Beruflich Dokumente

Kultur Dokumente

2012 VJC Prelim Answer

Hochgeladen von

Poh Wei PinCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2012 VJC Prelim Answer

Hochgeladen von

Poh Wei PinCopyright:

Verfügbare Formate

VICTORIA JUNIOR COLLEGE

2012 JC2 PRELIMINARY EXAM

H1 ECONOMICS (REVISED) PAPER NO. 8819/01

13 September 2012 2:00 5:00 pm

READ THESE INSTRUCTIONS FIRST

Write your name and class on all the work you hand in.

Write in dark blue or black pen.

You may use a soft pencil for diagrams.

Do not use staples, paper clips, glue or correction fluid on the work that you hand in.

Section A

Answer all questions.

Section B

Answer one question.

The number of marks is given in [ ] at the end of each question or part question.

At the end of the examination, fasten your work securely, by question, using the strings

provided.

_________________________________________________________________

This document consists of 9 printed pages.

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Section A

Answer all questions in this section.

Question 1

Sustainable Energy Development

Table 1: World price of crude oil 2002 - 2010

Year Price in US$*

2002 31.4

2003 36.7

2004 47.5

2005 62.7

2006 71.0

2007 75.5

2008 101.9

2009 62.4

2010 79.4

* figures are based on the average over 4 quarters, in real 2010 prices

Source : US Energy Information Administration, accessed 25 May 2012

Extract 1 : Cheap natural gas making inroads as US fuel

Americas natural gas boom continues to amaze. Between 2005 and 2010 the countrys

shale-gas industry, which produces natural gas from shale rock by bombarding it with water

and chemicalsa technique known as fracking grew by 45% a year. As a proportion of

Americas overall gas production, shale gas has increased from 4% in 2005 to 24% today.

Natural gas emits less carbon dioxide than oil-based gasoline (this is the American term for

petrol, which is distilled from crude oil). Thus, it can be considered a "green" fuel. The use

of natural gas instead of gasoline to drive the country's cars and trucks "is definitely starting

to take off," said Mark Hanson, an analyst at investment research firm Morningstar.

Compressed natural gas (CNG), a form of natural gas used to power vehicles, is believed to

offer a lot of potential. The technology is promising," said a General Motors spokesman.

"Fracking" has drawn fire from environmentalists as the method threatens the air we

breathe, the water we drink, and the climate on which we depend and thus the federal

government and regulators in various states are considering tighter regulations on it. CNG

is pressurized gas stored in a similar way to a vehicle's gasoline tank but it has several

drawbacks at the moment. CNG vehicles can only operate at relatively short distances from

a refuelling hub. Large businesses with substantial scale of production can potentially justify

the cost of investing in their own specialized refuelling stations. But for individual consumers,

the refuelling infrastructure is limited - currently there are only about 400 CNG stations in the

US. Moreover, CNG is still expensive relative to gasoline and requires a greater amount of

space for storage than conventional gasoline powered vehicles.

Source : Adapted from news.discovery.com, 28 Mar 2012 and Economist, 2 Jun 2012

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Table 2:

Total carbon emissions (Million Metric Tons):

2005 2006 2007 2008 2009

United States 5991.5 5913.7 6018.1 5833.1 5424.5

Singapore 133.9 140.1 146.9 156.4 156.4

Per capita carbon emissions (Million Metric Tons):

2005 2006 2007 2008 2009

United States 20.3 19.8 20.0 19.2 17.7

Singapore 30.2 31.2 32.3 34.0 33.6

Source : US Energy Information Administration, accessed 25 May 2012

Extract 2: Is Singapore part of the problem, or can it be part of the solution?

That human activity is changing the Earth's climate is now accepted by all but a small

minority of climate change deniers. There is now in-principle agreement among governments

in most large developed countries that they must reduce greenhouse gas emissions, the

most significant of which are emissions of carbon dioxide. Carbon emissions are not only

harmful to the environment, but also to human health as warmer temperatures would bring

diseases, and probably lead to fast-melting ice sheets, rising sea levels, drought and crop

destruction.

In the 'National Climate Change Strategy' (NCCS) released in 2008, Singapore calls for

responsible action to tackle the threat of climate change, including efforts at mitigation. One

underlying aim of its mitigation strategy is to tweak the price-based incentives of firms and

households to be more energy efficient. Other government policies aim to promote new

sources of GDP growth by developing 'clean energy' industries. There were already several

initiatives in place to protect the environment it had long controlled its vehicle population

growth, for example. One measure that will kick in next year is an emissions-based vehicle

scheme that rewards drivers of fuel-efficient cars. The government is also studying the

possibility of a carbon tax. Residents are also encouraged to use energy-efficient devices

and public transport and turn off lights not in use. Among its various environmental

accomplishments, Singapore has achieved its carbon intensity target. The carbon intensity

of the economy refers to carbon dioxide emissions per dollar of GDP, and Singapore has

reduced these by 25% from the 1990 level even before its target date of 2012. However,

over the same period, actual emissions have increased.

Given its 'special circumstances' - its small size, urban landscape and industrialized

economy - Singapore cannot cut its emissions significantly, if at all. Its size makes it hard to

harness solar and wind energy effectively; its emissions are in fact encouraged by the

pursuit of an economic growth model that has been accompanied by increasing carbon

emissions the growth of Changi airport, oil refining and related petrochemicals

development are industries long encouraged by government policy. Moreover, its emissions

are only a small fraction, 0.2%, of the global total. One could say that since its contribution

is so small, it doesn't matter what it does. But some have argued that its emissions matter

because its wealth and success have made it an attractive growth model for many countries

in the region and if they follow its model of raising their per capita income, the world will have

no chance of averting disastrous climate change.

Source : Adapted from http://www.videtteonline.com, 5/12/2011

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Extract 3: US commerce department brings heavy tariffs against Chinese solar panels

The Obama administration which champions the clean energy industry yesterday imposed

tariffs of as much as 250 percent on Chinese-made solar panels to aid domestic

manufacturers beset by foreign competition. Critics said the decision may end up raising

prices and hurting the US renewable energy industry.

The US Commerce Department ruled that Chinese manufacturers sold solar panels in the

US at prices below the cost of production. A few of those companies have acknowledged

receiving cheap loans and other government support. The decision will benefit the US solar

panel makers who were struggling against Chinese competition and weakening demand in

Europe. Chinese imports drive down the price of solar panels by 80% over the last five

years, and by 40% in the last year alone. The price drops drove some US solar panel

makers such as Solyndra to collapse. Another maker, Evergreen Solar, embarrassed

the administration by announcing plans to move production from Massachusetts to China

because of lower costs, after laying off 800 workers.

