Beruflich Dokumente

Kultur Dokumente

Maria Carolina Araullo Vs Benigno Aquino III

Hochgeladen von

ZydalgLadyz Nead100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

142 Ansichten3 SeitenFrom UBER. Araullo v Aquino

Originaltitel

Maria Carolina Araullo vs Benigno Aquino III

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenFrom UBER. Araullo v Aquino

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

142 Ansichten3 SeitenMaria Carolina Araullo Vs Benigno Aquino III

Hochgeladen von

ZydalgLadyz NeadFrom UBER. Araullo v Aquino

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

MariaCarolinaAraullovsBenigno

AquinoIII

Political Law Constitutional Law Separation of Powers Fund

Realignment Constitutionality of the Disbursement Acceleration Program

Power of the Purse Executive Impoundment

W hen President Benigno Aquino III took office, his administration

noticed the sluggish growth of the economy. The World Bank advised that

the economy needed a stimulus plan. Budget Secretary Florencio Butch

Abad then came up with a program called the Disbursement Acceleration

Program (DAP).

The DAP was seen as a remedy to speed up the funding of government

projects. DAP enables the Executive to realign funds from slow moving

projects to priority projects instead of waiting for next years

appropriation. So what happens under the DAP was that if a certain

government project is being undertaken slowly by a certain executive

agency, the funds allotted therefor will be withdrawn by the Executive.

Once withdrawn, these funds are declared as savings by the Executive

and said funds will then be reallotted to other priority projects. The DAP

program did work to stimulate the economy as economic growth was in

fact reported and portion of such growth was attributed to the DAP (as

noted by the Supreme Court).

Other sources of the DAP include the unprogrammed funds from the

General Appropriations Act (GAA). Unprogrammed funds are standby

appropriations made by Congress in the GAA.

Meanwhile, in September 2013, Senator Jinggoy Estrada made an expos

claiming that he, and other Senators, received Php50M from the President

as an incentive for voting in favor of the impeachment of then Chief

Justice Renato Corona. Secretary Abad claimed that the money was taken

from the DAP but was disbursed upon the request of the Senators.

This apparently opened a can of worms as it turns out that the DAP does

not only realign funds within the Executive. It turns out that some non-

Executive projects were also funded; to name a few: Php1.5B for the CPLA

(Cordillera Peoples Liberation Army), Php1.8B for the MNLF (Moro National

Liberation Front), P700M for the Quezon Province, P50-P100M for certain

Senators each, P10B for Relocation Projects, etc.

This prompted Maria Carolina Araullo, Chairperson of the Bagong

Alyansang Makabayan, and several other concerned citizens to file various

petitions with the Supreme Court questioning the validity of the DAP.

Among their contentions was:

DAP is unconstitutional because it violates the constitutional rule which

provides that no money shall be paid out of the Treasury except in

pursuance of an appropriation made by law.

Secretary Abad argued that the DAP is based on certain laws particularly

the GAA (savings and augmentation provisions thereof), Sec. 25(5), Art. VI

of the Constitution (power of the President to augment), Secs. 38 and 49

of Executive Order 292 (power of the President to suspend expenditures

and authority to use savings, respectively).

Issues:

I. Whether or not the DAP violates the principle no money shall be paid

out of the Treasury except in pursuance of an appropriation made by law

(Sec. 29(1), Art. VI, Constitution).

II. Whether or not the DAP realignments can be considered as

impoundments by the executive.

III. Whether or not the DAP realignments/transfers are constitutional.

IV. Whether or not the sourcing of unprogrammed funds to the DAP is

constitutional.

V. Whether or not the Doctrine of Operative Fact is applicable.

HELD:

I. No, the DAP did not violate Section 29(1), Art. VI of the Constitution.

DAP was merely a program by the Executive and is not a fund nor is it an

appropriation. It is a program for prioritizing government spending. As

such, it did not violate the Constitutional provision cited in Section 29(1),

Art. VI of the Constitution. In DAP no additional funds were withdrawn from

the Treasury otherwise, an appropriation made by law would have been

required. Funds, which were already appropriated for by the GAA, were

merely being realigned via the DAP.

