Beruflich Dokumente

Kultur Dokumente

313asi Accstand1

Hochgeladen von

mknatoo1963Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

313asi Accstand1

Hochgeladen von

mknatoo1963Copyright:

Verfügbare Formate

671

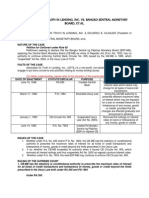

Accounting Standards Interpretation (ASI) 11

Substantial Period of Time

Accounting Standard (AS) 16, Borrowing Costs

ISSUE

1. Accounting Standard (AS) 16, Borrowing Costs, defines the term

‘qualifying asset’ as “an asset that necessarily takes a substantial period of

time to get ready for its intended use or sale”.

2. The issue is what is the meaning of the expression ‘substantial period of

time’ for the purpose of this definition.

CONSENSUS

3. The issue as to what constitutes a substantial period of time primarily

depends on the facts and circumstances of each case. However, ordinarily,

a period of twelve months is considered as substantial period of time unless

a shorter or longer period can be justified on the basis of facts and

circumstances of the case. In estimating the period, time which an asset

takes, technologically and commercially, to get it ready for its intended use

or sale should be considered.

4. The following assets ordinarily take twelve months or more to get ready

for intended use or sale unless the contrary can be proved by the enterprise:

(i) assets that are constructed or otherwise produced for an

enterprise’s own use, e.g., assets constructed under major capital

expansions.

(ii) assets intended for sale or lease that are constructed or otherwise

produced as discrete projects (for example, ships or real estate

developments).

5. In case of inventories, substantial period of time is considered to be

1 Published in ‘The Chartered Accountant’, June 2002, pp. 1512. The authority

of this ASI is the same as that of the Accounting Standard to which it relates.

The contents of this ASI are intended for the limited purpose of the Accounting

Standard

to which it relates. ASI is intended to apply only to material items.

672 Compendium of Accounting Standards

involved where time is the major factor in bringing about a change in the

condition of inventories. For example, liquor is often required to be kept in

store for more than twelve months for maturing.

BASIS FOR CONCLUSIONS

6. Paragraph 6 of AS 16 provides that “Borrowing costs that are directly

attributable to the acquisition, construction or production of a qualifying

asset should be capitalised as part of the cost of that asset. The amount

of borrowing costs eligible for capitalisation should be determined in

accordance with this Statement. Other borrowing costs should be

recognised as an expense in the period in which they are incurred”.

This paragraph recognises that borrowing costs should be expensed except

where they are directly attributable to acquisition, construction or production

of a qualifying asset. To qualify for capitalisation of borrowing costs, the

asset should take a long period of time to get ready for its intended use or

sale.

7. Paragraph 5 of AS 16 gives examples of manufacturing plants, power

generation facilities etc. as qualifying assets. In these cases, normally a period

of more than twelve months is required for getting them ready for their

intended use. Therefore, a rebuttable presumption of a period of twelve

months is considered “substantial” period of time.

8. Paragraph 5 of AS 16 provides, inter alia, that “inventories that are

routinely manufactured or otherwise produced in large quantities on a

repetitive basis over a short period of time, are not qualifying assets.”

Paragraph 12 of Accounting Standard (AS) 2, Valuation of Inventories,

provides that “Interest and other borrowing costs are usually considered

as not relating to bringing the inventories to their present location and

condition and are, therefore, usually not included in the cost of

inventories”. It is only in exceptional cases, where time is a major factor in

bringing about change in the condition of inventories that borrowing costs

are included in the valuation of inventories.