Todays decision is expected to have an impact on the US marketplace for Chinese

manufacturers since it will begin to remove the advantage they have had as a result of their

illegal trade practices, the Coalition for American Solar Panel Manufacturing said in a

statement. Hong Lei, a Foreign Ministry spokesman, told reporters today in Beijing that

Chinese companies have a price advantage because they have reduced costs through

technological research. China criticized the action, saying the US is hurting itself and

cooperation between the worlds two largest economies. The tariffs will probably drive up

prices for solar projects in the US, according to Shyam Mehta, an analyst with GTM

Research in Boston, and may prompt Chinese companies to shift production to other

countries to evade them. Jigar Shah, president of the Coalition for Affordable Solar Energy,

said the tariffs wont benefit the rest of the US solar industry, including developers that buy

solar panels and companies that sell the gear used to produce them. They will increase

solar electricity prices in the US precisely at the moment solar power is becoming a

competitive alternative energy for fossil fuel generated electricity, Shah said in a statement.

This new artificial tax will mean higher prices for consumers and will set back the adoption

of solar power, undermining the success of the US solar industry. He also warned that

China might retaliate against American manufacturers, sparking a trade war.

The US solar industry grew by 109 percent from 2010 to 2011. It has made $56bn in clean

energy investment in 2011, overtaking China, which invested $47.4bn. The growth of the

US clean energy industry was led by the plummeting costs of Chinese-made solar panels.

Protecting US panel makers may not be the best way to promote renewable energy in the

US, according to Tom Gutierrez, chief executive officer of GT Advanced Technologies Inc.

(GTAT), a Merrimack, New Hampshire-based supplier of solar manufacturing gear. The

war we are fighting is a technology way, Gutierrez said in an interview. If we get stuck

protecting low level assembly jobs, we lose on the future.

President Barack Obama is trying to create a market for solar in the US, so its curious why

he wants to impose tariffs, which will make it more expensive, said Dan Ikenson, director of

the Washington-based Cato Institutes Herbert A. Stiefel Center for Trade Policy Studies. It

will imperil jobs in the much more economically significant downstream.

Source : Bloomberg, May 18, 2012

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Questions:

(a) (i) Summarise the trend in world price of crude oil between 2002 and 2010 [2]

as shown in Table 1.

(ii) With reference to Extract 1 and using demand and supply analysis, [4]

explain whether the availability of natural gas in the US will affect the

price of gasoline.

(b) (i) Compare the trends for total carbon emissions by Singapore and the US [2]

from 2005 2009.

(ii) Explain how carbon emissions can lead to market failure. [4]

(c) To what extent should Singapore contribute towards the reduction of [8]

world carbon emissions?

(d) Given that the US government champions the clean energy industry, [10]

discuss its justifications for imposing heavy tariffs on solar panels from

China.

Total: 30m

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Question 2

Economic Growth in Indonesia and Singapore

Table 3: Indonesia: selected economic indicators 2006-2010

2006 2007 2008 2009 2010

Real GDP growth (%) 5.5 6.3 6.0 4.6 6.2

Inflation rate (%) 13.1 6.7 9.8 4.8 5.1

Unemployment rate (%) 10.3 9.1 8.4 7.9 7.1

Interest rate (%) 9.75 8.0 9.25 6.5 6.5

Population growth (annual % change) 1.1 1.1 1.1 1.0 1.0

Source: Adapted from the World Bank, July 2012, Bank Indonesia 2012

Table 4: Singapore: selected economic indicators 2006-2010

2006 2007 2008 2009 2010

Real GDP growth (%) 8.8 8.9 1.7 -1.0 14.8

Inflation rate (%) 1.0 2.1 6.6 0.6 2.8

Interest rate (%) 3.44 2.0 0.75 0.44 0.31

Source: Adapted from the World Bank, July 2012, Monetary Authority of Singapore July 2012

Extract 4: Indonesia posts rising GDP growth

Indonesia's GDP grew 6.2 per cent in 2010, officials said as Southeast Asia's biggest

economy confirmed its position among the top ranks of emerging markets. Central Statistics

Agency Chairman, Rusman Heriawan said the resource-rich country of 240 million people

posted 6.9 per cent growth in the fourth quarter of 2010, making it among the best

performers in the Group of 20 rich and developing countries.

Indonesia is on course to reach its target of 6.0-6.5 per cent growth in 2011. The country's

stock market has shed more than five per cent so far in 2011 due to concerns about rising

inflation, persistent infrastructure bottlenecks and endemic corruption.

Heriawan said Indonesia could look forward to stronger growth in 2011, in line with the

broader recovery of the global economy from the 2008-2009 financial crisis. The agency said

exports in the fourth quarter of 2010 increased 16.1 per cent, a sign of the appetite for

Indonesian resources from China and India. Investment climbed 8.7 per cent and

government spending rose 7.3 per cent. Household consumption increased 4.4 per cent, a

key figure given that some 60 per cent of Indonesia's GDP is attributed to domestic demand.

In 2010, President Susilo Bambang Yudhoyono announced a massive overhaul of the

country's deteriorating infrastructure worth $140 billion over 5 years, $90 billion of which has

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

to come from the private sector. Standard Chartered Bank economist FauziIkhsan said new

and improved ports, roads, bridges and railways were essential to Indonesia's ambitions to

become a regional economic powerhouse. "The economic growth was supported by high

commodities prices which raised the country's export income. Foreign direct investment and

public consumption also helped the growth," he said. "In the near future, the government

should push infrastructure development as this is important to attract private investment."

Source: Adapted from Channelnewsasia.com, 7 Feb 2011

Extract 5: Fear of inflation spiral

In the face of increasing inflation and to quell the fears of an inflation spiral, the central bank

raises the interest rate from 6.5% to 6.75%. Indonesia has previously resisted raising the

interest rate, fearing it would attract capital flows, putting pressure on its currency to rise.

The continuing increase in inflation is driven by the rise in global commodity prices,

accelerating domestic demand, and relatively high inflation expectation, the central bank

said. Bank Indonesia is continuously vigilant to these risks on accelerating inflation

pressures, as well as inflation pressures that may rise if government were to reduce fuel and

electricity subsidies.

Source: Adapted from Bloomberg, 9 June 2011

Extract 6: Singapore economic expansion quickens inflation

Singapores inflation rate rose to 3.8 percent in November from a year earlier, an

acceleration that may put pressure on the central bank to allow further currency appreciation

to curb price increases.

Singapores economic expansion this year has fuelled prices, prompting the central bank to

allow faster currency gains and leading the government to implement measures to cool the

property market. The Monetary Authority of Singapore uses the exchange rate instead of

interest rates to manage inflation, which it forecasts may stay high in the first half of 2011.

Rising food, transport and housing costs, compounded by escalating wage pressures, will

likely keep inflation above 4 percent in early 2011, Mr. Chua, BOA Merrill Lynch economist

said before the report. MAS will have to stay tight, in our view, with the risk for further

tightening in April next year.

