Beruflich Dokumente

Kultur Dokumente

Chattel Mortgage Compilation

Hochgeladen von

Krizea Marie Duron0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

167 Ansichten15 SeitenChattel Mortgage Compilation of case digests

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenChattel Mortgage Compilation of case digests

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

167 Ansichten15 SeitenChattel Mortgage Compilation

Hochgeladen von

Krizea Marie DuronChattel Mortgage Compilation of case digests

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 15

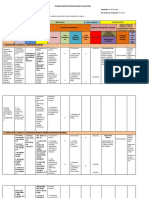

Chattel Mortgage Case Digests Mortgage.

The Deed of Chattel

Mortgage was duly recorded in the

B. 2140: Chattel Mortgage Registry of Quezon

City. Gencor failed to comply with its

a. Aleman vs Catera (Julius Ragay) obligation. Petitioner Allied bank

extrajudicially foreclosed the chattel

Facts: Catera owned several passenger mortgage. Prior to the foreclosure,

trucks. A truck driven by Amborgo fell respondent Metropolitan Bank and Trust

into a ditch because it was overspeeding Company filed an action for a sum of

as it was trying to overtake another money with prelim attachment against

truck. Real died and Aleman was Clarencio Yujuico. Judge Salas issued a

injured. Ontanillas and Montefrio, writ of attachment over the properties of

passengers of the truck, also died. In the Yujuico. Clarencio was the owner of the

suit for damages, another truck owned property mortgaged by Gencor.

by Catera was attached. Southern ISSUE: Who between Allied Bank and

Motors, Inc. filed a third party claim to Metropolitan Bank have preference over

the bus on the basis of a being the the properties

mortgagee of the bus as vendor. The RULING: Allied Bank. The registration

lien was previously registered with the of the chattel mortgage prior to the writ

registry of deeds. of attachment is an effective and binding

notice to other creditors of its existence

Issue: Whose claim should be granted? and creates a real right or a lien, which

Ruling: Those injured in the accident. A being recorded, follows the chattel

Mortgage in order to affect persons wherever it goes. Allied Bank, as

should not only be registered in the attaching creditor acquired the

Chattel Mortgage Registry, but the same properties in question subject to

should also be recorded in the Motor petitioners mortgage lien as it existed

Vehicle Office as required by section 5(e) thereon at the time of the attachment.

of the Revised Motor Vehicle Law." Here,

the Southern Motor, Inc. did not record

in the Motor Vehicle Office the mortgage c. Makati Leasing vs Wearever Textiles

executed in it's favor. Such being the (Ian Mamugay)

case the mortgage is ineffective as far as

the appellees are concerned. Its right or Facts: Wearever Textile Mills, Inc.

interest, therefore, in the truck, because executed a chattel mortgage contract in

of the mortgage constituted in its favor, favor of Makati Leasing and Finance

cannot prevail over of that appellees Corporation covering certain raw

who thought mere judgement creditors materials and machinery. Upon default,

may be deemed innocent purchase of the Makati Leasing filed a petition for

bus owner-operator Precentacion de judicial foreclosure of the properties

Catera, who had her purchase of the bus mortgaged. Acting on Makati Leasings

from Wenceslao Defensor recorded in application for replevin, the lower court

the Motor Vehicles Office. issued a writ of seizure. Pursuant

thereto, the sheriff enforcing the seizure

b. Allied Bank vs Salas (Junn Guazon) order, seized the machinery subject

matter of the mortgage. In a petition for

Allied Bank v. Salas (Guazon) certiorari and prohibition by Wearever,

FACTS: Allied Banks predecessor, the Court of Appeals ordered the return

General Bank and Trust Company of the machinery on the ground that the

granted Gencor Marketing a loan. It same cannot be the subject of replevin

was covered by a Deed of Chattel because it is a real property pursuant to

Article 415 of the new Civil Code, the character determined by the parties. It is

same being attached to the ground by undeniable that the parties to a contract

means of bolts and the only way to may by agreement treat as personal

remove it from Wearever textiles plant property that which by nature would be

would be to drill out or destroy the real property, as long as no interest of

concrete floor. When the motion for third parties would be prejudiced

reconsideration of Makati Leasing was thereby.

denied by the Court of Appeals, Makati Wearever further contends that

Leasing elevated the matter to the estoppel cannot apply against it because

Supreme Court. it had never agreed that the machinery

be considered as personal property but

Issue:Whether the machinery is real or was merely required and dictated by

personal property Makati Leasing to sign a printed form of

Note: determination on the nature/type chattel mortgage which was in a blank

of property is in question since if form at the time of signing.

Wearever is correct that machinery is Court is not persuaded. Court

real property, the chattel mortgage ruled that even if the argument was true,

constituted is null and void. such fact alone does not render a

Ruling: In an identical situation in contract void ab initio, but can only be a

the case of Tumalad vs VIcencio, Court ground for rendering said contract

ruled that if a house of strong materials, voidable, or annullable pursuant to

like what was involved in Article 1390 of the new Civil Code, by a

the Tumalad case, may be considered as proper action in court. There is nothing

personal property for purposes of on record to show that the mortgage has

executing a chattel mortgage thereon as been annulled. Neither is it disclosed

long as the parties to the contract so that steps were taken to nullify the

agree and no innocent third party will be same. On the other hand, as pointed out

prejudiced thereby, there is by Makati Leasing and again not refuted

absolutely no reason why a machinery, by Wearever, the latter has indubitably

which is movable in its nature and benefited from said contract. Equity

becomes immobilized only by destination dictates that one should not benefit at

or purpose, may not be likewise treated the expense of another. Private

as such. This is really because one who respondent could not now therefore, be

has so agreed is estopped from the allowed to impugn the efficacy of the

denying the existence of the chattel chattel mortgage after it has benefited

mortgage. therefrom,

When the CA rejected the

applicability of the Tumalad doctrine, it d. Tsai vs. Court of Appeals (Garry Gallo)

stressed that the house involved in that

case was built on a land that did not Facts: Ever Textile Mills, Inc.

belong to the owner of such house. (EVERTEX) obtained loan from

However, the law makes no distinction Philippine Bank of Communications

with respect to the ownership of the land (PBCom), secured by a deed of Real and

on which the house is built and we Chattel Mortgage over the lot where its

should not lay down distinctions not factory stands, and the chattels located

contemplated by law. therein as enumerated in a schedule

It must be pointed out that the attached to the mortgage contract.

characterization of the subject PBCom again granted a second loan to

machinery as chattel by the private EVERTEX which was secured by a

respondent is indicative of intention and Chattel Mortgage over personal

impresses upon the property the properties enumerated in a list attached

thereto. These listed properties were thereof that: "a chattel mortgage shall

similar to those listed in the first be deemed to cover only the property

mortgage deed. After the date of the described therein and not like or

execution of the second mortgage substituted property thereafter acquired

mentioned above, EVERTEX purchased by the mortgagor and placed in the same

various machines and equipments. Upon depository as the property originally

EVERTEX's failure to meet its obligation mortgaged, anything in the mortgage to

to PBCom, the latter commenced the contrary notwithstanding." And,

extrajudicial foreclosure proceedings since the disputed machineries were

against EVERTEX under Act 3135 and acquired in 1981 and could not have

Act 1506 or "The Chattel Mortgage been involved in the 1975 or 1979

Law". PBCom then consolidated its chattel mortgages, it was consequently

ownership over the lot and all the an error on the part of the Sheriff to

properties in it. It leased the entire include subject machineries with the

factory premises to Ruby Tsai and sold to properties enumerated in said chattel

the same the factory, lock, stock and mortgages.

