Beruflich Dokumente

Kultur Dokumente

Cindys Notes Taxation

Hochgeladen von

Remle AisebaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cindys Notes Taxation

Hochgeladen von

Remle AisebaCopyright:

Verfügbare Formate

IMPORTANCE OF TAXATION AS

ATTRIBUTE TO SOVEREIGNTY: ESSENTIAL CHARACTERISTICS OF

A TAX:

The power of taxation is an

essential an inherent attribute to 1. It is an enforced contribution;

sovereignty, belonging as a matter of 2. It is generally payable in money;

right to every independent government 3. It is proportionate in character;

without being expressly granted by the 4. It is levied on person, on rights

people. Tax is an attribute to and on property;

sovereignty, which emanates from 5. It is levied by the state which has

necessity upon which the very existence the jurisdiction over the person

of the government is dependent. Without or property;

tax money, the government would not 6. It is levied by the law making

be able to undertake for the purposes of body of the state;

which it was organized, thus negating 7. It is levied for public purpose.

the need of its existing.

REQUISITES FOR A VALID TAX:

Being derogatory to sovereignty,

the governing principle is that the tax 1. Should be for a public purpose;

exemptions are to be construed in 2. The rule of taxation shall be

strictissimi juris against the taxpayer and uniform;

liberally in favor of the taxing authority; 3. That either the person or the

and he who claims an exemption must property taxed should be within

be able to justify his claim by the the jurisdiction of the taxing

clearest grant of statute. authority;

4. That the assessment and the

BASIC PRINCIPLE OF SOUND TAX collection of a certain kinds of

SYSTEM (FAT): taxes guarantees against

injustice to individuals, especially

1. Fiscal Adequacy sources of by way of notice and opportunity

government revenue must be for hearing is provided;

sufficient to meet government 5. The tax must not impinge on the

expenditures and other public inherent and Constitutional

needs. limitations on the power of

2. Administrative Feasibility tax taxations.

laws must be capable of

effective and efficient DOCTRINE OF IMPRESCRIPTIBILITY:

enforcement.

3. Theoretical Justice a sound As a rule, taxes are

tax system must take into imprescriptible as they are lifeblood of

consideration the taxpayers the government. However, tax statute

ability to pay. may provide for statute limitations.

THEORIES ON TAXATION: Rules have been adopted are as

follows:

1. Lifeblood theory a. National Internal Revenue

2. Necessity theory Code

3. Benefits-Protection/ Reciprocity b. Tariff and Customs Code

Theory (symbiotic relationship) c. Local Government Code

4. Jurisdiction over the subjects

and objects (SITUS)

DOUBLE TAXATION:

Means taxing the same property TAX AVOIDANCE V. TAX EVASION:

twice when it should be taxed once.

TAX AVOIDANCE refers to the

ELEMENTS: action taken by the taxpayer to minimize

the payment or altogether eliminate his

1. The same property or subject tax liability by lawful means, while TAX

matter is taxed twice when is EVASION refers to the willful and

should be taxed once; deliberate attempt done by a taxpayer to

2. Both taxes are levied for the reduce or altogether eliminate his tax

same purpose; liability by unlawful means or device.

3. Imposed by the same taxing

authority;

4. Imposed within the same FACTORS IN FRAUD OR EVASIONS:

jurisdiction;

5. During the same taxing period; 1. The end to be achieved;

6. Covering the same kind or 2. The accompanying state of

character of tax. mind;

3. The overt act done or

METHODS IN REDUCING THE scheme used by the

RIGORS OF DOUBLE TAXATION: taxpayer.

1. Tax credits

2. Tax reductions

3. Reduction of the Philippines

income tax rates TWO CLASSES OF LIMITATIONS OF

4. Tax exemptions TAXATIONS:

5. Tax treaties

1. The Constitutional limitations

Q: When an item of income taxed in 2. The inherent limitations

the Philippines and the same income

is taxed in another country, is there a

case of double taxation? CONTITUTIONAL LIMITATIONS:

Answer: Generally yes, but being

indirectly a double taxation imposed Bill of Rights ARTICLE III

different taxing authority, it is not

prohibited. However, to avoid the impact SECTION 1. No person shall be

of double taxation, some countries have deprived of life, liberty or property

considered it as allowable deduction as without due process of law, nor shall be

a tax credit. denied the equal protection of the law.

