Beruflich Dokumente

Kultur Dokumente

IFS WHT Foreign Services - Accounting Treatment

Hochgeladen von

FrancisCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IFS WHT Foreign Services - Accounting Treatment

Hochgeladen von

FrancisCopyright:

Verfügbare Formate

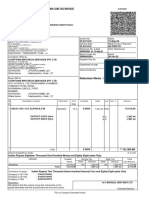

Withholding Tax - Accounting Treatment on Foreign Services

SEK is faced with multiple scenarios when accounting for WHT on foreign services, dependant on the commercial arrangem

Example for Accounting Purposes - Invoice Value $10,000

SCENARIO 1 - WHT is deducted in accordance with DRC law from supplier's invoice

Step 1 Dr Cost/Project 10,000.00 Being recording of vaue of foreign service awaiting pa

Cr GRNI/AP (10,000.00)

Step 2 Dr AP 1,400.00 Being recognition of 14% WHT deducted from supplie

Cr WHT Payable (1,400.00)

Step 3 Dr AP 8,600.00 Being payment to supplier net of WHT

Cr Bank (8,600.00)

Step 4 Dr WHT Payable 1,400.00 Being payment to DRC Govt for WHT

Cr Bank (1,400.00)

Cost Account (P&L) WHT Payable (BS)

Step 1 10,000 Step 4 1,400 Step 2 1,400

SCENARIO 2 - Invoice value is grossed up to allow WHT to be deducted correctly and supplier to be paid invoice va

Step 1 Dr Cost/Project 11,627.91 Being recording of vaue of foreign service awaiting pa

Cr GRNI/AP 11,627.91

Step 2 Dr AP 1,627.91 Being recognition of 14% WHT deducted from supplie

Cr WHT Payable (1,627.91)

Step 3 Dr AP 10,000.00 Being payment to supplier net of WHT

Cr Bank (10,000.00)

Step 4 Dr WHT Payable 1,627.91 Being payment to DRC Govt for WHT

Cr Bank (1,627.91)

Cost Account (P&L) WHT Payable (BS)

Step 1 11,627 Step 4 1,627 Step 2 1,627

SCENARIO 3 - Supplier refuses to have WHT deducted from Invoice value nor agrees to gross up invoice value for

Step 1 Dr Cost/Project 10,000.00 Being recording of vaue of foreign service awaiting pa

Cr GRNI/AP 10,000.00

Step 2 Dr WHT Expense 1,400.00 Being expensing of WHT not deductible

Cr WHT Payable (1,400.00)

Step 3 Dr AP 10,000.00 Being payment to supplier

Cr Bank (10,000.00)

Step 4 Dr WHT Payable 1,400.00 Being payment to DRC Govt for WHT

Cr Bank (1,400.00)

Cost Account (P&L) WHT Payable (BS)

Step 1 10,000 Step 4 1,400 Step 2 1,400

ign Services

nt on the commercial arrangement agreed with the supplier

of foreign service awaiting payment

% WHT deducted from supplier invoice

er net of WHT

Govt for WHT

AP/GRNI (BS) Bank (BS)

Step 2 1,400 Step 1 10,000 Step 3 8,600

Step 3 8,600 Step 4 1,400

upplier to be paid invoice value prior to gross up

of foreign service awaiting payment

% WHT deducted from supplier invoice

er net of WHT

Govt for WHT

AP/GRNI (BS) Bank (BS)

Step 2 1,627 Step 1 11,627 Step 3 10,000

Step 3 10,000 Step 4 1,627

o gross up invoice value for WHT

of foreign service awaiting payment

T not deductible

Govt for WHT

AP/GRNI (BS) Bank (BS) WHT Expense (P&L)

Step 3 10,000 Step 1 10,000 Step 3 10,000 Step 2 1,400

Step 4 1,400

WHT Expense (P&L)

Das könnte Ihnen auch gefallen

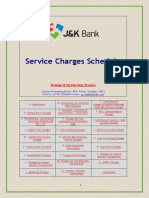

- MDB Schedule of Charges Foreign Trade NRB Banking 2015Dokument8 SeitenMDB Schedule of Charges Foreign Trade NRB Banking 2015Mohammad Ariful Hoque ShuhanNoch keine Bewertungen

- Bangladesh Commerce Bank Limited: Trade Division, Head Office, DhakaDokument5 SeitenBangladesh Commerce Bank Limited: Trade Division, Head Office, DhakanurulbibmNoch keine Bewertungen

