Beruflich Dokumente

Kultur Dokumente

DHFC PDF

Hochgeladen von

Vikas TiwariOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

DHFC PDF

Hochgeladen von

Vikas TiwariCopyright:

Verfügbare Formate

Stock Update 05 May 2017

RETAIL RESEARCH

Dewan Housing Finance Ltd

Industry CMP Recommendation Add on Dips to band Sequential Targets Time Horizon

BFSI Rs. 438 Buy at CMP and add on dips Rs. 392-400 Rs. 516 & Rs. 578 2-3 quarters

We had issued a Stock Note report on Oct 19, 2016 with a recommendation to buy at CMP and add the stock in the price

HDFC Scrip Code DEWHOUEQNR

band of Rs. 281-292 for sequential targets of Rs. 387 and Rs. 428 in 2-3 quarters. The stock achieved both the targets on 6th

BSE Code 511072 Apr and 25th Apr 2016 respectively and later made a high of Rs. 455 on 3rd May 2017. Refer:

NSE Code DHFL http://hdfcsec.com/Research/ResearchDetails.aspx?report_id=3019606. We now review the latest developments in the

company and provide our updated view on the stock.

Bloomberg DEWH IN

CMP as on 04 May 17 438.00 Company Description:

Eq. Capital (Rs crs) 313.15 Dewan Housing Finance Ltd. (DHFL) was established in 1984 by Late Shri Rajesh Kumar Wadhawan to enable access to

affordable housing finance to the lower and middle income groups in semi-urban and rural parts of India. Since its inception

Face Value (Rs) 10.0 the company has grown stronger and has become the second largest housing finance company in the private sector. DHFL

Equity Sh. Outs (Cr) 31.3 has an extensive network of 352 offices and an outstanding loan book of Rs 738 bn at the end of FY17. It also has tie-ups

with leading private sector banks namely United Bank of India, Dhanlaxmi Bank and YES bank to provide home loans to

Market Cap (Rs crs) 13716

customers sourced by them through a home loan syndication agreement. DHFL has also set up representative offices in

Book Value 255.3 London and Dubai to serve the ever increasing NRI population in these regions.

Avg. 52 Week Vol 27,82,000

Investment Rationale

52 Week High 455.20 Strong results despite lower disbursements growth in Q4/H2FY17

52 Week Low 182.70 Sale proceeds of stake in Insurance company received; CAR strengthens

Other investments awaiting unlocking of value

Significant reduction in CoF leading to steady NIMs

Shareholding Pattern-% (Mar-2017)

Promoters 39.29 Concerns

Slowdown in real estate sector

Institutions 32.50

Regulatory changes

Non Institutions 28.21 Rising competition from banks and peer companies

Total 100.00 Asset quality might worsen as lending to projects and LAP/SME book rises

Financial Summary

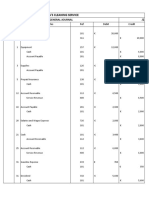

Research Analyst: Atul Karwa Rs in Cr Q4FY17 Q4FY16 YoY (%) Q3FY17 QoQ (%) FY16 FY17 FY18E FY19E

atul.karwa@hdfcsec.com NII 536 486 10.3 516 3.9 1669 2000 2398 3022

PPP 459 333 37.9 417 10.1 1277 1621 1979 2506

PAT 249 190 31.3 245 1.5 729 928 1129 1430

EPS (Rs) 8.0 6.5 22.3 7.8 1.5 25.0 29.6 36.1 45.7

RETAIL RESEARCH P age |1

RETAIL RESEARCH

P/E (x) 17.5 14.8 12.1 9.6

P/ABV (x) 2.7 1.8 1.6 1.4

RoAA (%) 1.2 1.2 1.2 1.3

(Source: Company, HDFC sec)

View and Valuation

DHFL, with its expertise in lending to the lower/middle income group in Tier II and Tier III cities while maintaining strong

asset quality would be a key beneficiary of the governments thrust on promoting affordable housing. Managements

commitment to lower funding cost along with a higher proportion of non-housing loans should result in net interest margin

expansion for the company. DHFL trades at a significant discount (as per street estimates) to other HFC like Indiabulls

Housing Finance (quoting at 2.6x FY19E ABV) and Canfin Home Finance (quoting at 4.7x FY19E ABV) and given the strong

growth trajectory this gap is likely to come down. The company has sold its stake in life insurance business resulting in a

33% jump in its networth. While monetization of stake in other associate companies could result in significant value

unlocking we have valued the company on a standalone basis and have not attributed any value to the

subsidiaries/associates.

We feel investors could buy the stock at the CMP and add on declines to Rs. 392-400 band (~1.3x FY19E ABV) for sequential

targets of Rs. 516 (1.7x FY19E ABV) and Rs. 578 (1.9x FY19E ABV) in 2-3 quarters.