FORMS OF ESCAPE FROM

TAXATION: SECTION 4. No law shall be pass

abridging the freedom of speech, of

1. Shifting expression or of press or the right of the

2. Capitalization people peaceably to assemble and

3. Transformation petition of the government for redress or

4. Tax avoidance grievances.

5. Tax evasions

6. Tax fraud

SECTION 5. No law shall be made SECTIOON 6. Local government units

respecting an establishment of religion shall have a just share, as determined

or prohibiting the free exercise thereof. by law, in the national taxes which shall

The free exercise and enjoyment of be automatically released by them.

religious profession and worship, without

discrimination or preference, shall

forever be allowed. No religious test SECTION 34 OF NIRC. ALLOWABLE

shall be required for the exercise of civil DEDUCTIONS: (LITO BAD PED PRC)

and political rights.

1. Expenses

SECTION 10. No law impairing the 2. Interest

obligations and contracts shall be 3. Taxes

passed. 4. Losses

5. Bad Debts

SECTION 20. No person shall be 6. Depreciation

imprisoned for debt or non payment of 7. Depletion of Oil and Gas

poll tax. Wells and Mines

8. Charitable and Other

Legislative Department ARTICLE VI Contributions

9. Research and Development

SECTIONS 25, 26, 27, 28, 29 10. Pension Trusts

11. Additional Requirements for

Judiciary Department ARTICLE VIII Deductibility of Certain

Payments

SECTION 2. The Congress shall have 12. Optional Standard Deduction

the power to define, prescribe and 13. Premium Payments on

apportion the jurisdictions of the various Health and/or Hospitalization

courts but may not deprive the Supreme Insurance of an Individual

Court of its jurisdiction over cases Taxpayer

enumerated in Section 5 hereof.

SECTION 21 OF NIRC. SOURCES OF

SECTION 5. The Supreme Court shall REVENUE.

have the following powers.

1. Income tax;

2. Estate and donors tax;

Local Government ARTICLE X 3. Value-added tax;

4. Other percentage taxes;

SECTION 2. The territorial and political 5. Excise taxes;

subdivision shall enjoy local autonomy. 6. Documentary stamp taxes; and

7. Such other taxes as are or

SECTION 5. Each local government unit hereafter maybe imposed and

shall have the power to create its owns collected by the Bureau of

sources of revenues and to levy taxes, Internal Revenue. (a)

fees and charges subject to such

guidelines and limitations as the

Congress may provide, consistent with

the basic policy of local autonomy. Such

taxes, fees and charges shall accrue

exclusively to the local governments.

STAGES OR ASPECTS OF 6. Protectionism to protect local

TAXATION: industries from foreign

competition.

1. Levy - refers to the enactment of

the laws of the Congress., NOTE: Taxes and debts cannot be the

imposing tax. subject of compensation the government

2. Assessment and collection the and the taxpayer are not mutually

act of administration and creditors and debtors of each other and

implementation of the tax law by a claim for taxes is not a debt, demand

the executive department contract, or judgment as is allowable to

through the administrative be set off.

agencies.

3. Payment act of compliance by NOTE: The term tax applies generally

taxpayer, including such options, to al kinds of exactions which become

schemes or remedies as may be public funds.

legally available to him.

NOTE: Sin Tax progressive income

PURPOSES AND OBJECTIVES OF taxes alleviate the margin between rich

TAXATION: and poor.

1. Revenue to raise revenue to NOTE: Taxation is distinguished from

promote the general welfare and police power as to the means employed

protection of its citizens. to implement public good goals.

2. Regulatory to provide means REQUISITES FOR VALIDITY OF

for the rehabilitation and REGULATIONS:

stabilization of a threatened

industry which is affected by 1. It is issued under the authority of

public interest as to be within the law

police power of the state. 2. It must be within the scope and

purview of the law

3. Promotion of general welfare- 3. It is reasonable

may be use as implement of the 4. It must be published in the

police power to promote the official Gazette or in a

general welfare of the people. newspaper of general

circulations

4. Reduction of social equality 5. Where the regulations impose

progressive system of taxation penal sanctions, the law itself

prevents the undue must declare as punishable the

concentration of wealth in the violation of the administrative

few individuals. rule or regulations and the law

should fix and define the penalty

5. Encourage the economic growth for the violation of the rule or

by granting incentives and regulation.

exemptions the power to tax

and the power to exempt are

inherent in the State and in Local

Governments.