barrel including the contested (2) A purchaser in good faith and

machineries. for value is one who buys the property of

EVERTEX filed a complaint for another without notice that some other

annulment of sale, reconveyance, and person has a right to or interest in such

damages against PBCom, alleging inter property and pays a full and fair price

alia that the extrajudicial foreclosure of for the same, at the time of purchase, or

subject mortgage was not valid, and that before he has notice of the claims or

PBCom, without any legal or factual interest of some other person in the

basis, appropriated the contested property. Records reveal, however, that

properties which were not included in when Tsai purchased the controverted

the Real and Chattel Mortgage of the properties, she knew of respondent's

first mortgage contract nor in the second claim thereon. Well-settled is the rule

contract which is a Chattel Mortgage, that the person who asserts the status of

and neither were those properties a purchaser in good faith and for value

included in the Notice of Sheriff's Sale. has the burden of proving such

Petitioner Tsai argued that assertion.Petitioner Tsai failed to

assuming that PBCom's title over the discharge this burden persuasively.

contested properties is a nullity, she is

nevertheless a purchaser in good faith e. ACME SHOE VS. CA (Kate Derrama)

and for value who now has a better right

than EVERTEX. While a pledge, real estate mortgage, or

antichresis may exceptionally secure

Issue: (1) Is the inclusion of the after-incurred obligations so long as

questioned properties in the foreclosed these future debts are accurately

properties proper? described, a chattel mortgage, however,

(2) Is the sale of these properties can only cover obligations existing at the

to petitioner Tsai valid? time the mortgage is constituted.

Ruling: (1) No. Accordingly, the SCfinds

no reversible error in the respondent Facts: Chua Pac, the president and

appellate court's ruling that inasmuch as general manager of co-petitioner Acme

the subject mortgages were intended by Shoe, Rubber & Plastic Corporation,

the parties to involve chattels, insofar as executed, for and in behalf of the

equipment and machinery were company, a chattel mortgage in favor of

concerned, the Chattel Mortgage Law Producers Bank of the Philippines. A

applies, which provides in Section 7 provision in the chattel mortgage

agreement xx subsequent promissory whereon the promise is written but, of

note or notes either as a renewal of the course, the remedy of foreclosure can

former note, as an extension thereof, or only cover the debts extant at the time of

as a new loan, or is given any other kind constitution and during the life of the

of accommodations such as overdrafts, chattel mortgage sought to be

letters of credit, acceptances and bills of foreclosed.

exchange, releases of import shipments Contracts of security are either

on Trust Receipts, etc.,xxx. The first personal or real. In contracts of

loan was paid by petitioner corporation. personal security, such as a guaranty or

Subsequently, in 1981, it obtained from a suretyship, the faithful performance of

Producers Bank additional financial the obligation by the principal debtor is

accommodations. These borrowings secured by the personal commitment of

were on due date also fully paid. The another (the guarantor or surety). In

bank yet again extended a 3 rd loam to contracts of real security, such as a

ACME a covered by four promissory pledge, a mortgage or an antichresis,

notes. Due to financial constraints, the that fulfillment is secured by

loan was not settled at maturity. The an encumbrance of property in pledge,

bank thereupon applied for an the placing of movable property in the

extrajudicial foreclosure of the chattel possession of the creditor;

mortgage, prompting ACME to forthwith in chattel mortgage, by the execution of

file an action for injunction, with the corresponding deed substantially in

damages and a prayer for a writ of the form prescribed by law; in real

preliminary injunction. estate mortgage, by the execution of a

public instrument encumbering the real

Issue: Whether or not chattel mortgage property covered thereby; and

may secure after incurred obligations. in antichresis, by a written instrument

Held: While a pledge, real estate granting to the creditor the right to

mortgage, or antichresis may receive the fruits of an immovable

exceptionally secure after-incurred property with the obligation to apply

obligations so long as these future debts such fruits to the payment of interest, if

are accurately described, a chattel owing, and thereafter to the principal of

mortgage, however, can only cover his credit upon the essential condition

obligations existing at the time the that if the principal obligation becomes

mortgage is constituted. Although due and the debtor defaults, then the

a promise expressed in a chattel property encumbered can be alienated

mortgage to include debts that are yet to for the payment of the obligation, but

be contracted can be a binding that should the obligation be duly paid,

commitment that can be compelled then the contract is automatically

upon, the security itself, however, does extinguished proceeding from the

not come into existence or arise until accessory characterof the agreement.

after a chattel mortgage agreement As the law so puts it, once the obligation

covering the newly contracted debt is is complied with, then the contract of

executed either by concluding a fresh security becomes, ipso facto, null and

chattel mortgage or by amending the old void.

contract conformably with the form Advertisements

prescribed by the Chattel Mortgage Law.

Refusal on the part of the borrower to f. MONTANO, vs. JOSE LIM (Karen

execute the agreement so as to cover the Dungog)

after-incurred obligation can constitute

an act of default on the part of the Facts: Montano brought to the

borrower of the financing agreement Philippines from the US a Cadillac car

which he registered in his name in the Lim failed to pay the balance of the

Motor Vehicles Office and for which he purchase price to Montano in spite of

obtained a certificate of registration. He the latter's demand and so on Montano

sold the car to Lim and his wife for requested the sheriff of Manila to sell

P28,000.00, payable in installments, for the car in accordance with the

which the latter executed a promissory conditions agreed upon in the chattel

note. Having paid part of the price, said mortgage. Having found, however, that

spouses executed on the same date a the car was no longer in the possession

chattel mortgage on the car in favor of of Lim but in that of Tinio who claimed

Montano to guarantee the payment of ownership thereof, Montano commenced

the balance. Because Montano did not an action of replevin against Lim & his

want to transfer the registration wife and Tinio.

certificate to Lim before the registration

of the mortgage, the latter was ISSUE:

registered in the office of the register of (1) whether the chattel mortgage

deeds on June 4, 1952, but Montano executed by Lim and his wife before the

failed to notify the Motor Vehicles Office car was actually registered in their name

of the execution of the mortgage is valid and regular?

pursuant to the requirement of Section (2) Whether or not the chattel mortgage

5(e) of Act No. 3992, known as the executed by Lim and his wife in favor of

Revised Motor Vehicle Law. Montano is binding against third persons

Lim transferred the registration even if they failed to give notice thereof

certificate to Villanueva who to the Motor Vehicles Office?

subsequently sold the car to Santos HELD:

transferring to the latter the registration 1. yes. It is not disputed that Montano

certificate. On the same date, Santos agreed to sell and Lim and his wife

sold the car to the Manila Trading and agreed to buy the car for P28,000.00 for

on the same date this company sold the which a promissory note was executed

car to Tinio for P26,000.00. Tinio made a and that to guarantee the same the

down payment of P12,000.00 and for the spouses executed a chattel mortgage

balance he executed a promissory note and took possession of the car sold. It is

which he assumed to pay in monthly therefore safe to conclude that at the

installments. He also executed a chattel time of the sale wherein the parties

mortgage on the same car to secure the agreed over the car and the price, the

payment of the promissory note. This contract became perfected, and when

mortgage was registered both in the part of the purchase price was paid and

office of the register of deeds as well as the car was delivered upon the execution

in the Motor Vehicles Office. After of the promissory note and the

paying his obligation in full, the mortgage, the same became

mortgage executed by Tinio in favor of consummated. The fact that the

the Manila Trading was cancelled, and registration certificate of the car has not

as a consequence he secured the as yet been transmitted to the

transfer to his name of the certificate of purchasers when the mortgage was

registration from the Motor Vehicles constituted is of no moment for, as this

Office. None of the transferees took the Court well said: "The registry of the

trouble of investigating from whom Lim transfer of automobiles and of the

had acquired the Cadillac car, and certificates of license for their use in the

neither did any of them investigate in Bureau of Public Works (now Motor

the office of the register of deeds if there Vehicles Office) merely constitutes an

was any encumbrance existing thereon. administrative proceeding which does

not bear any essential relation to the

contract of sale entered into between the promissory note that Cerna was a co-

parties." At any rate, this flaw, if any, is debtor. The law is clear that contracts

deemed to have been cured when after take effect only between the parties. But

the registration of the mortgage the by some stretch of the imagination,

registration certificate was transferred Cerna was held solidarily liable for the

to the purchasers on June 4, 1952. debt allegedly because he was a co-

2. No."A mortgage in order to affect third mortgagor of the principal debtor,

persons should not only be registered in Delgado. This ignores the basic precept

the Chattel Mortgage Registry, but the that there is solidary liability only when

same should also be recorded in the the obligation expressly so states, or

Motor Vehicles Office as required by when the law or the nature of the

section 5(e) of the Revised Motor Vehicle obligation requires solidarity.

