Beruflich Dokumente

Kultur Dokumente

6 - 2 - 2017 Tpe

Hochgeladen von

Samuel FonsecaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

6 - 2 - 2017 Tpe

Hochgeladen von

Samuel FonsecaCopyright:

Verfügbare Formate

ThePlasticsExchange Market Update June 2nd, 2017

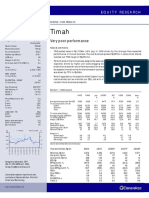

bringing the market to you Resin for Sale 16,200,264 lbs Spot Range TPE Index

The spot resin markets remained active in this past holiday shortened week; month-end fell midweek and

completed volumes were high. Spot supply for most commodity grades of Polyethylene and Polypropylene Resin Total lbs Low High Bid Offer

were available and ample; prime prices were steady across the board, offgrade was weaker. Most PE produc-

ers have conceded a $.03/lb contract decrease for May; several have also rescinded outstanding nominations, HDPE - Blow 2,669,588 $ 0.490 $ 0.560 $ 0.470 $ 0.510

so June contracts will be flat at best. PP contracts declined $.075/lb in May, equal to the drop in PGP monomer

LDPE - Film 2,293,220 $ 0.560 $ 0.650 $ 0.580 $ 0.620

costs; indications currently point to little change, neither up nor down, for June. Incremental high volume ex-

ports have been sluggish, as international resin market sentiment has been neutral to bearish and regional HMWPE - Film 1,865,496 $ 0.500 $ 0.565 $ 0.490 $ 0.530

www.ThePlasticsExchange.com

MARKET UPDATE

supply quite competitive.

PP Copo - Inj 1,741,288 $ 0.500 $ 0.590 $ 0.510 $ 0.550

The major energy markets fell sharply, highs were seen as trading began on Tuesday with lows made near the PP Homo - Inj 1,685,288 $ 0.490 $ 0.560 $ 0.480 $ 0.520

end of the week. Although WTI Crude Oil recovered almost a buck from its Friday low, the July futures contract

was still down a net $2.14/bbl to $47.66/bbl. August Brent Oil futures lost $2.56/bbl, nearly 5%, to settle Friday LLDPE - Film 1,465,472 $ 0.510 $ 0.595 $ 0.510 $ 0.550

at $49.95/bbl - which kinda seems like a promotional sales price! July Natural Gas futures chunked off a whop- LLDPE - Inj 1,148,460 $ 0.530 $ 0.620 $ 0.550 $ 0.590

ping $.311/mmBtu, nearly 10%, and went into the weekend just below the $3/mmBtu threshold $2.999/

mmBtu to be exact, which is the lowest close since the end of Feb. LDPE - Inj 906,460 $ 0.560 $ 0.635 $ 0.560 $ 0.600

HDPE - Inj 350,644 $ 0.610 $ 0.670 $ 0.590 $ 0.630

Prompt NGL markets were pressured and priced lower. Ethane for June fell almost $.02/gal, to end the week

below $.24/gal ($.101/lb). Propane lost a hefty 7% to close the week at $.61/gal ($.173/lb). Spot Ethylene activ-

ity picked up and the market firmed. Material for June delivery, which had been discounted to May, was marked

higher to $.27/lb, quickly recouping most of that backwardation. The spot Propylene market has yet to re-

awaken and held steady to a penny firmer near $.37/lb. Current spot PGP levels indicate that the 2 nd quarter

break seems to have already run its course, and even points to a slightly higher contract level for June, perhaps

a penny.

Spot Polyethylene trading was busy, there was a flurry of railcar offers into month-end and the offers continued

to flow as June began. There was a good mix of prime and offgrade seen and though prime held steady, the

offgrade discount widened. The material was well received by processors who had been whittling down their

inventories awaiting cheaper prices. Completed volumes were heavily favored towards film grades, including all

HMW, LDPE and LLDPE. Injection grade HDPE remained super snug and all reasonably priced offers were HDPE Blow Molding

quickly snatched up. Some unreasonably priced material went unsold proving that there is a limit to acceptable 1 Year

pricing, even in very tight markets.

Most Polyethylene contracts were down $.03/lb in May and currently sit up a nickel during 2017. The spot Poly-

ethylene market peaked in the beginning of March and except for HDPE Injection, has come down sharply, and

in varying degrees based on product. We normally see some price movement between grades, but the pre-

mium swings in this down cycle have been extraordinary. The Polyethylene markets upward momentum is long

gone and even considering the $.03/lb May decrease, spot PE is transacting at a nice discount to general con- PP Homopolymer

tract levels. There is not a cohesive price increase effort on the table for June and it seems that contracts have 1 Year

room to slide a bit further.