- Annexure 1Dokument3 SeitenAnnexure 1ANUSHKA GUPTANoch keine Bewertungen

- Schedule of Charges 2010Dokument2 SeitenSchedule of Charges 2010Fcma0903Noch keine Bewertungen

- NBP Schedule of Bank ChargesDokument15 SeitenNBP Schedule of Bank ChargesaavaraichNoch keine Bewertungen

- Accounting System 0Dokument24 SeitenAccounting System 0ramyaa baluNoch keine Bewertungen

- Ans - 21.11.23 CA-foun. MTP Accounts Dec. 23Dokument10 SeitenAns - 21.11.23 CA-foun. MTP Accounts Dec. 23RohitNoch keine Bewertungen

- Kunci NL PD - SejahteraDokument7 SeitenKunci NL PD - SejahteraWidya Putri DamayantiNoch keine Bewertungen

- Schedule of Charges.2011 - 2Dokument20 SeitenSchedule of Charges.2011 - 2Kazi HasanNoch keine Bewertungen

- NBP Bank ChargesDokument28 SeitenNBP Bank Chargesayub_balticNoch keine Bewertungen

- Immediate Payment NotificationDokument1 SeiteImmediate Payment NotificationcyrilpjoodNoch keine Bewertungen

- Islamic Soc July Dec 2022 enDokument22 SeitenIslamic Soc July Dec 2022 enMuhammad Dilawar HayatNoch keine Bewertungen

- Group 6 Exercises 05022021 TTH ClassDokument8 SeitenGroup 6 Exercises 05022021 TTH ClassShara Monique RolunaNoch keine Bewertungen

- Accounts List Detail - destyXIIBDokument1 SeiteAccounts List Detail - destyXIIBSuara HatiKitaNoch keine Bewertungen

- GST Icai 15072023Dokument98 SeitenGST Icai 15072023Selvakumar MuthurajNoch keine Bewertungen

- PLP Government Accounting Final ExamDokument4 SeitenPLP Government Accounting Final ExamApril ManjaresNoch keine Bewertungen

- 03 Statement of Cash FlowDokument1 Seite03 Statement of Cash FlowKatrin8Noch keine Bewertungen

- AA 4102 TTH 3 430PM - Group 5 ExercisesDokument8 SeitenAA 4102 TTH 3 430PM - Group 5 ExercisesShara Monique RolunaNoch keine Bewertungen

- Accounting For Revenue and Other Receipts: Lester C. ArnadoDokument39 SeitenAccounting For Revenue and Other Receipts: Lester C. ArnadoRica BlancaNoch keine Bewertungen

- Chapter 1 9 AnswerDokument24 SeitenChapter 1 9 AnswerPhương Anh Lê HàNoch keine Bewertungen

- CIR Vs PAL - ConstructionDokument15 SeitenCIR Vs PAL - ConstructionEvan NervezaNoch keine Bewertungen

- Accounts Solution Mock 2 12-11Dokument21 SeitenAccounts Solution Mock 2 12-11Foundation Group tuitionNoch keine Bewertungen

- 150722-Revision in Service Charges Updated As On 30062022Dokument21 Seiten150722-Revision in Service Charges Updated As On 30062022Vinoth KumarNoch keine Bewertungen

- Schedule of Charges - FX PartDokument9 SeitenSchedule of Charges - FX Partbony78juNoch keine Bewertungen

- LSP ExcelDokument2 SeitenLSP ExcelDinna Jundari SuryaNoch keine Bewertungen

- Lembar Siklus BerkahDokument34 SeitenLembar Siklus BerkahSri Muji RahayuNoch keine Bewertungen

- TD Simple Checking: Account SummaryDokument6 SeitenTD Simple Checking: Account SummaryElizabeth HacheyNoch keine Bewertungen

- Accounts Prelim Solution 28-11-23Dokument9 SeitenAccounts Prelim Solution 28-11-23roshanchoudhary4350Noch keine Bewertungen

- Payment NotificationDokument1 SeitePayment NotificationZairo MosesNoch keine Bewertungen

- Illustrative Entries For Regular Agency FundDokument24 SeitenIllustrative Entries For Regular Agency FundYixing XingNoch keine Bewertungen

- Payment NotificationDokument1 SeitePayment Notificationbongekamakhaye116Noch keine Bewertungen

- Cma CGM-FRT Inv Idim0279701Dokument1 SeiteCma CGM-FRT Inv Idim0279701BERITA TERKININoch keine Bewertungen

