Beruflich Dokumente

Kultur Dokumente

Accountreceivablearincomingpaymentprocessinsap 140202123003 Phpapp02

Hochgeladen von

Talha KhalidOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accountreceivablearincomingpaymentprocessinsap 140202123003 Phpapp02

Hochgeladen von

Talha KhalidCopyright:

Verfügbare Formate

Account Receivable AR Incoming Payment process in SAP

This Process Definition document describes the process of Incoming Payment (Other than down

payment) received from the Customer against an Invoice.

These Payments are received from the Customer for

Product Sale

Project sale

Service Contract

Export Sale

An organization Can receive incoming payment on following account

Incoming Payment Received from Customers (Product / Project / Service )

Incoming Payment from One Time Customers

Incoming Payment Received from Employees against sale of Products.

Incoming Payment received from Export Customers

Creation of Payment Advice (FBE1)

Payment advice will be prepared by Commercial Department .This will facilitate Cheque information to

flow in Accounts . Finance will select the payment Advice & post the payment by using the T-Code

F-28 once the Cheque is received with payment advice number.

Commercial will Input the following details in Payment Advice:

Company Code

Account Type D( Customer)

Account Customer Code

Payment Amount Cheque Amount

Deductions with reason for deduction

Assignment (Cheque Number),

Invoice Number

Save the Payment Advice document. A payment advice number will be generated.

Posting of Customer Receipt will be done in Finance by using T-Code F-28. Procedure of Processing the

payment is same as mentioned below except enter or select the payment advice number in the payment

advice number field.

Post Incoming Payment Procedure (F-28)

Case I : Incoming payment with reference to payment advice

All Cheque which are received by Commercial are to be handed over to Accounts based on the

prerequisites defined above. Accounts will simulate & post the Payment using the Incoming Payment

transaction F-28

Following inputs to be entered by accounts

Payment Advice number

Document Date (date of the instrument)

Posting Date

Document Type (DZ for Customer Payment),

Assignment Cheque Number

GL Account code for bank Incoming Clearing A/c,

Amount

Value Date (Expected date of credit in bank account)

Profit Centre

Text (Narration )

In case of Cheque received against payment advice, no open items other than Invoice number enter in

the payment advice will be displayed. Simulate & Post the payment document.

Accounting Entry will be passed:

Cheque Deposited but not Cleared Dr.

Freight/Water/Electricity Expenses Dr.

To Customer Account Cr.

Payment advice number will be deleted from the system ,once the incoming document is posted.

Case II : Incoming payment without payment advice

In case Cheque is received by finance directly we have to enter all above parameter & Customer number

then Select option Process Open Items .System will show all open items of that customer. Choose the

billing document to be cleared. Choose relevant option from Standard or Residual Payment. Simulate

& Post the document.

Accounting Entry will be passed:

Cheque Deposited but not Cleared Dr.

Freight/Water/Electricity Expenses Dr.

To Customer Account Cr.

Incoming Payment Procedure from Customers (Fast Entry) F-26

This is another method of entering Cheque received from the Customer against an Invoice .System will

default the Bank Header Data throughout the Incoming Payment Process. Select respective Invoice &

Clear the Document. Simulate the Accounting Entries & Post the Document

Following inputs must be entered.

Bank header Data

Bank GL Account

Bank Profit Center

Currency

Cheque Value Date

Posting Period

Payment Details

Customer Code

Cheque Amount

Cheque Date

Cheque Number

Select option Process Open Items. Choose relevant option from Options Standard, Residual

Payment. All open transactions of the customer including down payments are displayed. Select the

Invoice & clear the outstanding. Simulate & Post the document.

Accounting entries:

Cheque Deposited but not Cleared Dr.

Water/Electricity/Freight expenses Account Dr.

To Customer Account Cr.

