Beruflich Dokumente

Kultur Dokumente

9706 w05 QP 4

Hochgeladen von

Jean EmanuelOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

9706 w05 QP 4

Hochgeladen von

Jean EmanuelCopyright:

Verfügbare Formate

UNIVERSITY OF CAMBRIDGE INTERNATIONAL EXAMINATIONS

General Certificate of Education

Advanced Subsidiary Level and Advanced Level

ACCOUNTING 9706/04

Paper 4 Problem Solving (Supplementary Topics)

October/November 2005

2 hours

Additional Materials: Answer Booklet/Paper

READ THESE INSTRUCTIONS FIRST

If you have been given an Answer Booklet, follow the instructions on the front cover of the Booklet.

Write your Centre number, candidate number and name on all the work you hand in.

Write in dark blue or black pen on both sides of the paper.

You may use a soft pencil for any diagrams, graphs or rough working.

Do not use staples, paper clips, highlighters, glue or correction fluid.

Answer all questions.

At the end of the examination, fasten all your work securely together.

The questions in this paper carry equal marks.

All accounting statements are to be presented in good style. Workings should be shown.

You may use a calculator.

The number of marks is given in brackets [ ] at the end of each question or part question.

This document consists of 7 printed pages and 1 blank page.

SP (NH) T08260/4

UCLES 2005 [Turn over

2

1 Suck and Blow were in partnership and decided to retire and sell the business to Harmonica Ltd

on 1 October 2004. The partnership Balance Sheet at 30 September 2004 was as follows:

Cost Depreciation Net Book Value

$000 $000 $000

Fixed assets

Freehold premises 400 300 100

Plant and machinery 270 190 80

Motor vehicles 100 76 24

Office equipment 60 50 10

830 616 214

Current assets

Stock 55

Debtors 61

Bank 28

144

Current liabilities

Creditors 73 71

285

Long term liability

Loan from Suck at 12% per annum 50

235

Partners capital accounts 235

The assets and liabilities were valued as follows for the sale:

$000 $000

Freehold premises 200

Plant and machinery 60

Motor vehicles 18

Office equipment 5

283

Stock 40

Debtors 50

90

Creditors 73 17

300

Harmonica Ltd did not take over the partnership bank account.

The consideration for the purchase of the partnership was $400 000 and was satisfied as follows:

1 The issue to Suck of an amount of 8% debentures which would ensure that he would

continue to receive the same amount of interest as he had received from the partnership.

2 A cash payment of $60 000.

3 200 000 ordinary shares in Harmonica Ltd for the balance of the purchase consideration.

UCLES 2005 9706/04 O/N/05

3

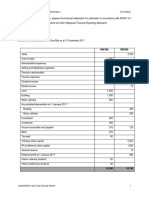

Harmonica Ltds Balance Sheet at 30 September 2004 was as follows:

Cost Depn. N.B.V.

$000 $000 $000

Fixed assets

Freehold premises 1000 200 800

Plant and machinery 500 300 200

Motor vehicles 230 170 60

Office equipment 100 60 40

1830 730 1100

Current assets

Stock 78

Debtors 90

Bank 120

288

Current liabilities

Creditors 112 176

1276

Share capital and reserves

Ordinary shares of $1 1000

General reserve 200

Retained profit 76

1276

REQUIRED

(a) Prepare Harmonica Ltds Balance Sheet at 1 October 2005 after the acquisition of the

partnership business and before any other transactions had occurred. [17]

During the year ended 31 July 2005 Harmonica Ltd, in addition to the acquisition of the

partnership business of Suck and Blow, disposed of another of its operations. An extract from

the companys trial balance at 31 July 2005 was as follows:

$000 $000

Turnover: continuing operations 1300

acquisition 217

discontinued operation 80

Cost of sales 925

Distribution costs 140

Administration expenses 180

Profit on sale of discontinued operation 24

The operating profits/(losses) were as follows:

$000

Continuing operations 500

Acquisition 60

Discontinued operation (108)

UCLES 2005 9706/04 O/N/05 [Turn over

4

REQUIRED

(b) Prepare Harmonica Ltds published Profit and Loss Account for the year ended 31 July 2005

to show the profit before taxation and in the form required by current standards. [19]

(c) State four exceptional items that should be included in Harmonica Ltds Profit and Loss

Account for the year ended 31 July 2005. [4]

[Total: 40]

UCLES 2005 9706/04 O/N/05

5

2 The chairman of Kalamitty Ltd needs to obtain the consent of the shareholders to a reduction of

capital.