Investment Rationale

Strong results despite lower disbursements in Q4/H2FY17

DHFL reported a PAT of Rs 2218 cr in Q4FY17 which included exceptional profit of Rs 1969 cr from sale of its 50% stake in

DHFL Pramerica Life Insurance (DPLI) to its wholly owned subsidiary. Excluding the exceptional gains PAT grew by 31% yoy

to Rs 249 cr. Net interest income grew by 10% yoy as interest expenses grew faster than interest income resulting in 3 bps

compression in NIMs to 3.04%. Disbursements continued to be impacted by the demonetization as the growth remained at

a subdued 11% yoy (H2FY17 growth ~11%) as compared to 29% growth in H1FY17. AUM was up 20% yoy to Rs 83560 cr

driven by higher growth in non-home loans which now constitute 34.2% of AUMs against 31.1% at the end of Q3FY17. Asset

quality was stable with GNPAs at 0.94%. The company utilized gains from non-interest income to make prudent provisions.

Particulars Q4FY17 Q4FY16 YoY (%) Q3FY17 QoQ (%) FY17 FY16 YoY (%)

Interest Income 2283 1964 16.2 2316 -1.4 8654 7246 19.4

Interest Expenses 1747 1479 18.2 1800 -3.0 6653 5490 21.2

Net Interest Income 536 486 10.3 516 3.9 2000 1756 13.9

Non-interest income 95 45 111.0 51 86.3 219 71 208.9

Total Income 631 488 29.3 567 11.3 2219 1827 21.5

Operating Expenses 172 155 10.8 150 14.7 597 598 0.0

Pre Prov. Profit 459 333 37.9 417 10.1 1622 1229 31.9

Prov. & Cont. 83 50 66.0 45 84.4 218 127 71.7

RETAIL RESEARCH P age |2

RETAIL RESEARCH

PBT 376 283 33.0 372 1.1 1404 1102 27.3

Tax 127 93 36.3 127 0.3 475 373 27.4

PAT 249 190 31.3 245 1.5 928 729 27.3

EPS 8.0 6.5 22.3 7.8 1.5 29.6 25.0 18.6

Sales proceeds of stake in Insurance JV received; CAR strengthens

DHFL sold its 50% stake in DPLI (DHFL Pramerica Life Insurance) (out of 51% held) to its wholly owned subsidiary DHFL

Investments (DIL) for a consideration of Rs 2000.5 cr. The book value of the stake stood at Rs 31.1 cr resulting in profit of Rs

1969.4 cr which was booked during the quarter. DIL would fund the transaction by issuing Compulsorily Convertible

Debentures (CCD) worth Rs 1901 cr to DHFLs promoters. The transaction has added Rs 62.9 per share to DHFLs networth

while CRAR has strengthened by ~400 bps. This would be sufficient to drive the companys business for the next 2-3 years

without any further dilution.

Other investments awaiting unlocking of value

DHFL has other minority investments in DHFL Vysya Housing Finance (9.47%), Aadhar Housing Finance (14.90%), Avanse

Education Loans (36.78%) and DHFL Pramerica Asset Management (50%). All these companies have witnessed substantial

growth over the past year. These investments can result in significant value unlocking whenever the company decides to

monetize them.

Corporate Structure

Wadhawan Global

Capital (WGC)

37.39%

Dewan Housing 100% DHFL

Finance Ltd (DHFL) Investments

9.47% 14.90% 36.78% 50.00% 50.00%

DHFL Vysya Aadhar Housing Avanse Education DHFL Pramerica DHFL Pramerica

Housing Finance Finance Loans Asset Managers Life Insurance

(Source: Company, HDFC sec)

RETAIL RESEARCH P age |3

RETAIL RESEARCH

Company FY17 Performance

DHFL Vysya Housing Finance Disbursements increased by 46% to Rs 646 cr, AUM were up 23% to Rs 1808 cr

Aadhar Housing Finance Disbursements increased by 68% to Rs 1696 cr, AUM were up 76% to Rs 3184 cr

Avanse Education Loans Disbursements increased by 70% to Rs 584 cr, AUM were up 85% to Rs 982 cr

DHFL Pramerica Asset Management AUM were up 37% to Rs 28224 cr

Significant reduction in CoF

DHFL has re-negotiated its bank loans in FY17 bringing down its cost of bank borrowings by 119 bps to 8.91%. Further share

of NCDs in total borrowings has increased from 33% in FY16 to 42% in FY17. Overall cost of funds decreased by 84 bps in

FY17 enabling the company to offer loans at competitive rates without impacting its NIMs. The company is seeking

shareholder approval to raise upto Rs 20,000 cr through debentures in FY18 which should result in further decline in cost of

funds.

Capital market borrowing increased in funding mix leading to lower cost of funds (%)

(Source: Company, HDFC sec)

leading to steady NIMs

Reported NIMs were steady at 3.04% in Q4FY17 and 2.99% for the entire year against 2.90% in Q4FY16 and 2.96% for FY16.

The improvement was largely driven by re-negotiation of bank loans to a lower rate and higher share of borrowing from

debt capital markets. Decreased cost of funds was offset by decline in yields on back of falling interest rates. Margins of the

company have stayed at ~3% levels historically and the management has guided for similar range going forward.

