Beruflich Dokumente

Kultur Dokumente

Medicaid "Asset Transfer" Handout

Hochgeladen von

Anna WolfeCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Medicaid "Asset Transfer" Handout

Hochgeladen von

Anna WolfeCopyright:

Verfügbare Formate

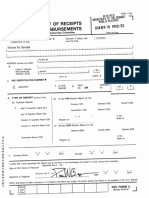

Transfer of Assets and 5-Year Look-back Period

The Division of Medicaid is required by Federal Law to verify and review assets (income and

resources) that belong to you (the applicant) and your spouse. These assets may be owned,

either individually or jointly, at the present time or during the 5 year period before applying for

Medicaid to pay for long term care services. Long term care can be:

Nursing Facility (including an ICF/IID facility), or

Home & Community Based (HCBS) waiver program.

The purpose of the 5-year look-back is to determine if any assets (income & resources) were

transferred out of your name with the intent to qualify for Medicaid.

Transfers happen when you, your spouse, or someone acting on your behalf:

Give away income or resources or the right of ownership to income/resources, or

Sell assets for less than current market value, or

Shelter assets in a non-allowable way, such as setting up certain trusts or annuities.

Assets include any real or personal property that you and/or your spouse own, or any interest

in a resource that you/your spouse own with someone else. Assets also include income that is

given to another individual by you or your spouse. As discussed, below, certain transfers of

assets do not count.

5-Year Lookback Period

The 5-year look-back period begins on the 1st date that you apply for Medicaid and are in a

nursing facility (includes a swing bed in a hospital) or apply for HCBS waiver placement. If you

apply for Medicaid for long term care multiple times or go in and out of long term care

placements, the 5-year look-back begins with the 1st application filed for long term care services

unless that application was withdrawn. The full 5 years prior to the 1st application must have

expired to be out of the look-back period.

Transfer Penalty

The penalty for transferring assets, during the 5-year look-back period or any time after the 5-

year period expires is as follows for individuals in a nursing facility:

Effective Date: November 2016

Medicaid will not pay for long term care services provided in a nursing facility, ICF/IID or

swing bed during the penalty period.

The penalty period is based on the value of the asset(s) transferred divided by the

average monthly cost to a private pay patient in Mississippi for nursing facility services.

You can qualify for payment of all other Medicaid services if you are found to be

otherwise eligible during the penalty period.

The penalty period includes full and partial months, depending on the value of asset(s)

transferred.

The 1st month of the penalty is the month you are both in a facility and other wise

eligible for Medicaid except for the imposition of the transfer penalty.

The penalty for HCBS waiver applicants is total ineligibility for Medicaid during the 5 years

following a countable transfer of assets.

Types of Information You Will be Asked to Provide

In order for us to make a decision on whether or not assets have been transferred with intent

to qualify for Medicaid, we will ask you to provide the following:

Bank statements for all bank or credit union accounts on which your name, or the name

of your spouse, appears currently and within the 5-year look-back period.

o We will start with current and anniversary bank statements for all accounts

during the look-back period to determine if there is a need for additional

documentation.

o If bank statements for all accounts are not available, federal tax returns with all

attachments for the year(s) bank statements are not available will be needed.

o In reviewing bank account activity, we will look for normal patterns of spending

in the process of spending your cash assets.

o Spending that is out of the ordinary and not for your benefit will need

explanation.

All deeds and property agreements are needed for real property on which your name or

your spouses name appears currently and during the 5-year look-back period.

o Your equity value in any property ownership transferred during this time will

count if a countable transfer has occurred.

Effective: Date: November 2016

Page 2 of 3

Official documentation of ownership of any other types of assets will require verification

during the 5-year look-back period, including but not limited to, proof of ownership and

the value of retirement funds, annuities, trust funds, stocks, bonds, loans, vehicles, life

insurance, and any other similar investments that may have been sold or given away.

Transfers that Do Not Count

Certain transfers do not result in a transfer penalty. These include:

A transfer of assets to your spouse, child under age 21, or a disabled or blind adult child.

o The disability or blindness of an adult child must be verified using Social Security

disability or blindness criteria.

The transfer of home property to a sibling who is part owner of the home who lived in

the home for 1 year prior to you entering a nursing facility.

The transfer of home property to your child who lived in the home for a minimum of 2

years before you entered a nursing facility and provided care to you so that you could

remain at home.

The transfer of assets to a Special Needs Trust established in accordance with Medicaid

policy if you are disabled and under age 65.

Undue Hardship

Certain transfers that have happened may not have been authorized by you. In addition, you

may not be able to recover your transferred assets on your own.