The central bank said in October that it will steepen and widen the currencys trading band

while continuing to seek a modest and gradual appreciation, after undertaking a one-time

revaluation in April. The Singapore dollar has gained more than 7 percent against the U.S.

currency this year. Moreover, to maintain a stable and sustainable property market, the

government will also be imposing higher stamp levies for owners of new properties who sold

them within 4 years (previously 3 years) of purchase. This takes effect in January 2011.

Source: Adapted from Bloomberg, 23 December 2010

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Extract 7: Singapore lowers 2011 growth forecast as global risks threaten Asia

Singapore reduced the top end of its growth forecast for 2011 as a faltering U.S. economy

and the European debt crisis heightened the risks to global expansion. Singapores GDP will

probably rise 5-6 percent this year, Prime Minister Lee said yesterday. The government

previously predicted growth of as much as 7 percent.

Asia, led by China and India, is expected to continue growing but the global outlook remains

uncertain, Lee said. Europes debt problems are far from solved despite the recent bailout

of Greece by the European Union. The U.S. economy remains sluggish. Asia faces the

threats of weakening demand and rising currencies after Standard & Poors cut U.S. credit

rating and a sell-off in Italian and Spanish debt intensified risks to the world recovery.

Singapore remains vulnerable to fluctuations in overseas orders for manufactured goods

even as the government boosts financial services and tourism, making it the most volatile

Asian economy, according to Credit Suisse Group AG. If the U.S. goes into a recession,

then no doubt Singapore will get hurt significantly, said Kun, Credit Suisse analyst.

However, thats not our current view yet. We still expect U.S. growth to continue but at a

very weak level.

Source: Adapted from Bloomberg, 8 Aug 2011

Questions

(a) (i) With reference to Table 3, describe the trend of Indonesias [1]

unemployment rate for the period 2006 to 2010.

(ii) From the data, what can you conclude about the standard of living of [4]

Indonesians?

(b) (i) State the relationship between Indonesias inflation rate and the interest [1]

rate shown in Table 3.

(ii) Analyse the impact of the increase in interest rate in 2011 by the [6]

Indonesian central bank.

(c) With reference to Extract 4, discuss whether the governments [8]

infrastructural spending can help Indonesia to achieve the

macroeconomic objective of non-inflationary economic growth.

(d) If you were the economic advisor to the Singapore government, would [10]

you recommend that the government continues to allow the exchange

rate to strengthen?

Total: 30m

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Section B

Answer one question from this section.

3. A year on since the first of Singapore's two casinos opened its doors, there are

now growing calls to review the entry levy that locals have to fork out if they wish

to gamble there.

The Business Times 21/02/2011

a) Explain why the casino is a private good and how it leads to market failure. [10]

b) Discuss if the imposition of an entry levy is the most appropriate measure [15]

to correct the market failure.

4. Recovering global economies have led to rising oil prices and this has affected

oil importers such as Singapore.

Adapted from Mas.gov.sg/May 2010

a) Explain the impact of rising global oil prices on the Singapore economy. [12]

b) Discuss the extent to which supply side policies can help to manage the [13]

most harmful effects of rising oil prices.

---- End of paper ----

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Victoria Junior College

2012 H1 Economics Preliminary Exam

Section A:

CSQ1:

(a) (i) Summarise the trend in world price of crude oil between 2002 and 2010 [2]

as shown in Table 1.

World price of crude oil

has risen steadily from 2002 to a peak in 2008 [1] but fell sharply in 2009 and then resumed

its rise again thereafter [1].

Or

was generally rising [1] with the exception of a sharp fall in 2009.[1]

(ii) With reference to Extract 1 and using demand and supply analysis, [4]

explain whether the availability of natural gas in the US will affect the

price of gasoline.

How it will affect the price of gasoline

The availability of natural gas in the US will cause the supply of natural gas to increase and the

price of natural gas to fall.

As natural gas can be used as an alternative to gasoline, there may be a switch to natural gas

away from gasoline, i.e. demand for gasoline will fall, driving down the price of gasoline.

Effect is insignificant at the moment

However, the supply of gasoline will not increase very significantly as the share of natural gas

in the total gas production is still small (24% of the total) and there are environmental concerns

over its extraction. Hence, the price of natural gas will not fall very much and thus widespread

use of natural gas by individual consumers is not likely yet since it will still be expensive and

there will thus be little fall in demand for gasoline.

Moreover, there is a lack of refuelling infrastructure for CNG vehicles that use natural gas as

these vehicles can only operate short distances from a refuelling hub and the bigger storage

space required by these vehicles also prevent them from catching on in popularity and hence

little fall in demand for gasoline.

The insignificant fall in demand for gasoline, assuming no change in supply of gasoline will

thus lead to an insignificant fall in the price of gasoline.

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Effect will be more significant given time

As the technology is promising, the extraction of natural gas may become safer and more

acceptable, increasing its supply and bringing down its price significantly. The storage space

required in vehicles may also be possibly reduced and the demand for CNG vehicles may then

rise. It may then be an alternative energy to gasoline, reducing the dependence on gasoline,

in turn reducing the demand for gasoline more significantly and thus lower the price of gasoline

more significantly, assuming no change in supply of gasoline.

Students are expected to explain, with supporting evidence,

-how and whether it will affect Up to 3 m

-extent of effect, whether insignificant at the moment or more significant given time Up to 2 m

[3 + 2 = 4m, If nothing on extent, capped at 3m]

(b) (i) Compare the trends for total carbon emissions by Singapore and the US [2]

from 2005 2009.

While total carbon emissions by the US have been falling since 2005, with the exception of a

slight rise in 2007, Singapores total carbon emissions have been rising to a peak in 2008 and

stay constant in 2009.[2]

Total emissions by US was higher than Singapores throughout. [1]

(ii) Explain how carbon emissions can lead to market failure. [4]

x carbon dioxide emissions caused by production/consumption of gasoline are negative

externalities or external costs (or harmful effects) imposed on people (or third parties)

who are not directly involved in the production/consumption of gasoline.

x There is thus a divergence between marginal private costs (MPC) and marginal social

costs(MSC).

x Examples of such third party effects include harm to the environment, health costs due to

diseases, drought and crop destruction, caused by pollution/global warming.

Costs/

MSC

Benefits A

Es MPC

Ep

MPB = MSB

0 Quantity of production

Qs Qp

/consumption using gasoline

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

x When deciding on production or consumption, the free market will

produce/consume up to the point where MPB = MPC, achieving private

efficiency but does not take into account the external costs generated.

x As such, Qp is being produced/consumed. However, the socially efficient level

is at Qs, where MSC = MSB. The market is thus said to fail,

overproducing/consuming QsQp units, which give rise to more costs than

benefits to the society, resulting in welfare loss of area AEs Ep.

x Diagram if used for explanation.

(c) To what extent should Singapore contribute towards the reduction of [8]

world carbon emissions?

Singapore should contribute:

-on a per capita basis, her emissions are very high and rising and she should thus do

something to reduce them.

-her contribution, even small, will help to improve world resource allocation and increase world

allocative efficiency

-and at the same time improve the non-material well being of her residents by improving the

air quality.