Sharp improvement in cost/income ratio

Cost-income has always been higher as compared to peers and a cause of concern for the company. DHFL has been

reducing its Cost/Income Ratio through focus on efficiency improvement and technology led initiatives. Calculated cost-

RETAIL RESEARCH P age |4

RETAIL RESEARCH

income ratio improved by 360 bps in FY17 to 26.5% as compared to 30.1% in FY16. While the last 3 years have witnessed a

steady improvement, sustenance of the same would be important going forward.

Stable asset quality

Despite of demonetization asset quality (GNPA) of DHFL has remained fairly stable at <1% due to the robust credit appraisal

process followed by the company. GNPA in Q4FY17 came in at 0.94% compared to 0.95% in Q3FY17. Lower dependence on

intermediaries and lower LTV ratios provide comfort on the asset quality front. However, increasing project/construction

finance loans and LAP/SME loans can be a cause of concern going forward.

AUM growth driven by non-housing loans

Post demonetization, though we have witnessed some traction in disbursements sequentially, it continues to remain

subdued as compared to the high growth seen in H1FY17. Disbursements grew 23% qoq/11% yoy largely driven by non-

housing loans. Housing loans AUM were up 2% qoq/9.4% yoy as compared to 17.3% qoq/48.4% yoy growth in non-housing

loans. Average ticket size increased by 12.9% in FY17 to Rs 14 lakhs. Project finance now constitutes 14% of AUM with

management earlier stating a higher proportion at 15%, which is a key monitorable. Share of LAP loans increased to 16.9%

at the end of FY17 against 15.7% in FY16.

Increasing share of non-housing loans (%)

(Source: Company, HDFC sec)

Concerns

Slowdown in real estate sector

Over the last 2-3 years, housing sector has seen an inventory pile up situation in India and launching of new projects has

come down in the past two years. A number of houses, flats and apartments are being sold without getting booked.

However, slowdown in loan demand has been reported in the high end segments, which are driven by investment demand.

RETAIL RESEARCH P age |5

RETAIL RESEARCH

Regulatory changes

Regulatory changes like increase in risk weights for a certain category, cap on interest rates under refinance could mar the

growth and profitability of the company.

Rising competition from banks and peer companies

There is strong competition from banks and peer companies in the housing finance industry as it is considered relatively

lower risk loan. Higher competition might result in lower yields going forward. This also means that the monies raised by

DHFL by way of NCDs in early FY17 will sit on its books as current Investments till it is profitably deployed, impacting its

spread/NIMs in the meanwhile.

Asset quality might worsen

Although the asset quality has largely remained stable, high proportion of LAP loans to self-employed category where

income is volatile could result in defaults leading to higher provisioning requirements. The company has also increased

project finance loans which could turn into NPAs in the event of slowdown.

Unclear terms about sale of stake in Insurance JV

DHFL Investments will issue compulsorily convertible debentures (CCDs) to Wadhawan Global Capital Pvt. Ltd, with a

conversion period of 100 months. Wadhawan Global is the promoter entity of DHFL. DHFL will continue to have an option

in it which may result in the housing financier owning DHFL Pramerica Life Insurance once again. Once the conversion

period on the CCDs ends, Wadhawan Global would own more than 50% in DHFL Investments and would thus end up

controlling the insurance company as well. There is uncertainty on the terms of CCD issue, interest rate on CCD, conversion

price, stake in DHFL Investments to be acquired in future by Wadhawan Global, terms of option exercise by DHFL etc.

View and Valuation

DHFL, with its expertise in lending to the lower/middle income group in Tier II and Tier III cities while maintaining strong

asset quality would be a key beneficiary of the governments thrust on promoting affordable housing. Managements

commitment to lower funding cost along with a higher proportion of non-housing loans should result in net interest margin

expansion for the company. DHFL trades at a significant discount (as per street estimates) to other HFC like Indiabulls

Housing Finance (quoting at 2.6x FY19E ABV) and Canfin Home Finance (quoting at 4.7x FY19E ABV) and given the strong

growth trajectory this gap is likely to come down. The company has sold its stake in life insurance business resulting in a

33% jump in its networth. While monetization of stake in other associate companies could result in significant value

unlocking we have valued the company on a standalone basis and have not attributed any value to the

subsidiaries/associates.

We feel investors could buy the stock at the CMP and add on declines to Rs. 392-400 band (~1.3x FY19E ABV) for sequential

targets of Rs. 516 (1.7x FY19E ABV) and Rs. 578 (1.9x FY19E ABV) in 2-3 quarters.