Incoming Payment Procedure Employee Customer

Initially the employee will be created as customer and vendor as well. When a product is sold to the

employee, the customer employee balance will be updated by the commercial with installment payment

terms. When the salary is due at the end of the month, then installment which was also became due will

be deducted from the salary & posted in Employee Vendor account.

Accounting Entries created at the time of billing (VF01)

Receivable Employee Dr.

To Sales Revenue Account Cr.

Accounting Entries at the time of Salary Process Month end (Installment)

Payroll Clearing Account Dr.

To Employee -Vendor Account Cr.

Accounting entries at the time of Knocking monthly installment

Employee Vendor Account Dr.

To Employee Customer Account Cr.

To Outgoing Clearing (Bank) Account Cr.

Incoming Payment Export Customers (F-28)

Incoming Payments against Export Customers is received directly at accounts. Then account will post the

Incoming payments as per the procedure mentioned above.

Bank Account Dr.

To Customer Account Cr.

Foreign Exchange Rate Fluctuation (In case of Export)

Exchange rate fluctuation is booked for all incoming payments received from the Foreign Customer.

Unrealized gain/loss will be calculated based on the exchange rate maintained as on last day of the

month. In case of Realized gain/loss, exchange rate fluctuation will be calculated based on the date

payment is received.

If there is a Gain in Foreign exchange rate (Unrealized)

Adjustment for Exchange Fluctuation A/C Dr.

To Exchange Gain Export Unrealized Cr.

If there is a loss in Foreign Exchange rate (Unrealized)

Exchange Loss Export Unrealized Dr.

To Adjustment for Exchange Fluctuation A/C Cr.

These entries will get reversed on next day of the month.

If there is a Gain in Foreign Exchange rate (Realized)

Adjustment for Exchange Fluctuation A/C Dr.

To Exchange Gain Export Realized Cr.

If there is a loss in Foreign Exchange rate (Realized)

Exchange Loss Export Realized Dr.

To Adjustment for Exchange Fluctuation A/C Cr.

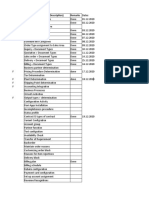

SAP T Codes to be used

Post Incoming Payments : F-28

Reset Cleared Items : FBRA

Customer Line item display : FBL5N

Incoming Payments-Fast Entry F-26

Customer Balance : FD10N

Create Payment Advice : FBE1

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Is 3073Dokument34 SeitenIs 3073rohan sharmaNoch keine Bewertungen

- Compt I A Network Plus 008Dokument902 SeitenCompt I A Network Plus 008trainmNoch keine Bewertungen

- Sample Deed of DonationDokument2 SeitenSample Deed of DonationMenchie Ann Sabandal Salinas100% (1)

- Green Tyre TechnologyDokument4 SeitenGreen Tyre TechnologyAnuj SharmaNoch keine Bewertungen

- EAU 2022 - Prostate CancerDokument229 SeitenEAU 2022 - Prostate Cancerpablo penguinNoch keine Bewertungen

- SCADA Generic Risk Management FrameworkDokument49 SeitenSCADA Generic Risk Management FrameworkAnak PohonNoch keine Bewertungen

- Beginners Guide (Description) Remarks DatesDokument3 SeitenBeginners Guide (Description) Remarks DatesTalha KhalidNoch keine Bewertungen

- Distribution Channel Division: BSTKDDokument62 SeitenDistribution Channel Division: BSTKDTalha KhalidNoch keine Bewertungen

- Business Catalogue Description App ID App NameDokument11 SeitenBusiness Catalogue Description App ID App NameTalha KhalidNoch keine Bewertungen

- Business Analyst - Talha Khalid-SDokument2 SeitenBusiness Analyst - Talha Khalid-STalha KhalidNoch keine Bewertungen

- Minutes Sheet FileDokument1 SeiteMinutes Sheet FileTalha KhalidNoch keine Bewertungen