II. No, there is no executive impoundment in the DAP. Impoundment of

funds refers to the Presidents power to refuse to spend appropriations or

to retain or deduct appropriations for whatever reason. Impoundment is

actually prohibited by the GAA unless there will be an unmanageable

national government budget deficit (which did not happen). Nevertheless,

theres no impoundment in the case at bar because whats involved in the

DAP was the transfer of funds.

III. No, the transfers made through the DAP were unconstitutional. It is

true that the President (and even the heads of the other branches of the

government) are allowed by the Constitution to make realignment of

funds, however, such transfer or realignment should only be made within

their respective offices. Thus, no cross-border transfers/augmentations

may be allowed. But under the DAP, this was violated because funds

appropriated by the GAA for the Executive were being transferred to the

Legislative and other non-Executive agencies.

Further, transfers within their respective offices also contemplate

realignment of funds to an existing project in the GAA. Under the DAP,

even though some projects were within the Executive, these projects are

non-existent insofar as the GAA is concerned because no funds were

appropriated to them in the GAA. Although some of these projects may be

legitimate, they are still non-existent under the GAA because they were

not provided for by the GAA. As such, transfer to such projects is

unconstitutional and is without legal basis.

On the issue of what are savings

These DAP transfers are not savings contrary to what was being

declared by the Executive. Under the definition of savings in the GAA,

savings only occur, among other instances, when there is an excess in the

funding of a certain project once it is completed, finally discontinued, or

finally abandoned. The GAA does not refer to savings as funds

withdrawn from a slow moving project. Thus, since the statutory definition

of savings was not complied with under the DAP, there is no basis at all for

the transfers. Further, savings should only be declared at the end of the

fiscal year. But under the DAP, funds are already being withdrawn from

certain projects in the middle of the year and then being declared as

savings by the Executive particularly by the DBM.

IV. No. Unprogrammed funds from the GAA cannot be used as money

source for the DAP because under the law, such funds may only be used if

there is a certification from the National Treasurer to the effect that the

revenue collections have exceeded the revenue targets. In this case, no

such certification was secured before unprogrammed funds were used.

V. Yes. The Doctrine of Operative Fact, which recognizes the legal effects

of an act prior to it being declared as unconstitutional by the Supreme

Court, is applicable. The DAP has definitely helped stimulate the economy.

It has funded numerous projects. If the Executive is ordered to reverse all

actions under the DAP, then it may cause more harm than good. The DAP

effects can no longer be undone. The beneficiaries of the DAP cannot be

asked to return what they received especially so that they relied on the

validity of the DAP. However, the Doctrine of Operative Fact may not be

applicable to the authors, implementers, and proponents of the DAP if it is

so found in the appropriate tribunals (civil, criminal, or administrative)

that they have not acted in good faith.

Das könnte Ihnen auch gefallen

- Perfect Ed SheeranDokument2 SeitenPerfect Ed SheeranOrlando Lana67% (9)

- Meyer v. Nebraska Case DigestDokument2 SeitenMeyer v. Nebraska Case DigestAshreabai Kam SinarimboNoch keine Bewertungen

- IBP V. ZAMORA G.R. No. 141284Dokument12 SeitenIBP V. ZAMORA G.R. No. 141284salemNoch keine Bewertungen

- Del Rosario vs. ComelecDokument1 SeiteDel Rosario vs. ComelecDaniel FradejasNoch keine Bewertungen

- Evidence For The ProsecutionDokument6 SeitenEvidence For The ProsecutionEdwino Nudo Barbosa Jr.Noch keine Bewertungen

- #64 & 65 Artcle 2 Section 2 Saguisag vs. ES & Bayan Vs Gazmin (GRs 212426 & 212444)Dokument2 Seiten#64 & 65 Artcle 2 Section 2 Saguisag vs. ES & Bayan Vs Gazmin (GRs 212426 & 212444)Edito Jr BautistaNoch keine Bewertungen