RETAIL RESEARCH P age |6

RETAIL RESEARCH

Financial Statements (Standalone)

Income Statement Ratio Analysis

Particulars FY15 FY16 FY17 FY18E FY19E Particulars FY15 FY16 FY17 FY18E FY19E

Interest Income 5716 7159 8654 10194 11934 Return Ratios

Interest Expenses 4460 5490 6654 7796 8912 Calc. Yield on adv 12.4% 12.6% 12.7% 12.6% 12.3%

Net Interest Income 1256 1669 2000 2398 3022 Calc. Cost of borr 10.5% 10.4% 9.7% 9.6% 9.6%

Non interest income 142 158 204 268 291 NIM 2.7% 2.9% 2.9% 3.0% 3.1%

Operating Income 1399 1827 2204 2666 3313 RoAE 12.1% 15.1% 14.3% 13.4% 15.0%

Operating Expenses 474 550 583 687 807 RoAA 1.0% 1.2% 1.2% 1.2% 1.3%

PPP 925 1277 1621 1979 2506 Asset Quality Ratios

Prov & Cont 105 175 218 268 340 GNPA 1.0% 0.9% 0.9% 1.0% 1.0%

Profit Before Tax 820 1102 1403 1711 2167 NNPA 0.7% 0.6% 0.5% 0.5% 0.5%

Tax 322 373 475 582 737 Growth Ratios

PAT 498 729 928 1129 1430 Advances 25.6% 20.9% 18.5% 20.0% 19.0%

Borrowings 22.2% 25.5% 32.4% 8.8% 19.4%

Balance Sheet NII 81.0% 32.8% 19.8% 19.9% 26.0%

Particulars FY15 FY16 FY17 FY18E FY19E PPP 82.9% 38.1% 26.9% 22.1% 26.7%

Share Capital 146 292 313 313 313 PAT 117.0% 46.5% 27.2% 21.7% 26.6%

Reserves & Surplus 4490 4725 7683 8605 9772 Valuation Ratios

Shareholder funds 4636 5017 7996 8918 10085 EPS 17.1 25.0 29.6 36.1 45.7

Borrowings 46848 58781 77799 84608 101056 P/E 25.6 17.5 14.8 12.1 9.6

Other Liab & Prov. 3131 4055 6503 5970 7094 Adj. BVPS 159.1 159.6 243.0 269.6 303.7

SOURCES OF FUNDS 54615 67853 92298 99496 118235 P/ABV 2.8 2.5 1.7 1.5 1.4

Fixed Assets 188 202 209 214 217 Dividend per share 6.0 8.0 4.0 5.5 7.0

CWIP 796 579 634 634 634 Dividend Yield (%) 1.4 1.8 0.9 1.3 1.6

Investment 1006 893 13535 7532 8963 Other Ratios

Cash & Bank Balance 676 3408 3430 1772 2109 Cost-Income 33.9 30.1 26.5 25.8 24.4

Advances 51511 62295 73840 88608 105443

Other Assets 437 476 651 736 870

TOTAL ASSETS 54615 67853 92298 99496 118235

RETAIL RESEARCH P age |7

RETAIL RESEARCH

One year Forward PABV One year Price chart

RETAIL RESEARCH P age |8

RETAIL RESEARCH

Fundamental Research Analyst: Atul Karwa, atul.karwa@hdfcsec.com

Disclosure:

I, Atul Karwa, MMS, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities. HSL has no material

adverse disciplinary history as on the date of publication of this report. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd. does have/ does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its Associate may have beneficial

ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does

have/does not have any material conflict of interest.

Any holding in stock Yes/ No

HDFC Securities Limited (HSL) is a SEBI Registered Research Analyst having registration no. INH000002475.

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information

obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or

correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to

be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other jurisdiction

where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HSL or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or published

for any purposes without prior written approval of HSL.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in

securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HSL may from time to time solicit from, or perform broking, or other services for, any company mentioned in this mail and/or its

attachments.

HSL and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other

transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies)

or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HSL, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report, including but not

restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HSL and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or other deals in these

securities from time to time or may deal in other securities of the companies / organizations described in this report.

HSL or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

HSL or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from t date of this report for services in respect of managing or co-managing public

offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business.

HSL or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HSL nor Research Analysts

have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. HSL may

have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any compensation/benefits

from the subject company or third party in connection with the Research Report.

This report is intended for non-Institutional Clients only. The views and opinions expressed in this report may at times be contrary to or not in consonance with those of Institutional Research or PCG Research teams of HDFC

Securities Ltd. and/or may have different time horizons

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066

Compliance Officer: Binkle R. Oza Email: complianceofficer@hdfcsec.com Phone: (022) 3045 3600

HDFC Securities Limited, SEBI Reg. No.: NSE-INB/F/E 231109431, BSE-INB/F 011109437, AMFI Reg. No. ARN: 13549, PFRDA Reg. No. POP: 04102015, IRDA Corporate Agent License No.: HDF 2806925/HDF C000222657, SEBI

Research Analyst Reg. No.: INH000002475, CIN - U67120MH2000PLC152193

Mutual Funds Investments are subject to market risk. Please read the offer and scheme related documents carefully before investing.

