Beruflich Dokumente

Kultur Dokumente

Inventory Estimation

Hochgeladen von

Fiona Morales0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

102 Ansichten2 SeitenThis document provides four cases with data to calculate ending inventory using different methods. Case 1-3 use the gross profit method with data on beginning inventory, purchases, sales and gross profit rates. Case 4 uses the retail inventory method with cost and retail data as well as calculations for additional markup, markdowns and other adjustments. Students are asked to calculate ending inventory for each case using specified approaches like conservative, average cost, or FIFO retail.

Originalbeschreibung:

:)))

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides four cases with data to calculate ending inventory using different methods. Case 1-3 use the gross profit method with data on beginning inventory, purchases, sales and gross profit rates. Case 4 uses the retail inventory method with cost and retail data as well as calculations for additional markup, markdowns and other adjustments. Students are asked to calculate ending inventory for each case using specified approaches like conservative, average cost, or FIFO retail.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

102 Ansichten2 SeitenInventory Estimation

Hochgeladen von

Fiona MoralesThis document provides four cases with data to calculate ending inventory using different methods. Case 1-3 use the gross profit method with data on beginning inventory, purchases, sales and gross profit rates. Case 4 uses the retail inventory method with cost and retail data as well as calculations for additional markup, markdowns and other adjustments. Students are asked to calculate ending inventory for each case using specified approaches like conservative, average cost, or FIFO retail.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

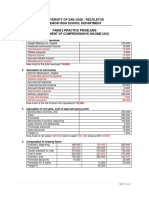

Ateneo de Zamboanga University

School of Management and Accountancy

Financial Accounting, Part I

Assignment 6: Inventory estimation

Instructor: Kelvin Jaluag Culajara, BSA, CPA

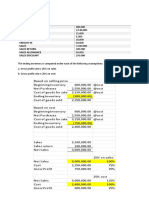

Case 1: Gross profit method

Compute for the ending inventory using the following data:

Beginning inventory, P100,000

Net purchases, P500,000

Net sales, P700,000

Gross profit rate based on sales is 40%

Case 2: Gross profit method

Compute for the ending inventory using the following data:

Beginning inventory, P200,000

Net purchases, P1,000,000

Net sales, P1,260,000

Gross profit rate based on cost is 40%

Case 3: Gross profit method

The following data are gathered for the current year:

Inventory, beginning, P600,000

Purchases return, P2,530,000

Purchase return, P15,000

Purchase allowance, P5,000

Purchase discount, P10,000

Freight in, P50,000

Sales, P3,100,000

Sales return, P100,000

Sales allowance, P50,000

Sales discount, P150,000

Compute for the ending inventory using the following independent assumptions:

Gross profit rate is 25% on sales

Gross profit rate is 25% on cost

Case 4: Retail inventory method

Use the following data:

Cost Retail

Beginning inventory 180,000 250,000

Net purchases 1,020,000 1,575,000

Additional markup 200,000

Markup cancelation 25,000

Markdown 140,000

Markdown cancelation 15,000

Sales 1,450,000

Sales return 50,000

Sales allowance 10,000

Sales discount 20,000

Employee discount 40,000

Spoilage and breakage 35,000

Compute the ending inventory under each of the following approaches:

Conservative approach

Average cost approach

Case 4: Retail inventory method

Use the following data:

Cost Retail

Beginning inventory 495,000 900,000

Net purchases 1,800,000 3,300,000

Net markup 300,000

Net markdown 600,000

Net sales 2,700,000

Compute for the ending inventory using the FIFO retail approach

Das könnte Ihnen auch gefallen

- Sales and Distribution Management by Krishna K Havaldar 3rd EdDokument313 SeitenSales and Distribution Management by Krishna K Havaldar 3rd EdKamakshi Khanna80% (15)

- Test Bank 2 - Ia 3Dokument31 SeitenTest Bank 2 - Ia 3Xiena100% (6)

- Chapter 33 - Retail Method: Problem 33-1 (AICPA Adopted)Dokument15 SeitenChapter 33 - Retail Method: Problem 33-1 (AICPA Adopted)Kimberly Claire Atienza83% (6)

- Schaum's Outline of Principles of Accounting I, Fifth EditionVon EverandSchaum's Outline of Principles of Accounting I, Fifth EditionBewertung: 5 von 5 Sternen5/5 (3)