- Emissions TradingDokument22 SeitenEmissions Tradingasofos100% (1)

- 5.23 Nepomuceno Vs Surigao PDFDokument8 Seiten5.23 Nepomuceno Vs Surigao PDFEvan NervezaNoch keine Bewertungen

- Marcos v. Manglapus, G.R. No. 88211 September 15, 1989Dokument2 SeitenMarcos v. Manglapus, G.R. No. 88211 September 15, 1989Mark Lester AlariaoNoch keine Bewertungen

- SCRIPT: Definition and Purpose of Legal ResearchDokument14 SeitenSCRIPT: Definition and Purpose of Legal ResearchMonicDuranNoch keine Bewertungen

- Case Digest - Manila Prince HotelDokument5 SeitenCase Digest - Manila Prince HotelApril Joy OmboyNoch keine Bewertungen

- Supreme Court upholds FPJ's citizenshipDokument2 SeitenSupreme Court upholds FPJ's citizenshipJomar Teneza100% (1)

- Bases Conversion and Development Authority v. CoA, 580 SCRA 295Dokument10 SeitenBases Conversion and Development Authority v. CoA, 580 SCRA 295Maricar Corina CanayaNoch keine Bewertungen

- Supreme Court Rules Against Immunity for Public Officials in Eviction CaseDokument2 SeitenSupreme Court Rules Against Immunity for Public Officials in Eviction CaseYhan AberdeNoch keine Bewertungen

- US v. Ling Su Fan 1908Dokument2 SeitenUS v. Ling Su Fan 1908Charlyn SabioNoch keine Bewertungen

- Festejo VDokument4 SeitenFestejo VAbegail De LeonNoch keine Bewertungen

- K-12 Law Upheld by Supreme CourtDokument1 SeiteK-12 Law Upheld by Supreme CourtMikhael OngNoch keine Bewertungen

- CD - Municipality of San Juan V CA G.R. No. 125183, September 29, 1997Dokument3 SeitenCD - Municipality of San Juan V CA G.R. No. 125183, September 29, 1997KrizzaShayneRamosArquero100% (1)

- Philippine Bar Association V COMELECDokument2 SeitenPhilippine Bar Association V COMELECChristian AribasNoch keine Bewertungen

- RODOLFO G NAVARRO Et Al Versus EXECUTIVE SECRETARY EDUARDO ERMITA G R No 180050 February 10 2010Dokument1 SeiteRODOLFO G NAVARRO Et Al Versus EXECUTIVE SECRETARY EDUARDO ERMITA G R No 180050 February 10 2010D'Judds ManggadNoch keine Bewertungen

- Chavez v. Romulo Notice and HearingDokument2 SeitenChavez v. Romulo Notice and HearingRowardNoch keine Bewertungen

- Atty. Rodolfo D. Mateo V. Executive Secretary Alberto ROMULO, Et Al. G. R. No. 177875, 8 August 2016, FIRST DIVISION (Bersamin, J.)Dokument2 SeitenAtty. Rodolfo D. Mateo V. Executive Secretary Alberto ROMULO, Et Al. G. R. No. 177875, 8 August 2016, FIRST DIVISION (Bersamin, J.)Fatima PascuaNoch keine Bewertungen

- Sanidad V Comelec DigestDokument3 SeitenSanidad V Comelec DigestClarisa NatividadNoch keine Bewertungen

- Arnault vs. Nazareno, 87 Phils. 29Dokument2 SeitenArnault vs. Nazareno, 87 Phils. 29Pauline DgmNoch keine Bewertungen

- Belgica V OchoaDokument2 SeitenBelgica V Ochoamark anthony mansuetoNoch keine Bewertungen

- Bermudez SummaryDokument2 SeitenBermudez SummaryDaby BautistaNoch keine Bewertungen

- Macalintal vs. PET, 635 SCRA 783 and 651 SCRA 239Dokument15 SeitenMacalintal vs. PET, 635 SCRA 783 and 651 SCRA 239Luna KimNoch keine Bewertungen