RETAIL RESEARCH P age |9

Das könnte Ihnen auch gefallen

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesVon EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNoch keine Bewertungen

- LIC Housing Ltd. - InitiatingDokument7 SeitenLIC Housing Ltd. - InitiatingAnantharaman RamasamyNoch keine Bewertungen

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsVon EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsNoch keine Bewertungen

- Dewan Housing Finance: CMP: INR374 Fuelled With CapitalDokument6 SeitenDewan Housing Finance: CMP: INR374 Fuelled With Capitalsaran21Noch keine Bewertungen

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesVon EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesNoch keine Bewertungen

- Eicher Motors: Whethering The StormDokument11 SeitenEicher Motors: Whethering The StormAnonymous y3hYf50mTNoch keine Bewertungen

- Dewan Housing Finance Corporation Limited 4 QuarterUpdateDokument7 SeitenDewan Housing Finance Corporation Limited 4 QuarterUpdatesandyinsNoch keine Bewertungen

- GRUH-Finance-Limited 204 QuarterUpdateDokument10 SeitenGRUH-Finance-Limited 204 QuarterUpdatevikasaggarwal01Noch keine Bewertungen

- Muthoot Finance - HDFC Sec 2017Dokument10 SeitenMuthoot Finance - HDFC Sec 2017Puneet367Noch keine Bewertungen

- HDFC Bank: CMP: INR1,872 The JuggernautDokument22 SeitenHDFC Bank: CMP: INR1,872 The JuggernautSwapnil pawarNoch keine Bewertungen

- Accumulate HDFC Bank: Performance HighlightsDokument9 SeitenAccumulate HDFC Bank: Performance Highlightsimran shaikhNoch keine Bewertungen

- LIC Housing Finance: Eye On MarginsDokument11 SeitenLIC Housing Finance: Eye On Marginssaran21Noch keine Bewertungen

- Omkar Speciality ChemicalsDokument16 SeitenOmkar Speciality Chemicalssiddhu444Noch keine Bewertungen

- Power Grid Corporation: Hunky-DoryDokument8 SeitenPower Grid Corporation: Hunky-DoryjaimaaganNoch keine Bewertungen

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Dokument10 SeitenSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoNoch keine Bewertungen

- JM - Homefirst PDFDokument10 SeitenJM - Homefirst PDFSanjay PatelNoch keine Bewertungen

- IDirect HDFCBank ConvictionIdeaDokument9 SeitenIDirect HDFCBank ConvictionIdeaSilambarasan AshokkumarNoch keine Bewertungen

- Federal Bank - Update - Nov23 - HSIE-202311070920067095600Dokument12 SeitenFederal Bank - Update - Nov23 - HSIE-202311070920067095600adityazade03Noch keine Bewertungen

- RBL Bank - 4QFY19 - HDFC Sec-201904191845245959765Dokument12 SeitenRBL Bank - 4QFY19 - HDFC Sec-201904191845245959765SachinNoch keine Bewertungen

- Centrum Suryoday Small Finance Bank Q3FY23 Result UpdateDokument10 SeitenCentrum Suryoday Small Finance Bank Q3FY23 Result UpdateDivy JainNoch keine Bewertungen

- Dewan Housing Finance - IC - HDFC Sec-201710301503499151644Dokument27 SeitenDewan Housing Finance - IC - HDFC Sec-201710301503499151644Arbaj MansuriNoch keine Bewertungen

- J. Kumar Infraprojects: Execution Key For Re-RatingDokument8 SeitenJ. Kumar Infraprojects: Execution Key For Re-Ratingarun_algoNoch keine Bewertungen

- Indiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Dokument12 SeitenIndiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Veronika AkheevaNoch keine Bewertungen

- Triveni Turbine: Margins SurpriseDokument9 SeitenTriveni Turbine: Margins SurprisejaimaaganNoch keine Bewertungen

- HDFC Bank: Performance HighlightsDokument4 SeitenHDFC Bank: Performance HighlightsAditi TyagiNoch keine Bewertungen

- SBI LTD Initiating Coverage 19062020Dokument8 SeitenSBI LTD Initiating Coverage 19062020Devendra rautNoch keine Bewertungen

- Reliance Capital: Reliance Home Finance: A Deep Dive Into Business ModelDokument15 SeitenReliance Capital: Reliance Home Finance: A Deep Dive Into Business Modelsharkl123Noch keine Bewertungen

- Muthoot Finance: Steady QuarterDokument7 SeitenMuthoot Finance: Steady QuarterMukeshChauhanNoch keine Bewertungen

- HDFC Securities Sees 24% UPSIDE in IDFC LTDDokument14 SeitenHDFC Securities Sees 24% UPSIDE in IDFC LTDTarunNoch keine Bewertungen

- Management Meeting Update: Bhansali Engineering Polymers - New Shade of GrowthDokument5 SeitenManagement Meeting Update: Bhansali Engineering Polymers - New Shade of GrowthSBNoch keine Bewertungen

- Suprajit Engineering: Status QuoDokument10 SeitenSuprajit Engineering: Status QuoDinesh ChoudharyNoch keine Bewertungen

- Engineers India: On A Road To RecoveryDokument9 SeitenEngineers India: On A Road To RecoveryDinesh ChoudharyNoch keine Bewertungen