TAX EVASION is a scheme used

outside of those lawful means and when While it is true that the Philippines as a

availed of, it is usually subjects the State is not obliged to admit aliens

taxpayer to further or additional civil or within its territory, once an alien is

criminal liabilities. admitted, he cannot be deprived of life

TAX AVOIDANCE is the tax saving without due process of law. This

device within the means sanctioned by guarantee includes the means of

law. This method should be used by the livelihood. The shelter of protection

taxpayer in good faith and at arms under the due process and equal

length. protection clause is given to all persons

both aliens and citizens. (Villegas v. Hiu

CONSTITUTIONAL LIMITATIONS: Chong Tsai Pao Ho)

Sec. 29, Article VI. NO MONEY SHALL NOR SHALL ANY PERSON BE

BE PAID OUT OF THE TREASURY, DENIED THE EQUAL [ROTECTION OF

EXCEPT IN PURSUANCE OF AN THE LAW:

APPROPRIATION MADE BYLAW.

For the classification to be reasonable, it

Sec. 5, Article X. Constitution has must be shown that:

given broad powers of taxation to 1. It rests on substantial

local government units, this distinctions;

delegation, however, is subject to 2. It is germane to the purpose

such limitations as may be provided of the law;

by law. 3. It is not limited to the

existing conditions only;

The Local Tax Code only allows 4. It applies equally to all

provinces and cities to impose a tax members of the same class.

on the transfer of ownership of real

property.

NO LAW IMPAIRING THE

Foreign corporations effecting a OBLIGATION OF CONTRACTS

donations are subject to donors tax only SHALL BE PASSED. (Sec. 10, Article

if the property donated is located in the III).

Philippines.

What constitutes an impairment of the

Executive agreement has the force and obligation of contract is the revocation of

effect of treaty under the provision of an exemption which is founded on a

Revenue Code. Taxation is subject to valuable consideration because it takes

International Comity. a form and essence of a contract.

NO PERSON SHALL BE DEPRIVED

OF LIFE, LIBERTY AND PROPERTY

WITHOUT DUE PROCESS OF LAW.

(Sec. 1, Article III).

There can be no discrimination where

the tax bases and rates for self-

employed and professionals, on one

hand, and for salaried employees, on

the other hand, are different. (Sidon v.

Ancheta)

THE FREE EXERCISE AND

ENJOYMENT OF RELIGIUS

PROFESSION AND WORSHP,

WITHOUT DISCRIMINATION OR

PREFERENCE, SHALL FOREVER BE

ALLOWED. (Sec. 5, Article III).

Requiring a person to secure a Mayors

permit before he can engage in

businesses, trade or occupation, does

not impair the plaintiff constitutional

right. (American Bible v. City of Manila)

TAX EXEMPTION OF PROPERTIES

FOR RELIGIOUS , CHARITABLE AND

EDUCATIONAL PURPOSES. ( Sec 28

[3], Article III).

The exemption applies only to property

taxes. What is exempted is not the

institution itself but the lands, buildings,

and improvements actually, directly and

exclusively used for religious, charitable,

and educational purposes.

The usage of the property and not the

ownership is the determining factor

whether or not the property is taxable.

ALL APPROPRIATION, REVENUE OR

TARIFF BILLS SHALL ORIGINATE

FROM HOUSE OF

REPRESENTATIVES, BUT THE

SENATE MAY PROPOSE OR

CONCUR WITH AMENDMENTS. (Sec.

24, Article VI)

What is prohibited is for the Senate to

enact revenue measures on is own

without a bill originating from the House.