- Consti Page 23-12 PhilConsa Vs GPH, GR 218406 (Nov. 29, 2016)Dokument9 SeitenConsti Page 23-12 PhilConsa Vs GPH, GR 218406 (Nov. 29, 2016)Lu CasNoch keine Bewertungen

- Legal Research CasesDokument20 SeitenLegal Research CasesReth GuevarraNoch keine Bewertungen

- Tan V Gal 43 SCRA 677, Feb29'72Dokument1 SeiteTan V Gal 43 SCRA 677, Feb29'72BudoyNoch keine Bewertungen

- Javellana v. Executive SecretaryDokument2 SeitenJavellana v. Executive SecretaryJuvial Guevarra BostonNoch keine Bewertungen

- German Machineries Corporation VS EndayaDokument2 SeitenGerman Machineries Corporation VS EndayaSherimar BongdoenNoch keine Bewertungen

- Senate Blue Ribbon Committee Vs MajaduconDokument2 SeitenSenate Blue Ribbon Committee Vs MajaducontenNoch keine Bewertungen

- Petitioners, vs. Pepsi Cola Products Phils., Inc. and Pepsico Inc., RespondentsDokument5 SeitenPetitioners, vs. Pepsi Cola Products Phils., Inc. and Pepsico Inc., RespondentsAngelo GabrilloNoch keine Bewertungen

- (ANDRADE) GARCIA v. BOI, G.R No. 92024 PDFDokument2 Seiten(ANDRADE) GARCIA v. BOI, G.R No. 92024 PDFkeithNoch keine Bewertungen

- Case Digest - Funa Vs ErmitaDokument3 SeitenCase Digest - Funa Vs ErmitaHezro Inciso CaandoyNoch keine Bewertungen

- 5 Tablarin v. GutierrezDokument1 Seite5 Tablarin v. GutierrezMigs GayaresNoch keine Bewertungen

- Manalo vs. SistozaDokument3 SeitenManalo vs. SistozaSe'f BenitezNoch keine Bewertungen

- Rules for Interpreting the ConstitutionDokument8 SeitenRules for Interpreting the ConstitutionTom HerreraNoch keine Bewertungen

- Estrada Vs EscritorDokument2 SeitenEstrada Vs EscritorEthan ZacharyNoch keine Bewertungen

- Rufino v. Endriga, G.R. No. 139554, July 21, 2006 HI-LITEDokument15 SeitenRufino v. Endriga, G.R. No. 139554, July 21, 2006 HI-LITEEmil BautistaNoch keine Bewertungen

- 49 Scra 105Dokument2 Seiten49 Scra 105Johnny EnglishNoch keine Bewertungen

- IBP Vs ZamoraDokument1 SeiteIBP Vs ZamoraJonathan PacificoNoch keine Bewertungen

- Imbong Vs OchoaDokument6 SeitenImbong Vs OchoaStephen Roy ArgosinoNoch keine Bewertungen

- Digest 15. Lozano vs. Nograles, G.R. No. 187883Dokument2 SeitenDigest 15. Lozano vs. Nograles, G.R. No. 187883Inez Monika Carreon PadaoNoch keine Bewertungen

- Consti Executive 1Dokument8 SeitenConsti Executive 1Aria LimNoch keine Bewertungen

- Legislative Dept Powers & LimitsDokument20 SeitenLegislative Dept Powers & LimitsRyDNoch keine Bewertungen

- People v. Mandoriaov SDokument2 SeitenPeople v. Mandoriaov SmarthaNoch keine Bewertungen

- Tan's emergency powersDokument1 SeiteTan's emergency powersSean GalvezNoch keine Bewertungen

- TRADERS ROYAL BANK vs. INTERMEDIATE APPELLATE COURTDokument2 SeitenTRADERS ROYAL BANK vs. INTERMEDIATE APPELLATE COURTHanneza Mae DualloNoch keine Bewertungen

- Matibag vs. Benipayo, G.R. No. 149036Dokument4 SeitenMatibag vs. Benipayo, G.R. No. 149036RowardNoch keine Bewertungen