Law. As between Montano whose There is also no legal provision nor

mortgage over the car was not recorded jurisprudence in our jurisdiction which

in the Motor Vehicles Office and Tinio makes a third person who secures the

who notified said office of his purchase fulfillment of another's obligation by

and registered the car in his name, the mortgaging his own property to be

latter is entitled to preference solidarily bound with the principal

considering that the mere registration of obligor. A chattel mortgage may be "an

the chattel mortgage in the office of the accessory contract" to a contract of loan,

register of deeds is in itself not sufficient but that fact alone does not make a

to hold it binding against third persons. third-party mortgagor solidarily bound

with the principal debtor in fulfilling the

C. Article 2141: principal obligation that is, to pay the

loan. The signatory to the principal

a. Cerna vs CA (Christal Javier) contract loan remains to be

primarily bound. It is only upon the

Facts: Delgado and Leviste entered into default of the latter that the creditor

a loan agreement which was evidenced may have been recourse on the

by a promissory note. On the same date, mortgagors by foreclosing the

Delgado executed a chattel mortgage mortgaged properties in lieu of an action

over a Willy's jeep owned by him. And for the recovery of the amount of the

acting as the attorney-in-fact of Manuel loan. And the liability of the third-party

Cerna, he also mortgage a "Taunus' car mortgagors extends only to the property

owned by Cerna. The period lapsed mortgaged. Should there be any

without Delgado paying the loan. This deficiency, the creditors has recourse on

prompted Leviste to a file a collection the principal debtor.

suit against Delgado and Cerna as Only Delgado signed as the

solidary debtors. Delgado died. Cerna mortgagor. The Special Power of

argued that the suit should be filed Attroney executed by Cerna in favor of

against the estate of Delgado. Delgado to mortgage his property does

not make him a mortgagor.

Issue: Can the owner of the mortgaged We agree with Cerna that the filing

property be sued in a collection for a of collection suit barred the foreclosure

sum of money based on a promissory of the mortgage. A mortgage who files a

note when it was not signed by him but suit for collection abandons the remedy

by the principal debtor? of foreclosure of the chattel mortgage

Ruling: No. Only Delgado signed the constituted over the personal property

promissory note and accordingly, he was as security for the debt or value of the

the only one bound by the contract of promissory note which he seeks to

loan. Nowhere did it appear in the recover in the said collection suit. The

creditor must choose one remedy: connection with the foreclosure of

foreclose the mortgage or file a chattel mortgages. This amendment

collection suit. prevents mortgagees from seizing the

mortgaged property, buying it at

b. Magna Financial Services Group vs. foreclosure sale for a low price and then

Colarina (R-U, Glenna) bringing the suit against the mortgagor

for a deficiency judgment. The almost

Facts: Elias Colarina bought on invariable result of this procedure was

installment from Magna Financial that the mortgagor found himself minus

Services Group, Inc., 1 unit of Suzuki the property and still owing practically

Multicab. After making a down payment, the full amount of his original

Colarina executed a PN for the balance indebtedness.

of P229,284. To secure payment thereof, In its complaint, Magna Financial

Colarina executed an integrated PN and prayed for the principal sum of

deed of chattel mortgage over the motor P131,607, attorneys fees etc. It is

vehicle. further prayed that pendent lite, an

Colarina failed to pay the monthly Order of Replevin issue commanding the

amortization beginning January 1999, Provincial Sheriff at Legazpi City or any

accumulating an unpaid balance of of his deputies to take such multicab into

P131,607. Despite repeated demands, he his custody and, after judgment, upon

failed to make the necessary payment. default in the payment of the amount

Magna Financial Services Group, adjudged due to the plaintiff, to sell said

Inc. filed a Complaint for Foreclosure of chattel at public auction in accordance

Chattel Mortgage with Replevin before with the chattel mortgage law. In its

the MTCC. Upon filing of a bond, a writ Memorandum before us, petitioner

of replevin was issued. Colarina who resolutely declared that it has opted for

voluntarily surrendered physical the remedy provided under Article

possession of the vehicle to the Sheriff. 1484(3) CC that is, to foreclose the

After declaring Colarina in default, the chattel mortgage.

trial court ruled against defendant and It is, however, unmistakable from

ordered him to pay the sum of P131,607 the Complaint that petitioner preferred

plus penalty charges, attorneys fees and to avail itself of the first and third

cost. In case of nonpayment, the remedies under Article 1484, at the

multicab shall be sold at public auction. same time suing for replevin. For this

The RTC affirmed. The CA rendered its reason, the Court of Appeals justifiably

decision ruling that the courts erred in set aside the decision of the RTC.

ordering the defendant to pay the unpaid Perusing the Complaint, the petitioner,

balance of the purchase price under its prayer number 1, sought for

irrespective of the fact that the the payment of the unpaid amortizations

complaint was for the foreclosure of the which is a remedy that is provided under

chattel mortgage. Article 1484(1) of the Civil Code,

allowing an unpaid vendee to exact

Issue: What is the true nature of a fulfillment of the obligation. At the same

foreclosure of chattel mortgage under time, petitioner prayed that Colarina be

Article 1484(3). ordered to surrender possession of the

Ratio: Our Supreme Court in Bachrach vehicle so that it may ultimately be sold

Motor Co., Inc. v. Millan held: at public auction, which remedy is

Undoubtedly the principal object of the contained under Article 1484(3). Such a

above amendment (referring to Act 4122 scheme is not only irregular but is a

amending Art. 1454, Civil Code of 1889) flagrant circumvention of the prohibition

was to remedy the abuses committed in of the law.

By praying for the foreclosure of No. 1508, or the Chattel Mortgage Law.

the chattel, Magna Financial Services This rule governs extrajudicial

Group, Inc. renounced whatever claim it foreclosure of chattel mortgage.

may have under the promissory note. In sum, since the petitioner has

Article 1484, paragraph 3, undeniably elected a remedy of

provides that if the vendor has availed foreclosure under Article 1484(3) of the

himself of the right to foreclose the Civil Code, it is bound by its election and

chattel mortgage, he shall have no thus may not be allowed to change what

further action against the purchaser to it has opted for nor to ask for more. On

recover any unpaid balance of the this point, the Court of Appeals correctly

purchase price. Any agreement to the set aside the trial courts decision and

contrary shall be void. In other words, instead rendered a judgment of

in all proceedings for the foreclosure of foreclosure as prayed for by the

chattel mortgages executed on chattels petitioner.

which have been sold on the installment

plan, the mortgagee is limited to the Issue: WON there has been an actual

property included in the mortgage. foreclosure of the vehicle

Contrary to petitioners claim, a contract Ratio: In the case at bar, there is no

of chattel mortgage, which is the dispute that the subject vehicle is

transaction involved already in the possession of the

in the present case, is in the nature of a petitioner, Magna Financial Services

conditional sale of personal property Group, Inc. However, actual foreclosure

given as a security for the payment of a has not been pursued, commenced or

debt, or the performance of some other concluded by it.

obligation specified therein, the Where the mortgagee elects a

condition being that the sale shall be remedy of foreclosure, the law requires

void upon the seller paying to the the actual foreclosure of the mortgaged

purchaser a sum of money or doing some chattel. Thus, in Manila Motor Co. v.