The summarised Balance Sheet of Kalamitty Ltd at 30 September 2005 was as follows:

$000

Goodwill 50

Tangible fixed assets 1 300

Net current assets 725

2 075

Ordinary shares of $1 2 500

Profit and Loss Account (425)

2 075

Further information:

The company has not paid a dividend for the past few years.

The directors are aware of the following matters:

1 Goodwill is now valueless.

2 The freehold premises have developed a structural fault and must now be written down by

$225 000.

3 Stock has been damaged by flooding and must be written down by $20 000.

4 A major debtor owing $30 000 is in financial difficulties and is unlikely to pay.

The company has secured a number of new, long-term profitable contracts and the directors are

confident that in future the company will make annual profits of at least $70 000.

The directors propose a scheme of capital reconstruction which will enable them to write off the

debit balance on the Profit and Loss Account and adjust the accounts for items numbered 1 to 4

above. The scheme will not result in a change in the number of shares that have been issued.

The directors are confident that the capital reconstruction will enable them to commence paying

annual dividends of $50 000 in the year ending 30 September 2006. The current rate of interest on

money invested outside the business is 2.8%.

REQUIRED

(a) Using the information given above, state the facts which the chairman should include in his

letter to the shareholders to obtain their consent to the scheme of capital reduction. [12]

The directors have obtained the necessary consent and the scheme of capital reduction has been

implemented.

REQUIRED

(b) Prepare the Balance Sheet as it appears after the scheme of capital reduction has been

implemented. [7]

UCLES 2005 9706/04 O/N/05 [Turn over

6

Kalamitty Ltds accountant has prepared a forecast cash flow statement for the year ending

30 September 2006 as follows:

Cash flow from operating activities $000 $000

Operating profit 110

Depreciation of fixed assets 280

Loss on sales of fixed assets 30

Stock 16

Debtors (20)

Creditors (13)

Cash inflow from operating activities 403

Capital expenditure

Purchase of fixed assets (230)

Disposals of fixed assets 50 (180)

Equity dividends paid (50)

Increase in cash 173

REQUIRED

(c) Prepare a forecast Balance Sheet at 30 September 2006. [11]

Kalamitty Ltds published accounts must include a directors report.

REQUIRED

(d) State five matters which should be included in the directors report. Give one reason why

each of the matters you have identified is important. [10]

[Total: 40]

UCLES 2005 9706/04 O/N/05

7

3 Laurus manufactures two products which involve three processes. They pass through processes 1

and 2 as a single product and separate into product X and product Y in process 3.

Laurus uses a standard costing system and the following information has been extracted from the

standard cost records:

Process 1 Process 2

Materials per unit 4 litres 5 litres

Cost of material per litre $1.50 $3

Cost of materials used in process 1 $12 000

Cost of materials used in process 2 to be calculated

Direct labour hours per unit 3.5 2.2

Hourly labour cost $8 $10

Variable overhead per unit $5 per direct $3 per direct

labour hour labour hour

Fixed overhead absorption rate $7 per direct $8 per direct

labour hour labour hour

Opening stock of work in progress nil nil

Closing stock of work in progress nil 1000 units

The closing stock of work in progress in process 2 is complete as to 100 per cent materials and

75% labour.

REQUIRED

(a) Prepare the ledger account for process 1. [9]

(b) Prepare the ledger account for process 2. [23]

The completed units in process 2 are transferred to process 3 where they separate into joint

products, X and Y.

70% of the finished units are X and 30% are Y.

The costs in process 3 are as follows:

Added materials: 2 kilos per unit at $6.80 per kilo

Direct labour: 2 hours per unit at $7 per hour

Variable overheads: $5 per direct labour hour

Fixed overhead absorption rate: $11 per direct labour rate.

10% of the production in process 3 was spoiled.