Polypropylene trading activity was pretty good; while there were plenty of buyer inquiries, completed volumes

fell short and below average. Fresh railcar offers have slowed to a trickle; generic prime resin is somewhat

scarce, especially Copolymer, and available offgrade resin is leaning towards lower-end quality. Resellers with

recently purchased inventory have generally raised asking prices a tad, though some with older and lower

priced stocks are still dealing on price, which is a sign that demand has disappointed as pockets of old inven-

tory still remain.

Expectations for another price decrease in June appear to be squashed by firmer monomer costs and tighten-

ing supply/demand dynamics. However, processors continue to scour the market for cheap price levels that we

have not seen for weeks. Upstream inventories are relatively snug and it seems that processors will need to

Michael Greenberg

come back to procure material. We believe there is potential for modest upside ahead in pricing.

312.202.0002 Disclaimer: The information and data in this report is gathered from exchange observations as well as interactions with producers, distributors, brokers and

@ResinGuru

processors. These are considered reliable. The accuracy and completeness of this information is not guaranteed. Any decision to purchase or sell as a result of

the opinions expressed in this report will be the full responsibility of the person authorizing such a transaction. Our market updates are complied with integrity and

we hope that you find them of value. Chart values reflect our asking prices of generic prime railcars delivered in USA. Dominick Russo and Fred Dial Editors

Copyright 2017 The Plastics Exchange, LLC | Patent Protected | All Rights Reserved.

Das könnte Ihnen auch gefallen

- The Exchange: PlasticsDokument1 SeiteThe Exchange: PlasticsSamuel FonsecaNoch keine Bewertungen

- The Exchange: PlasticsDokument3 SeitenThe Exchange: PlasticsJohn SotoNoch keine Bewertungen

- The Plastic Exchange Report 2015.09.04Dokument1 SeiteThe Plastic Exchange Report 2015.09.04contreraeNoch keine Bewertungen

- Argus DeWitt PolymersDokument9 SeitenArgus DeWitt Polymersdrmohamed120Noch keine Bewertungen

- Prices PE y PP JulyDokument6 SeitenPrices PE y PP JulySamuel FonsecaNoch keine Bewertungen

- 12 06 2013 PDFDokument1 Seite12 06 2013 PDFMelih AltıntaşNoch keine Bewertungen

- Argus PolymersDokument11 SeitenArgus PolymersIvan PavlovNoch keine Bewertungen

- Polyethylene Europe: Chemical Prices - News - AnalysisDokument5 SeitenPolyethylene Europe: Chemical Prices - News - AnalysisJuan Carlos BeltranNoch keine Bewertungen

- Oxychem Raising Caustic Soda PricesDokument1 SeiteOxychem Raising Caustic Soda PricesKimberly ConleyNoch keine Bewertungen

- Argus Propylene and DerivativesDokument11 SeitenArgus Propylene and Derivativesagarwalashwin32Noch keine Bewertungen

- Pricing Sample All PetrochemicalsDokument18 SeitenPricing Sample All Petrochemicalsrbrijeshgbiresearch100% (1)

- Chemicals Dimethyl TerephthalateDokument3 SeitenChemicals Dimethyl TerephthalateHafiz Rama DevaraNoch keine Bewertungen

- Sample: Butanediol (Asia Pacific)Dokument2 SeitenSample: Butanediol (Asia Pacific)Pradhita Ramdani HNoch keine Bewertungen

- Olefins E-Ethy 2 - 15 - 2013Dokument3 SeitenOlefins E-Ethy 2 - 15 - 2013Amin Soleimani MehrNoch keine Bewertungen

- Natural Gas - A Messy Bottom - Seeking AlphaDokument7 SeitenNatural Gas - A Messy Bottom - Seeking AlphalusavkaNoch keine Bewertungen

- Chemicals PropyleneDokument3 SeitenChemicals PropyleneTrizEugheneSilesNoch keine Bewertungen

- Phthalic Anhydride (Europe) 5 Jul 2019Dokument3 SeitenPhthalic Anhydride (Europe) 5 Jul 2019Kalai Arasi100% (1)