other act named. If the condition is Fernandez, our Supreme Court said that

performed according to its terms, the it is actual sale of the mortgaged chattel

mortgage and sale immediately become in accordance with Sec. 14 of Act No.

void, and the mortgagee is thereby 1508 that would bar the creditor (who

divested of his title. On the other hand, chooses to foreclose) from recovering

in case of non-payment, foreclosure is any unpaid balance. And it is deemed

one of the remedies available to a that there has been foreclosure of the

mortgagee by which he subjects the mortgage when all the proceedings of

mortgaged property to the satisfaction of the foreclosure, including the sale of the

the obligation to secure that for which property at public auction, have been

the mortgage was given. Foreclosure accomplished.

may be effected either judicially or Be that as it may, although no

extrajudicially, that is, by ordinary action actual foreclosure as contemplated

or by foreclosure under power of sale under the law has taken place in this

contained in the mortgage. It may be case, since the vehicle is already in the

effected by the usual methods, including possession of Magna Financial Services

sale of goods at public auction. Group, Inc. and it has persistently and

Extrajudicial foreclosure, as chosen by consistently avowed that it elects the

the petitioner, is attained by causing the remedy of foreclosure, the Court of

mortgaged property to be seized by the Appeals, thus, ruled correctly in

sheriff, as agent of the mortgagee, and directing the foreclosure of the said

have it sold at public auction in the vehicle without more.

manner prescribed by Section 14 of Act

c. BA Finance vs CA (Krizea Duron) insurer, Zenith Insurance Corporation.

The Cuadys asked the B.A. Finance

FACTS: Private respondents Manuel Corporation to consider the same as a

Cuady and Lilia Cuady obtained from total loss, and to claim from the insurer

Supercars, Inc. a credit of P39,574.80, the face value of the car insurance policy

which amount covered the cost of one and apply the same to the payment of

unit of Ford Escort 1300, four-door their remaining account and give them

sedan. Said obligation was evidenced by the surplus thereof, if any. But instead of

a promissory note executed by private heeding the request of the Cuadys, B.A.

respondents in favor of Supercars, Inc., Finance Corporation prevailed upon the

obligating themselves to pay the latter former to just have the car repaired. Not

the sum of P39,574.80, inclusive of long thereafter, however, the car bogged

interest at 14% per annum, payable on down. The Cuadys wrote B.A. Finance

monthly installments August 16, 1977, Corporation requesting the latter to

and on the 16th day of the next 35 pursue their prior instruction of

months from September 16, 1977 until enforcing the total loss provision in the

full payment thereof. There was also insurance coverage. When B.A. Finance

stipulated a penalty of P10.00 for every Corporation did not respond favorably to

month of late installment payment. To their request, the Cuadys stopped paying

secure the faithful and prompt their monthly installments on the

compliance of the obligation under the promissory note. BA finance sued them

said promissory note, the Cuady spouses for the payment of the remaining

constituted a chattel mortage on the instalments.

aforementioned motor vehicle. On July

25, 1977, Supercars, Inc. assigned the ISSUE: Whether or not B.A. Finance

promissory note, together with the Corporation waive its right to collect the

chattel mortgage, to B.A. Finance unpaid balance of the Cuady spouses on

Corporation. The Cuadys paid a total of the promissory note for failure of the

P36,730.15 to the B.A. Finance former to enforce the total loss provision

Corporation, thus leaving an unpaid in the insurance coverage of the motor

balance of P2,344.65 as of July 18, 1980. vehicle subject of the chattel mortgage.

In addition thereto, the Cuadys owe B.A. RULING: Yes. B.A. Finance Corporation

Finance Corporation P460.00 was deemed subrogated to the rights

representing penalties or surcharges for and obligations of Supercars, Inc. when

tardy monthly instalments. B.A. Finance the latter assigned the promissory note,

Corporation, as the assignee of the together with the chattel mortgage

mortgage lien obtained the renewal of constituted on the motor vehicle in

the insurance coverage over the question in favor of the former.

aforementioned motor vehicle for the Consequently, B.A. Finance Corporation

year 1980 with Zenith Insurance is bound by the terms and conditions of

Corporation, when the Cuadys failed to the chattel mortgage executed between

renew said insurance coverage the Cuadys and Supercars, Inc. Under

themselves. Under the terms and the deed of chattel mortgage, B.A.

conditions of the said insurance Finance Corporation was constituted

coverage, any loss under the policy shall attorney-in-fact with full power and

be payable to the B.A. Finance authority to file, follow-up, prosecute,

Corporation. On April 18, 1980, the compromise or settle insurance claims;

aforementioned motor vehicle figured in to sign execute and deliver the

an accident and was badly damaged. The corresponding papers, receipts and

unfortunate happening was reported to documents to the Insurance Company as

the B.A. Finance Corporation and to the may be necessary to prove the claim,

and to collect from the latter the There was a deficiency in the amount of

proceeds of insurance to the extent of its P5,158.06 where BISLA made a demand

interests, in the event that the to pay the same. Petitioner BISLA

mortgaged car suffers any loss or (plaintiff therein) filed a complaint for

damage. In granting B.A. Finance the recovery of a sum of money

Corporation the aforementioned powers constituting the deficiency after

and prerogatives, the Cuady spouses foreclosure of the chattel mortgage put

created in the former's favor an agency. up by the principal borrower Depositario

Thus, under Article 1884 of the Civil against the latter and his solidary co-

Code of the Philippines, B.A. Finance maker Guinhawa (herein private

Corporation is bound by its acceptance respondent) as defendants. Eventually, a

to carry out the agency, and is liable for stipulation of facts was entered into

damages which, through its non- between BISLA and Guinhawa. They

performance, the Cuadys, the principal agreed to drop Depositario, as "his

in the case at bar, may suffer. whereabouts being unknown now and he

Unquestionably, the Cuadys suffered could not be served with summons". The

pecuniary loss in the form of salvage creditor claims that he can maintain an

value of the motor vehicle in question, action for deficiency and claim P5k

not to mention the amount equivalent to balance.

the unpaid balance on the promissory

note, when B.A. Finance Corporation Issue: Won creditor can claim remaining

steadfastly refused and refrained from balance?

proceeding against the insurer for the Ruling: Yes. The creditor may maintain

payment of a clearly valid insurance an action for deficiency although the

claim, and continued to ignore the chattel mortgage law Is silent on this

yearning of the Cuadys to enforce the point. The reason is tat a chattel

total loss provision in the insurance mortgage is only given as a security and

policy, despite the undeniable fact that not as payment for the debt in case of

Rea Auto Center, the auto repair shop failure of payment

chosen by the insurer itself to repair the

aforementioned motor vehicle, e. PAMECA WOOD v CA (June Lacpao)

misrepaired and rendered it completely

useless and unserviceable. FACTS: On April 17, 1980,PAMECA

Wood Treatment Plant, Inc. (PAMECA)

d. BICOL SAVINGS v GUINHAWA obtained a loan of US$267,881.67, or the

(Krizza Batulan) equivalent of P2,000,000.00 from

Development Bank. By virtue of this

Facts: Victorio Depositario together with loan, petitioner PAMECA, through its

private respondent Jaime Guinhawa, President, petitioner Herminio C. Teves,

acting as solidary co-maker, took a loan executed a promissory note for the said

from petitioner Bicol Savings and Loan amount, promising to pay the loan by

Association (BISLA) payable every 19th installment.

day of each month. To secure the As security for the said loan, a

payment of the foregoing loan chattel mortgage was also executed over

obligation, the principal borrower PAMECA's properties in Dumaguete City,

Victorio Depositario put up as security a consisting of inventories, furniture and

chattel mortgage which was a Yamaha equipment, to cover the whole value of

Motorcycle. Said motorcycle was the loan.

eventually foreclosed by reason of the On January 18, 1984, and upon

failure of Depositario and private petitioner PAMECA's failure to pay,

respondent Guinhawa to pay the loan. Development Bank extrajudicially

foreclosed the chattel mortgage, and, as an unpaid balance of the price, where

sole bidder in the public auction, the vendor opts to foreclose the chattel

purchased the foreclosed properties for mortgage on the thing sold, should the

a sum of P322, 350.00. vendee's failure to pay cover two or

On June 29, 1984, Development more installments, this provision is

Bank filed a complaint for the collection specifically applicable to a sale on

of the balance. installments.

