Beruflich Dokumente

Kultur Dokumente

Assigment 2

Hochgeladen von

Vanessa Alfaro Sanz0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten2 SeitenOriginaltitel

ASSIGMENT 2 (1).docx

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten2 SeitenAssigment 2

Hochgeladen von

Vanessa Alfaro SanzCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

ASSIGMENT 2

LP is a company formed by one or more general partners and one of several

limited partners. A general partner may be an individual or a corporation, the

general partner is legally responsible for all obligations and debts of the LP, while

the limited partner is only responsible for the amount that he has decided to

contribute, the general partner participates in the management and management of

the company, but the limited cannot do it. The LP cannot be sued or sued, nor

does it have to pay taxes. But each individual partner if, in addition, pays the taxes

based on the profits or benefits that obtains. Wisfall (1997).

An LLC, a limited liability company may sue and be sued, owns property in its

name, partners may be individuals or companies, partners are not directly

responsible, unless it is for individual omission or some wrongdoing, but not for

omissions or illegals of the LLP, each partner will pay taxes according to the

income obtained from the LLP

The most important difference between an LLC and an LP has to do with the

personal responsibility of the participants. A limited liability company is managed

by one or more general partners who control the day-to-day operations of the

company. These general partners have unlimited personal liability for the debts

and obligations of the limited partnership, which implies that they can be held

personally liable for such debts and obligations. A limited partner has no personal

responsibility for the company's obligations, but is not allowed to actively

participate in the day-to-day management of the limited partnership. If a limited

partner is significantly involved in administration, a court may treat that limited

partner as if it were a general partner if the limited partnership is sued, and impose

personal liability on the investor. Tilley & Young (2009)

To avoid the personal liability of a general partner, an entity such as a corporation

or an LLC may act as the general partner of a limited partnership. However,

creating an independent entity to act as a general partner adds additional cost and

complexity, and could have adverse tax consequences. The LLC was created in

order to provide some flexibility of a partnership but trying to provide protection

against personal liability offered by a corporation. One or more of its members can

manage an LLC. However, unlike a limited liability company, a participant involved

in the management of the company is not personally liable for the liabilities of the

entity. Given the personal responsibility that is applied in a limited partnership,

many clients ask why a person would choose to constitute a limited partnership. As

mentioned above, LLC is a relatively new corporate type (since 1992) and, as a

result, the jurisprudence on LLC is much less solid and is not yet as consolidated

as the legislation applicable to limited companies.

In this case both Yolanda and Zachary are responsible for the damages that have

been caused to the seller by the type of company that signed, since Zachary

having the role of limited partner can be understood as a passive partner whose

fundamental role is to invest in the business and being active not in the activity of

controlling, directing and managing the management of the company .But the key

is that both contributed the same amount of money, so Zachary despite being a

limited partner must respond by the amount of money that contributed, being this

the half of the society.

If the company had been constituted by LLC, Zachary or who had made the

mistake, would be the only responsible, because in this type of society each

partner has responsibility for their actions and decisions. Therefore, it must assume

the consequences of these in a legal and social.

BIBLIOGRAPHY

Tilley, F., & Young, W. (2009). Sustainability Entrepreneurs. Greener Management

International, (55).

Wiswall, F. L. (1997). Classification societies: issues considered by the Joint

Working Group. International Journal of Shipping Law, 171-187.

Das könnte Ihnen auch gefallen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Chapter 18Dokument2 SeitenChapter 18Vanessa Alfaro SanzNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Case Manner Between Lease Corporation InvestmentDokument2 SeitenCase Manner Between Lease Corporation InvestmentVanessa Alfaro SanzNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- A Dollar Is 0,843917465Dokument1 SeiteA Dollar Is 0,843917465Vanessa Alfaro SanzNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Fin Asssigment1Dokument3 SeitenFin Asssigment1Vanessa Alfaro SanzNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Fin Asssigment1Dokument3 SeitenFin Asssigment1Vanessa Alfaro SanzNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A8: Political PartiesDokument1 SeiteA8: Political PartiesVanessa Alfaro SanzNoch keine Bewertungen

- A7: Media Paola HurtadoDokument1 SeiteA7: Media Paola HurtadoVanessa Alfaro SanzNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Your Electronic Ticket-EMD ReceiptDokument2 SeitenYour Electronic Ticket-EMD Receiptazeaq100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Bridal ContractDokument5 SeitenBridal ContractStacey MarieNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Carrier Liability for Passenger DeathDokument256 SeitenCarrier Liability for Passenger DeathLouie EllaNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Sanskritisation Westernisation ModernisationDokument12 SeitenSanskritisation Westernisation ModernisationMansi Agarwal100% (1)