-with her wealth, the need to grow rapidly for survival reason has become less justified and she

has the ability and moral obligation to make a contribution by pursuing new sources of growth

that develop clean energy instead of continuing to depend on those which cause increasing

levels of emissions. It may even be a new source of export revenue if she succeeds in

developing her clean energy industry.

-even if she cannot reduce the emissions significantly or at all, she can still contribute in terms

of mitigation efforts, which she is already doing:

-cap her carbon intensity reduce its carbon emission per dollar of GDP

-take steps to be more energy efficient, so as to cut down as much emissions as

possible eg encourage fuel-efficient cars through a carbon tax, use of energy-efficient

devices at homes, control vehicle population and encourage use of public transport.

-she can be a role model for other countries who pursue her growth model if she succeeds at

her mitigation effort.

Singapore should not contribute:

-the benefits of reducing world carbon emissions are negligible as her emissions form only

0.2% of the global total while

-the costs of reducing the emissions are huge since

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

i)her economic growth will be adversely affected

-being a city state and an industrialised economy that depends on production activity,

emissions will be inevitable. She needs to undertake production such as growing her air hub,

oil refining and petrochemicals development which will give rise to carbon emissions.

-emissions reducing effort will add to costs and reduce export competitiveness, putting her at a

disadvantage compared to competitors who did not make such an effort.

ii)being small, she does not have the space to tap and harness cleaner energy like solar and

wind energy and thus any attempt to reduce carbon emissions will be very costly.

Synthesis:

x To the extent that her economic growth is not too adversely affected, she should make

a contribution, however small, towards mitigating, if not reducing, world carbon

emissions, to improve world allocative efficiency as well as the non-material well being

of her people. She might even gain a new source of export revenue.

x Although she may not be able to reduce significantly her level of carbon emissions, she

can still compensate by promoting efficient use and exploring cleaner energy which she

is already doing.

x Even if she cannot make much of a difference given her low level of total emissions,

her contribution can be a signal to get others to do their parts and together with them,

make a collective difference.

Level Descriptors Marks

L1 Largely cut and paste or smattering of points limited to how carbon 1-2

emissions can or cannot be reduced.

L2 2 sided answer with some reference to data but under-developed 3-5

economic analysis (or vice versa)

Or

1 sided answer with some reference to data and well developed

economic analysis

L3 2 sided answer with adequate analysis /weighing and good use of data to 6-7

support both views.

+E Provide a substantiated and synthesized view +1

[10]

(d) Given that the US government champions the clean energy industry,

discuss its justifications for imposing heavy tariffs on solar panels from

China.

Solar energy is cleaner and cuts down on carbon emissions. The US government champions

the clean energy industry as evident by her higher investment of $56bn in clean energy in

2011, overtaking Chinas $47.4bn. The US solar industry grew by 109 percent from 2010 to

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

2011. The main reason behind the industrys growth was the availability of low cost Chinese-

made solar panels.

Why the move by the US is justified:

-However, such low cost solar panels have adversely affected the US solar panel makers.

-The US Commerce department ruled that the Chinese solar panel manufacturers have an

unfair advantage over their US counterparts as they have received cheap loans and other

government support and these have helped them to sell their solar panels in the US at prices

below the cost of production.

-They have caused the price of solar panels in the US to fall by 80% over the last five years,

and by 40% in the last year alone. Some US solar panel makers who could not compete with

the low price and incur losses have since closed down. Others have decided to move their

production from the US to China to take advantage of the low costs. As a result, production of

US solar panels fall, which will in turn cause the workers to become unemployed.

-Imposing heavy tariffs of as much as 250 percent on Chinese-made solar panels will raise

their price, removing the price advantage they have had as a result of illegal trade practices, so

that US consumers will switch from Chinese-made solar panels to domestic solar panels,

which thus help the domestic producers to stay in production and the workers to keep their

jobs.

[Not expected to but can be illustrated with diagram showing effects of tariff in reducing imports

and increasing domestic production.]

Why the move by the US is not justified:

-However, the Chinese Foreign Ministry spokesman has maintained that Chinese companies

have a price advantage because they have reduced costs through technological research.

-Critics have also argued that the tariffs, by raising prices of solar panels, will push up the

costs of producing solar energy, raising the price of solar power for consumers, setting back

the adoption of clean energy, thus end up hurting the US clean energy industry. After all, the

rapid growth of the solar industry was mainly attributed to the low costs solar panels from

China. Hence, by removing the availability of such an alternative source of energy which is

just beginning to become competitive, there would be job losses.

-The tariffs will also hurt relations and invite retaliation from China which may counter with

tariffs on US products entering China, hurting the US export industry and causing job losses.

-Chinese solar panel producers may also shift their production to other countries to avoid the

tariffs which may mean that their solar panels will still be able to enter the US market to

compete with the US solar panel makers and hence jobs in the industry will still be lost.

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Synthesis/Conclusion:

x The US move in imposing heavy tariffs on solar panels from China is hardly justified on

economics grounds.

x It will be lose-lose for the US and China as both will end up worse off, including the US

solar panel producers whom the US government tries to protect. Their expensive solar

panels may find few buyers and consumers may switch back to conventional energy,

setting her back on her clean energy initiative.

x Instead of a tariff, it might be better for the US to counter the competition by offering the

same low cost loan assistance to their solar panel firms like China. However, that

might not be easy in the aftermath of the financial crisis when banks became risk

averse.

x Or perhaps the US could have explored the possible reason behind her high costs, one

of which is likely to be her high wages and hence the need to raise productivity to bring

down unit cost.

x Or perhaps she should consider developing new areas of comparative advantage in the

downstream solar industry that requires high technology and move out of solar

manufacturing which she apparently has a comparative disadvantage.

x Thus, the US move in imposing heavy tariffs on Chinese solar panels is difficult to

justify and other better solutions should be explored.

Level Descriptors Marks

L1 x Only able to mention concepts relevant to the question and identify 1-2

some relevant points from the data but not able to explain the

economics of those points (i.e. answer is not developed using

economics).

L2 x Able to explain the economics of the US governments move but one- 3-5

sided answer

OR

Two-sided answer but answer is underdeveloped

x Limited use of data

L3 x Well-developed (using economic analysis) and balanced answer 6-8

x Sufficient breadth, covering impact on different parties consumers,

domestic and foreign producers of the protected industry as well as

related industries.

x Sufficient reference to the data that is available

+E1 x Provides a stand that responds to the question but did not +1

substantiate or synthesize views.

+E2 x Provides a justified stand. i.e. Makes a clear stand and provides a +2

critical assessment of the views based on the synthesis of the

theoretical and evidential arguments.

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

CSQ2:

(a) (i) With reference to Table 3, describe the trend of Indonesias [1]

unemployment rate for the period 2006 to 2010.

Indonesias unemployment rate fell throughout. (1m)

(ii) From the data, what can you conclude about the standard of living of [4]

Indonesians?