REQUIRED

(c) Prepare the ledger account for process 3. [8]

[Total: 40]

UCLES 2005 9706/04 O/N/05

8

BLANK PAGE

Permission to reproduce items where third-party owned material protected by copyright is included has been sought and cleared where possible. Every

reasonable effort has been made by the publisher (UCLES) to trace copyright holders, but if any items requiring clearance have unwittingly been included, the

publisher will be pleased to make amends at the earliest possible opportunity.

University of Cambridge International Examinations is part of the University of Cambridge Local Examinations Syndicate (UCLES), which is itself a department of

the University of Cambridge.

9706/04 O/N/05

Das könnte Ihnen auch gefallen

- Credit Analysis NotesDokument5 SeitenCredit Analysis NotesNoni100% (1)

- How To Create Budget in Excel Spreadsheet With TemplateDokument7 SeitenHow To Create Budget in Excel Spreadsheet With TemplateAldrin LiwanagNoch keine Bewertungen

- Private Foundations Tax GuideDokument48 SeitenPrivate Foundations Tax GuideKyu Chang HanNoch keine Bewertungen

- Groups 5 QuestionsDokument31 SeitenGroups 5 QuestionsMd Rasel Uddin ACMANoch keine Bewertungen

- Audel Guide to the 2005 National Electrical CodeVon EverandAudel Guide to the 2005 National Electrical CodeBewertung: 4 von 5 Sternen4/5 (1)

- Renovating For Profit PDFDokument23 SeitenRenovating For Profit PDFgreen1up100% (1)

- Chapter 7 Choosing A Source of Credit The Costs of Credit AlternativesDokument40 SeitenChapter 7 Choosing A Source of Credit The Costs of Credit Alternativesgyanprakashdeb302Noch keine Bewertungen

- Accounting Cycle Week 2 ReviewerDokument11 SeitenAccounting Cycle Week 2 ReviewerVinz Danzel BialaNoch keine Bewertungen

- Statements of Changes in EquityDokument2 SeitenStatements of Changes in EquityJean EmanuelNoch keine Bewertungen

- P2 Reviewer PDFDokument64 SeitenP2 Reviewer PDFBeef TestosteroneNoch keine Bewertungen

- Taxation-Income From House PropertyDokument17 SeitenTaxation-Income From House PropertyYang DeyNoch keine Bewertungen

- Coursebook Chapter 9 AnswersDokument5 SeitenCoursebook Chapter 9 AnswersAhmed Zeeshan92% (12)

- Q1 Pie LTD: $000 $000 $000 Cost Depn NBVDokument3 SeitenQ1 Pie LTD: $000 $000 $000 Cost Depn NBVmelody shayanwakoNoch keine Bewertungen

- Joinpdf PDFDokument428 SeitenJoinpdf PDFOwen Bawlor Manoz100% (1)

- Istaimy PLC: Chapter 26 Business PurchaseDokument3 SeitenIstaimy PLC: Chapter 26 Business PurchaseSir YusufiNoch keine Bewertungen

- Questions Level 2 Series 2006 3Dokument4 SeitenQuestions Level 2 Series 2006 3Ppii FfrtrNoch keine Bewertungen

- Cash Flow StatementsDokument21 SeitenCash Flow StatementsAnaya KaleNoch keine Bewertungen

- Accounting Advanced Level Test#1: Section A Anwser All The QuestionsDokument6 SeitenAccounting Advanced Level Test#1: Section A Anwser All The QuestionsHuzaifa AbdullahNoch keine Bewertungen

- Afm June 2003 QT AnsDokument25 SeitenAfm June 2003 QT AnsBijay AgrawalNoch keine Bewertungen

- Tutorial 12 Performance MeasurementDokument4 SeitenTutorial 12 Performance MeasurementEsther LuehNoch keine Bewertungen

- Final Accounts ProblemsDokument7 SeitenFinal Accounts ProblemsTushar SahuNoch keine Bewertungen

- Acc311 2021 2Dokument4 SeitenAcc311 2021 2hoghidan1Noch keine Bewertungen

- Accounting: PAPER 4 Problem Solving (Extension Topics)Dokument8 SeitenAccounting: PAPER 4 Problem Solving (Extension Topics)PRANAV NARAYANANNoch keine Bewertungen