But once the revenue bill was passed by

the House and sent to the Senate, the

latter can passed its on version on the

same subject matter consonant with the

latters power to propose or concur with

amendments. This follows from the co

equality of the two chambers of

Congress. (Tolentino v. Sec. of Finance)

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Income From House Property SEM IVDokument8 SeitenIncome From House Property SEM IVThenmozhi RameshNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Isa 230Dokument13 SeitenIsa 230Paul Michael JaramilloNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Strama LBP MapDokument190 SeitenStrama LBP Mapmitti panelNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Financial Markets (Beginner Module)Dokument98 SeitenFinancial Markets (Beginner Module)gauravNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Simple Day Trading Strategy Using Bollinger & MACD - Trading Setups Review PDFDokument15 SeitenA Simple Day Trading Strategy Using Bollinger & MACD - Trading Setups Review PDFzooor100% (1)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Model Agreement For An Assured Shorthold Tenancy and Accompanying GuidanceDokument50 SeitenModel Agreement For An Assured Shorthold Tenancy and Accompanying GuidancesokrisbaNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Rites Ltd. Update: January 2021 EditionDokument6 SeitenRites Ltd. Update: January 2021 EditionjageshwariNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Mycem CementDokument89 SeitenMycem CementushadgsNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Solution Manual For Principles of Corporate Finance 12th Edition by BrealeyDokument3 SeitenSolution Manual For Principles of Corporate Finance 12th Edition by BrealeyNgân HàNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Tutorial 1 Q - MergedDokument37 SeitenTutorial 1 Q - MergedWeiqin ChanNoch keine Bewertungen

- 3 Spreadsheet PR 3.5ADokument2 Seiten3 Spreadsheet PR 3.5ARizkyDirectioners'ZaynsterNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Property - Case DigetsDokument40 SeitenProperty - Case DigetsChristopher G. HalninNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoiceMã H IêNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Aci Training Companies v20140926Dokument17 SeitenAci Training Companies v20140926RoninKiNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Marketing Digest PDFDokument26 SeitenMarketing Digest PDFRia SinghNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- (Original For Recipient) : Credit NoteDokument1 Seite(Original For Recipient) : Credit NoteParthiva SinhaNoch keine Bewertungen

- Acbp5112+W - Acbp5122+w Assignment 1 - Answer BookletDokument17 SeitenAcbp5112+W - Acbp5122+w Assignment 1 - Answer BookletKagiso MahlanguNoch keine Bewertungen

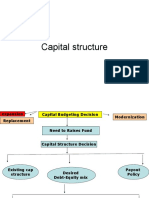

- Capital StructureDokument41 SeitenCapital StructuremobinsaiNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Set 2Dokument6 SeitenSet 2Nicco OrtizNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- HW5 SolnDokument7 SeitenHW5 SolnZhaohui Chen100% (1)

- 5201 - 21 AIS 008 Rashed Assignment - 095526Dokument20 Seiten5201 - 21 AIS 008 Rashed Assignment - 095526RashedNoch keine Bewertungen

- Mobasser Monem AssigenmentDokument8 SeitenMobasser Monem AssigenmentMirza ArnabNoch keine Bewertungen

- ECO 303 Practice For Test 2Dokument2 SeitenECO 303 Practice For Test 2AH HarpNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Duties of A Director.: Non-Executive DirectorsDokument4 SeitenDuties of A Director.: Non-Executive DirectorsHitesh ShahNoch keine Bewertungen

- Somaliland Revenue Act 2016 English v2Dokument129 SeitenSomaliland Revenue Act 2016 English v2Mohamed DaudNoch keine Bewertungen

- Bal Annual Report 2012Dokument324 SeitenBal Annual Report 2012amuandrabi0% (1)

- Name:Sunil Biradar: 506, Surya Kiran Building, 19 K G Marg, Connaught Place, NewDokument1 SeiteName:Sunil Biradar: 506, Surya Kiran Building, 19 K G Marg, Connaught Place, NewKiran DeshpandeNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Lecture Week 14Dokument23 SeitenLecture Week 14XS3 GamingNoch keine Bewertungen

- Banate vs. Philippine Countryside Rural Bank (Liloan, Cebu), Inc., G.R. No. 163825, July 13, 2010Dokument2 SeitenBanate vs. Philippine Countryside Rural Bank (Liloan, Cebu), Inc., G.R. No. 163825, July 13, 2010Wella BrazilNoch keine Bewertungen

- Financial Statement Analysis: Submitted By: Saket Jhanwar 09BS0002013Dokument5 SeitenFinancial Statement Analysis: Submitted By: Saket Jhanwar 09BS0002013saketjhanwarNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)