Das könnte Ihnen auch gefallen

- Accounting treatment of ROU land acquisitionDokument3 SeitenAccounting treatment of ROU land acquisitionVeronica RiveraNoch keine Bewertungen

- Ia 3 Chapter 2 DraftDokument48 SeitenIa 3 Chapter 2 DraftRuiz, CherryjaneNoch keine Bewertungen

- Summary of Jason A. Scharfman's Private Equity Operational Due DiligenceVon EverandSummary of Jason A. Scharfman's Private Equity Operational Due DiligenceNoch keine Bewertungen

- IAS - 23 - Borrowing - Costs For EditedDokument23 SeitenIAS - 23 - Borrowing - Costs For Editednati100% (1)

- Caballero Ba53 Chap 2Dokument32 SeitenCaballero Ba53 Chap 2Drew BooNoch keine Bewertungen

- IAS - 23 - Borrowing - Costs Edited 6 KiloDokument19 SeitenIAS - 23 - Borrowing - Costs Edited 6 KilonatiNoch keine Bewertungen

- Ias 23 Borrowing CostsDokument18 SeitenIas 23 Borrowing Costsesulawyer2001Noch keine Bewertungen

- Us2016 02 Fasb Lease Accounting Model Asc 842Dokument20 SeitenUs2016 02 Fasb Lease Accounting Model Asc 842CustSat ChunduriNoch keine Bewertungen

- 32 As 16 Borrowing CostsDokument17 Seiten32 As 16 Borrowing CostsParas JainNoch keine Bewertungen

- Ias 23 Borrowing CostsDokument18 SeitenIas 23 Borrowing CostsHagere EthiopiaNoch keine Bewertungen

- PWC Reportingperspectives: Ind As 23, Borrowings Costs' - From Theory To PracticeDokument13 SeitenPWC Reportingperspectives: Ind As 23, Borrowings Costs' - From Theory To PracticewileyNoch keine Bewertungen

- IAS - 23 - Borrowing - Costs IAS 23Dokument18 SeitenIAS - 23 - Borrowing - Costs IAS 23ramayoseframaNoch keine Bewertungen

- Borrowing Costs: Accounting Standard (AS) 16Dokument9 SeitenBorrowing Costs: Accounting Standard (AS) 16Deepak BhatiaNoch keine Bewertungen

- Article Review IAS 23Dokument3 SeitenArticle Review IAS 23belay27haileNoch keine Bewertungen

- AS 16 - Borrowing CostsDokument6 SeitenAS 16 - Borrowing CostsNilesh MandlikNoch keine Bewertungen

- Eac Query 1Dokument6 SeitenEac Query 1ratiNoch keine Bewertungen

- Material of As 16Dokument21 SeitenMaterial of As 16emmanuel JohnyNoch keine Bewertungen

- Borrowing Costs PDFDokument9 SeitenBorrowing Costs PDFanjcabsNoch keine Bewertungen

- Assignment of Management of Working Capital On Dehejia CommiteeDokument3 SeitenAssignment of Management of Working Capital On Dehejia CommiteeShubhamNoch keine Bewertungen

- Chapter 2 - Statement of Financial PositionDokument22 SeitenChapter 2 - Statement of Financial PositionKarylle EntinoNoch keine Bewertungen

- Manage Working CapitalDokument24 SeitenManage Working CapitalRushi RoyNoch keine Bewertungen

- Reviewer Borrowing Cost Sec. 1-10Dokument4 SeitenReviewer Borrowing Cost Sec. 1-10imsana minatozakiNoch keine Bewertungen

- Resource Planning PolicyDokument3 SeitenResource Planning Policymadhvi GajjarNoch keine Bewertungen

- Ind AS 23 Borrowing CostsDokument11 SeitenInd AS 23 Borrowing CostsvarshaNoch keine Bewertungen

- Chapter 8Dokument12 SeitenChapter 8ydinaNoch keine Bewertungen

- Intermediate Accounting Stice 18th Edition Solutions ManualDokument24 SeitenIntermediate Accounting Stice 18th Edition Solutions ManualCynthiaWalkerfeqb100% (35)

- IAS 23 Borrowing CostsDokument25 SeitenIAS 23 Borrowing Costsঅরূপ মিস্ত্রী বলেছেনNoch keine Bewertungen

- IAS 23 Borrowing Costs SummaryDokument4 SeitenIAS 23 Borrowing Costs Summaryanh anhNoch keine Bewertungen