- ICICI - Piramal PharmaDokument4 SeitenICICI - Piramal PharmasehgalgauravNoch keine Bewertungen

- VIB - Section2 - Group5 - Final Project - ReportDokument13 SeitenVIB - Section2 - Group5 - Final Project - ReportShrishti GoyalNoch keine Bewertungen

- BajconDokument22 SeitenBajcon354Prakriti SharmaNoch keine Bewertungen

- Sadbhav Engineering: Execution-Driven GrowthDokument11 SeitenSadbhav Engineering: Execution-Driven GrowthDinesh ChoudharyNoch keine Bewertungen

- Ashoka BuildconDokument11 SeitenAshoka Buildconpritish070Noch keine Bewertungen

- Banco Products (India) LTD: Retail ResearchDokument15 SeitenBanco Products (India) LTD: Retail Researcharun_algoNoch keine Bewertungen

- SobhaDokument21 SeitenSobhadigthreeNoch keine Bewertungen

- Kiri Industries - 2017 - HdfcsecDokument16 SeitenKiri Industries - 2017 - HdfcsecHiteshNoch keine Bewertungen

- Aptus Housing Finance LTD: SubscribeDokument5 SeitenAptus Housing Finance LTD: SubscribeupsahuNoch keine Bewertungen

- HDFC Bank: CMP: INR2,416 Getting Bigger, Better and StrongerDokument16 SeitenHDFC Bank: CMP: INR2,416 Getting Bigger, Better and StrongerHrishikesh ShewalkarNoch keine Bewertungen

- Hai-O Enterprise Berhad: MLM Division Slows Down - 28/06/2010Dokument4 SeitenHai-O Enterprise Berhad: MLM Division Slows Down - 28/06/2010Rhb InvestNoch keine Bewertungen

- IDBI Diwali Stock Picks 2019Dokument12 SeitenIDBI Diwali Stock Picks 2019Akt ChariNoch keine Bewertungen

- Spritzer MIDS Initiation Thrist For Growth MIDF 020617 PDFDokument13 SeitenSpritzer MIDS Initiation Thrist For Growth MIDF 020617 PDFAnonymous UfsZYUVcNoch keine Bewertungen

- Shriram City Union Finance Limited - 204 - QuarterUpdateDokument12 SeitenShriram City Union Finance Limited - 204 - QuarterUpdateSaran BaskarNoch keine Bewertungen

- Faze Three Initial (HDFC)Dokument11 SeitenFaze Three Initial (HDFC)beza manojNoch keine Bewertungen

- Breadtalk Group LTD: Singapore Company GuideDokument11 SeitenBreadtalk Group LTD: Singapore Company GuideBrandon TanNoch keine Bewertungen

- Relaxo Footwears Initiating Coverage 11062020Dokument7 SeitenRelaxo Footwears Initiating Coverage 11062020Vaishali AgrawalNoch keine Bewertungen

- Federal Bank LTD.: PCG ResearchDokument11 SeitenFederal Bank LTD.: PCG Researcharun_algoNoch keine Bewertungen

- HuataiResearch Lifeinsurancereformongoing Aug 04 2021Dokument9 SeitenHuataiResearch Lifeinsurancereformongoing Aug 04 2021hanochyangNoch keine Bewertungen

- InfosysDokument13 SeitenInfosysreena21a9Noch keine Bewertungen

- Iiww 161210Dokument4 SeitenIiww 161210rinku23patilNoch keine Bewertungen

- JSTREET Volume 330Dokument10 SeitenJSTREET Volume 330JhaveritradeNoch keine Bewertungen

- HDFC Ltd-Company Update-3 December 2021Dokument8 SeitenHDFC Ltd-Company Update-3 December 2021Abhishek SaxenaNoch keine Bewertungen

- Beijing Capital Intl Airport: China / Hong Kong Company GuideDokument10 SeitenBeijing Capital Intl Airport: China / Hong Kong Company GuideajayNoch keine Bewertungen

- Britannia Industries - Initiating coverage-Jan-16-EDEL PDFDokument58 SeitenBritannia Industries - Initiating coverage-Jan-16-EDEL PDFRecrea8 EntertainmentNoch keine Bewertungen

- IDFC First BankDokument12 SeitenIDFC First BankRanjan SharmaNoch keine Bewertungen

- Can Fin Homes: Investment ArgumentDokument5 SeitenCan Fin Homes: Investment ArgumentmilandeepNoch keine Bewertungen

- Axis Bank - 2QFY18 Result Update - 181017Dokument10 SeitenAxis Bank - 2QFY18 Result Update - 181017johnmecNoch keine Bewertungen

- Parklex Facade Booklet English Uk SpreadsDokument5 SeitenParklex Facade Booklet English Uk SpreadsSreenivasulu E NNoch keine Bewertungen

- Breakupfor ZONE-V VI0618Dokument1 SeiteBreakupfor ZONE-V VI0618Sreenivasulu E NNoch keine Bewertungen

- Corrigendum Paramedical 2Dokument1 SeiteCorrigendum Paramedical 2Sreenivasulu E NNoch keine Bewertungen