PAMECA submit that Articles 1484 and

2115 of the Civil Code be applied in f. Superlines vs ICC, G.R. No.

analogy to the instant case to preclude 150673. February 28, 2003 (Salesheil

the recovery of a deficiency claim. Du)

ISSUES: Whether or not the foreclosure Facts: Superlines Transportation Co.,

of the chattel mortgage was valid? Inc. (Superlines) decided to acquire five

RULING: Yes. The court did not find new buses from the Diamond Motors

anything irregular or fraudulent in the Corporation. However, Superlines lacked

circumstance that respondent bank was financial resources for the purpose. By

the sole bidder in the sale, as all the virtue of a board resolution, Superlines

legal procedures for the conduct of a authorized its President and General

foreclosure sale have been complied Manager, Lavides, to look for and

with, thus giving rise to the presumption negotiate with a financing corporation

of regularity in the performance of for a loan for the purchase of said buses.

public duties. Lavides negotiated with ICC Leasing &

The effects of foreclosure under Financing Corporation (ICC, for brevity)

the Chattel Mortgage Law run for a financial scheme for the planned

inconsistent with those of pledge under purchase. ICC agreed to finance the

Article 2115. Whereas, in pledge, the purchase of the new buses via a loan and

sale of the thing pledged extinguishes proposed a three-year term for the

the entire principal obligation, such that payment at a fixed interest rate of 22%

the pledgor may no longer recover per annum. The new buses to be

proceeds of the sale in excess of the purchased were to be used by Superlines

amount of the principal obligation, as security for the loan. ICC required

Section 14 of the Chattel Mortgage Law Superlines to submit certificates of

expressly entitles the mortgagor to the registration of the said buses under the

balance of the proceeds, upon name of Superlines before the

satisfaction of the principal obligation appropriate document was executed by

and costs. the parties and their transactions

Since the Chattel Mortgage Law bars the consummated. In October 1995,

creditor-mortgagee from retaining the Diamond Motors Corporation sold to

excess of the sale proceeds there is a Superlines five new buses. Superlines,

corollary obligation on the part of the through Lavides, acknowledged receipt

debtor-mortgagee to pay the deficiency of the buses. In November 1995, the

in case of a reduction in the price at vehicle invoices were filed with the LTO

public auction. which then issued certificates of

As correctly pointed out by the registration covering the five buses

trial court, the said article applies under the name of Superlines. With the

clearly and solely to the sale of personal buses now registered under its name,

property the price of which is payable in Superlines, through Lavides, executed

installments. Although Article 1484, two documents, namely: a deed of

paragraph (3) expressly bars any further chattel mortgage over the said buses as

action against the purchaser to recover security for the purchase price of the

buses loaned by ICC to Superlines, mortgage, do not contain any provision,

which deed was annotated on the face of expressly or impliedly, precluding the

said certificates of mortgagee from recovering deficiency of

registration, and a promissory note in the principal obligation.

favor of ICC binding and obliging itself In a case of recent vintage, this Court

to pay the latter Superlines and Lavides held that if the proceeds of the sale are

executed a Continuing Guaranty to pay insufficient to cover the debt in an extra-

jointly and severally in favor of ICC. judicial foreclosure of the mortgage, the

After paying only seven monthly mortgagee is still entitled to claim the

amortizations, Superlines defaulted in deficiency from the debtor:

the payment of its obligation to ICC. In To begin with, it is settled that if the

April 1997, ICC wrote Superlines proceeds of the sale are insufficient to

demanding full payment of its cover the debt in an extrajudicial

outstanding obligation. However, foreclosure of the mortgage, the

Superlines failed to heed said demand. mortgagee is entitled to claim the

ICC filed a complaint for collection of deficiency from the debtor. For when the

sum of money with prayer for a writ legislature intends to deny the right of a

of replevin of the Regional Trial Court creditor to sue for any deficiency

Superlines and Lavides. resulting from foreclosure of security

given to guarantee an obligation it

Issue: Is respondent entitled to a expressly provides as in the case of

deficiency judgment against the pledges [Civil Code, Art. 2115] and in

petitioners? chattel mortgages, while silent as to the

Ruling: The evidence on record shows mortgagees right to recover, does not,

that under the Promissory Note, Chattel on the other hand, prohibit recovery of

Mortgage and Continuing Guaranty, deficiency. Accordingly, it has been held

respondent was the creditor-mortgagee that a deficiency claim arising from the

of petitioner Superlines and not the extrajudicial foreclosure is allowed.

vendor of the new buses. Hence, In the case of PAMECA Wood

petitioners cannot find refuge in Article Treatment Plant, Inc. vs. Court of

1484(3) of the New Civil Code. As Appeals, this Court declared that under

correctly held by the Court of Appeals, Section 14 of the Chattel Mortgage Law,

what should apply was the Chattel the mortgagor is entitled to recover the

Mortgage executed by petitioner balance of the proceeds, upon

Superlines and respondent in relation to satisfaction of the principal obligation

the Chattel Mortgage Law. This Court and costs, thus there is a corollary

had consistently ruled that if in an extra- obligation on the part of the debtor-

judicial foreclosure of a chattel mortgagor to pay the deficiency in case

mortgage a deficiency exists, an of a reduction in the price at public

independent civil action may be auction. In fine then, the Court of

instituted for the recovery of said Appeals correctly ruled that respondent

deficiency. To deny the mortgagee the is entitled to a deficiency judgment

right to maintain an action to recover against the petitioners.

the deficiency after foreclosure of the

chattel mortgage would be to overlook g. Esguerra vs CA (Celeste Suamen)

the fact that the chattel mortgage is only

given as security and not as payment for FACTS: GA Machineries Inc.(GAMI) sold

the debt in case of failure of a Ford-trader cargo to Hilario Lagmay

payment. Both the Chattel Mortgage and Bonifacio Masilungan. Subsequently,

Law and Act 3135 governing extra- Montelibano Esguerra bought the right

judicial foreclosure of real estate to the cargo truck and assumed paying

the unpaid purchase price.In so doing, mortgage constituted thereon either

Esguerra executed in favor of GAMI a judicially or extrajudicially and thereby,

promissory note and chattel mortgage liquidate the indebtedness in accordance

over the truck. Esguerra defaulted in his with law.

obligations. Gami took the truck from More than that, even if such automatic

Esguerra who gave his consent on the appropriation of the cargo truck in

condition that he be allowed to recover question can be inferred from or be

its possession upon payment of its contemplated under the aforesaid

account. Esguerra tried to repossess the mortgage contract, such stipulation

truck by sending his wife to Gami to would be pactum commissorium which is

partially settle his account. Still, Gami expressly prohibited by Article 2088 of

refused to deliver the truck, compelling the Civil Code and therefore, null and

Esguerra to file a complaint. The trial void.