- Accounting Standard (AS) 16 Borrowing Costs: ExplanationDokument5 SeitenAccounting Standard (AS) 16 Borrowing Costs: ExplanationArshad Hussain MazumderNoch keine Bewertungen

- Intermediate Accounting Stice 18th Edition Solutions ManualDokument45 SeitenIntermediate Accounting Stice 18th Edition Solutions ManualJames CarsonNoch keine Bewertungen

- As 16: Borrowing Cost: OverviewDokument7 SeitenAs 16: Borrowing Cost: OverviewShree Tisai100% (1)

- IAS 23 Borrowing Costs ExplainedDokument23 SeitenIAS 23 Borrowing Costs ExplainedMaybelle BernalNoch keine Bewertungen

- Accounting Standards FinalDokument13 SeitenAccounting Standards FinalHema GolaniNoch keine Bewertungen

- 6 - As-16 Borrowing CostsDokument15 Seiten6 - As-16 Borrowing CostsKrishna JhaNoch keine Bewertungen

- "Accounting Standard 6": Cbc10/2007/prakra177/javak/5/2062008 A Project Report OnDokument7 Seiten"Accounting Standard 6": Cbc10/2007/prakra177/javak/5/2062008 A Project Report OnparliavinashNoch keine Bewertungen

- GN Draft Exposure Capital ReserveDokument8 SeitenGN Draft Exposure Capital ReserveMURALI jNoch keine Bewertungen

- Indian Accounting Standard (Ind AS) 23 Borrowing Costs: ParagraphsDokument11 SeitenIndian Accounting Standard (Ind AS) 23 Borrowing Costs: ParagraphsSarathNoch keine Bewertungen

- Chapter Ii: Working Capital Management - A Conceptual OverviewDokument8 SeitenChapter Ii: Working Capital Management - A Conceptual OverviewAnkit ShahNoch keine Bewertungen

- Working Capital: EntryDokument9 SeitenWorking Capital: EntryOlagunju OlalekanNoch keine Bewertungen

- Intermediate Accounting Stice 18th Edition Solutions ManualDokument36 SeitenIntermediate Accounting Stice 18th Edition Solutions Manualdireful.trunnionmnwf5100% (33)

- Full Download Intermediate Accounting Stice 18th Edition Solutions Manual PDF Full ChapterDokument36 SeitenFull Download Intermediate Accounting Stice 18th Edition Solutions Manual PDF Full Chapternomaunerring1qqz100% (13)

- Statement of Financial PositionDokument36 SeitenStatement of Financial PositionAbdulmajed Unda MimbantasNoch keine Bewertungen

- 57053aasb46101 1Dokument17 Seiten57053aasb46101 1MuhammadNaumanNoch keine Bewertungen

- AC301 Off Balance Sheet FinancingDokument25 SeitenAC301 Off Balance Sheet Financinghui7411Noch keine Bewertungen

- 5.IAS 23 .Borrowing Cost Q&ADokument12 Seiten5.IAS 23 .Borrowing Cost Q&AAbdulkarim Hamisi KufakunogaNoch keine Bewertungen

- Module 3 - Statement of Financial Position PDFDokument22 SeitenModule 3 - Statement of Financial Position PDFSandyNoch keine Bewertungen

- AS 16 Borrowing Cost ThoeryDokument16 SeitenAS 16 Borrowing Cost ThoeryBharatbhusan RoutNoch keine Bewertungen

- To Keep Inventory at Sufficiently HighDokument2 SeitenTo Keep Inventory at Sufficiently HighMokhlesurNoch keine Bewertungen

- Ebook Company Accounting 10Th Edition Leo Solutions Manual Full Chapter PDFDokument67 SeitenEbook Company Accounting 10Th Edition Leo Solutions Manual Full Chapter PDFjezebelkaylinvpoqn100% (11)

- TermsDokument24 SeitenTermsreena_h_107776Noch keine Bewertungen

- FM Assignment PDFDokument9 SeitenFM Assignment PDFkhetaljainNoch keine Bewertungen