- (A26) LAW 121 - Sanlakas vs. Executive Secretary (G.R. No. 159085)Dokument4 Seiten(A26) LAW 121 - Sanlakas vs. Executive Secretary (G.R. No. 159085)mNoch keine Bewertungen

- 174 Imbong vs. OchoaDokument11 Seiten174 Imbong vs. OchoaAli NamlaNoch keine Bewertungen

- Ginsberg V New YorkDokument2 SeitenGinsberg V New YorkeevanuyNoch keine Bewertungen

- Belgica, Et Al. v. Exec. Sec. Paquito N. Ochoa, Et Al., G.R. No. 208566, 710 SCRA 1, 89, Nov. 19, 2013, en BancDokument6 SeitenBelgica, Et Al. v. Exec. Sec. Paquito N. Ochoa, Et Al., G.R. No. 208566, 710 SCRA 1, 89, Nov. 19, 2013, en BancGabriel HernandezNoch keine Bewertungen

- NACOCO Not a Government EntityDokument1 SeiteNACOCO Not a Government EntityHenteLAWcoNoch keine Bewertungen

- Santiago vs. COMELECDokument8 SeitenSantiago vs. COMELECFenina ReyesNoch keine Bewertungen

- Steps in The Amendatory Process IncludeDokument1 SeiteSteps in The Amendatory Process IncludeAnne DesalNoch keine Bewertungen

- NAVA v. GATMAITAN G.R. No. L-4855 - 11 October 1951Dokument1 SeiteNAVA v. GATMAITAN G.R. No. L-4855 - 11 October 1951Reynald LacabaNoch keine Bewertungen

- Risos-Vidal vs. COMELECDokument1 SeiteRisos-Vidal vs. COMELECMarianne NicerNoch keine Bewertungen

- Supreme Court rules key parts of Aquino's Disbursement Acceleration Program unconstitutionalDokument3 SeitenSupreme Court rules key parts of Aquino's Disbursement Acceleration Program unconstitutionalKeyba Dela CruzNoch keine Bewertungen

- Araullo Vs Aquino DAP Case Digest PDFDokument2 SeitenAraullo Vs Aquino DAP Case Digest PDFManuel RodriguezNoch keine Bewertungen

- Republic Act NoDokument16 SeitenRepublic Act NoZydalgLadyz NeadNoch keine Bewertungen

- Sandiganbayan ruling on conspiracy chargeDokument6 SeitenSandiganbayan ruling on conspiracy chargeVienna Mantiza - PortillanoNoch keine Bewertungen

- Securities and Exchange Commission, Petitioner, V. Price Richardson Corporation, Consuelo Velarde-Albert, and Gordon Resnick, Respondents.Dokument2 SeitenSecurities and Exchange Commission, Petitioner, V. Price Richardson Corporation, Consuelo Velarde-Albert, and Gordon Resnick, Respondents.ZydalgLadyz NeadNoch keine Bewertungen

- Alvero V DizonDokument7 SeitenAlvero V DizonArief O ReefNoch keine Bewertungen

- Over the Rainbow Israel KamakawiwoʻoleDokument2 SeitenOver the Rainbow Israel KamakawiwoʻoleZydalgLadyz NeadNoch keine Bewertungen

- Jaime Soriano Et. Al vs. Secretary of Finance, G.R. No. 184450 January 24, 2017Dokument2 SeitenJaime Soriano Et. Al vs. Secretary of Finance, G.R. No. 184450 January 24, 2017ZydalgLadyz NeadNoch keine Bewertungen

- Cant Help Falling in LoveDokument1 SeiteCant Help Falling in LoveZydalgLadyz NeadNoch keine Bewertungen

- God Always Gives His Best To Those Who Leave The Choice To HimDokument1 SeiteGod Always Gives His Best To Those Who Leave The Choice To HimZydalgLadyz NeadNoch keine Bewertungen

- DonorDokument8 SeitenDonorZydalgLadyz NeadNoch keine Bewertungen

- Over the Rainbow Israel KamakawiwoʻoleDokument2 SeitenOver the Rainbow Israel KamakawiwoʻoleZydalgLadyz NeadNoch keine Bewertungen