We will apply undue hardship that will allow us to waive a transfer penalty under certain

conditions if you are unable to recover your assets after taking reasonable attempts through

verifiable action:

Legal or civil action,

Involvement by the Attorney Generals office to attempt recovery through the

Vulnerable Adult program,

Police or other official investigation into the transfer or financial exploitation that has

occurred.

Effective Date: November 2016

Page 3 of 3

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Test Bank For Basic Geriatric Nursing 7th Edition Patricia A WilliamsDokument6 SeitenTest Bank For Basic Geriatric Nursing 7th Edition Patricia A WilliamsShannon Melancon100% (37)

- MDHS TANF Denial Reasons 2017-2018Dokument2 SeitenMDHS TANF Denial Reasons 2017-2018Anna WolfeNoch keine Bewertungen

- Case Study 3Dokument6 SeitenCase Study 3May Teng0% (1)

- Ebersole Hess Gerontological Nursing Healthy Aging Canada 2nd Touhy Test BankDokument7 SeitenEbersole Hess Gerontological Nursing Healthy Aging Canada 2nd Touhy Test BankSaifoqq100% (1)

- FY 2017 TANF Denial RatesDokument16 SeitenFY 2017 TANF Denial RatesAnna WolfeNoch keine Bewertungen

- FY 2017 TANF Denial RatesDokument16 SeitenFY 2017 TANF Denial RatesAnna WolfeNoch keine Bewertungen

- MDHS 2017 Annual ReportDokument28 SeitenMDHS 2017 Annual ReportAnna WolfeNoch keine Bewertungen

- FY 2017 TANF Denial RatesDokument16 SeitenFY 2017 TANF Denial RatesAnna WolfeNoch keine Bewertungen

- CCDF at 20Dokument84 SeitenCCDF at 20Anna WolfeNoch keine Bewertungen

- FY 2017 TANF Denial RatesDokument16 SeitenFY 2017 TANF Denial RatesAnna WolfeNoch keine Bewertungen

- FY 2017 TANF Denial RatesDokument16 SeitenFY 2017 TANF Denial RatesAnna WolfeNoch keine Bewertungen

- FY 2017 TANF Denial RatesDokument16 SeitenFY 2017 TANF Denial RatesAnna WolfeNoch keine Bewertungen

- FY 2017 TANF Denial RatesDokument16 SeitenFY 2017 TANF Denial RatesAnna WolfeNoch keine Bewertungen

- MDHS 2018 Annual ReportDokument22 SeitenMDHS 2018 Annual ReportAnna WolfeNoch keine Bewertungen

- FY 2017 TANF Denial RatesDokument16 SeitenFY 2017 TANF Denial RatesAnna WolfeNoch keine Bewertungen

- Anna Wolfe V MDHSDokument4 SeitenAnna Wolfe V MDHSAnna WolfeNoch keine Bewertungen

- Child Support SNAP LetterDokument4 SeitenChild Support SNAP LetterAnna WolfeNoch keine Bewertungen

- Medicare Rates January 2018Dokument679 SeitenMedicare Rates January 2018Anna Wolfe0% (1)

- Anna Wolfe Ethics Complaint Against MDHSDokument4 SeitenAnna Wolfe Ethics Complaint Against MDHSAnna WolfeNoch keine Bewertungen

- North Mississippi Medical Clinics 990Dokument47 SeitenNorth Mississippi Medical Clinics 990Anna WolfeNoch keine Bewertungen

- Communication B/W Anna Wolfe, MDHSDokument50 SeitenCommunication B/W Anna Wolfe, MDHSAnna WolfeNoch keine Bewertungen

- UMMC "Quality Report"Dokument7 SeitenUMMC "Quality Report"Anna WolfeNoch keine Bewertungen

- Insurance Commissioner Air Ambulance Letter To CongressDokument3 SeitenInsurance Commissioner Air Ambulance Letter To CongressAnna WolfeNoch keine Bewertungen

- Prescription Affordability ActDokument2 SeitenPrescription Affordability ActAnna WolfeNoch keine Bewertungen

- Roger Wicker Campaign Finance Report April 2018Dokument384 SeitenRoger Wicker Campaign Finance Report April 2018Anna WolfeNoch keine Bewertungen

- Motion For Class ActionDokument13 SeitenMotion For Class ActionAnna WolfeNoch keine Bewertungen

- David Baria Campaign Finance Report April 2018Dokument42 SeitenDavid Baria Campaign Finance Report April 2018Anna WolfeNoch keine Bewertungen

- Pre-Filled MCSD Form TemplateDokument3 SeitenPre-Filled MCSD Form TemplateAnna WolfeNoch keine Bewertungen

- Attorney General Investigation at Pine GroveDokument3 SeitenAttorney General Investigation at Pine GroveAnna WolfeNoch keine Bewertungen

