Beruflich Dokumente

Kultur Dokumente

2017-03-30 - The Income-Tax (4th Amendment) Rules, 2017 - Forms of Returns of Income PDF

Hochgeladen von

Raj A KapadiaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2017-03-30 - The Income-Tax (4th Amendment) Rules, 2017 - Forms of Returns of Income PDF

Hochgeladen von

Raj A KapadiaCopyright:

Verfügbare Formate

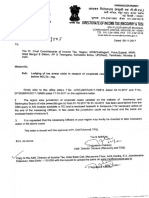

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3,

SUB- SECTION (ii)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

[CENTRAL BOARD OF DIRECT TAXES]

NOTIFICATION

New Delhi, the 30th day of March, 2017

Income-tax

S.O.1006(E). In exercise of the powers conferred by section 139 read with section 295 of the

Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following

rules further to amend the Income-tax Rules, 1962, namely:-

1. (1) These rules may be called the Income-tax (Fourth Amendment) Rules, 2017.

(2) They shall come into force with effect from the 1st day of April, 2017.

2. In the Income-tax rules, 1962 (hereinafter referred to as the principal rules), in rule 12,

(a) in sub-rule (1),-

(I) in the opening portion, for the figures 2016, the figures 2017 shall be

substituted;

(II) in clause (a), in the proviso,-

(i) in sub-clause (II), the word or coming at the end shall be omitted;

(ii) after sub-clause (III), the following sub-clauses shall be inserted,

namely:-

(IV) has total income, exceeding fifty lakh rupees;

(V) has income taxable under section 115BBDA; or

(VI) has income of the nature referred to in section 115BBE;;

(III) clause (b) and clause (ba) shall be omitted;

(IV) for clause (c), the following clause shall be substituted, namely:-

(c) in the case of a person being an individual [not being an individual to

whom clause (a) applies] or a Hindu undivided family where the total

income does not include income derived from a proprietory business or

profession, be in Form No.ITR-2 and be verified in the manner indicated

therein;;

(V) in clause (ca),-

(i) in the opening portion, for the words, figures and letters business

income and such income is computed in accordance with special

provisions referred to in section 44AD and section 44AE of the Act for

computation of business income, be in Form SUGAM (ITR-4S), the

words, figures and letters income under the head Profits or gains of

business or profession and such income is computed in accordance with

special provisions referred to in section 44AD, section 44ADA and

section 44AE of the Act for computation of such income, be in Form

SUGAM (ITR-4) shall be substituted;

(ii) in the proviso,-

(A) in sub-clause (II), the word or coming at the end shall be

omitted;

(B) after sub-clause (III), the following sub-clause shall be

inserted, namely:-

(IV) has income taxable under section 115BBDA; or

(V) has income of the nature referred to in section

115BBE;;

(VI) in clause (d),-

(i) the words, brackets and letter clause (b) shall be omitted;

(ii) for the words, letters and number Form No. ITR-4 the words, letters

and number Form No. ITR-3 shall be substituted;

(b) in sub-rule (2), for the words, letters, brackets and number Form SUGAM

(ITR-4S) or Form No. ITR-4 the words, letters, brackets and number Form

SUGAM (ITR-4) shall be substituted;

(c) in sub-rule (3), in the Table,-

(A) for serial number 1 and entries relating thereto, the following serial

number and entries thereto shall be substituted, namely:-

Sl. Person Condition Manner of furnishing return

of income

(i) (ii) (iii) (iv)

1 Individual (a) Accounts are required Electronically under digital

or Hindu to be audited under section signature;

undivided 44AB of the Act;

family (b) Where total income (A) Electronically under

assessable under the Act digital signature; or

during the previous year of (B) Transmitting the data

a person,- electronically in the return

(i) being an individual of under electronic verification

the age of 80 years or code; or

more at any time during (C) Transmitting the data in

the previous year; or the return electronically and

(ii) whose income does thereafter submitting the

not exceed five lakh verification of the return in

rupees and no refund is Form ITR-V; or

claimed in the return of (D) Paper form;

income,

and who furnishes the

return in Form No. SAHAJ

ITR-1 or Form No.

SUGAM (ITR-4)

(c) In any other case (A) Electronically under

digital signature; or

(B) Transmitting the data

electronically in the return

under electronic verification

code; or

(C) Transmitting the data in

the return electronically and

thereafter submitting the

verification of the return in

Form ITR-V;;

(d) in sub-rule (5), for the figures 2015, the figures 2016 shall be substituted.

3. In the principal rules, in Appendix II,-

(a) for Form Sahaj (ITR-1), the following Form shall be substituted, namely:- Sahaj

(ITR-1);

(b) for Form ITR-2, the following Form shall be substituted, namely:- ITR-2;

(c) Form ITR-2A shall be omitted;

(d) for Form ITR-3 the following Form shall be substituted, namely:- ITR-3;

(e) for Form ITR-4S, the following Form shall be substituted, namely:- Sugam

(ITR-4);

(f) Form ITR-4 shall be omitted;

(g) for Form ITR-5, the following Form shall be substituted, namely:- ITR-5;

(h) for Form ITR-6, the following Form shall be substituted, namely:- ITR-6;

(i) for Form ITR-7, the following Form shall be substituted, namely:- ITR-7;

(j) for Form ITR-V, the following Form shall be substituted, namely:- ITR-V.