court dismissed the complaint. CA Having opted to foreclose the

sustained the findings of the trial court chattel mortgage, respondent GAMI can

that it was not unlawful on the part of no longer cancel the sale. The three

GAMI to repossess the cargo truck in remedies of the vendor in case the

question as Esguerra gave his consent to vendee defaults, in a contract of sale of

the repossession. However, said personal property the price of which is

appellate court, took exception to payable in installment under Article

GAMI's failure to sell at public auction 1484 of the Civil Code, are alternative

said truck. It held that while it is true the and cannot be exercised simultaneously

chattel mortgage contract, the or cumulatively by the vendor-creditor.In

mortgagee can take possession of the Cruz vs. Filipinas Investment and

chattel but such taking did not amount Finance Corporation (23 SCRA 791,

to the foreclosure of the mortgage. [19681; the Supreme Court construing

Otherwise stated, GAMI should have Article 1484 of the Civil Code, held:

foreclosed the mortgage. Should the vendee or purchaser of a

personal property default in the payment

ISSUE: WON the mortgage vendor of of two or more of the agreed

personal property sold on installment is installments, the vendor or seller has the

legally obligated to foreclose the chattel option to avail of any one of these three

mortgage and sell the chattel subject remedies either to exact fulfillment by

thereof at public auction in case the the purchaser of the obligation, or to

mortgagor-vendee defaults in the cancel the sale, or to foreclose the

payment of the agreed installments. mortgage on the purchased personal

HELD: The respondent appellate court property, if one was constituted. These

did not err in holding that while the remedies have been recognized as

mortgagee can take possession of the alternative, not cumulative, that the

chattel, such taking did not amount to exercise of one would bar the exercise of

the foreclosure of the mortgage. the others. It may also be stated that the

Otherwise stated, the taking of established rule is to the effect that the

Esguerra's truck without proceeding to foreclosure and actual sale of a

the sale of the same at public auction, mortgaged chattel bars further recovery

but instead, appropriating the same in by the vendor of any balance on the

payment of Esguerra's indebtedness, is purchaser's outstanding obligation not

not lawful. so satisfied by the sale.

As clearly stated in the chattel mortgage Respondent GAMI is hereby

contract, the express purpose of the ordered to foreclose the chattel

taking of the mortgaged property is to mortgage by selling the subject cargo

sell the same and/or foreclose the

truck at public auction and liquidate the Although he had not yet fully paid

indebtedness in accordance with law. its purchase price, Cabacungan became

the owner of the vehicle, otherwise the

h. BPI Credit v. CA (Julius Ragay) seller would not have accepted it in

mortgage. He was entitled to its

Facts: Cabacungan purchased a vehicle possession and use until appropriate

from BM Domingo Motor Sales on lawful proceedings would have been

installment basis to be used in his taken by Filinvest to obtain possession of

furniture business. A 2% penalty charge the vehicle preliminary to foreclosure of

per month is added on each unpaid the mortgage.

installment from the date of its maturity.

Aside from a promissory note, i. Servicewide Vs. CA (Junn Guazon)

Cabacungan executed a chattel

mortgage to secure the obligation. In a FACTS: Leticia Laus purchased on credit

Deed of Assignment, BM Domingo a Colt Galant from Fortune Motors

assigned to Filinest its rights, title and (Phils.) Corporation and executed a

interest in the chattel mortgage and promissory note for the amount

promissory note. Cabacungan delayed in of P56,028.00, inclusive of 12% annual

his payments, saying that he wanted a interest, payable within a period of 48

recomputation of the interest because he months. In case of default in the

was paying amounts in excess of the payment of any installment, the total

stipulated installment. Subsequently, principal sum, together with the interest,

Filinvest seized the vehicle from the shall become immediately due and

employees of Cabacungan. Cabacungan payable. As a security for the promissory

tendered a check for the unpaid note, a chattel mortgage was constituted

installments but it was not accepted by over the said motor vehicle, with a deed

Filinvest, which demanded the balance of assignment incorporated therein such

of the entire promissory note. that the credit and mortgage rights were

assigned by Fortune Motors Corp. in

Issue: Did Filinvest have the right to favor of Filinvest Credit Corporation

take possession of the vehicle? with the consent of the mortgagor-

Ruling: No, because it did not make a debtor Laus. Filinvest in turn assigned

prior demand to Cabacungan to the credit in favor of Servicewide

surrender the vehicle prior to making Specialists, Inc.Laus failed to pay the

the seizure. The law does not allow the monthly installment for April 1977 and

creditor himself to possess the the succeeding 17 months. Servicewide

mortgaged property through violence demanded payment of the entire

and against the will of the debtor outstanding balance with interests

because the creditor's right of but Laus failed to pay despite formal

possession is conditioned upon the fact demands. As a result of Laus failure to

of default, and the existence of this fact settle her obligation, or at least to

may naturally be the subject of surrender possession of the motor

controversy. While Filinvest may have all vehicle for foreclosure, Servicewide

the right in the world to foreclose the instituted a complaint for replevin,

mortgage, that right did not grant it impleading Hilda Tee and John Dee in

untrammeled license to intercept the whose custody the vehicle was believed

property subject of the mortgage and to be at the time of the filing of the

seize it wherever it may be found, in a suit. Plaintiff alleged, among others, that

manner contrary to the stipulations set it had superior lien over the mortgaged

forth in the Chattel Mortgage contract. vehicle. The court approved the replevin

bond. Alberto Villafranca filed a third

party claim contending that he is the party, should have been impleaded in the

absolute owner of the subject motor complaint for replevin and damages. An

vehicle after purchasing it from a certain indispensable party is one whose

Remedios Yang free from all lien and interest will be affected by the courts

emcumbrances; and that on July 1984, action in the litigation, and without

the said automobile was taken from his whom no final determination of the case

residence by Deputy Sheriff Bernardo can be had.

Bernabe pursuant to the seizure order

issued by the court a quo.

ISSUE: WON a case for replevin may be

pursued against the defendant, Alberto

Villafranca, without impleading the

absconding debtor-mortgagor

RULING: No. Rule 60 of the Revised

Rules of Court requires that an applicant

for replevin must show that he is the

owner of the property claimed,

particularly describing it, or is entitled

to the possession thereof. Where the

right of the plaintiff to the possession of

the specified property is so conceded or

evident, the action need only be

maintained against him who so

possesses the property. However, in

case the right of possession on the part

of the plaintiff, or his authority to claim

such possession or that of his principal,

is put to great doubt (a contending party

may contest the legal bases for plaintiffs

cause of action or an adverse and

independent claim of ownership or right

of possession may be raised by that

party), it could become essential to have

other persons involved and impleaded

for a complete determination and

resolution of the controversy. In a suit

for replevin, a clear right of possession

must be established. The conditions

essential for foreclosure of chattel

mortgage would be to show, firstly, the

existence of the chattel mortgage and,

secondly, the default of the

mortgagor. Since the mortgagees right

of possession is conditioned upon the

actual fact of default which itself may be

controverted, the inclusion of other

parties, like the debtor or the mortgagor

himself, may be required in order to

allow a full and conclusive determination

of the case. Laus, being an indispensable

Das könnte Ihnen auch gefallen

- Whether The Contract Is Equitable Mortgage PDFDokument16 SeitenWhether The Contract Is Equitable Mortgage PDFverANoch keine Bewertungen

- Compilation of Digested Cases in PALEDokument75 SeitenCompilation of Digested Cases in PALERollane ArceNoch keine Bewertungen

- 5.title vs. Certificate of Title Duty of LRADokument7 Seiten5.title vs. Certificate of Title Duty of LRAJanneil Monica MoralesNoch keine Bewertungen

- Warehouse Receipts LawDokument8 SeitenWarehouse Receipts LawChris T NaNoch keine Bewertungen

- Kinds of PleadingsDokument2 SeitenKinds of PleadingsSircanit BentayoNoch keine Bewertungen

- Negotiable Instruments Law - Chapter 5: By: Atty. Richard M. Fulleros, CPA, MBADokument39 SeitenNegotiable Instruments Law - Chapter 5: By: Atty. Richard M. Fulleros, CPA, MBAjobelle barcellanoNoch keine Bewertungen

- Foreclosure of REMDokument10 SeitenForeclosure of REMShanelle NapolesNoch keine Bewertungen