- Pre AssessmentDokument9 SeitenPre AssessmentVenkatramana KNoch keine Bewertungen

- Schedule of Charges Lending Products, SME BankingDokument4 SeitenSchedule of Charges Lending Products, SME BankingAbu Syeed Md. Aurangzeb Al MasumNoch keine Bewertungen

- SOBC - IB - English Final Jul - Dec 19Dokument45 SeitenSOBC - IB - English Final Jul - Dec 19muhammad ihtishamNoch keine Bewertungen

- Answer Key AccgovDokument13 SeitenAnswer Key AccgovDeloria DelsaNoch keine Bewertungen

- Acctg 13-07 Acctg For Governmental NGO With AnswersDokument7 SeitenAcctg 13-07 Acctg For Governmental NGO With AnswerskylacerroNoch keine Bewertungen

- Annex H Regular Agency FundDokument125 SeitenAnnex H Regular Agency FundKelvin CaldinoNoch keine Bewertungen

- Receipt - Annual Return of The Company (Form 15) : Receipt No: INV240130673 Payment Date and Time: 2024-01-30 12:25:41Dokument1 SeiteReceipt - Annual Return of The Company (Form 15) : Receipt No: INV240130673 Payment Date and Time: 2024-01-30 12:25:41isimadmiiniistratorNoch keine Bewertungen

- July 2020 - ACCTG CEP 24362280Dokument2 SeitenJuly 2020 - ACCTG CEP 24362280Jayson Berja de LeonNoch keine Bewertungen

- Payment NotificationDokument1 SeitePayment NotificationcyrilpjoodNoch keine Bewertungen

- FGE Revision IllustrationDokument28 SeitenFGE Revision Illustrationmubarek kemalNoch keine Bewertungen

- GAFMIS CL2003-004 AnnexADokument3 SeitenGAFMIS CL2003-004 AnnexATokkiNoch keine Bewertungen

- Service Charges Schedule - 31012022Dokument39 SeitenService Charges Schedule - 31012022Bilal AhmadNoch keine Bewertungen

- Export Negotiation Collection Schedule-2015Dokument1 SeiteExport Negotiation Collection Schedule-2015kongbengNoch keine Bewertungen

- Goodwill 2004 - 3,43,700 (Printing Mistake)Dokument9 SeitenGoodwill 2004 - 3,43,700 (Printing Mistake)vasanthgurusamynsNoch keine Bewertungen

- Chase Sep V 2.9Dokument11 SeitenChase Sep V 2.9faxev83733100% (1)

- Chase Sep V 2.9Dokument11 SeitenChase Sep V 2.9faxev8373350% (2)

- AC - Acctg Gov Quiz 01 SolutionsDokument12 SeitenAC - Acctg Gov Quiz 01 SolutionsErjohn Papa100% (1)

- TD Commission To To BPMDokument4 SeitenTD Commission To To BPMSai GuruNoch keine Bewertungen

- HO 3 - Journal Entries - Revenue and Other ReceiptsDokument9 SeitenHO 3 - Journal Entries - Revenue and Other ReceiptsMELBERT JOHN M. BRILLANTESNoch keine Bewertungen

- Audit 2022 CBPJDokument1 SeiteAudit 2022 CBPJGoumang ArtsNoch keine Bewertungen

- Activity 2-1 Labausa Catering (Answer)Dokument13 SeitenActivity 2-1 Labausa Catering (Answer)Vince EspinoNoch keine Bewertungen

- Quiz On Journalizing, Posting & Preparation of Trial BalanceDokument28 SeitenQuiz On Journalizing, Posting & Preparation of Trial BalanceBpNoch keine Bewertungen

- Financial Management of NGOsDokument6 SeitenFinancial Management of NGOsammumonuNoch keine Bewertungen

- Financial Management of NGOsDokument6 SeitenFinancial Management of NGOsammumonuNoch keine Bewertungen

- Kunci PT Adijaya-Paket 1Dokument9 SeitenKunci PT Adijaya-Paket 1novita retno anggraini (nino)Noch keine Bewertungen

- Jomar V. Villena, Cpa, Mba: Accounting and Auditing Assurance ServicesDokument2 SeitenJomar V. Villena, Cpa, Mba: Accounting and Auditing Assurance ServicesJM Valonda Villena, CPA, MBANoch keine Bewertungen

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersVon EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNoch keine Bewertungen