[Notification No. 21/2017/ F.No.370142/5/2017-TPL]

(Dr. T.S. Mapwal)

Under Secretary to the Government of India

Note.- The principal rules were published in the Gazette of India, Extraordinary, Part-II, Section 3,

Sub-section (ii) vide notification number S.O.969(E), dated the 26th March, 1962 and last amended by

the Income-tax (Third Amendment) Rules, 2017, vide notification number S.O. No. 283(E), dated

23rd March, 2017.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Our Identity in Christ Part BlessedDokument11 SeitenOur Identity in Christ Part BlessedapcwoNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Text and Meaning in Stanley FishDokument5 SeitenText and Meaning in Stanley FishparthNoch keine Bewertungen

- Jewish Reception of Greek Bible Versions (N. de Lange - J. G. Krivoruchko) PDFDokument348 SeitenJewish Reception of Greek Bible Versions (N. de Lange - J. G. Krivoruchko) PDFFray Duván OfmNoch keine Bewertungen

- Travel Services AgreementDokument36 SeitenTravel Services AgreementEllijala VarunNoch keine Bewertungen

- Solar - Bhanu Solar - Company ProfileDokument9 SeitenSolar - Bhanu Solar - Company ProfileRaja Gopal Rao VishnudasNoch keine Bewertungen

- 2019-10-30 - H R 116-266 - REPORT On H R 660 (Directing Continuation of Impeachment Investigation)Dokument25 Seiten2019-10-30 - H R 116-266 - REPORT On H R 660 (Directing Continuation of Impeachment Investigation)Raj A KapadiaNoch keine Bewertungen

- Income-Tax Appellate Tribunal - Mumbai Bench (Es) - Cause List For Period 31-12-2018 To 03-01-2019Dokument37 SeitenIncome-Tax Appellate Tribunal - Mumbai Bench (Es) - Cause List For Period 31-12-2018 To 03-01-2019Raj A KapadiaNoch keine Bewertungen

- Mumbai ITAT Erred in Applying Ejusdem Generis Rule (2019) 105 Taxmann - Com 240 (Art) (IE)Dokument20 SeitenMumbai ITAT Erred in Applying Ejusdem Generis Rule (2019) 105 Taxmann - Com 240 (Art) (IE)Raj A KapadiaNoch keine Bewertungen

- 2017-10-06 - CBDT's Letter Inviting Comments - DRAFT Rules For CBC Report & Master FileDokument15 Seiten2017-10-06 - CBDT's Letter Inviting Comments - DRAFT Rules For CBC Report & Master FileRaj A KapadiaNoch keine Bewertungen

- 2018-03-27 - ORDER - Extension Until 30 June of Deadline For PAN-AADHAAR LinkingDokument1 Seite2018-03-27 - ORDER - Extension Until 30 June of Deadline For PAN-AADHAAR LinkingRaj A KapadiaNoch keine Bewertungen

- 2017-11-08 - Issue Re Representation Before Benches of NCLT PDFDokument5 Seiten2017-11-08 - Issue Re Representation Before Benches of NCLT PDFRaj A KapadiaNoch keine Bewertungen

- 2017-07-31 - Office Memorandum - Stay of Demand at 1st Appeal Stage - Partial Modification of Instruction No 1914 DT 21-Mar-1996Dokument1 Seite2017-07-31 - Office Memorandum - Stay of Demand at 1st Appeal Stage - Partial Modification of Instruction No 1914 DT 21-Mar-1996Raj A KapadiaNoch keine Bewertungen

- 2017-07-04 - The Income-Tax (19th Amendment) Rules, 2017 - Amendment of Rule 29-B and Form No 15-CDokument1 Seite2017-07-04 - The Income-Tax (19th Amendment) Rules, 2017 - Amendment of Rule 29-B and Form No 15-CRaj A KapadiaNoch keine Bewertungen

- Vodafone India Services P LTD V DCIT (Trib-Ahd) (23-Jan-2018)Dokument161 SeitenVodafone India Services P LTD V DCIT (Trib-Ahd) (23-Jan-2018)Raj A KapadiaNoch keine Bewertungen

- 2017-11-08 - CBDT - Lodging of Tax Arrear Claim in Respect of Corporate Cases Filed Under IBC-2016Dokument35 Seiten2017-11-08 - CBDT - Lodging of Tax Arrear Claim in Respect of Corporate Cases Filed Under IBC-2016Raj A KapadiaNoch keine Bewertungen