Living standard refers to the material and non-material well-being of Indonesians. Data

only shows the material living standard, i.e. the amount of goods and services available

for consumption. Non-material living standard refers to the quality of life, i.e. working

hours / conditions, stress, external costs, etc.

As Indonesias real GDP grew at a faster rate than population growth for the period 2006

to 2010, real GDP per capita has risen over the years. (1m) Also unemployment rate has

been falling, so more Indonesians would have jobs and the ability to purchase goods and

services. (1m) Thus, the material living standard of Indonesians would have improved.

(1m)

There is lack of data to comment on the non-material standard of living, though we can

infer that the rising economic growth may lead to longer working hours and stress. (1m).

(b) (i) State the relationship between Indonesias inflation rate and the interest [1]

rate shown in Table 3.

There was a direct relationship between Indonesias inflation rate and interest rate (1m).

OR Interest rate was raised (2006, 2008) when inflation rate was high and interest rate

declined when inflation rate fell. (1m)

(ii) Analyse the impact of the increase in interest rate in 2011 by the [6]

Indonesian central bank.

Indonesian central bank increased the interest rate from 6.5% to 6.75% in 2011 in the

face of inflationary pressures brought about by a booming economy due to higher global

commodity prices, accelerating domestic demand and relative high inflation expectation.

(1m)

A higher interest rate will increase the returns to savings but raises the opportunity costs

of consumption and investment. This causes households to save more and consume

less and firms to reduce investment, so with falling C and I, AD will fall. The fall in AD,

also induces less spending in other sectors, resulting in a multiple fall in real output and

thus easing the inflationary pressures. (2m)

Impact is likely to be significant since domestic demand accounts for a large proportion

of Indonesian GDP, however it can also be counter-argued that in a booming economy

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

with high consumer confidence and positive business prospects, C and I may not fall

significantly. Also the increase in interest rate is only 0.25%. (2m)

However, the higher interest rate may attract capital inflows as investors take advantage

of the higher returns in investing in Indonesian assets and higher confidence in the

central banks attempt to control inflation. (2m) With the capital inflows, investors will

need to exchange foreign currencies for the Rupiah, exerting upward pressure on the

exchange rate. The appreciating exchange rate may cause the exports to be price

uncompetitive, reducing net exports and leading to a negative impact on GDP growth,

though demand-pull inflationary pressures will be eased. (2m)

Impact on FDI if investors perceived that the rise in interest rate is able to control

inflation, the lower costs of production will attract FDI.

Explanation of direct impact of domestic interest rate on domestic demand and economy

(2m)

Explanation of impact on other aspects (capital inflows, ER and feedback effect on

domestic economy) 2m

Significance of impact 2m

(c) With reference to Extract 4, discuss whether the governments [8]

infrastructural spending can help Indonesia to achieve the

macroeconomic objective of non-inflationary economic growth.

To achieve non-inflationary economic growth, there must be both an increase in actual

growth and potential growth.

Thesis

The Indonesia government intends to have a massive overhaul of the country's

deteriorating infrastructure totalling $140 billion over 5 years. New and improved ports,

roads, bridges and railways were essential to Indonesia's ambitions to become a

regional economic powerhouse.

With investment in infrastructure, there will be a rise in aggregate demand for goods and

services (raw materials, relevant goods to build the ports, roads, bridges and railways).

As the government pays the contractors, engineers, workers involved in the construction,

the government spending will boost the construction sector, raising the demand for

labour, boosting output and employment. The rise in income will spur further domestic

consumption and spillover into the domestic consumer industries, hence boosting real

GDP.

In the longer term, when the infrastructure is completed, there will be increase in

efficiency (reduce persistent infrastructural bottlenecks) and productivity, thus boosting

productive growth.

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

With the rise in actual and potential growth, the Indonesian government will be able to

achieve a sustainable economic growth. Also, FDI may be attracted by the improved

infrastructure, further boosting I and growth.

Anti-thesis

The government has to spend $50 billion in building the infrastructure, so there will be a

strain on the governments budget and the government may have to cut down on fuel

and electricity subsidies. It may have to finance the expenditure through borrowings,

raising its public debt which may have to be paid back through higher taxes in the future.

The higher borrowings may lead to crowding out effect, as demand for loans drive up

interest rate. The higher interest rate increases returns to savings but deter domestic C

and I due to the higher borrowing costs. The fall in C and I may offset the rise in G and

hence economic growth.

Given the inflationary pressures currently faced by Indonesia, the further rise in I may

worsen the inflation in the short run due to structural bottlenecks. As investment is

spread over 5 years, the rise in productive capacity may not be fast enough to meet the

rise in AD.

Synthesis / Evaluation

The rise in government infrastructural spending can help Indonesia to expand its

productive capacity to achieve non-inflationary economic growth, and the improved

infrastructure will boost efficiency and reduce the persistent infrastructural bottlenecks.

With a booming economic growth and rising tax revenue, the government seems to have

the funds for the infrastructural development. However, in order to have a sustained

economic growth, actual growth is also needed and this is also dependent on the growth

in domestic and external demand.

Level Descriptors Marks

L1 An answer that shows how the government spending work but the 1-2

explanation is not clear (or not sufficiently developed). No reference to

data.

L2 Adequate one-sided explanation of how the planned government 3-5

spending can help to achieve a non-inflationary economic growth with

some use of data

Or

Provided both sides as to why it may help or not help to achieve a non-

inflationary economic growth, but explanation is not sufficient and some

use of data.

L3 A balanced answer with good analysis and good usage of data. 6-7

+E Well supported stand +1

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

(d) If you were the economic advisor to the Singapore government, would [10]

you recommend that the government continues to allow the exchange

rate to strengthen?

Inflation rate has risen from 0.6% in 2009 to 2.8% in 2010. It is expected to rise to about

3% in 2011. Singapores economic expansion (14.8% in 2010) has resulted in demand-

pull inflation as there is lack of spare capacity given that the economy is already in full

employment (Table 4, unemployment rate of 2.2%).

The tight labour market has also resulted in escalating wage pressures. This together

with rising transport costs has resulted in cost-push inflation (likely keep inflation above

4 percent in early 2011).

Thesis: Continue to allow the exchange rate to appreciate

By strengthening the S$, exports will become less price competitive, reducing foreigners

demand for Singapore exports. Imports will become relatively cheaper in S$ and locals

will switch to buying imported goods. Assuming demand for imports is price elastic, there

will be a more than proportionate rise in import expenditure. A fall in export revenue and

a rise in import expenditure will reduce net exports, aggregate demand and ease the

inflationary pressure. With the fall in net exports, wage pressure will also be reduced,

helping to keep prices down.

Cheaper imports will also help to reduce imported inflation as the stronger S$ means that

food prices will be cheaper and transport costs will fall. This is particularly important to

Singapore due to our lack of natural resources and our heavy import dependency. Food

and transport costs were also cited in the case as the reasons for the inflationary

pressure.