- 21St Century Computer Solutions: A Manual Accounting SimulationVon Everand21St Century Computer Solutions: A Manual Accounting SimulationNoch keine Bewertungen

- Problem IntxDokument7 SeitenProblem IntxSophia KeratinNoch keine Bewertungen

- COR and Income Payee's Sworn Declaration of Gross Receipts - Sales - Lone Income PayorDokument2 SeitenCOR and Income Payee's Sworn Declaration of Gross Receipts - Sales - Lone Income PayorKw1kS0T1kNoch keine Bewertungen

- General IELTS - Reading Sample Test 2Dokument2 SeitenGeneral IELTS - Reading Sample Test 2JonathanNoch keine Bewertungen

- Report MoDokument3 SeitenReport MoPaul VillacortaNoch keine Bewertungen

- Computation of Total Income For ItrDokument2 SeitenComputation of Total Income For Itravisinghoo7Noch keine Bewertungen

- E229EMBNT78989Dokument2 SeitenE229EMBNT78989mansoor 31 shaikhNoch keine Bewertungen

- Calculator For MilestonesDokument9 SeitenCalculator For Milestonessidra awanNoch keine Bewertungen

- Statement Redesign OnlineDokument2 SeitenStatement Redesign OnlineJoshua LaporteNoch keine Bewertungen

- 463 Key Information Document PayeDokument1 Seite463 Key Information Document Payesawuni953Noch keine Bewertungen

- PayrollDokument4 SeitenPayrollAnonymous 4FjBYMRNoch keine Bewertungen

- Detailed Analysis of Section 115BAA & Section 115BABDokument3 SeitenDetailed Analysis of Section 115BAA & Section 115BABdamanoberoiNoch keine Bewertungen

- Salary SlipDokument1 SeiteSalary SlipMunib ParachaNoch keine Bewertungen

- Adobe Scan 03 Apr 2022Dokument1 SeiteAdobe Scan 03 Apr 2022Venkatesh KumarNoch keine Bewertungen

- Dean Elvena Passive IncomDokument2 SeitenDean Elvena Passive IncomRik GarciaNoch keine Bewertungen

- Tax AssignmentDokument7 SeitenTax AssignmentNaiha AbidNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 57372718Dokument1 SeiteIncome Tax Payment Challan: PSID #: 57372718Kashif NiaziNoch keine Bewertungen

- Test Bank Public Finance DR - Ali UpdateDokument51 SeitenTest Bank Public Finance DR - Ali UpdateMahmoud Ayoub Goda100% (2)

- Pay Slip July 2020...Dokument2 SeitenPay Slip July 2020...laxman lucky100% (2)

- OD426863892903857100Dokument1 SeiteOD426863892903857100SethuNoch keine Bewertungen

- Challan Cum Tax InvoiceDokument1 SeiteChallan Cum Tax InvoiceSahil KadamNoch keine Bewertungen

- Fundraising Dinner For Mary Bono MackDokument2 SeitenFundraising Dinner For Mary Bono MackSunlight FoundationNoch keine Bewertungen

- Community TaxDokument3 SeitenCommunity TaxSuzette VillalinoNoch keine Bewertungen

- P&A - Taxation of Retirement BenefitsDokument2 SeitenP&A - Taxation of Retirement BenefitsCkey ArNoch keine Bewertungen

- MCQ'S - 1 To 50Dokument12 SeitenMCQ'S - 1 To 50varunendra pandeyNoch keine Bewertungen

- Chapter 8 Output Vat Zero-Rated SalesDokument8 SeitenChapter 8 Output Vat Zero-Rated SalesJamaica DavidNoch keine Bewertungen

- South Western Federal Taxation 2015 Essentials of Taxation Individuals and Business Entities 18th Edition Smith Test BankDokument39 SeitenSouth Western Federal Taxation 2015 Essentials of Taxation Individuals and Business Entities 18th Edition Smith Test Bankihlemadonna100% (12)

- Business Tax Reviewer IDokument5 SeitenBusiness Tax Reviewer IMariefel Irish Jimenez KhuNoch keine Bewertungen

- JRZDokument4 SeitenJRZJamaica RamosNoch keine Bewertungen

- Addendum-I CGLE 2022 26042023Dokument13 SeitenAddendum-I CGLE 2022 26042023BM JEETNoch keine Bewertungen

- SalaryDokument29 SeitenSalarySarvar PathanNoch keine Bewertungen