- Notifn - No.57.STAFF NURSE PDFDokument22 SeitenNotifn - No.57.STAFF NURSE PDFE.n. SreenivasuluNoch keine Bewertungen

- CladdingDokument4 SeitenCladdingSreenivasulu E NNoch keine Bewertungen

- Notifn - No.57.STAFF NURSE PDFDokument22 SeitenNotifn - No.57.STAFF NURSE PDFE.n. SreenivasuluNoch keine Bewertungen

- Equity-Currency Ledger of ENSREENIDokument3 SeitenEquity-Currency Ledger of ENSREENISreenivasulu E NNoch keine Bewertungen

- Saptarishi Nadi Marriage Timing PDFDokument18 SeitenSaptarishi Nadi Marriage Timing PDFSreenivasulu E NNoch keine Bewertungen

- Stock Statement: Torlys Leather FlooringDokument1 SeiteStock Statement: Torlys Leather FlooringSreenivasulu E NNoch keine Bewertungen

- Personalized Astrology LessonsDokument35 SeitenPersonalized Astrology LessonsKiana Tehrani67% (6)

- Personalized Astrology LessonsDokument35 SeitenPersonalized Astrology LessonsKiana Tehrani67% (6)

- Ashish Chugh Reveals Top Secrets To Finding Multibagger StocksDokument10 SeitenAshish Chugh Reveals Top Secrets To Finding Multibagger StocksSreenivasulu E NNoch keine Bewertungen

- Stock Statement: Above 5000 ItemDokument1 SeiteStock Statement: Above 5000 ItemSreenivasulu E NNoch keine Bewertungen

- From The Desk of Astrologer E K Dhilip KumarDokument4 SeitenFrom The Desk of Astrologer E K Dhilip KumarmsmldxbNoch keine Bewertungen

- IGNOU Programmes On Offer 1-6-2017Dokument43 SeitenIGNOU Programmes On Offer 1-6-2017econpearlNoch keine Bewertungen

- Jain Irrigation 180817Dokument12 SeitenJain Irrigation 180817Sreenivasulu E NNoch keine Bewertungen

- Tenders ImportantDokument112 SeitenTenders ImportantSreenivasulu E NNoch keine Bewertungen

- K.A Ramachandra Reddy (Badminton-Maple Sup & Ins)Dokument4 SeitenK.A Ramachandra Reddy (Badminton-Maple Sup & Ins)Sreenivasulu E NNoch keine Bewertungen

- Marriage Biodata For Boy: Personal DetailsDokument2 SeitenMarriage Biodata For Boy: Personal DetailsSreenivasulu E N100% (1)

- All BSP Techniques On One ChartDokument13 SeitenAll BSP Techniques On One Chartpblsvraman97% (38)

- CAMSKRA Individual Form PDFDokument2 SeitenCAMSKRA Individual Form PDFKowshik ChakrabortyNoch keine Bewertungen

- 021 - Badminton Court PDFDokument2 Seiten021 - Badminton Court PDFNurliyana RosliNoch keine Bewertungen

- Proforma-Invoice: Buildstar Projects PVT LimitedDokument1 SeiteProforma-Invoice: Buildstar Projects PVT LimitedSreenivasulu E NNoch keine Bewertungen

- JK Lakshmi Cement - 210817Dokument5 SeitenJK Lakshmi Cement - 210817Sreenivasulu E NNoch keine Bewertungen

- Predictive Astro M N KedarDokument388 SeitenPredictive Astro M N KedarPrasan Nanda71% (7)

- Tata Steel - Q3FY17 Result Update - Centrum 07022017 PDFDokument7 SeitenTata Steel - Q3FY17 Result Update - Centrum 07022017 PDFSreenivasulu E NNoch keine Bewertungen

- What Do The Sanskrit Lyrics in Dhivara Song in Baahubali Mean - Kumar NarasimhaDokument11 SeitenWhat Do The Sanskrit Lyrics in Dhivara Song in Baahubali Mean - Kumar NarasimhaSreenivasulu E N100% (3)

- Tirreno Tech SpecsDokument2 SeitenTirreno Tech SpecsSreenivasulu E NNoch keine Bewertungen

- How To Make Jupiter StrongDokument6 SeitenHow To Make Jupiter StrongSreenivasulu E NNoch keine Bewertungen

- Modern Principles Macroeconomics 3rd Edition Cowen Test Bank 1Dokument86 SeitenModern Principles Macroeconomics 3rd Edition Cowen Test Bank 1george100% (49)

- Akash Britannia Final ProjectDokument42 SeitenAkash Britannia Final ProjectSaravanakumar SaravanaNoch keine Bewertungen

- CEMEX EditedDokument5 SeitenCEMEX EditedzawadinneNoch keine Bewertungen

- Accounting MS1 2022Dokument18 SeitenAccounting MS1 2022Faaz SheriffdeenNoch keine Bewertungen

- TFM Session Five FX ManagementDokument64 SeitenTFM Session Five FX ManagementmankeraNoch keine Bewertungen