- 2017-06-09 - The Income-Tax (14th Amendment) Rules, 2017 - Amendment of 2nd Proviso To Rule 114-BDokument2 Seiten2017-06-09 - The Income-Tax (14th Amendment) Rules, 2017 - Amendment of 2nd Proviso To Rule 114-BRaj A KapadiaNoch keine Bewertungen

- CBDT Instruction No 05-2017 - Guidelines For Selection of Cases For Scrutiny During F Y 2017-18Dokument2 SeitenCBDT Instruction No 05-2017 - Guidelines For Selection of Cases For Scrutiny During F Y 2017-18Raj A KapadiaNoch keine Bewertungen

- 2017-04-05 - The Income-Tax (7th Amendment) Rules, 2017 - Amendment of 4th Proviso To Rule 114-BDokument3 Seiten2017-04-05 - The Income-Tax (7th Amendment) Rules, 2017 - Amendment of 4th Proviso To Rule 114-BRaj A KapadiaNoch keine Bewertungen

- 2017-06-05 - The Income-Tax (11th Amendment) Rules, 2017 - Claim For Refund of TDS U-S 194-IA in Form No 26-BDokument6 Seiten2017-06-05 - The Income-Tax (11th Amendment) Rules, 2017 - Claim For Refund of TDS U-S 194-IA in Form No 26-BRaj A KapadiaNoch keine Bewertungen

- Quality Audit Report TemplateDokument3 SeitenQuality Audit Report TemplateMercy EdemNoch keine Bewertungen

- Mun Experience ProposalDokument2 SeitenMun Experience Proposalapi-296978053Noch keine Bewertungen

- Why Study in USADokument4 SeitenWhy Study in USALowlyLutfurNoch keine Bewertungen

- Engels SEM1 SECONDDokument2 SeitenEngels SEM1 SECONDJolien DeceuninckNoch keine Bewertungen

- Curriculam Vitae: Job ObjectiveDokument3 SeitenCurriculam Vitae: Job ObjectiveSarin SayalNoch keine Bewertungen

- People vs. PinlacDokument7 SeitenPeople vs. PinlacGeenea VidalNoch keine Bewertungen

- Case Presentation and Analysis - Operations JollibeeDokument7 SeitenCase Presentation and Analysis - Operations JollibeeDonnabie Pearl Pacaba-CantaNoch keine Bewertungen

- Problem Solving and Decision MakingDokument14 SeitenProblem Solving and Decision Makingabhiscribd5103Noch keine Bewertungen

- A#2 8612 SehrishDokument16 SeitenA#2 8612 SehrishMehvish raniNoch keine Bewertungen

- Research ProposalDokument21 SeitenResearch Proposalkecy casamayorNoch keine Bewertungen

- OECD - AI Workgroup (2022)Dokument4 SeitenOECD - AI Workgroup (2022)Pam BlueNoch keine Bewertungen

- DIS Investment ReportDokument1 SeiteDIS Investment ReportHyperNoch keine Bewertungen

- Prayer For World Teachers Day: Author: Dr. Anthony CuschieriDokument1 SeitePrayer For World Teachers Day: Author: Dr. Anthony CuschieriJulian ChackoNoch keine Bewertungen

- Direktori Rekanan Rumah Sakit Internasional 2015Dokument1.018 SeitenDirektori Rekanan Rumah Sakit Internasional 2015Agro Jaya KamparNoch keine Bewertungen

- SaveHinduTemples PDFDokument7 SeitenSaveHinduTemples PDFRavi RathoreNoch keine Bewertungen

- Noodles Illinois LocationDokument2 SeitenNoodles Illinois LocationWardah AuliaNoch keine Bewertungen

- XZNMDokument26 SeitenXZNMKinza ZebNoch keine Bewertungen

- Mulanay SummaryDokument1 SeiteMulanay SummaryJex Lexell BrionesNoch keine Bewertungen

- Minutes of Second English Language Panel Meeting 2023Dokument3 SeitenMinutes of Second English Language Panel Meeting 2023Irwandi Bin Othman100% (1)

- 2nd Prelim ExamDokument6 Seiten2nd Prelim Exammechille lagoNoch keine Bewertungen

- A Wolf by The Ears - Mattie LennonDokument19 SeitenA Wolf by The Ears - Mattie LennonMirNoch keine Bewertungen

- ,وثيقة تعارفDokument3 Seiten,وثيقة تعارفAyman DarwishNoch keine Bewertungen

- Louis I Kahn Trophy 2021-22 BriefDokument7 SeitenLouis I Kahn Trophy 2021-22 BriefMadhav D NairNoch keine Bewertungen

- Merger and Acquisition Review 2012Dokument2 SeitenMerger and Acquisition Review 2012Putri Rizky DwisumartiNoch keine Bewertungen

- People Vs Gonzales-Flores - 138535-38 - April 19, 2001 - JDokument10 SeitenPeople Vs Gonzales-Flores - 138535-38 - April 19, 2001 - JTrexPutiNoch keine Bewertungen