- National University of Science and TechnologyDokument8 SeitenNational University of Science and TechnologyPATIENCE MUSHONGANoch keine Bewertungen

- Session 1 Practice 3Dokument4 SeitenSession 1 Practice 3yimin liuNoch keine Bewertungen

- Statement of Financial Position at 30 June 2013: A2 Accounting Usman Arif 03214065420Dokument2 SeitenStatement of Financial Position at 30 June 2013: A2 Accounting Usman Arif 03214065420Aimen AhmedNoch keine Bewertungen

- Relax CompanyDokument7 SeitenRelax CompanyRegine CalipusanNoch keine Bewertungen

- Additional Self-Test ProblemsDokument80 SeitenAdditional Self-Test Problemsnsrivastav1Noch keine Bewertungen

- Practice QuestionsDokument14 SeitenPractice QuestionskantarubanNoch keine Bewertungen

- Cash Flows Tutorial QuestionsDokument6 SeitenCash Flows Tutorial Questionssmlingwa100% (1)

- Buy Back AssingmentDokument5 SeitenBuy Back AssingmentDARK KING GamersNoch keine Bewertungen

- C 20: C C F: Hapter Onsolidation ASH LowsDokument1 SeiteC 20: C C F: Hapter Onsolidation ASH Lows.Noch keine Bewertungen

- Statement of Cash FlowsDokument11 SeitenStatement of Cash FlowsanjuNoch keine Bewertungen

- P3 Set 1-1Dokument5 SeitenP3 Set 1-1Shingirayi MazingaizoNoch keine Bewertungen

- Finacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsDokument5 SeitenFinacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsJohanna AseliNoch keine Bewertungen

- Lecture 5 NotesDokument3 SeitenLecture 5 NotesAna-Maria GhNoch keine Bewertungen

- (BUS-AC1) : Finbus2Dokument7 Seiten(BUS-AC1) : Finbus2mNoch keine Bewertungen

- Accounting 621Dokument2 SeitenAccounting 621Sarah Precious NkoanaNoch keine Bewertungen

- BSC (Hons) Financial Services (General) : Cohort: Bfsg/08/Ft - Year 1 Examinations For 2008 - 2009 Semester IiDokument8 SeitenBSC (Hons) Financial Services (General) : Cohort: Bfsg/08/Ft - Year 1 Examinations For 2008 - 2009 Semester Iipriyadarshini212007Noch keine Bewertungen

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Dokument5 SeitenThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNoch keine Bewertungen

- Express (PVT) LTD Trading Profit & Loss Account For The Year Ended 31st March 2010Dokument25 SeitenExpress (PVT) LTD Trading Profit & Loss Account For The Year Ended 31st March 2010MartinolesterNoch keine Bewertungen

- UBFI Resit Exam PaperDokument7 SeitenUBFI Resit Exam PaperAdv Sailja Rohit DhootNoch keine Bewertungen

- Management Programme: Assignment First Semester 2009Dokument4 SeitenManagement Programme: Assignment First Semester 2009gkmishra2001 at gmail.com100% (2)

- Incomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Dokument5 SeitenIncomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Tawanda Tatenda Herbert100% (1)

- Solved StatamentsDokument16 SeitenSolved StatamentsHaris AhnedNoch keine Bewertungen

- Management AccountingDokument13 SeitenManagement AccountingbhushspatilNoch keine Bewertungen

- Business Administration, Managemnt& Commercial Sciences Accounting 512 Assignment 2 SEMESTER - 2017Dokument6 SeitenBusiness Administration, Managemnt& Commercial Sciences Accounting 512 Assignment 2 SEMESTER - 2017NomaSonto NaMakoNoch keine Bewertungen

- Financial AccountingDokument4 SeitenFinancial AccountingManish KushwahaNoch keine Bewertungen

- Tutorial 13 14 RevisedDokument4 SeitenTutorial 13 14 RevisedEsther LuehNoch keine Bewertungen

- Vertical Financial StatementDokument4 SeitenVertical Financial StatementForam VasaniNoch keine Bewertungen