- Chattel Mortgage DigestDokument17 SeitenChattel Mortgage DigestEuodia HodeshNoch keine Bewertungen

- Notes Jurisprudence Drug CasesDokument7 SeitenNotes Jurisprudence Drug CasesJairus Rubio100% (1)

- Credit Transactions Finals Reviewer PDFDokument3 SeitenCredit Transactions Finals Reviewer PDFEANoch keine Bewertungen

- Foreclosure Checklist of ComplianceDokument3 SeitenForeclosure Checklist of CompliancetracybiermannNoch keine Bewertungen

- Haj DigestsDokument14 SeitenHaj DigestsKeroleen BelloNoch keine Bewertungen

- Sec 39conditio Nal IndorsementDokument10 SeitenSec 39conditio Nal IndorsementgoerginamarquezNoch keine Bewertungen

- Pledge Mortgage Presentation1Dokument158 SeitenPledge Mortgage Presentation1MaruelQueennethJeanMielNoch keine Bewertungen

- Special Proceedings Set 1Dokument122 SeitenSpecial Proceedings Set 1KathleenNoch keine Bewertungen

- PlaintDokument41 SeitenPlaintWXYZ-TV Channel 7 DetroitNoch keine Bewertungen

- Complaint - Eminent DomainDokument1 SeiteComplaint - Eminent DomainJsimNoch keine Bewertungen

- Act No. 2137 - The Warehouse Receipts LawDokument12 SeitenAct No. 2137 - The Warehouse Receipts LawCacaCamenforteNoch keine Bewertungen

- Credit Transactions DoctinesDokument18 SeitenCredit Transactions Doctinesmanol_salaNoch keine Bewertungen

- MortgageDokument7 SeitenMortgageGaurav GoyalNoch keine Bewertungen

- Outline in Negotiable Instruments Law1Dokument17 SeitenOutline in Negotiable Instruments Law1Arvin AbyadangNoch keine Bewertungen

- Revocation of Deed of TrustDokument1 SeiteRevocation of Deed of Trustkhairon sophiaNoch keine Bewertungen

- Credit DigestDokument4 SeitenCredit DigestRobert Ross Dulay100% (1)

- Ferrel L. Agard,: DebtorDokument20 SeitenFerrel L. Agard,: DebtorJfresearch06100% (1)

- United States District Court Order To Show CauseDokument2 SeitenUnited States District Court Order To Show CauseAndre Duke CoulterNoch keine Bewertungen

- Bulk Sales LawDokument2 SeitenBulk Sales LawTew BaquialNoch keine Bewertungen

- Levy v. GervacioDokument4 SeitenLevy v. GervacioFD Balita100% (1)

- Tax ReviewerDokument39 SeitenTax ReviewerLuigiMangayaNoch keine Bewertungen

- Angela Sacchi V Mers June 24 2011 - HOMEOWNER SURVIVES MOTION TO DISMISS FAC IN CALIFORNIA-THIS JUDGE GETS ITDokument18 SeitenAngela Sacchi V Mers June 24 2011 - HOMEOWNER SURVIVES MOTION TO DISMISS FAC IN CALIFORNIA-THIS JUDGE GETS IT83jjmackNoch keine Bewertungen

- YHT Realty Corporation Vs Court of AppealsDokument11 SeitenYHT Realty Corporation Vs Court of AppealsSarah De GuzmanNoch keine Bewertungen

- United State District Court Todd Adderly Not in ForeclosureDokument88 SeitenUnited State District Court Todd Adderly Not in ForeclosureTaipan KinlockNoch keine Bewertungen

- PledgeDokument3 SeitenPledgeKimboy J-javier100% (1)

- ForeclosureDokument19 SeitenForeclosure'Joshua Crisostomo'Noch keine Bewertungen

- Extrajudicial Foreclosure of MortgageDokument25 SeitenExtrajudicial Foreclosure of MortgageJuris PoetNoch keine Bewertungen

- NegotiableDokument121 SeitenNegotiableHiru Gustavo Arellano UndalokNoch keine Bewertungen

- Quieting of TitleDokument5 SeitenQuieting of TitleIZZA GARMANoch keine Bewertungen

- Union Bank VDokument5 SeitenUnion Bank VGlyza Kaye Zorilla PatiagNoch keine Bewertungen

- Commercial Law Review Case Doctrines Fin-3Dokument145 SeitenCommercial Law Review Case Doctrines Fin-3Cyr Evaristo FrancoNoch keine Bewertungen

- New Code of Judicial ConductDokument6 SeitenNew Code of Judicial ConductnicoNoch keine Bewertungen

- Quiz NegoDokument3 SeitenQuiz NegoMarlon CorpuzNoch keine Bewertungen

- SPL CommDokument16 SeitenSPL CommIssa GayasNoch keine Bewertungen

- JPMC v. Butler WDokument6 SeitenJPMC v. Butler WDinSFLANoch keine Bewertungen

- Wrongful Foreclosure SurveyDokument2 SeitenWrongful Foreclosure SurveyForeclosure FraudNoch keine Bewertungen

- MortgageDokument109 SeitenMortgageErole John AtienzaNoch keine Bewertungen

- Negotiable InstrumentsDokument14 SeitenNegotiable InstrumentsAlyza Montilla BurdeosNoch keine Bewertungen

- Got $3.1 Million?? Judge Magner Fines Wells Fargo in Her Scathing Opinion For Wells Fargo Bad Mortgage Servicing ConductDokument21 SeitenGot $3.1 Million?? Judge Magner Fines Wells Fargo in Her Scathing Opinion For Wells Fargo Bad Mortgage Servicing Conduct83jjmackNoch keine Bewertungen

- Duties of BaileeDokument6 SeitenDuties of BaileeDip Jyoti ChakrabortyNoch keine Bewertungen

- Foreclosure of Real Estate MortgageDokument13 SeitenForeclosure of Real Estate MortgageTrudgeOn100% (1)

- Digest UCPB Vs Spouses BelusoDokument2 SeitenDigest UCPB Vs Spouses BelusoylessinNoch keine Bewertungen

- Extrajudicial Foreclosure of Real Estate MortgageDokument3 SeitenExtrajudicial Foreclosure of Real Estate Mortgageclifford b cubianNoch keine Bewertungen

- 10) Breach of ContractDokument19 Seiten10) Breach of ContractMaryam MalikNoch keine Bewertungen

- JAI-ALAI V BPIDokument6 SeitenJAI-ALAI V BPIKeej DalonosNoch keine Bewertungen

- Estafu Thru Falsification of Commercial DocumentDokument2 SeitenEstafu Thru Falsification of Commercial DocumentnamNoch keine Bewertungen

- 137 Pascual v. Orozco (1911)Dokument2 Seiten137 Pascual v. Orozco (1911)May RMNoch keine Bewertungen

- Sec Form 12-1 Registration Statement With Prospectus PDFDokument53 SeitenSec Form 12-1 Registration Statement With Prospectus PDFIrwin Ariel D. MielNoch keine Bewertungen

- Last Will and Testament - Will and Testament - Property Law PDFDokument7 SeitenLast Will and Testament - Will and Testament - Property Law PDFMeshelle HuffmanNoch keine Bewertungen

- CounterclaimDokument25 SeitenCounterclaimRichie CollinsNoch keine Bewertungen

- 10-Makati Leasing and Finance Corp. vs. Wearever Textile Mills, Inc.Dokument9 Seiten10-Makati Leasing and Finance Corp. vs. Wearever Textile Mills, Inc.resjudicataNoch keine Bewertungen

- Makati Leasing v. Wearever TextileDokument1 SeiteMakati Leasing v. Wearever TextileJoyce ManuelNoch keine Bewertungen

- Credit Transactions Compilation #6Dokument27 SeitenCredit Transactions Compilation #6Vic RabayaNoch keine Bewertungen