- Accounting Standard 6Dokument9 SeitenAccounting Standard 6api-3828505Noch keine Bewertungen

- Financial Management Chapter 10.1Dokument33 SeitenFinancial Management Chapter 10.1CA Uma KrishnaNoch keine Bewertungen

- Objectives of Financial StatementsDokument20 SeitenObjectives of Financial StatementsCharlene ViceralNoch keine Bewertungen

- 66681bos53808 cp10 UnlockedDokument147 Seiten66681bos53808 cp10 UnlockedThe FlashNoch keine Bewertungen

- Measurement and Depreciation-Part 1Dokument5 SeitenMeasurement and Depreciation-Part 1HoJoJoNoch keine Bewertungen

- Ias 23Dokument6 SeitenIas 23faridaNoch keine Bewertungen

- Ias 23 PDFDokument4 SeitenIas 23 PDFArvind PremNoch keine Bewertungen

- Illustrations: I. Computation and Discharge of Purchase Consideration Illustration - 1Dokument1 SeiteIllustrations: I. Computation and Discharge of Purchase Consideration Illustration - 1mknatoo1963Noch keine Bewertungen

- Graduate Engineers' Association: Maharashtra State Power Generation Company Ltd. (M.S.E.B.)Dokument1 SeiteGraduate Engineers' Association: Maharashtra State Power Generation Company Ltd. (M.S.E.B.)mknatoo1963Noch keine Bewertungen

- Chemistry Part-I Notes on SolidsDokument2 SeitenChemistry Part-I Notes on Solidsmknatoo1963Noch keine Bewertungen

- NDMA India's Pocketbook of Do's and Don'ts For Various DisastersDokument118 SeitenNDMA India's Pocketbook of Do's and Don'ts For Various DisastersNdma India100% (2)

- R A & A W: Eactions of Lkenes Lkynes OrksheetDokument2 SeitenR A & A W: Eactions of Lkenes Lkynes Orksheetmknatoo1963Noch keine Bewertungen

- Maharashtra Board SSC-X Algebra Sample Paper 1Dokument2 SeitenMaharashtra Board SSC-X Algebra Sample Paper 1mknatoo1963Noch keine Bewertungen

- ) Maharashtra Board SSC-X Algebra Sample Paper 2Dokument2 Seiten) Maharashtra Board SSC-X Algebra Sample Paper 2mknatoo1963Noch keine Bewertungen

- 02 Gravitation PDFDokument6 Seiten02 Gravitation PDFmknatoo1963Noch keine Bewertungen

- Illustration 6Dokument6 SeitenIllustration 6mknatoo1963Noch keine Bewertungen

- MknspashtagrahaDokument3 SeitenMknspashtagrahamknatoo1963Noch keine Bewertungen

- Taxation Syllabus SolutionsDokument10 SeitenTaxation Syllabus Solutionsmknatoo1963Noch keine Bewertungen

- Paper 5Dokument9 SeitenPaper 5mknatoo1963Noch keine Bewertungen

- Clarification Academics DPT 2014Dokument1 SeiteClarification Academics DPT 2014mknatoo1963Noch keine Bewertungen

- Financial Reserves and Capital MovementsDokument1 SeiteFinancial Reserves and Capital Movementsmknatoo1963Noch keine Bewertungen

- Maharashtra SSC 2013 Exam Date SheetDokument1 SeiteMaharashtra SSC 2013 Exam Date Sheetmknatoo1963Noch keine Bewertungen

- "Darkred" "Red": For To For ToDokument7 Seiten"Darkred" "Red": For To For Tomknatoo1963Noch keine Bewertungen

- General Election 2014 Live ResultsisNULL MAHARASHTRADokument4 SeitenGeneral Election 2014 Live ResultsisNULL MAHARASHTRAmknatoo1963Noch keine Bewertungen

- This Program Performs Matrix AdditionDokument6 SeitenThis Program Performs Matrix Additionmknatoo1963Noch keine Bewertungen