Moreover, the imported inputs will also be cheaper and this will lower the costs of

production and thus prices of domestic goods and services.

Singapore economy is still expected to grow at a reasonable 5-6%. Moreover, the Asian

currencies are also strengthening, so the impact on export competitiveness of a strong

S$ is less adverse.

Anti-thesis: Not to continue to let S$ strengthen

There are signs that Singapores GDP growth in 2011 is slowing down (cut in growth

forecast from 7% to 5-6% for 2011) as a faltering U.S. economy and the European debt

crisis heightened the risks to global expansion. Asia, led by China and India, is expected

to continue growing but the global outlook remains uncertain.

As Singapore is heavily reliant on trade and its major trading partners (US, Europe and

Asian countries, including China and India) are expected to face slowdown in their

economy, export expansion is expected to be reduced. To strengthen the S$ further will

result in a loss of our export competitiveness and further decline in the demand for our

exports. MAS has already allowed the S$ to strengthen significantly from 2009 to 2010

(Table 4, Extract 6 paragraph 3) and given that demand for our high value exports are

income elastic (slowdown in global economy/fall in GDP will lead to a more than

proportionate fall in demand for our exports), coupled with loss in export competitiveness

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

(foreigners may switch to cheaper substitutes) will significantly affect our export revenue,

leading to a further slowdown in our growth.

The use of S$ may not be effective in tackling inflation caused by rising housing costs.

The more effective measure would be specific policy targeted at properties, which the

government are already implementing (Extract 2, last paragraph), which will reduce

speculative demand and housing prices.

Synthesis / Evaluation

Singapores small domestic economy and openness to trade mean that the exchange

rate is very effective in ensuring economic growth with price stability. When the economy

rebounded with strong growth of 14.8% in 2010 and full employment of 2.2%, the upward

price / wages pressures together with imported inflation, provided strong justification for

MAS to appreciate the S$ to counter the accelerating inflationary pressures as it

addresses the root cause.

However, given that the global economy is slowing down and external demand is

expected to be affected, MAS should not continue the appreciation of the currency as it

may lead to an economic downturn if the stronger S$ makes our exports uncompetitive in

the midst of a slowing global demand.

Level Descriptors Marks

L1 An answer that shows how the government spending work but the 1-2

explanation is not clear (or not sufficiently developed). No reference to

data.

L2 Adequate one-sided explanation of why the Singapore government 3-5

should allow the currency to continue to strengthen, with some use of

data

Or

Provided both sides in analysing why the government should or should

not allow the currency to strengthen, but not adequately explained and

supported by data.

L3 A balanced answer with good analysis and good usage of data. 6-7

+ E1 Attempts to make judgement but assertions are not supported. +1

+ E2 Judgements are well explained and supported by analysis. +2

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Section B: Essays

3. A year on since the first of Singapore's two casinos opened its doors, there are

now growing calls to review the entry levy that locals have to fork out if they wish

to gamble there.

The Business Times 21/02/2011

a) Explain why the casino is a private good and how it leads to market failure. [10]

b) Discuss if the imposition of an entry levy is the most appropriate measure [15]

to correct the market failure.

a)

Whether a good is a private or public good will depend on whether it is excludable / non-

excludable and rivalrous /non-rivalrous.

Excludable

A private good is one that is excludable in nature. For such goods, it is possible to exclude a

person who did not pay from accessing the good and enjoying the benefits. Only a person who

has paid can enjoy the good. Thus, for the casino, as it is possible for the owners to physically

exclude people from entering its premises if they were to charge an entrance fee, it is

considered as a good that is excludable.

(This is totally different for a public good which is non-excludable in nature whereby it is

impossible or economically impractical to exclude anyone who has not paid, from enjoying the

benefits once it is produced. No rational consumers would be willing to be pay for these goods

and the problem of free riders will arise. For example, once a defence force is set up, those

who do not pay taxes which provide funds for the setting up of the defence force also enjoy the

security provided.)

Rivalrous

Private goods are considered rivalrous in nature because if one unit of the good is consumed,

there is less leftover for the next customer and more resources need to be utilised to produce

additional units. The casino is considered rivalrous as an additional person in the casino

gambling either at the tables or slot machines will mean that there is less space for someone

else to gamble. Given that a casino is a good that is both excludable and rivalrous, it can thus

be classified as a private good.

(On the other hand, a public good is non-rivalrous because the consumption or use of the good

by one person does not diminish the benefit available to the next person consuming the good.

The consumption of the good by an additional person does not require extra production costs.)

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

How does it lead to market failure

A casino causes market failure as it can be viewed as a demerit good with significant negative

externalities as well as consumer ignorance and thus the consumption of it leads to an

inefficient allocation of resources.

Negative externalities

Gambling at the casino causes various social issues for both the families as well as the

broader society (addiction leading to heavy losses, causing stress on families as gamblers go

into debt, higher crime rates etc..) generating external costs on third parties. If left to market

forces, the casino tends to be over-consumed at OQ units instead of the socially optimal level

at OQ* units.

Consumer ignorance

People visiting the casinos probably gamble more than what is usually socially (even private)

optimal due to ignorance and irrationality. They usually do not recognise or understand the true

consequence of their actions. Many do not fully comprehend the true odds of gambling or

mistakenly think that it is possible to beat the casino in the long run. Furthermore, when they

spend long hours in the casino, these people get addicted and irrationally gamble OQ units which

are more than the true beneficial amount of OQ* units.

Error! Objects cannot be created from editing field codes.

Level Descriptors Marks

L1 Some knowledge of the characteristics of private and public goods 1-4

and generic causes of market failure with limited reference to the

context.

L2 Undeveloped explanation about whether the casino is a public or 5-6

private good and incomplete analysis on why the casino is a form

of market failure.

L3 Thoroughly justifies why a casino is considered a private good and 7-10

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

a well-developed analysis of how externalities and ignorance cause

the market to fail to allocate resources efficiently for casinos.

b)

The current $100 entry levy can help to reduce the amount of gambling at the casino by

increasing the cost of entering the casino for the consumer so that it reflects both the social

and true private costs. With the levy, the marginal private cost will shift nearer to the social

marginal cost. Given the new costs to the consumers, they will find it less beneficial to gamble

as much as before and reduce the time spent at the casino, moving the quantity consumed

from OQ to OQ*.

However, the amount of entry levy might not be accurately calculated by the government and

this might lead to a less than optimal or even a worse outcome. If the levy is too little, gamblers

might still be willing to go to the casinos (demand for gambling has proven to be more price

inelastic than expected and thus the need to increase the levy from the current level) and if the

levy is too much, business of the casino might be adversely affected and cause problems by

causing it to close down and resulting in loss of jobs and income for the economy. Even if the

amount is correct, changing conditions might render the levy ineffective. For example, given

the robust economic growth in Singapore, consumers might view the $100 levy as affordable

and increase their visits to the casino.