- Chapter 32 - Gross Profit MethodDokument17 SeitenChapter 32 - Gross Profit MethodKimberly Claire Atienza100% (3)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EVon EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EBewertung: 4.5 von 5 Sternen4.5/5 (6)

- Chapter 8Dokument14 SeitenChapter 8Kanton FernandezNoch keine Bewertungen

- Chapter 34Dokument7 SeitenChapter 34loise0% (1)

- Inventory Estimation and LCNRV Sample ProblemsDokument3 SeitenInventory Estimation and LCNRV Sample Problemsaldric taclanNoch keine Bewertungen

- Chapter 13 Test Bank Romney AisDokument35 SeitenChapter 13 Test Bank Romney AisAldwin Calamba100% (1)

- ManaccDokument12 SeitenManaccCynthia KesumaNoch keine Bewertungen

- Natureview Case StudyDokument3 SeitenNatureview Case StudySachin KamraNoch keine Bewertungen

- Retail Inventory MethodDokument2 SeitenRetail Inventory Methodpcdesktop.brarNoch keine Bewertungen

- Cpa Review School of The Philippines Mani LaDokument2 SeitenCpa Review School of The Philippines Mani LaGuinevereNoch keine Bewertungen

- 1.0 Inventories Exercise 4.0Dokument1 Seite1.0 Inventories Exercise 4.0Elmer, Jr. LimbauanNoch keine Bewertungen

- Cpa Review School of The Philippines Mani LaDokument2 SeitenCpa Review School of The Philippines Mani LaJustine CruzNoch keine Bewertungen

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDokument3 SeitenFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDokument3 SeitenFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- 08.12.2017 Activity - Acfunda LabDokument2 Seiten08.12.2017 Activity - Acfunda LabPatOcampoNoch keine Bewertungen

- Problem 1Dokument3 SeitenProblem 1Cinderella Ladyong0% (2)

- CHEER UP Chapter 14 Retail Inventory MethodDokument5 SeitenCHEER UP Chapter 14 Retail Inventory MethodaprilNoch keine Bewertungen

- Inventory EstimationDokument11 SeitenInventory EstimationTrace ReyesNoch keine Bewertungen

- 4 Gross and Profit Method Retail Inventory MethodDokument6 Seiten4 Gross and Profit Method Retail Inventory MethodSilverly Batisla-ongNoch keine Bewertungen

- Statement of Comprehensive IncomeDokument4 SeitenStatement of Comprehensive Incomezacharaya abegailNoch keine Bewertungen

- 8-Inventory EstimationDokument5 Seiten8-Inventory EstimationYulrir Alesteyr HiroshiNoch keine Bewertungen

- Lesson 2 The Statement of Comprehensive Income (Part 2 of 2)Dokument4 SeitenLesson 2 The Statement of Comprehensive Income (Part 2 of 2)Franchesca CalmaNoch keine Bewertungen

- Henri Emanuel Reforba - Learning Task #2Dokument6 SeitenHenri Emanuel Reforba - Learning Task #2Rhea BernabeNoch keine Bewertungen

- Retail Method: Problem 20-1 (AICPA Adapted)Dokument9 SeitenRetail Method: Problem 20-1 (AICPA Adapted)Anne EstrellaNoch keine Bewertungen

- FDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFDokument5 SeitenFDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFJames de LeonNoch keine Bewertungen

- Kelompok 4 Tugas Inter 1Dokument9 SeitenKelompok 4 Tugas Inter 1louisNoch keine Bewertungen

- AccountingDokument5 SeitenAccountingMarinie CabagbagNoch keine Bewertungen

- Long Quiz 2Dokument3 SeitenLong Quiz 2Carlos VillanuevaNoch keine Bewertungen

- Retail Method and Biological AssetDokument3 SeitenRetail Method and Biological AssetLuiNoch keine Bewertungen

- Problems - Inventory Estimation: Gross Profit MethodDokument13 SeitenProblems - Inventory Estimation: Gross Profit MethodmercyvienhoNoch keine Bewertungen

- Comprehensive IncomeDokument2 SeitenComprehensive IncomeLeomar CabandayNoch keine Bewertungen

- Problems - Inventory Estimation: Retail Inventory MethodDokument13 SeitenProblems - Inventory Estimation: Retail Inventory MethodKez MaxNoch keine Bewertungen

- Price and Quantity: Inventory Cost Flow Purchase CommitmentsDokument10 SeitenPrice and Quantity: Inventory Cost Flow Purchase CommitmentsShane CalderonNoch keine Bewertungen