- February 28Dokument23 SeitenFebruary 28mknatoo1963Noch keine Bewertungen

- MarutiDokument6 SeitenMarutimknatoo1963Noch keine Bewertungen

- Study MaterialDokument6 SeitenStudy Materialmknatoo1963Noch keine Bewertungen

- Financial Reserves and Capital MovementsDokument1 SeiteFinancial Reserves and Capital Movementsmknatoo1963Noch keine Bewertungen

- 800 Andalto 800Dokument15 Seiten800 Andalto 800mknatoo1963Noch keine Bewertungen

- Clock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following OccasionsDokument5 SeitenClock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following Occasionsmknatoo1963Noch keine Bewertungen

- Cons Sa P11-S2Dokument58 SeitenCons Sa P11-S2mknatoo1963Noch keine Bewertungen

- Corporate Laws MyNotesDokument10 SeitenCorporate Laws MyNotesmknatoo1963Noch keine Bewertungen

- SMDokument1 SeiteSMmknatoo1963Noch keine Bewertungen

- Car BrochureDokument2 SeitenCar Brochuremknatoo1963Noch keine Bewertungen

- Clock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following OccasionsDokument5 SeitenClock Shall Show Correct Time Even If Minute and Hour Hand Interchanged On Following Occasionsmknatoo1963Noch keine Bewertungen

- "Darkred" "Red": For To For ToDokument7 Seiten"Darkred" "Red": For To For Tomknatoo1963Noch keine Bewertungen

- IGNOU MBA Project ManagemntDokument27 SeitenIGNOU MBA Project ManagemntAmit SharmaNoch keine Bewertungen

- 1.1. Introduction To Engineering Management 2 2019Dokument30 Seiten1.1. Introduction To Engineering Management 2 2019NelsonTingNoch keine Bewertungen

- Advocates of Til vs. BSPDokument3 SeitenAdvocates of Til vs. BSPIrene RamiloNoch keine Bewertungen

- Internship Journal SBE Accounting DepartmentDokument7 SeitenInternship Journal SBE Accounting DepartmentMirza Bake BahorNoch keine Bewertungen

- Functions & Power - Suruhanjaya Syarikat Malaysia (SSM)Dokument1 SeiteFunctions & Power - Suruhanjaya Syarikat Malaysia (SSM)Khairun NisyaNoch keine Bewertungen

- PWC Financing Guide 122022Dokument382 SeitenPWC Financing Guide 122022M Tariqul Islam Mishu100% (1)

- Frequently Asked Questions UP Provident FundDokument2 SeitenFrequently Asked Questions UP Provident FundPam Otic-ReyesNoch keine Bewertungen

- Sale Deed and Power of Attorney - 20200429165630Dokument14 SeitenSale Deed and Power of Attorney - 20200429165630harmanpreet kaurNoch keine Bewertungen

- Introduction To Accounting and Business: Principles of Financial Accounting With Conceptual Emphasis On IFRSDokument109 SeitenIntroduction To Accounting and Business: Principles of Financial Accounting With Conceptual Emphasis On IFRSRandita SyafrandinelNoch keine Bewertungen

- Great Pacific Life vs. CA Scire LicetDokument2 SeitenGreat Pacific Life vs. CA Scire LicetJetJuárezNoch keine Bewertungen

- Csec Poa June 2013 p1Dokument13 SeitenCsec Poa June 2013 p1Maya Willims85% (20)

- Sesbreno vs. CADokument5 SeitenSesbreno vs. CALyNne OpenaNoch keine Bewertungen

- 201244WAR1Dokument716 Seiten201244WAR1Sam MaurerNoch keine Bewertungen

- Civil ProcedureDokument6 SeitenCivil ProcedureAya BeltranNoch keine Bewertungen

- Icici PolicyDokument2 SeitenIcici Policydeepak7837Noch keine Bewertungen

- Verification of Cash Payment To SubscriptionDokument2 SeitenVerification of Cash Payment To SubscriptionAlexNoch keine Bewertungen