- Partnership Changes: 1 Compiled by T T Herbert (0773 038 651 / 0712 560 772)Dokument4 SeitenPartnership Changes: 1 Compiled by T T Herbert (0773 038 651 / 0712 560 772)Tawanda Tatenda HerbertNoch keine Bewertungen

- Zimbabwe School Examinations Council: Accounting 9197/3Dokument8 SeitenZimbabwe School Examinations Council: Accounting 9197/3nyashamagutsa93Noch keine Bewertungen

- Management Accounting Problem Unit 2Dokument7 SeitenManagement Accounting Problem Unit 2princeNoch keine Bewertungen

- 9706 s06 QP 2Dokument16 Seiten9706 s06 QP 2roukaiya_peerkhanNoch keine Bewertungen

- Fim 3B November Examination 2013Dokument13 SeitenFim 3B November Examination 2013Dolly VongweNoch keine Bewertungen

- University of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelDokument16 SeitenUniversity of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelMunyaradzi MhlangaNoch keine Bewertungen

- Account Title: Unadjusted Adjussting Entries Adjussted T B Income Statement Dr. Cr. Dr. Cr. Dr. Cr. DRDokument4 SeitenAccount Title: Unadjusted Adjussting Entries Adjussted T B Income Statement Dr. Cr. Dr. Cr. Dr. Cr. DREmail PentingNoch keine Bewertungen

- 2022 Grade 10 Controlled Test 3 QP EngDokument5 Seiten2022 Grade 10 Controlled Test 3 QP EngkellzylesediNoch keine Bewertungen

- 2023 Specimen Paper 3 InsertDokument6 Seiten2023 Specimen Paper 3 InsertMuhammad Arham KhaliqNoch keine Bewertungen

- FE QUESTION FIN 2224 Sept2021Dokument6 SeitenFE QUESTION FIN 2224 Sept2021Tabish HyderNoch keine Bewertungen

- Tutorial 1 - Financial Statement (Basic)Dokument6 SeitenTutorial 1 - Financial Statement (Basic)danial kalNoch keine Bewertungen

- Buacc5932 Assign. s1 2011Dokument4 SeitenBuacc5932 Assign. s1 2011Dishank JainNoch keine Bewertungen

- Assignment 1 - 29th March 2021 - Group FS - Interpretation - IFRS ApplicationDokument6 SeitenAssignment 1 - 29th March 2021 - Group FS - Interpretation - IFRS ApplicationGanbilegBatnasanNoch keine Bewertungen

- Asset Base Approach ProblemsDokument5 SeitenAsset Base Approach Problemspratik waliwandekarNoch keine Bewertungen

- ACCT 101 - Assignment Question (13861)Dokument5 SeitenACCT 101 - Assignment Question (13861)Aneziwe ShangeNoch keine Bewertungen

- KABURIDokument3 SeitenKABURIarnoldobonyoNoch keine Bewertungen

- MAC 102 201905 Foundations of Accounting II.Dokument6 SeitenMAC 102 201905 Foundations of Accounting II.Angellah Batiraishe MoyoNoch keine Bewertungen

- Lira Trading Company LimitedDokument3 SeitenLira Trading Company LimitedYusuf Muh'd JamiuNoch keine Bewertungen

- Difference Between Profit Making and Non-Profit Making OrganisationDokument3 SeitenDifference Between Profit Making and Non-Profit Making OrganisationJean EmanuelNoch keine Bewertungen

- 7115 s17 QP 12Dokument12 Seiten7115 s17 QP 12Jean EmanuelNoch keine Bewertungen

- Correction of ErrorsDokument2 SeitenCorrection of ErrorsJean Emanuel100% (1)

- 9706 w16 QP 12Dokument12 Seiten9706 w16 QP 12Jean EmanuelNoch keine Bewertungen

- 9706 w16 Ms 22Dokument7 Seiten9706 w16 Ms 22Jean EmanuelNoch keine Bewertungen

- Principle 1-Working As A Team: Commented (T1) : ElaborateDokument3 SeitenPrinciple 1-Working As A Team: Commented (T1) : ElaborateJean EmanuelNoch keine Bewertungen