- Sample: PhenolDokument3 SeitenSample: PhenolArif PurwadanaNoch keine Bewertungen

- JP Morgan KLBN4@BZ Pulp Open Parachute - Downgrading SUZB & KLBN To NeutraDokument26 SeitenJP Morgan KLBN4@BZ Pulp Open Parachute - Downgrading SUZB & KLBN To NeutraVinicius AssisNoch keine Bewertungen

- Greenea Market Watch April 2019Dokument6 SeitenGreenea Market Watch April 2019Kerr JavierNoch keine Bewertungen

- AsiaNaphtha SampleDokument14 SeitenAsiaNaphtha SamplefajaradityadarmaNoch keine Bewertungen

- Alternative Fuels & Products 2022-02-14Dokument11 SeitenAlternative Fuels & Products 2022-02-14JoeNoceraNoch keine Bewertungen

- Acetone MarketDokument7 SeitenAcetone MarketRocío Vallejo ValeroNoch keine Bewertungen

- ICIS Ethylene Glycols US - Pricing & Insight-17-Aug-2023Dokument5 SeitenICIS Ethylene Glycols US - Pricing & Insight-17-Aug-2023Jesús GonzálezNoch keine Bewertungen

- Propylene (Asia-Pacific) 31 Jan 2020Dokument5 SeitenPropylene (Asia-Pacific) 31 Jan 2020Wira Nata S SinuhajiNoch keine Bewertungen

- Intermodal Weekly Market Report 3rd February 2015, Week 5Dokument9 SeitenIntermodal Weekly Market Report 3rd February 2015, Week 5Budi PrayitnoNoch keine Bewertungen

- Sample: Acrylonitrile (US Gulf)Dokument3 SeitenSample: Acrylonitrile (US Gulf)martmrdNoch keine Bewertungen

- PET Raw Material Futures OutlookDokument4 SeitenPET Raw Material Futures OutlookMd. Saidul IslamNoch keine Bewertungen

- Angela CancelledDokument4 SeitenAngela CancelledMike KrugerNoch keine Bewertungen

- Chemical, Petrochemical Prices, Margins and Trends: February 2021Dokument36 SeitenChemical, Petrochemical Prices, Margins and Trends: February 2021crazyman2009Noch keine Bewertungen

- Tins 060831Dokument2 SeitenTins 060831Cristiano DonzaghiNoch keine Bewertungen

- Denali Investors - Columbia Business School Presentation 2008 Fall v3Dokument28 SeitenDenali Investors - Columbia Business School Presentation 2008 Fall v3ValueWalkNoch keine Bewertungen

- Commodity IndexDokument4 SeitenCommodity IndexEdson MutyavaviriNoch keine Bewertungen

- Nov/30/2010 - Free Intelligent Investors (UK Edition)Dokument7 SeitenNov/30/2010 - Free Intelligent Investors (UK Edition)International Business TimesNoch keine Bewertungen

- AsiaNaphtha SampleDokument21 SeitenAsiaNaphtha Samplesmartleo_waloNoch keine Bewertungen

- Ping An Insurance Group: Merger Between SDB and Ping An Bank Announced - AlertDokument5 SeitenPing An Insurance Group: Merger Between SDB and Ping An Bank Announced - Alertcma_adpradhanNoch keine Bewertungen

- Understanding Flexible PU Prices IncreaseDokument38 SeitenUnderstanding Flexible PU Prices IncreasedangcongsanNoch keine Bewertungen

- Peyto Exploration & Development Corp. President's Monthly ReportDokument2 SeitenPeyto Exploration & Development Corp. President's Monthly ReportCanadianValueNoch keine Bewertungen

- RBS Round Up: 09 September 2010Dokument8 SeitenRBS Round Up: 09 September 2010egolistocksNoch keine Bewertungen

- Sample: Polyethylene Terephthalate (Asia Pacific)Dokument2 SeitenSample: Polyethylene Terephthalate (Asia Pacific)ivanNoch keine Bewertungen

- Price Report Jun 11Dokument3 SeitenPrice Report Jun 11shigidimNoch keine Bewertungen

- Market Watch Synopsis March 02 2012Dokument4 SeitenMarket Watch Synopsis March 02 2012allwell12Noch keine Bewertungen

- JP Morgan Research Report - RBDokument11 SeitenJP Morgan Research Report - RBankigoelNoch keine Bewertungen