Furthermore given the irrational mentality of Singaporeans, when they have to pay a levy,

some consumers will want to maximise the usage so it actually encourages some to gamble

even more than socially optimal and lead to greater inefficiencies.

There might also be monitoring costs involve in ensuring that only the people who pay the levy

are allowed entry and this might lead to a wastage of resources.

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Other possible policies to correct the market failure

Public education

Governments could also have advertisements, campaigns and other programmes such as the

gambling addiction management through education (G.A.M.E) to educate consumers about

the true costs of gambling and the negative effects it has on third parties like their families.

This would allow gamblers to more accurately understand their true costs and benefits,

bringing perceived benefits closer to the true benefits and help them make a more informed

choice to reduce the hours that they spend gambling or stop doing it completely.

However, such methods usually require a long time to achieve its desired effects as it would

take time for people to fully understand the information provided. Furthermore, it may also be

difficult to change or influence peoples mindsets effectively as gamblers might feel that the

government is needlessly interfering with their lives.

Legal regulations

Governments can use legal regulations to directly influence the behavior of the gamblers. They

can allow family members to exclude individuals who may not fully understand the true costs

and benefits or just ban all locals from entering the casino. Individuals can also voluntarily opt

to exclude themselves from entering the casino. As regulations are usually backed by severe

penalties such as fines and jail time, they tend to be very effective in changing the actions of

the gamblers.

Other than controlling the consumers, the government can also implement regulations for the

casino operators so that people will be less tempted to gamble. For example, the casino act in

Singapore regulates the amount and type of advertising that the casino can adopt as well as

restrictions such as prohibiting services such as the provision of free transport from certain

heartland areas to the casino. Given the strong legal system in Singapore, such legal

regulations would likely be effective in helping to correct the market failure.

The disadvantage of having voluntary exclusion will be that the parties involved may not have the

required information to make a rational decision and as such, they might not opt to exclude

themselves from the casino. But if a ban for all locals was implemented, it would be considered a

blunt tool as there are inevitably benefits for gamblers as well if they do not overdo it. If the parties

involved better understand the consequences of gambling and are able to control their time spent

in the casino, allowing them in the casino might increase the net benefits for the economy.

Furthermore, banning all locals might adversely the business of the casino and lead to job losses

in the country.

Conclusion

Although the entry levy imposed should have an effect in reducing the number of gamblers at

the casino, the more than expected number of people still visiting the casino means that it

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

might not have been a large enough amount in the first place. Furthermore, with the strong

economic growth, the value of the initial levy seems to have fallen and thus it might have to

be raised to correctly reflect the true costs of gambling. Nonetheless, since the free market is

still allowed to operate even with levy, it is considered the most appropriate amongst all

policies as it would lead to the least distortions.

As the irrationality exhibited by gamblers will mean that imposing a levy might not be enough

for certain groups to change their behavior, there is a need to use other policies to complement

it so as to ensure that resource allocation is more efficient. A conscious effort must also be

made to ensure that the government intervention does not adversely affect the market

mechanism too much and end up causing a greater welfare loss instead.

Level Descriptors Marks

L1 Some knowledge of how the various policies might help to correct 1-5

the market failure.

L2 Incomplete explanation of the workings of the entry levy and its 6-8

limitations as well as alternative policies with some reference to context.

L3 Well-developed analysis of the effectiveness of the entry levy and other 9-11

appropriate policies suitable for achieving a more efficient allocation of

resources in the casino market in Singapore.

+ E1 Unexplained judgement or one not supported by economic analysis. +1-2

+ E2 Justify the appropriateness of the policies considering the Singapore +3-4

context.

4. Recovering global economies have led to rising oil prices and this has affected

oil importers such as Singapore.

Adapted from Mas.gov.sg/May 2010

a) Explain the impact of rising global oil prices on the Singapore economy. [12]

b) Discuss the extent to which supply side policies can help to manage the [13]

most harmful effects of rising oil prices.

a)

Briefly refer to the quote. Explain why global oil prices have been rising in recent years.

Interpret the meaning of impact on Singapore economy internal and external macro goals.

Body:

Explain crude oil as an essential resource for many industries and products, e.g.

transportation, utilities, petrochemicals and plastic products.

A persistent rise in global oil prices will eventually seep into the economy through higher

imported energy costs, transport and utility costs, leading to cost-push inflation (imported

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

inflation). Being small and open, as well as oil reliant, Singapore is more vulnerable to a rise in

oil prices. Therefore since demand for oil imports is price inelastic, import expenditure will rise.

This might lead to rising cost of living as oil related products will see a price increase as well.

Over time, as cost of production rises, AS falls leading to the general price level rising and

hence our export prices will rise relative to our import prices. Given the rise in export prices,

quantity demanded for exports will fall. Assuming the demand for exports is price elastic; this

will lead to a significant fall in the net export revenue (X-M). Hence as Singapore faced

reduced export competitiveness due to rising oil prices, actual growth will be affected, resulting

in a rise in demand deficient unemployment. (Shift of AS causing a movement along AD

curve.)

Given that export revenue falls and import expenditure rises, Singapores trade balance will

worsen. Furthermore, a rise in overall inflation rate may deter FDI causing a worsening of the

capital account.

In all, a rise in global oil prices has a significant impact t on both the internal and external

economy unless MAS intervene in the exchange rate policy to prop up the exchange rate

during time s like this so that the impact on rising cost will not cause a huge deterioration to

our economy. However, it should be noted that the oil rig industry in Singapore may benefit

from a rise in oil prices which could partly offset the negative impact on the economy.

Level Descriptors Marks

L1 Identifies the cause-effects correctly but with little or no economic 1-4

reasoning or application of economic theories / models.

L2 Undeveloped explanation on the effects on the macro goals or mere 5-8

explanation on either internal or external economy.

L3 An in-depth explanation of how higher global oil prices eventually 9-12

worsens Singapore's balance of payments positions with the use of

demand elasticity concepts and on the other internal macro goals with

good use of AD-AS framework.

b)

Intro: Briefly explain some of the most harmful effects of rising oil prices on the economy (BOT,

cost push inflation etc). Justify based on our dependence on trade and imported inputs.

Body: Explain how supply side policies can help in reducing the impact of the above

problems.

1) Supply side policy can come in the form of government subsidizing oil importers on

condition that they will not pass on higher energy costs to consumers and the rest of

the economy. Have to link back to how lowering of cost will help to alleviate the impact

of cost push inflation and that on the BOT.

This will benefit oil consumers probably only in the short term. Furthermore, this measure is

unlikely to be undertaken by Singapore government at this point in time as funds will be

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

needed for the subsidy and over the long-term, the appropriateness and sustainability of

continuing to use taxpayers' money to compensate a few oil-importing firms becomes

questionable.

2) Government could also provide more rebates and tax free incentives especially to

energy intensive industries to encourage them to start taking steps to be greener in

their production process, therefore reducing their reliance on oil.