- Local Purchase Order: Amount in WordsDokument1 SeiteLocal Purchase Order: Amount in WordsTina MillerNoch keine Bewertungen

- AUDIT - EvidenceDokument12 SeitenAUDIT - EvidenceCostancia rwehaburaNoch keine Bewertungen

- Preprint Not Peer ReviewedDokument56 SeitenPreprint Not Peer Reviewedprabin ghimireNoch keine Bewertungen

- Marine InsuranceDokument4 SeitenMarine InsuranceRio AborkaNoch keine Bewertungen

- Investment Pattern: A Psychographic Study of Investors' of Garhwal Region of UttrakhandDokument16 SeitenInvestment Pattern: A Psychographic Study of Investors' of Garhwal Region of UttrakhandVandita KhudiaNoch keine Bewertungen

- 2015 IOMA Derivatives Market SurveyDokument41 Seiten2015 IOMA Derivatives Market SurveyAlexandra IoanaNoch keine Bewertungen

- Verified Complaint: Allison Huynh V Scott Hassan, Blue Ocean, Beam Robots, Suitable TechnologiesDokument71 SeitenVerified Complaint: Allison Huynh V Scott Hassan, Blue Ocean, Beam Robots, Suitable TechnologiesJillian D'OnfroNoch keine Bewertungen

- TCF Free Checking: Linda Renee Nelson 214 Sycarmore ST GRAHAM MO 64455Dokument6 SeitenTCF Free Checking: Linda Renee Nelson 214 Sycarmore ST GRAHAM MO 64455PatriciaNoch keine Bewertungen

- Karthick Loganathan: Senior Manager, Corporate Finance Infrastructure BankingDokument2 SeitenKarthick Loganathan: Senior Manager, Corporate Finance Infrastructure BankingKarthick LoganathanNoch keine Bewertungen

- Essential Corporate Information (ECI) : ParticularsDokument4 SeitenEssential Corporate Information (ECI) : ParticularsKartheek BecksNoch keine Bewertungen

- BLOOMBERG Quick Start GuideDokument138 SeitenBLOOMBERG Quick Start Guidejean_gourdonNoch keine Bewertungen

- Mutual FundDokument2 SeitenMutual Fundkum_praNoch keine Bewertungen

- IAS 19 Employee BenefitsDokument56 SeitenIAS 19 Employee BenefitsziyuNoch keine Bewertungen

- St. Marry Inter CollegeDokument15 SeitenSt. Marry Inter CollegeSTAR PRINTINGNoch keine Bewertungen

- Chapter 8 - CorporationDokument7 SeitenChapter 8 - CorporationNyah MallariNoch keine Bewertungen

- Invoice - 2019-12-24T121855.363Dokument2 SeitenInvoice - 2019-12-24T121855.363garima kathuriaNoch keine Bewertungen

- Notes in Insurance Law - 2Nd Semester Ay 2017-2018Dokument22 SeitenNotes in Insurance Law - 2Nd Semester Ay 2017-2018Kurt Paul Gacoscos BagayaoNoch keine Bewertungen

- Financial TechnologyDokument14 SeitenFinancial Technologykishoretvis3Noch keine Bewertungen

- Money Laundering EssayDokument4 SeitenMoney Laundering EssayAnmari SablanNoch keine Bewertungen

- Chapter 1 FOA-Introduction To AcctgDokument25 SeitenChapter 1 FOA-Introduction To AcctgBardenas JoybieNoch keine Bewertungen

- Lec 8 Corporate Parenting and Good GovernanceDokument59 SeitenLec 8 Corporate Parenting and Good Governancegina renathaNoch keine Bewertungen

- Ambit - Strategy - Scalability Thematic - Destined For Greater Scale - 16dec2020Dokument126 SeitenAmbit - Strategy - Scalability Thematic - Destined For Greater Scale - 16dec2020Deepak SharmaNoch keine Bewertungen

- SGVFS015182 : Manila Electric Company and Subsidiaries Consolidated Statements of Financial PositionDokument8 SeitenSGVFS015182 : Manila Electric Company and Subsidiaries Consolidated Statements of Financial Positionjosie belazaNoch keine Bewertungen