- Westpack JUL 15 Mornng ReportDokument1 SeiteWestpack JUL 15 Mornng ReportMiir ViirNoch keine Bewertungen

- Glencore: Revised Guidance Highlights Cash Flow Underpin. BUYDokument13 SeitenGlencore: Revised Guidance Highlights Cash Flow Underpin. BUYMudit KediaNoch keine Bewertungen

- 0707PMDokument2 Seiten0707PMZerohedgeNoch keine Bewertungen

- RBS Round Up: 02 September 2010Dokument8 SeitenRBS Round Up: 02 September 2010egolistocksNoch keine Bewertungen

- Material Price List PDFDokument6 SeitenMaterial Price List PDFerwin sarmiento100% (1)

- China, SE Asia and Turkey Polyolefins: Impact On Increasing Global CapacityDokument30 SeitenChina, SE Asia and Turkey Polyolefins: Impact On Increasing Global CapacitySam Cheng100% (1)

- EMEA First To Market: Top Research For Monday, 17 May 2010Dokument30 SeitenEMEA First To Market: Top Research For Monday, 17 May 2010jimmyttlNoch keine Bewertungen

- Rate Report 3.4.19Dokument13 SeitenRate Report 3.4.19PolymerBazaarNoch keine Bewertungen

- 1.4 Buffer StocksDokument6 Seiten1.4 Buffer StocksUwais. PatelNoch keine Bewertungen

- Intelligent Investor UK Edition January 17 2011Dokument7 SeitenIntelligent Investor UK Edition January 17 2011International Business TimesNoch keine Bewertungen

- February - 2022 - PET (& Raw Materials) Profitability in 2022 - West Welcomes Sharp ImprovementDokument6 SeitenFebruary - 2022 - PET (& Raw Materials) Profitability in 2022 - West Welcomes Sharp ImprovementGudNoch keine Bewertungen

- RBS: Round Up For 27 August 2010Dokument11 SeitenRBS: Round Up For 27 August 2010egolistocksNoch keine Bewertungen

- Brace Yourself For Natural Gas Supply and Demand Mismatch On Hurricane Delta - Seeking AlphaDokument7 SeitenBrace Yourself For Natural Gas Supply and Demand Mismatch On Hurricane Delta - Seeking AlphalusavkaNoch keine Bewertungen

- RBS Round Up: 25 October 2010Dokument9 SeitenRBS Round Up: 25 October 2010egolistocksNoch keine Bewertungen

- GMS Ship Recycling - Weekly FactsDokument9 SeitenGMS Ship Recycling - Weekly FactsTom LNoch keine Bewertungen

- Costco Wholesale Corporation: July Core SSS Turns Negative 0.3%, Deflation To Blame - ALERTDokument4 SeitenCostco Wholesale Corporation: July Core SSS Turns Negative 0.3%, Deflation To Blame - ALERTJohnAnnaIdaNoch keine Bewertungen

- Commodities for Every Portfolio: How You Can Profit from the Long-Term Commodity BoomVon EverandCommodities for Every Portfolio: How You Can Profit from the Long-Term Commodity BoomNoch keine Bewertungen

- LDI2020 enUS ASTMDokument1 SeiteLDI2020 enUS ASTMSamuel FonsecaNoch keine Bewertungen

- 7 7 2017Dokument1 Seite7 7 2017Samuel FonsecaNoch keine Bewertungen

- Tpe 6 - 9 - 2017Dokument1 SeiteTpe 6 - 9 - 2017Samuel FonsecaNoch keine Bewertungen

- 6 - 2 - 2017 TpeDokument1 Seite6 - 2 - 2017 TpeSamuel FonsecaNoch keine Bewertungen

- 7 - 21 - 2017 TpeDokument1 Seite7 - 21 - 2017 TpeSamuel FonsecaNoch keine Bewertungen

- Plastic Exchange Report JuneDokument1 SeitePlastic Exchange Report JuneSamuel FonsecaNoch keine Bewertungen

- From Good To Great: An Introduction To Servant Leadership Gemeco March 2018Dokument33 SeitenFrom Good To Great: An Introduction To Servant Leadership Gemeco March 2018Papa KingNoch keine Bewertungen

- ConceptDraw Project 8 Reference MacDokument90 SeitenConceptDraw Project 8 Reference MacGerome KlausNoch keine Bewertungen

- Project Appraisal FinanceDokument20 SeitenProject Appraisal Financecpsandeepgowda6828Noch keine Bewertungen