However, rebates and tax free incentive do not necessarily mean that there will be

major changes to their production methods as some firms may find it hard and

costly to switch to greener technology.

3) Government can invest in more research and development into alternative energy in

order to reduce dependence on crude oil as the only energy source and diversify into

alternative forms of energy, e.g. liquefied natural gas (LNG). The availability of

substitutes will raise the PED for oil and reduce imported inflation due to rising oil

prices.

4) The government can also collaborate with industries to improve energy efficiency and

to reduce cost of production in other areas.

However it is easier said than done. These are very long-term measures. Despite the

painful lessons from the global oil crises of the 1970s, Singapore and many other

countries are still heavily dependent on crude oil. For a number of reasons, such as no

ideal location to locate nuclear plant, geographical and climate constraints, it may not

be viable or cost-effective to generate nuclear, solar and thermal energy in Singapore.

5) Our government could directly intervene in the markets to increase the aggregate

supply in the long run. Measures such as increases in productivity thorough

technological advances or the development of human capital through retraining etc will

increase the productive capacity of our country. This would lead to lower inflation in the

long run as capacity is increased and pricing pressures are eased.

Since measures are to increase productive capacity but results are not guaranteed as

there may be uncertainties in the outcome of technology and it takes a long time to

develop human capital. Given that the rising oil price is a pressing problem, effects of

such measures may kick in too late.

Conclusion:

In times of rising oil prices, it is possible that the supply side policies implemented by the

Singapore government can help to mitigate the most harmful effects to a certain degree but it

may not solve the root problem. Moreover, most of these measures take a long time to see the

effects .The problem is thus better solved by exchange rate policy as it targets the root source

of rising cost of production. In the meantime, the Singapore government could use targeted

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

measure such as giving out transport and utility vouchers to help the lower income households

cope with the rise in oil-related costs.

Level Descriptors Marks

L1 An answer that shows some knowledge of supply side policies, e.g. 1-4

unexplained statements with little or reference to economic theories,

concepts or principles.

L2 For an undeveloped explanation of how supply side policies could cushion 5-6

Singapore from the effects of rising global oil prices. Only some hint of

criticism of these measures is offered.

L3 Able to correctly apply economic reasoning and theories to explain fully 7-9

how supply side policies can alleviate the most adverse effects of rising

global oil prices on Singapore with evaluation pertaining to context.

+E1 For an unexplained judgement, or one that is not supported by economic +1-2

analysis.

+E2 For an explained judgement with evaluation made reference to +3-4

Singapores context.

Visit bit.ly/JCpapers for more cheap and latest JC prelim papers

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Monsoon 2023 Registration NoticeDokument2 SeitenMonsoon 2023 Registration NoticeAbhinav AbhiNoch keine Bewertungen

- Ethical Game MonetizationDokument4 SeitenEthical Game MonetizationCasandra EdwardsNoch keine Bewertungen

- EU Regulation On The Approval of L-Category VehiclesDokument15 SeitenEU Regulation On The Approval of L-Category Vehicles3r0sNoch keine Bewertungen

- Voltas Case StudyDokument27 SeitenVoltas Case Studyvasistakiran100% (3)

- Traffic Problem in Chittagong Metropolitan CityDokument2 SeitenTraffic Problem in Chittagong Metropolitan CityRahmanNoch keine Bewertungen

- Zubair Agriculture TaxDokument3 SeitenZubair Agriculture Taxmunag786Noch keine Bewertungen

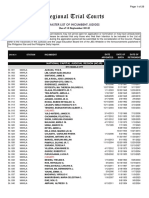

- Regional Trial Courts: Master List of Incumbent JudgesDokument26 SeitenRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaNoch keine Bewertungen

- Irda CircularDokument1 SeiteIrda CircularKushal AgarwalNoch keine Bewertungen

- Session 2Dokument73 SeitenSession 2Sankit Mohanty100% (1)

- Oil Opportunities in SudanDokument16 SeitenOil Opportunities in SudanEssam Eldin Metwally AhmedNoch keine Bewertungen

- Exim BankDokument79 SeitenExim Banklaxmi sambre0% (1)

- Why The Strengths Are Interesting?: FormulationDokument5 SeitenWhy The Strengths Are Interesting?: FormulationTang Zhen HaoNoch keine Bewertungen

- Application Form For Subscriber Registration: Tier I & Tier II AccountDokument9 SeitenApplication Form For Subscriber Registration: Tier I & Tier II AccountSimranjeet SinghNoch keine Bewertungen

- Dimapanat, Nur-Hussein L. Atty. Porfirio PanganibanDokument3 SeitenDimapanat, Nur-Hussein L. Atty. Porfirio PanganibanHussein DeeNoch keine Bewertungen

- Rental AgreementDokument1 SeiteRental AgreementrampartnersbusinessllcNoch keine Bewertungen

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokument1 SeiteBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSudesh SharmaNoch keine Bewertungen

- What Is Zoning?Dokument6 SeitenWhat Is Zoning?M-NCPPCNoch keine Bewertungen

- Pune HNIDokument9 SeitenPune HNIAvik Sarkar0% (1)

- Accounting CycleDokument6 SeitenAccounting CycleElla Acosta0% (1)

- Use CaseDokument4 SeitenUse CasemeriiNoch keine Bewertungen

- Pandit Automotive Pvt. Ltd.Dokument6 SeitenPandit Automotive Pvt. Ltd.JudicialNoch keine Bewertungen

- Agony of ReformDokument3 SeitenAgony of ReformHarmon SolanteNoch keine Bewertungen

- Modified Jominy Test For Determining The Critical Cooling Rate For Intercritically Annealed Dual Phase SteelsDokument18 SeitenModified Jominy Test For Determining The Critical Cooling Rate For Intercritically Annealed Dual Phase Steelsbmcpitt0% (1)

- Revenue Procedure 2014-11Dokument10 SeitenRevenue Procedure 2014-11Leonard E Sienko JrNoch keine Bewertungen

- BAIN REPORT Global Private Equity Report 2017Dokument76 SeitenBAIN REPORT Global Private Equity Report 2017baashii4Noch keine Bewertungen

- BIR Form 1707Dokument3 SeitenBIR Form 1707catherine joy sangilNoch keine Bewertungen

- Forex Fluctuations On Imports and ExportsDokument33 SeitenForex Fluctuations On Imports and Exportskushaal subramonyNoch keine Bewertungen

- Environment Case Alcoa 2016Dokument4 SeitenEnvironment Case Alcoa 2016Victor TorresNoch keine Bewertungen

- Nissan Leaf - The Bulletin, March 2011Dokument2 SeitenNissan Leaf - The Bulletin, March 2011belgianwafflingNoch keine Bewertungen

- Manual Goldfinger EA MT4Dokument6 SeitenManual Goldfinger EA MT4Mr. ZaiNoch keine Bewertungen