- AIMSJ Vol 9 No 1 2006 P 45-66Dokument22 SeitenAIMSJ Vol 9 No 1 2006 P 45-66Le Xuan LapNoch keine Bewertungen

- Chap 1 Quiz - BA211Dokument4 SeitenChap 1 Quiz - BA211kenozin272Noch keine Bewertungen

- Paper 1 Business Studies Grde 12 Preliminary Examination Revision StrategyDokument10 SeitenPaper 1 Business Studies Grde 12 Preliminary Examination Revision Strategycianjacob46Noch keine Bewertungen

- 11th Accountancy 80 MarksDokument5 Seiten11th Accountancy 80 Marksyuktaagrawal017Noch keine Bewertungen

- Entrepreneurial Marketing: After Completion of The Course, The Students Will Be Able ToDokument2 SeitenEntrepreneurial Marketing: After Completion of The Course, The Students Will Be Able ToMurugan MNoch keine Bewertungen

- TYBFMDokument20 SeitenTYBFMshoaib8682Noch keine Bewertungen

- Contribution MarginDokument6 SeitenContribution Marginajeng.saraswatiNoch keine Bewertungen

- 2.0assessment Exam Problem 2Dokument3 Seiten2.0assessment Exam Problem 2Joe Honey Cañas Carbajosa100% (1)

- 1 Risk Management 00 - 1Dokument34 Seiten1 Risk Management 00 - 1RiantyasYunelzaNoch keine Bewertungen

- Career in CommerceDokument29 SeitenCareer in CommerceNaman TiwariNoch keine Bewertungen

- Market SegmentationDokument10 SeitenMarket SegmentationHardeep SinghNoch keine Bewertungen

- Case Study On App: Didi TaxiDokument4 SeitenCase Study On App: Didi TaxiUpmanyu KrishnaNoch keine Bewertungen

- Theory of Production - 05012015 - 060332AM PDFDokument17 SeitenTheory of Production - 05012015 - 060332AM PDFsanaNoch keine Bewertungen

- GMAT - Math (19.5.2023)Dokument17 SeitenGMAT - Math (19.5.2023)thelkokomg_294988315Noch keine Bewertungen

- Jade McCarneyDokument4 SeitenJade McCarneyjademariemccarneyNoch keine Bewertungen

- Salesman ReportDokument10 SeitenSalesman ReportJaninne BianesNoch keine Bewertungen

- Anya's Cleaning ServiceDokument22 SeitenAnya's Cleaning ServiceArya HerdiansyahNoch keine Bewertungen

- Santoor Marketing Project PDFDokument47 SeitenSantoor Marketing Project PDFshubhi abrol100% (2)

- Chapter 1Dokument2 SeitenChapter 1Jhonathan ArguelloNoch keine Bewertungen

- Theory of ProductionDokument19 SeitenTheory of ProductionJessica Perez Pastorfide II100% (1)

- Inventories: © 2008-16 Nelson Lam and Peter Lau Intermediate Financial Reporting: An IFRS Perspective (Chapter 9) - 1Dokument42 SeitenInventories: © 2008-16 Nelson Lam and Peter Lau Intermediate Financial Reporting: An IFRS Perspective (Chapter 9) - 1林義哲Noch keine Bewertungen

- TNA (Training Need Analys)Dokument6 SeitenTNA (Training Need Analys)Sahman WiparnaNoch keine Bewertungen

- BabygarmentsDokument20 SeitenBabygarmentsMSM HUBNoch keine Bewertungen

- Tutorial Test 3 - QDokument2 SeitenTutorial Test 3 - QSakamoto HiyoriNoch keine Bewertungen

- Best Practices For Supply Chain Management Techniques and Concepts Across IndustriesDokument17 SeitenBest Practices For Supply Chain Management Techniques and Concepts Across IndustriesSeerat JangdaNoch keine Bewertungen

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyVon EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyBewertung: 4.5 von 5 Sternen4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InVon EverandGetting to Yes: How to Negotiate Agreement Without Giving InBewertung: 4 von 5 Sternen4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantVon EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantBewertung: 4.5 von 5 Sternen4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyVon EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyBewertung: 5 von 5 Sternen5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItVon EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItBewertung: 5 von 5 Sternen5/5 (13)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditVon EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditBewertung: 5 von 5 Sternen5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceVon EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNoch keine Bewertungen

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelVon Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNoch keine Bewertungen

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Von EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Bewertung: 4 von 5 Sternen4/5 (33)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineVon EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNoch keine Bewertungen

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsVon EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsBewertung: 5 von 5 Sternen5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeVon EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeBewertung: 4 von 5 Sternen4/5 (21)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageVon EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageBewertung: 4.5 von 5 Sternen4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Von EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Von EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Bewertung: 4.5 von 5 Sternen4.5/5 (24)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingVon EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingBewertung: 4.5 von 5 Sternen4.5/5 (760)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesVon EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesBewertung: 5 von 5 Sternen5/5 (4)