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Dokument2 SeitenChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNoch keine Bewertungen

- Mdoukle 3Dokument2 SeitenMdoukle 3Mina MyouiNoch keine Bewertungen

- 4 2 Endless Company PDFDokument3 Seiten4 2 Endless Company PDFJulius Mark Carinhay TolitolNoch keine Bewertungen

- CHEER UP Chapter 13 Gross Profit MethodDokument7 SeitenCHEER UP Chapter 13 Gross Profit MethodaprilNoch keine Bewertungen

- VALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutDokument5 SeitenVALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutEllah RahNoch keine Bewertungen

- LESSON10Dokument6 SeitenLESSON10Carl Daniel DoromalNoch keine Bewertungen

- 8 Inventory EstimationDokument3 Seiten8 Inventory EstimationJorufel PapasinNoch keine Bewertungen

- Classroom Exercises On Inventories: Problem 1Dokument4 SeitenClassroom Exercises On Inventories: Problem 1Amy SpencerNoch keine Bewertungen

- Oss Profit Retail Inventory MethodDokument4 SeitenOss Profit Retail Inventory MethodLily of the ValleyNoch keine Bewertungen

- Proforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Dokument6 SeitenProforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Kelsey VersaceNoch keine Bewertungen

- ACC 102 - QuizDokument11 SeitenACC 102 - QuizSarah Mae EscutonNoch keine Bewertungen

- ABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 4 (A04) - Inventory Estimation Methods 3.0Dokument7 SeitenABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 4 (A04) - Inventory Estimation Methods 3.0Lorraine Joy AbanillaNoch keine Bewertungen

- 03 - HO - Statement of Comprehensive IncomeDokument3 Seiten03 - HO - Statement of Comprehensive IncomeYoung MetroNoch keine Bewertungen

- Group Quiz InstructionsDokument9 SeitenGroup Quiz InstructionsRaidenhile mae VicenteNoch keine Bewertungen

- Answers MerchandisingDokument11 SeitenAnswers MerchandisingAltea AroganteNoch keine Bewertungen

- Inventory - GP and Retail MethodDokument2 SeitenInventory - GP and Retail MethodFlorimar LagdaNoch keine Bewertungen

- Lecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceDokument16 SeitenLecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceGarp BarrocaNoch keine Bewertungen

- 2 Assignment Unit III Accounts ReceivableDokument2 Seiten2 Assignment Unit III Accounts ReceivableSilverly Batisla-ongNoch keine Bewertungen

- December 16 Complete Lecture With SolutionsDokument6 SeitenDecember 16 Complete Lecture With SolutionsJa FranciscoNoch keine Bewertungen

- Bsa Midterm Non Graded Exercises Worksheet and Financial Statements Preparation Answer KeyDokument7 SeitenBsa Midterm Non Graded Exercises Worksheet and Financial Statements Preparation Answer KeyGarp BarrocaNoch keine Bewertungen

- Intermediate Accounting 1 - Meeting 2 (Answers Sheets)Dokument4 SeitenIntermediate Accounting 1 - Meeting 2 (Answers Sheets)WILLIAM CHANDRANoch keine Bewertungen

- Gross Profit and Retail MethodDokument2 SeitenGross Profit and Retail MethodMary Dale Joie Bocala0% (1)

- Gross Profit and Retail MethodDokument2 SeitenGross Profit and Retail MethodMary Dale Joie BocalaNoch keine Bewertungen

- Inventory Accounting: A Comprehensive GuideVon EverandInventory Accounting: A Comprehensive GuideBewertung: 5 von 5 Sternen5/5 (1)

- Equity Valuation: Models from Leading Investment BanksVon EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNoch keine Bewertungen

- EngagementLetter ArdentHuskies GC2019Dokument4 SeitenEngagementLetter ArdentHuskies GC2019Fiona MoralesNoch keine Bewertungen

- Practice SetDokument2 SeitenPractice SetFiona MoralesNoch keine Bewertungen

- Problem No. 1: Practice Set Property Plant and EquipmentDokument4 SeitenProblem No. 1: Practice Set Property Plant and EquipmentFiona MoralesNoch keine Bewertungen

- MAS Long QuizDokument3 SeitenMAS Long QuizFiona MoralesNoch keine Bewertungen

- Module 07.5 - Foreign Currency Accounting PSDokument5 SeitenModule 07.5 - Foreign Currency Accounting PSFiona Morales100% (2)