- Complaint-Affidavit - Bp22 CaseDokument9 SeitenComplaint-Affidavit - Bp22 CaseKrizea Marie DuronNoch keine Bewertungen

- Affidavit of ComplaintDokument3 SeitenAffidavit of ComplaintKrizea Marie DuronNoch keine Bewertungen

- Cardino and EjercitoDokument2 SeitenCardino and EjercitoKrizea Marie DuronNoch keine Bewertungen

- Ra 9262Dokument5 SeitenRa 9262Krizea Marie DuronNoch keine Bewertungen

- Azucena Cottage Briefing KitDokument41 SeitenAzucena Cottage Briefing KitKrizea Marie DuronNoch keine Bewertungen

- Case of Doorson v. The NetherlandsDokument28 SeitenCase of Doorson v. The NetherlandsKrizea Marie DuronNoch keine Bewertungen

- C.F. Sharp Crew Vs CastilloDokument1 SeiteC.F. Sharp Crew Vs CastilloKrizea Marie DuronNoch keine Bewertungen

- IX. Q. B. DBP vs. Licuanan (Duron)Dokument2 SeitenIX. Q. B. DBP vs. Licuanan (Duron)Krizea Marie Duron100% (1)

- V. 109. Sta. Lucia East Commercial Corp. vs. Sec. of Labor (Duron)Dokument1 SeiteV. 109. Sta. Lucia East Commercial Corp. vs. Sec. of Labor (Duron)Krizea Marie Duron100% (1)

- VI. 139. Filipinas Synthetic Fiber vs. NLRC (Duron)Dokument1 SeiteVI. 139. Filipinas Synthetic Fiber vs. NLRC (Duron)Krizea Marie DuronNoch keine Bewertungen

- IX. 18. Chua vs. Villanueva (Duron)Dokument1 SeiteIX. 18. Chua vs. Villanueva (Duron)Krizea Marie DuronNoch keine Bewertungen

- IX. Q. O. Saguan Vs PBCom (Duron)Dokument1 SeiteIX. Q. O. Saguan Vs PBCom (Duron)Krizea Marie DuronNoch keine Bewertungen

- Labor Batch 3 Compilation 29 72Dokument40 SeitenLabor Batch 3 Compilation 29 72Krizea Marie DuronNoch keine Bewertungen

- Nerissa Buenviaje Et Al Vs CADokument2 SeitenNerissa Buenviaje Et Al Vs CAKrizea Marie DuronNoch keine Bewertungen

- ASEAN Integration DuronDokument1 SeiteASEAN Integration DuronKrizea Marie DuronNoch keine Bewertungen

- V. B. I. Pantilla Vs Baliwag (Duron)Dokument1 SeiteV. B. I. Pantilla Vs Baliwag (Duron)Krizea Marie DuronNoch keine Bewertungen

- G Holdings Vs National Mines and Allied Workers UnionDokument1 SeiteG Holdings Vs National Mines and Allied Workers UnionKrizea Marie DuronNoch keine Bewertungen

- ASEAN Integration DuronDokument1 SeiteASEAN Integration DuronKrizea Marie DuronNoch keine Bewertungen

- Mat Boundary Spring Generator With KX Ky KZ KMX KMy KMZDokument3 SeitenMat Boundary Spring Generator With KX Ky KZ KMX KMy KMZcesar rodriguezNoch keine Bewertungen

- T1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurningDokument16 SeitenT1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurninghosseinNoch keine Bewertungen

- 2021S-EPM 1163 - Day-11-Unit-8 ProcMgmt-AODADokument13 Seiten2021S-EPM 1163 - Day-11-Unit-8 ProcMgmt-AODAehsan ershadNoch keine Bewertungen

- Section 8 Illustrations and Parts List: Sullair CorporationDokument1 SeiteSection 8 Illustrations and Parts List: Sullair CorporationBisma MasoodNoch keine Bewertungen

- BluetoothDokument28 SeitenBluetoothMilind GoratelaNoch keine Bewertungen

- Week 8: ACCG3001 Organisational Planning and Control Tutorial In-Class Exercise - Student HandoutDokument3 SeitenWeek 8: ACCG3001 Organisational Planning and Control Tutorial In-Class Exercise - Student Handoutdwkwhdq dwdNoch keine Bewertungen

- 1934 PARIS AIRSHOW REPORT - Part1 PDFDokument11 Seiten1934 PARIS AIRSHOW REPORT - Part1 PDFstarsalingsoul8000Noch keine Bewertungen

- Lending OperationsDokument54 SeitenLending OperationsFaraz Ahmed FarooqiNoch keine Bewertungen

- Engine Diesel PerfomanceDokument32 SeitenEngine Diesel PerfomancerizalNoch keine Bewertungen

- Income Statement, Its Elements, Usefulness and LimitationsDokument5 SeitenIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNoch keine Bewertungen

- Fidp ResearchDokument3 SeitenFidp ResearchIn SanityNoch keine Bewertungen

- Prachi AgarwalDokument1 SeitePrachi AgarwalAnees ReddyNoch keine Bewertungen

- 5 Deming Principles That Help Healthcare Process ImprovementDokument8 Seiten5 Deming Principles That Help Healthcare Process Improvementdewi estariNoch keine Bewertungen

- Guide To Growing MangoDokument8 SeitenGuide To Growing MangoRhenn Las100% (2)

- Brand Positioning of PepsiCoDokument9 SeitenBrand Positioning of PepsiCoAbhishek DhawanNoch keine Bewertungen

- 2016 066 RC - LuelcoDokument11 Seiten2016 066 RC - LuelcoJoshua GatumbatoNoch keine Bewertungen

- Linux For Beginners - Shane BlackDokument165 SeitenLinux For Beginners - Shane BlackQuod Antichristus100% (1)

- Cam Action: Series: Inch StandardDokument6 SeitenCam Action: Series: Inch StandardVishwa NNoch keine Bewertungen

- CI Principles of EconomicsDokument833 SeitenCI Principles of EconomicsJamieNoch keine Bewertungen

- Doterra Enrollment Kits 2016 NewDokument3 SeitenDoterra Enrollment Kits 2016 Newapi-261515449Noch keine Bewertungen

- Notifier AMPS 24 AMPS 24E Addressable Power SupplyDokument44 SeitenNotifier AMPS 24 AMPS 24E Addressable Power SupplyMiguel Angel Guzman ReyesNoch keine Bewertungen

- Fake PDFDokument2 SeitenFake PDFJessicaNoch keine Bewertungen

- Amerisolar AS 7M144 HC Module Specification - CompressedDokument2 SeitenAmerisolar AS 7M144 HC Module Specification - CompressedMarcus AlbaniNoch keine Bewertungen

- A320 Basic Edition Flight TutorialDokument50 SeitenA320 Basic Edition Flight TutorialOrlando CuestaNoch keine Bewertungen

- Extent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home EconomicsDokument47 SeitenExtent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home Economicschukwu solomon75% (4)

- The Art of Blues SolosDokument51 SeitenThe Art of Blues SolosEnrique Maldonado100% (8)

- Cs8792 Cns Unit 1Dokument35 SeitenCs8792 Cns Unit 1Manikandan JNoch keine Bewertungen

- 3125 Vitalogic 4000 PDFDokument444 Seiten3125 Vitalogic 4000 PDFvlaimirNoch keine Bewertungen

- Are Groups and Teams The Same Thing? An Evaluation From The Point of Organizational PerformanceDokument6 SeitenAre Groups and Teams The Same Thing? An Evaluation From The Point of Organizational PerformanceNely Noer SofwatiNoch keine Bewertungen

- FIRE FIGHTING ROBOT (Mini Project)Dokument21 SeitenFIRE FIGHTING ROBOT (Mini Project)Hisham Kunjumuhammed100% (2)