- Sales TcodesDokument1 SeiteSales TcodesTalha KhalidNoch keine Bewertungen

- Lezione Argiolu - Master Roma3!3!12-2010 - Test Di Application SecurityDokument26 SeitenLezione Argiolu - Master Roma3!3!12-2010 - Test Di Application SecurityWB_YeatsNoch keine Bewertungen

- CHAPTER 22-Audit Evidence EvaluationDokument27 SeitenCHAPTER 22-Audit Evidence EvaluationIryne Kim PalatanNoch keine Bewertungen

- Harmony Radio, R2.8: Order Codes ReferenceDokument51 SeitenHarmony Radio, R2.8: Order Codes ReferenceRalaivao Solofohery Dieu-donnéNoch keine Bewertungen

- ExamDokument446 SeitenExamkartikNoch keine Bewertungen

- L - HRF22B0301 - Hose & Pulley Block (ZM, METRIC)Dokument5 SeitenL - HRF22B0301 - Hose & Pulley Block (ZM, METRIC)Gustavo RodriguezNoch keine Bewertungen

- Eco SPARDokument3 SeitenEco SPARMohammad LabinNoch keine Bewertungen

- HCL Corporate-PresentationDokument14 SeitenHCL Corporate-Presentationtony_reddyNoch keine Bewertungen

- 5 Axis Lesson 2 PDFDokument36 Seiten5 Axis Lesson 2 PDFPC ArmandoNoch keine Bewertungen

- Ultrajet 376 Installation Data: Ultra Dynamics Marine, LCC Ultra Dynamics LimitedDokument2 SeitenUltrajet 376 Installation Data: Ultra Dynamics Marine, LCC Ultra Dynamics LimitedhaujesNoch keine Bewertungen

- Uj 76 HD 5 CdivutDokument18 SeitenUj 76 HD 5 Cdivuttfrcuy76Noch keine Bewertungen

- Basic Principles of Immunology: Seminar OnDokument43 SeitenBasic Principles of Immunology: Seminar OnDr. Shiny KajalNoch keine Bewertungen

- Mas MockboardDokument7 SeitenMas MockboardMaurene DinglasanNoch keine Bewertungen

- (A) Universality Principle and Subject To I.LDokument11 Seiten(A) Universality Principle and Subject To I.LKELVIN A JOHNNoch keine Bewertungen

- Strategic Issues of Information TechnologyDokument23 SeitenStrategic Issues of Information TechnologySamiksha SainiNoch keine Bewertungen

- ME232 Thermodynamics 2 Quiz 1 - P1&P3 Complete SolutionDokument2 SeitenME232 Thermodynamics 2 Quiz 1 - P1&P3 Complete Solutioncarlverano0428Noch keine Bewertungen

- TUF-2000M User Manual PDFDokument56 SeitenTUF-2000M User Manual PDFreinaldoNoch keine Bewertungen

- What Is Highway EngineeringDokument4 SeitenWhat Is Highway EngineeringNagesh SinghNoch keine Bewertungen

- Harrod-Domar ModelDokument13 SeitenHarrod-Domar ModelsupriyatnoyudiNoch keine Bewertungen

- b1722Dokument1 Seiteb1722RaziKhanNoch keine Bewertungen

- Vocabulary List Year 6 Unit 10Dokument2 SeitenVocabulary List Year 6 Unit 10Nyat Heng NhkNoch keine Bewertungen

- U90 Ladder Tutorial PDFDokument72 SeitenU90 Ladder Tutorial PDFMarlon CalixNoch keine Bewertungen

- Mid Semester Question Paper Programming in CDokument8 SeitenMid Semester Question Paper Programming in CbakaNoch keine Bewertungen

- Metrologic Colombia S.A.S. Medellín Medellín Colombia: Oferta Economica CO20233ADokument3 SeitenMetrologic Colombia S.A.S. Medellín Medellín Colombia: Oferta Economica CO20233AJulian MoraNoch keine Bewertungen

- Chapter 9 CompensationDokument24 SeitenChapter 9 CompensationSophie CheungNoch keine Bewertungen