- AC - IntAcctg1 Quiz 04 With AnswersDokument2 SeitenAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- (U) D A R: Marshall DistrictDokument5 Seiten(U) D A R: Marshall DistrictFauquier NowNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- COMMERCIAL LAW REVIEW - SamplexDokument10 SeitenCOMMERCIAL LAW REVIEW - SamplexML BanzonNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Assurance Services: Definition, Types and LimitationsDokument146 SeitenAssurance Services: Definition, Types and LimitationsMudassar Iqbal0% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 2011 Veterans' Hall of Fame Award RecipientsDokument46 Seiten2011 Veterans' Hall of Fame Award RecipientsNew York SenateNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- John Hankinson AffidavitDokument16 SeitenJohn Hankinson AffidavitRtrForumNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Affidavit of ConsentDokument2 SeitenAffidavit of ConsentRocketLawyer100% (1)

- Follow Up of DCPS Emergency Response Planning and ReadinessDokument12 SeitenFollow Up of DCPS Emergency Response Planning and ReadinessABC7NewsNoch keine Bewertungen

- CASE BRIEF Switzerland v. Nigeria San Pedro Pio Case PDFDokument3 SeitenCASE BRIEF Switzerland v. Nigeria San Pedro Pio Case PDFDILG STA MARIANoch keine Bewertungen

- Pharma Society of GB Vs Boots Cash ChemistsDokument2 SeitenPharma Society of GB Vs Boots Cash ChemistsRadhe MohanNoch keine Bewertungen

- Class 9 Extra Questions on What is Democracy? Why DemocracyDokument13 SeitenClass 9 Extra Questions on What is Democracy? Why DemocracyBlaster-brawl starsNoch keine Bewertungen

- Unit-1 - AR ACTDokument174 SeitenUnit-1 - AR ACTgeorgianaborzaNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- ResultGCUGAT 2018II - 19 08 2018Dokument95 SeitenResultGCUGAT 2018II - 19 08 2018Aman KhokharNoch keine Bewertungen

- Will NEET PG 2023 Be Postponed Students ApproachDokument1 SeiteWill NEET PG 2023 Be Postponed Students ApproachBhat MujeebNoch keine Bewertungen

- Motion To DismissDokument4 SeitenMotion To DismissYulo Vincent Bucayu Panuncio100% (1)

- Financial Statement: Funds SummaryDokument1 SeiteFinancial Statement: Funds SummarymorganNoch keine Bewertungen

- Identity Theft WebquestDokument2 SeitenIdentity Theft Webquestapi-256439506Noch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Chopin SongsDokument8 SeitenChopin Songsgstewart_pianoNoch keine Bewertungen

- BL TestbankDokument47 SeitenBL TestbankTrixie de LeonNoch keine Bewertungen

- Module 2 - Part III - UpdatedDokument38 SeitenModule 2 - Part III - UpdatedDhriti NayyarNoch keine Bewertungen

- Reset NVRAM or PRAM On Your Mac - Apple SupportDokument1 SeiteReset NVRAM or PRAM On Your Mac - Apple SupportRudy KurniawanNoch keine Bewertungen

- Administrative Law Judge's Ruling Following Second Prehearing Conference 12-26-12Dokument6 SeitenAdministrative Law Judge's Ruling Following Second Prehearing Conference 12-26-12L. A. PatersonNoch keine Bewertungen

- Elements of Cost SheetDokument11 SeitenElements of Cost SheetPratiksha GaikwadNoch keine Bewertungen

- Nomination As Chairman - Haryana Biodiversity Board, Against VacancyDokument149 SeitenNomination As Chairman - Haryana Biodiversity Board, Against VacancyNaresh KadyanNoch keine Bewertungen

- Doing Business in Canada GuideDokument104 SeitenDoing Business in Canada Guidejorge rodriguezNoch keine Bewertungen

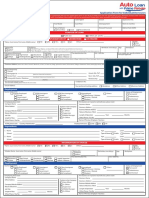

- Psbank Auto Loan With Prime Rebate Application Form 2019Dokument2 SeitenPsbank Auto Loan With Prime Rebate Application Form 2019jim poblete0% (1)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)