- Chris McDaniel April 2018 Campaign Finance ReportDokument42 SeitenChris McDaniel April 2018 Campaign Finance ReportAnna WolfeNoch keine Bewertungen

- Sheriff Tucker Responds To ACLU LegislationDokument2 SeitenSheriff Tucker Responds To ACLU LegislationAnna WolfeNoch keine Bewertungen

- Madison County Sgt. "WHITE Power" EmailDokument10 SeitenMadison County Sgt. "WHITE Power" EmailAnna WolfeNoch keine Bewertungen

- Madison County Sheriff Response To LawsuitDokument47 SeitenMadison County Sheriff Response To LawsuitUploadedbyHaroldGaterNoch keine Bewertungen

- Nursing Home AdministratorDokument2 SeitenNursing Home Administratorapi-78009605100% (1)

- The Eldercare Cliff ReportDokument4 SeitenThe Eldercare Cliff Reportedwardsmarketin5567Noch keine Bewertungen

- BOMA BEST 3.0 Application GuideDokument123 SeitenBOMA BEST 3.0 Application Guidedavid messierNoch keine Bewertungen

- Barier and EnablesDokument52 SeitenBarier and EnablesAnonymous 8rsxG4Noch keine Bewertungen

- Balancing Infection Control, Quality of Life and Resilience in Nursing Home DesignDokument7 SeitenBalancing Infection Control, Quality of Life and Resilience in Nursing Home DesignGino StasinopoulosNoch keine Bewertungen

- Formal Long Term Care: Informal Caregivers' Subjective Well Being and Service UtilizationDokument240 SeitenFormal Long Term Care: Informal Caregivers' Subjective Well Being and Service UtilizationCHEE KOK SENGNoch keine Bewertungen

- Care For The Family CaregiverDokument46 SeitenCare For The Family CaregiverAmy AdamsNoch keine Bewertungen

- CalPERS LTC LawsuitDokument28 SeitenCalPERS LTC Lawsuitjon_ortizNoch keine Bewertungen

- 2018 H1 Economics Combined PDFDokument168 Seiten2018 H1 Economics Combined PDFLee Jia QingNoch keine Bewertungen

- Gender Identity in Informal Care: Impact On Health in Spanish CaregiversDokument15 SeitenGender Identity in Informal Care: Impact On Health in Spanish CaregiversAUCANLATINMAILNoch keine Bewertungen

- Discharge Planning ChecklistDokument6 SeitenDischarge Planning Checklistaris kumala santiNoch keine Bewertungen

- Laws Regarding Criminal Background in Nursing HomesDokument6 SeitenLaws Regarding Criminal Background in Nursing HomesThinkProgressNoch keine Bewertungen

- 8 17 16Dokument16 Seiten8 17 16greercitizenNoch keine Bewertungen

- Medicare Reform - A Push Towards Home Based CareDokument15 SeitenMedicare Reform - A Push Towards Home Based CareCharlie BenandiNoch keine Bewertungen

- Elderly Services in Health CentersDokument73 SeitenElderly Services in Health CentersHsk MiaoNoch keine Bewertungen

- Aging in Place - From Theory To Practice PDFDokument12 SeitenAging in Place - From Theory To Practice PDFYvonne Yap Ying Ying100% (1)

- Long Term CareDokument17 SeitenLong Term CareJhon Brian VargasNoch keine Bewertungen

- Challenges in Long-Term Care in Europe: A Study of National Policies 2018Dokument66 SeitenChallenges in Long-Term Care in Europe: A Study of National Policies 2018Alexandru ConstantinNoch keine Bewertungen

- Stroke 2016 WinsteinDokument73 SeitenStroke 2016 WinsteinTegar Fadeli ArrahmaNoch keine Bewertungen

- Health in A Glance 2023 OCDEDokument234 SeitenHealth in A Glance 2023 OCDERui MonteiroNoch keine Bewertungen

- John Zoltowski ResumeDokument2 SeitenJohn Zoltowski Resumeapi-432139205Noch keine Bewertungen

- Respite CareDokument2 SeitenRespite CareNoven AfiyataNoch keine Bewertungen

- Fiscal FitnessDokument256 SeitenFiscal Fitnessvasgosun100% (1)

- Five Questions About Long Term CareDokument2 SeitenFive Questions About Long Term CareLindsey HarrisNoch keine Bewertungen

- Mcss Brief Abuse by Ministry-1Dokument17 SeitenMcss Brief Abuse by Ministry-1api-239460708Noch keine Bewertungen

- Designing Universal Family Care Digital Version FINALDokument310 SeitenDesigning Universal Family Care Digital Version FINALPyaePhyoAungNoch keine Bewertungen

- Gonzales Cannon August 16 IssueDokument38 SeitenGonzales Cannon August 16 IssueGonzales CannonNoch keine Bewertungen