungen

- 009 Villasanta vs. Peralta Case Digest - Criminal Law NotesDokument1 Seite009 Villasanta vs. Peralta Case Digest - Criminal Law NotesRoze JustinNoch keine Bewertungen

- Civ Rev 2Dokument5 SeitenCiv Rev 2Roze JustinNoch keine Bewertungen

- Transfer of Zamboanga Province Assets to CityDokument1 SeiteTransfer of Zamboanga Province Assets to CityRoze JustinNoch keine Bewertungen

- Ledesma vs. Municipality of Iloilo Et Al - Case DigestsDokument3 SeitenLedesma vs. Municipality of Iloilo Et Al - Case DigestsRoze JustinNoch keine Bewertungen

- G.R. No. L-27038 January 30, 1970 - Pechueco Sons Company v. Provincial Board of Antique - January 1970 - Philippine Supreme Court Jurisprudence - Chanrobles Virtual Law LibraryDokument4 SeitenG.R. No. L-27038 January 30, 1970 - Pechueco Sons Company v. Provincial Board of Antique - January 1970 - Philippine Supreme Court Jurisprudence - Chanrobles Virtual Law LibraryRoze JustinNoch keine Bewertungen

- 004 in Re - Al C. Argosino 246 SCRA 14 (1995) - Philippines Case DigestsDokument2 Seiten004 in Re - Al C. Argosino 246 SCRA 14 (1995) - Philippines Case DigestsRoze JustinNoch keine Bewertungen

- 003 in Re - Lanuevo - LegalialexDokument1 Seite003 in Re - Lanuevo - LegalialexRoze JustinNoch keine Bewertungen

- 004 in Re - Al C. Argosino 246 SCRA 14 (1995) - Philippines Case DigestsDokument2 Seiten004 in Re - Al C. Argosino 246 SCRA 14 (1995) - Philippines Case DigestsRoze JustinNoch keine Bewertungen

- IatoDokument3 SeitenIatorishil1Noch keine Bewertungen

- Presentation Custom ProcedureDokument30 SeitenPresentation Custom ProcedureSohail Saahil0% (1)

- History of The Department of AgricultureDokument6 SeitenHistory of The Department of AgricultureEren JaegerNoch keine Bewertungen

- New Public Administration TheoryDokument11 SeitenNew Public Administration TheoryZyra C.Noch keine Bewertungen

- Kushboo v. Kanniammal &anrDokument16 SeitenKushboo v. Kanniammal &anraghilan.hb19009Noch keine Bewertungen

- SCSL 2014 BillbookDokument70 SeitenSCSL 2014 Billbookapi-196888580Noch keine Bewertungen

- CASE #1 Firestone v. CADokument2 SeitenCASE #1 Firestone v. CApistekayawaNoch keine Bewertungen

- GS Jdo State Level MockDokument55 SeitenGS Jdo State Level Mockgopala krishnanNoch keine Bewertungen

- Citadines T's & C's 6.08.18Dokument5 SeitenCitadines T's & C's 6.08.18NeenNoch keine Bewertungen

- Prejudicial QuestionDokument8 SeitenPrejudicial QuestioncaseskimmerNoch keine Bewertungen

- UK Visit VisaDokument1 SeiteUK Visit VisaTony VargheseNoch keine Bewertungen

- RA 1425 Establishes Obligatory Study of Rizal's WorksDokument6 SeitenRA 1425 Establishes Obligatory Study of Rizal's WorkselaineNoch keine Bewertungen

- 3 Year Ll.b-Lecturenotes - First YearDokument1.385 Seiten3 Year Ll.b-Lecturenotes - First YearGAVASKAR S0% (1)

- Juridical Necessity: ObligationsDokument11 SeitenJuridical Necessity: ObligationsAllyna Jane EnriquezNoch keine Bewertungen

- February 1, 2017 G.R. No. 188146 Pilipinas Shell Petroleum Corporation, Petitioner Royal Ferry Services, Inc., Respondent Decision Leonen, J.Dokument13 SeitenFebruary 1, 2017 G.R. No. 188146 Pilipinas Shell Petroleum Corporation, Petitioner Royal Ferry Services, Inc., Respondent Decision Leonen, J.Graile Dela CruzNoch keine Bewertungen

- Paramount Vs AC OrdonezDokument12 SeitenParamount Vs AC OrdonezCielo Revilla SantosNoch keine Bewertungen

- Billing Summary for IT@CFIIPAK.COMDokument1 SeiteBilling Summary for IT@CFIIPAK.COMfaisal benisonNoch keine Bewertungen

- Labor Case 2Dokument169 SeitenLabor Case 2Ralf JOsef LogroñoNoch keine Bewertungen

- Notice: Antidumping and Countervailing Duties: Administrative Review RequestsDokument3 SeitenNotice: Antidumping and Countervailing Duties: Administrative Review RequestsJustia.comNoch keine Bewertungen

- Heirs of Malaban V RepublicDokument3 SeitenHeirs of Malaban V RepublicJohnson YaplinNoch keine Bewertungen

- Dallas County Republicans Lawsuit Part 2 of 2Dokument93 SeitenDallas County Republicans Lawsuit Part 2 of 2KERANewsNoch keine Bewertungen

- VakalatnamaDokument1 SeiteVakalatnamaAadil KhanNoch keine Bewertungen

- Creating APIC without share issuanceDokument2 SeitenCreating APIC without share issuanceTina Reyes-BattadNoch keine Bewertungen

- Comparative AnalysisDokument16 SeitenComparative AnalysisPaul Arman MurilloNoch keine Bewertungen

- Offer Letter: July 01, 2021 Norma Delgado 760-807-7021Dokument2 SeitenOffer Letter: July 01, 2021 Norma Delgado 760-807-7021Norma DuenasNoch keine Bewertungen

- United States v. Jack McNatt, 842 F.2d 564, 1st Cir. (1988)Dokument4 SeitenUnited States v. Jack McNatt, 842 F.2d 564, 1st Cir. (1988)Scribd Government DocsNoch keine Bewertungen