- New RulesDokument1 SeiteNew RulesZydalgLadyz NeadNoch keine Bewertungen

- Sunflower Song LyricsDokument2 SeitenSunflower Song LyricsJavedNoch keine Bewertungen

- Prayer and Fasting 2018Dokument1 SeitePrayer and Fasting 2018ZydalgLadyz NeadNoch keine Bewertungen

- Environmental Summit AquiatanDokument26 SeitenEnvironmental Summit AquiatanZydalgLadyz NeadNoch keine Bewertungen

- Jaime Soriano Et. Al vs. Secretary of Finance, G.R. No. 184450 January 24, 2017Dokument2 SeitenJaime Soriano Et. Al vs. Secretary of Finance, G.R. No. 184450 January 24, 2017ZydalgLadyz NeadNoch keine Bewertungen

- Kilosbayan vs. Manuel L. Morato: FactsDokument1 SeiteKilosbayan vs. Manuel L. Morato: FactsZydalgLadyz NeadNoch keine Bewertungen

- RR No. 7-2018Dokument2 SeitenRR No. 7-2018Rheneir MoraNoch keine Bewertungen

- NPC Vs City of CabanatuanDokument8 SeitenNPC Vs City of CabanatuanZydalgLadyz NeadNoch keine Bewertungen

- LAUD Vs People Case DigestDokument3 SeitenLAUD Vs People Case DigestZydalgLadyz NeadNoch keine Bewertungen

- Technical Script Nasseriya Villa Kids Church OCTOBER 28 FRIDAY, 9:00AM - 10:30AM One 2 One Discipleship Week 4: Wall CompletedDokument1 SeiteTechnical Script Nasseriya Villa Kids Church OCTOBER 28 FRIDAY, 9:00AM - 10:30AM One 2 One Discipleship Week 4: Wall CompletedZydalgLadyz NeadNoch keine Bewertungen

- Footnotes MacedaDokument4 SeitenFootnotes MacedaZydalgLadyz NeadNoch keine Bewertungen

- Intravenous Fluid GuidelineDokument4 SeitenIntravenous Fluid GuidelineZydalgLadyz NeadNoch keine Bewertungen

- GDokument4 SeitenGZydalgLadyz NeadNoch keine Bewertungen

- HavanaDokument1 SeiteHavanaZydalgLadyz NeadNoch keine Bewertungen

- Greco Belgica Vs Executive Secretary Paquito OchoaDokument2 SeitenGreco Belgica Vs Executive Secretary Paquito OchoaZydalgLadyz Nead100% (1)

- Greco Belgica Vs Executive Secretary Paquito OchoaDokument2 SeitenGreco Belgica Vs Executive Secretary Paquito OchoaZydalgLadyz Nead100% (1)

- 7 Scriptures For Troubled Married CouplesDokument3 Seiten7 Scriptures For Troubled Married CouplesZydalgLadyz NeadNoch keine Bewertungen

- Police Officers Dismissed for Torturing Terrorism SuspectDokument12 SeitenPolice Officers Dismissed for Torturing Terrorism SuspectZydalgLadyz NeadNoch keine Bewertungen

- RubricsDokument2 SeitenRubricsScarlette Beauty EnriquezNoch keine Bewertungen

- Communicating Vessels Communicating Vessels Issue 20 Fallwinter 20082009Dokument48 SeitenCommunicating Vessels Communicating Vessels Issue 20 Fallwinter 20082009captainfreakoutNoch keine Bewertungen

- Sisig HoorayDokument3 SeitenSisig HoorayMaria Freyja Darlene CruzNoch keine Bewertungen

- Inventory Cost MethodsDokument8 SeitenInventory Cost MethodswijayaNoch keine Bewertungen

- Project Study Template - Ver2.0Dokument14 SeitenProject Study Template - Ver2.0Ronielle MercadoNoch keine Bewertungen

- Private Equity Real Estate FirmsDokument13 SeitenPrivate Equity Real Estate FirmsgokoliNoch keine Bewertungen