- Law Oblicon :) )Dokument9 SeitenLaw Oblicon :) )Fiona MoralesNoch keine Bewertungen

- Inventory Management at MarsDokument2 SeitenInventory Management at MarsYaniNoch keine Bewertungen

- ARRIVAL NOTICE VietnamDokument2 SeitenARRIVAL NOTICE VietnamQuo QingNoch keine Bewertungen

- Checklist For Creating Epicor PresentationsDokument1 SeiteChecklist For Creating Epicor PresentationsBatara100% (1)

- Third Party Sales Process With Configuration in S/4HANA: by René Rodrigue Efila Minkoulou (SAP S/4HANA MM/SD Consultant)Dokument16 SeitenThird Party Sales Process With Configuration in S/4HANA: by René Rodrigue Efila Minkoulou (SAP S/4HANA MM/SD Consultant)karthikbjNoch keine Bewertungen

- SCM PrelimDokument6 SeitenSCM Prelimabc xyzNoch keine Bewertungen

- A Case Study of ERP ImplementationDokument25 SeitenA Case Study of ERP ImplementationDharti SarageNoch keine Bewertungen

- Difference Between Bill of Lading and Air Way BillDokument2 SeitenDifference Between Bill of Lading and Air Way BillAk SharmaNoch keine Bewertungen

- Arkieva Corporate BrochureDokument8 SeitenArkieva Corporate BrochureThanh NguyenNoch keine Bewertungen

- Supply Chain 4.0 - The Next Generation Digital Supply Chain - McKinseyDokument16 SeitenSupply Chain 4.0 - The Next Generation Digital Supply Chain - McKinseyanon_515138572Noch keine Bewertungen

- Assignement: Financial Management Submitted To: Sir Shoaib Nisar Submitted By: Farida Kausar ROLL NO: MBA-18-32 Class: Mba-4 SmesterDokument7 SeitenAssignement: Financial Management Submitted To: Sir Shoaib Nisar Submitted By: Farida Kausar ROLL NO: MBA-18-32 Class: Mba-4 Smestersehar chNoch keine Bewertungen

- Book 8 Jul 2023Dokument4 SeitenBook 8 Jul 2023Kinza KhanNoch keine Bewertungen

- Supply Chain Management Case StudiesDokument11 SeitenSupply Chain Management Case StudiesAnkit SinhaNoch keine Bewertungen

- SCLMDokument4 SeitenSCLMAravinth SNoch keine Bewertungen

- SAP Report Painter Tutorial - Step by Step InstructionsDokument21 SeitenSAP Report Painter Tutorial - Step by Step InstructionsAdauto PolizeliNoch keine Bewertungen

- FMC Filing Manual 010920 UpdateDokument18 SeitenFMC Filing Manual 010920 Updatewinda.yudhithasari.11Noch keine Bewertungen

- Material ManagementDokument18 SeitenMaterial Managementgayatri_vyas1Noch keine Bewertungen

- Preliminary Examination MC (Q)Dokument9 SeitenPreliminary Examination MC (Q)Vanessa HaliliNoch keine Bewertungen

- Managing Director: Gokce YanasmayanDokument1 SeiteManaging Director: Gokce YanasmayanDana GnNoch keine Bewertungen

- Elements of Logistics and Supply Chain Management SYLLABUS 5.4Dokument3 SeitenElements of Logistics and Supply Chain Management SYLLABUS 5.4Jerson D'Mello50% (2)

- Iso Ts 16949 Tamil Training ProgramDokument51 SeitenIso Ts 16949 Tamil Training ProgramGanesan Sankaranarayanan88% (8)

- TRTRTTWDokument112 SeitenTRTRTTWCap NetNoch keine Bewertungen

- Supply Chai ManagementDokument13 SeitenSupply Chai ManagementPooja ShahNoch keine Bewertungen

- Kale LogisticsDokument37 SeitenKale LogisticsshishirkrNoch keine Bewertungen

- Project Report: "Understanding The Marketing Strategies and Customer Satisfaction Towards VRL Logistics Limited"Dokument64 SeitenProject Report: "Understanding The Marketing Strategies and Customer Satisfaction Towards VRL Logistics Limited"Kaustubh SavanurNoch keine Bewertungen

- OM Unit 2.1 OverviewDokument28 SeitenOM Unit 2.1 OverviewMapuia Lal PachuauNoch keine Bewertungen

- RCM 09Dokument21 SeitenRCM 09Priyajit ChandaNoch keine Bewertungen