- MBA Result 2014 16Dokument7 SeitenMBA Result 2014 16SanaNoch keine Bewertungen

- Goldenson 2020Dokument123 SeitenGoldenson 2020wajiceNoch keine Bewertungen

- ISO 17025 PresentationDokument48 SeitenISO 17025 PresentationSanthosh Srinivasan100% (1)

- INTERN 1 DefinitionsDokument2 SeitenINTERN 1 DefinitionsJovis MalasanNoch keine Bewertungen

- Merchandise Assortment PlanningDokument9 SeitenMerchandise Assortment PlanningJyotika ThakurNoch keine Bewertungen

- Biz - Quatitative - Managment.Method Chapter.07Dokument27 SeitenBiz - Quatitative - Managment.Method Chapter.07phannarithNoch keine Bewertungen

- Mid Term Exam 1 - Fall 2018-799Dokument3 SeitenMid Term Exam 1 - Fall 2018-799abdirahmanNoch keine Bewertungen

- Amount of Investment Bonus Method: Than Investment Greater Than InvestmentDokument14 SeitenAmount of Investment Bonus Method: Than Investment Greater Than InvestmentElla Mae Clavano NuicaNoch keine Bewertungen

- Organizational StructureDokument7 SeitenOrganizational StructureSiva Prasad KantipudiNoch keine Bewertungen

- Unit 4 The Hospitality Industry: Ntroduction To Tourism HMGTDokument44 SeitenUnit 4 The Hospitality Industry: Ntroduction To Tourism HMGTdilanocockburnNoch keine Bewertungen

- Evolution: Maintenance ObjectivesDokument8 SeitenEvolution: Maintenance ObjectivesAkshay SharmaNoch keine Bewertungen

- Comparing FTTH Access Networks Based On P2P and PMP Fibre TopologiesDokument9 SeitenComparing FTTH Access Networks Based On P2P and PMP Fibre TopologiesWewe SlmNoch keine Bewertungen

- Royal Laundry ServicesDokument34 SeitenRoyal Laundry ServicesRian Atienza EclarNoch keine Bewertungen

- Ax2012 Enus Deviv 05 PDFDokument32 SeitenAx2012 Enus Deviv 05 PDFBachtiar YanuariNoch keine Bewertungen

- BXL22 23437Dokument1 SeiteBXL22 23437zilaniNoch keine Bewertungen

- Announcement Invitation For Psychotest (October)Dokument17 SeitenAnnouncement Invitation For Psychotest (October)bgbfbvmnmNoch keine Bewertungen

- Perfetti (Himanshu)Dokument84 SeitenPerfetti (Himanshu)Sanjay Panwar33% (3)

- OTS Prepay and Valuing Individual Mortgage Servicing Contracts - A Comparison Between Adjust Rate Mortgages and Fixed Rate MortgagesDokument16 SeitenOTS Prepay and Valuing Individual Mortgage Servicing Contracts - A Comparison Between Adjust Rate Mortgages and Fixed Rate MortgagesfhdeutschmannNoch keine Bewertungen

- TOA Reviewer (UE) - Bank Reconcilation PDFDokument1 SeiteTOA Reviewer (UE) - Bank Reconcilation PDFjhallylipmaNoch keine Bewertungen

- Constitutional Provisions For Labor Law PhilippinesDokument1 SeiteConstitutional Provisions For Labor Law PhilippinesAgnes GamboaNoch keine Bewertungen

- MM Module Course Contents PDFDokument3 SeitenMM Module Course Contents PDFpunamNoch keine Bewertungen

- DO Section 5-6Dokument46 SeitenDO Section 5-6Gianita SimatupangNoch keine Bewertungen

- Evaluating Personnel and DivisionsDokument37 SeitenEvaluating Personnel and DivisionsGaluh Boga KuswaraNoch keine Bewertungen

- Threat and Risk Assessment TemplateDokument30 SeitenThreat and Risk Assessment TemplateMarija PetkovicNoch keine Bewertungen

- Materi 9A Bench MarkingDokument66 SeitenMateri 9A Bench Markingapi-3756301100% (5)

- Comparative Case Study Between Two AirlineDokument56 SeitenComparative Case Study Between Two AirlineGagandeep SinghNoch keine Bewertungen

- Lennox ReportDokument2 SeitenLennox ReportSaj JadNoch keine Bewertungen