- Manual of Regulations For Non Banks Financial Inst Vol 2Dokument337 SeitenManual of Regulations For Non Banks Financial Inst Vol 2Neneng KunaNoch keine Bewertungen

- EXTRAS DE CONT ACCOUNT STATEMENTDokument1 SeiteEXTRAS DE CONT ACCOUNT STATEMENTAndreeaNoch keine Bewertungen

- Time Value of Money ExplainedDokument24 SeitenTime Value of Money ExplainedRionel Kristian Lee ZarateNoch keine Bewertungen

- BillingStatement - LOLITA P. AREVALO - 2Dokument2 SeitenBillingStatement - LOLITA P. AREVALO - 2Franco Evale YumulNoch keine Bewertungen

- Financial Research Report Fin 534Dokument15 SeitenFinancial Research Report Fin 534Angelo Logan75% (4)

- CBSE Class 10 EconomicsDokument4 SeitenCBSE Class 10 EconomicsVishal DeyNoch keine Bewertungen

- Jaminan Kewangan BiDokument4 SeitenJaminan Kewangan BiWilson Lim100% (1)

- Promissory Note TemplateDokument1 SeitePromissory Note TemplateJhoana Parica FranciscoNoch keine Bewertungen

- Rashmi PDF of ReportDokument67 SeitenRashmi PDF of ReportrashmiNoch keine Bewertungen

- Sworn Statement of Assets, Liabilities and Net WorthDokument3 SeitenSworn Statement of Assets, Liabilities and Net WorthJf ManejaNoch keine Bewertungen

- Whistleblower Report On Bank of America Foreclosure Reviews Ebook 4 13Dokument72 SeitenWhistleblower Report On Bank of America Foreclosure Reviews Ebook 4 13Allen Kaul100% (3)

- Simple and General Annuities: LessonDokument18 SeitenSimple and General Annuities: LessonLyka MercadoNoch keine Bewertungen

- English - FINAL DRAFT UNS P1-11 HUMAN OBLIGATION GENERAL LEDGER EXAMPLE FOR DISTRIBUTION PHASE 2Dokument5 SeitenEnglish - FINAL DRAFT UNS P1-11 HUMAN OBLIGATION GENERAL LEDGER EXAMPLE FOR DISTRIBUTION PHASE 2UN Swissindo100% (1)

- FM12 CH 05 Tool KitDokument31 SeitenFM12 CH 05 Tool KitJamie RossNoch keine Bewertungen

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetVon EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNoch keine Bewertungen

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- Profit First for Therapists: A Simple Framework for Financial FreedomVon EverandProfit First for Therapists: A Simple Framework for Financial FreedomNoch keine Bewertungen

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (12)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantVon EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantBewertung: 4.5 von 5 Sternen4.5/5 (146)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyVon EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyBewertung: 5 von 5 Sternen5/5 (1)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItVon EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItBewertung: 5 von 5 Sternen5/5 (13)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Project Control Methods and Best Practices: Achieving Project SuccessVon EverandProject Control Methods and Best Practices: Achieving Project SuccessNoch keine Bewertungen

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesVon EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesBewertung: 4.5 von 5 Sternen4.5/5 (30)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Von EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Bewertung: 5 von 5 Sternen5/5 (1)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Von EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Bewertung: 4 von 5 Sternen4/5 (33)

- Basic Accounting: Service Business Study GuideVon EverandBasic Accounting: Service Business Study GuideBewertung: 5 von 5 Sternen5/5 (2)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelVon Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNoch keine Bewertungen

- Cost & Managerial Accounting I EssentialsVon EverandCost & Managerial Accounting I EssentialsBewertung: 4 von 5 Sternen4/5 (14)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyVon EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyBewertung: 4 von 5 Sternen4/5 (4)

- B2B Marketing 123: A 3 Step Approach for Marketing to BusinessesVon EverandB2B Marketing 123: A 3 Step Approach for Marketing to BusinessesNoch keine Bewertungen