- Briefing Note: "2011 - 2014 Budget and Taxpayer Savings"Dokument6 SeitenBriefing Note: "2011 - 2014 Budget and Taxpayer Savings"Jonathan Goldsbie100% (1)

- PPE0045 MidTest T3 1112Dokument6 SeitenPPE0045 MidTest T3 1112Tan Xin XyiNoch keine Bewertungen

- By: John Paul Diaz Adonis Abapo Alvin Mantilla James PleñosDokument9 SeitenBy: John Paul Diaz Adonis Abapo Alvin Mantilla James PleñosRhea Antonette DiazNoch keine Bewertungen

- Econ 002 - INTRO MACRO - Prof. Luca Bossi - February 12, 2014 Midterm #1 SolutionsDokument9 SeitenEcon 002 - INTRO MACRO - Prof. Luca Bossi - February 12, 2014 Midterm #1 SolutionsinmaaNoch keine Bewertungen

- Work Plan and Monitoring TemplateDokument8 SeitenWork Plan and Monitoring TemplateromeeNoch keine Bewertungen

- ....Dokument60 Seiten....Ankit MaldeNoch keine Bewertungen

- IFB Washing Machines Marketing Analysis: N V Jagadeesh Kumar TDokument10 SeitenIFB Washing Machines Marketing Analysis: N V Jagadeesh Kumar TomprakashNoch keine Bewertungen

- Title:-Home Service at A Click: Presented byDokument14 SeitenTitle:-Home Service at A Click: Presented byPooja PujariNoch keine Bewertungen

- Export Import Condition of BangladeshDokument19 SeitenExport Import Condition of BangladeshYeasir Malik100% (9)

- E WasteDokument47 SeitenE WasteGeorge Dlima67% (9)

- Rancang Bangun Alat Mixer Vertikal Adonan Kue Donat Dengan Gearbox Tipe Bevel Gear Kapasitas 7 KilogramDokument6 SeitenRancang Bangun Alat Mixer Vertikal Adonan Kue Donat Dengan Gearbox Tipe Bevel Gear Kapasitas 7 KilogramRachmad RisaldiNoch keine Bewertungen

- Nluj Deal Mediation Competition 3.0: March 4 - 6, 2022Dokument4 SeitenNluj Deal Mediation Competition 3.0: March 4 - 6, 2022Sidhant KampaniNoch keine Bewertungen

- Chomsky On AnarchismDokument7 SeitenChomsky On AnarchismPedro SilvaNoch keine Bewertungen

- Microeconomics I - Chapter FiveDokument36 SeitenMicroeconomics I - Chapter FiveGena DuresaNoch keine Bewertungen

- Sentence Completion..fillersDokument5 SeitenSentence Completion..fillersShahan DashtiNoch keine Bewertungen

- Chapter 11 AnswerDokument16 SeitenChapter 11 AnswerKathy WongNoch keine Bewertungen

- Interest Change Prepayment Repayment Schedule: Input Details Details 14396Dokument22 SeitenInterest Change Prepayment Repayment Schedule: Input Details Details 14396bidyut_roy_1Noch keine Bewertungen

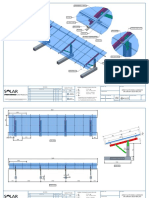

- Array 5x2 On Concrete Block Ballast-01Dokument2 SeitenArray 5x2 On Concrete Block Ballast-01Wisnu WicaksonoNoch keine Bewertungen

- Japan's Lost DecadeDokument2 SeitenJapan's Lost DecadeEerika RsNoch keine Bewertungen

- Sample MC QuestionsDokument6 SeitenSample MC QuestionsJoshua OhNoch keine Bewertungen

- TPS and ERPDokument21 SeitenTPS and ERPTriscia QuiñonesNoch keine Bewertungen

- PPP Force MajeureDokument7 SeitenPPP Force MajeureJasonafarrellNoch keine Bewertungen

- PerdiscoDokument10 SeitenPerdiscogarytrollingtonNoch keine Bewertungen